Lovei Case 22 Lululemon Athletica Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lululemon: Encouraging a Healthier

Daniels Fund Ethics Initiative University of New Mexico http://danielsethics.mgt.unm.edu Lululemon: Encouraging a Healthier Lifestyle INTRODUCTION Lululemon Athletica is an athletic apparel company intended for individuals with active lifestyles. The organization has deep roots in the yoga community and is one of the few businesses to offer apparel for this specific market. Lululemon is based in Vancouver, British Columbia, Canada and operates its clothing stores in numerous countries throughout the world. The apparel store offers product lines that include fitness pants, shorts, tops, and jackets for activities such as yoga, running, and other fitness programs. The organization operates in three segments. These segments consist of corporate-owned and operated retail stores, a direct to consumer e-commerce website, and wholesale avenues. As of 2014, the company operates 254 stores predominantly in the United States, Canada, Australia, and New Zealand. With nearly 8,000 worldwide employees, Lululemon has grown rapidly in the last 20 years and is expected to continue its growth strategy well into the foreseeable future. It has also established a subsidiary geared toward youth called Ivivva Athletica. Store growth and expansion into other countries has allowed Lululemon to achieve financial success. The organization has seen continuous increases in revenue, with a 2013 annual revenue nearing $1.6 billion. Over the past four years, Lululemon has consistently boasted annual revenue increases of about $300 million. While financially stable, the organizational structure has seen changes in recent months with the hiring of a new CEO. Lululemon hired Laurent Potdevin in January of 2014 hoping to appoint a worthy and experienced industry professional. -

Team Store Catalog

TEAM STORE CATALOG If you wish to purchase Gear, Suits, or Spirit Wear contact Julie Tellier at [email protected] SWIM GEAR & PRACTICE EQUIPTMENT $12 TEAM SWIM CAP Speedo Silicone Swim Cap • 100% Silicone • Solid Color Lime Green with Team Logo • One size • Reduces drag and protects hair ** CUSTOM PERSONALIZED SWIM CAPS** - Twice a year the store will send out an order form to purchase custom personalized swim caps . The minimum order is 2 caps for $25 with the same customization. Additional custom personalized caps can be ordered in sets of 2. Please ask your team store volunteers when order forms will be available $20 DELUXE MESH BAG Speedo Deluxe Ventilator Mesh Bag • Dimensions: 24'' x 17"; Front zip pocket: 13'' x 10'' • Open weave mesh for strength and quick drying • Exterior zip pocket • Shoulder straps for backpack carry AVAILABLE COLORS : • Black • Grey/Forrest Camouflage • Jasmine Green $15 MESH BAG Speedo Ventilator Mesh Bag • Medium-sized equipment bag designed to hold all your swimming essentials • Open weave mesh for strength and quick drying • Drawstring closure keeps items together and secure in bag • Exterior zip pocket AVAILABLE COLORS : • Black • Silver • Jasmine Green $50 BACKPACK Speedo 35L Teamster Backpack • Dimensions: 20" x 17" x 8" • Front and side zip pockets. • Large main compartment with organizer. • Side media pouch and water bottle holder. • Removable dirt bag keeps wet and dirty items away from electronics and clean clothes. • Removable bleacher seat behind the laptop sleeve for cold/hard surfaces. AVAILABLE COLORS : • Black • Jasmine Green **Backpacks are sent to American Stitch for embroidery of Team Logo and Athlete’s Name. -

Rules and Regulations of Competition PART THREE T Rights, Privileges, Code of Conduct 3

