Annual Report 2014 Vision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jebel Ali Raises Curtain on New UAE Season

28 October 2016 www.aladiyat.ae ISSUE 593 Dhs 5 Jebel Ali raises curtain on new UAE season Previews Jebel Ali (Fri) Sharjah (Sat) Cards Pages 50/55 Pages 57/62 28 October 2016 3 Familiar faces with few new names to follow ITH the new season upon Contents us, owners and trainers NEWS 3-21 have clearly completed Wtheir planning ahead of five months UK RACING 22-29 of competition with retained and AUSTRALIAN RACING 31 stable jockeys firmly in place. After a stellar campaign both USA RACING 32-35 domestically and at the Meydan SH MANSOUR FESTIVAL 36-37 Carnival, Champion Trainer Doug BLOODSTOCK 38-43 Watson will again be availing of the services of Pat Dobbs and NICHOLAS GODFREY 44 Sam Hitchcott, while apprentice Adam McLean is also on his Red HOWARD WRIGHT 45 Doug Watson Tadhg O’Shea Stables’ roster. Richard Mullen JOHN BERRY 46 is long established as stable jockey Mansour’s Haajeb in the middle DEREK THOMPSON 47 for Satish Seemar and their round of the Al Maktoum Challenge formidable partnership continues and Sheikh Khalifa’s Abhaar in the MICHELE MACDONALAD 48 with Cameron Noble the latest Emirates Championship. TOM JENNINGS 49 apprentice to grace Zabeel Stables. He is replaced at Millennium PREVIEWS / CARDS Champion Jockey Tadhg O’Shea II Stables, home of Ismail settled in well at Grandstand Mohammed, by ‘The Flying JEBEL ALI (FRIDAY) 50-55 Stables with Ali Rashid Al Rayhi Dutchman’, Adrie de Vries. SHARJAH (SATURDAY) 57-62 last season and is based there again, Erwan Charpy, master of Green while enjoying the opportunity to Stables, has recruited the talents of Editorial ride the cream of Eric Lemartinel’s Antonio Fresu, an Italian whose Purebred Arabians. -

Justin Bahen

EVEREST DIARIES PLATINUM SOUVENIR O C T O B E R 2 0 1 9 A S E C R E T A R I A T ' S W O R L D P U B L I C A T I O N Quality Feed For Superior Results KENSINGTON PRODUCE Q U A L I T Y F E E D F O R S U P E R I O R R E S U L T S F O L L O W U S O N I N S T A G R A M @ K E N S I N G T O N P R O D U C E P : + 6 1 ( 0 2 ) 9 6 6 6 7 7 5 5 W : W W W . K E N S I N G T O N P R O D U C E . C O M . A U Everest Diaries Platinum Souvenir 2019 Welcome, I have always loved magazines. I read the articles, stare at the photos, and study how text and image combined to create in my imagination stories, people, and news events. I notice the headlines and white space and typography and savour the whole experience found in those pages that carry me into the wider world. A Editor-in-chief Pallavi Shevade magazine could be picked up, put down, returned to at will. Creative Director Ritesh Jamkhedkar The greatest magazines tell stories enabling the reader’s Senior Editor Archana Bansode thoughts to travel far beyond the carriage of paper and Editorial Assistant Prajwal Jain ink. -

=Malaguerra (AUS)

