Real Estate Market Dynamics in the City of Naples: an Integration of a Multi-Criteria Decision Analysis and Geographical Information System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Rough Guide to Naples & the Amalfi Coast

HEK=> =K?:;I J>;HEK=>=K?:;je CVeaZh i]Z6bVaÒ8dVhi D7FB;IJ>;7C7B<?9E7IJ 7ZcZkZcid BdcYgV\dcZ 8{ejV HVc<^dg\^d 8VhZgiV HVciÉ6\ViV YZaHVcc^d YZ^<di^ HVciVBVg^V 8{ejVKiZgZ 8VhiZaKdaijgcd 8VhVaY^ Eg^cX^eZ 6g^Zcod / AV\dY^EVig^V BVg^\a^Vcd 6kZaa^cd 9WfeZ_Y^_de CdaV 8jbV CVeaZh AV\dY^;jhVgd Edoojda^ BiKZhjk^jh BZgXVidHVcHZkZg^cd EgX^YV :gXdaVcd Fecf[__ >hX]^V EdbeZ^ >hX]^V IdggZ6ccjco^ViV 8VhiZaaVbbVgZY^HiVW^V 7Vnd[CVeaZh GVkZaad HdggZcid Edh^iVcd HVaZgcd 6bVa[^ 8{eg^ <ja[d[HVaZgcd 6cVX{eg^ 8{eg^ CVeaZh I]Z8Vbe^;aZ\gZ^ Hdji]d[CVeaZh I]Z6bVa[^8dVhi I]Z^haVcYh LN Cdgi]d[CVeaZh FW[ijkc About this book Rough Guides are designed to be good to read and easy to use. The book is divided into the following sections, and you should be able to find whatever you need in one of them. The introductory colour section is designed to give you a feel for Naples and the Amalfi Coast, suggesting when to go and what not to miss, and includes a full list of contents. Then comes basics, for pre-departure information and other practicalities. The guide chapters cover the region in depth, each starting with a highlights panel, introduction and a map to help you plan your route. Contexts fills you in on history, books and film while individual colour sections introduce Neapolitan cuisine and performance. Language gives you an extensive menu reader and enough Italian to get by. 9 781843 537144 ISBN 978-1-84353-714-4 The book concludes with all the small print, including details of how to send in updates and corrections, and a comprehensive index. -

Bagnoli, Fuorigrotta, Soccavo, Pianura, Piscinola, Chiaiano, Scampia

Comune di Napoli - Bando Reti - legge 266/1997 art. 14 – Programma 2011 Assessorato allo Sviluppo Dipartimento Lavoro e Impresa Servizio Impresa e Sportello Unico per le Attività Produttive BANDO RETI Legge 266/97 - Annualità 2011 Agevolazioni a favore delle piccole imprese e microimprese operanti nei quartieri: Bagnoli, Fuorigrotta, Soccavo, Pianura, Piscinola, Chiaiano, Scampia, Miano, Secondigliano, San Pietro a Patierno, Ponticelli, Barra, San Giovanni a Teduccio, San Lorenzo, Vicaria, Poggioreale, Stella, San Carlo Arena, Mercato, Pendino, Avvocata, Montecalvario, S.Giuseppe, Porto. Art. 14 della legge 7 agosto 1997, n. 266. Decreto del ministro delle attività produttive 14 settembre 2004, n. 267. Pagina 1 di 12 Comune di Napoli - Bando Reti - legge 266/1997 art. 14 – Programma 2011 SOMMARIO ART. 1 – OBIETTIVI, AMBITO DI APPLICAZIONE E DOTAZIONE FINANZIARIA ART. 2 – REQUISITI DI ACCESSO. ART. 3 – INTERVENTI IMPRENDITORIALI AMMISSIBILI. ART. 4 – TIPOLOGIA E MISURA DEL FINANZIAMENTO ART. 5 – SPESE AMMISSIBILI ART. 6 – VARIAZIONI ALLE SPESE DI PROGETTO ART. 7 – PRESENTAZIONE DOMANDA DI AMMISSIONE ALLE AGEVOLAZIONI ART. 8 – PROCEDURE DI VALUTAZIONE E SELEZIONE ART. 9 – ATTO DI ADESIONE E OBBLIGO ART. 10 – REALIZZAZIONE DELL’INVESTIMENTO ART. 11 – EROGAZIONE DEL CONTRIBUTO ART. 12 –ISPEZIONI, CONTROLLI, ESCLUSIONIE REVOCHE DEI CONTRIBUTI ART. 13 – PROCEDIMENTO AMMINISTRATIVO ART. 14 – TUTELA DELLA PRIVACY ART. 15 – DISPOSIZIONI FINALI Pagina 2 di 12 Comune di Napoli - Bando Reti - legge 266/1997 art. 14 – Programma 2011 Art. 1 – Obiettivi, -

