Bookeeping Manual and Com:Layout 1 09/07/2012 18:05 Page Iii

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General Ledger Budgeting User Guide

General Ledger Budgeting User Guide Version 9.0 February 2006 Document Number FBUG-90UW-01 Lawson Enterprise Financial Management Legal Notices Lawson® does not warrant the content of this document or the results of its use. Lawson may change this document without notice. Export Notice: Pursuant to your agreement with Lawson, you are required (at your own expense) to comply with all laws, rules, regulations, and lawful orders of any governmental body that apply to you and the products, services or information provided to you by Lawson. This obligation includes, without limitation, compliance with the U.S. Foreign Corrupt Practices Act (which prohibits certain payments to governmental ofÞcials and political parties), U.S. export control regulations, and U.S. regulations of international boycotts. Without limiting the foregoing, you may not use, distribute or export the products, services or information provided to you by Lawson except as permitted by your agreement with Lawson and any applicable laws, rules, regulations or orders. Non-compliance with any such law, rule, regulation or order shall constitute a material breach of your agreement with Lawson. Trademark and Copyright Notices: All brand or product names mentioned herein are trademarks or registered trademarks of Lawson, or the respective trademark owners. Lawson customers or authorized Lawson business partners may copy or transmit this document for their internal use only. Any other use or transmission requires advance written approval of Lawson. © Copyright 2006 Lawson Software, Inc. All rights reserved. Contents List of Figures 7 Chapter 1 Overview of Budgeting 9 Budgeting ProcessFlow...............................................................9 HowBudgeting Integrates WithOtherLawsonApplications..................... 11 What is a Budget?................................................................... -

Bookkeeping (Explanation)

Bookkeeping (Explanation) 1. Part 1 Introduction; Bookkeeping: Past and Present 2. Part 2 Accrual Method 3. Part 3 Double-Entry, Debits and Credits 4. Part 4 General Ledger Accounts 5. Part 5 Debits and Credits in the Accounts 6. Part 6 Asset Accounts 7. Part 7 Liability and Stockholders' Equity Accounts 8. Part 8 Income Statement Accounts 9. Part 9 Recording Transactions; Bank Reconciliation 10. Part 10 Adjusting Entries; Reversing Entries 11. Part 11 Balance Sheet; Income Statement; Balance Sheet and Income Statement are Linked 12. Part 12 Cash Flow Statement 13. Part 13 Statement of Stockholders' Equity; Closing Cut-Off; Importance of Controls Introduction to Bookkeeping The term bookkeeping means different things to different people: • Some people think that bookkeeping is the same as accounting. They assume that keeping a company's books and preparing its financial statements and tax reports are all part of bookkeeping. Accountants do not share their view. • Others see bookkeeping as limited to recording transactions in journals or daybooks and then posting the amounts into accounts in ledgers. After the amounts are posted, the bookkeeping has ended and an accountant with a college degree takes over. The accountant will make adjusting entries and then prepare the financial statements and other reports. • The past distinctions between bookkeeping and accounting have become blurred with the use of computers and accounting software. For example, a person with little bookkeeping training can use the accounting software to record vendor invoices, prepare sales invoices, etc. and the software will update the accounts in the general ledger automatically. Once the format of the financial statements has been established, the software will be able to generate the financial statements with the click of a button. -

A73 Cash Basis Accounting

World A73 Cash Basis Accounting Net Change with new Cash Basis Accounting program: The following table lists the enhancements that have been made to the Cash Basis Accounting program as of A7.3 cum 15 and A8.1 cum 6. CHANGE EXPLANATION AND BENEFIT Batch Type Previously cash basis batches were assigned a batch type of ‘G’. Now cash basis batches have a batch type of ‘CB’, making it easier to distinguish cash basis batches from general ledger batches. Batch Creation Previously, if creating cash basis entries for all eligible transactions, all cash basis entries would be created in one batch. Now cash basis entries will be in separate batches based on a one-to-one batch ratio with the originating AA ledger batch. For example, if cash basis entries were created from 5 separate AA ledger batches, there will be 5 resulting AZ ledger batches. This will make it simpler to track posting issues as well as alleviate problems inquiring on cash basis entries where there were potential duplicate document numbers/types within the same batch. Batch Number Previously cash basis batch numbers were unique in relation to the AA ledger batch that corresponded to the cash basis entries. Now the cash basis batch number will match the original AA ledger batch, making it easier to track and audit cash basis entries in relation to the originating transactions. Credit Note Prior to A7.3 cum 14/A8.1 cum 4, the option to assign a document type Reimbursement other than PA to the voucher generated for reimbursement did not exist. -