RULEBOOK 2020 MAJOR LEGISLATION AND RULE CHANGES FOR 2020 (currently effective except as otherwise noted) 1. The Zone Board of Review structure was eliminated and jurisdiction was extended to the National Board of Review. (Various Articles and LSC Bylaws) 2. USA Swimming’s Rules were aligned with the U.S. Center for SafeSport’s required Minor Athlete Abuse Prevention Policies. (Various Articles) 3. Therapeutic elastic tape was specifically prohibited. (Article 102.8.1 E) [Effective May 1, 2020] 4. Three separate advertising logos are now permitted on swimsuits, caps and goggles. (Article 102.8.3 A (1), (2) & (3)) 5. For Observed Swims, the rule was eased to permit observers to simply be in a position on deck where they can properly observe the swims. (Article 202.8.4) 6. The 120 day rule was clarified. (Article 203.3) 7. The national scratch rule was changed to permit re-entry into the remainder of the day’s events of a swimmer who failed to show up in a preliminary heat. (Article 207.11.6) 8. The definition of a swimmer’s age for Zone Open Water Championships was changed. (Article 701.2) 1 DOPING CONTROL MEMBERSHIP ANTI-DOPING OBLIGATIONS. It is the duty of individual members of USA Swimming, including athletes, athlete support person- nel, and other persons, to comply with all anti-doping rules of the World Anti-Doping Agency (WADA), FINA, the USOPC, including the USOPC National Anti-Doping Policy, and the U.S. Anti- Doping Agency (USADA), including the USADA Protocol for Olympic and Paralympic Movement Testing (USADA Protocol), and all other policies and rules adopted by WADA, FINA, the USOPC and USADA. -

Download Our Catalog (13

SUPERIOR PERFORMANCE EXTREME RESULTS THE GAFFRIG STORY… In 1984, James Gaffrig, a long time family friend and my father’s partner on the Chicago Police force for more than 10 years, left the force armed with a talent for building quality, marine-capable speedometers and gauges, and the ambition to turn this talent into one of the most respected businesses in the boating industry. I began working with Jimmy when he opened his first shop in Chicago in 1984. It was here that he began manufacturing what are still known today to be the best gauges in the trade. Shortly after bringing these gauges to the forefront of the industry, Jimmy began engineering a series of Gaffrig mufflers, silencers, flame arrestors and throttle brackets. Soon, like Gaffrig gauges, these products proved to the boating industry that Gaffrig was synonomous with quality. For several years I worked closely with Jimmy, building the business through personal dedication and quality craftsmanship surpassed by no one. Sadly, in 1992, my friend and mentor, James Gaffrig, passed away. I purchased the business shortly there- after and continue to strive each day to operate and expand the Gaffrig line with the same passion set forth by James Gaffrig so many years ago. Our commitment in 1984 remains the same to this day...to be the best manufacturer of boating accessories, providing the serious performance boater with unsurpassed quality, performance, innovation and service. I am dedicated to continuously researching new product ideas, as well as ways to improve Gaffrig’s current product line. Most importantly, I listen to the feedback of you, my customers. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

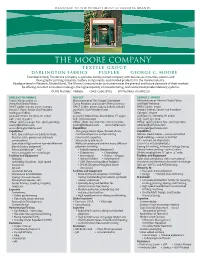

Moore Company Single Sheet Rvs 7-17-13

TEXTILE GROUP DARLINGTON FABRICS FULFLEX GEORGE C. MOORE Founded in 1909, The Moore Company is a private, family-owned company with businesses in textiles, elastics and flexographic printing materials, battery components, and molded products for the marine industry. Headquartered in Westerly, Rhode Island, The Moore Company helps customers meet the present and future demands of their markets by offering constant innovation in design, the highest quality of manufacturing, and customized product delivery systems. DUNS Number: 1199926 CAGE Code:1EYE5 EIN Number: 05-0185270 DARLINGTON FABRICS FULFLEX GEORGE C. MOORE Textile Manufacturer of Manufacturer of Thin-Gauge Calendered Manufacturer of Narrow Elastic Fabric Warp Knit Elastic Fabrics Elastic Products and Custom Mixing Services and Rigid Webbing NAICS Codes: 313249, 313312, 314999 NAICS Codes: 325211, 323212, 326291, 326299 NAICS Codes: 313221 Steven F. Perry, Senior Vice President Jay Waltz, Vice President Sales Andrew Dreher, Senior Vice President Darlington Fabrics Fulflex George C. Moore 36 Beach Street, Westerly, RI 02891 32 Justin Holden Drive, Brattleboro, VT 05301 36 Beach St., Westerly, RI 02891 Cell: (401) 743-3614 Cell: (781) 264-5030 Cell: (401) 339-9294 Office: (401) 315-6346 Fax: (401) 348-6049 Office: (800) 283-2500 Fax: (802) 257-5602 Office: (401) 315-6223 Fax: (401) 637-4852 [email protected] jwaltz@fulflexinc.com www.fulflex.com [email protected] www.darlingtonfabrics.com Capabilities www.georgecmoore.com Capabilities Thin gauge elastic tapes, thread, sheets Capabilities -