Metropolitane E Linee Regionali: Mappa Della

Formia Caserta Caserta Benevento Villa Literno San Marcellino Sant’Antimo Frattamaggiore Cancello Albanova Frignano Aversa Sant’Arpino Grumo Nevano 12 Acerra 11Aversa Centro Acerra Alfa Lancia 2 Aversa Ippodromo Giugliano Alfa Lancia 4 Casalnuovo igna Baiano Casoria 2 Melito 1 in costruzione Mugnano Afragola La P Talona e e co o linea 1 in costruzione Casalnuovo ont Ar erna iemont Piscinola ola P Brusciano Salice asalcist Scampia co P Prat C De Ruggier Chiaiano Par 1 11 Aeroporto Pomigliano d’ Giugliano Frullone Capodichino Volla Qualiano Colli Aminei Botteghelle Policlinico Poggioreale Materdei Madonnelle Rione Alto Centro Argine Direzionale Palasport Montedonzelli Salvator Stazione Rosa Cavour Centrale Medaglie d’Oro Villa Visconti Museo 1 Garibaldi Gianturco anni rocchia Quar v cio T esuvio Montesanto a V Quar La Piazza Olivella S.Gioeduc fficina cola to C Socca Corso Duomo T O onticelli onticelli De Meis er ollena O Quar P T T Quattro in costruzione a Barr P P C P Guindazzi fficina entr P ianura rencia raiano P C Vittorio Dante to isani ia Giornate Morghen Emanuele t v v o o o e Montesanto S.Maria Bartolo Longo Madonna dell’Arco Via del Pozzo 5 8 C Gianturco S.Giorgio Grotta Vanvitelli Fuga A Toledo S. Anastasia Università Porta 3 a Cremano del Sole Petraio Corso Vittorio Nolana S. Giorgio Cavalli di Bronzo Villa Augustea ostruzione Cimarosa Emanuele 3 12131415 Portici Bellavista Somma Vesuviana Licola B Palazzolo linea 7 in c Augusteo Municipio Immacolatella Portici Via Libertà Quarto Corso Vittorio Emanuele A Porto di Napoli Rione Trieste Ercolano Scavi Marina di Marano Corso Vittorio Ottaviano di Licola Emanuele Parco S.Giovanni Barra 2 Ercolano Miglio d’Oro Fuorigrotta Margherita ostruzione S. -

PTCP 2006 – Rapporto Ambientale

PTCP 2006 – Rapporto Ambientale 1 PTCP 2006 – Rapporto Ambientale Sub-Ambiti compresi nell’AIL AIL AIR n° Sub-ambito trame APR Ha (*) E COLLINE DI 1 22 Colline di Napoli RT 11-10-13 3431 80,9% NAPOLI 23 Napoli Vomero CP 11-10-13 808 19,1% 4239 100,0% (*) Percentuale di superficie totale dell’AIL relativa al singolo sub-ambito Comuni ricadenti, in tutto o in parte, nel Sub-ambito n° Sub-ambito N° Comuni (**) Ha 22 Colline di Napoli 3 Marano 19,15%, Napoli 79,66%, Quarto 1,19% 3431 23 Napoli Vomero 1 Napoli 100% 808 (**) Percentuale di superficie totale del sub-ambito relativa al singolo comune 2 PTCP 2006 – Rapporto Ambientale Parte I Descrizione Ambiente Insediativo 1. Caratteristiche del territorio L’area comprende il complesso sistema collinare, localizzato nella parte nord-occidentale dell’area urbana napoletana, fortemente caratterizzato dalla presenza di estese aree boscate e di aree agricole prevalentemente arborate. L’Ail, che corrisponde per gran parte della sua estensione al Parco Regionale Metropolitano delle Colline di Napoli recentemente istituito con legge regionale (L.R. 17/2003), confina ad occidente con il Parco regionale dei Campi Flegrei, con i comuni di Pozzuoli, Quarto e Marano e interessa le circoscrizioni di Napoli di Pianura, Soccavo, Arenella, Chiaiano, Piscinola- Marianella, Miano, S.Carlo all’Arena e Vomero. L’Ail si configura come un’area complessa dal punto di vista geomorfologico caratterizzata dalla presenza di rilievi collinari, valloni, ampie conche ed estese aree coltivate prevalentemente terrazzate. Nell’area è possibile riconoscere ambiti diversamente caratterizzati dal punto di vista naturalistico, insediativo e funzionale: la conca dei Pisani, le colline dei Camaldoli, la Selva di Chiaiano, le aree delle masserie di Chiaiano, il Vallone San Rocco, lo Scudillo. -

