Discovering North America's Next Generation of Gold Mines October

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Social Indicators for Arctic Mining

SOCIAL INDICATORS FOR ARCTIC MINING ISER Working Paper 2011.2 Sharman Haley, Professor of Public Policy Nick Szymoniak, Matthew Klick, Andrew Crow and Tobias Schwoerer, Research Associates May 12, 2011 Institute of Social and Economic Research University of Alaska Anchorage 3211 Providence Drive Anchorage, Alaska 99508 Abstract This paper reviews and assesses the state of the data to describe and monitor mining trends in the pan-Arctic. It constructs a mining index and discusses its value as a social impact indicator and discusses drivers of change in Arctic mining. The widely available measures of mineral production and value are poor proxies for economic effects on Arctic communities. Trends in mining activity can be characterized as stasis or decline in mature regions of the Arctic, with strong growth in the frontier regions. World prices and the availability of large, undiscovered and untapped resources with favorable access and low political risk are the biggest drivers for Arctic mining, while climate change is a minor and locally variable factor. Historical data on mineral production and value is unavailable in electronic format for much of the Arctic, specifically Scandinavia and Russia; completing the historical record back to 1980 will require work with paper archives. The most critically needed improvement in data collection and reporting is to develop comparable measures of employment: the eight Arctic countries each use different definitions of employment, and different methodologies to collect the data. Furthermore, many countries do not report employment by county and industry, so the Arctic share of mining employment cannot be identified. More work needs to be done to develop indicator measures for ecosystem service flows. -

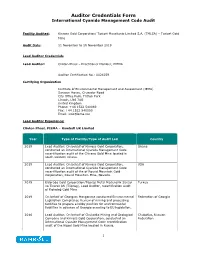

Auditor Credentials Form International Cyanide Management Code Audit

Auditor Credentials Form International Cyanide Management Code Audit Facility Audited: Kinross Gold Corporation/ Tasiast Mauritanie Limited S.A. (TMLSA) – Tasiast Gold Mine Audit Date: 11 November to 18 November 2019 Lead Auditor Credentials Lead Auditor: Clinton Phaal – Practitioner Member, PIEMA Auditor Certification No.: 0024259 Certifying Organization Institute of Environmental Management and Assessment (IEMA) Saracen House, Crusader Road City Office Park, Tritton Park Lincoln, LN6 7AS United Kingdom Phone: +44 1522 540069 Fax: +44 1522 540090 Email: [email protected] Lead Auditor Experience: Clinton Phaal, PIEMA – Ramboll UK Limited Year Type of Facility/Type of Audit Led Country 2019 Lead Auditor: On behalf of Kinross Gold Corporation, Ghana conducted an International Cyanide Management Code recertification audit of the Chirano Gold Mine located in south western Ghana. 2019 Lead Auditor: On behalf of Kinross Gold Corporation, USA conducted an International Cyanide Management Code recertification audit of the of Round Mountain Gold Corporation, Round Mountain Mine, Nevada. 2019 Eldorado Gold Corporation/Tüprag Metal Madencilik Sanayi Turkey ve Ticaret AS (Tüprag), Lead Auditor, recertification audit of Kışladağ Gold Mine 2019 On behalf of Georgian Manganese conducted Environmental Federation of Georgia Legislation Compliance Review of mining and processing facilities to prepare a lobby position for environmental liabilities in advance of Georgia acceding to EU legislation. 2016 Lead Auditor: On behalf of Chukotka Mining and Geological Chukotka, Russian Company and Kinross Gold Corporation, conducted an Federation International Cyanide Management Code recertification audit of the Kupol Gold Mine located in Russia. 1 Auditor Credentials Form International Cyanide Management Code Audit Year Type of Facility/Type of Audit Led Country 2016 Lead Auditor: On behalf of Kinross Gold Corporation, led an Ghana International Cyanide Management Code (ICMC) re- certification audit of the Chirano Gold Mine located in southwestern Ghana. -

