Big Mixed-Use Developments and the Remaking of Houston

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Houston Retail August 2016

MARKET WATCH HOUSTON RETAIL AUGUST 2016 RECENT RETAIL LEASES RETAIL LEASE STATISTICS Baytown/Chambers :: Marshalls 23,000 SF new lease at Baytown Marketplace Overall Vacancy Rates Asking Rental Rates (NNN) Pasadena/Galena Park :: Boot Barn 11.0% $18.25 13,249 SF new lease at Federal East Plaza 10.0% $18.00 Pearland/Manvel :: Village Family Practice 8,763 SF new lease at Silverlake Plaza Shopping Center 9.0% $17.75 RECENT RETAIL SALES 8.0% $17.50 Copperfield :: West Junction Center 64,340 SF 7.0% $17.25 Buyer: Transnational Investments Seller: KBP Group III 6.0% $17.00 5.0% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 $16.75 RETAIL IN THE NEWS 13 13 13 14 14 14 14 15 15 15 15 16 16 Paris gelato shop arrives in River Oaks District Source: CoStar - Houston retail buildings 5,000 SF and greater with French flair and rose-shaped cones link to story CultureMap Houston, August 23, 2016 Retail Sales Statistics HOUSTON MSA UNITED STATES SoulCycle’s second Houston studio sets opening QUARTER TO LAST QUARTER TRAILING 12 LAST QUARTER TRAILING 12 date DATE (Q2 2016) MONTHS (Q2 2016) MONTHS link to story Volume ($ $78.1 $357.1 $1,401.3 $17,774.7 $80,587.8 Houston Business Journal, August 19, 2016 Mil) No. of 14 30 149 1,404 6,856 Fast-growing pizza chain continues Houston Properties expansion Total SF 469,938 1,586,161 8,750,872 79,754,256 410,607,933 link to story Average N/A $185 $201 $232 $210 Houston Business Journal, August 16, 2016 Price/SF Average Cap N/A 7.8% 6.7% 6.4% 6.5% Rate (Yield) Source: Real Capital Analytics Retail Market Indicators DIRECT -

Harrisburg Tax Increment Reinvestment Zone May 2016 Inside Cover Table of Contents

Existing Conditions Harrisburg Tax Increment Reinvestment Zone May 2016 Inside Cover Table of Contents Introduction Housing LOCATION .......................................................... 5 HOUSING STOCK ................................................ 29 EXISTING PL ANS AND STUDIES ............................... 12 HOUSING TYpeS ................................................. 30 Land Use & Mobility AGE ................................................................ 30 EleMENTS OF THE DISTRICT ................................... 13 Crime LAND USE/PROpeRTY CL ASSIFICATION ..................... 13 Economic Indicators ROADWAYS ........................................................ 16 BUSINESS SUMMARY ............................................ 35 TRAFFIC VOLUMES ............................................... 16 RETAIL TRADE .................................................... 38 RAILROAD ......................................................... 17 DAY TIME POPUL ATION .......................................... 40 BIKEWAYS ......................................................... 17 Planned Infrastructure Improvements RAILS TO TRAILS ................................................. 17 CAPITAL IMPROveMENTS ....................................... 45 PARKS & TRAILS ................................................. 21 RebUILD HOUSTON +5 ........................................ 45 REIMAGINE METRO ............................................. 21 Observations People OBSERVATIONS ................................................... 49 -

