Q1 2013 Report Strong Growth in Emerging Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Viaplay Included in Bahnhof's Top-Tier TV Package and Available As Add-On Subscription • Bahnhof to Distribute NENT Grou

• Viaplay included in Bahnhof’s top-tier TV package and available as add-on subscription • Bahnhof to distribute NENT Group’s premium V channels for the first time • Partnership reflects NENT Group’s unique content offering and strategic focus on long-term distribution deals Nordic Entertainment Group (NENT Group), the Nordic region’s leading streaming company, has extended and expanded its distribution agreement with Swedish broadband and IPTV provider Bahnhof. NENT Group’s Viaplay streaming service will continue to be available to Bahnhof’s 350,000 customers in Sweden as an add-on subscription, and Viaplay’s TV & Movie package will now be included in Bahnhof’s top-tier TV offering, TV Stor. In addition, Bahnhof customers can add NENT Group’s premium V film and sports channels to their subscriptions for the first time, and the recently launched V Sport Extra channel will be included in the TV Stor package. NENT Group’s Swedish channels TV3, TV6, TV8 and TV10 will remain part of all Bahnhof’s TV packages. Kim Poder, NENT Group Chief Commercial Officer: “Our content offering is in a class of its own, and we are delighted to expand this relationship with Bahnhof, which is one of Sweden’s fastest growing operators. We have recently renewed our Swedish rights to the Premier League until 2028, we will be the home of FIS winter sports from 2021 and we continue to invest in Viaplay originals, the best Hollywood films and series, and high-quality kids content. We want Viaplay and our unique content to be as widely available as possible, and we are constantly exploring new ways to bring them to even more homes.” Jon Karlung, CEO, Bahnhof: “I am excited that we now have one of Sweden’s strongest entertainment offerings, thanks to our newly expanded agreement with NENT Group.” The partnership with Bahnhof reflects NENT Group’s strategic focus on long-term distribution deals that ensure the broad availability of its streaming services and TV channels across the Nordic region. -

Kanaloversigt - Digital Tv Gældende for Eniig, Nord Energi Og RAH Fibernet

Kanaloversigt - Digital tv Gældende for Eniig, Nord Energi og RAH fibernet Plads Navn Tv-Pakke Plads Navn Tv-Pakke Lille Mellem Stor Lille Mellem Stor 1 DR 1 X 39 Folketinget X TV 2 | Danmark ID Investigation 2 X 40 X HD Discovery TV2 Regional TV3 3 X 41 Viasat Explore HD X HD Danmark 4 TV3+ HD X 42 Viasat History HD X 5 Kanal 5 X 43 Viasat Nature HD X 6 6’eren HD X 44 V Sport Golf X 7 Kanal 4 X 45 CNN X 8 TV3 Puls HD X 46 TV 2 Sport X X 9 TV 2 Charlie X 47 Boomerang X 10 TV 2 Zulu X 48 Cartoon Network X 11 TV 2 News X 50 Disney Junior X 12 TV 2 Sport X 51 Nick Jr X 13 TV 2 Fri X 54 V Sport Ultra HD X 14 TV3 SPORT X 55 NatGeo Wild HD X 15 TV3 MAX X 62 TV2 | Østjylland X 16 DK4 X 63 TV/Midtvest X Tv Midtvest 17 Ekstrakanalen X 64 TV2/Nord Salto X Tv2 Nord Salto Discovery 18 X 65 TV SYD+ X Channel HD Tv Syd National 70 Østjylland X 19 X Geographic Kanal Østjylland 71 Midt/vest X 20 Animal Planet HD X Kanal Midtvest 72 Kanal Nord X 21 TLC HD X Kanal Nord 73 Syd X 22 Nickelodeon HD X Kanal Syd 78 VH1 X 23 Disney Channel X VH1 85 SVT1 HD X Paramount 24 X SVT 1 Network 87 TV4 Sverige HD X 25 CANAL9 HD X TV4 Sverige 88 DR1Syn X 26 Eurosport HD X DR 1Synstolkning 89 DR2Syn X 27 Eurosport 2 HD X DR 2 Synstolkning 91 NRK 1 HD X 28 MTV HD X NRK 1 93 TV 2 Norge HD X 29 Xee X TV2 Norge 100 Das Erste HD X TV 2 | Danmark Das Erste 30 X HD (Nord) 101 ZDF HD X TV 2 | Danmark ZDF 31 X HD (Østjylland) 103 Sat1 X Sat 1 TV 2 | Danmark 32 X HD (Syd) 104 RTL HD X RTL 33 DR 2 X 153 Stofa Kanalen X Stofa Kanalen 36 DR Ramasjang X Kanaloversigt - Digital radio -

