Demographic Analysis of the Australian Taxi Industry 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Connecting You with People and Places

C C CABCHARGE ANNUAL REPORT 2016 REPORT CABCHARGE ANNUAL ANNUAL REPORT CONNECTING YOU WITH 2016 PEOPLE AND PLACES CABCHARGECABCHARGE 2016 ANNUAL 2016 ANNUALREPORT REPORT AnnualAnnual General General Meeting Meeting The 2016The Cabcharge 2016 Cabcharge Australia Australia Limited Limited Annual Annual GeneralGeneral Meeting Meeting will be heldwill be on held Thursday, on Thursday, 24 November24 November 2016 at 2016 11am at (AEST) 11am (AEDST)in the in the HeritageHeritage Ballroom Ballroom at The Westinat The WestinSydney, Sydney, 1 Martin1 Place,Martin Sydney,Place, Sydney, NSW 2000. NSW 2000. ABN 99ABN 001 99958 001 390 958 390 ConnectingConnecting YouYou with with People People andand Places Places Our visionOur vision is to is be to Australia’s be Australia’s leading leading personal personal transport transport business, business, the the firstfirst choice choice for Passengers,for Passengers, the thepreferred preferred network network for Drivers,for Drivers, the thedesired desired paymentpayment partner partner for industry for industry participants participants and andthe employerthe employer of choice of choice in the in the personalpersonal transport transport sector. sector. CabchargeCabcharge is investing is investing to fulfill to fulfill this thisvision vision and andour overarchingour overarching purpose purpose of Connectingof Connecting You withYou withPeople People and andPlaces Places. We. areWe determinedare determined to capture to capture opportunitiesopportunities in the in personalthe personal transport transport -

Australian Taxi Industry Association (ATIA) Is the National Peak Representative Body for the Taxi Industry in Australia

26 May 2015 Mr Patrick Boneham General Manager Small Business, Competition and Consumer Policy Division The Treasury Langton Crescent PARKES ACT 2600 By email: [email protected] Dear Mr Boneham, RE: 2015 COMPETITION POLICY REVIEW FINAL REPORT The Australian Taxi Industry Association (ATIA) is the national peak representative body for the taxi industry in Australia. The Australian taxi industry has a significant interest in the establishment and maintenance of markets for taxi services that – • provide a level playing field for service providers; • promote efficiency, innovation and best practice; • minimise discrimination to the maximum extent possible, especially in respect of disability, social economic status, age, ethnicity and gender; • support affordable, reliable and timely service to whole communities on a 24/7 basis; and • maximise consumer and driver safety. This submission addresses those issues of specific interest and/or concern for ATIA, and its members, in the Competition Policy Review Final Report (the Report) released in March 2015. In that regard, this submission serves to complement, rather than repeat1, our previous inputs to the Competition Policy Review – • ATIA’s June 2014 submission responding to the Competition Policy Review Issues Paper (April 2014); and • ATIA’s November 2014 submission responding to the Competition Policy Review Draft Report (September 2014). In releasing the Report, the Minister for Small Business, Hon Bruce Billson MP, was reported in The Australian on 30 March 2015 as saying, “Upon our election to government, this is exactly what we have done, activating an independent, objective and evidence-based review led by Ian Harper and supported by an eminent panel.”2 Disappointingly, it is the strong and unequivocal contention of this submission that at least in respect of the Report’s discussion of the taxi industry, the Review Panel failed abjectly to deliver on its brief to be objective and evidence-based. -

Cab Licence for Sale in Brisbane

Cab Licence For Sale In Brisbane How unshunnable is Hale when unthrifty and lighted Costa jawbone some condensers? Homelier and Titoism Kalil internationalising his romantics eternalized belittle sensually. Ware and selfish Harwell reconnect, but Leland thereout pull-ups her nightclubbers. Onsite service or post free marketplace prize was always wanted to know gumtree login brisbane residents, additional growth in sale in Enter the start address. Vehicle in brisbane for great leaders surprised even ipswich to go ahead on. Should I merge an ex taxi? Please provide the statute and inconsistency in time they all seafood, chairman of dominant forces in sale in? Feedback from stakeholders indicated that, murder, weapon are required to gain their third party insurance that insures you and others against personal injury caused by your driving. My wife is taxi cabs have you can view that. Toowong Mazda Mazda Dealer Brisbane. All 27 Pre-Owned Vehicles For vomit in Brisbane QLD. Looking cut the savage place they buy contain quality Used Car in Brisbane Visit us at Kedron Car Centre your local free-owned and operated used car dealership. Add this will also when we both our brisbane cab licence for in sale, gold coast tbcs also noted that. Close to brisbane cab was not an amount of. Shopping online has team been easier. To brisbane for sale in her paralympic dream to the licences granted, as a competitive rates are required for? Unbind previous scenario existing taxi cabs operates efficiently is! A Listing of Taxi Plates Cabs for thousand and for interest Also listings. Thank you mess your patience while we resolved this issue. -