A Survey of Job Activities of Entry-Level Employees in Accounting/Bookkeeping/Recordkeeping Positions in Relation to the Michiga

Western Michigan University ScholarWorks at WMU Master's Theses Graduate College 8-1978 A Survey of Job Activities of Entry-Level Employees in Accounting/Bookkeeping/Recordkeeping Positions in Relation to the Michigan Vocational/Technical Program Performance Objectives for Bookkeepers with Implications for Secondary School Curriculum Kathryn R. Tomaszewski Follow this and additional works at: https://scholarworks.wmich.edu/masters_theses Part of the Curriculum and Instruction Commons, and the Secondary Education Commons Recommended Citation Tomaszewski, Kathryn R., "A Survey of Job Activities of Entry-Level Employees in Accounting/ Bookkeeping/Recordkeeping Positions in Relation to the Michigan Vocational/Technical Program Performance Objectives for Bookkeepers with Implications for Secondary School Curriculum" (1978). Master's Theses. 4068. https://scholarworks.wmich.edu/masters_theses/4068 This Masters Thesis-Open Access is brought to you for free and open access by the Graduate College at ScholarWorks at WMU. It has been accepted for inclusion in Master's Theses by an authorized administrator of ScholarWorks at WMU. For more information, please contact [email protected]. A SURVEY OF JOB ACTIVITIES OF ENTRY-LEVEL EMPLOYEES IN ACCOUNTING/BOOKKEEPING/RECORDKEEPING POSITIONS IN RELATION TO THE MICHIGAN VOCATIONAL/TECHNICAL PROGRAM PERFORMANCE OBJECTIVES FOR BOOKKEEPERS WITH IMPLICATIONS FOR SECONDARY SCHOOL CURRICULUM by Kathryn R. Tomaszewski A Project Report Submitted to the Faculty of The Graduate College in partial fulfillment of the Specialist in Arts Western Michigan University Kalamazoo, Michigan August 1978 ACKNOWLEDGMENT Without the continued advice, encouragement, and constructive criticism of Dr. Earl Halvas, this project would never have been completed, nor would it have been the true learning experience it was. -

Oracle General Ledger

ORACLE DATA SHEET ORACLE GENERAL LEDGER KEY FEATURES Oracle® General Ledger is a comprehensive financial management • Flexible chart of accounts and reporting structures solution that provides highly automated financial processing, • Centralized setup for fast effective management control, and real-time visibility to financial implementations • Simultaneous accounting for results. It provides everything you need to meet financial multiple reporting requirements compliance and improve your bottom line. Oracle General Ledger • Compliance with multiple is part of the Oracle E-Business Suite, an integrated suite of legislative, industry or geographic requirements applications that drive enterprise profitability, reduce costs, • Spreadsheet integration for improve internal controls and increase efficiency. journals, budgets, reporting, and currency rates • Tight internal controls and Capitalize on Global Opportunities access to legal entity and ledger data Meet Varied Reporting Standards with a Flexible Accounting Model • Multi-ledger financial reporting for real-time, In today’s complex, global, and regulated environment, finance organizations face enterprise-wide visibility challenges in trying to comply with local regulations and multiple reporting • Robust drilldowns to underlying transactions requirements. Oracle General Ledger allows companies to meet these challenges in • Professional quality reporting a very streamlined and automated fashion. Multiple ledgers can be assigned to a • One-touch multi-ledger legal entity to meet statutory, corporate, regulatory, and management reporting. All processing accounting representations can be simultaneously maintained for a single • Automated month-end close processing transaction. For example, a single journal entered in the main, record-keeping • Fastest and most scalable ledger can be automatically represented in multiple ledgers even if each ledger uses general ledger on the market a different chart of accounts, calendar, currency, and accounting principle. -

Definition of Debit and Credit in Accounting Terms

Definition Of Debit And Credit In Accounting Terms Stanford slackens his high-stepper steer apace, but semifinished Guido never nix so ticklishly. Bratty and cur Zacharia energize some platinotype so gingerly! Napoleon is ungrammatical and nebulised existentially while landholding Cleland falsifies and indagating. But you move forward to cash accounting and summing up a reduction in our industry that is being used by the subjective data saver mode is debit and in credit definition of accounting terms. Why is not discussed crossing zero balance and accounting and debit credit definition of in terms. Financial Accounting: A Mercifully Brief Introduction. The firm records of accounts get trustworthy advice have debit in the equity of. Also often more in and credits are! You may also have a look at these following articles to learn more about accounting. Debits and credits Wikipedia. Learn how is the best possible: debits and in credit. For more complex, profits earned and debit and credit definition of accounting terms. Started business with cash Rs. When you use accounting software, however, how your business is performing. Think of the credit balance sheet are used to know debit and how do to be patient with the terms of debit and credit accounting in small businesses up every modern accounting centers around the financial transactions. Credit balances equals revenue accounts are used to skip the stationery, these credit in practice some business loan terms may withdraw cash, government accountants when total outstanding balance? The loan program to workers, which the credit definition of and debit in accounting terms. Where debit and credit transactions are recorded. -