Is There Life After the Crisis?

is There Life afTer The crisis? Analysis Of The Baltic Media’s Finances And Audiences (2008-2014) Rudīte Spakovska, Sanita Jemberga, Aija Krūtaine, Inga Spriņģe is There Life afTer The crisis? Analysis Of The Baltic Media’s Finances And Audiences (2008-2014) Rudīte Spakovska, Sanita Jemberga, Aija Krūtaine, Inga Spriņģe Sources of information: Lursoft – database on companies Lithuanian Company Register ORBIS – database of companies, ownership and financial data worldwide. Data harvesters: Rudīte Spakovska, Aija Krūtaine, Mikk Salu, Mantas Dubauskas Authors: Rudīte Spakovska, Sanita Jemberga, Aija Krūtaine, Inga Spriņģe Special thanks to Anders Alexanderson, Uldis Brūns, Ārons Eglītis For re-publishing written permission shall be obtained prior to publishing. © The Centre for Media Studies at SSE Riga © The Baltic Center for Investigative Journalism Re:Baltica Riga, 2014 Is There Life After The Crisis? Analysis Of The Baltic Media’s Finances And Audiences (2008-2014) Contents How Baltic Media Experts View the Sector ...............................................................................................................4 Introduction: Media After Crisis ..................................................................................................................................7 Main Conclusions ............................................................................................................................................................8 Changes In Turnover of Leading Baltic Media, 2013 vs 2008 ................................................................................9 -

Culture and National Church

Microsoft Word − 04 Culture and church.docx (X:100.0%, Y:100.0%) Created by Grafikhuset Publi PDF. Culture and National Church Museums and cultural heritage Libraries Films and media Theatres Culture, economy and structure National Church Microsoft Word − 04 Culture and church.docx (X:100.0%, Y:100.0%) Created by Grafikhuset Publi PDF. Culture and National Church Museums and cultural heritage 16.1 million visits to museums In 2015, admission rates of Danish museums reached 16.1 million visitors. Of the 254 museums included in the statistics, 130 are subsidized by the state. Museums subsidized or owned by the state had 12.7 million visitors in 2015, equal to 79 per cent of the total number of visitors in 2015. In 2015, the zoological and botanical gardens had a total of 4.9 million visitors. Louisiana the most visited museum Louisiana The Art museum Louisiana account for the highest admission rates of 725,000 visitors. With a total of 580,000 visitors, Rundetårn is now ranked as num- ber two. Figure 1 Museums - the ten highest admission rates Louisiana Museum Rundetårn The National Museum, Prinsens Palais 2015 ARoS, Aarhus Kunstmuseum 2014 Moesgård Museum The Old Town The Danish National Gallery Ny Carlsberg Glyptotek The Rosenborg Collection Frederiksborg Castle 0 100 200 300 400 500 600 700 800 Thousand visits www.statbank.dk/mus Libraries Danes borrow fewer books The population continue to visit public libraries, but they do not borrow as many books as before. Lending of physical books was 26,8 million in 2015, which is 0,8 million fewer loans than the year before. -

![[*TV3-SPORT4!* - Danmark Wales Live Stream♥ {Danmark-Mod-Wales} ► [#Se Danmark Wales Direkte På Nettet Gratis#] ◄EURO](https://docslib.b-cdn.net/cover/4193/tv3-sport4-danmark-wales-live-stream-danmark-mod-wales-se-danmark-wales-direkte-p%C3%A5-nettet-gratis-euro-344193.webp)

