Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Danish Immigrant Museum

The Danish Immigrant Museum An International Cultural Center Her Majesty Queen Margrethe II of Denmark, Protector ® Your visit to THE DANISH IMMIGRANT MUSEUM is a Journey . A LETTER FROM THE PRESIDENT January 2008 did we do to deserve this”? As my four grandparents Dear Friends and immigrated separately to this emerging nation, I speculate what their Supporters of thoughts must have been. Certainly The Danish their feelings must have been mixed. Immigrant Museum, Probably immense sadness at leaving family knowing they may never n calendar year 2008, The Danish see them again. I suspect there was IImmigrant Museum celebrates its anxiety at how they would cope in the 25th anniversary. Over the past 25 new world probably not knowing the years, much has been accomplished. language. There must have been great anticipation as to what opportunities A tremendous thank you goes to the Marc L. Petersen, President many dedicated people, volunteers and they would fi nd. The questions and staff, who have made this possible. Pat speculation could go on and on, but challenges of the future, we must yourself on the back as without you we all know courage had to be a have a fi rm foundation upon which there would be no national museum strong part of the constitution of the to build. We need both your fi nancial in the heart of the continent. Our immigrant striking out to a new life in and volunteer support. Certainly Danish heritage would not have been an unfamiliar world. membership renewal and recruitment preserved to the extent it is today The immigrant experiences of the is a key way to assist. -

2011 Annual Report

Annual Report 2011 NEBRASKA DEPARTMENT OF BANKING AND FINANCE DAVE HEINEMAN, GOVERNOR JOHN MUNN, DIRECTOR Annual Report July 1, 2010 - June 30, 2011 NEBRASKA DEPARTMENT OF BANKING AND FINANCE Commerce Court, Suite 400 1230 “O” Street Lincoln, NE 68508-1402 Main Office: (402) 471-2171 Consumer Hotline: (877) 471-3445 www.ndbf.ne.gov www.ndbf.ne.gov 2011 NDB&F Annual Report 1 Leadership Through the Years 1892 to 1895 Richard H. Townley, Secretary, State Banking Board 1895 to 1901 P.L. Hall, Secretary, State Banking Board 1901 to 1917 Edward Royse, Secretary, State Banking Board 1917 to 1919 J.J. Tooley, Secretary, State Banking Board 1919 to 1925 J.E. Hart, Secretary, State Banking Board 1925 to 1927 Kirk Griggs, Secretary, State Banking Board 1927 to 1931 Clarence G. Bliss, Secretary, State Banking Board 1929 to 1931 George W. Woods, Bank Commissioner 1931 to 1933 E.H. Luikart, Secretary, State Banking Board 1933 to 1935 George W. Woods, Deputy Superintendent 1935 to 1939 B.N. Saunders, Superintendent of Banking 1939 to 1943 Wade R. Martin, Director of Banking 1943 to 1947 J. Fred Peters, Director of Banking 1947 to 1959 J.F. McLain, Director of Banking 1959 to 1961 Edwin N. Van Horne, Director of Banking 1961 to 1964 Ralph E. Misko, Director of Banking 1964 to 1966 Henry E. Ley, Director of Banking 1966 to 1967 Byron Dunn, Director of Banking 1967 to 1969 C.R. Haines, Director of Banking 1969 to 1970 Edwin A. Langley, Director of Banking 1971 to 1975 Henry E. Ley, Director of Banking 1975 to 1978 William H. -

Mr. Jeffrey T. Wegner Kutak Rock the Omaha Building 1650 Famam Street Omaha, Nebraska 68102-2186

. BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM WSHINGT~N,0. c. EC551 Mr. Jeffrey T. Wegner Kutak Rock The Omaha Building 1650 Famam Street Omaha, Nebraska 68102-2186 Dear Mr. Wegner: The Secretary of the Board of Governors of the Federal Reserve System, acting pursuant to authority delegated by the Board, and having considered the record of this application in light of the relevant statutory factors, has approved the application by Lauritzen Corporation, Omaha, Nebraska (“Lauritzen”), to acquire 10,000 shares ofcommon stock of First National of Nebraska, Inc., Omaha, Nebraska (“FNNI”), pursuant to section 3(a)(3) of the Bank Holding Company Act (“BHC Act”) (12 U.S.C. 5 1842(a)(3)), and thereby increase Lauritzen’s ownership interest in FNNI from 21.22 percent to 24.95 percent. In approving this application, the Secretary has relied on all the facts of record and all representations and commitments made by Lauritzen in its application and in related correspondence in light of the factors set forth in the BHC Act. These commitments are conditions imposed in writing in connection with the findings and decision herein, and, as such, may be enforced under applicable provisions of law. The acquisition may not be consummated before the fifteenth calendar day following the effective date of this letter, or later than three months after the effective date of this letter, unless such period is extended for good . 2 cause by the Federal Reserve Bank of Kansas City. In connection with these provisions, advice of the fact of consummation shouId be given in writing to the Reserve Bank. -