Alaska's Mineral Industry 1995: a Summary by T.K

Alaska's Mineral Industry 1995: A Summary by T.K. Bundtzen, R.C. Swainbank, A.H. Clough, M.W. Henning, and K.M. Charlie Mine construction at the Fort Knox project. When the mine is in production in the fourth quarter of 1996, it will be Alaska's largest gold mine. Photo by R.C. Swainbank. PRODUCTZON4n 1995 production gross value EXPLORATION-Grass-roots exploration spending of Alaska's mineral industry increased 6 percent to increased 9 percent statewide to $34.0 million with th $539.5 million. Red Dog zinc, lead, and silver greatest increase in the Eastern Interior Region. mine became the world's largest producer of zinc. Gold production was down by 25 percent from EMPLOYMENT-With about 3,405 full-time- i 1994 levels. equivalent jobs, mineral industry employment was up 10 percent from 1994 levels. DEVELOPMENT--Expenditures reached $147.8 nullion in 1995, up 234 percent from 1993 levels. GOVERNMENT ACTIONS-Governor Knowles The main reasons for the increase were mine signed an exploration incentive bill. US.Bureau of expansion at Red Dog and mine construction at Mines was dissolved. Eleven firms received reclama- Fort Knox and Nixon Fork. tion awards. s INFORMATION CIRCULAR 41 Alaska Department of Division of Geological & Geophysical Surveys March 1996 NATURAL ALASKA MINERAL INDUSTRY 1995: INTRODUCTION Table 1. Total value of the mineral industry in Alaska by year (in millions of dollars) This report summarizes mined industry activity of the 1995 calendar year. Much of the information it contains is based Exploration Development Production Total on a Department of Natural Resources (DNR) questionnaire 1981 sent to approximately 985 companies, individuals, and govern- 1982 ment agencies involved in mineral extractive industries. -

Alaska Resource Data File, Fairbanks Quadrangle, Alaska

Alaska Resource Data File, Fairbanks quadrangle, Alaska By Curtis J. Freeman1 and Janet Schaefer1 Open-File Report 01–426 2001 This report is preliminary and has not been reviewed for conformity with U.S. Geological Survey editorial standards or with the North American Stratigraphic Code. Any use of trade, firm, or product names is for descriptive purposes only and does not imply endorsement by the U.S. Government. U.S. DEPARTMENT OF THE INTERIOR U.S. GEOLOGICAL SURVEY 1 Fairbanks, Alaska Fairbanks quadrangle Descriptions of the mineral occurrences shown on the accompanying figure fol- low. See U.S. Geological Survey (1996) for a description of the information content of each field in the records. The data presented here are maintained as part of a statewide database on mines, prospects and mineral occurrences throughout Alaska. o o o o o o o o Distribution of mineral occurrences in the Fairbanks 1:250,000-scale quadrangle, Alaska This and related reports are accessible through the USGS World Wide Web site http://ardf.wr.usgs.gov. Comments or information regarding corrections or missing data, or requests for digital retrievals should be directed to: Frederic Wilson, USGS, 4200 University Dr., Anchorage, AK 99508-4667, e-mail [email protected], telephone (907) 786-7448. This compilation is authored by: Curtis J. Freeman and Janet Schaefer Fairbanks, Alaska Alaska Resource Data File This report is preliminary and has not been reviewed for conformity with U.S. Geologi- cal Survey editorial standards or with the North American Stratigraphic code. Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. -

Economic Benefits of Alaska's Mining Industry

The Economic Benefits of ALASKA’S MINING INDUSTRY March 2018 PREPARED FOR PREPARED BY The Economic Benefits of Alaska’s Mining Industry Prepared for: Prepared by: McDowell Group Anchorage Office 1400 W. Benson Blvd., Suite 510 Anchorage, Alaska 99503 McDowell Group Juneau Office 9360 Glacier Highway, Suite 201 Juneau, Alaska 99801 March 2018 Website: www.mcdowellgroup.net Table of Contents Executive Summary ............................................................................................................................. 1 Key Findings................................................................................................................................................................... 1 Overall Summary.......................................................................................................................................................... 7 Study Purpose and Methodology ...................................................................................................... 8 Purpose............................................................................................................................................................................ 8 Methodology ................................................................................................................................................................. 8 Overview of Alaska’s Mining Industry ............................................................................................ 10 Reconnaissance Exploration and Advanced Exploration -

Avidian Gold Acquires the Fish Creek Property, Alaska

Avidian Gold to Acquire 100% of the Fish Creek Gold Property Located Adjacent to Fort Knox Gold Mine and Gil Deposit TORONTO, Ontario, June 1, 2020 – Avidian Gold Corp. (“Avidian” or the “Company”) (TSX- V: AVG) is pleased to announce that it has agreed to terms and signed a Binding Letter of Intent ("LOI") with Keltic Enterprises Inc. (“Keltic”) to acquire a 100% interest in the Fish Creek gold property. The Fish Creek gold property is a State of Alaska mineral lease totaling 418 hectares (1032 acres) and is located 6.5 km east of Kinross Gold’s Fort Knox Gold Mine and immediately west of Kinross's Gil deposit (Figure 1) in the Fairbanks Mining District. Please note: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. David Anderson, Chairman and CEO of Avidian states: "The acquisition of the Fish Creek project is a continuation of our plan to acquire additional properties in the Fairbanks Mining District and Fort Knox area in particular. This is a prolific gold district that lends itself to favourable metallurgy through heap leaching of oxidized mineralization. We have seen oxidation profiles similar to Fort Knox in mineralization identified on our Amanita prospect located 5.5 kilometres south of the Fort Knox pit and anticipate a similar situation at Fish Creek. We look forward to continuing exploration at Amanita and initiating exploration at Fish Creek this summer." Figure 1 – Fairbanks Mining District The Fish Creek project has potential to host both lode and placer gold deposits due to its shared regional geology and down-slope location from both Kinross Gold’s Fort Knox mine and their Gil project. -

