Worcestershire Local Investment Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Records Indexes Apprentices

Records Service Records Indexes Apprentices The most common (and sometimes the only) way of learning a trade was to become apprenticed to a skilled labourer. An indenture was signed which bound a young person into the care of a person or family for whom they worked for a certain period of time, usually until they were 21. There were two types of indenture; those issued to poor children, sent to work in order to get them off Parish support, and those issued by Guilds. Apprenticeship indentures contained the name of the apprentice, in most cases the name of the apprentice's parent or guardian (usually the father, though sometimes the mother, if the father was dead), the place the apprentice came from, his father's trade, the name of the master to whom he was indentured, the master's trade, the place where the master lived, and the value of the premium paid to the master for taking on the apprentice. This index contains the names and parishes of both apprentice and master together with the length of indenture, trade and reference number in our collections www.worcestershire.gov.uk/records Surname of First name of Parish of Date of Surname of First name of Parish of Length if Number of Additional Apprentice Apprentice Apprentice indenture Master Master Master Indenture Trade BA number document Info Abbington John Ripple 1700 Styles Wm. Not given to 24 Husbandry 348/5B 31 Abell Elizabeth Bromsgrove 1740 Sharpton Thos. Bromsgrove Not given Housewifery 9135/38 not given Abell Elizabeth Bromsgrove 20/08/1740 Wasill Sam. -

![PROVINCIAL NEDICAL and SURGICAL ASSOCIATION. [The Talnmbr, Cormced to Oat Ist of &Pamer, Ie 22W0.]](https://docslib.b-cdn.net/cover/0327/provincial-nedical-and-surgical-association-the-talnmbr-cormced-to-oat-ist-of-pamer-ie-22w0-1620327.webp)

PROVINCIAL NEDICAL and SURGICAL ASSOCIATION. [The Talnmbr, Cormced to Oat Ist of &Pamer, Ie 22W0.]

LIST OF MEMBERS FOR 1854 O1 gum PROVINCIAL NEDICAL AND SURGICAL ASSOCIATION. [The talnmbr, cormced to OAt Ist of &pamer, ie 22W0.] ENGAAND , ISLE OF MAN..................3 .......1. 57 WALES ..... 130 SCOTLAND........................ CHANNEL ISLANDS IRELAND . FOREIGN COUNTRIES .............................. 11 The Names of Members of the Gener Council ur printed in CxrrrLs. c Is prefixed to the Names of Members of Branch Counec Godden, Joseph, Esq ........ Oxton, Birkenhhl ENGLAND. Number of Members , 23 Gorst, Robert E., Esq..... Rock Ferry, Birkenheid Members of Council . 6 Kenderdine, T. B., Esq ...... Macclesield RRDIOIkDSHRR. Admsitted before Ist January, 1853-22. Maund, Henry, Esq. ........ Chester Number of Mlembers ........ 12 ENOLAND, Willian, Fsq. .... Wisbeach 1 Adlmitted durint 18$47. Member of Council ........ FAIECLOTH, Richard, Esq. Newmarket Alcock, Thomas, Esq......Hyde,neaMaiWeY Admitted before lst farnary, 1853-8 FISHER, W. W., M.D., Down- Brigham, William, Esq.Lymm,nr.W..gtoB BURST, Isaac, Esq., Surgeon ing Professor of Medicine. .Canbridge Dixon, J., Esq., Consulting to the Infirmary .......... Bedford Humpeay, G. M, Esq., Surg. .Birkenhead to Addenbrooke's Hospital, Surgeon to the Hospital . Lesh, T. C., Fsq............. Hyde, nr. Manchester Barker,T. Herbert,M.D ....Bedford SEC. FOR CAXB5MDEHIIIEH Renshaw, Jeremiah, Esq.....Altrincham EIamilton, Andrew, Esq.....Ampthill AND HUNrTINGDONsrRh ..Cambridge .... near Warrington ......... Woburn Esq. ly Simpson, Henry, Esq Lymun, Parker, Thomas, Esq MURIEL, JOhnI, ......E.. Wilson, Edwin, Esq......... Hyde, near Manchest. Paxon, George K., lEsq....Ca...Crnfeld,Wobum WALEs, Robert, Esq......... Wisbeach Stedman, Rt. Sfvignac, Esq.. Sharnbrook CORJWALL. Teasey, H., Esq . ............ Woburm Adams, Dennis, Esq. ........ Cambridge Williams, James, M.D....... Aspley Guise, Woburn Bond, H1. J. H., M.D., Regius Nuumber of Members ....... -

