Auditor Credentials Form International Cyanide Management Code Audit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Social Indicators for Arctic Mining

SOCIAL INDICATORS FOR ARCTIC MINING ISER Working Paper 2011.2 Sharman Haley, Professor of Public Policy Nick Szymoniak, Matthew Klick, Andrew Crow and Tobias Schwoerer, Research Associates May 12, 2011 Institute of Social and Economic Research University of Alaska Anchorage 3211 Providence Drive Anchorage, Alaska 99508 Abstract This paper reviews and assesses the state of the data to describe and monitor mining trends in the pan-Arctic. It constructs a mining index and discusses its value as a social impact indicator and discusses drivers of change in Arctic mining. The widely available measures of mineral production and value are poor proxies for economic effects on Arctic communities. Trends in mining activity can be characterized as stasis or decline in mature regions of the Arctic, with strong growth in the frontier regions. World prices and the availability of large, undiscovered and untapped resources with favorable access and low political risk are the biggest drivers for Arctic mining, while climate change is a minor and locally variable factor. Historical data on mineral production and value is unavailable in electronic format for much of the Arctic, specifically Scandinavia and Russia; completing the historical record back to 1980 will require work with paper archives. The most critically needed improvement in data collection and reporting is to develop comparable measures of employment: the eight Arctic countries each use different definitions of employment, and different methodologies to collect the data. Furthermore, many countries do not report employment by county and industry, so the Arctic share of mining employment cannot be identified. More work needs to be done to develop indicator measures for ecosystem service flows. -

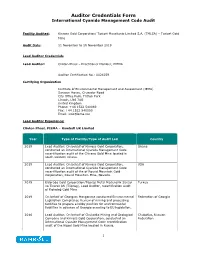

Auditor Credentials Form International Cyanide Management Code Audit

Auditor Credentials Form International Cyanide Management Code Audit Facility Audited: Kinross Gold Corporation/ Tasiast Mauritanie Limited S.A. (TMLSA) – Tasiast Gold Mine Audit Date: 11 November to 18 November 2019 Lead Auditor Credentials Lead Auditor: Clinton Phaal – Practitioner Member, PIEMA Auditor Certification No.: 0024259 Certifying Organization Institute of Environmental Management and Assessment (IEMA) Saracen House, Crusader Road City Office Park, Tritton Park Lincoln, LN6 7AS United Kingdom Phone: +44 1522 540069 Fax: +44 1522 540090 Email: [email protected] Lead Auditor Experience: Clinton Phaal, PIEMA – Ramboll UK Limited Year Type of Facility/Type of Audit Led Country 2019 Lead Auditor: On behalf of Kinross Gold Corporation, Ghana conducted an International Cyanide Management Code recertification audit of the Chirano Gold Mine located in south western Ghana. 2019 Lead Auditor: On behalf of Kinross Gold Corporation, USA conducted an International Cyanide Management Code recertification audit of the of Round Mountain Gold Corporation, Round Mountain Mine, Nevada. 2019 Eldorado Gold Corporation/Tüprag Metal Madencilik Sanayi Turkey ve Ticaret AS (Tüprag), Lead Auditor, recertification audit of Kışladağ Gold Mine 2019 On behalf of Georgian Manganese conducted Environmental Federation of Georgia Legislation Compliance Review of mining and processing facilities to prepare a lobby position for environmental liabilities in advance of Georgia acceding to EU legislation. 2016 Lead Auditor: On behalf of Chukotka Mining and Geological Chukotka, Russian Company and Kinross Gold Corporation, conducted an Federation International Cyanide Management Code recertification audit of the Kupol Gold Mine located in Russia. 1 Auditor Credentials Form International Cyanide Management Code Audit Year Type of Facility/Type of Audit Led Country 2016 Lead Auditor: On behalf of Kinross Gold Corporation, led an Ghana International Cyanide Management Code (ICMC) re- certification audit of the Chirano Gold Mine located in southwestern Ghana. -

