PEAB ANNUAL REPORT 1999 C O N T E N T S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual and Sustainability Report 2018

Annual and Sustainability Report 2018 We build for a better society. B Skanska Annual and Sustainability Report 2018 Operations Skanska’s operations consist of Construction and Project Development, including Residential Development, Commercial Property Development and, until 2018, Infrastructure Development. Business units within these streams collaborate in various ways, creating operational and financial synergies that generate increased value. Residential Commercial Property Infrastructure Construction Development Development Development 1 Constructs and renovates build- Develops new residential projects, Develops customer-focused office Secures and manages the value ings, infrastructure and homes, including single and multi-family buildings, shopping centers and of Skanska’s existing public- along with facilities manage- housing, built by the Construction logistics properties built by the private partnership (PPP) assets. ment and other related services. business stream. Construction business stream. 1 As of January 1, 2019, Infrastructure Development is no longer a business stream and is reported in Central on a separate line. Well diversified, Percentage of total revenue in 2018 with a leading market position Skanska’s diversification across various business streams with operations in eleven countries and several market segments strengthens the Group’s 40% SwedenSweden competitive standing and ensures FinlandFinland Norway a balanced and diversified risk profile. USA 38% Denmark United Kingdom Poland Czech Republic SlovakiaSlovakia Hungary 22% Romania Green revenue in 2018 Green market value in 2018 Green financing in 2018 Percentage of total Construction revenue Percentage of Commercial Property Percentage of total central debt 3 that is that is Green and Deep green, as defined Development market value from Green Green, according to the Skanska Green by the Skanska Color Palette™ 2. -

Annual Report 2001 (Pdf)

NCC 2001 REPORT ANNUAL CONTENTS/TURN FLAP responsibility focus simplicity NCC AB, SE-170 80 Solna, Sweden. Tel +46 8 585 510 00. Fax +46 8 85 77 75. www.ncc.se NCC Annual Report 2001 CONTENTS THIS IS NCC TOMORROW’S ENVIRONMENTS FOR WHERE TO FIND NCC WORKING, LIVING AND COMMUNICATIONS ASPHALT, AGGREGATES, MACHINERY RENTAL 1 Responsibility,focus,simplicity SALES NCC is one of the leading construction and property-developing companies in the Nordic region. NCC AB NCC Construction NCC Construction se Norway Sweden PAVING, CONCRETE, 1997–2001, SEK BN -170 80 Solna Altima AB 2 Highlights of 2001 The Group had annual sales of SEK 46 billion in 2001, with 28,000 employees. Street address: Vallgatan 3 NCC Norge A/S se-170 80 Solna ROAD SERVICES, p.b Tagenevägen 25 3 Review by the president 50 Tel: +46 8 585 510 00 93 Sentrum Tel: +46 8 585 510 00 TRAFFIC SAFETY se- 46.1 n 425 37 Hisings Kärra NCC constructs roads and civil engineering facilities, telecommunications infrastructure, hous- Fax: +46 8 85 77 75 -0101 Oslo Fax: +46 8 624 05 19 NCC Roads 6 Strategic orientation and financial objectives 40.8 Tel: +46 31 57 67 00 40 E-mail: [email protected] Tel: +47 22 98 68 00 E-mail: [email protected] Tuborg Havnevej 15 10 The NCC share 37.5 ing, offices and other buildings. It also produces building materials and is one of the largest sup- Fax: +46 31 57 67 50 34.2 www.ncc.se Fax: +47 22 98 69 23 www.ncc.se dk 32.1 -2900 Hellerup www.altima.se pliers of aggregates, asphalt and ready-mixed concrete in the Nordic region. -