Lululemon Remains in High Demand and in Command of Pricing

Hitha Prabhakar, [email protected] REPORT Reverdy Johnson, [email protected] Lululemon Remains in High Demand and in Command of Pricing Companies: BRK.A, ETR:ADS, DKS, GPS, JCP, JWN, LULU, NKE, SHLD, TGT, TJX, UA, VFC, WMT March 11, 2013 Research Question: Can Lululemon successfully defend and grow its market share in the activewear market as competition increases? Summary of Findings Silo Summaries Thirty-two of 44 sources said Lululemon Athletica Inc. (LULU) 1) FASHION MAGAZINE AND WEBSITE EDITORS remains the leading high-end activewear brand and will Two of three sources said LULU still is in high demand and will not lose out to the growing list of competitors. The third remain in demand despite greater competition. source questioned Lululemon’s ability to stave off Lululemon is expected to be able to maintain its pricing competitors because of its high prices and the improved power because it also has become a lifestyle brand. Three quality from lower-priced competitors. retail consultant sources said Lulu could successfully push 2) RETAIL CONSULTANTS through a 10% to 15% price increase, and two specialists All three sources said Lululemon is the leading high-end cautioned that Lulu could damage its brand identity and brand and could successfully push through a 10% to 15% cache if it were to lower prices. In fact, they said it was more price increase. Two sources raised concerns about LULU’s susceptible to threats from higher-priced entrants than from back-end operations, which resulted in supply chain low-end competitors. mismanagement and inventory shortages during the holidays and could hamper efforts to expand online. -

USA SWIMMING SPEEDO SECTIONALS at COLUMBUS CENTRAL ZONE SECTIONAL 3 Wednesday, July 20 – Saturday, July 23, 2016

9/1/15 czt page 1 Reviewed 4/25/16 Bonus Entries update 5/2/16 Update LSC contact 5/10/16 USA SWIMMING SPEEDO SECTIONALS AT COLUMBUS CENTRAL ZONE SECTIONAL 3 Wednesday, July 20 – Saturday, July 23, 2016 Hosted by the Ohio State Swim Club at The Ohio State University Held under the Sanction of Ohio Swimming, Inc. Sanction # OH-16LC-25/ OH-16LC-34TT Welcome The Ohio State Swim Club and the Department of Recreational Sports are pleased to host the 2016 Speedo Sectionals at Columbus – Central Zone Sectional 3 at The Ohio State University. The most current meet information, including notices of program changes, warm-up times, warm-up lane assignments, and complete meet results and computer backups will be posted on the Ohio State Swim Club’s website at www.swimclub.osu.edu. Facility McCorkle Aquatic Pavilion Information 1847 Neil Ave. Columbus, Ohio 43210 The McCorkle Aquatic Pavilion is The Ohio State University’s competitive aquatic facility and consists of two large bodies of water for competition and warm-up/cool-down: the Mike Peppe Natatorium Competition Pool and the Ron O’Brien Diving Well. The Mike Peppe Natatorium Competition Pool is a 10 lane, 50 meter, all-deep water indoor pool. The competition course has been certified in accordance with 104.2.2C(4). The copy of such certification is on file with USA Swimming. Due to moveable bulkheads, the course will be re-certified prior to and following each session. Water depth is greater than 7ft. from the starting blocks at both ends of the pool. -

