Chinese Supermarket Opens NZ Section

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

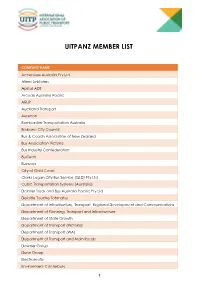

Uitpanz Member List

UITPANZ MEMBER LIST COMPANY NAME Accenture Australia Pty Ltd Allens Linklaters Apical ADS Arcadis Australia Pacific ARUP Auckland Transport Aurecon Bombardier Transportation Australia Brisbane City Council Bus & Coach Association of New Zealand Bus Association Victoria Bus Industry Confederation BusTech Busways City of Gold Coast Clarks Logan City Bus Service (QLD) Pty Ltd Cubic Transportation Systems (Australia) Daimler Truck and Bus Australia Pacific Pty Ltd Deloitte Touche Tohmatsu Department of Infrastructure, Transport, Regional Development and Communications Department of Planning, Transport and Infrastructure Department of State Growth Department of Transport (Victoria) Department of Transport (WA) Department of Transport and Main Roads Downer Group Dunn Group Electromotiv Environment Canterbury 1 Go Bus Transport Greater Wellington Regional Council GTA Consultants INIT Australia Institute of Transport and Logistics Studies John Holland Group KDR Gold Coast Keolis Downer Kinetic LEK Consulting Liftango Liverpool City Council Macquarie Group Major Transport Infrastructure Authority Metro Tasmania Metro Trains Melbourne Monash University, Institute of Transport Studies Movement & Place Consulting MRCagney National Transport Commission netBI New Zealand Transport Agency NTT DATA Payment Services Victoria NZ Bus Ltd Public Transport Authority of Western Australia Pulitano Group (dba Bus Queensland) PwC Strategy& (Australia) RATP DEV Australia Ritchies Transport Holdings Scania Australia SmedTech Snapper Services Southern Cross Station Sydney Metro 2 Sydney Trains Toshiba International Corporation Pty Ltd Tourism and Transport Forum Transdev Australasia Transdev Sydney Ferries Transit Australia Group Transport Canberra and City Services Transport for Brisbane Transport for NSW Tranzit Coachlines Trapeze Group Asia Pacific V/Line VIA Transportation VicTrack Volvo WSP Australia Yarra Trams END 3 . -

Notice of Meeting

NOTICE OF MEETING Notice is hereby given of the Meeting of the Community Services Committee to be held in the Council Chamber, First Floor, Civic Administration Building, 101 Esk Street, Invercargill on Monday 09 February 2015 at 4.00pm His Worship the Mayor Mr T R Shadbolt JP Cr R L Abbott (Chair) Cr P W Kett (Deputy Chair) Cr R R Amundsen Cr N D Boniface Cr I L Esler Cr G D Lewis Cr Rowly Currie (Environment Southland) (Total Mobility and Passenger Transport) EIRWEN HARRIS MANAGER, SECRETARIAL SERVICES Finance and Corporate Services Directorate Civic Administration Building • 101 Esk Street • Private Bag 90104 Invercargill • 9840 • New Zealand DX No. YA90023 • Telephone 03 211 1777 • Fax 03 211 1433 2 A G E N D A Page 1. APOLOGIES 2. PUBLIC FORUM 2.1 REGIONAL PUBLIC TRANSPORT PLAN HEARING TIMETABLE 5 3. MONITORING OF SERVICE PERFORMANCE 3.1 LEVELS OF SERVICE 7 3.1.1 Community Development 8 3.1.2 Passenger Transport 9 3.1.3 Pools 10 3.1.4 Libraries and Archives 12 3.1.5 Housing Care Service 17 4. MONITORING OF FINANCIAL PERFORMANCE 19 4.1 COMMUNITY DEVELOPMENT 20 4.2 PASSENGER TRANSPORT 20 4.3 POOLS 20 4.4 LIBRARY AND ARCHIVES 20 4.5 HOUSING CARE 20 4.6 FINANCIAL SUMMARY 21 5. ACTIVITY PLAN REVIEW/FORWARD PLANS 5.1 SUBMISSIONS TO REGIONAL PUBLIC TRANSPORT PLAN 27 Appendix 1 29 Appendix 2 102 Appendix 3 129 6. ACTION SHEET 3 7. OTHER BUSINESS 7.1 REPORT OF THE CHIEF EXECUTIVE 7.1.1 Community Development Projects 133 7.2 REPORT OF THE DIRECTOR OF WORKS AND SERVICES 7.2.1 Gymnasium Addition Revised 135 Appendix 1 137 7.3 REPORT OF THE DIRECTOR OF FINANCE AND CORPORATE SERVICES 7.3.1 2015/16 Fees and Charges 167 Appendix 1 169 8. -