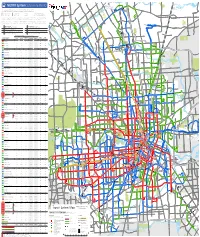

TRANSIT SYSTEM MAP Local Routes E

Non-Metro Service 99 Woodlands Express operates three Park & 99 METRO System Sistema de METRO Ride lots with service to the Texas Medical W Center, Greenway Plaza and Downtown. To Kingwood P&R: (see Park & Ride information on reverse) H 255, 259 CALI DR A To Townsen P&R: HOLLOW TREE LN R Houston D 256, 257, 259 Northwest Y (see map on reverse) 86 SPRING R E Routes are color-coded based on service frequency during the midday and weekend periods: Medical F M D 91 60 Las rutas están coloradas por la frecuencia de servicio durante el mediodía y los fines de semana. Center 86 99 P&R E I H 45 M A P §¨¦ R E R D 15 minutes or better 20 or 30 minutes 60 minutes Weekday peak periods only T IA Y C L J FM 1960 V R 15 minutes o mejor 20 o 30 minutos 60 minutos Solo horas pico de días laborales E A D S L 99 T L E E R Y B ELLA BLVD D SPUR 184 FM 1960 LV R D 1ST ST S Lone Star Routes with two colors have variations in frequency (e.g. 15 / 30 minutes) on different segments as shown on the System Map. T A U College L E D Peak service is approximately 2.5 hours in the morning and 3 hours in the afternoon. Exact times will vary by route. B I N N 249 E 86 99 D E R R K ") LOUETTA RD EY RD E RICHEY W A RICH E RI E N K W S R L U S Rutas con dos colores (e.g. -

Winter-Spring 1994

28 C i t e 3 I 1 9 9 4 The mall before the roof was added in 1966. Gulf gain, view from loop 610 oaQtfga^ The BRUCE C. W E B B C i t e 3 1 : 1 9 9 4 29 Gulf gale in ihe lot e 1950s. HI-; PROJK.T of relocating vintage center - Houston's first regional America's urban life into shopping center, located at Houston's entirely new, free-floating sub- first freeway interchange - was designed urban forms, begun after and built before the ubiquitous mall for TWorld War II, was accomplished in such mula had been fully developed and codi- short order and is now so pervasive that it fied. Gulfgate defies expectation by being is difficult to see it as a process at all. lopsidedly organized: its two anchor stores, Sakowitz (emptied out when the Particularly in a city such as Houston, 1 whose character was established along the Sakowitz chain folded in the early eight- lines of a suburban model, growth has ies) and Joske's (now Dillard's) were become synonymous with sprawl, and the located side by side at one end of the Gulfgate: view from the southeast showing entrance to underground servke tunnel an right. automobile orientation is so deeply woven center, whereas the usual plan forms the into the spatial fabric that even coherent mall into a dumbbell, with the two high- remnants of the city past, when they are volume "magnet" stores at either end of preserved at all, are splintered and frag- an inside street. -

Rider Guide / Guía De Pasajeros

Updated 02/10/2019 Rider Guide / Guía de Pasajeros Stations / Estaciones Stations / Estaciones Northline Transit Center/HCC Theater District Melbourne/North Lindale Central Station Capitol Lindale Park Central Station Rusk Cavalcade Convention District Moody Park EaDo/Stadium Fulton/North Central Coffee Plant/Second Ward Quitman/Near Northside Lockwood/Eastwood Burnett Transit Center/Casa De Amigos Altic/Howard Hughes UH Downtown Cesar Chavez/67th St Preston Magnolia Park Transit Center Central Station Main l Transfer to Green or Purple Rail Lines (see map) Destination Signs / Letreros Direccionales Westbound – Central Station Capitol Eastbound – Central Station Rusk Eastbound Theater District to Magnolia Park Hacia el este Magnolia Park Main Street Square Bell Westbound Magnolia Park to Theater District Downtown Transit Center Hacia el oeste Theater District McGowen Ensemble/HCC Wheeler Transit Center Museum District Hermann Park/Rice U Stations / Estaciones Memorial Hermann Hospital/Houston Zoo Theater District Dryden/TMC Central Station Capitol TMC Transit Center Central Station Rusk Smith Lands Convention District Stadium Park/Astrodome EaDo/Stadium Fannin South Leeland/Third Ward Elgin/Third Ward Destination Signs / Letreros Direccionales TSU/UH Athletics District Northbound Fannin South to Northline/HCC UH South/University Oaks Hacia el norte Northline/HCC MacGregor Park/Martin Luther King, Jr. Southbound Northline/HCC to Fannin South Palm Center Transit Center Hacia el sur Fannin South Destination Signs / Letreros Direccionales Eastbound Theater District to Palm Center TC Hacia el este Palm Center Transit Center Westbound Palm Center TC to Theater District Hacia el oeste Theater District The Fare/Pasaje / Local Make Your Ride on METRORail Viaje en METRORail Rápido y Fare Type Full Fare* Discounted** Transfer*** Fast and Easy Fácil Tipo de Pasaje Pasaje Completo* Descontado** Transbordo*** 1. -