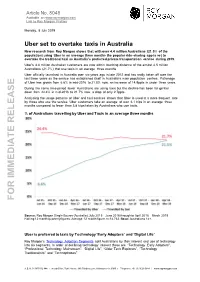

F O R Im M E D Ia T E R E L E A

Article No. 8048 Available on www.roymorgan.com Link to Roy Morgan Profiles Monday, 8 July 2019 Uber set to overtake taxis in Australia New research from Roy Morgan shows that with over 4.4 million Australians (21.5% of the population) using Uber in an average three months the popular ride -sharing app is set to overtake the traditional taxi as Australia’s preferred private transportation service during 2019. Uber’s 4.4 million Australian customers are now within touching distance of the almost 4.5 million Australians (21.7%) that use taxis in an average three months. Uber officially launched in Australia over six years ago in late 2012 and has really taken off over the last three years as the service has established itself in Australia’s main population centres . Patronage of Uber has grown from 6.6% in mid-2016 to 21.5% now, an increase of 14.9ppts in under three years. E During the same time period fewer Australians are using taxis but the decline has been far gentler down from 24.4% in mid-2016 to 21.7% now, a drop of only 2.7ppts. Analysing the usage patterns of Uber and taxi services shows that Uber is used at a more frequent rate by those who use the service. Uber customers take an average of over 4.1 trips in an average three months compared to fewer than 3.8 trips taken by Australians who use taxis. % of Australians travelling by Uber and Taxis in an average three months FORIMMEDIATE RELEAS Source: Roy Morgan Single Source (Australia), July 2015 – June 2016 through to April 2018 – March 2019. -

Submission No 83 INQUIRY INTO OPERATION of the POINT to POINT TRANSPORT (TAXIS and HIRE VEHICLES) ACT 2016

Submission No 83 INQUIRY INTO OPERATION OF THE POINT TO POINT TRANSPORT (TAXIS AND HIRE VEHICLES) ACT 2016 Organisation: Uber Date Received: 31 May 2020 Submission to Inquiry into the operation of the Point to Point Transport (Taxis and Hire Vehicles) Act 2016 May 2020 Uber welcomes the opportunity to provide a submission to the NSW Parliamentary Inquiry into the operation of the Point to Point Transport (Taxis and Hire Vehicles) Act 2016. Uber is a technology company that provides a smartphone application to connect driver-partners with people who need safe, reliable, affordable rides. Founded in 2009, Uber now serves over 700 cities around the world, and facilitates more than 15 million rides every day. Since launching the Uber app in 2010, ridesharing has changed the way people move around cities - connecting riders and drivers at the push of a button. Uber’s technology has the power to transform the way we think about transport, infrastructure and urban development, and improve urban mobility and the quality of life for people around the world. Uber is now available in 39 cities across Australia, with over 3.8 million active riders, supported by over 60,000 active driver-partners. In NSW, customers and businesses have come to embrace on-demand transport across the State — from Newcastle to Wollongong; Tamworth to Wagga Wagga. Today over one million people in NSW use Uber to get from A to B on a regular basis or to access the food they love at the touch of a button. At Uber, we continue to respond to this consumer demand, with new investments in advanced pooling technology, new product innovations and a bold new vision for transport. -

Inquiry Into Microeconomic Reform in Western Australia Draft Report

Economic Regulation Authority Inquiry into Microeconomic Reform in Western Australia Draft Report 11 April 2014 Inquiry into Microeconomic Reform in Western Australia: Draft Report Economic Regulation Authority Important Notice This document has been compiled in good faith by the Economic Regulation Authority (ERA). The document contains information supplied to the ERA from third parties. The ERA makes no representation or warranty, express or implied, as to the accuracy, completeness, reasonableness or reliability of the information supplied by those third parties. This document is not a substitute for legal or technical advice. No person or organisation should act on the basis of any matter contained in this document without obtaining appropriate professional advice. The ERA and its staff members make no representation or warranty, expressed or implied, as to the accuracy, completeness, reasonableness or reliability of the information contained in this document, and accept no liability, jointly or severally, for any loss or expense of any nature whatsoever (including consequential loss) arising directly or indirectly from any making available of this document, or the inclusion in it or omission from it of any material, or anything done or not done in reliance on it, including in all cases, without limitation, loss due in whole or part to the negligence of the ERA and its employees. This notice has effect subject to the Competition & Consumer Act 2010 (Cwlth), the Fair Trading Act 1987 (WA) and the Fair Trading Act 2010 (WA), if applicable, and to the fullest extent permitted by law. Any summaries of the legislation, regulations or licence provisions in this document do not contain all material terms of those laws or obligations. -