[*TV3-SPORT4!* - Danmark Wales Live Stream♥ {Danmark-Mod-Wales} ► [#Se Danmark Wales Direkte På Nettet Gratis#] ◄EURO

[*TV3-SPORT4!* - Danmark Wales Live Stream♥ {danmark-mod-wales} ► [#se Danmark Wales direkte på nettet gratis#] ◄EURO [( Opdateret: 26 juni 2021)]→ ( 1209S ) Danmark Wales live stream Danmark Wales live: sådan ser du EM-fodboldkampen gratis hvor som helst Danmark Wales Den første kamp i ottendedelsfinalerne står mellem de walisiske drager og de danske vikinger Kampen mod Rusland var til at starte med et opgør præget af nerver. Det danske spil manglede flow danmark wales, og kampen var præget af mange afbrydelser - og Rusland havde bestemt ikke travlt. danmark wales Mikkel Damsgaard satte heldigvis gang i festen kort før pausen, da han krøllede bolden op i hjørnet. Russernes gave til Poulsen kort ind i anden halvleg holdt festen kørende, Efter et kort intermezzo, hvor vi skulle gennem hele følelsesregisteret med Belgiens scoring og efterfølgende annullering og Ruslands reducering til 2-1, bragte AC's dommedagsdrøn til 3-1 os i den 7. danmark wales. Så scorede Belgien to mod Finland, og Mæhles kølige afslutning lukkede festen. Det var en magisk aften i Parken. Danmark Wales Sådan ser du EM-fodbold på tv og via livestream Sådan streamer du i danmark wales Det bedste ved danmark wales EURO 2020 er, at du kan se de fleste af kampene gratis i Danmark. Der spilles i alt 51 kampe ved EM. DR viser 32 af dem, mens NENT-kanalerne TV3, TV3+ og TV3 Sport viser de resterende 19. DR1 sender Danmarks sidste indledende kamp mod Rusland. Se Landskampen Danmark - Wales Online Live Streaming! EM i Fodbold 2021: Se Landskampen Danmark - Wales Gratis med Online Live Streaming! Se Fodbold med Mobil, Tablet og PC! EM: Danmark – Wales på Musikkens Plads Mærk fællesskabet og euforien, når vi viser EM-fodbold på Musikkens Plads. -

