169 Annex 5–List of Subsidiaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case COMP/38.432 – Professional Videotape

COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 20.11.2007 C(2007)5469 final COMMISSION DECISION of 20 November 2007 relating to a proceeding under Article 81 of the EC Treaty and Article 53 of the EEA Agreement Case COMP/38.432 – Professional Videotape (ONLY THE ENGLISH TEXT IS AUTHENTIC) (Text with EEA relevance) EN EN TABLE OF CONTENTS 1. INTRODUCTION.................................................................................................. 6 2. THE INDUSTRY SUBJECT TO THE PROCEEDINGS .................................... 6 2.1. The product ............................................................................................................ 6 2.2. The undertakings subject to these proceedings..................................................... 6 2.2.1. Sony ......................................................................................................................... 6 2.2.2. Fuji .......................................................................................................................... 7 2.2.3. Maxell...................................................................................................................... 8 2.3. Description of the sector......................................................................................... 8 2.3.1. The supply................................................................................................................ 8 2.3.2. The demand............................................................................................................. -

LQ043T3DX02 TFT-LCD Module

PRODUCT SPECIFICATIONS Mobile Liquid Crystal Displays Group LQ043T3DX02 TFT-LCD Module Spec. Issue Date: Feb. 8, 2005 No: LCP-05005 SPECIFICATIONS ARE SUBJECT TO CHANGE WITHOUT NOTICE. Suggested applications (if any) are for standard use; See Important Restrictions for limitations on special applications. See Limited Warranty for SHARP’s product warranty. The Limited Warranty is in lieu, and exclusive of, all other warranties, express or implied. ALL EXPRESS AND IMPLIED WARRANTIES, INCLUDING THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR USE AND FITNESS FOR A PARTICULAR PURPOSE, ARE SPECIFICALLY EXCLUDED. In no event will SHARP be liable, or in any way responsible, for any incidental or consequential economic or property damage. NORTH AMERICA EUROPE JAPAN SHARP Microelectronics of the Americas SHARP Microelectronics Europe SHARP Corporation 5700 NW Pacific Rim Blvd. Division of Sharp Electronics (Europe) GmbH Electronic Components & Devices Camas, WA 98607, U.S.A. Sonninstrasse 3 22-22 Nagaike-cho, Abeno-Ku Phone: (1) 360-834-2500 20097 Hamburg, Germany Osaka 545-8522, Japan Fax: (1) 360-834-8903 Phone: (49) 40-2376-2286 Phone: (81) 6-6621-1221 Fast Info: (1) 800-833-9437 Fax: (49) 40-2376-2232 Fax: (81) 6117-725300/6117-725301 www.sharpsma.com www.sharpsme.com www.sharp-world.com TAIWAN SINGAPORE KOREA SHARP Electronic Components SHARP Electronics (Singapore) PTE., Ltd. SHARP Electronic Components (Taiwan) Corporation 438A, Alexandra Road, #05-01/02 (Korea) Corporation 8F-A, No. 16, Sec. 4, Nanking E. Rd. Alexandra Technopark, RM 501 Geosung B/D, 541 Taipei, Taiwan, Republic of China Singapore 119967 Dohwa-dong, Mapo-ku Phone: (886) 2-2577-7341 Phone: (65) 271-3566 Seoul 121-701, Korea Fax: (886) 2-2577-7326/2-2577-7328 Fax: (65) 271-3855 Phone: (82) 2-711-5813 ~ 8 Fax: (82) 2-711-5819 CHINA HONG KONG SHARP Microelectronics of China SHARP-ROXY (Hong Kong) Ltd. -