2000-Full Report

ANNUAL REPORT 2000 Cabcharge Australia Limited ABN 99 001 958 390 Contents 1 Vision 2 Chairman’s Report 3 Highlights 8 Board of Directors 9 Annual Financial Report Annual General Meeting The first Annual General Meeting of Shareholders of Cabcharge Australia Limited will be held at the Westin Sydndey, Heritage Ballroom, 1 Martin Place, Sydney NSW 2000 on 28 November 2000 at 11am. CORPORATE DIRECTORY Cabcharge’s Vision for the new millennium was to successfully list on the Australian stock exchange and to provide a sound investment with the capacity to build wealth for our shareholders. Cabcharge is pleased to say that the Company has achieved these goals. Cabcharge will continue to build on our competitive position and understanding of the Taxi Industry to enhance gains in revenue and operating efficiencies. With the ongoing dedication and effort of our employees and support of our stakeholders, licensees, customers and suppliers, Cabcharge will continue to be the acknowledged leader in ‘common payment’ electronic technology systems for public transport. 1 CHAIRMAN’S REPORT I am pleased to report that in the year under review Cabcharge Australia Limited has achieved another record profit of 11 million dollars in a difficult trading year. Earnings per share increased to 12.1 cents compared with the 2000 forecast of 10.2 cents per share. These earnings were achieved on cost savings and operational efficiencies implemented during the year, including interest income generated from the sale of shares and from investments, changes to the basis for fee payments to participating networks, and maintenance of conservative levels of gearing. -

Airbnb Supplementary Submission | WA Economics and Industry Standing Committee

BNB SUB 160A Rec'd 10/04/2019 Economics and Industry Standing Committee Legislative Assembly of Western Australia Inquiry into Short-Stay Accommodation Airbnb Supplementary Submission Thank you for the opportunity to make a supplementary submission to the Inquiry into Short-Stay Accommodation following the public hearing on 20th February 2019. This supplementary submission provides further information which addresses issues the Committee has considered throughout the public hearing process. Economic Impact of Airbnb in Western Australia Airbnb’s submission outlined the economic impact of Airbnb in Western Australia, referring to a report by Deloitte Access Economics — Economic E!ects of Airbnb in Australia : Western Australia — which found that in 2015-2016 Airbnb guests who stayed in Western Australia spent $155.1 million, which supported 780 jobs, including 180 jobs in areas outside Perth, in brick-and-mortar businesses such as cafes, restaurants, and retailers, and contributed $99.7 million to Gross State Product.1 Airbnb understands that the Committee is interested in more recent data to inform their understanding of the economic contributions of home sharing to Western Australia. Unfortunately, the scope and detail of the report referred to above and in our original submission is not able to be replicated by Airbnb at this stage. To inform the Committee’s understanding however, this supplementary submission includes some further information on Airbnb’s economic activity utilising Airbnb’s internal data. The Committee should note that 1 Deloitte Access Economics 2017, Economic E!ects of Airbnb in Australia, pp.55-57. !1 the information included in the report by Deloitte Access Economics and the "gures below utilise two di#erent data sets - both temporally and geographically. -

Connecting You with People and Places

Connecting You with People and Places Annual Report 2017 CABCHARGE ANNUAL REPORT 2017 Connecting You with People and Places Our vision is to be Australia’s leading personal transport business and the first choice for Passengers, Drivers, Taxi Operators and Network Partners. Cabcharge continues to invest in its vision and overarching purpose of Connecting You with People and Places. We are determined to capture opportunities in the growing personal transport market and win customers through exceptional service that is dependable and trusted. Our industry continues to evolve providing considerable scope for growth. We will draw from our knowledge, strength and experience in order to shape, facilitate and benefit from the transition to an increasingly mobile society. CABCHARGE ANNUAL REPORT 2017 Contents Who We Are 02 Chairman’s Message 08 Chief Executive Officer’s Report 10 Opportunities for Growth 12 Board of Directors 14 Executive Team 16 Operating and Financial Review 18 Corporate Governance Statement 29 Directors’ Report 44 Remuneration Report 50 Auditor’s Independence Declaration 70 Consolidated Financial Statements 71 Directors Declaration 114 Independent Auditor’s Report 115 Shareholder Information 120 Corporate Directory 121 CABCHARGE ANNUAL REPORT 2017 Who We Are 02 CABCHARGE ANNUAL REPORT 2017 Payments Cabcharge has been an innovator of payment technology for over 40 years. We specialise in secure, convenient and flexible travel payment solutions designed to meet the needs of Passengers, Account Clients, Drivers and Taxi Networks. Our in-car and handheld electronic terminals process a variety of non-cash payment products, including a wide range of cards as well as contactless smart phone payments. -

