The Mineral Industry of Ghana in 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2010 Minerals Yearbook

2010 Minerals Yearbook GOLD U.S. Department of the Interior October 2012 U.S. Geological Survey GOLD By Micheal W. George Domestic survey data and tables were prepared by Wanda G. Wooten, statistical assistant, and the world production table was prepared by Lisa D. Miller, international data coordinator. In 2010, domestic mine production of gold increased to end use of gold were jewelry and arts, 54%; dental and medical, 231,000 kilograms (kg), 4% more than that in 2009 (tables 1–2). 10%; electrical and electronics, 7%; and other, 29%. This marks the fi rst increase in 10 years, although production Refi ned bullion comprised 33% of U.S. gold imports and 77% was 37% lower than the historical high of 366,000 kg in of exports; the United States was a net exporter of 95,700 kg of 1998. In 2010, the value of domestic production increased to bullion in 2010 (tables 4, 6). The imports and exports of gold $9.13 billion, up 30% compared with that in 2009 because of bullion increased by 57% and 5%, respectively, from those in 2009. the increase in the price of gold and the increase in domestic The increases in imports mainly were from Canada and Mexico, production. It was the ninth straight year that the value had which provided almost 51% and 25%, respectively, of the refi ned increased. Gold recovery from the major mines in Nevada bullion imported. Imports of ores and concentrates increased by decreased because mining lower grade ore was more profi table 450% because of a substantial increase in imports from Mexico for with high gold price. -

Kinross Gold Corporation

KINROSS GOLD CORPORATION ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2016 Dated March 31, 2017 TABLE OF CONTENTS Page CAUTIONARY STATEMENT .................................................................................................................. 3 CORPORATE STRUCTURE ..................................................................................................................... 5 GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................... 10 OVERVIEW .............................................................................................................................................. 10 THREE YEAR HISTORY ........................................................................................................................ 10 DESCRIPTION OF THE BUSINESS....................................................................................................... 11 COMPETITIVE CONDITIONS ............................................................................................................... 12 ENVIRONMENTAL PROTECTION ....................................................................................................... 12 OPERATIONS .......................................................................................................................................... 14 GOLD EQUIVALENT PRODUCTION AND SALES ............................................................................ 15 MARKETING .......................................................................................................................................... -

Summary Audit Report

SUMMARY AUDIT REPORT for the November 2019 International Cyanide Management Code Recertification Audit Prepared for: Kinross Gold Corporation Chirano Gold Mining Ltd. (CGML) Submitted to: International Cyanide Management Institute 1400 “I” Street NW, Suite 550 Washington, D.C. 20005 FINAL 1 April 2020 Ramboll Canada Inc. 100 Park Royal, Suite 200 West Vancouver, British Columbia, V7T 1A2, Canada www.ramboll.com SUMMARY AUDIT REPORT Name of Mine: Chirano Gold Mine Name of Mine Owner: Kinross Gold Corporation Name of Mine Operator: Chirano Gold Mines Ltd. (CGML) Name of Responsible Manager: Terence Watungwa, General Manager Address: P.O. Box 57, Bibiani Western Region, Ghana Telephone: +233 552 838 283 Fax: N/A E-mail: [email protected] Location detail and description of operation: Kinross Gold (Kinross) Chirano gold mine is located in southwestern Ghana, approximately 100 kilometres southwest of the city of Kumasi. The mine lies within the Bibiani gold belt and consists of several conventional open pit mining sites as well as underground workings. Ore is transported to a centrally located processing plant, where it is crushed and milled before undergoing conventional carbon in leach (CIL) processing. The general location of the Chirano mining operation is shown on the figure below: Page 1 of 46 Cyanide facilities include a warehouse for storage of cyanide reagent in solid briquette form, a cyanide mixing and storage facility, leach tank, CIL processing circuit, a clarifier and tailings box, two lined event ponds, tailings and reclaim water return pipelines, tailing storage facilities (TSFs), reclaim water settling and management ponds, and various other process water control features and connecting pipelines. -