THOMAS DEW Colonial Virginia Pioneer Immigrant

GENEALOGY of some of the descendants of THOMAS DEW Colonial Virginia Pioneer Immigrant TOGETHER WITH GENEALOGICAL RECORDS AND BIOGRAPHICAL SKETCHES OF FAMILIES IN VIRGINIA, MARYLAND, NORTH CAROLINA, SOUTH CAROLINA, WEST VIRGINIA AND TENNESSEE ♦ All Rights Reserved ♦ Compiled by ERNESTINE DEW WHITE GREENVILLE, s. C. 1937 A worthy ancestry is a stimulus to a worthy life . ... RusKIN COPYRIGHT, I~ J 7 By ERNESTINE DEW WHITE GREENVILLE, $. C. ) r This 'Book is 'JJedicated To the descendants of our American progenitor-to foster the privilege to emulate him in his uprightness and to keep unspotted the family name. To my two livi11g aunts-Mrs. Thomas Baylor Henley; nee Fannie LeRoy Dew, now in her 90th year, and Mrs. Alex ander Campbell Acree; nee Lucy Themas Dew, now in her 8 5th year, who, by their reverence for their forebears, have preserved old letters, portraits and other heirlooms. PREFACE In the year 19 31, an incident happened which caused me to endeavor to trace authentically my paternal Dew lineage. Until then I had been quite content knowing my lineage back to my great-grandfather and also knowing the history of the family, which had been handed down tradi tionally and otherwise from generation to generation. Since traditions are generally based on facts my research has sub stantiated practically everything which had been passed down in my branch of the faITily. We were not aware, however, that the Dew family had so many branches and was such a large family. The Dew family, that came to Virginia in the early part of the seventeenth century, was descended from an old English family. -

Annual Report

THE ANNUAL REPORT OF THE COMMITTEE OF THF. liaptist itttsstonarjj £>ocit% Addressed to the General Meeting, held at S P A FIELDS CHAPEL, On Thursday, June 19, 1828. BEING A CONTINUATION OF THE PERIODICAL ACCOUNTS Relative to the Society. PRINTED BY ORDER OF THE GENERAL MEETING. LONDON: PRINTED BY J. HADDON, CASTLE STREET, FINSBURY. RESOLUTIONS OF THE GENERAL MEETING, HELD On Thursday, June 19, 1828, at Spa Fields Chapel: W. B. GURNEY, E sq . IX THE CHAIR. Moved by the Rev. I s a i a h B i r t , of Hackney, seconded by the Rev. F. A. Cox, LL.D. I. That the Report now read be adopted, and circulated under the direction of the Committee ; and that while this Meeting grate fully acknowledges the Divine goodness, in the degree of success which has been granted to the efforts of the Society, from the period of its formation, it cherishes a humble confidence that events ap parently adverse, as well as those of a pleasing character, will, in the providence of God, concur to promote the cause of Christ in the world. Moved by the Rev. W. H. M u r c h , Theological Tutor of the Stepney Academical Institution, seconded by the Rev. E u s t a c e C a r e y , II. That this Meeting sincerely rejoices in all the tokens of his gracious approbation with which God has been pleased to honour the exertions of kindred Institutions, and desires ever to cherish unfeigned affection and regard for all who are engaged in an enter- prize at once so arduous and honourable. -

West Midlands)

OFFICE OF THE TRAFFIC COMMISSIONER (WEST MIDLANDS) APPLICATIONS AND DECISIONS PUBLICATION NUMBER: 2705 PUBLICATION DATE: 26 September 2016 OBJECTION DEADLINE DATE: 17 October 2016 Correspondence should be addressed to: Office of the Traffic Commissioner (West Midlands) Hillcrest House 386 Harehills Lane Leeds LS9 6NF Telephone: 0300 123 9000 Fax: 0113 248 8521 Website: www.gov.uk/traffic-commissioners The public counter at the above office is open from 9.30am to 4pm Monday to Friday The next edition of Applications and Decisions will be published on: 10/10/2016 Publication Price 60 pence (post free) This publication can be viewed by visiting our website at the above address. It is also available, free of charge, via e-mail. To use this service please send an e-mail with your details to: [email protected] APPLICATIONS AND DECISIONS Important Information All correspondence relating to public inquiries should be sent to: Office of the Traffic Commissioner (West Midlands) 38 George Road Edgbaston Birmingham B15 1PL The public counter in Birmingham is open for the receipt of documents between 9.30am and 4pm Monday Friday. There is no facility to make payments of any sort at the counter. General Notes Layout and presentation – Entries in each section (other than in section 5) are listed in alphabetical order. Each entry is prefaced by a reference number, which should be quoted in all correspondence or enquiries. Further notes precede each section, where appropriate. Accuracy of publication – Details published of applications reflect information provided by applicants. The Traffic Commissioner cannot be held responsible for applications that contain incorrect information. -