PUBLIC SUBMISSION Posted: November 20, 2020 Tracking No

Page 1 of 2 As of: 11/23/20 10:03 AM Received: November 18, 2020 Status: Posted PUBLIC SUBMISSION Posted: November 20, 2020 Tracking No. 1k4-9k60-8cjw Comments Due: December 03, 2020 Submission Type: Web Docket: PTO-C-2020-0055 Request for Comments on Discretion to Institute Trials Before the Patent Trial and Appeal Board Comment On: PTO-C-2020-0055-0001 Discretion to Institute Trials Before the Patent Trial and Appeal Board Document: PTO-C-2020-0055-0452 Comment from Japan Business Machine and Information System Industries Association Submitter Information Name: Hideaki Chishima Address: Lila Hijirizaka 7FL 3-4-10, Mita Minato-ku, Tokyo, Japan, 1080073 Email: [email protected] Phone: +81-3-6809-5495 Fax: +81-3-3451-1770 Submitter's Representative: Hideki Sanatake Organization: Japan Business Machine and Information System Industries Association General Comment Dear Sir, This post is for Japan Business Machine and Information System Industries Association (JBMIA) to submit its comments in response to solicitation of public comments by USPTO as announced in Federal Register / Docket No. PTO-C-2020-0055. The comments are attached hereto. JBMIA is a Japanese incorporated association which was renamed in 2002 from Japan Business Machine Makers Association established originally in 1960. JBMIA consists of 40 member companies engaged in business machine and information system and 5 supporting companies. Almost all of the member companies have actively filed patent applications in the USA. https://www.fdms.gov/fdms/getcontent?objectId=0900006484967b2a&format=xml&sho... 11/23/2020 Page 2 of 2 Sincerely, Hideaki Chishima (Mr) Intellectual Property Committee Secretariat Attachments JBMIA Comment (finnal) https://www.fdms.gov/fdms/getcontent?objectId=0900006484967b2a&format=xml&sho.. -

Camera Control Pro 2 Reference Manual Overview Using Camera

Camera Control Pro 2 Reference Manual Overview This section describes the structure of this manual, outlines the main func- tions of Camera Control Pro 2, and gives the system requirements and instal- lation instructions. Using Camera Control Pro 2 This section describes how to use Camera Control Pro 2. Appendices This section lists preferences and describes how to uninstall the software. Important Information on the Product Key The product key may be found on the CD-ROM case. Do not lose this key. It is required when installing or upgrading this software and can not be replaced if lost. xxxxx–xxx–xxxx–xxxx–xxxx–xxxx Product key SB8A02(B1) 6MS541B1-02 Overview Using Camera Control Pro Appendices Overview Introduction 3 About This Manual 6 System Requirements Windows 7 Macintosh 8 Installing Camera Control Pro 9 Windows 10 Macintosh 16 Getting Started Starting and Exiting Camera Control Pro 21 Getting Help 28 Software Updates 29 Click a page number to view. Return to fi rst page Camera Control Pro 2 2 Overview Using Camera Control Pro Appendices Introduction 1/3 This manu al has been written to help you take advantage of the many features in- cluded in Camera Control Pro 2. Be sure to read this manual thoroughly, and to keep it handy when using Camera Control Pro 2. Conventions This manual assumes basic knowledge of cameras and Windows or Finder operations. Refer to the documentation provided with your computer or camera for more information. Where the Windows and Macintosh versions of the program use diff ering commands, the Windows menu name is listed fi rst, followed by the Macintosh menu name in square brackets. -

Proposal of a Data Processing Guideline for Realizing Automatic Measurement Process with General Geometrical Tolerances and Contactless Laser Scanning

Proposal of a data processing guideline for realizing automatic measurement process with general geometrical tolerances and contactless laser scanning 2018/4/4 Atsuto Soma Hiromasa Suzuki Toshiaki Takahashi Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 1 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for point cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 2 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for Point Cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 3 Introduction of JEITA What is JEITA? The objective of the Japan Electronics and Information Technology Industries Association (JEITA) is to promote healthy manufacturing, international trade and consumption of electronics products and components in order to contribute to the overall development of the electronics and information technology (IT) industries, and thereby to promote further Japan's economic development and cultural prosperity. JEITA’s Policy and Strategy Board > Number of full members: 279> Number of associate members: 117(as of May 13, 2014) - Director companies and chair/subchair companies - Policy director companies (alphabetical) Fujitsu Limited (chairman Masami Yamamoto) Asahi Glass Co., Ltd. Nichicon Corporation Sharp Corporation Azbil Corporation IBM Japan, Ltd. Hitachi, Ltd. Advantest Corporation Nippon Chemi-Con Corporation Panasonic Corporation Ikegami Tsushinki Co., Ltd. Japan Aviation Electronics Industry, Ltd. SMK Corporation Mitsubishi Electric Corporation Nihon Kohden Corporation Omron Corporation NEC Corporation JRC Nihon Musen Kyocera Corporation Sony Corporation Hitachi Metals, Ltd KOA Corporation Fuji Xerox Co., Ltd. -