The Hamilton City Accessible Journey Trial

The Hamilton City Accessible Journey Trial An evaluation January 2009 Prepared for The Hamilton City Accessible Journey Trial Project Team C/- Marceli Davison New Zealand Transport Agency Hamilton Prepared by Kay Kristensen Girls on Coffee Ltd the research evaluation group Cambridge Ph: 07 8239011 021 888512 [email protected] 1 Executive summary Introduction: Hamilton’s disabled community had been advocating to relevant authorities for many years for an accessible public land transport system. This, together with the Human Rights Commission’s inquiry into accessible public land transport for people with disabilities, inspired the Hamilton city Accessible Journey Trial’s project team to modify two medium buses servicing the inner city route and provide changes to five on-route bus stops in an effort to improve public land transport accessibility for people with disabilities in Hamilton and in doing so improve access for all. This evaluation documents the approach undertaken by the project team and reports the impact of the modifications from the project team’s and consumer’s perspective. Background: Transport is critical to participation in society. Disabled people in New Zealand have never had a public transport system that is accessible and affordable. The Human Rights Commission began an inquiry in 2003 prompted by the experiences and concerns of disabled people seeking enforcement of their right not to be discriminated against in the provision of public transport. The framework for the Inquiry was the concept of the accessible journey which is described as all the steps needed for a person to get from their home to their destination and back. -

Public Transport Committee

Public Transport Committee NOTICE IS GIVEN that the next meeting of the Public Transport Committee will be held in Mauao Rooms, Bay of Plenty Regional Council Building, 87 First Avenue, Tauranga on: Friday, 8 February 2019 commencing at 9.30 am. Fiona McTavish Chief Executive 31 January 2019 Public Transport Committee Terms of Reference The Public Transport Committee has the core function of implementing and monitoring Regional Council public transport strategy and policy. Delegated Function To set the operational direction for approved Regional Council public transport policy and strategy and monitor how it is implemented. This will be achieved through the development of specific operational decisions which translate policy and strategy into action. Membership • Eight councillors (one of whom will be the Chair and one of whom will be the Deputy Chair) and the Chairman as ex-officio; and • One representative from Tauranga City Council, one representative from Rotorua Lakes Council and one representative from Western Bay of Plenty District Council. Quorum In accordance with Council standing order 10.2, the quorum at a meeting of the committee is not fewer than four Regional Council members of the committee. Term of the Committee For the period of the 2016-2019 Triennium unless discharged earlier by the Regional Council. Meeting frequency At least quarterly, or as frequently as required. Specific Responsibilities and Delegated Authority The Public Transport Committee is delegated the power of authority to: • Approve and review the Bay of Plenty Regional Public Transport Plan. • Approve, implement, monitor and review operational public transport policy and plans and enter into contracts on matters within its terms of reference, provided that the exercise of this power shall be subject to a total financial limit of $200,000 per decision and within the allocation of funds set aside for that purpose in the Long Term Plan or Annual Plan or as otherwise specifically approved by Council. -

Daimler Trucks Reclaiming Fuso NZ Distribution?