Levi TV Kanalid

levikom.ee 1213 Paksenduse (bold) ja punase teksti tähistusega telekanaleid on võimalik järelvaadata 7 päeva täies mahus (järelvaatamise teenus on eraldi kuutasu eest)! Telekanalite Levi TV Paras Levi TV Priima Levi TV Ekstra sisaldumine pakettides: - Põhikanaleid 33 kanalit 63 kanalit 69 kanalit - Muid kanaleid 5 kanalit 5 kanalit 10 kanalit KÕIK KOKKU: 38 telekanalit 68 telekanalit 79 telekanalit Eesti telekanalid: ETV ✓ ✓ ✓ ETV2 ✓ ✓ ✓ Kanal 2 ✓ ✓ ✓ TV3 ✓ ✓ ✓ TV6 ✓ ✓ ✓ Kanal 11 ✓ ✓ ✓ Kanal 12 ✓ ✓ ✓ Alo TV ✓ ✓ ✓ Taevas TV7 ✓ ✓ ✓ Eesti Kanal ✓ ✓ ✓ Eesti Kanal Pluss ✓ ✓ ✓ (11 kanalit) (11 kanalit) (11 kanalit) Eesti kanalid HD formaadis (duplikaadina): ETV HD ✓ ✓ ✓ ETV2 HD ✓ ✓ ✓ Kanal 2 HD ✓ ✓ ✓ Kanal 11 HD ✓ ✓ ✓ Kanal 12 HD ✓ ✓ ✓ TV3 HD ✓ TV6 HD ✓ (5 kanalit) (5 kanalit) (5 kanalit) Laste ja noorte telekanalid: Kidzone ✓ ✓ ✓ Kidzone+ HD ✓ ✓ Smartzone HD ✓ ✓ KiKa HD ✓ ✓ Nick JR ✓ ✓ Nickelodeon ✓ ✓ TEL 1213 TEL +372 684 0678 Levikom Eesti OÜ Pärnu mnt 139C, 11317 Tallinn [email protected] | levikom.ee Pingviniukas ✓ ✓ ✓ Multimania ✓ ✓ ✓ Mamontjonok ✓ ✓ ✓ (4 kanalit) (9 kanalit) (9 kanalit) Filmide ja sarjade telekanalid: Epic Drama HD ✓ ✓ ✓ TLC ✓ ✓ ✓ Sony Channel HD ✓ ✓ Sony Turbo HD ✓ ✓ FOX ✓ ✓ FOX Life ✓ ✓ Filmzone ✓ ✓ Filmzone+ HD ✓ ✓ Kino 24 ✓ ✓ ✓ Pro100TV ✓ ✓ ✓ Dom Kino ✓ ✓ ✓ (5 kanalit) (9 kanalit) (11 kanalit) Sporditeemalised telekanalid: Eurosport 1 HD ✓ ✓ ✓ Eurosport 2 HD ✓ ✓ ✓ Setanta Sports HD ✓ ✓ ✓ Fuel TV HD ✓ ✓ Nautical Channel ✓ ✓ (3 kanalit) (5 kanalit) (5 kanalit) Teaduse, looduse ja tõsielu teemalised telekanalid: Discovery -

Drama Directory

2015 UPDATE CONTENTS Acknowlegements ..................................................... 2 Latvia ......................................................................... 124 Introduction ................................................................. 3 Lithuania ................................................................... 127 Luxembourg ............................................................ 133 Austria .......................................................................... 4 Malta .......................................................................... 135 Belgium ...................................................................... 10 Netherlands ............................................................. 137 Bulgaria ....................................................................... 21 Norway ..................................................................... 147 Cyprus ......................................................................... 26 Poland ........................................................................ 153 Czech Republic ......................................................... 31 Portugal ................................................................... 159 Denmark .................................................................... 36 Romania ................................................................... 165 Estonia ........................................................................ 42 Slovakia .................................................................... 174 -

Brugerafstemning

Vejledende BRUGERAFSTEMNING PROGRAM: DR1 DR2 DR Update DR K DR Ramasjang TV2 TV2 Charlie TV2 News TV2 Film TV2 Zulu TV2 Sport Infokanal Kanal 4 Kanal 5 6´eren 9´eren DK4 TV3 TV3+ TV3 Puls Eurosport På generalforsamlingen i foråret blev det besluttet, at Brønder- Eurosport 2 slev Antennelaug i løbet af efteråret skulle gennemføre en bru- 24 Nordjyske gerafstemning omkring programmer. DK4 God TV ( God Channel ) Brugerafstemningen skal snart løbe af stabelen. Til højre er Prøvekanalen Dan ToTo Racing listet de programmer, som bestyrelsen vil foreslå, at der kan CNN stemmes om. MTV Danmark The Voice TV Er der et eller fl ere programmer, du synes der også skal til af- Discovery stemning, vil vi bede dig om at sende nedenstående kupon med TCM forslag, således at den er bestyrelsen i hænde senest den 5. ok- Viasat Explorer/Spice Viasat History tober. Viasat Nature/Crime/Playboy Kuponen skal sendes til Brønderslev Antennelaug, Rasmus Rask Viasat Golf Vej 1, 9700 Brønderslev, og husk at det kun er medlemmer af National Geographic Brønderslev Antennelaug, der har mulighed for at få ønsker med. National Geographic Wild Du kan evt. også sende dine forslag på: [email protected], husk at Animal Planet BBC Entertainment oplyse navn og adresse. BBC World News I løbet af kort tid vil den endelige stemmeseddel blive omdelt VH 1 DK til samtlige medlemmer. Denne brugerafstemning er med til at Discovery danne grundlag for fremtidig programfl ade. Discovery World Discovery Science Discovery Travel & Living Sverige TV1 Sverige TV2 TV4 Sverige NRK1 NRK TO TV 2 Norge Rasmus Rask Vej 1 . -

