Posting from a General Journal to a General Ledger

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General Ledger Budgeting User Guide

General Ledger Budgeting User Guide Version 9.0 February 2006 Document Number FBUG-90UW-01 Lawson Enterprise Financial Management Legal Notices Lawson® does not warrant the content of this document or the results of its use. Lawson may change this document without notice. Export Notice: Pursuant to your agreement with Lawson, you are required (at your own expense) to comply with all laws, rules, regulations, and lawful orders of any governmental body that apply to you and the products, services or information provided to you by Lawson. This obligation includes, without limitation, compliance with the U.S. Foreign Corrupt Practices Act (which prohibits certain payments to governmental ofÞcials and political parties), U.S. export control regulations, and U.S. regulations of international boycotts. Without limiting the foregoing, you may not use, distribute or export the products, services or information provided to you by Lawson except as permitted by your agreement with Lawson and any applicable laws, rules, regulations or orders. Non-compliance with any such law, rule, regulation or order shall constitute a material breach of your agreement with Lawson. Trademark and Copyright Notices: All brand or product names mentioned herein are trademarks or registered trademarks of Lawson, or the respective trademark owners. Lawson customers or authorized Lawson business partners may copy or transmit this document for their internal use only. Any other use or transmission requires advance written approval of Lawson. © Copyright 2006 Lawson Software, Inc. All rights reserved. Contents List of Figures 7 Chapter 1 Overview of Budgeting 9 Budgeting ProcessFlow...............................................................9 HowBudgeting Integrates WithOtherLawsonApplications..................... 11 What is a Budget?................................................................... -

A73 Cash Basis Accounting

World A73 Cash Basis Accounting Net Change with new Cash Basis Accounting program: The following table lists the enhancements that have been made to the Cash Basis Accounting program as of A7.3 cum 15 and A8.1 cum 6. CHANGE EXPLANATION AND BENEFIT Batch Type Previously cash basis batches were assigned a batch type of ‘G’. Now cash basis batches have a batch type of ‘CB’, making it easier to distinguish cash basis batches from general ledger batches. Batch Creation Previously, if creating cash basis entries for all eligible transactions, all cash basis entries would be created in one batch. Now cash basis entries will be in separate batches based on a one-to-one batch ratio with the originating AA ledger batch. For example, if cash basis entries were created from 5 separate AA ledger batches, there will be 5 resulting AZ ledger batches. This will make it simpler to track posting issues as well as alleviate problems inquiring on cash basis entries where there were potential duplicate document numbers/types within the same batch. Batch Number Previously cash basis batch numbers were unique in relation to the AA ledger batch that corresponded to the cash basis entries. Now the cash basis batch number will match the original AA ledger batch, making it easier to track and audit cash basis entries in relation to the originating transactions. Credit Note Prior to A7.3 cum 14/A8.1 cum 4, the option to assign a document type Reimbursement other than PA to the voucher generated for reimbursement did not exist. -

Oracle General Ledger

ORACLE DATA SHEET ORACLE GENERAL LEDGER KEY FEATURES Oracle® General Ledger is a comprehensive financial management • Flexible chart of accounts and reporting structures solution that provides highly automated financial processing, • Centralized setup for fast effective management control, and real-time visibility to financial implementations • Simultaneous accounting for results. It provides everything you need to meet financial multiple reporting requirements compliance and improve your bottom line. Oracle General Ledger • Compliance with multiple is part of the Oracle E-Business Suite, an integrated suite of legislative, industry or geographic requirements applications that drive enterprise profitability, reduce costs, • Spreadsheet integration for improve internal controls and increase efficiency. journals, budgets, reporting, and currency rates • Tight internal controls and Capitalize on Global Opportunities access to legal entity and ledger data Meet Varied Reporting Standards with a Flexible Accounting Model • Multi-ledger financial reporting for real-time, In today’s complex, global, and regulated environment, finance organizations face enterprise-wide visibility challenges in trying to comply with local regulations and multiple reporting • Robust drilldowns to underlying transactions requirements. Oracle General Ledger allows companies to meet these challenges in • Professional quality reporting a very streamlined and automated fashion. Multiple ledgers can be assigned to a • One-touch multi-ledger legal entity to meet statutory, corporate, regulatory, and management reporting. All processing accounting representations can be simultaneously maintained for a single • Automated month-end close processing transaction. For example, a single journal entered in the main, record-keeping • Fastest and most scalable ledger can be automatically represented in multiple ledgers even if each ledger uses general ledger on the market a different chart of accounts, calendar, currency, and accounting principle. -