Formato Europeo Per Il Curriculum Vitae

Curriculum Vitae Dr. Jonathan Pratschke PERSONAL INFORMATION Name Jonathan Pratschke Address Via S. M. Avvocata n. 18, 80139 Napoli (NA), Italy Telephone +39 081 675036 Cell phone +39 320 4640577 Fax +39 (081) 6581182 E-mail j onathan. pratschke@uni n a.it Nationality Irish Place and date of birth Mufulira, Zambia, 8 June 1972 WORK EXPERIENCE • Dates 2018- • Name and address of University of Naples “Federico II”, Complesso employer Universitario di Monte Sant’Angelo, Via Cintia 21, 80126 Napoli (NA). • Type of business or sector Public university • Occupation or position Associate Professor • Main activities and Research and teaching in Economic Sociology (14/D1) responsibilities • Dates 2006-2018 • Name and address of University of Salerno, Via Giovanni Paolo II, 132, 84084 employer Fisciano (SA). • Type of business or sector Public university • Occupation or position Research Fellow (ricercatore universitario) • Main activities and Research and teaching in Economic Sociology responsibilities • Dates 2004-2006 • Name and address of Agenzia Regionale per il Lavoro della Campania (ARLAV), employer Isola C5, Centro Direzionale, 80148, Napoli (NA). • Type of business or sector Regional administration • Occupation or position Consultant • Main activities and Development of the regional data infrastructure (Sistema responsibilities Informativo Lavoro) and analysis of data from employment centres Page 1 - Curriculum vitae PRATSCHKE Jonathan EDUCATION AND TRAINING • Dates 1994-2003 • Name and type of Department of Sociology, Trinity College Dublin, College organisation providing Green, Dublin 2, Ireland. education or training • Title of thesis “The responses of hospital nurses in Ireland and Southern Italy to the rationalization of public health care” • Qualification PhD • Dates 2000-2002 • Name and type of Department of Government, Essex University, Colchester, organisation providing England. -

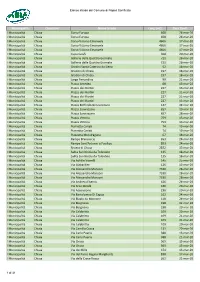

Municipalità Quartiere Nome Strada Lung.(Mt) Data Sanif

Elenco strade del Comune di Napoli Sanificate Municipalità Quartiere Nome Strada Lung.(mt) Data Sanif. I Municipalità Chiaia Corso Europa 608 24-mar-20 I Municipalità Chiaia Corso Europa 608 24-mar-20 I Municipalità Chiaia Corso Vittorio Emanuele 4606 17-mar-20 I Municipalità Chiaia Corso Vittorio Emanuele 4606 17-mar-20 I Municipalità Chiaia Corso Vittorio Emanuele 4606 17-mar-20 I Municipalità Chiaia Cupa Caiafa 368 20-mar-20 I Municipalità Chiaia Galleria delle Quattro Giornate 721 28-mar-20 I Municipalità Chiaia Galleria delle Quattro Giornate 721 28-mar-20 I Municipalità Chiaia Gradini Santa Caterina da Siena 52 18-mar-20 I Municipalità Chiaia Gradoni di Chiaia 197 18-mar-20 I Municipalità Chiaia Gradoni di Chiaia 197 18-mar-20 I Municipalità Chiaia Largo Ferrandina 99 21-mar-20 I Municipalità Chiaia Piazza Amedeo 68 13-mar-20 I Municipalità Chiaia Piazza dei Martiri 227 13-mar-20 I Municipalità Chiaia Piazza dei Martiri 227 21-mar-20 I Municipalità Chiaia Piazza dei Martiri 227 21-mar-20 I Municipalità Chiaia Piazza dei Martiri 227 13-mar-20 I Municipalità Chiaia Piazza Roffredo Beneventano 147 24-mar-20 I Municipalità Chiaia Piazza Sannazzaro 657 20-mar-20 I Municipalità Chiaia Piazza Sannazzaro 657 28-mar-20 I Municipalità Chiaia Piazza Vittoria 759 13-mar-20 I Municipalità Chiaia Piazza Vittoria 759 13-mar-20 I Municipalità Chiaia Piazzetta Cariati 74 19-mar-20 I Municipalità Chiaia Piazzetta Cariati 74 19-mar-20 I Municipalità Chiaia Piazzetta Mondragone 67 18-mar-20 I Municipalità Chiaia Rampe Brancaccio 653 24-mar-20 I Municipalità -