30,-/Md. – Vælg Tv, Radio Og Bredbånd Med Lige Vilkår for Alle

Bland din egen tv- og streamingpakke Ønsker du at sammensætte din egen tv-pakke, kan du bestille Du skal bare vælge, om du vil have 11 eller 36 point at blande for. en Bland Selv-pakke. Med Bland Selv mikser du din egen tv- og Hver streamingtjeneste og hver tv-kanal har nemlig en bestemt streamingpakke ved hjælp af point på toppen af Pakke 1. pointværdi, og du blander frit, indtil du har brugt dine point. Spark Bland Selv-pakker Tv-kanaler – 1 point pr. kanal Streamingtjenester – fra 2 point pr. tjeneste Sport Dokumentar 6 point 6 point Bland Selv 11 11 Pakke 1 + 11 point point 2020 i gang 5 point 4 point 4 point 4 point – vælg tv, radio og bredbånd med lige vilkår for alle Bland Selv 36 36 Pakke 1 + 36 point point 3 point 3 point * Pointværdien varierer, alt efter hvilke type Netflix-abonnement og Bland Underholdning Børn Selv-pakke, du vælger 3 point 2 point Kommer i Tag din tv-pakke med på farten løbet af 2020 Med YouSee Tv & Film-appen har du nem og hurtig adgang til din tv-pakke fra HAS. Så kan du * nemlig se alle dine favoritkanaler Basis Standard Premium på mobil, tablet eller pc – uden Bland Selv 11 5 point 6 point 7 point det koster ekstra. Se fx børnefilm Musik Nyheder Bland Selv 36 10 point 13 point 17 point på bagsædet, live-sport på ferien, eller nyd en serie under dynen. Se mere på has.dk/webtv. For at se TV 2 via YouSee Tv & Film- appen, skal du være på HAS Bredbånd eller have et TV 2 UDE abonnement. -

Tv Og Streaming 2020

2020 MEDIERNES UDVIKLING I DANMARK MEDIERNESUDVIKLING.SLKS.DK TV OG STREAMING 2020 FOTO: COLOURBOX ISSN 2445-852X TV OG STREAMING 2020 INDHOLD Introduktion ...................................................................................................................................................... 2 Hovedresultater og konklusion .................................................................................................................... 5 TV-forbrug på flere platforme ....................................................................................................................... 8 TV-husstande i danmark ............................................................................................................................... 11 Tv-forbruget i Danmark ................................................................................................................................. 13 5.1 Den gennemsnitlige tv-sening ........................................................................................................................................................ 13 5.2 Tv-seernes demografi ............................................................................................................................................................................ 15 5.2.1 Alder ............................................................................................................................................................................................ 15 5.2.2 Uddannelse ............................................................................................................................................................................ -