The Mineral Industry of Alaska

THE MINERAL INDUSTRY OF ALASKA In 1996, Alaska had an estimated $523 million in total about 340 or 10% from the 3,400 Alaskan mine-related nonfuel mineral production value,1 according to the U.S. jobs in 1995. Most of the job increases were attributed to: Geological Survey (USGS). However, the dollar value (1) new hardrock mine employment at the Greens Creek totals for 1995-96, as given in table 1, are artificially low polymetallic mine near Juneau and the Nixon Fork because data have been withheld to avoid disclosing gold-copper mine near McGrath; (2) mineral development company proprietary data. With these data included, the projects at the Red Dog zinc-lead-silver mine near State would have ranked 22d among the 50 States in 1996 Kotzebue, the Illinois Creek gold project near Galena, and and 20th in 1995. In addition, Alaska’s nonfuel mineral the Fort Knox gold project near Fairbanks; and (3) new production value showed an increase rather than a decrease exploration jobs statewide. Contrasting the increases in (as shown in table 1) from 1995 to 1996. The State hardrock mineral-related job opportunities was a decrease accounted for approximately 1.5% of the U.S. total nonfuel in employment at placer gold mines. mineral production value. According to DGGS, the value of 1996 Alaska mineral Overall, metallic minerals accounted for more than production increased by an estimated $53.8 million or 85% of the State's total nonfuel mineral production value, nearly 10% above the 1995 value. Overall value for and the large majority of this was from zinc, lead, and metallic products climbed from $443 million in 1995 to silver production at the Red Dog Mine in northwestern $495 million in 1996, a 12% increase. -

GOLD by Earle B

GOLD By Earle B. Amey Domestic survey data and tables were prepared by Mahbood Mahdavi, statistical assistant, Shonta E. Osborne, supervisory statistical assistant, and Imogene P. Bynum, chief, mineral commodities data unit. The world production table was prepared by Regina R. Coleman, international data coordinator. Domestic gold mine production in 2001 fell to its lowest level nearly $257 per troy ounce1 on April 2 to a high of about $294 since 1996. Primarily, the 5% drop from the 2000 level was the per ounce on September 17, soon after the terror attacks of result of weak gold prices, the strengthening of the U.S. dollar September 11. The average for the year was, to the nearest in the global economy, and slowing retail consumption. The dollar, $272 per ounce. The previous year’s prices ranged from United States has been the second largest gold producer (behind about $265 per ounce to $314 per ounce and averaged $280 per South Africa) since 1991, when U.S. production surpassed that ounce. of the Soviet Union for the first time in five decades. Nevada By May, 12-month London gold lease rates rose from about produced more than three-fourths of domestic production; the 1.1% in January to 2.1% before starting a downward trend that remaining output came from 10 other States. Gold was returned to the January level in November and rose slightly to produced at 53 lode mines; about a dozen large placer mines, all 1.2% in December. Short-term lease rates dropped to new lows in Alaska; and numerous small placer mines, mostly in Alaska of 0.2% near the beginning of the fourth quarter of 2001 before and the Western States. -

NI 43-101 Technical Report Golden Summit Project Preliminary Economic Assessment Fairbanks North Star Borough, Alaska USA

FREEGOLD VENTURES LIMITED PO BOX 10351 SUITE 888 – 700 WEST GEORGIA STREET VANCOUVER, BRITISH COLUMBIA V7Y 1G5 PHONE: (604) 662-7307 | FAX: (604) 662-3791 NI 43-101 Technical Report Golden Summit Project Preliminary Economic Assessment Fairbanks North Star Borough, Alaska USA Document: 910054-REP-R0001-01 RESOURCE EFFECTIVE DATE: MAY 31, 2013 REPORT EFFECTIVE DATE: JANUARY 20, 2016 ISSUE DATE: MARCH 10, 2016 AMENDED AND RESTATED DATE: MAY 11, 2016 Prepared by List of Qualified Persons and Designations Mark J. Abrams, C.P.G. Jackie A. Blumberg, P.E. Gary H. Giroux, P.Eng. Chris Johns, P.Eng. Edwin C. Lips, P.E. Nick Michael, QP Dave M. Richers, QP, PG Vicki J. Scharnhorst, P.E., LEED AP D. Erik Spiller, QP Keith Thompson, CPG, PG 350 Indiana Street, Suite 500, Golden, CO 80401 Phone: 303-217-5700 Fax: 303-217-5705 TABLE OF CONTENTS 1.0 SUMMARY ................................................................................................................................................... 1-1 1.1 INTRODUCTION ................................................................................................................................. 1-1 1.2 KEY OUTCOMES ............................................................................................................................... 1-1 1.3 PROJECT DESCRIPTION & OWNERSHIP ............................................................................................. 1-2 1.4 HISTORY ......................................................................................................................................... -