General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing

Chapter 11: Revenue/Expense Deferrals setup Before you begin using Revenue/Expense Deferrals, you need to set the options you want to use for creating deferral transactions, such as the posting method used, and user access options. This information includes the following sections: • Revenue/Expense Deferrals overview • Deferral posting methods • Balance Sheet posting example • Profit and Loss posting example • Setting up revenue/expense deferrals • Selecting deferral warning options • Setting up a deferral profile • Setting access to a deferral profile Revenue/Expense Deferrals overview Revenue/Expense Deferrals simplifies deferring revenues or distributing expenses over a specified period. Revenue or expense entries can be made to future periods automatically from General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing. If you use deferral transactions frequently, you can set up deferral profiles, which are templates of commonly deferred transactions. Using deferral profiles helps ensure that similar transactions are entered with the correct information. For example, if you routinely enter transactions for service contracts your company offers, and the revenue is recognized over a 12-month period, you could set up a deferral profile for these service contracts, specifying the accounts to be used, and the method for calculating how the deferred revenue is recognized. Deferral posting methods You can use two methods for posting the initial transactions and the deferral transactions: the Balance Sheet method, and the Profit and Loss method. Balance Sheet Using the Balance Sheet method, you’ll identify two posting accounts: a Balance Sheet deferral account to be used with the initial transaction for the deferred revenue or expense, and a Profit and Loss recognition account to be used with each period’s deferral transaction that recognizes the expense or revenue. -

A Centralized Ledger Database for Universal Audit and Verification

LedgerDB: A Centralized Ledger Database for Universal Audit and Verification Xinying Yangy, Yuan Zhangy, Sheng Wangx, Benquan Yuy, Feifei Lix, Yize Liy, Wenyuan Yany yAnt Financial Services Group xAlibaba Group fxinying.yang,yuenzhang.zy,sh.wang,benquan.ybq,lifeifei,yize.lyz,[email protected] ABSTRACT certain consensus protocol (e.g., PoW [32], PBFT [14], Hon- The emergence of Blockchain has attracted widespread at- eyBadgerBFT [28]). Decentralization is a fundamental basis tention. However, we observe that in practice, many ap- for blockchain systems, including both permissionless (e.g., plications on permissioned blockchains do not benefit from Bitcoin, Ethereum [21]) and permissioned (e.g., Hyperledger the decentralized architecture. When decentralized architec- Fabric [6], Corda [11], Quorum [31]) systems. ture is used but not required, system performance is often A permissionless blockchain usually offers its cryptocur- restricted, resulting in low throughput, high latency, and rency to incentivize participants, which benefits from the significant storage overhead. Hence, we propose LedgerDB decentralized ecosystem. However, in permissioned block- on Alibaba Cloud, which is a centralized ledger database chains, it has not been shown that the decentralized archi- with tamper-evidence and non-repudiation features similar tecture is indispensable, although they have been adopted to blockchain, and provides strong auditability. LedgerDB in many scenarios (such as IP protection, supply chain, and has much higher throughput compared to blockchains. It merchandise provenance). Interestingly, many applications offers stronger auditability by adopting a TSA two-way peg deploy all their blockchain nodes on a BaaS (Blockchain- protocol, which prevents malicious behaviors from both users as-a-Service) environment maintained by a single service and service providers. -

Accounting Information Systems: a View from the Public Eye Rachelle Paige Miller, Staff Associate, Henry Peters, P.C., USA Esther Bunn, Stephen F