BRITISH MEDICAL Yournal

D;)ec. i8, 1875.1 THE BRITISH MEDICAL yOURNAL. BRITISH MEDICAL- ASSOCIATION. OFFICERS AND COUNCIL FOR 1875-76. President-SIR R. CHRISTISON, M.D., D.C.L., LL.D., V.P.R.S.Ed.; Professor of Materia Medica in the University of Edinburgh. President-Elect-SIR j. CORDY BURROWS, F.R.C.S., Brighton. Permanent Vice-Presidents. ELECTED ELECTED 1873 ALFRED BAKER, F.R.C.S., Birmingham. I872 W. D. HUSBAND, F.R.C.S., York. 1863 SIR GEORGE BURROWS, Bart., M.D., F.R.C.P., F.R.S., I852 GEORGE S. JENKS, M.D., F.R.C.P., Bath. London. I862 ALFRED LOCHIE, M.D., F.R.C.P., Canterbury. I870 CHARLES CHADWICK, M.D., D.C.L., F.R.C.P., Leeds. I869 FRANCIS SIBSON, M.D., D.C.L., F.R.S., London. I875 EDWARD COPEMAN, M.D., F.R.C.P., Norwich. I875 GEORGE SOUTHAM, F.R.C.S., Manchester. 1875 R. WILBRAHAM FALCONER, M.D., F.R.C.P., D.C.L., Bath. x86o JAMES R. W. VosE, M.D., F.R.C.P., LiverpooL 1874 SIR WILLIAM FERGUSSON, Bart., F.R.S., F.R.C.S., London. 1867 EDWARD WATERS, M.D., F.K.Q.C.P., Chester. I86i C. RADCLYFFE HALL, M.D., F.R.C.P., Torquay. 1872 JOHN WHIPPLE, F.R.C.S., Plymouth. President of Council-RANDLE WILBRAHAM FALCONER, M.D., F.R.C.P., D.C.L., Senior Physician to the General Hospital, Bath. Treasurer-WILLIAM D. HIUSBAND, F.R.C.S., Senior Surgeon to the County Hospital, York. -

Grain and Chaff from an English Manor 1 Grain and Chaff from an English Manor

Grain and Chaff from an English Manor 1 Grain and Chaff from an English Manor The Project Gutenberg EBook of Grain and Chaff from an English Manor by Arthur H. Savory This eBook is for the use of anyone anywhere at no cost and with almost no restrictions whatsoever. You may copy it, give it away or re−use it under the terms of the Project Gutenberg License included with this eBook or online at www.gutenberg.net Title: Grain and Chaff from an English Manor Author: Arthur H. Savory Release Date: August 21, 2004 [EBook #13239] Language: English Character set encoding: ISO−8859−1 *** START OF THIS PROJECT GUTENBERG EBOOK GRAIN AND CHAFF *** Produced by Malcolm Farmer, Keith M. Eckrich, and the Project Gutenberg Online Distributed Proofreaders Team GRAIN AND CHAFF FROM AN ENGLISH MANOR By ARTHUR H. SAVORY OXFORD BASIL BLACKWELL 1920 PREFACE As a result of increased facilities within the last quarter of a century for the exploration of formerly inaccessible parts of the country, interest concerning our ancient villages has been largely awakened. Most of these places have some unwritten history and peculiarities worthy of attention, and an extensive literary field is thus open to residents with opportunities for observation and research. Such records have rarely been undertaken in the past, possibly because those capable of doing so have not recognized that what are the trivial features of everyday life in one generation may become exceptional in the next, and later still will have disappeared altogether. Gilbert White, who a hundred and thirty years ago published his _Natural History of Selborne_, was the first, and I suppose the most eminent, historian of any obscure village, and it is surprising, as his book has for so long been regarded as a classic, that so few have attempted a similar record. -