Mining News 012614 Petroleum News 121403

3 EPA report arms Pebble resistance Bristol Bay review provides mine foes with powerful tactical resource 10 New predator roams the Yukon Three juniors with promising assets unite to form new Golden Predator 16 Mining endures as BC cornerstone New Afton, Mt. Milligan start in 2013; Red Chris, Roman target 2014 This bar contains the six-millionth ounce of gold poured at Kinross Gold Corp.’s Fort Knox Mine near Fairbanks, Alaska. Including the record 428,822 ounces recovered A special supplement to Petroleum News from the rejuvenated Fort Knox Mine, Alaska gold production topped 1 million ounces in 2013 for the first time since 1906. WEEK OF PHOTO BY GREG MARTIN, COURTESY OF KINROSS GOLD CORP. January 26, 2014 2 NORTH OF 60 MINING PETROLEUM NEWS • WEEK OF JANUARY 26, 2014 Only pay for the speed you need... Dynamic Routing! SM At Lynden, we understand that plans change but deadlines don’t. That’s why we proudly offer our exclusive Dynamic Routing system. Designed to work around your unique requirements, Dynamic Routing allows you to choose the mode of transportation — air, sea or land — to control the speed of your deliveries so they arrive just as they are needed. With Lynden you only pay for the speed you need! www.lynden.com 1-888-596-3361 PETROLEUM NEWS • WEEK OF JANUARY 26, 2014 NORTH OF 60 MINING 3 l ALASKA Report backs bid to smash Pebble EPA assessment claims large-scale mining could harm Bristol Bay fishery; Sen. Mark Begich, D-Alaska: ‘Pebble is not worth the risk’ By SHANE LASLEY “There are a variety of authorities Mining News under the Clean Water Act and the National Environmental Policy Act and he final rendition of the U.S. -

Senate Revives ANWR No News Is Bad News

page Ted Stevens tells Alaska legislators A7 to focus on investment climate Vol. 11, No. 13 • www.PetroleumNews.com A weekly oil & gas newspaper based in Anchorage, Alaska Week of March 26, 2006 • $1.50 WASHINGTON, D.C. This month’s Mining News inside Senate revives ANWR Delegation, Arctic Power gird for battle in U.S. House with budget resolution BY ROSE RAGSDALE 49 vote victories on the overall budget For Petroleum News resolution and an amendment intro- duced by Sen. Pete Domenici, R-N.M., aving survived the U.S. Senate to fund the Energy Reserve Fund with budget resolution process against all revenues from ANWR leases. H odds, language that calls for open- ANWR opponents, led by Sen. Maria ing the coastal plain of the Arctic Cantwell, D-Wash., bypassed an attempt National Wildlife Refuge to development to spike ANWR drilling language in is moving to the next arena in Congress. favor of trying to bring down the entire The U.S. House of Representatives is “I am optimistic our budget resolution if ANWR instruction scheduled to debate the proposed blue- chances are better was included. The effort failed despite print for the FY2007 federal budget dur- this year than they hope fostered earlier in the week when were last year. That ing the week of March 26. Senate vote was several Republican senators vowed to The Senate adopted $2.9 trillion legis- mouth-to-mouth vote against drilling. lation March 16, including a provision for resuscitation.” The White House included ANWR – Jerry Hood, Arctic oil and gas exploration and development Power in ANWR. -

Fort Knox Gold Mine

Resource Development Council 2019 Fort Knox Gold Mine: Gilmore & Beyond Kinross Gold Corporation Cautionary Statement on Forward-Looking Information All statements, other than statements of historical fact, contained or incorporated by reference in or made in giving this presentation and responses to questions, including but not limited to any information as to the future performance of Kinross, constitute “forward looking statements” within the meaning of applicable securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this presentation. Forward-looking statements contained in this presentation include those statements on slides with, and statements made under, the headings “Mill Operations”, “Heap Leach Operations”, “Fort Knox Gilmore”, “Project Overview”, “Feasibility Study Results”, “Gilmore Capital Estimate”, “Annual Production Estimates”, “Additional Information”, “U.S. Tax Reform”, “Impact of Pit Wall Slide”, “Fort Knox Gilmore: Next Steps”, “Fort Knox Gilmore: Permitting” and “Future Potential” and include, without limitation, statements with respect to mine life extensions, costs and timing of development activities, the receipt of necessary permits and the timing for such receipt, future production, production costs of sales, all-in sustaining cost and capital expenditures, continuous improvement and other cost savings opportunities,