Facilitation of Information Transfer on Chemicals in Products

Facilitation of Information Transfer on Chemicals in Products The Ministry of Economy, Trade and Industry (METI) developed ‘chemSHERPA’ [kémʃéərpə] as a new information transfer scheme for chemicals in products throughout their supply chains. METI hopes that the dissemination of chemSHERPA may contribute to reduce the workload of both providers and recipients of the information. From the beginning of the development of chemSHERPA, METI has been in communication with international bodies such as the IEC and the IPC, etc., with the aim of developing chemSHERPA into not only a Japanese standard but also an International standard. To make it a de-facto standard, METI has introduced this scheme to international organizations and governments of other countries for their active use. The Joint Article Management Promotion Consortium (JAMP) is a governing body for chemSHERPA from April 2016 and see a shift to chemSHERPA. We believe many companies are preparing towards implementing chemSHERPA. Based on the efforts mentioned above, the following companies and company groups have agreed with the dissemination of chemSHERPA, and METI will continue to work with JAMP and companies to spread the use of chemSHERPA to internal as well as external supply chains as needed.(Please contact us if any company or company group has interest in putting its name below.) It should be noted, the use of the provision of data entry support tools is free of charge in principle with the aim of promoting wider use of chemSHERPA. [Contact information] Chemical Management Policy Division Manufacturing Industries Bureau Ministry of Economy, Trade and Industry [email protected] 03-3501-0080 (direct) 03-3501-1511 (ex. -

GP2Y0D310K 1 Bit Output Distance Measuring Sensor

PRODUCT DOCUMENTATION Sharp Optoelectronic Components GP2Y0D310K 1 Bit Output Distance Measuring Sensor Issue Date: January 18, 2005 No: ED-05G009 SPECIFICATIONS ARE SUBJECT TO CHANGE WITHOUT NOTICE. Suggested applications (if any) are for standard use; See Important Restrictions for limitations on special applications. See Limited Warranty for SHARP’s product warranty. The Limited Warranty is in lieu, and exclusive of, all other warranties, express or implied. ALL EXPRESS AND IMPLIED WARRANTIES, INCLUDING THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR USE AND FITNESS FOR A PARTICULAR PURPOSE, ARE SPECIFICALLY EXCLUDED. In no event will SHARP be liable, or in any way responsible, for any incidental or consequential economic or property damage. NORTH AMERICA EUROPE JAPAN SHARP Microelectronics of the Americas SHARP Microelectronics Europe SHARP Corporation 5700 NW Pacific Rim Blvd. Division of Sharp Electronics (Europe) GmbH Electronic Components & Devices Camas, WA 98607, U.S.A. Sonninstrasse 3 22-22 Nagaike-cho, Abeno-Ku Phone: (1) 360-834-2500 20097 Hamburg, Germany Osaka 545-8522, Japan Fax: (1) 360-834-8903 Phone: (49) 40-2376-2286 Phone: (81) 6-6621-1221 Fast Info: (1) 800-833-9437 Fax: (49) 40-2376-2232 Fax: (81) 6117-725300/6117-725301 www.sharpsma.com www.sharpsme.com www.sharp-world.com TAIWAN SINGAPORE KOREA SHARP Electronic Components SHARP Electronics (Singapore) PTE., Ltd. SHARP Electronic Components (Taiwan) Corporation 438A, Alexandra Road, #05-01/02 (Korea) Corporation 8F-A, No. 16, Sec. 4, Nanking E. Rd. Alexandra Technopark, RM 501 Geosung B/D, 541 Taipei, Taiwan, Republic of China Singapore 119967 Dohwa-dong, Mapo-ku Phone: (886) 2-2577-7341 Phone: (65) 271-3566 Seoul 121-701, Korea Fax: (886) 2-2577-7326/2-2577-7328 Fax: (65) 271-3855 Phone: (82) 2-711-5813 ~ 8 Fax: (82) 2-711-5819 CHINA HONG KONG SHARP Microelectronics of China SHARP-ROXY (Hong Kong) Ltd. -