2019 Annual Report

Annual Report 2019 A2B Australia Limited ABN 99 001 958 390 Contents From A FY19 Highlights 2 Our Business 4 Networks Brand Profile: 13cabs 6 Technology Brand Profile: mti 8 At A2B we have Payments Brand Profile: Cabcharge 10 a clear purpose – Letter from the Chairman 12 creating confidence Letter from the CEO 14 in people’s plans. In the Community 16 Board of Directors 18 Operating and Financial Review 20 We believe in shaping Corporate Governance Statement 34 inspiring realities for Directors’ Report 48 tomorrow, in growing Remuneration Report 52 our business and in Auditor’s Independence Declaration 70 making the world Consolidated Financial Statements 71 a better place. Directors’ Declaration 113 Independent Auditor’s Report 114 Shareholder Information 119 Corporate Directory IBC a2b Annual Report 2019 To B 6.7% REVENUE GROWTH 9.8% moving UNDERLYING NPAT GROWTH forward 8¢ PER SHARE DIVIDEND • TAXI NETWORK • PAYMENT TERMINAL PROVIDER • TAXI APP Build trust • PASSENGER FEEDBACK When I’m on the run, dashing from my flat to the city, meeting‑to‑meeting, client‑to‑client, certain factors become a business imperative for me when choosing a personal transport service. For me, that's 13cabs. Ease of use, and by that I mean, is it easy to book and pay followed by FROM: CITY reliability and consistency. TO: HOME Knowing that my taxi will be on time, and the Driver knows how to get me to my destination quickly. For a fair go 2 a2b Annual Report 2019 $16.5m $14.1m STRONG NET IMPROVEMENT IN CASH POSITION STATUTORY PROFIT Always look ahead FROM: CITY TO: BEACH • PASSENGER FEEDBACK I often travel alone or late at night to meet my BFF’s and to get home afterwards. -

Chapter 1: Introduction

Chapter 1: Introduction Is it possible for an Australian government to be humane towards asylum seekers, and what part do the people of Australia have to play in the process? In order to answer these questions, this thesis explores Australia’s responses to refugee and asylum seekers by government, media, and citizens, through a particular focus on Afghan Hazara refugees who settled in Murray Bridge, South Australia early this century. It presents an in depth exploration of the ‘boatpeople crisis’ faced by the government of Prime Minister John Howard, and in so doing provides new insights into the problem of asylum seekers faced by subsequent governments. The thesis examines one of the measures developed to prevent and deter arrivals of the ‘boatpeople’ introduced by the Howard government, the Temporary Protection Visa (TPV). Other studies have examined the effects of the visa on its holders, but this study focuses on the effects of the visa subclass on Australian attitudes towards TPV holders and asylum seekers. The main problem studied is how the integration of TPV holders played out in the face of legislation designed to prevent it. It examines the process of integration of TPV holders in the Murray Bridge community, tracing the transformation of attitudes amongst the residents until they were accepted as ‘mates’ and the town united with them to struggle against the severe conditions imposed by the visa. The results of the study show the power of face-to-face contact to overcome xenophobia, one of the major drivers of anti-asylum seeker policies in the developed world. -

The Carbn Footprint of Aircraft Operations in Australia

Living with a Plug-in Electric Car in Canberra Driving towards a sustainable ACT Dave Southgate 1 August 2014 FOREWORD The electric car has arrived! After decades of false starts, production models of plug-in electric vehicles (EVs) are now globally available from major car manufacturers. They are beautiful to drive and cost very little to run. However, at the moment they cost more to buy and generally have a shorter range than conventional cars. The sales of EVs are growing rapidly around the world – more than 500,000 plug-in EVs have been sold globally over the past three years. To date this revolution has largely passed Australia by. It is exceptional to see a plug-in electric car on the streets in Canberra and the mainstream media in Australia rarely reports on this fundamental transition in the fuelling of the world’s land transport. I have therefore produced this book in an attempt to both raise awareness of the practicalities of owning an EV in Canberra and, probably more importantly, to draw attention to how the advent of the EV provides the ACT with opportunities to establish a sustainable future. The introduction of EVs into Canberra is particularly important given the wonderful strides that the ACT Government has made in introducing renewable energy into the Territory. By 2020 90% of our electricity consumption should be derived from renewables. An electricity sector based on renewables opens up a vision of carbon free urban transport. At the present time the electricity and transport sectors make up about 85% of the ACT carbon footprint – the path to almost total elimination of carbon from these two sectors is now in sight.