Ncc A-Del ENG Slutkorr 2 98-04-01 10.33 Sidan 1 Summary

/ncc A-del ENG slutkorr 2 98-04-01 10.33 Sidan 1 Summary Summary Pro forma consolidated income after net financial KEY FIGURES IN BRIEF items, excluding merger costs, amounted to SEK 1997 1996 Income after net financial items 74 m. (273). Including merger costs, a loss of SEK excluding merger costs, SEK m.1 74 273 375 m. was reported after net financial items. Equity/assets ratio 33% 30% Net income after full tax and excluding merger Earnings/loss per share excluding merger costs, SEK 2.60 2.00 costs amounted to SEK 276 m. (159) which Dividend per share, SEK 1.50 2 1.50 corresponds to SEK 2.60 (2.00) per share. 1) Pro forma, see page 62. Including merger costs, a net loss of SEK 173 m. 2) Board of Directors’ proposal to Annual General Meeting was reported, which corresponds to a loss of SEK 1.60 per share. A dividend of SEK 1.50 (1.50) per share is proposed. BO AX:SON JOHNSON Bo Ax:son Johnson died on May 9, 1997, Total orders received by construction operations at an age of 79. Bo Ax:son Johnson was rose 9 percent to SEK 29.8 billion (27.3). On a active in the Nordstjernan Group for 52 years, the last 18 of which as Chairman of pro forma basis, orders received by NCC’s Nordstjernan. Swedish construction operations declined by During these years, Bo Ax:son Johnson 9 percent during the year to SEK 18.3 billion became intimately associated with Sweden’s industrial history and the (20.0). -

Communication of Corporate Social Responsibility

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Epsilon Archive for Student Projects Communication of Corporate Social Responsibility - the case of Skanska AB Carolina von Schantz SLU, Department of Economics Thesis 403 Masters Thesis in Business Administration Uppsala 2005 D-level, 30 ECTS credits ISSN 1401-4084 ISRN SLU-EKON-EX--403--SE iiiii ii Communication of Corporate Social Responsibility – the case of Skanska AB Kommunikation av företagens samhällsansvar – Fallstudien Skanska AB Carolina von Schantz Supervisor: Cecilia Mark-Herbert iii © Carolina von Schantz, [email protected] Swedish University of Agricultural Sciencesa Department of Economics Box 7013 SE-750 07 Uppsala ISSN 1401-4084 ISRN SLU-EKON-EX--403--SE Tryck: SLU, Institutionen för ekonomi, Uppsala, 2005 iv Acknowledgements The Masters thesis is intended to be the final assignment for each student from the Business Administration program at the Swedish University of Agriculture, SLU. I have studied and worked at SLU since 1999 and it is not without a feeling of nostalgia that I am closing my time as a student with this Masters thesis assignment. I have chosen a topic that I find very important and interesting and I believe this has helped me in the process of accomplishing the thesis. While I have been solely responible for the writing of this thesis, I would like to extend my thanks to the following people for their valuable contributions to the process in general. Cecilia Mark-Herbert from the Department of Economics at SLU has been my instructor and advisor. I am very happy that I have had the opportunity to work together with Cecilia, she has been very engaged in my task and shared her knowledge about the chosen research topic as well as her experiences as a researcher. -

Annual Report

NCC ANNUAL REPORT 2016 Annual Report 2016 II NCC 2016 AVSNITTSMARKERING NCC Annual Report 2016 Contents NCC in brief 2 Review by the President 4 The inclusive city 6 Driving forces 8 Value generation for stakeholders 9 Strategy 10 – NCC’s objectives 12 The NCC share 16 BUSINESS AREAS Industry 18 Building 22 Infrastructure 27 Property Development 32 SUSTAINABILITY NCC’s sustainability efforts 36 Health and safety 39 Social inclusion 40 Materials and waste 41 Climate and energy 42 Ethics and compliance 44 Product portfolio 45 FINANCIAL REPORT Reports of the Board of Directors 46 Risk 51 Consolidated income statement 54 Consolidated balance sheet 56 Parent Company income statement 58 Parent Company balance sheet 59 Changes in shareholders’ equity 60 Cash-flow statements 62 Notes 64 Appropriations of profits 98 Auditors’ report 99 Multi-year review 102 Quarterly data 105 CORPORATE GOVERNANCE Corporate governance report 106 Report on internal control 110 Board of Directors and Auditors 112 Group Management 114 “ We will Financial information/contacts 116 Definitions 117 renew our industry The formal Annual Accounts, which have been signed by the Board of Directors and examined by the providing auditors, are pages 46–98. superior sustainable solutions.” NCC 2016 1 AVSNITTSMARKERING Cash flow before financing 1,050 Orders received SEK M 56,506 Return on equity SEK M 23% Operating profit 1,453 SEK M Net sales 52,934 SEK M “ We will Key figures above pertain to remaining operations in NCC, excluding Bonava. renew our industry providing superior sustainable COVER solutions.” Aarhus: Library and Municipal Building at Aarhus Harbor – completed in 2016. -