Appendix a – Responses to Preferred Draft Core Strategy Consultation

Appendix A – Responses to Preferred Draft Core Strategy consultation Analysis of Green Belt and Areas of Development Restraint .................................................................................................................................2 Attractive Facilities................................................................................................................................................................................................22 Balance between housing and employment...........................................................................................................................................................45 Climate change and sustainability .........................................................................................................................................................................80 Cross Boundary....................................................................................................................................................................................................130 Delivery Strategy .................................................................................................................................................................................................193 Design and Safety ................................................................................................................................................................................................205 Development Strategy..........................................................................................................................................................................................208 -

Association Intelligence

1044 THE BRITISH MEDICAL .OURNAL. [[Dec. 27, 1879. Mr. LAWSON TAIT proposed, and Mr. FOLKER seconded, that the attention of the Committee of Council of the Association be respectfully ASSOCIATION INTELLIGENCE, drawn to the resolution referred to in the report, and which was unani- mously passed at the ordinary meeting of the Branch held at Stafford COMMITTEE OF COUNCIL: last February, and to which no answer has been received. NOTICE OF MEETING. Financial Statement.-Mr. J. G. U. WEST read the statement of A MEETING of the Committee of Council will be held at the offices of accounts for the past year, which showed a balance of £x3 5s. 6d. the Association, I6IA, Strand, London, on Wednesday, the 14th day of Next AnnualAMeeting. -Mr. GRAY proposed that the next annual meeting be held at Stoke. This was seconded by Dr. G. LOWE, and January next, at 2 o'clock in the afternoon. agreed to. FRANCIS FOWKE, Genzeral Secretary. Election of Officers for 1879-80.-The following were elected. Pre- I6IA, Strand, London, December igth, 1879. sident-elect: W. H. Folker, Esq. Vice-Presidents: J. T. Arlidge, M.D.; E. F. Weston, Esq. Honorary Secretaries: Vincent Jackson, Esq.; STAFFORDSHIRE BRANCH: ANNUAL J. G. U. W'est, Esq. Council: Henry Day, M.D.; E. Fernie, M.D.; MEETING. J. Gailey, M.D.; F. J. Gray, Esq.; J. T. Hartill, Esq.; Joseph Hunt, THE sixth annual meeting of this Branch was held on Thursday, Octo- M.D.; H. H. Morgan, Esq.; C. Orton, Esq.; G. G. Sharp, Esq.; ber 30th, I879, at the George Hotel, Walsall; twenty-three members J. -

Annual Report Baptist Missionary Society

THE ANNUAL REPORT OF THE COMMITTEE OF THE BAPTIST MISSIONARY SOCIETY, FOR THE YEAR ENDING MARCH THE THIRTY-FIRST, M.D.CCC.XLIV. W IT H A L IST OF C O N T R IB U T IO N S ; BEING A CONTINUATION OF THE PERIODICAL ACCOUNTS. LONDON: PRINTED BY J. HADDON, CASTLE STREET, FINSBURY. SOLD-AT THE MISSION HOUSE, MOORGATE STREET; A.ND BY IIOULSTON AND STONEMAN, PATERNOSTER ROW: AND WILLIAM INNES, HANOVER STREET, EDINBURGH. 1844. N . B . — T h e A n n u a l A c c o u n t s o f t h e P a r e n t S o c i e t y a r e m a d e u p o n t h e 3 1s t M a r c h , p r e a ' i o u s t o w h i c h a l l contributions m u s t b e f o r w a r d e d ; IT IS t h e r e f o r e d e s i r a b l e t h a t t h e c u r r e n t y e a r o f auxiliaries s h o u l d b e f r o m J a n u a r y t o D e c e m b e r , in o r d e r t o a l l o w t i m e f o r t h e r e m i t t a n c e o f C ontributions . -