Lululemon Craze Has Not Peaked, Thanks to Crossover Styling

REPORT Ryan Duck, [email protected], 415.364.3779 Lululemon Craze Has Not Peaked, Thanks to Crossover Styling Companies: FRA:ADS, GPS, HBI, LULU, NKE, TGT, UA, VFC, WMT May 10, 2012 Research Question: Has the Lululemon yoga clothing craze peaked? Silo Summaries Summary of Findings 1) LULULEMON STORES The craze for Lululemon Athletica Inc. (LULU) clothing has not All six sources said sales were positive and growing and peaked, and the brand‘s popularity is expected to further increase that the men‘s and running lines were gaining traction. this year. Lululemon continues to extend beyond the yoga Lululemon‘s popularity has continued because of word of community into other sports and everyday wear. mouth, lifestyle branding, and frequent color and style changes. Lululemon is opening new stores worldwide, The ability to wear Lululemon for both style and exercise which should boost its popularity even further. The distinguishes the brand from its competitors. Twenty-two of 28 company has no close competitor. Inventory levels have Lululemon customers taking part in an online Blueshift survey been appropriate, and prices are the same year to year. said style played heavily in their decisions to choose Lululemon. 2) APPAREL SHOPS Lululemon has experienced an increase in male customers, Lululemon is continuing to grow for all six sources. The according to all six store sources. Also, its greater emphasis on its shops‘ customers wear Lululemon for workouts and to run running gear, which four store sources described as the brand‘s errands. Four of six sources said the Lululemon craze has trendiest line, has helped grow sales and store traffic. -

An Overview of Working Conditions in Sportswear Factories in Indonesia, Sri Lanka & the Philippines

An Overview of Working Conditions in Sportswear Factories in Indonesia, Sri Lanka & the Philippines April 2011 Introduction In the final quarter of 2010 the ITGLWF carried for export to the EU and North America, and out research in major sportswear producer many of those in the Philippines are also countries to examine working conditions in exporting to Japan. factories producing for multinational brands and retailers such as adidas, Dunlop, GAP, Greg Collectively the 83 factories employed over Norman, Nike, Speedo, Ralph Lauren and 100,000 workers, the majority of whom were Tommy Hilfiger (for a full list of the brands females under the age of 35. This report con- and retailers please see Annex 1). tains an executive summary of the findings, based on information collected from workers, The researchers collected information on work- factory management, supervisors, human ing conditions at 83 factories, comprising 18 resource staff and trade union officials. factories in Indonesia, 17 in Sri Lanka and 47 in the Philippines. In Indonesia researchers focused The research was carried out by the ITGLWF’s on 5 key locations of sportswear production: Bekasi, Bogor, Jakarta, Serang and Tangerang. affiliates in each of the target countries, in In Sri Lanka researchers examined conditions some cases with the assistance of research in the major sportswear producing factories, institutes. The ITGLWF would like to express mainly located in Export Processing Zones, and our gratitude to the Free Trade Zones and in the Philippines researchers focused on the General Services Employees Union, the National Capital Region, Region III and Region ITGLWF Philippines Council, Serikat Pekerja IV-A. -

VF to Acquire Two Brands: 7 for All Mankind(R) Premium Denim-Lifestyle Brand and Lucy(R) Women's Activewear Brand