2010 Minerals Yearbook

2010 Minerals Yearbook GOLD U.S. Department of the Interior October 2012 U.S. Geological Survey GOLD By Micheal W. George Domestic survey data and tables were prepared by Wanda G. Wooten, statistical assistant, and the world production table was prepared by Lisa D. Miller, international data coordinator. In 2010, domestic mine production of gold increased to end use of gold were jewelry and arts, 54%; dental and medical, 231,000 kilograms (kg), 4% more than that in 2009 (tables 1–2). 10%; electrical and electronics, 7%; and other, 29%. This marks the fi rst increase in 10 years, although production Refi ned bullion comprised 33% of U.S. gold imports and 77% was 37% lower than the historical high of 366,000 kg in of exports; the United States was a net exporter of 95,700 kg of 1998. In 2010, the value of domestic production increased to bullion in 2010 (tables 4, 6). The imports and exports of gold $9.13 billion, up 30% compared with that in 2009 because of bullion increased by 57% and 5%, respectively, from those in 2009. the increase in the price of gold and the increase in domestic The increases in imports mainly were from Canada and Mexico, production. It was the ninth straight year that the value had which provided almost 51% and 25%, respectively, of the refi ned increased. Gold recovery from the major mines in Nevada bullion imported. Imports of ores and concentrates increased by decreased because mining lower grade ore was more profi table 450% because of a substantial increase in imports from Mexico for with high gold price. -

Alaska's Mineral Industry 1995: a Summary by T.K

Alaska's Mineral Industry 1995: A Summary by T.K. Bundtzen, R.C. Swainbank, A.H. Clough, M.W. Henning, and K.M. Charlie Mine construction at the Fort Knox project. When the mine is in production in the fourth quarter of 1996, it will be Alaska's largest gold mine. Photo by R.C. Swainbank. PRODUCTZON4n 1995 production gross value EXPLORATION-Grass-roots exploration spending of Alaska's mineral industry increased 6 percent to increased 9 percent statewide to $34.0 million with th $539.5 million. Red Dog zinc, lead, and silver greatest increase in the Eastern Interior Region. mine became the world's largest producer of zinc. Gold production was down by 25 percent from EMPLOYMENT-With about 3,405 full-time- i 1994 levels. equivalent jobs, mineral industry employment was up 10 percent from 1994 levels. DEVELOPMENT--Expenditures reached $147.8 nullion in 1995, up 234 percent from 1993 levels. GOVERNMENT ACTIONS-Governor Knowles The main reasons for the increase were mine signed an exploration incentive bill. US.Bureau of expansion at Red Dog and mine construction at Mines was dissolved. Eleven firms received reclama- Fort Knox and Nixon Fork. tion awards. s INFORMATION CIRCULAR 41 Alaska Department of Division of Geological & Geophysical Surveys March 1996 NATURAL ALASKA MINERAL INDUSTRY 1995: INTRODUCTION Table 1. Total value of the mineral industry in Alaska by year (in millions of dollars) This report summarizes mined industry activity of the 1995 calendar year. Much of the information it contains is based Exploration Development Production Total on a Department of Natural Resources (DNR) questionnaire 1981 sent to approximately 985 companies, individuals, and govern- 1982 ment agencies involved in mineral extractive industries. -

Alaska Resource Data File, Fairbanks Quadrangle, Alaska

Alaska Resource Data File, Fairbanks quadrangle, Alaska By Curtis J. Freeman1 and Janet Schaefer1 Open-File Report 01–426 2001 This report is preliminary and has not been reviewed for conformity with U.S. Geological Survey editorial standards or with the North American Stratigraphic Code. Any use of trade, firm, or product names is for descriptive purposes only and does not imply endorsement by the U.S. Government. U.S. DEPARTMENT OF THE INTERIOR U.S. GEOLOGICAL SURVEY 1 Fairbanks, Alaska Fairbanks quadrangle Descriptions of the mineral occurrences shown on the accompanying figure fol- low. See U.S. Geological Survey (1996) for a description of the information content of each field in the records. The data presented here are maintained as part of a statewide database on mines, prospects and mineral occurrences throughout Alaska. o o o o o o o o Distribution of mineral occurrences in the Fairbanks 1:250,000-scale quadrangle, Alaska This and related reports are accessible through the USGS World Wide Web site http://ardf.wr.usgs.gov. Comments or information regarding corrections or missing data, or requests for digital retrievals should be directed to: Frederic Wilson, USGS, 4200 University Dr., Anchorage, AK 99508-4667, e-mail [email protected], telephone (907) 786-7448. This compilation is authored by: Curtis J. Freeman and Janet Schaefer Fairbanks, Alaska Alaska Resource Data File This report is preliminary and has not been reviewed for conformity with U.S. Geologi- cal Survey editorial standards or with the North American Stratigraphic code. Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. -