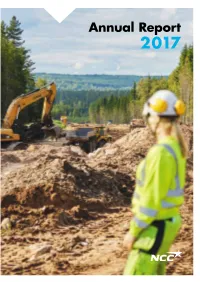

Annual Report 2017 (Pdf)

NCC ANNUAL REPORT 2017 Annual Report 2 017 NCC’s Annual Report 2017 Contents THIS IS NCC NCC 2017 2 Review by the President 4 STRATEGY Strategy 6 Sustainability strategy 8 Financial – and sustainability targets 10 Challenges and needs for cities 13 THE OFFERING Live 18 Work 20 Travel 22 Care 24 Learn 26 NCC Design housing with a high-quality living standard designed for the Nordic Experience 28 ecolabel. Read more on p. 19. What has to work 30 Employees 32 Value creation 34 The NCC share 36 FINANCIAL REPORT Report of the Board of Directors 38 Risk 46 Consolidated income statement 48 Consolidated balance sheet 50 Parent Company income statement 52 Parent Company balance sheet 53 Changes in shareholders’ equity 54 Cash-flow statements 56 Notes 58 Appropriation of profits 96 Auditors’ report 97 Multi-year review 100 Quarterly data 103 Loop Rocks is an open platform and app for the smarter and more efficient handling of rock, earth and other secondary construction masses at construction sites, between businesses and private individuals. Read more on p. 30. SUSTAINABILITY NOTES Sustainability governance 104 Stakeholder dialog and materiality analysis 105 Material topics 106 GRI Index 111 CORPORATE GOVERNANCE Corporate governance report 114 Report on internal control 118 Board of Directors and Auditors 120 Executive Management Group 122 Financial information/contacts 124 Definitions/glossary 125 NCC has total responsibility for the maintenance of Frogner Park, one of the largest tourist attractions in Norway. Read more on p. 28. The formal Annual Accounts documentation, which has been prepared according to the Annual Accounts Act, has been signed by the Board of Directors and examined by the auditors, are pp. -

Epoc 2016 European Powers of Construction Epoc Is an Annual Publication Produced by Deloitte and Distributed Free of Charge

EPoC 2016 European Powers of Construction EPoC is an annual publication produced by Deloitte and distributed free of charge Director Javier Parada, partner in charge of the Infrastructure Industry, EMEA Coordinated by Margarita Velasco Martín Alurralde Serra Raquel Sánchez Macías Published by Communications, Brand and Business Development department Contact Infrastructure Department, Deloitte Madrid Plaza Pablo Ruiz Picasso, S/N Torre Picasso 28020 Madrid, Spain Phone + 34 91 514 50 00 Fax + 34 91 514 51 80 June 2017 EPoC 2015 | European powers of construction Contents 4 Introduction 5 Ranking of listed European construction companies 7 Top 50 EPoC – ranking by sales 8 Top 20 EPoC – ranking by market capitalisation 10 Outlook for the construction industry in the EU 15 Top 20 EPoC strategies: internationalisation and diversification 21 EPoC 2016 financial performance 33 Diversification of the EPoC 2016 40 Financing of EPoC 2016 43 Internationalisation: Business opportunities 51 Performance of non-European construction companies 58 Top 20 EPoC – Company profiles 3 EPoC 2016 | European Powers of Construction Introduction The fourteenth edition of European Powers of Construction analyses the current economic situation of the construction industry and examines the strategies and performance of the most representative listed European construction groups in 2016. We are pleased to present European This publication includes an analysis of 20 listed European construction companies Powers of Construction 2016, our annual the current macroeconomic situation in terms of revenue. For the selected publication in which we identify and outline and expectations for coming years in companies, we present key data regarding the major listed European construction the European construction industry. -