equineline.com Product 43P 05/14/16 04:46:25 EDT =Malaguerra (AUS) Bay Gelding; Oct 20, 2011 Danehill, 86 b =Flying Spur (AUS), 92 b Rolls, 84 ch =Magnus (AUS), 02 b =Snippets (AUS), 84 b =Scandinavia (AUS), 94 =Song Of Norway (AUS), 82 gr =Malaguerra (AUS) ch =Biscay (AUS), 65 ch Foaled in Australia =Tennessee Morn, 91 br =Coogee (GB), 59 b =Bletchingly (AUS), 70 br Whiskey Road, 72 b =Misty Vain (AUS), 76 gr =Tennessee Vain (AUS), 84 br Inbreeding: =Vain (AUS): 4S X 4D Dosage Profile: 1 2 4 1 0 Northern Dancer: 5S X 5D Dosage Index: 1.67 =Wilkes (FR): 5S X 5D Center of Distribution: +0.38 =Elated (AUS): 5S X 5D (SPR=93; CPI=7.0) By MAGNUS (AUS) (2002). Stakes winner of $1,083,141 USA in Australia, 1st Bisley Workwear Galaxy [G1], etc. Sire of 6 crops of racing age, 512 foals, 271 starters, 11 stakes winners, 184 winners of 510 races and earning $13,973,286 USA, including Magnifisio (to 6, 2015, $1,319,346 USA, 1st Crown Perth Winterbottom S. [G1], etc.), Miss Promiscuity (to 5, 2015, $468,574 USA, 1st PFD Food Services Sir John Monash S. [G3], etc.), Malaguerra (to 4, 2015, $328,170 USA, 1st Tab Star Kingdom S. [G3], etc.), Magnapal (to 6, 2015, $303,842 USA, 1st Bendigo Bank East Malvern MRC Foundation Cup [G3], etc.), Platinum Kingdom ($276,888 USA, 1st Grinders Coffee Fred Best Classic [G3], etc.), The Alfonso (to 6, 2016, $262,289 USA, 1st SJM Macau Derby, etc.), The River (at 2, 2015, $236,758 USA, 1st Magic Millions Wa 2yo Classic, etc.). -

Sire Reference Lovingly Prepared by Weatherbys

A P INDY (USA) Brown horse, 1989, by Seattle Slew (USA), out of Weekend Surprise (USA), by Secretariat (USA). Champion 3yr old colt in U.S.A. in 1992, Jt 4th top rated 2yr old in U.S.A. in 1991. Won 8 races, value $2,979,815, at 2 and 3, from 6½ furlongs to 1 mile 4 furlongs, Belmont S., Belmont Park, Gr.1, Breeders' Cup Classic, Gulfstream Park, Gr.1, Hollywood Futurity, Hollywood Park, Gr.1, Santa Anita Derby, Santa Anita, Gr.1, Peter Pan S., Belmont Park, Gr.2, etc. Retired to Stud in 1993. Maternal grandsire of ARTEMIS AGROTERA (USA) (Roman Ruler (USA), Frizette S.Gr.1, Ballerina S.Gr.1), CROWN QUEEN (USA) (Smart Strike (CAN), Queen Elizabeth II Challenge Cup S.Gr.1), IMAGINING (USA) (Giant's Causeway (USA), Man O'War S.Gr.1), MORENO (USA) (Ghostzapper (USA), Whitney S.Gr.1), CENTRE COURT (USA) (Smart Strike (CAN), Jenny Wiley S.Gr.1), ROYAL DELTA (USA) (Empire Maker (USA), Alabama S.Gr.1, Delaware H.Gr.1, Personal Ensign H.Gr.1, Breeders' Cup Ladies' Classic, Gr.1, Breeders' Cup Ladies' Classic, Gr.1), PLUM PRETTY (USA) (Medaglia d'Oro (USA), Apple Blossom H.Gr.1, Kentucky Oaks, Gr.1), MORNING LINE (USA) (Tiznow (USA), Carter H.Gr.1), MR DANY (CHI) (Powerscourt (GB), C. Polla de Potrillos (2000 Guineas), Gr.1), SUPER SAVER (USA) (Maria's Mon (USA), Kentucky Derby, Gr.1), MR SIDNEY (USA) (Storm Cat (USA), Maker's Mark Mile S.Gr.1), WAIT A WHILE (USA) (Maria's Mon (USA), Yellow Ribbon S.Gr.1, Yellow Ribbon S.Gr.1, American Oaks Invitational S.Gr.1), ANY GIVEN SATURDAY (USA) (Distorted Humor (USA), Haskell Invitational S.Gr.1), BLUEGRASS CAT (USA) (Storm Cat (USA), Haskell Invitational S.Gr.1). -

Nature Strip Named Australian Racehorse of the Year | 2 | Tuesday, October 6, 2020

