March 2015 Manhattan Office Leasing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States District Court Southern District of New York

Case 1:08-cv-02764-LAK Document 99 Filed 06/12/2008 Page 1 of 3 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK CSX CORPORATION, Plaintiff, v. THE CHILDREN'S INVESTMENT FUND MANAGEMENT (UK) LLP, THE CHILDREN'S INVESTMENT FUND MANAGEMENT (CAYMAN) LTD., THE CHILDREN'S INVESTMENT MASTER FUND, 3G CAPITAL PARTNERS LTD., 3G CAPITAL PARTNERS, L.P., 3G FUND, L.P., CHRISTOPHER HOHN, ECF Case SNEHAL AMIN AND ALEXANDRE BEHRING, A/K/A ALEXANDRE BEHRING COSTA, 08 Civ. 02764 (LAK) Defendants. NOTICE OF APPEAL THE CHILDREN'S INVESTMENT MASTER FUND, Counterclaim and Third- Party Plaintiff, v. CSX CORPORATION AND MICHAEL WARD, Counterclaim and Third- Party Defendants. 3G CAPITAL PARTNERS LTD., 3G CAPITAL PARTNERS, L.P. AND 3G FUND, L.P., Counterclaim Plaintiffs, v. CSX CORPORATION AND MICHAEL WARD, Counterclaim Defendants. Case 1:08-cv-02764-LAK Document 99 Filed 06/12/2008 Page 2 of 3 PLEASE TAKE NOTICE that plaintiff CSX Corporation hereby appeals to the United States Court of Appeals for the Second Circuit from the Final Judgment and Permanent Injunction of this Court entered June 11, 2008, and from the Opinion of this Court entered the same day, to the extent the Court denied injunctive relief sought by plaintiff (e.g., the Court refused to enjoin "defendants from voting the 6.4 percent of [plaintiffs] shares that they acquired between the expiration of []10 days following the formation of the group no later than February 13, 200[7] and the date of the trial"). June 12, 2008 Respectfully submitted, CRAVATH, SWAINE & MOORE LLP, by toryD7lVmi«on Francis P. -

MANHATTAN COMMUNITY BOARD 6 FULL BOARD MEETING MINUTES Wednesday, January 11, 2012 NYU MEDICAL CENTER 550 FIRST AVENUE Hon. Ma

MANHATTAN COMMUNITY BOARD 6 FULL BOARD MEETING MINUTES Wednesday, January 11, 2012 NYU MEDICAL CENTER 550 FIRST AVENUE Hon. Mark Thompson, Chair ATTENDANCE Members answering first roll call: Arcaro, Badi, Barrett, Buchwald, Collins, Curtis, Disman, Eggers, Figueroa, Friedman, Haile, Humphrey, Imbimbo, Keane, Landesman, Marton, McKee, Nariani, Negrete, O’Neal, Paikoff, Papush, Parrish, Pellezzi, Reiss, Schachter, Schaeffer, Scheyer, Seligman, Sepersky, Sherrod, Simon, Steinberg, Thompson, Vigh-Lebowitz, Weder, West, Winfield Members answering second roll call: Arcaro, Badi, Barrett, Buchwald, Collins, Curtis, Disman, Eggers, Figueroa, Friedman, Haile, Humphrey, Imbimbo, Keane, Landesman, Marton, McKee, Nariani, Negrete, O’Neal, Paikoff, Papush, Parrish, Pellezzi, Reiss, Schachter, Schaeffer, Scheyer, Seligman, Sepersky, Sherrod, Simon, Steinberg, Thompson, Vigh-Lebowitz, Weder, West, Winfield Excused: Dankberg, Dubnoff, Frank, Hollister, Judge, McIntosh, Absent: Garland, Gonzalez, Moses, Parise Scala, Guests signed in: B.P. Scott Stringer; Zach Gamza-Sen Krueger; Enrique Lopez-Sen. Tom Duane; Shelby Garner-Cg/M Maloney; Jenna Adams-A/M Brian Kavanagh; Jeffrey LeFrancois-A/M Gottfried; Elena Arons-C/M Dan Garodnick; C/M Jessica Lappin; Matt Walsh-C/M Dan Quart; Susan Loghito, Amir Talai, Constance Unger, Willam Zeckendorf, Jyna Scheeren, Sherrill Kazan, Kathy Thompson, Shamina deGonzaga, Paul, Adamopolous, Colin Cathcart, Paul Crawford INDEX Meeting Called to Order 3 Adoption of the Agenda 3 Roll Call 3 Public Session 3 Business Session -