New Zealand’s news source for road transport, logistics & heavy equipment industries Volume 3 | Issue 9 | April 2016 Daimler Trucks reclaiming Fuso NZ distribution? aimler Trucks Asia and successful cooperation has confirmed to with our dealers, and con- DDIESELTalk that it is tinue to serve our customers looking at the distribution with the best products and arrangements for Fuso truck services,” says Laudan. and bus in New Zealand but “New Zealand is an has not made any immedi- important market for Fuso, ate decisions. and we intend to grow “In New Zealand, we are further our business and in the process of evaluat- market position here.” ing adaptions in our sales Mitsubishi Motors New setup,” says Daimler Trucks Zealand General Man- Asia head of communica- ager Warren Brown told tions Florian Laudan. DIESELTalk that the compa- “We have heard that ny is in ongoing discussions there are speculations in the with Daimler Trucks. market, that there are going “The truth is that we are to changes in the New Zea- still in talks with Daimler so land Fuso Sales setup.” have no comments at this “While there are no deci- point,” says Brown. sions taken, we can ensure The New Zealand arm of we will continue the long Continued on page 4 TRUCK ARRIVALS STRONGEST YET ore than 406 new February, so the momen- Muir says that Isuzu believe that we can achieve heavy trucks (over tum is continuing to grow Trucks will continue to the set targets while others M3500kg GVM) in this sector of the market. buck the trend of declin- may face a decline,” he arrived in March 2016, the Isuzu Trucks general ing sales faced by other says. -

Transport Activity Procurement Strategy

Transport Activity Procurement Strategy Title Title part 2 Bay of Plenty Regional Council Transport Publication 2013/01 5 Quay Street PO Box 364 Whakatāne 3158 NEW ZEALAND ISSN: 1175-8538 (Print) ISSN: 1179-9552 (Online) Transport Activity Procurement Strategy Transport Publication 2013/01 ISSN: 1175-8538 (Print) ISSN: 1179-9552 (Online) 18 February 2014 Bay of Plenty Regional Council 5 Quay Street PO Box 364 Whakatāne 3158 NEW ZEALAND Prepared by Rachel Pinn, Senior Transport Planner Executive summary The Procurement Strategy shares the Council’s procurement vision: “To support the strategic objectives of the Bay of Plenty Regional Council by providing best value for Council’s ratepayers through intelligent, best practice, sustainable procurement”. To achieve the Strategy objectives that Council has set for this Transport Activities Procurement Strategy, it applies the following features: Implementation of the Public Transport Operating Model - Council is committed to implementing the new Public Transport Operating Model (PTOM). This Procurement Strategy forms part of the implementation plan for PTOM and includes partnering features such as annual business planning and financial incentive mechanisms. All procurement will comply with the New Zealand Transport Agency’s (NZTA’s) Procurement Manual. Supplier selection method/contract delivery model - The price quality supplier selection method and the partnering delivery model will predominantly be used for the public transport services with the exception of one staged small rural contract. The transition phase of the school buses recommends a direct appointment process. Council will predominantly use the direct appoint and quality methods for the appointment of professional services. Public transport Vehicle Quality Standards (VQS) - Council will implement the NZTAs Requirements for Urban Buses in Tauranga, the Tauranga school bus services will utilise the current Ministry of Education (MoE) approach to vehicle safety as described in the Tauranga School Bus business case. -

Business Unit Report Template

Board Meeting | 27 June 2016 Agenda Item no.9 Open Session Business Report Recommendation: That the Chief Executive’s report be received. Prepared by: David Warburton, Chief Executive Corporate Special Housing Areas (SHAs) A total of 154 SHAs have been approved under the Housing Accords and Special Housing Areas Act 2013 (HASHA) legislation providing a potential yield of some 55,500 sections or units. The HASHA legislation that enables the SHAs to be created expires in September 2016. SHAs that require a plan variation need to be approved by this date under the current legislation. It is estimated that there are 10 SHAs requiring plan variation decisions before the expiry date. Local Boards All local boards have now allocated their full Local Board Transport Capital Fund (LBTCF) budgets to June 30 2016 and many have committed a proportion of their 2016/2017 money. AT is aiming to deliver all of the committed projects prior to the end of this election cycle. However, some projects may not be able to be completed in this timeframe and appropriate funding carryover is being arranged for these. Material is being prepared for the induction of new local board members and councillors. These workshops are scheduled for late January. Road Death Investigations AT investigated one Road Death that occurred in May, two reports have been sent to Police, and there are seven reports being finalised. In the completed reports which were sent to Police in May a number of general road improvement/maintenance issues were identified and these have been included in the safety delivery programme including signage and assets condition improvement requests. -