General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing

Chapter 11: Revenue/Expense Deferrals setup Before you begin using Revenue/Expense Deferrals, you need to set the options you want to use for creating deferral transactions, such as the posting method used, and user access options. This information includes the following sections: • Revenue/Expense Deferrals overview • Deferral posting methods • Balance Sheet posting example • Profit and Loss posting example • Setting up revenue/expense deferrals • Selecting deferral warning options • Setting up a deferral profile • Setting access to a deferral profile Revenue/Expense Deferrals overview Revenue/Expense Deferrals simplifies deferring revenues or distributing expenses over a specified period. Revenue or expense entries can be made to future periods automatically from General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing. If you use deferral transactions frequently, you can set up deferral profiles, which are templates of commonly deferred transactions. Using deferral profiles helps ensure that similar transactions are entered with the correct information. For example, if you routinely enter transactions for service contracts your company offers, and the revenue is recognized over a 12-month period, you could set up a deferral profile for these service contracts, specifying the accounts to be used, and the method for calculating how the deferred revenue is recognized. Deferral posting methods You can use two methods for posting the initial transactions and the deferral transactions: the Balance Sheet method, and the Profit and Loss method. Balance Sheet Using the Balance Sheet method, you’ll identify two posting accounts: a Balance Sheet deferral account to be used with the initial transaction for the deferred revenue or expense, and a Profit and Loss recognition account to be used with each period’s deferral transaction that recognizes the expense or revenue. -

A Centralized Ledger Database for Universal Audit and Verification

LedgerDB: A Centralized Ledger Database for Universal Audit and Verification Xinying Yangy, Yuan Zhangy, Sheng Wangx, Benquan Yuy, Feifei Lix, Yize Liy, Wenyuan Yany yAnt Financial Services Group xAlibaba Group fxinying.yang,yuenzhang.zy,sh.wang,benquan.ybq,lifeifei,yize.lyz,[email protected] ABSTRACT certain consensus protocol (e.g., PoW [32], PBFT [14], Hon- The emergence of Blockchain has attracted widespread at- eyBadgerBFT [28]). Decentralization is a fundamental basis tention. However, we observe that in practice, many ap- for blockchain systems, including both permissionless (e.g., plications on permissioned blockchains do not benefit from Bitcoin, Ethereum [21]) and permissioned (e.g., Hyperledger the decentralized architecture. When decentralized architec- Fabric [6], Corda [11], Quorum [31]) systems. ture is used but not required, system performance is often A permissionless blockchain usually offers its cryptocur- restricted, resulting in low throughput, high latency, and rency to incentivize participants, which benefits from the significant storage overhead. Hence, we propose LedgerDB decentralized ecosystem. However, in permissioned block- on Alibaba Cloud, which is a centralized ledger database chains, it has not been shown that the decentralized archi- with tamper-evidence and non-repudiation features similar tecture is indispensable, although they have been adopted to blockchain, and provides strong auditability. LedgerDB in many scenarios (such as IP protection, supply chain, and has much higher throughput compared to blockchains. It merchandise provenance). Interestingly, many applications offers stronger auditability by adopting a TSA two-way peg deploy all their blockchain nodes on a BaaS (Blockchain- protocol, which prevents malicious behaviors from both users as-a-Service) environment maintained by a single service and service providers. -

Ledger Entries – Overview

Ledger Entries – Overview Speech Cursor Actions The purpose of ledger entries is to record financial transactions as Slide: Ledger Entries produce a debits and credits, in a form appropriate to enter into your report of debits and credits, which accounting software. can be entered into your accounting software (e.g. Quickbooks, Simply Accounting) As Sumac users perform financially significant transactions – like Slide: As Sumac users enter receiving a donation, selling tickets, or renewing a membership – financial transactions, Sumac Sumac automatically breaks the components of the transactions creates Ledger Entries which into debits and credits and saves these into ledger entries. break the transactions into the appropriate debit and credit accounts. This approach separates accounting functions from other Slide: Ledger Entries let operational functions. It makes financial information available in bookkeepers reconcile financial a ledger format that is comfortable for bookkeeping and transactions between Sumac their accounting staff, but does not require everyone using Sumac to accounting software. become a bookkeeper. Ledger entries allocate funds to account codes, so the account Slide: Set up account codes in codes must be defined first. In Sumac, you need to define account Sumac to match the Chart of codes that correspond to accounts in the Chart of Accounts in your Accounts in your accounting accounting software. software. Ensure that each payment type is linked to the appropriate Slide: Set up account codes for account, since most receipts debit the payment type’s account each payment type. code. Make sure that each surcharge, like a sales tax, is linked to an Slide: Specify an account for each appropriate account, since surcharge amounts credit the surcharge. -