Summer 2007 Vol

America Letter Summer 2007 Vol. XX, No. 4 Your Museum in the An International THE DANISH IMMIGRANT MUSEUM Her Majesty Queen Margrethe II of Denmark, Protector Heart of the Continent Cultural Center ® Member of the American Association of Museums BOX 470 • ELK HORN, IOWA 51531 Across Oceans, Across Time, Across Generations®: The Lauritzens By Eva Nielsen This story involves – among others – a ship builder, an artist, a banker, and a master painter. It links a house by the sea in Denmark with a bank in Omaha, Nebraska with The Danish Immigrant Museum in Elk Horn, Iowa. It’s a story connect- ing past to present – and a story about making something beautiful to remember the journey. Let’s start with Bruce Lauritzen. He is the banker, the chairman of First National Bank of Omaha and Bruce Lauritzen’s great-great-grandfather, Carl Christian, would have seen the Honorary Royal this view of the sea from his home in Ærøskøbing, Denmark. Carl Christian Danish Consul for was a ship builder and skipper. He immigrated to America in 1891 at the Nebraska. First Na- age of 77. tional Bank is 150 years building and laid a foundation for the Museum’s future old this year. Established growth. in 1857, it is the largest Now here’s where the artist comes into the story. Ear- privately held bank holding lier this year, The Danish Immigrant Museum contacted company in the U.S. Danish goldsmith and designer Helle Jørvad, commis- Lauritzen and his family sioning her to create a sculpture for Lauritzen, a thank own the Shelby County State you for the role the Lauritzen family and the Lauritzen Bank which has an offi ce Corporation has played in building the Museum – a thank in Elk Horn. -

Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Federal Reserve Release H.2 Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received No. 27 Week Ending July 5, 2003 Board of Governors of the Federal Reserve System, Washington, DC 20551 H.2 Board Actions June 29, 2003 to July 5, 2003 Bank Holding Companies The Royal Bank of Scotland Group plc, Edinburgh, Scotland, The Royal Bank of Scotland, and RBSG International Holdings Ltd; and Citizens Financial Group, Inc., Providence, Rhode Island -- to acquire Port Financial Corp., Brighton, Massachusetts, and its subsidiary, Cambridgeport Bank, Cambridge; and acquire Port Financial Corp.'s investment in Cambridge Bancorp and its subsidiary, Cambridge Trust Company. - Approved, June 30, 2003 The Royal Bank of Scotland Group plc, Edinburgh, Scotland, The Royal Bank of Scotland, and RBSG International Holdings Ltd; and Citizens Financial Group, Inc., Providence, Rhode Island -- commenter's request to extend the comment period on the applications to acquire Port Financial Corp., Brighton, Massachusetts, and its subsidiary, Cambridgeport Bank, Cambridge; and acquire Port Financial Corp.'s investment in Cambridge Bancorp and its subsidiary, Cambridge Trust Company. - Denied, July 2, 2003 (AC) = Addition or Correction Board - Page 1 of 1 H.2 Actions under delegated authority June 29, 2003 to July 5, 2003 BS&R Banking Supervision and Regulation RBOPS Reserve Bank Operations and Payment Systems C&CA Consumer and Community Affairs IF International Finance FOMC Federal Open Market Committee OSDM Office of Staff Director for Management Bank Branches, Domestic Atlanta Colonial Bank, Montgomery, Alabama -- to establish a branch at 1691 Michigan Avenue, Miami Beach, Florida. - Approved, July 3, 2003 Kansas City Community Banks of Colorado, Greenwood Village, Colorado -- to establish a branch at 277 Broadway, Suite C, Denver. -

Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Federal Reserve Release H.2 Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received No. 32 Week Ending August 9, 2003 Board of Governors of the Federal Reserve System, Washington, DC 20551 H.2 Board Actions August 3, 2003 to August 9, 2003 Bank Holding Companies Woori Finance Holdings Co., Ltd., Seoul, Korea, and Woori Bank -- to acquire Panasia Bank, National Association, Fort Lee, New Jersey. - Approved, August 4, 2003 Regulations And Policies Basel Capital Accord -- request for comment on interagency documents related to proposed implementation of the new Basel Capital Accord in the United States. - Announced, August 4, 2003 Disciplinary Actions against Accountants -- final interagency regulations on disciplinary actions against accountants who fail to meet certain professional standards (Docket No. R-1139). - Approved, July 25, 2003 (AC) Identity Theft -- request for comment on proposed interagency guidance that would require financial institutions to develop programs to respond to incidents of unauthorized access to customer information, including notification procedures under certain circumstances. - Approved, August 4, 2003 (AC) = Addition or Correction Board - Page 1 of 1 H.2 Actions under delegated authority August 3, 2003 to August 9, 2003 BS&R Banking Supervision and Regulation RBOPS Reserve Bank Operations and Payment Systems C&CA Consumer and Community Affairs IF International Finance FOMC Federal Open Market Committee OSDM Office of Staff Director for Management Bank Branches, Domestic Richmond Albemarle First Bank, Charlottesville, Virginia -- to establish a branch in the General Electric Fanuc Office Park at Route 29 North and Highway 606. - Approved, August 4, 2003 Atlanta AmSouth Bank, Birmingham, Alabama -- to establish a branch at 3242 Little Road, Trinity, Florida. -

Federal Register / Vol. 62, No. 109 / Friday, June 6

31102 Federal Register / Vol. 62, No. 109 / Friday, June 6, 1997 / Notices and regulations to become a bank Board of Governors of the Federal Reserve FEDERAL RESERVE SYSTEM holding company and/or to acquire the System, June 2, 1997. assets or the ownership of, control of, or Jennifer J. Johnson, Federal Open Market Committee; the power to vote shares of a bank or Deputy Secretary of the Board. Domestic Policy Directive of March 25, bank holding company and all of the [FR Doc. 97±14748 Filed 6±5±97; 8:45 am] 1997 banks and nonbanking companies BILLING CODE 6210±01±F In accordance with § 271.5 of its rules owned by the bank holding company, regarding availability of information (12 including the companies listed below. CFR part 271), there is set forth below The applications listed below, as well FEDERAL RESERVE SYSTEM the domestic policy directive issued by as other related filings required by the Formations of, Acquisitions by, and the Federal Open Market Committee at Board, are available for immediate its meeting held on March 25, 1997.1 Mergers of Bank Holding Companies inspection at the Federal Reserve Bank The directive was issued to the Federal indicated. Once the application has The companies listed in this notice Reserve Bank of New York as follows: been accepted for processing, it will also have applied to the Board for approval, The information reviewed at this be available for inspection at the offices pursuant to the Bank Holding Company meeting suggests that relatively strong of the Board of Governors. Interested Act of 1956 (12 U.S.C. -

Appendix Tables, Small Business Lending in the U.S., 2016

CONTENTS Table 1. Lending by Large Lending Institutions Based on Call Report Data, June 2016 1A. Small Business Lending of $ 1 Million or Less 1B. Business Lending Under $100,000 1C. Business Lending of $100,000 – $1 Million Table 2. Lending by Large Lending Institutions Based on CRA Data, 2015 2A. Small Business Lending of $ 1 Million or Less 2B. Business Lending Under $100,000 2C. Business Lending of $100,000 – $1 Million Table 3. Top Lenders by State and Territory Based on Call Report Data, June 2016 3A. Small Business Lending of $ 1 Million or Less 3B. Business Lending Under $100,000 3C. Business Lending of $100,000 – $1 Million Table 4. Top Lenders by State and Territory Based on CRA Data, 2015 4A. Small Business Lending of $ 1 Million or Less 4B. Business Lending Under $100,000 4C. Business Lending of $100,000 – $1 Million Table 5. Total Amount and Number of Small Business Loans per Small Business Employee by State Based on CRA Data, 2015 Table 6. Number of Reporting Institutions by Asset Size and State and Territory Based on Call Report Data, June 2016 Table 1A. Small Business Lending by Large Lending Institutions Based on Call Report Data, June 2016 All Small Business Loans Loans Loans ($1 million or less) Less than $100k $100k – $1 million HQ Amount Lender Asset Amount Amount CC Name of Lending Institution State Rank TA Ratio1 TBL Ratio1 ($1,000) Number Size ($1,000) Number ($1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) American Express Company UT 1 0.235 1.000 20,499,039 2,976,888 >50B 20,406,488 2,976,481 92,551 407 0.420 First Citizens Bancshares, Inc. -