Swedish Transport Administration Minnesota Department of Transportation September 28-29, 2015 Minnesota Visit

Swedish Transport Administration Minnesota Department of Transportation September 28-29, 2015 Minnesota Visit Monday September 28th @MnROAD Research Facility 9:00 Welcome / Introductions Group 9:30 Goals for the next two days Group 9:45 MnROAD overview Worel 10:15 MnROAD Tour (Mainline / Low Volume Road) Worel 12:00 Lunch (Box Lunch) 1:00 Strategy for test section planning, reasoning behind etc Worel / Group NRRA (National Road Research Alliance) Involvement 1:15 Instrumentation and Data Gathering Palek / Group 2:00 Rolling resistance / Noise Izevbekhai 3:00 Break 3:30 MnROAD and NCAT Partnership • Pavement Preservation Johnson • HMA Performance Test Van Deusen 4:25 Minnesota DCT Testing Hanson 4:45 International Cooperation Worel DCT Testing of Norwegian and Swedish HMA samples 5:00 Adjourn Evening On your own Tuesday September 29th @Maplewood Lab Facility 9:00 Welcome / Introductions Engstrom 9:15 Swedish Company/Group Presentations Group (Visit Objectives) Optimized asphalt thickness in road a constructions-project Gudmarsson Test Road Skänninge - Design-Build project Ekblad 10:15 Break 10:45 Maplewood Lab Overview Engstrom 11:00 Maplewood Lab Tour (3 groups) • Binder Lab Tour • Mixture Lab • DCT Testing 12:00 Lunch 1:00 Intelligent Construction Embacher 1:45 Pavement Design (MnDOT and Sweden) Andersen • (12) MnPAVE Tanquest • (13) MnPAVE Inputs Henricks • (14) MnDOT Asphalt Specs Gallistel • Minnesota Experiences with the Design Guide (comments) Dai 3:00 Break 3:15 Minnesota’s Experience with 3D GPR Dai 3:45 Discussion – other topics **Not Presented topics** Swedish experience of TSD-testing (Nilsson) MnDOT GeoGrid Design Process (Siekmeier) 4:00 Swedish Research Priorities Winnerholt Minnesota Research Priorities VanDeusen 5:00 Adjourn Evening All participants, presenters and guides are invited to join a dinner hosted by the “Optimized asphalt thickness in road constructions-project”. -

Case M.9316 - PEAB / YIT's PAVING and MINERAL AGGREGATES BUSINESS

EUROPEAN COMMISSION DG Competition Case M.9316 - PEAB / YIT'S PAVING AND MINERAL AGGREGATES BUSINESS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 26/03/2020 In electronic form on the EUR-Lex website under document number 32020M9316 EUROPEAN COMMISSION Brussels, 26.03.2020 C(2020) 2002 final PUBLIC VERSION In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party Subject: Case M.9316 – PEAB / YIT’s PAVING AND MINERAL AGGREGATES BUSINESS Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 20 February 2020, the Commission received the notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043 by which Peab AB (“Peab” or “Notifying Party”) acquires sole control of the mineral aggregates business of YIT Oyj (“YIT”) in Denmark, Finland, Norway and Sweden (the “Transaction”, as set out in paragraph 5 below). The business targeted by the acquisition is referred to as the “Target”, while Peab and the Target are collectively referred to as the “Parties”. In a post-Transaction context, Peab, all the subsidiaries under its control and the Target may also be collectively referred to as the “merged entity”. -