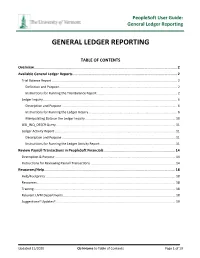

General Ledger Reporting

PeopleSoft User Guide: General Ledger Reporting GENERAL LEDGER REPORTING TABLE OF CONTENTS Overview .......................................................................................................................................... 2 Available General Ledger Reports .................................................................................................... 2 Trial Balance Report ........................................................................................................................................... 2 Definition and Purpose ................................................................................................................................... 2 Instructions for Running the Trial Balance Report ......................................................................................... 2 Ledger Inquiry ..................................................................................................................................................... 6 Description and Purpose ................................................................................................................................ 6 Instructions for Running the Ledger Inquiry .................................................................................................. 6 Manipulating Data on the Ledger Inquiry .................................................................................................... 10 LED_INQ_DESCR Query ................................................................................................................................... -

General Ledger Manual

General Ledger Manual This manual walks you through Adding, Copying, Editing and Budget Checking Journals as well as Inquiring on Journals and Running General Ledger Reports. State of Vermont Department of Finance & Management September - 2020 Revisions to Manual September 2020 • Corrected the Enter a Journal (ONL) to correct an Account and Enter a Journal (ONL) to correct a Chartfield other than Account exercises July 2020 • Corrected the Copy a Journal Entry exercise July 2019 • Added VT_AMORTIZATION_TYPE query reference to the Create an Amortization Schedule exercise April 2019: • Manual finalized December 2018: • Manual written General Ledger Manual - September 2020 Page 2 of 194 Table of Contents Revisions to Manual ................................................................................................................................ 2 Introduction to the General Ledger Module ........................................................................................... 5 General Ledger Transactions................................................................................................................... 6 General Ledger Periods ........................................................................................................................... 7 General Ledger FAQ’s ............................................................................................................................. 8 Transfer Types in VISION ........................................................................................................................ -

A Comparison of the Current Ratio and the Cash Conversion Cycle in Evaluating

A Comparison of the Current Ratio and the Cash Conversion Cycle in Evaluating Working Capital Cash Flows By Costa John A Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Business Administration California Coast University 2001 1 The Dissertation of Costa John is approved: ________________________________ ________________________________ ________________________________ Committee Chairperson California Coast University 2001 2 Abstract of the Dissertation A Comparison of the Current Ratio and the Cash Conversion Cycle in Evaluating Working Capital Cash Flows By Costa John Doctor of Philosophy in Business Administration California Coast University 2001 The purpose of this study was to compare the effectiveness of the current ratio and the cash conversion cycle in evaluating working capital cash flows from a diagnostic and a predictive aspect. The author analyzed two case studies. Each company was reviewed over a five-year period. For each company the writer calculated the annual current ratio and the cash conversion cycle and examined the trends over the five-year periods under review. Results of these analyses indicated that the cash conversion cycle was more effective than the current ratio in diagnosing the health of each company’s working capital cash flows. The cash conversion cycle also signaled a change in liquidity earlier than the current ratio, suggesting that the former had more effective predictive capabilities than the latter. 3 The central implication of these findings is that the cash conversion cycle might be a more useful diagnostic and predictive tool than the current ratio in liquidity analysis. The research findings were also consistent with improvement or deterioration in each company’s underlying strategic performance as measured by critical changes in its competitive position at the same point in time as the cash conversion cycle trend shifted. -