The Mineral Industry of Ghana in 2010

2010 Minerals Yearbook GHANA U.S. Department of the Interior August 2012 U.S. Geological Survey THE MINERAL INDUSTRY OF GHANA By Omayra Bermúdez-Lugo Ghana was among the world’s top 10 producers of gold Production and was ranked 13th among the world’s leading producers of diamond, by volume. Other mineral commodities produced in Gold production, which excluded production from the country included manganese, salt, and silver (George, 2011; small-scale and artisanal mining, decreased by about 4% to Kimberley Process Rough Diamond Statistics, 2011). 76,332 kilograms (kg) compared with 79,883 kg produced in 2009. Cement production increased by 33% to 2.4 million Minerals in the National Economy metric tons (Mt), mined manganese production increased by 20% to 420,000 metric tons (t), and diamond production Ghana’s mineral sector, which grew by 10.4% in 2010, was decreased by 11% to 334,000 carats. Data on mineral production a major contributor to Government revenues and accounted for are in table 1. about 11% of fiscal receipts by the Internal Revenue Service. Gold, in particular, accounted for more than 80%, by value, of Structure of the Mineral Industry the total income from the mineral sector. About 20,000 Ghanaian nationals were directly employed in large-scale mining, 6,000 The Ministry of Lands and Natural Resources (MLNR), were employed in providing services to the mineral sector, and through the Geological Survey Department (GSD), the about 500,000 were employed in small-scale mining of diamond, Minerals Commission, and the Precious Minerals Marketing gold, and industrial minerals for the construction sector Co. -

Economic Benefits of Alaska's Mining Industry

The Economic Benefits of ALASKA’S MINING INDUSTRY March 2018 PREPARED FOR PREPARED BY The Economic Benefits of Alaska’s Mining Industry Prepared for: Prepared by: McDowell Group Anchorage Office 1400 W. Benson Blvd., Suite 510 Anchorage, Alaska 99503 McDowell Group Juneau Office 9360 Glacier Highway, Suite 201 Juneau, Alaska 99801 March 2018 Website: www.mcdowellgroup.net Table of Contents Executive Summary ............................................................................................................................. 1 Key Findings................................................................................................................................................................... 1 Overall Summary.......................................................................................................................................................... 7 Study Purpose and Methodology ...................................................................................................... 8 Purpose............................................................................................................................................................................ 8 Methodology ................................................................................................................................................................. 8 Overview of Alaska’s Mining Industry ............................................................................................ 10 Reconnaissance Exploration and Advanced Exploration -

Kinross Gold Corporation

KINROSS GOLD CORPORATION ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2016 Dated March 31, 2017 TABLE OF CONTENTS Page CAUTIONARY STATEMENT .................................................................................................................. 3 CORPORATE STRUCTURE ..................................................................................................................... 5 GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................... 10 OVERVIEW .............................................................................................................................................. 10 THREE YEAR HISTORY ........................................................................................................................ 10 DESCRIPTION OF THE BUSINESS....................................................................................................... 11 COMPETITIVE CONDITIONS ............................................................................................................... 12 ENVIRONMENTAL PROTECTION ....................................................................................................... 12 OPERATIONS .......................................................................................................................................... 14 GOLD EQUIVALENT PRODUCTION AND SALES ............................................................................ 15 MARKETING .......................................................................................................................................... -

Avidian Gold Acquires the Fish Creek Property, Alaska

Avidian Gold to Acquire 100% of the Fish Creek Gold Property Located Adjacent to Fort Knox Gold Mine and Gil Deposit TORONTO, Ontario, June 1, 2020 – Avidian Gold Corp. (“Avidian” or the “Company”) (TSX- V: AVG) is pleased to announce that it has agreed to terms and signed a Binding Letter of Intent ("LOI") with Keltic Enterprises Inc. (“Keltic”) to acquire a 100% interest in the Fish Creek gold property. The Fish Creek gold property is a State of Alaska mineral lease totaling 418 hectares (1032 acres) and is located 6.5 km east of Kinross Gold’s Fort Knox Gold Mine and immediately west of Kinross's Gil deposit (Figure 1) in the Fairbanks Mining District. Please note: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. David Anderson, Chairman and CEO of Avidian states: "The acquisition of the Fish Creek project is a continuation of our plan to acquire additional properties in the Fairbanks Mining District and Fort Knox area in particular. This is a prolific gold district that lends itself to favourable metallurgy through heap leaching of oxidized mineralization. We have seen oxidation profiles similar to Fort Knox in mineralization identified on our Amanita prospect located 5.5 kilometres south of the Fort Knox pit and anticipate a similar situation at Fish Creek. We look forward to continuing exploration at Amanita and initiating exploration at Fish Creek this summer." Figure 1 – Fairbanks Mining District The Fish Creek project has potential to host both lode and placer gold deposits due to its shared regional geology and down-slope location from both Kinross Gold’s Fort Knox mine and their Gil project. -