Del Comune Di Napoli

del comune di Napoli a cura del WWF Campania e della cooperativa La Locomotiva Centro di Documentazione CESPIA-CRIANZA Indagine sui servizi e la fruibilità dei Parchi e Giardini pubblici del comune di Napoli 3 Indice IL WWF A NAPOLI LA COOPERATIVA LA LOCOMOTIVA INTRODUZIONE E METODOLOGIA CARTA DEI PARCHI DEL COMUNE DI NAPOLI L’IMPORTANZA DELLE AREE VERDI E IL PROGRAMMA ECOREGIONALE DEL WWF DATI PRELIMINARI GLI INDICATORI UTILIZZATI CONCLUSIONI ALLEGATI: LE SCHEDE Municipalità no 1 Chiaia-S. Ferdiando-Posillipo Municipalità no 2 Avvocata-Mercato-Pendino-Porto-S. Giuseppe Municipalità no 3 Stella-S. Carlo all’Arena Municipalità no 4 S. Lorenzo-Vicaria-Poggioreale-Zona Industriale Municipalità no 5 Arenella-Vomero Municipalità no 6 Barra-S. Giovanni-Ponticelli Municipalità no 7 Miano-S. Pietro-Secondigliano Municipalità no 8 Chiaiano-Marianella-Piscinola-Scampia Municipalità no 9 Pianura-Soccavo Municipalità no 10 Bagnoli-Fuorigrotta ALLEGATI: APPROFONDIMENTI NATURALSITICI Bosco di Capodimonte Parco dei Camaldoli Parco del Poggio Parco Virgiliano Villa Comunale Villa Floridiana Parco Viviani RINGRAZIAMENTI E CREDITS Stesura e coordinamento gruppo di lavoro: Giovanni La Magna per il WWF, Anna Esposito per la cooperativa La Locomotiva. Hanno inoltre collaborato alla stesura del dossier: Giovanni La Magna, Ornella Capezzuto per il WWF, Anna Esposito, Marilina Cassetta per la cooperativa La Loco- motiva. Gli approfondimenti naturalistici sono stati curati da Anna Esposito e Giovanni La Magna, Nicola Bernardo, Giusy De Luca, Valerio Elefante, Martina Genovese, Natale Mirko, Antonio Pignalosa, Valerio Giovanni Russo, Andrea Sene- se, un gruppo di studenti di Scienze della Natura volontari del WWF. Gli approfondimenti del Real Parco di Capodi- monte, sono state fornite da Elio Esse. -

Naples Photo: Freeday/Shutterstock.Com Meet Naples, the City Where History and Culture Are Intertwined with Flavours and Exciting Activities