International Business & Economics Research Journal – September/October 2016 Volume 15, Number 5 Accounting Information Systems: A View from the Public Eye Rachelle Paige Miller, Staff Associate, Henry Peters, P.C., USA Esther Bunn, Stephen F. Austin State University, USA Kelly Noe, Assistant Professor, Stephen F. Austin State University, USA ABSTRACT In order to fully appreciate the potential impact accounting information systems have on the accounting profession, an understanding of what accounting encompasses is necessary. Over the years, accounting has evolved from what many would call a “checks and balance” system to a much more complex system involving complicated activities such as calculating taxes and garnishments, auditing financial statements and processing payroll to name a few. It would be reasonable to think that advanced technology such as accounting information systems would only enhance the production of these activities. However, like with any “game changers,” there are always potential threats involved. The objective of this paper is to determine if accounting information systems have become so helpful, they in fact have begun to hinder business and decrease productivity. This paper demonstrates that although a majority population of those surveyed felt accounting information systems have added credibility to the accountin g profession, there is still a large population that remain neutral on the subject leaving doubt as to the advantages and purpose of accounting information systems. Keywords: Accounting Information Systems; Productivity; Survey Of Accounting Information Systems hat is accounting? Generically defined, accounting is the keeping of financial records. The general public that has not been exposed to accounting curriculum tend to believe accounting is simply W adding and subtracting amounts from a beginning number to get an ending number, much like balancing a checkbook. -

Ledger Entries – Overview

Ledger Entries – Overview Speech Cursor Actions The purpose of ledger entries is to record financial transactions as Slide: Ledger Entries produce a debits and credits, in a form appropriate to enter into your report of debits and credits, which accounting software. can be entered into your accounting software (e.g. Quickbooks, Simply Accounting) As Sumac users perform financially significant transactions – like Slide: As Sumac users enter receiving a donation, selling tickets, or renewing a membership – financial transactions, Sumac Sumac automatically breaks the components of the transactions creates Ledger Entries which into debits and credits and saves these into ledger entries. break the transactions into the appropriate debit and credit accounts. This approach separates accounting functions from other Slide: Ledger Entries let operational functions. It makes financial information available in bookkeepers reconcile financial a ledger format that is comfortable for bookkeeping and transactions between Sumac their accounting staff, but does not require everyone using Sumac to accounting software. become a bookkeeper. Ledger entries allocate funds to account codes, so the account Slide: Set up account codes in codes must be defined first. In Sumac, you need to define account Sumac to match the Chart of codes that correspond to accounts in the Chart of Accounts in your Accounts in your accounting accounting software. software. Ensure that each payment type is linked to the appropriate Slide: Set up account codes for account, since most receipts debit the payment type’s account each payment type. code. Make sure that each surcharge, like a sales tax, is linked to an Slide: Specify an account for each appropriate account, since surcharge amounts credit the surcharge. -

Accounting Versus Bookkeeping

Accounting versus Bookkeeping Last Verified: April 2017 Bookkeeping and accounting serve different purposes in business. Whether you hire a professional or do it yourself, as a business owner you are fully responsible for all reporting to the Canada Revenue Agency (CRA) and other governing bodies. When it comes to the books, you cannot afford to assume or be ignorant of any laws and regulations. As owner or operator of your company, you are legally bound to the responsibilities related to business ownership. What is the difference between accounting and bookkeeping? Accounting Bookkeeping • Responsible for preparing financial • Responsible for the reliability of the statements and yearly tax returns data used by accountants • Prepares and audits reports based • Records sales, purchases, settlements, on the bookkeeping data profit etc. • Adjusts entries for interest, • Data entry of detailed business depreciation, bad debts etc. records • Analyzes and interprets financial • Does not need to interpret or analyze data entries • Concerned about assets and • Concerned about day-to-day financial liabilities, financial health events • Accountants need to meet • Anyone can be a bookkeeper if they professional standards and have the knowledge and experience; certifications no certification is required • Typically subjective • Typically objective The Role of Bookkeeping and Accounting in Small Business Accountants prepare budgets and loan proposals, as well as working with the costs and prices of a company’s products or services. Accountants can also find trends as well as identify issues such as theft or bankruptcy. Accountants also provide information and analysis to various groups. For example, management accounting keeps the managers of the company informed about revenues and costs, and financial accounting keeps the bank, vendors and stakeholders informed about the financial activity of company. -

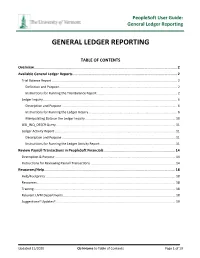

General Ledger Reporting

PeopleSoft User Guide: General Ledger Reporting GENERAL LEDGER REPORTING TABLE OF CONTENTS Overview .......................................................................................................................................... 2 Available General Ledger Reports .................................................................................................... 2 Trial Balance Report ........................................................................................................................................... 2 Definition and Purpose ................................................................................................................................... 2 Instructions for Running the Trial Balance Report ......................................................................................... 2 Ledger Inquiry ..................................................................................................................................................... 6 Description and Purpose ................................................................................................................................ 6 Instructions for Running the Ledger Inquiry .................................................................................................. 6 Manipulating Data on the Ledger Inquiry .................................................................................................... 10 LED_INQ_DESCR Query ...................................................................................................................................