Vol 28 No4 1981.Pdf

Published by THE TENNESSEE GENEALOGICAL SOCIETY. .. ,Memphis, Tennessee VOLuME 28 WINTER 1981 NUMBER 4 - CONTENTS - OVER THE ED,ITOR' S DESK •• • '. •• • •• 151 NEWS & NOTES FROM OTHER PUBLICATIONS • . '. • 151 BOOK REVIEWS •• •• •••••• ·. .. • 153 ). 1805 ENUMERATION, GREENE COUNTY, TENNESSEE • · . .. .. .. •• 159 ORGANIZ~NGGENEAI..OGICAL RECORDS .. .. ... · .. · . •• 164 THE FAMILIES OF WHITE COUNTY ,TENNESSEE IN 1860 · .. • 165 FAMILY GATHERINGS. .. •• ••••• •• ••• .. ·. • 171 FRANKLIN COUNTY, TENNESSEE WILL BOOK 1808-1847 • · . ... ... · . • 176 INDEX,T() 1840 CENSUS,WILLIAMSONCO'(JNTY, TEmlESSEE • .. ". • 184 WILLIAMSON COUNTY, TENNESSEE REVOLUTIONARY ,&MILITARY PENSIONERS • •• · . 189 ROANE COUNTY , TENNESSEE MARRIAGE BONDS • · . ... 190 ~UERIES ••• •• .. •• . • 194 SURNAME INDEX FOR 1981 •• .. 201 President Wilma Sutton Cogde;n Vice President Jane Cook Hollis Recording Secretary Marilyn Johnson Baugus Correspondence Secretary R. F. Simpson, Jr. Librarian Louise Tittsworth Tyus Assistant Librarian Evelyn Duncan Sigler Surname ,Index Secretary Betty Key Treasurer Jean Williams Turner Editor Betsy Foster West Managing Editor Herbert Ray Ashworth Director Eleanor Riggins Barham Director Laurence B.Gardiner liBRARY STAFF BUSINESS STAFF Pauline Casey,. Briscoe Herman L. Bogan Henrietta ,D.' Gilley !.'ucileHendren.Cox Eleanor W. Griffin -Betty Cline Miller Lynn HodgesCrayen Thomas Proctor Hughes, Jr. AtD.elia.Pike Eddlemon Elizabeth Riggins Nichols Mary Frances"Gert:z Myrtle Louise Shelton Helen Culbre~th Hamer Margaret N. Sinclair E1J!lDaFisher O'.Ne~l Gerry Byers Spence' Jessie 'Waylor •• Webb Jean Alexander West' "ANS EARCHIN'" .NEWS is the officialpublicatiOll.of THETENNESSE~.GENEALPG~CJU, SOCIETY: published quarterly inMat"cll,Jutle,.Sept~mber,an.dD~cemoe.r,.;•..ann.u~;t ~ubscription •$8.00. All sU"bscriptioIlsb~ginwith.thefirsti$~\1~of,theyc!al:" Non-deliyery of any issue shoulclberegorted to THE TENNESSEE GENEALOgICAL SOCIETY ,within .two.mo.nths' .of .date· of. -

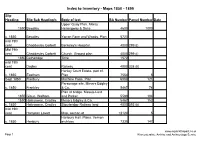

Index to Inventory - Maps 1850 - 1899

Index to Inventory - Maps 1850 - 1899 Slip Heading Slip Sub Heading/s Body of text BA Number Parcel Number Date Upper Quay Plan. Marcy 1850 Bewdley Hemingway & Sons 4600 1000 c. 1850 Bewdley Yarron Farm and Woods. Plan 5723 mid 19th cent Chaddesley Corbett Berkeley's Hospital 4000 299 (i) Mid 19th cent Chaddesley Corbett Church. Ground plan 4000 299 (i) 1850 Cotheridge Tithe 1572 mid 19th cent Dudley Railway 4000 338 (ii) Hanley Court Estate, part of. c. 1850 Eastham Plan 7554 5 Sept 1850 Fladbury Machine Farm. Plan 6088 121 Parsonage site. Messrs Edgley c. 1850 Frankley & Co. 5467 74 Plan of bridge. Messts Lord 1850 Glouc. Walham and Parker 5589 104 1850 Halesowen, Cradley Messrs Edgley & Co. 5467 152 c. 1850 Halesowen, Cradley Stourbridge Railway land 4000 593 (ii) mid 19th cent Hampton Lovett Map, section of 12124 5 Hanbury Hall. Plans. Vernon c. 1850 Hanbury archives 7335 147 www.explorethepast.co.uk Page 1 Worcestershire Archive and Archaeology Service Index to Inventory - Maps 1850 - 1899 Slip Heading Slip Sub Heading/s Body of text BA Number Parcel Number Date Plan of land field by Thomas 1850 Hartlebury Wheeler 5403 20 Hawne, parish of c. 1850 Halesowen Photocopy 7835 Honeybourne, Low Copy of particulars of sale of 1850 Honeybourne property with plan 6088 81 Oxford, Worcester & Wolverhampton RW. Scale 1 c. 1850 Kidderminster Foreign inch :4 chains 4766 27 Vicarage & Glebe lands. Scale c. 1850 Kidderminster Foreign 2 chains:1 inch 4766 27 Vicarage and nearby land, c. 1850 Kidderminster Foreign Scale 2 chain:1 inch 4766 31 c.