Summary Audit Report

SUMMARY AUDIT REPORT for the November 2019 International Cyanide Management Code Recertification Audit Prepared for: Kinross Gold Corporation Chirano Gold Mining Ltd. (CGML) Submitted to: International Cyanide Management Institute 1400 “I” Street NW, Suite 550 Washington, D.C. 20005 FINAL 1 April 2020 Ramboll Canada Inc. 100 Park Royal, Suite 200 West Vancouver, British Columbia, V7T 1A2, Canada www.ramboll.com SUMMARY AUDIT REPORT Name of Mine: Chirano Gold Mine Name of Mine Owner: Kinross Gold Corporation Name of Mine Operator: Chirano Gold Mines Ltd. (CGML) Name of Responsible Manager: Terence Watungwa, General Manager Address: P.O. Box 57, Bibiani Western Region, Ghana Telephone: +233 552 838 283 Fax: N/A E-mail: [email protected] Location detail and description of operation: Kinross Gold (Kinross) Chirano gold mine is located in southwestern Ghana, approximately 100 kilometres southwest of the city of Kumasi. The mine lies within the Bibiani gold belt and consists of several conventional open pit mining sites as well as underground workings. Ore is transported to a centrally located processing plant, where it is crushed and milled before undergoing conventional carbon in leach (CIL) processing. The general location of the Chirano mining operation is shown on the figure below: Page 1 of 46 Cyanide facilities include a warehouse for storage of cyanide reagent in solid briquette form, a cyanide mixing and storage facility, leach tank, CIL processing circuit, a clarifier and tailings box, two lined event ponds, tailings and reclaim water return pipelines, tailing storage facilities (TSFs), reclaim water settling and management ponds, and various other process water control features and connecting pipelines. -

The Mineral Industry of Alaska

THE MINERAL INDUSTRY OF ALASKA In 1996, Alaska had an estimated $523 million in total about 340 or 10% from the 3,400 Alaskan mine-related nonfuel mineral production value,1 according to the U.S. jobs in 1995. Most of the job increases were attributed to: Geological Survey (USGS). However, the dollar value (1) new hardrock mine employment at the Greens Creek totals for 1995-96, as given in table 1, are artificially low polymetallic mine near Juneau and the Nixon Fork because data have been withheld to avoid disclosing gold-copper mine near McGrath; (2) mineral development company proprietary data. With these data included, the projects at the Red Dog zinc-lead-silver mine near State would have ranked 22d among the 50 States in 1996 Kotzebue, the Illinois Creek gold project near Galena, and and 20th in 1995. In addition, Alaska’s nonfuel mineral the Fort Knox gold project near Fairbanks; and (3) new production value showed an increase rather than a decrease exploration jobs statewide. Contrasting the increases in (as shown in table 1) from 1995 to 1996. The State hardrock mineral-related job opportunities was a decrease accounted for approximately 1.5% of the U.S. total nonfuel in employment at placer gold mines. mineral production value. According to DGGS, the value of 1996 Alaska mineral Overall, metallic minerals accounted for more than production increased by an estimated $53.8 million or 85% of the State's total nonfuel mineral production value, nearly 10% above the 1995 value. Overall value for and the large majority of this was from zinc, lead, and metallic products climbed from $443 million in 1995 to silver production at the Red Dog Mine in northwestern $495 million in 1996, a 12% increase. -

Kinross Gold Corporation

KINROSS GOLD CORPORATION ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2020 Dated March 30, 2021 TABLE OF CONTENTS Page CAUTIONARY STATEMENT .................................................................................................................. 3 CORPORATE STRUCTURE ..................................................................................................................... 6 GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................... 10 OVERVIEW .............................................................................................................................................. 10 THREE YEAR HISTORY ........................................................................................................................ 10 DESCRIPTION OF THE BUSINESS....................................................................................................... 12 EMPLOYEES ........................................................................................................................................... 12 COMPETITIVE CONDITIONS ............................................................................................................... 13 ENVIRONMENTAL PROTECTION ....................................................................................................... 13 OPERATIONS .......................................................................................................................................... 15 GOLD EQUIVALENT PRODUCTION