ROAD TO THE MELBOURNE INGLIS READY 2 RACE INDUSTRY NEWS | 'PRIZE- CUP | READ THE THOUGHTS VENDOR PROFILE MONEY DISTRIBUTION VITAL OF OTI RACING'S TERRY BLAKE RYAN FACTOR IN RISING STRENGTH OF HENDERSON - PAGE 12 - PAGE 17 AUSTRALIAN RACING' - PAGE 14 Tuesday, October 6, 2020 | Dedicated to the Australasian bloodstock industry - subscribe for free: Click here STALLION WATCH - PAGE 19 YESTERDAY'S RACE RESULTS - PAGE 28 Nature Strip named Read Tomorrow's Issue For: Australian Racehorse Steve Moran What's on Race meetings: Goulburn (NSW), Orange of the Year (NSW), Donald (VIC), Mackay (QLD) Top sprinter joins greats of the turf as Waller dominates virtual Barrier trials / Jump-outs: Goulburn ceremony, presented from Brisbane (NSW), Orange (NSW), Caulfield (VIC), Colac (VIC), Doomben (QLD), Longford (TAS) International meetings: Catterick (UK), Leicester (UK), Lingfield (UK), Southwell (UK), Durbanville (SAF) International sales: Tattersalls October Yearling Sale - Book 1 (UK), Fasig-Tipton Midlantic Fall Yearling Sale (USA) BY ANDREW HAWKINS | @ANZ_NEWS WINNERS ature Strip (6 g Nicconi - Strikeline CHAMPION 2YO - FARNAN CHAMPION 3YO COLT/GELDING - YES YES YES by Desert Sun) was last night CHAMPION 3YO FILLY - LOVING GABY named Australian Racehorse of CHAMPION SPRINTER - NATURE STRIP the Year for the 2019-20 season, CHAMPION MIDDLE DISTANCE HORSE Ngiving trainer Chris Waller his fifth straight REGAL POWER/FIERCE IMPACT victory in Australia’s most prominent equine CHAMPION STAYER - VOW AND DECLARE award, while former stablemate Yes Yes Yes (4 c CHAMPION SIRE - SNITZEL GROUP 1 JOCKEY OF THE YEAR - CRAIG WILLIAMS Rubick - Sin Sin Sin by Fantastic Light) became GROUP 1 TRAINER OF THE YEAR CHRIS WALLER the first Champion Three-Year-Old Colt or CHAMPION JUMPER - TALLYHO TWINKLETOE Gelding to secure the title without a Group 1 win to his name. -

Sydney Autumn Racing Carnival » 14 Mar - 18 Apr

SYDNEY AUTUMN RACING CARNIVAL » 14 MAR - 18 APR Get your fun back on track MEDIA GUIDE 2020 CONTENTS 02 28 CHAIRMAN’S WELCOME ROYAL RANDWICK HOSPITALITY 03 29 MAJOR PARTNERS THE STAR CHAMPIONSHIPS DAY 1 04 34 CALENDAR OF MEDIA EVENTS THE CHAMPIONSHIPS DAY 2 - LONGINES & ATC FOUNDATION QUEEN ELIZABETH STAKES DAY 05 39 FAST FACTS SCHWEPPES ALL AGED STAKES DAY 06 SYDNEY AUTUMN CARNIVAL 42 HORSES TO WATCH RACEDAY SUMMARY 44 10 JOCKEYS & TRAINERS TO WATCH ROSEHILL GARDENS HOTSPOTS 12 46 ROSEHILL GARDENS HOSPITALITY HOW TO GET TO THE TRACK 13 47 CHANDON LADIES DAY ENTERTAINMENT 15 48 LONGINES GOLDEN SLIPPER DAY STYLE & BEAUTY 21 50 STAKES DAY CARNIVAL AMBASSADORS 26 52 ROYAL RANDWICK HOTSPOTS MEDIA & PR INFORMATION 01 CHAIRMAN’S WELCOME THE AUSTRALIAN TURF CLUB AT OUR HOME HERE IN THIS GLOBAL CITY OF SYDNEY WELCOMES ALL MEDIA TO ONE OF THE WORLD’S BEST THOROUGHBRED RACING CARNIVALS. The six-week Sydney Autumn Racing Carnival at Rosehill Gardens and Royal Randwick features a suite of some of the most famous and highest rated races in international racing. From the iconic Longines Golden Slipper Stakes and Carnival at Rosehill Gardens, to Australia’s highest rated race for the past three years in the Longines Queen Elizabeth Stakes at Royal Randwick, the eyes of the racing world focus on Sydney this March and April. With Australia’s best horses, jockeys and trainers, the Sydney Autumn Racing Carnival is attracting competitors from the Northern Hemisphere, including some of the biggest stables in the UK and Japan, along with the great strength of New Zealand’s renowned racing industry. -