Admission to Trading on Nasdaq Stockholm for Shares Of

Admission to trading on Nasdaq Stockholm for shares of series A and series B in Bonava AB (publ) IMPORTANT NOTICE ment nevertheless be provided or made, it tion statements include, but are not limited to, This prospectus (the “Prospectus”) has been should not be considered to have been those described in the section “Risk factors”. prepared due to the resolution of the annual approved by Bonava, and Bonava is not respon- These risk factors include, inter alia, that general meeting of NCC AB (publ) (“NCC”) on sible for such information or statements. Neither Bonava’s earning capacity is dependent on its 12 April 2016 to distribute all shares in Bonava the publication or distribution of this Prospectus, ability to sell housing units to, inter alia, AB (publ) (“Bonava”) through a dividend to the nor any transaction made in respect of the consumers on satisfactory terms, that Bonava’s shareholders of NCC and the application by the Prospectus, shall be deemed to imply that the operations are affected by project related risks board of directors of Bonava to have Bonava’s information in this Prospectus is accurate or and Bonava’s ability to acquire building rights as shares of series A and shares of series B applicable at any time other than on the date of well as Bonava’s ability to maintain equivalent admitted to trading on Nasdaq Stockholm. the publication of this Prospectus or that there brand awareness and position in the market as For definitions of certain terms used in the have been no changes in Bonava’s business Bonava enjoyed as a part of the NCC group. -

Annual Report 1998 (Pdf)

2188/NCC År-98/en (del 1)-5 99-03-30 09.22 Sidan A ANNUAL REPORT 1998 2188/NCC ÅR-98/en (del 1) 99-03-30 08.24 Sidan B CONTENTS CONTENTS Review by the President . 2 FINANCIAL INFORMATION 1999 NCC Future project . 4 May 5 Interim report for the three-month period ending March 31, 1999 Corporate vision and strategy . 6 August 18 Interim report for the six-month NCC´s Trademark . 8 period ending June 30, 1999 Financial requirements . 9 November 8 Interim report for the nine-month period ending September 30, 1999 Human resources . 10 Environmental activities . 12 These reports are sent automatically to NCC shareholders who wish to receive them. Others requiring a copy of these NCC Technology . 13 reports can order them from NCC AB, SE-170 80 Solna; Markets . 14 tel: +46 8 655 20 00; fax: +46 8 85 77 75; e-mail: [email protected]; or website: www.ncc.se. NCC’s Environmental Report and Civil Engineering business area . 16 NCC’s Real Estate for 1998 can be ordered in the same way. Housing business area 20 NCC AB (publ) Corp. Reg. No: 556034-5174. Registered office: Solna, Sweden. Building business area . 24 Industry business area . 28 Real Estate business area . 32 Invest business area . 38 Subsidiaries . 41 Definitions . 43 Five-year review . 44 Board of Directors’ Report . 46 (as well as pages 71–73) The NCC share . 50 Financial accounts . 52 Accounting principles . 60 Comments and notes . 63 Proposed disposition of profits . 71 Auditors’ Report . 71 Board of Directors and Auditors . -

Company Valuation of NCC AB

Company Valuation of NCC AB Copenhagen Business School, 2016 M.Sc. in Economics and Business Administration Supervisor: Finn Østrup Finance and Strategic Management Submission date: 01.06.2016 Master Thesis Authors: Number of pages: 116 Peter Eriksson Number of characters: 195 336 Tobias Forsberg Executive Summary This thesis contains a valuation of the Swedish construction company NCC AB, and ultimately aims to answer the question “What is the fair value per share as the 18th of March 2016?”. The strategic analysis undertakes three well-established frameworks: PEST Analysis, Porter’s Five Forces Analysis, and SWOT Analysis. The aim of these is to present the driving factors, both internal and external, from a macroeconomic-, industrial-, and company perspective, which potentially will affect NCC’s businesses. The findings of the strategic analysis provided an opportunistic outlook for NCC based on the increasing population and urbanization, low expected interest rates, and stable expected GDP growth in especially NCC’s primary market, which is the main source for the company’s business. In addition, NCC’s foreseeing position within technology, environmental consciousness, and brand reputation contributes to a favorable future market position. The financial health of NCC is evaluated in the financial analysis, and considers its ten-year historical development. The revenues have shown an upward-sloping trend after the financial crisis, which indeed affected NCC but from which they have managed to recover. Essential key ratios such as ROE and ROIC are benchmarked against two competitors of NCC, in terms of Skanska and Peab. NCC outperformed its competitors regarding ROE, while Skanska performed better regarding ROIC.