Item 17 Auckland Transport Update to the Hibiscus and Bays Local Boar

ATTACHMENT A January - March 2017 Hibiscus and Bays Local Board This report provides a picture of Auckland Transport activities over the January - March 2017 Quarter. The report is in two sections: (a) Information on AT projects that are located within the Hibiscus and Bays Local Board area; (b) Information on Regional Projects. The numbering used in the report has no meaning other than as a reference to facilitate subsequent discussion. The report has been compiled by Auckland Transport's Elected Member Relationship Unit from data supplied by the Operations Division, Capital Development Division and Strategy and Planning Department. Thursday, 4 May 2017 Page 1 of 15 Hibiscus and Bays Assets and Maintenance Progr amme Item ID Start Finish Status Notes 31566 Torbay The Local Board intention is for an environmental enhancement of the C.100828 Jun 14 Apr 17 Construction Work was recommenced in mid- Revitalisation Torbay town centre to improve its attractiveness and economic February and has since had some Project performance. The work will include adjusting the road layout to delays. There have been design increase pedestrian space, installing new decorative paving, street challenges with the very flat nature furniture and enhanced lighting, undertaking substantial planting, of the site requiring some redesign moving the traffic circle to improve traffic flow, reinstating the zebra work. This along with several crossing, installing a new speed table and laying out new road markings. weather events has delayed progress with expected finish date now early May. Major Capital Progr amme Item ID Start Finish Status Notes 31567 Long Bay Glenvar Glenvar Ridge Road is a proposed new road extending from 285 C.001190 Nov 10 Nov 18 Construction Detailed design has been Ridge Road Glenvar Road to a point north of Ashley Reserve. -

OTAGO REGIONAL COUNCIL Agenda for a Meeting of The

OTAGO REGIONAL COUNCIL Agenda for a meeting of the Finance and Corporate Committee to be held in the Council Chamber, 70 Stafford Street, Dunedin on Wednesday 2 August 2017, following the Regulatory Committee Membership: Cr Doug Brown (Chairperson) Cr Andrew Noone (Deputy Chairperson) Cr Graeme Bell Cr Michael Deaker Cr Carmen Hope Cr Trevor Kempton Cr Michael Laws Cr Ella Lawton Cr Sam Neill Cr Gretchen Robertson Cr Bryan Scott Cr Stephen Woodhead Apologies: Cr Noone Leave of Absence: Cr Neill In attendance: Please note that there is an embargo on agenda items until 8:30am on Monday 31 July 2017 CONFIRMATION OF AGENDA CONFLICT OF INTEREST PUBLIC FORUM MINUTES The minutes of the meeting held on 14 June 2017, having been circulated, for adoption. ACTIONS Status report on the resolutions of the Finance & Corporate Committee Report No. Meeting Resolution Status 2017/0781 3/5/17 That Council receive a report on the effectiveness OPEN Grants, Legal and outcomes of each grant, including the bulk (schedule for report Cases and water grants at the end of this financial year, 30 to F&C Committee Personal June 2017. 13/9/17) Grievances PART A- RECOMMENDATIONS Item 1 2017/0951 Port Otago Ltd – Statement of Corporate Intent. DCS, 18/7/17 - The report summaries the Board of Port Otago Limited’s Draft Statement of Corporate Intent (SCI). The SCI is a requirement to provide to Council as shareholder for its comment and consideration. The Draft Statement of Corporate Intent for the three years to June 2020 is circulated with the agenda. Item 2 2017/0962 Public Transport Update – July 2017 DCS, 25/07/17 - This report provides staff response to the petition received and public forum comments made at Council’s 28 June meeting. -