Champagne Popped As Castelvecchio Lands First Group 1 Win for Litt

Maven becomes Read Tuesday's Issue For: American Stallion Watch Pharoah's The Week Ahead second winner What's On Race meetings: Mudgee (NSW), Nowra Morning Briefing (NSW), Mornington (VIC), Stawell (VIC), Page 8 Sunshine Coast (QLD), Penola (SA), Sunday, April 21, 2019 Albany (WA) International meetings: Kranji (SGP), Champagne popped as Macau (MAC) Castelvecchio lands first Group 1 win for Litt Juvenile colt also achieves milestone for young sire Dundeel with Randwick victory Pierata reaches pinnacle in All Aged Stakes Pierata sportpiX Pierata (Pierro) has all but secured his place as a stallion after adding an important Group 1 victory to his CV with a win in yesterday’s All Aged Stakes (Gr 1, 1400m) at Randwick. Castelvecchio AAP Three times-placed at Group 1 level prior to his breakthrough Randwick success, Pierata’s Slipper Stakes (Gr 1, 1200m) instead trainer Greg Hickman and the entire’s owners By Tim Rowe choosing to turn his focus on yesterday’s have resisted offers from studs over the past 12 ichard Litt was savouring the $500,000 Randwick feature. months and their patience will no doubt have biggest success of his short Jockey Josh Parr settled Castelvecchio in paid off, with his value set to have skyrocketed career after talented colta midfield position, eventually coming home after yesterday’s win. Castelvecchio produced a strongly to overhaul the favourite Loving Gaby (I Beaten a “pixel” in The Galaxy (Gr 1, 1100m) Rdominant performance in yesterday’s ATC Am Invincible) to beat the filly by one and a half in March before a last-start fifth to Santa Ana Champagne Stakes (Gr 1, 1600m), the first lengths, with the winner clocking a slick time Lane (Lope De Vega) in the TJ Smith Stakes (Gr Australian elite level win for his exciting young of 1:33.31 seconds (last 600 metres in 35.50 1, 1200m), Pierata finished a long-neck ahead sire Dundeel (High Chaparral). -

Vow and Declare Takes out Melbourne Cup for Australia | 2 | Wednesday, November 6, 2019

Wednesday, November 6, 2019 | Dedicated to the Australasian bloodstock industry - subscribe for free: Click here INTERNATIONAL FLAVOUR OF CUP LIKELY TO CONTINUE - PAGE 17 Vow And Declare Read Tomorrow's Issue For: takes out Melbourne Latest carnival news What's on Race meetings: Grafton (NSW), Kyneton Cup for Australia (VIC), Port Lincoln (SA), Launceston (TAS), Avondale (NZ) Danny O’Brien-trained stayer holds off internationals in tight International meetings: Happy Valley (HK). Flemington finish Barrier trials / Jump-outs: Warwick Farm (NSW), Caulfield (VIC). Sales: Keeneland (USA) - November Breeding Stock Sale - Day 1 elbourne Cup (Gr 1, 3200m) winner Vow And Declare, by American-bred stallion Declaration Of War (War MFront) who twice won on turf at the highest level in Europe, has delivered for Australia with a locally bred and trained victory in the country’s biggest race. The former Coolmore stallion Declaration Of War, now domiciled in Japan, certainly left his mark during his two-year stint Down Under, not least of which allows Australia to lay claim to breeding the winner of the $8 million cup for just the second time in a decade. Cont. on page 2>> WHAT THE JOCKEY'S SAID - PAGE 9 MELBOURNE CUP STAKE RESULT Vow And Declare GETTY IMAGES AND BREEDING INFO - PAGE 22 Follow us @anz_news: click here | 1 | Brought to you by Vow And Declare takes out Melbourne Cup for Australia | 2 | Wednesday, November 6, 2019 << Continued from page 1 In a thrilling four-way finish, the Danny O’Brien-trained Vow And Declare ($11), who had raced near the speed throughout, fought back under Craig Williams on the line to score by a head. -