SWUTC/15/600451-00048-1 Proposing Transportation Designs

Technical Report Documentation Page 1. Report No. 2. Government Accession No 3. Recipient's Catalog No SWUTC/15/600451-00048-1 4. Title and Subtitle 5. Report Date Proposing Transportation Designs and Concepts to Make Houston December 2015 METRO’s Southeast Line at the Palm Center Area more Walkable, 6. Performing Organization Code Bikeable, and Livable 7. Author(s) 8. Performing Organization Report No. Khosro Godazi, Latissha Clark, and Vincent Hassell 600451-00048-1 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) Center for Transportation Training and Research Texas Southern University 11. Contract or Grant No. 3100 Cleburne DTRT12-G-UTC06 Houston, Texas 77004 12. Sponsoring Agency Name and Address 13. Type of Report and Period Southwest Region University Transportation Center Texas A&M Transportation Institute Texas A&M University System 14. Sponsoring Agency Code College Station, Texas 77843-3135 15. Supplementary Notes Supported by a grant from the U.S. Department of Transportation, University Transportation Centers Program. 16. Abstract Over the years, the Palm Center (PC) in Houston, Texas, has been the beneficiary of several economic development endeavors designed to ignite economic and community growth and revitalization. While these endeavors brought forth initial success, they have failed to transform the PC into a lasting model of economic growth and prosperity and to inspire community pride and engagement. The development of METRO’s Southeast Line light rail station at the Palm Center Transit Center presents the prime opportunity for meeting the needs of the community by implementing design concepts and principles that provide social, environmental, and economic benefits to those living within close proximity of the transit station. -

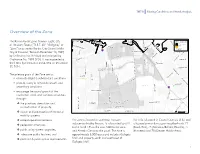

Overview of the Zone

TIRZ 8 Existing Conditions and Needs Analysis Overview of the Zone L TIRZ 7: O.S.T./ALMEDA BROADWAY ST OLD SPANISH TR Gulfgate Center ALLEN GENOA RD W HARRIS AVE The Reinvestment Zone Number Eight, City GRIGGS RD TIRZ 8: GULFGATE TIRZ 8: GULFGATE TIRZ 6: EASTSIDE TIRZ 8 Boundary Expansion GALVESTON RD of Houston, Texas, (“T.I.R.Z. #8,” “Gulfgate,” or YELLOWSTONE BLVD Other TIRZ LONG DR Herman A. Barnett Stadium City Limit Shopping Mall “Zone”) was created by the City Council of the Golf Course 610 PARK PLACE BLVD City of Houston, Texas on December 10, 1997, PARK PLACE BLVD ALLENDALE RD Glenbrook by Ordinance No. 97-1524 and enlarged by SCOTT ST RICHEY ST DIXIE DR HOWARD DR BROADWAY ST QUEENS RD Ordinance No. 1999-0706. It was expanded a HOLMES RD CRESTMONT ST S RICHEY ST W IN third time by Ordinance 2014-1192 on December K LER DR TELEPHONE RD 17, 2014. CULLEN BLVD HOUSTON BLVD SPENCER HWY BELLFORT ST S DRWAYSIDE JUTLAND RD The primary goals of the Zone are to: MYKAWA RD REED RD COLLEGE AVE G CITY OF HOUSTON A • eliminate blight & substandard conditions L V E S T O AIRPORT BLVD N R D • provide a way to remediate unsafe and MONROE RD OK DR EBRO Hobby Airport G ED unsanitary conditions 45 • SOUTH ACRES DR encourage the sound growth of the MARTINDALE RD residential, retail, and commercial sectors T SCOTT ST S R E AV D SH through: CLEARWOOD DR ALMEDA GENOA R S OREM RD E RDVILLE RD ALMEDA GENOA RD Almeda Mall the purchase, demolition and SCOTT ST OREM DR OREM DR WILLA reconstruction of property, ALMEDA GENOA RD Aerial Imagery, USDA NAIP 2014 ALLISON RD City Park Boundary, 2013 0 0.5 Miles Hawes Hill Calderon | www.hhcllp.com Aerial View, 2006 8/31/2015 INGSPOINT RD design and construction of improved K mobility systems, streetscape enhancements, The zone is located in southeast Houston The TIRZ is located in Council Districts D & I and pedestrian amenities, adjacent to Hobby Airport. -