Kinross Gold Corporation

KINROSS GOLD CORPORATION ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2020 Dated March 30, 2021 TABLE OF CONTENTS Page CAUTIONARY STATEMENT .................................................................................................................. 3 CORPORATE STRUCTURE ..................................................................................................................... 6 GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................... 10 OVERVIEW .............................................................................................................................................. 10 THREE YEAR HISTORY ........................................................................................................................ 10 DESCRIPTION OF THE BUSINESS....................................................................................................... 12 EMPLOYEES ........................................................................................................................................... 12 COMPETITIVE CONDITIONS ............................................................................................................... 13 ENVIRONMENTAL PROTECTION ....................................................................................................... 13 OPERATIONS .......................................................................................................................................... 15 GOLD EQUIVALENT PRODUCTION -

Corporate Responsibility Report 2017 KINROSS 2017 Corporate Responsibility Report 2017 Corporate Responsibility Report

Corporate Responsibility Report 2017 KINROSS 2017 Corporate Responsibility Report 2017 Corporate Responsibility Report Main Sections Message Performance Our Approach to from Highlights Managing Corporate the CEO Responsibility 03 05 12 Putting People Generating Engaging First – Health Socio-Economic Our and Safety Value Workforce 30 39 47 Empowering Managing Our 2017 CR Local Environmental Data Tables Communities Footprint 60 105 132 This report chronicles our progress over the past two years in delivering on our commitment to responsible mining. Our goal is to provide a transparent account of our impacts, our performance, and our relationships with the communities where we work, our employees and contractors, host governments, and non-proft and non-governmental organizations. This report includes our 2017 Performance Highlights, 2017 CR Data Tables, 2017 Communication on Progress and our GRI Index. 25 years of responsible mining. 2018 marks our 25th year. To learn more about our history, visit our 25th anniversary microsite at 25anniversary.kinross.com. Celebrating Kinross Gold’s 25th Anniversary 25 years of Delivering Value All dollar amounts shown in U.S. dollars unless otherwise noted. KINROSS 2017 Corporate Responsibility Report Contents 02 60 Kinross Gold Profle Empowering Local Communities 03 61 Our Strategy for Empowering Local Communities Message from the Chief Executive Offcer 64 Site Responsibility Plans 66 Community Planning for Mine Closure 07 68 Key Stakeholder Issues About this Report 77 Working with Indigenous Peoples 09 -

Kinross Gold Corporation

KINROSS GOLD CORPORATION ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2018 Dated March 29, 2019 TABLE OF CONTENTS Page CAUTIONARY STATEMENT........................................................................................................................ 3 CORPORATE STRUCTURE ........................................................................................................................... 6 GENERAL DEVELOPMENT OF THE BUSINESS ................................................................................... 10 OVERVIEW ..................................................................................................................................................... 10 THREE YEAR HISTORY .............................................................................................................................. 11 DESCRIPTION OF THE BUSINESS............................................................................................................ 12 EMPLOYEES .................................................................................................................................................. 13 COMPETITIVE CONDITIONS ..................................................................................................................... 13 ENVIRONMENTAL PROTECTION ............................................................................................................ 13 OPERATIONS ................................................................................................................................................ -

Chirano Gold Mines Compensation Struggle, Ghana | Ejatlas

11/1/2019 Chirano Gold Mines compensation struggle, Ghana | EJAtlas k.com/sharer/sharer.php?u=http%3A%2F%2Fejatlas.org%2Fconict%2Fchirano-gold-mines- -ghana) tent/tweet? no+Gold+Mines+compensation+struggle+on+%23EJAtlas%3A&url=https://ejatlas.org/conict/chirano- on-struggle-ghana) mines-compensation-struggle-ghana) Last update: 2015-08-26 Chirano Gold Mines compensation struggle, Ghana (https://le.ejatlas.org/img/Conict/c Description: We use cookies for statistical purposes and Utilizamos cookies para realizar el análisis de to improve our services. By clicking "Accept la navegación de los usuarios y mejorar cookies" you consent to place cookies when nuestros servicios. Al pulsar "Accept visiting the website. For more information, cookies" consiente dichas cookies. Puede Accept cookies and to nd out how to change the obtener más información, o bien conocer conguration of cookies, please read our cómo cambiar la conguración, pulsando en cookie policy. (/legal#cookies) más información. (/legal#cookies) Legal notice / Aviso legal (/legal) https://ejatlas.org/conflict/chirano-gold-mines-compensation-struggle-ghana 1/9 11/1/2019 Chirano Gold Mines compensation struggle, Ghana | EJAtlas Chirano Gold Mine is a combined underground and open pit gold mine in the Western Region of Ghana, owned by Red Back Mining up to 2010, when it was taken over by the Toronto based Kinross Gold (at 90%) and the Government of Ghana (10%). Over the past three decades the mining sector in Ghana rebounded, mainly on the back of gold production, thanks to the introduction of a new regime heavily inuenced by the World Bank and IMF in mid-1980s. -