Facilitation of Information Transfer on Chemicals in Products

Facilitation of Information Transfer on Chemicals in Products The Ministry of Economy, Trade and Industry (METI) has developed ‘chemSHERPA’ [kémʃéərpə] as a new information transfer scheme for chemicals in products throughout their supply chains. METI hopes that the dissemination of chemSHERPA may contribute to reduce the workload of both providers and recipients of the information. From the beginning of the development of chemSHERPA, METI has been in communication with international bodies such as the IEC and the IPC, etc., with the aim of developing chemSHERPA into not only a Japanese standard but also an International standard. To make it a de-facto standard, METI has introduced this scheme to international organizations and governments of other countries for their active use. The Joint Article Management Promotion Consortium (JAMP) will be a governing body for chemSHERPA from April 2016 and METI expects to see an orderly, step-by-step shift to chemSHERPA over the two years transition period. Accordingly JAMP has a plan to finish renewing the substances list in the existing JAMP scheme by the end of March of 2018. We believe many companies will begin advance preparations towards implementing chemSHERPA. Based on the efforts mentioned above, the following companies and company groups have agreed with the dissemination of chemSHERPA, and METI will continue to work with companies to spread the use of chemSHERPA to internal as well as external supply chains.(Please contact us if any company or company group has interest in putting its name below.) It should be noted, the use of the provision of data entry support tools is free of charge in principle with the aim of promoting wider use of chemSHERPA. -

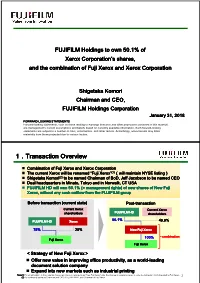

1.Transaction Overview Transaction Overview

FUJIFILM Holdings to own 50.1% of Xerox Corporation’s shares, and the combination of Fuji Xerox and Xerox Corporation Shigetaka Komori Chairman and CEO, FUJIFILM Holdings Corporation January 31, 2018 FORWARDFORWARD----LOOKINGLOOKING STATEMENTS Forward-looking statements, such as those relating to earnings forecasts and other projections contained in this material, are management’s current assumptions and beliefs based on currently available information. Such forward-looking statements are subject to a number of risks, uncertainties, and other factors. Accordingly, actual results may differ materially from those projected due to various factors. 111.1..TransactionTransaction Overview Combination of Fuji Xerox and Xerox Corporation The current Xerox will be renamed “Fuji Xerox” (1)(1)(1) (((will(will maintain NYSE listinglisting)))) Shigetaka Komori (2)(2)(2) to be named Chairman of BoDBoDBoD,BoD , Jeff Jacobson to be named CEO Dual headquarters in Minato, Tokyo and in NorwalkNorwalk,, CT USA FUJIFILM HD will own 50.1% (= management rights) of new sharesharess of New Fuji Xerox, without any cash outflow from the FUJIFILM group Before transaction (current state) PostPost----transactiontransaction Current Xerox Current Xerox FUJIFILM HD shareholders shareholders 50.1% FUJIFILM HD Xerox 50.1% 49.9% 757575%75 %%% 252525%25 %%% New Fuji Xerox 100% combination Fuji Xerox Fuji Xerox <<<Strategy<Strategy of New Fuji XeroxXerox>>>> Offer new value in improving office productivity, as a worldworld----leadingleading document solution company Expand intointointo newnewnew markets such asasas industrial printing Note(1) For simplification, in this material, the current Xerox is referred to as “New Fuji Xerox” after the change in company name, in order to distinguish it with the existing Fuji Xerox. -

LED Specification

Technical Document LED Specification EC/Opto Group PC817XxNiP0F Series Photocoupler Product Specification June 2008 PC817XxNiP0F Series Full Specification for part numbers: PC817XNNIP0F PC817XlNIP0F PC817X2NIP0F PC817X3NIP0F PC817X4NIP0F PC817X5NIP0F PC817X6NIP0F PC817X7NIP0F PC817X8NIP0F PC817X9NIP0F PC817XONIP0F Technical Document Opto Specification Opto/EC Group NORTH AMERICA EUROPE JAPAN Sharp Microelectronics of the Americas Sharp Microelectronics Europe Sharp Corporation 5700 NW Pacific Rim Blvd. Division of Sharp Electronics (Europe) GmbH Electronic Components & Devices Camas, WA 98607, U.S.A. Sonninstrasse 3 22-22 Nagaike-cho, Abeno-Ku Phone: (1) 360-834-2500 20097 Hamburg, Germany Osaka 545-8522, Japan Fax: (1) 360-834-8903 Phone: (49) 40-2376-2286 Phone: (81) 6-6621-1221 www.sharpsma.com Fax: (49) 40-2376-2232 Fax: (81) 6117-725300/6117-725301 www.sharpsme.com www.sharp-world.com TAIWAN Sharp Electronic Components SINGAPORE HONG KONG (Taiwan) Corporation Sharp Electronics (Singapore) PTE., Ltd. Sharp-Roxy (Hong Kong) Ltd. 8F-A, No. 16, Sec. 4, Nanking E. Rd. 438A, Alexandra Road, #05-01/02 Level 26, Tower 1, Kowloon Commerce Centre, Taipei, Taiwan, Republic of China Alexandra Technopark, No. 51, Kwai Cheong Road, Kwai Chung, Phone: (886) 2-2577-7341 Singapore 119967 New Territories, Hong Kong Fax: (886) 2-2577-7326/2-2577-7328 Phone: (65) 271-3566 Phone: (852) 28229311 Fax: (65) 271-3855 Fax: (852) 28660779 CHINA www.sharp.com.hk Sharp Microelectronics of China KOREA Shenzhen Representative Office: (Shanghai) Co., Ltd. Sharp Electronic Components Room 602-603, 6/F., 28 Xin Jin Qiao Road King Tower 16F (Korea) Corporation International Chamber of Commerce Tower, Pudong Shanghai, 201206 P.R. -