2018 Holiday Shopping Card Retailer List 29 North at the Post Oak Hotel

2018 Holiday Shopping Card Retailer List 29 North at The Post Oak Hotel Attitudes Paris; david-coiffure 51 fifteen Cuisine & Cocktails AVANTE LASER AND MEDISPA 7 for All Mankind Baanou Boutique A bientot Baby's & Kids 1st A. Taghi Fine Apparel & Shoes Baccarat River Oaks District Abejas Boutique Back Row Home Abrahams Oriental Rugs Bag 'n Baggage Abrahams Oriental Rugs - West U Bailey Banks & Biddle Abrahams Oriental Rugs - Woodway Bayou City Angler Adara Medical Spa BB1 Classic Adelaide's Boutique Be Sweet Ink Adelaide's Boutique Beckrew Wine House AG Jeans Beehive Houston Alchemia Bella Rinova Spa & Salon Alex and Ani Bellaqua Salon and Spa Alice + Olivia Bering's All About You Bering's Allen Edmonds Big Blue Whale Toys & Curiosities Al's Handmade Boots Bike Barn Alyson Jon Interiors Bill Walker Clothier Amazing Body Store at The Health Museum Billy Reid ANN MASHBURN Birch Modern Mercantile Anthropologie - Baybrook Mall Biscuit Home Anthropologie - CITYCENTRE Blondie's Treasure Chest Anthropologie - Highland Village Blue Leaf Anthropologie - The Woodlands Blue Willow Bookshop Antiquarium Studio - Fine Art and Custom Framing Body Mind & Soul Anything Bling Boutique Body Works & Fitness Studio Anything Bling Boutique Bonobos Anything Bling Boutique Bottega Veneta Arden's Picture Framing Bouchée Patisserie Ardith & Paul Custom Picture Framing Boxwood Interiors AREA Bradley's Art & Frame ARHAUS Branche ARHAUS - Baybrook Mall Brazos Bookstore ARHAUS - The Woodlands Briargrove Pharmacy & Gifts Artisan Designs Brighton Collectibles - Baybrook -

REQUEST for QUALIFICATIONS Co-Developer for Palm Center BTC

REQUEST FOR QUALIFICATIONS Co-Developer for Palm Center BTC Houston, Texas RFQ # 16-012 DUE DATE: October 11, 2016 4:00 P.M. C.S.T. Houston Business Development, Inc. 5330 Griggs Road Houston, Texas (713)845-2400 www.hbdi.org CONTENTS I. Introduction .................................................................................................................. 3 II. Definitions, Terms and Conditions .................................................................................7 III. General Information ...................................................................................................... 8 IV. Scope of Work ............................................................................................................. 15 V. Proposal Format and Content Requirements ............................................................. 18 VI. Evaluation Factors ....................................................................................................... 21 VII. Notice of Non-participation Form............................................................................... 23 VIII. Disclaimer .................................................................................................................... 24 2 I. INTRODUCTION 1. Introduction 1.1. Houston Business Development, Inc. (HBDi) is seeking a developer team to plan and co- develop parcels located within the southeast area of Houston, Texas (“the Site”). This area is currently owned by HBDi, and the developer will act as a partner with HBDi to create a sustainable, -