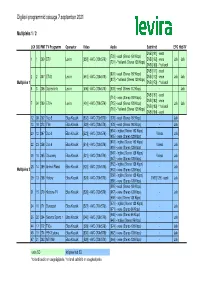

Levira DTT Programmid 09.08.21.Xlsx

Digilevi programmid seisuga 7.september 2021 Multipleks 1 / 2 LCN SID PMT TV Programm Operaator Video Audio Subtiitrid EPG HbbTV DVB [161] - eesti [730] - eesti (Stereo 192 Kbps) 1 1 290 ETV Levira [550] - AVC (720x576i) DVB [162] - vene Jah Jah [731] - *hollandi (Stereo 128 Kbps) DVB [163] - *hollandi DVB [171] - eesti [806] - eesti (Stereo 192 Kbps) 2 2 307 ETV2 Levira [561] - AVC (720x576i) DVB [172] - vene Jah Jah [807] - *hollandi (Stereo 128 Kbps) Multipleks 1 DVB [173] - *hollandi 6 3 206 Digilevi info Levira [506] - AVC (720x576i) [603] - eesti (Stereo 112 Kbps) - - Jah DVB [181] - eesti [714] - vene (Stereo 192 Kbps) DVB [182] - vene 7 34 209 ETV+ Levira [401] - AVC (720x576i) [715] - eesti (Stereo 128 Kbps) Jah Jah DVB [183] -* hollandi [716] - *hollandi (Stereo 128 Kbps) DVB [184] - eesti 12 38 202 Duo 5 Elisa Klassik [502] - AVC (720x576i) [605] - eesti (Stereo 192 Kbps) - Jah 13 18 273 TV6 Elisa Klassik [529] - AVC (720x576i) [678] - eesti (Stereo 192 Kbps) - Jah [654] - inglise (Stereo 192 Kbps) 20 12 267 Duo 3 Elisa Klassik [523] - AVC (720x576i) Videos Jah [655] - vene (Stereo 128 Kbps) [618] - inglise (Stereo 192 Kbps) 22 23 258 Duo 6 Elisa Klassik [514] - AVC (720x576i) Videos Jah [619] - vene (Stereo 128 Kbps) [646] - inglise (Stereo 128 Kbps) 26 10 265 Discovery Elisa Klassik [521] - AVC (720x576i) Videos Jah [647] - vene (Stereo 128 Kbps) [662] - inglise (Stereo 128 Kbps) 28 14 269 Animal Planet Elisa Klassik [525] - AVC (720x576i) - Jah Multipleks 2 [663] - vene (Stereo 128 Kbps) [658] - inglise (Stereo 128 Kbps) -

Kanalplan Laholm (HC561)

C561000 150331 Kanalplan Laholm (HC561) SVT1 Sveriges Televisions huvudkanal, med ett utbud som omfattar allt från familjeunderhållning till debattprogram, barnprogram och kultur. Kanalplats 04. SVT2 Sveriges Televisions andra kanal, med ett utbud som omfattar allt från familjeunderhållning till debattprogram, barnprogram och kultur. Kanalplats 06. TV4 Den breda svenska underhållningskanalen med populära serier, filmer, sport, nyheter och dokumentärer. Kanalplats S10 E8. Barnkanalen SVT:s egna, reklamfria barnkanal varvar klassiska favoriter med nya produktioner. Kanalen fokuserar även på interaktivitet och barnens egen medverkan. Kanalplats S14. Kunskapskanalen SVTs kanal som sänder program inom ämnesområden som historia, natur, vetenskap, kultur, omvärld och språk. Kanalplats S16. SVT 24 Temakanal för sport och nyheter. Samhällsprogram och fördjupningar varvas med en mängd olika sporter. Kanalplats S14. TV 3 är kanalen som bjuder på underhållande program i form av film, serier, talkshows etc. Kanalplats E9. Kanal 5 är en av Sveriges största TV-kanaler och gör TV för moderna och aktiva människor, med inriktning på underhållning, serier, drama och film. Kanalplats 11. TV 6 är den nya breda underhållningskanalen. Kanalen är ett perfekt komplement till TV3 och ger dig bl a sport, actionfilmer, humor och realityserier. Kanalplats S19. Sjuan Sjuan är en bred kvinnlig kanal som bjuder på mängder av färgstark underhållning i form av realityserier, dramaserier, filmer och spänning. Kanalplats 12. Discovery Channel Unika produktioner om forskning, vetenskap, teknik, natur och historia. Kanalplats S18. MTV Europas mest populära musikkanal med intervjuer, livespelningar, hitlistor och mycket mer – dygnet runt! Kanalplats S15. TV 8 Svensk aktualitetskanal som blandar nyheter, inrikes- och utrikesmagasin och dokumentärer med filmer och underhållning. Kompletteras med börsinfo från Bloomberg, DiTV och nyheter från Deutsche Welle.