'Standard Copyright' Agreed Upon by Most Contributors, and Is Currently the Canonical License Preferred by the X.Org Foundation

The following is the 'standard copyright' agreed upon by most contributors, and is currently the canonical license preferred by the X.Org Foundation. This is a slight variant of the common MIT license form published by the Open Source Initiative at http://www.opensource.org/licenses/mit-license.php Copyright holders of new code should use this license statement where possible, and insert their name to this list. Please sort by surname for people, and by the full name for other entities (e.g. Juliusz Chroboczek sorts before Intel Corporation sorts before Daniel Stone). See each individual source file or directory for the license that applies to that file. Copyright (C) 2003-2006,2008 Jamey Sharp, Josh Triplett Copyright © 2009 Red Hat, Inc. Copyright © 1990-1992,1999,2000,2004,2009 Sun Microsystems, Inc. All rights reserved. Permission is hereby granted, free of charge, to any person obtaining a copy of this software and associated documentation files (the "Software"), to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge, publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so, subject to the following conditions: The above copyright notice and this permission notice (including the next paragraph) shall be included in all copies or substantial portions of the Software. THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM, OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE. -

July 12-14, 2017 Tokyo Big Sight

International M odern H ospital Show 2017 JULY 12-14, 2017 TOKYO BIG SIGHT JAPAN HOSPITAL ASSOCIATION NIPPON OMNI-MANAGEMENT ASSOCIATION East Hall3 East Hall East Hall1 Stage② Stage① Lunch Shop Rest Area Nursing Ideas Awards Rest Organizer’s Area Exhibition Supporting Organizations Information Lunch Shop Japan Hospital Association Exhibitor Presentations B 3 AMANO Company Limited E-6 Bunkyo City H-11 http://www.amano-grp.co.jp/ http://www.city.bunkyo.lg.jp 3DIT inc. A-47 http://3dit.jp Aqua Sougo Kikaku MUKASA Inc. D-6 BYTECH(DONGTAI) CO.,LTD. G-17 http://www.aqua-mukasa.com http://www.bytech-dt.com/? A Arai Medical Instruments, Inc. H-11 C Advanced Media.Inc. A-9 http://www.ami-inc.jp http://www.advanced-media.co.jp/ Array Corporation B-5 CAPITAL MEDICA CO.,Ltd. G-21 http://capimedi.com/ Aero Facility Co.,ltd. D-13 https://www.array.co.jp http://www.aero.co.jp/ AS ONE CORPORATION G-22 CardEx co.,ltd A-93 http://www.cardex.jp/ AERO SERVICE CORPORATION H-15 http://www.as-1.co.jp/ http://www.aeroserv.co.jp ASAHI ELECTRONICS LABOLATORY CO.,LTD A-26 CARECOM CO.,LTD. A-28 http://www.aelnet.co.jp https://www.carecom.jp/ AIHO corporation H-6 http://www.aiho.co.jp/ Assetment CORP. A-86 CAREFORCE. Inc G-2 https://www.assetment.net/ http://www.careforce.jp/ AINET SYSTEMS Inc. A-35 http://www.ains.co.jp/ Asterisk Inc. A-24 Carina System Co., Ltd. B-9 https://www.asx.co.jp http://www.carinasystem.co.jp/ AIPHONE CO.,LTD.