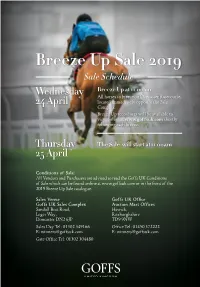

Breeze up Web App .Indd

Breeze Up Sale 2019 Sale Schedule Breeze Up at 11.00am Wednesday All horses to breeze on Doncaster Racecourse, located immediately opposite the Sale 24 April Complex. Breeze Up recordings will be available to view online at www.goffsuk.com shortly following each breeze. Thursday The Sale will start at 11.00am 25 April Conditions of Sale: All Vendors and Purchasers are advised to read the Goffs UK Conditions of Sale which can be found online at www.goffsuk.com or in the front of the 2019 Breeze Up Sale catalogue. Sales Venue Goffs UK Office Goffs UK Sales Complex Auction Mart Offices Sandall Beat Road, Hawick, Leger Way, Roxburghshire DoncasterTo DN2come 6JP TD9 9NW Sales Day Tel: 01302 349166 Office Tel: 01450 372222 E: [email protected] E: [email protected] Gate Office Tel: 01302 304480 1 Index To Consignors Index to Consignors Index toTo Consignors Consignors Lot Box Aguiar Bloodstock 34 f Starspangledbanner - Sister Sylvia...............................................................C165 68 f Cappella Sansevero - Zelie Martin...............................................................C166 75 c Cappella Sansevero - Almatlaie...............................................................C167 130 c Showcasing - Lady Brigid...............................................................C168 Ardglass Stables 5 c Hot Streak - Park Law...............................................................E251 11 f Declaration of War - Princess Consort...............................................................E252 Ballinahulla Stables 92 -

Mandaloun Turns the Tables in Risen Star

SUNDAY, FEBRUARY 14, 2021 MANDALOUN TURNS THE CLAIRIERE A FITTING WINNER OF THE RACHEL ALEXANDRA TABLES IN RISEN STAR Hall of Famer Rachel Alexandra carried the famed burgundy and gold silks of Stonestreet Farm to six victories, four of which were Grade Is, including the GI Preakness S. and GI Woodward S. So, it was only fitting that another filly carrying the colors of Barbara Banke's operation, Clairiere (Curlin), won that Horse of the Year's namesake Grade II race at the Fair Grounds Saturday. The event, which produced GI Kentucky Oaks winners in 2018 and 2019, offered 50 points towards this year's run for the lillies. Clairiere rallied strongly from well back to capture her 1 1/16-mile debut at Churchill Downs Oct. 25. She made another late run for the lead in that venue's GII Golden Rod S. Nov. 28, but was collared by the re-opposing Travel Column (Frosted) and forced to settled for second. Cont. p4 Mandaloun | Hodges IN TDN EUROPE TODAY Mandaloun added yet another feather to his superstar sire CLASSIC SIBLING AWAITED AT HISTORIC ROTTGEN Into Mischief's cap with a victory in Saturday's GII Risen Star S. at Emma Berry speaks with Gestut Rottgen's Frank Dorff on 2021 the Fair Grounds. Adding blinkers after a third-place finish in the mating plans and several exciting runners for the historic GIII Lecomte S. last time, the Juddmonte Farms homebred was operation this year. Click or tap here to go straight to TDN away alertly from stall 10 and rushed up to stalk from a two- Europe. -