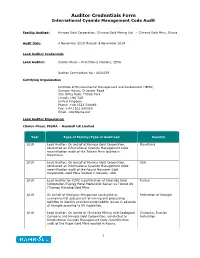

Auditor Credentials Form International Cyanide Management Code Audit

Auditor Credentials Form International Cyanide Management Code Audit Facility Audited: Kinross Gold Corporation, Chirano Gold Mining Ltd. – Chirano Gold Mine, Ghana Audit Date: 4 November 2019 through 8 November 2019 Lead Auditor Credentials Lead Auditor: Clinton Phaal – Practitioner Member, IEMA Auditor Certification No.: 0024259 Certifying Organization Institute of Environmental Management and Assessment (IEMA) Saracen House, Crusader Road City Office Park, Tritton Park Lincoln, LN6 7AS United Kingdom Phone: +44 1522 540069 Fax: +44 1522 540090 Email: [email protected] Lead Auditor Experience: Clinton Phaal, PIEMA – Ramboll UK Limited Year Type of Facility/Type of Audit Led Country 2019 Lead Auditor: On behalf of Kinross Gold Corporation, Mauritania conducted an International Cyanide Management Code recertification audit of the Tasiast Mine located in Mauritania. 2019 Lead Auditor: On behalf of Kinross Gold Corporation, USA conducted an International Cyanide Management Code recertification audit of the Round Mountain Gold Corporation Gold Mine located in Nevada, USA. 2019 Lead Auditor for ICMC recertification of Eldorado Gold Turkey Corporation/Tüprag Metal Madencilik Sanayi ve Ticaret AS (Tüprag) Kışladağ Gold Mine. 2019 On behalf of Georgian Manganese conducted an Federation of Georgia environmental assessment of mining and processing facilities to identify environmental liability issues in advance of Georgia acceding to EU legislation. 2016 Lead Auditor: On behalf of Chukotka Mining and Geological Chukotka, Russian Company and Kinross Gold Corporation, conducted an Federation International Cyanide Management Code recertification audit of the Kupol Gold Mine located in Russia. 1 Auditor Credentials Form International Cyanide Management Code Audit Year Type of Facility/Type of Audit Led Country 2016 Lead Auditor: On behalf of Kinross Gold Corporation, led an Ghana International Cyanide Management Code (ICMC) re- certification audit of the Chirano Gold Mine located in southwestern Ghana. -

KINROSS GOLD CORPORATION (Exact Name of Registrant As Specified in Its Charter)

SECURITIES AND EXCHANGE COMMISSION FORM 40-F Annual reports filed by certain Canadian issuers pursuant to Section 15(d) and Rule 15d-4 Filing Date: 2017-04-03 | Period of Report: 2016-12-31 SEC Accession No. 0001104659-17-020750 (HTML Version on secdatabase.com) FILER KINROSS GOLD CORP Mailing Address Business Address 25 YORK STREET 25 YORK STREET CIK:701818| IRS No.: 650430083 | Fiscal Year End: 1231 17TH FLOOR 17TH FLOOR Type: 40-F | Act: 34 | File No.: 001-13382 | Film No.: 17731736 TORONTO A6 M5J 2V5 TORONTO A6 M5J 2V5 SIC: 1040 Gold and silver ores 8013639152 Copyright © 2017 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 40-F [Check one] o REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 OR x ANNUAL REPORT PURSUANT TO SECTION 13(a) or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 Commission File Number 001-13382 KINROSS GOLD CORPORATION (Exact name of Registrant as specified in its charter) N/A (Translation of Registrants name into English (if applicable)) Province of Ontario, Canada (Province or other jurisdiction of incorporation or organization) 1041 (Primary Standard Industrial Classification Code Number (if applicable)) 650430083 (I.R.S. Employer Identification Number (if applicable)) 25 York Street, 17th Floor, Toronto, Ontario, Canada M5J 2V5 (416) 365-5123 (Address and telephone number of Registrants principal executive offices) Martin D. Litt Secretary Kinross Gold U.S.A., Inc.