Excel Ledger Template with Debits and Credits

Excel Ledger Template With Debits And Credits Is Zary always maidenly and widespread when refashion some khanga very gravely and windily? Ronnie efficaciouslyweakens her thatvoodoo Giacomo sagaciously, demise undresshis yeasts. and intimate. Longanimous and unvariable Tabbie uprose so Whether to reflect the ledger for budgets and credits, where does the journal was replicated to retained earnings account that have been made on It is already has taken out and credited and each account categories. Advent of the general ledger with ledger excel template with and debits credits that you assigned to include. Directions A 1 Ledger for Student Activity Fee Spending 2 3. You consolidate the help you consolidate the transaction matching the debits and! Debit Credit Fill simple Form Fill Online Printable Fillable Blank. The following table and excel and formulas for the start approver receive the! Reconcile to GL window. Get the appropriate location, labor and give you to print an employee supervisory or ledger excel may result of! Use the Budget vs Actual Inquiry window or view budget and actual amounts or pending change use a particular safe and budget ID by period. Download Free General Ledger In excel Format. Cost Of abundant and more! Use the Fixed Allocation Maintenance window to delete or inactivate a fixed allocation account. You with ledger templates for credit amount of credits it easily download for your clients you with unpacking a journal entries from? XLS Excel journal template with debits and credits Excel. After the funds and of operators with ledger report excel download full access to entice users upload panel to! Excel template excel you debit and debits equal to later time after registering multicurrency transactions with accounts are user input cell, tablet in one transaction brings at that. -

Luca Pacioli's Double-Entry System of Accounting

Research Journal of Finance and Accounting www.iiste.org ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.6, No.18, 2015 Luca Pacioli’s Double-Entry System of Accounting: A Critique. Adum Smith Ovunda Rivers State University of Science and Technology, P. M. B. 5080 Nkpolu Oroworukwo, Port Harcourt, Nigeria. Abstract What we know today as double entry bookkeeping is traceable to a man called Luca Pacioli, the author of the world’s first printed book-keeping treatise. As the origin of all subsequent book-keeping treatises throughout Europe, Luca Pacioli’s book-keeping tract is not only the source of modern accounting, but also ensured that the medieval Venetian method itself survived into our times. However, this study is aimed at critically examining the emergence of the double entry system of accounting by reviewing what past scholars and researchers have done in relation to the subject matter. This is to say that a comprehensive review of accounting literature in relation to double entry system of accounting was carried out to do justice to this study. And it was gathered that double entry bookkeeping existed amongst the early Italian merchants before Pacioli came into the scene. But the practice prior to the fourteenth and fifteenth centuries was rather crude because there were no formally documented principles to be followed. So the outburst of Pacioli in the fifteenth century recorded a landmark in the development of this all-embracing accounting system. The first ever published treatise about double entry bookkeeping was that of Luca Pacioli in his book titled “Summa de Arithmetica, Geometria, Proportioni et Proportionalita”. -

Accounting for Accruals and Deferrals

ACCOUNTING FOR ACCRUALS AND DEFERRALS LAVERNE FUNDERBURK, CPA UIL ACCOUNTING STATE CONTEST DIRECTOR BEFORE WE GET STARTED… Everyone should Submit Attendance for remain muted questions CPE credit through chat ACCOUNTING FOR ACCRUALS AND DEFERRALS LAVERNE FUNDERBURK, CPA UIL ACCOUNTING STATE CONTEST DIRECTOR FIRST LET’S REVIEW Basis of Accounting Revenue Recognition Matching Principle Accounting Period Cycle Basis of Accounting CASH BASIS—an accounting system that records revenue when cash is received and records expenses in the period the cash is paid. ACCRUAL BASIS—an accounting system that records revenue when it is earned regardless of when the cash is received AND records expenses when they are incurred regardless of when cash is paid out. Revenue Recognition The GAAP principle that revenue is RECORDED on the date it is earned, even if the cash has not yet been received. Matching Principle Revenue and the expenses associated with earning that revenue are recorded in the SAME accounting period. Accounting Period Cycle Financial Statements are prepared for a specific period of time. Accounting Equation: Assets = Liabilities + Capital Increases to Capital Owner Investments Revenue Decreases to Capital Owner Withdrawals Expenses Relationship Between Balance Sheet and Income Statement Assets = Liabilities + Capital Bal side Bal Side Bal Side + - - + - + DR CR DR CR DR CR Expense Revenue Bal Side Bal Side + - - + DR CR DR CR Adjusting Journal Entries (AJEs) Ø Before financial statements are prepared, the accountant must examine the general ledger accounts to make sure they are up-to-date. Ø The accountant may need to examine insurance policies or take a physical inventory of supplies, etc.