Naples Photo: Freeday/Shutterstock.com Meet Naples, the city where history and culture are intertwined with flavours and exciting activities. Explore the cemetery of skulls within the Fontanelle cemetery and the lost city of Pompeii, or visit the famous Vesuvius volcano and the island of Capri. Discover the lost tunnels of Naples and discover the other side of Naples, then end the day visiting the bars, restaurants and vivid nightlife in the evening. Castles, museums and churches add a finishing touch to the picturesque old-world feel. S-F/Shutterstock.com Top 5 Museum of Capodimonte The castle of Capodimonte boasts a wonderful view on the Bay of Naples. Buil... Castel Nuovo Also known as 'Maschio Angioino', this medieval castle dating back to 1279 w... Ovo Castle canadastock/Shutterstock.com Literally named 'Egg Castle', Castel dell'Ovo is a 12th-century fortress tha... Basilica of Saint Clare Not far from Church of Gesù Nuovo, the Basilica of Saint Clare is the bigges... Church of San Lorenzo Maggiore San Lorenzo Maggiore is an extraordinary building complex which mixes gothic... marcovarro/Shutterstock.com Updated 11 December 2019 Destination: Naples Publishing date: 2019-12-11 THE CITY is marked by contrasts and popular traditions, such as the annual miracle whereby San Gennaro’s ‘blood’ becomes liquid in front of the eyes of his followers. Naples is famous throughout the world primarly because of pizza (which, you'll discover, only constitutes a small part of the rich local cuisine) and popular music, with famous songs such as 'O Sole Mio'. canadastock/Shutterstock.com Museum of Capodimonte The historic city of Naples was founded about The castle of 3,000 years ago as Partenope by Greek Capodimonte boasts a merchants. -

Rete Metropolitana Napoli 1.Pdf

aversa piedimonte matese benevento caserta caserta formia frattamaggiore casoria cancello afragola acerra casalnuovo di napoli botteghelle volla poggioreale centro direzionale underground and railways map madonnelle argine palasport salvator gianturco rosa villa gianturco visconti formia vesuvio barra de meis duomo san ponticelli giovanni porta nolana san s. maria giovanni del pozzo bartolo longo licola quarto quarto torregaveta centro san pietrarsa giorgio cavalli di bronzo bellavista portici ercolano pompei castellammare sorrento pompei salerno pozzuoli capolinea autobus edenlandia bus terminal kennedy linea 1 ANM linea 2 Trenitalia collegamento marittimo torregaveta agnano line 1 line 2 sea transfer pozzuoli gerolomini linea 6 ANM parcheggio metrocampania nordest EAV parking line 6 metrocampania nordest line bagnoli ospedale cappuccini dazio funicolari ANM hospital funicolars linea circumvesuviana EAV circumvesuviana railway museo stazione museum station linea circumflegrea EAV castello stazione dell’arte circumflegrea railway castle art station linea cumana EAV università stazione in costruzione cumana railway university station under construction stadio scale mobili rete ferroviaria Trenitalia stadium escalators regional and national railway network mostra d’oltremare nodi di interscambio collegamento aeroporto interchange station airport transfer ostello internazionale Porto - Stazione Centrale - Aeroporto hostelling international APERTURA CHIUSURA PUOI ACQUISTARE I BIGLIETTI PRESSO I open closed DISTRIBUTORI AUTOMATICI O NEI RIVENDITORI -

Local Activities to Raise Awareness And

LOCAL ACTIVITIES TO RAISE AWARENESS AND PREPAREDNESS IN NEAPOLITAN AREA Edoardo Cosenza, Councillor for Civil Protection of Campania Region, Italy (better: professor of Structural Enngineering, University of Naples, Italy) Mineral and thermal water Port of Ischia (last eruption 1302) Campi Flegrei, Monte Nuovo, last eruption 1538 Mont Vesuvius, last eruption : march 23, 1944 US soldier and B25 air plan, Terzigno military base Municpalities and twin Regions 2 4 3 1 Evento del (Event of) 24/10/1910 Vittime (Fatalities) 229 Cetara 120, Maiori 50, Vietri sul Mare 50, Casamicciola Terme 9 Evento del (Event of) 25-28/03/1924 Vittime (Fatalities) 201 Amalfi 165, Praiano 36 Evento del (Event of) 25/10/1954 Vittime (Fatalities) 310 Salerno 109, Virtri sul Mare 100, Maiori 34, Cava de’ Tirreni 42, Tramonti 25, Evento del (Event of) 05/05/1998 Vittime (Fatalities) 200 Sarno area 184, Quindici 16 Analisi del dissesto da frana in campania. L.Monti, G.D’Elia e R.M.Toccaceli Atrani, September 2010 Cnr = National Council of Research From 1900: 51% of fatalities in Italy in the month of October !!! Cnr = National Council of Research From 1900: 25% of fatalities in Italy in Campania Region !!! Ipotesi nuova area rossa 2013 Municipi di Napoli Municipi di Napoli Inviluppo dei 1 - Chiaia,Posillipo, Inviluppo dei 1 - Chiaia,Posillipo, depositi degli ultimi S.Ferdinando depositi degli ultimi S.Ferdinando2 - Mercato, Pendino, 55 KaKa 2Avvocata, - Mercato, Montecalvario, Pendino, Avvocata,Porto, San Giuseppe.Montecalvario, Porto,3 - San San Giuseppe.Carlo all’Arena, 3Stella - San Carlo all’Arena, Stella4 - San Lorenzo, Vicaria, 4Poggioreale, - San Lorenzo, Z. -