2020 Restaurant Agreement

Dear Valued Restaurant: This has been a challenging time particularly for restaurants and retail businesses. The American Cancer Society has suffered a massive reduction in donations which seriously impacts their ability to provide services for the vulnerable population of cancer patients. The Holiday Shopping Card, which will be held this year from October 22 through November 1, is an event that will benefit both you and the American Cancer Society. By participating in this premiere fundraising event, you will be enhancing your brand image and increasing community engagement but most importantly, your location will be listed in the Holiday Shopping Card directory for the thousands of cardholders who can take advantage of your offer and visit your restaurant. Over the past 23 years, the women of VICTORY, a volunteer fundraising branch of the American Cancer Society, along with retailers, restaurants and sponsors, have raised more than $17.2 million through The Holiday Shopping Card program to help in the fight against cancer. Here’s how the program works The Holiday Shopping Card is sold online and at participating retailers for a $75 minimum donation. 100% of the donation benefits the American Cancer Society. Once purchased, the card is accepted at over 575 participating retailers and restaurants like yours. Here is how the program works for RESTAURANTS Restaurants are NOT required to sell The Holiday Shopping Card. You bring value to the Card by displaying marketing materials that promote the sale of the Card (which will be delivered by a VICTORY member just before the event) and by offering one of the following food options to holders of The Holiday Shopping Card during the 11 day event: • Complimentary appetizer with purchase of entrée during lunch and/or dinner, • Complimentary dessert with the purchase of entrée during lunch/dinner, OR • Complimentary option of your choice Signing Up Couldn’t Be Easier Sign up online at www.holidayshoppingcard.com. -

Download Brochure

Beechnut & Frankway - Houston, Texas 4545 /// beechnut plaza DEVELOPED BY //////////////////////// Citycentre 17 minutes DOWNTOWN HOUSTON 17 minutes river oaks upper Kirby 12 minutes 10 minutes I-45 galleria greenway 6 minutes 6 minutes I-69 texas overview 4545 Beechnut Plaza is centrally medical west center located near highly desired I-610 university 4 minutes 9 minutes neighborhoods such as Bellaire, W Holcombe Blvd location West University, River Oaks and bellaire 4545 /// beechnut plaza Memorial. This premier medical 3 minutes US-288 office building offers easy access Beechnut St meyerland to the 610 Loop/I-69 and is 3 minutes I-610 located less than ten minutes from Braeswood Blvd the Texas Medical Center. 45454545 ////// beechnutbeechnut plazaplaza //////////////////////// BELLAIRE WEST UNIVERSITY 18,479 15,477 population population $262,721 $330,459 average HH income average HH income 44 41 average age average age demographics RIVER OAKS/AFTON OAKS MEMORIAL 20,839 26,078 population population $172,353 $193,480 average HH income average HH income neighborhood 36 39 average age average age 45454545 ////// beechnutbeechnut plazaplaza PLATE FULL OF AMENITIESPLATE FULL OF WithinAMENITIES two miles of the city’s finest dining + retail + entertainment Within two miles of the city’s finest dining609 + retail + entertainment260 RETAILERS609 RESTAURANTS260 RETAILERS22 RESTAURANTS363 ENTERTAINMENT SERVICES //////////////////////// ///// 5 miles or less to22 Houston’s 363finest AREAENTERTAINMENT RETAILERS + RESTAURANTSSERVICES AREA RETAILERS -

Chapter 3 Affected Environment

CHAPTER 3 AFFECTED ENVIRONMENT Southeast Corridor Draft Environmental Impact Statement Chapter 3 – Affectred Environment 3. AFFECTED ENVIRONMENT This chapter describes the existing conditions in the Southeast Corridor and project study area that could be affected by the alternatives.1 2 It also establishes the focus and baseline for Chapter 4, Transportation Impacts, and Chapter 5, Environmental Consequences. The study area for the description of existing conditions is identified in Figure 1-2 (see Chapter 1, Purpose and Need). Unless otherwise stated, existing conditions are described with reference to the base year of 2006. The conditions described in this chapter include those related to: land use; population and employment; transportation services and facilities; air quality; noise and vibration; visual quality and aesthetics; ecosystems; water resources; historic and archaeological resources; parklands; geology and soils; hazardous materials or contamination; and safety and security. 3.1 Land Use This section describes existing land use patterns in the study area and along the project alignment, local plans and policies affecting land use in the corridor, and the major activity centers within and adjacent to the corridor. The section ends with a discussion of development activity and emerging trends within the study area. 3.1.1 Regional Summary The Southeast Corridor is located within metropolitan Houston. The City of Houston had a population of 2.01 million in mid-2004. Houston is the fourth largest city in the United States, trailing only New York, Los Angeles and Chicago, and it is the largest city in the southern United States and Texas. The Houston-Sugar Land-Baytown Metropolitan Statistical Area (Houston MSA) consists of 10 counties: Austin, Brazoria, Chambers, Fort Bend, Galveston, Harris, Liberty, Montgomery, San Jacinto and Waller.