Irish, European & World Thoroughbred Rankings 2016

IRISH, EUROPEAN & WORLD THOROUGHBRED RANKINGS 2016 INDEX OF CONTENTS Section 1 - Irish Thoroughbred Racehorse Rankings 2016 Overview 1 Category Champions 3 Irish Two Year Old Rankings 4 Irish Three Year Old Rankings 7 Irish Four Year Old & Upwards Rankings 12 Irish Thoroughbred Rankings by Distance Category 18 Irish Rating List 2016 – Alphabetical Listing 23 AW Rating List 32 Quality Control 32 Section 2 – Statistical Summary 2016 33 Ratings Review: All Horses 34 Ratings Review: Horses Rated 100 35 Summary of Performances: Overview 37 Summary of Performances: Pattern Races 40 Summary of Performances: Handicap Races 44 Summary of Performances: Maiden Races 47 Section 3 – LONGINES’ World Best Racehorse Rankings 2016 48 Category Champions 50 LWBRR Listing for 2016 51 Group/Grade One Races (3-y-o’s+) Order of Merit 57 Section 4 - European Thoroughbred Racehorse Rankings 2016 58 Category Champions 60 European Two Year Old Rankings (110+) 61 European Three Year Olds Rated 114-110 62 European Four Year Old & Upwards 114-110 64 Section 5 – Appendices 66 Irish Champion Racehorses 67 European Champion Racehorses 70 World Champion Racehorses 72 World Champion Racehorses - By Distance Category 75 SECTION 1 IRISH THOROUGHBRED RACEHORSE RANKINGS 2016 IRISH THOROUGHBRED RACEHORSE RANKINGS 2016 OVERVIEW 2016 was another hugely successful and unique year for Irish Flat Racing. All five Irish Classic winners were trained in Ireland and trained by five different trainers no less. Both Adrian Keatley (JET SETTING (IRE)(120)) and Willie Mullins (WICKLOW BRAVE) (GB)(115)) achieved first time Classic success in winning the Tattersalls Irish 1,000 Guineas (G1) and the Palmerstown House Estate Irish St Leger (G1) respectively while Kevin Prendergast (AWTAAD (IRE)(118)), Dermot Weld (HARZAND (IRE)(121)) and Aidan O’Brien (SEVENTH HEAVEN (IRE)(119) completed a unique nap hand for Irish trainers in annexing the Tattersalls Irish 2000 Guineas (G1), Dubai Duty Free Irish Derby (G1) and Darley Irish Oaks (G1) respectively. -

I Am Invincible Bay 2004 16.2 Hh

I Am Invincible_2021.qxp_Page 7/5/21 2:20 pm Page 188 I Am Invincible Bay 2004 16.2 hh VIDDORA (Colombia; Zeditave). 9 wins, $2,851,167, LIBERTINI (Encosta de Lago; Danehill). 5 wins, Race Record MVRC AJ Moir S.-G1, WATC Winterbottom S.- $1,497,950, ATC Furious S.-G2, Silver Shadow S.- Age Starts Wins 2nds 3rds G1, SAJC RN Irwin S.-G3, 2d MVRC AJ Moir S.- G2, 3d VRC Sprint Classic-G1, VRC (Ascot Vale S.) 23 1 - 1 G1, SAJC (Robert Sangster S.) Ubet Classic-G1. Coolmore Stud S.-G1, MVRC William Reid S.-G1. 31 - - - I AM A STAR (Dixieland Band; Common Grounds). INVINCIBLE GEM (Marwina; Al Khawaaneeg). 6 47 4 1 - 10 wins, $1,564,300, VRC (Empire Rose S.) Myer wins, $979,550, ATC Emancipation S.-G2, Missile Classic-G1, AV Kewney S.-G2, (Milady S.) Let's S.-G2, 2d ATC Randwick Guineas-G1, 3d ATC 52 - - - Elope S.-G2, 2d MRC Thousand Guineas-G1, 3d Winx S.-G1, Canterbury S.-G1. 13 5 1 1 SAJC (Robert Sangster S.) Ubet Classic-G1. PURE ELATION (Hussonet; Flying Spur). 3 wins, VOODOO LAD (Gilded Time; Salieri). 13 wins, $667,220, ATC (Keith Mackay H.) Percy Sykes S.- Stakes won: $270,050 $1,975,110, WATC Winterbottom S.-G1, VRC G2, NSW Tatt's RC Furious S.-G2. Aurie's Star H.-G3, MRC Heath S.-G3, 2d VRC ILLUSTRIOUS LAD (Zeditave; Century). 10 wins, 1st SAJC DC McKay S.-G3, Morphettville (1100m) Newmarket H.-G1, MRC (Invitation S.) Sir Rupert $840,662, VRC (Linlithgow S.) Tab.com.au S.-G2, MRC Sir John Monash S.-L, Caulfield (1100m) Clarke S.-G1.