July 26, 2007 VF to Acquire Two Brands: 7 For All Mankind(R) Premium Denim-Lifestyle Brand and lucy(R) Women's Activewear Brand Brands Will Form Foundation of VF's New 'Contemporary Brands' Coalition; 2007 Revenues Now Expected to Rise More Than 14% VF Will Hold a Conference Call and Webcast at 3 P.M. Et to Discuss Today's Announcement. Details Can Be Found at the End of This Release GREENSBORO, N.C.-- VF Corporation (NYSE: VFC), a global leader in lifestyle branded apparel, announced today that it has signed definitive agreements to acquire two dynamic and growing companies, Seven For All Mankind, LLC and lucy activewear, inc. The two companies will form the foundation of a new lifestyle brand-based coalition, VF Contemporary Brands, which VF intends to build with additional contemporary brands over time. VF's other coalitions are Outdoor, Jeanswear, Sportswear and Imagewear. Upon closing these transactions, VF will name Mike Egeck as President of VF Contemporary Brands, in addition to his current role as Chief Executive Officer of Seven For All Mankind, reporting to Eric Wiseman, President and Chief Operating Officer of VF Corporation. "Our ability to identify, acquire and grow brands has been a key driver of shareholder value over the past several years, and we're clearly maintaining this momentum," said Mackey J. McDonald, Chairman and Chief Executive Officer. "The acquisition of these high growth, high potential brands marks another milestone in the continuing success of our Growth Plan. These brands extend our reach to important and growing consumer segments, broaden our presence in healthy and growing channels of distribution, provide us with additional vehicles to expand our direct-to-consumer business through owned retail stores and online sales and offer the potential for continued growth internationally." Added Wiseman, "The formation of the VF Contemporary Brands coalition, with over $350 million in annual revenues, marks our commitment to building new platforms for sustainable growth. -

11Th Annual Pat's

12th Annual Pat's Run Tempe, Arizona 04/23/2016 **** Team Results **** 1. 2:06:43 PHOENIX FREE SOLES ( 25:21) ============================================================ 1 23:19 Brett Bernacchi 2 24:40 Dave Hurdle 3 25:02 Greg Hritzo 4 25:43 Andrew Wilson 5 27:59 Alanna Bernacchi 6 ( 45:51) Mark Gershman 2. 2:14:34 THE GREAT RUM RUNNERS ( 26:55) ============================================================ 1 19:34 Chris Westerman 2 25:33 Victor Mendoza 3 27:07 Sean Mendoza 4 29:52 Frankie Lebron 5 32:28 David Hicks 6 ( 35:34) Dc Mendoza 7 ( 36:21) Julio Ramirez 8 ( 38:31) Randy Brewer 9 ( 40:53) Wendy Brewer 10 ( 46:46) Tony Casellas 11 ( 47:55) Ramona Suetkamp 12 ( 59:55) Derling Gonzalez 13 ( 59:56) Shelly Gonzalez 14 (1:03:38) Paul Steinkuller 15 (2:06:50) Vanesa Sherman 16 (2:06:50) Scott Sherman 17 (2:09:11) Ron Rose 18 (2:09:11) Aracely Rose 3. 2:15:07 GDMS WE WILL NEVER FORGET ( 27:02) ============================================================ 1 24:13 Alexander Beebe 2 25:56 Lionel Silverston 3 27:04 Aaron Johnson 4 28:32 Joe Mooney 5 29:22 Barry Redman 6 ( 29:36) Mario Luera 7 ( 29:37) Raul Monreal III 8 ( 29:37) Mark Kaya 9 ( 30:13) Justin Delp 10 ( 32:32) Jonathan Pignetti 11 ( 32:39) Mark Rascoe 12 ( 32:47) Jason Wolfe 13 ( 32:53) Paul Korpalski 14 ( 32:59) Canaan Aguilar 15 ( 33:41) Jin Seder 16 ( 33:44) Nick Spirakus 17 ( 35:15) Joshua Bonk 18 ( 35:25) Nick Depalma 19 ( 36:34) Andrew Brown 20 ( 36:37) Jocelyn Gerken 21 ( 36:39) Steven Gerken 22 ( 36:40) Ray Massey 23 ( 37:46) Robert Durette 24 ( 37:57) Brian Terry 25 (