New Geomorphological and Historical Elements on Morpho-Evolutive Trends and Relative Sea-Level Changes of Naples Coast in the Last 6000 Years

water Article New Geomorphological and Historical Elements on Morpho-Evolutive Trends and Relative Sea-Level Changes of Naples Coast in the Last 6000 Years Gaia Mattei 1,* , Pietro P. C. Aucelli 1, Claudia Caporizzo 1 , Angela Rizzo 2 and Gerardo Pappone 1 1 Dipartimento di Scienze e Tecnologie, Università degli Studi di Napoli Parthenope, Centro Direzionale Is. C4, 80121 Napoli, Italy; [email protected] (P.P.C.A.); [email protected] (C.C.); [email protected] (G.P.) 2 REgional Models and geo-Hydrological Impacts (REMHI Division), Fondazione CMCC Centro Euro-Mediterraneo sui Cambiamenti Climatici, 73100 Lecce, Italy; [email protected] * Correspondence: [email protected] Received: 10 July 2020; Accepted: 17 September 2020; Published: 22 September 2020 Abstract: This research aims to present new data regarding the relative sea-level variations and related morpho-evolutive trends of Naples coast since the mid-Holocene, by interpreting several geomorphological and historical elements. The geomorphological analysis, which was applied to the emerged and submerged sector between Chiaia plain and Pizzofalcone promontory, took into account a dataset that is mainly composed of: measurements from direct surveys; bibliographic data from geological studies; historical sources; ancient pictures and maps; high-resolution digital terrain model (DTM) from Lidar; and, geo-acoustic and optical data from marine surveys off Castel dell’ Ovo carried out by using an USV (Unmanned Surface Vehicle). The GIS analysis of those data combined with iconographic researches allowed for reconstructing the high-resolution geomorphological map and three new palaeoenvironmental scenarios of the study area during the Holocene, deriving from the evaluation of the relative sea-level changes and vertical ground movements of volcano-tectonic origin affecting the coastal sector in the same period. -

Municipalità 1 - Chiaia, Posillipo, S

Indirizzi e contatti delle Municipalità cittadine Municipalità 1 - Chiaia, Posillipo, S. Ferdinando Sede Telefoni e fax Email Servizi Demografici Tel. 0817950512 [email protected] Chiaia - S.Ferdinando - Posillipo Fax 0817950502 [email protected] via S.Caterina a Chiaia, 76 [email protected] [email protected] Municipalità 2 - Avvocata, Montecalvario, Mercato, Pendino, Porto, S. Giuseppe Sede Telefoni e fax Email Ufficio anagrafe - Piazza Dante n. Fax 081 7950286 [email protected] 93 - 80135 Napoli (per i quartieri - 081 7950209 [email protected] Avvocata - Montecalvario - San Giuseppe - Porto) Municipalità 3 - Stella, S. Carlo all'Arena Sede Telefoni e fax Email Sezione San Carlo - Via Lieti, 97 Tel. 081 7952419 [email protected] 80131 Napoli Fax 081 7952451 municipalità[email protected] Sezione San Carlo - Via SS. Tel. 081 7952512 [email protected] Giovanni e Paolo, 125 Fax 081 7952501 municipalità[email protected] 80137 Napoli Sezione Stella - Via Sant'Agostino Tel. 081 7952632 [email protected] degli Scalzi, 61 80136 Napoli Fax 081 7952609 municipalità[email protected] Municipalità 4 - S. Lorenzo, Vicaria, Poggioreale, Zona Industriale Sede Telefoni e fax Email Ufficio Anagrafe di Poggioreale Tel. 081 7951317 [email protected] via E. Gianturco 99 - 80142 - Fax 081 7951378 [email protected] Napoli Ufficio Anagrafe di San Lorenzo Tel.081 7951918 [email protected] via Tribunali 227 - 80138 - Napoli Fax 081 7951934 [email protected] Municipalità 5 - Arenella, Vomero Sede Telefoni e fax Email Vomero Via Raffaele Morghen n.