John Lauritzen Chairman of the Board of First National Bank of Omaha, Lauritzen in the Face Drawing Is Surrounded by Credit Cards

No: 50 Date: 9/1/1992 Name: John Lauritzen Chairman of the board of First National Bank of Omaha, Lauritzen in the Face drawing is surrounded by credit cards. He introduced "First Charge Card" in 1953. His pioneer effort produced bank credit cards now known as Visa and Master Card. First National is now one of the top Visa and Master Card issuers in the United States. The artist went for irony when he showed Lauritzen sitting on top of the building, because Lauritzen did not like heights, especially the 22nd floor of the First National Center where most Face ceremonies are held. So his Face unveiling was instead held in his executive offices on the fourth floor. OPC members are seen looking out the window at their landlord as hawks that once lived on the roof fly nearby. At age 29, Lauritzen became the nation's youngest bank president when he purchased the Emerson State Bank in Iowa for $34,000. He raised the money by selling property, such as his house for $14,000 This was the start of the Lauritzen Corporation, a large multi-bank holding company and a principal owner of First National Bank of Omaha, a multi-billion dollar organization doing business throughout the United States. As a principal owner, Lauritzen organized many new banks such as First Westside and First Westroads in Omaha, and First National Bank in Elm Creek, Nebraska. Lauritzen also served on many community service boards and was drive chairman for the American Cancer Society and the United Appeal. In 1991 Mr. -

Wyoming Bankers Association March 2015 Ftwt

WyomingtizBankers Association ftwtMarch 2015 Upcoming Live ConferenceslSeminarsjWorkshopslConvention * 2016 WBA Credit Conference - April 29-30, 2015 - amada Plaza, Sillette, WY * 2015 Legal Issues of New Account bocumentation - May 5, 2015 - Best Western Pamkota Hotel, Casper, WY * 2015 WBA Agricultural Bankers Conference - May 14-15, 2015 - Jeffrey Center, awlins, WY * 2015 MT/WY Bankers Convention - June 11-13, 2015 - Snow King esort, Jackson, WY OMWV:IA. WEFIAK ov o4 WebIv r be -foo o, ocr webstte: - , ALjzg csIess FLvcLcL Stteets Mrth 2 2015 ‘ 2015 V erst g the New tertteo( t’I,soLostre Les: N&W Lot stivv-tfte - Mroh 3, 2015 AC-H- Risk M 2gektefrt - M0rc4’i 5, 2015 ‘ — , C-CLL Report ‘LIo Vpcote Mtwth 2015 ‘ R.Ls Assesse-,ts - Mroh 12, 2015 rc-tor Trg — Mtrth 13, 2015 ‘ AcLzIg C-ch FLow - Mcrth 1 30, 2015 i&pro4g t’eLIver’vS C-rect Sore& to yovr C-vstoker — Mtwth 17, 2015 AC-F-f C-o Li-cvce - Mcrth 1’, 2015 ‘‘ e-t - MOrc4i 2povse, 1, 2015 est Prattes RetaL,, Arcc,tivg Pr De?osit — Mrth 20, 2015 ‘fl’ 2015 ert4I-S the New kteSrcteG{ rLscLosvre tLes: New OLos’vig tsLoscre — Mrth 23, 2015 si.c,s o-f ReAL stte LoO o etctI-o - Morth 24 , 2-, 2015 seovr4j o-ffer Worshop - Mrc4i 25 AprL 1, 2015 trtg iwfor&oto -frovii - SSAE1 - Mcrth 27, 2015 TOTAL TRAENIW6 OLUTIOW WEERAfl$ Dev4 c o webwwrs be -fovi4 ov or wths’-te: C-ovL&pL1e-e Perpeti-jes: A Mo,tht Lkp1te — Mo,thL t’Irertors -tto Ser’es - Mo,th[ Seres AniLbLe e.ct-ver L,ce ecJLLctc -for C-oi&wercL Los Mcrch 3, 2015 C-opLetIg the SAR: LLe bj LI.v,e - Mrth 4, 2015 For scLes?eopLe: row yoL-cr LI44eSS wtki — MGrc,h3, 2015 NotCrj PvbL’ — Mm-oh 12, 2015 ESA SerLes: C-Ti?. -

Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Federal Reserve Release H.2 Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received No. 7 Week Ending February 16, 2002 Board of Governors of the Federal Reserve System, Washington, DC 20551 H.2 Board Actions February 10, 2002 to February 16, 2002 Enforcement MSB Shares, Inc., Jonesboro, Arkansas, and MidSouth Bank -- written agreement, dated February 5, 2002, with the Federal Reserve Bank of St. Louis and the Arkansas State Bank Department. - Announced, February 15, 2002 (AC) = Addition or Correction Board - Page 1 of 1 H.2 Actions under delegated authority February 10, 2002 to February 16, 2002 BS&R Banking Supervision and Regulation RBOPS Reserve Bank Operations and Payment Systems C&CA Consumer and Community Affairs IF International Finance FOMC Federal Open Market Committee OSDM Office of Staff Director for Management Bank Branches, Domestic Atlanta The Bank of Nashville, Nashville, Tennessee -- to establish a branch at 3169 Lebanon Pike. - Approved, February 12, 2002 Atlanta The Park Avenue Bank, Valdosta, Georgia -- to establish a branch at 4058 Continental Drive, Oakwood. - Approved, February 12, 2002 Atlanta Tennessee State Bank, Pigeon Forge, Tennessee -- to establish a branch at 3307 Winfield Dunn Parkway, Kodak. - Withdrawn, February 13, 2002 Bank Holding Companies Director, BS&R Bay Bancorporation, Green Bay, Wisconsin, and Bay Bank -- relief from certain commitments. - Granted, February 12, 2002 Chicago Central Bancshares, Inc., Muscatine, Iowa -- to acquire Marquette Bank Illinois, Galesburg, Illinois. - Approved, February 13, 2002 Secretary Chinatrust Financial Holding Company, Ltd., Taipei, Republic of China -- commenter's request to extend the comment period on the application to become a bank holding company through the acquisition of Chinatrust Commercial Bank, Ltd., and Chinatrust Bank (U.S.A.), Torrance, California. -

Repurchases Closed in 2005 - 2009 Report Summary by Quarter

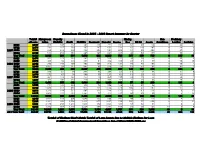

Repurchases Closed in 2005 - 2009 Report Summary by Quarter Total # Misrepresen Property Missing Non Predatory of Loans tation Eligibility Credit Eligibility Document Property Income Doc DU AS Assets Compliance Lending Servicing 05Q1 2,557 470 240 152 363 238 721 182 67 69 176 0 44 23 05Q2 2,473 544 217 210 485 247 682 234 61 110 207 0 46 6 2005 05Q3 2,264 639 212 268 523 206 594 208 81 89 203 0 67 4 05Q4 2,189 533 252 181 465 147 623 165 46 82 157 0 90 6 Year Total 9,483 2,186 921 811 1,836 838 2,620 789 255 350 743 0 247 39 06Q1 2,473 502 141 163 465 128 549 152 44 50 121 0 89 4 06Q2 2,075 448 92 143 333 91 432 109 23 44 87 0 70 10 2006 06Q3 2,942 706 148 185 502 188 919 187 58 58 109 0 98 1 06Q4 2,340 1,037 84 117 947 68 326 79 15 33 61 0 47 2 Year Total 9,830 2,693 465 608 2,247 475 2,226 527 140 185 378 0 304 17 07Q1 2,166 370 64 79 831 43 307 61 14 17 33 0 31 0 07Q2 2,370 272 67 93 506 50 237 63 13 20 39 0 33 2 2007 07Q3 1,737 431 124 147 277 79 430 100 24 29 75 0 38 1 07Q4 1,935 423 100 143 230 62 355 92 6 29 66 0 29 0 Year Total 8,208 1,496 355 462 1,844 234 1,329 316 57 95 213 0 131 3 08Q1 2,595 771 145 224 379 76 586 126 16 28 94 0 75 2 08Q2 5,758 2,600 351 803 935 335 1,134 328 106 62 287 0 57 3 2008 08Q3 3,013 1,326 349 531 807 121 746 175 21 43 121 0 9 12 08Q4 3,318 1,006 115 481 1,361 77 414 137 20 29 88 0 3 12 Year Total 14,684 5,703 960 2,039 3,482 609 2,880 766 163 162 590 0 144 29 09Q1 3,340 1,432 229 690 1,049 153 586 245 49 56 112 0 4 8 09Q2 7,865 3,361 201 1,796 2,347 675 1,047 559 182 57 688 6 4 12 2009 09Q3 5,951