Public Transport Committee

Public Transport Committee NOTICE IS GIVEN that the next meeting of the Public Transport Committee will be held in Council Meeting Room One, Bay of Plenty Regional Council, 5 Quay Street, Whakatāne on: Friday, 5 May 2017 commencing at 9.30 am. Mary-Anne Macleod Chief Executive 28 April 2017 Public Transport Committee Terms of Reference The Public Transport Committee has the core function of implementing and monitoring Regional Council public transport strategy and policy. Delegated Function To set the operational direction for approved Regional Council public transport policy and strategy and monitor how it is implemented. This will be achieved through the development of specific operational decisions which translate policy and strategy into action. Membership • Eight councillors (one of whom will be the Chair and one of whom will be the Deputy Chair) and the Chairman as ex-officio; and • One representative from Tauranga City Council, one representative from Rotorua Lakes Council and one representative from Western Bay of Plenty District Council. Quorum In accordance with Council standing order 10.2, the quorum at a meeting of the committee is not fewer than four Regional Council members of the committee. Term of the Committee For the period of the 2016-2019 Triennium unless discharged earlier by the Regional Council. Meeting frequency At least quarterly, or as frequently as required. Specific Responsibilities and Delegated Authority The Public Transport Committee is delegated the power of authority to: • Approve and review the Bay of Plenty Regional Public Transport Plan. • Approve, implement, monitor and review operational public transport policy and plans and enter into contracts on matters within its terms of reference, provided that the exercise of this power shall be subject to a total financial limit of $200,000 per decision and within the allocation of funds set aside for that purpose in the Long Term Plan or Annual Plan or as otherwise specifically approved by Council. -

Attachment A

ATTACHMENT A January - March 2017 Waiheke Local Board This report provides a picture of Auckland Transport activities over the January - March 2017 Quarter. The report is in two sections: (a) Information on AT projects that are located within the Waiheke Local Board area; (b) Information on Regional Projects. The numbering used in the report has no meaning other than as a reference to facilitate subsequent discussion. The report has been compiled by Auckland Transport's Elected Member Relationship Unit from data supplied by the Operations Division, Capital Development Division and Strategy and Planning Department. Thursday, 27 April 2017 Page 1 of 11 Waiheke Public Transport Programme Item ID Start Finish Status Notes 31957 Ferry Improvements Waiheke Ferry Services - Works / activities completed in the last Ferry On-going quarter: market assessment of retail options at Matiatia wharf, delivery of renewal maintenance work on berths 1 and 2 at Matiatia, completion of design and resource consent works at Kennedy Point. Completion of infrastructure repair works at Kennedy Point, Waiheke. Works planned for completion in the next quarter include: Upgrade works to Pier 2B at Downtown Ferry Terminal, to allow use on Waiheke services by new Fullers' boats, completion of Health and Safety improvement works on Pier 2C at Downtown Ferry Terminal to address occupational heal concerns and to further improve accessibility for mobility customers. Completion of repair works at Orapui, Waiheke. RCD Central Pavement Rehabilitation Programme 2016/17 Programme Item ID Start Finish Status Notes 31549 Gordons Road Deferred - 31550 Moa Avenue Physical work Target Length (m) 535 underway 31551 Palm Road Complete Target Length (m) 622 Thursday, 27 April 2017 Page 2 of 11 Regional Assets and Maintenance Progr amme Item ID Start Finish Status Notes 31613 Bus Lane Delivery of a network of bus and transit lanes throughout the Auckland C.100565 Jul 15 Jun 25 Detailed May Road, Sandringham Road, Improvement Region. -

Business Unit Report Template

Board Meeting | 12 September 2017 Agenda Item no.10 Open Session Business Report Recommendation: That the Chief Executive’s report be received. Prepared by: David Warburton, Chief Executive Corporate Preparation of the Regional Land Transport Plan (RLTP) The RLTP covers all capital projects and operating programmes for the region. Around 320 Auckland Transport and NZ Transport Agency capital projects have now been assessed through the ITP calculator to see which best deliver on the ATAP objectives. The Board has been updated at previous meetings on the process for prioritising the capital programme. The amount of funding available is still very uncertain. It will depend on factors such as which parties form the next Government, how roading projects are allocated between local and central Government and whether the Interim Transport Levy continues in some form. We have started the process of engaging with Local Boards on the RLTP, with presentations to cluster workshops in the South, Centre and North. Common themes coming through in these initial discussions included safety at rail crossings, benefits of Park & Rides, increasing maintenance requirements, poor condition of footpaths (partly due to utilities doing work), emphasis on active transport modes, quality standards for re- surfacing of rural roads and impact of quarries on local roads Engagement with iwi is planned to start over the next couple of months. The development of the Regional Public Transport Programme has also begun which will address the options for the future development of public transport. A Regional Transport Committee (RTC) meeting is being scheduled immediately following the 5 December Board meeting to consider a draft of the RLTP document (the RTC includes AT Directors with the Transport Agency representative having voting rights).