United States Bankruptcy Court Eastern District of Michigan Northern Division

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN NORTHERN DIVISION IN RE: § § DOW CORNING CORPORATION § CASE NO. 95-20512 AJS § (CHAPTER 11) DEBTOR. § § Judge Arthur J. Spector ORDER APPROVING AMENDED JOINT DISCLOSURE STATEMENT, SETTING HEARING ON CONFIRMATION OF THE PLAN, AND ESTABLISHING DEADLINES FOR VOTING ON THE PLAN AND FILING OBJECTIONS TO CONFIRMATION OF THE PLAN An Amended Joint Disclosure Statement With Respect to Amended Joint Plan of Reorganization (the ``Disclosure Statement'') and an Amended Joint Plan of Reorganization (the ``Plan'') were ®led by the Debtor and the Tort Claimants' Committee (collectively, the ``Proponents'') on February 4, 1999. The Court, after hearing, is of the opinion that the Disclosure Statement should be approved and that notice of the hearing has been given in accordance with the procedures approved and prescribed by this Court and is adequate and suf®cient pursuant to the Bankruptcy Code, the Bankruptcy Rules and other applicable law. It is therefore ORDERED and notice is hereby given that: 1. The Disclosure Statement is hereby found to contain ``adequate information'' as such term is de®ned in section 1125 of the Bankruptcy Code and is hereby approved. 2. On or before March 15, 1999, the Disclosure Statement, the Plan, a copy of this Order, ballots and voting instructions, any communications from the Proponents and the Of®cial Committees, the Special Note to Breast Implant and Other Personal Injury Claimants, and related materials (collectively, the ``Solicitation Package'') shall be transmitted by the Proponents to creditors, equity security holders, other parties in interest and the United States Trustee pursuant to the procedures and guidelines established by prior orders of this Court. -

No. 13-3148 in the UNITED STATES COURT of APPEALS for THE

Case: 13-3148 Document: 20-2 Filed: 01/10/2014 Pages: 43 No. 13-3148 IN THE UNITED STATES COURT OF APPEALS FOR THE SEVENTH CIRCUIT INTERCON SOLUTIONS, INC., Plaintiff-Appellee, v. BASEL ACTION NETWORK AND JAMES PUCKETT, Defendants-Appellants. ON APPEAL FROM THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS Case No. 12-CV-6814 (Hon. Virginia M. Kendall) _____________________________________________________________________________________________________________________ BRIEF OF AMICI CURIAE ADVANCE PUBLICATIONS, INC., ALLIED DAILY NEWSPAPERS OF WASHINGTON, AMERICAN SOCIETY OF NEWS EDITORS, ASSOCIATION OF ALTERNATIVE NEWSMEDIA, THE ASSOCIATION OF AMERICAN PUBLISHERS, INC., BLOOMBERG L.P., CABLE NEWS NETWORK, INC., DOW JONES & COMPANY, INC., THE E.W. SCRIPPS COMPANY, HEARST CORPORATION, THE MCCLATCHY COMPANY, MEDIA LAW RESOURCE CENTER, THE NATIONAL PRESS CLUB, NATIONAL PRESS PHOTOGRAPHERS ASSOCIATION, NATIONAL PUBLIC RADIO, INC., NEWS CORPORATION, NEWSPAPER ASSOCIATION OF AMERICA, ONLINE NEWS ASSOCIATION, PRO PUBLICA, INC., RADIO TELEVISION DIGITAL NEWS ASSOCIATION, REPORTERS COMMITTEE FOR FREEDOM OF THE PRESS, SEATTLE TIMES COMPANY, SOCIETY OF PROFESSIONAL JOURNALISTS, TIME INC., TRIBUNE COMPANY, THE WASHINGTON NEWSPAPER PUBLISHERS ASSOCIATION, AND THE WASHINGTON POST IN SUPPORT OF DEFENDANTS-APPELLANTS AND REVERSAL _____________________________________________________________________________________________ Bruce E. H. Johnson Laura R. Handman Ambika K. Doran Alison Schary DAVIS WRIGHT TREMAINE LLP DAVIS WRIGHT TREMAINE LLP 1201 Third Avenue, Suite 2200 1919 Pennsylvania Avenue, NW Seattle, WA 98101 Suite 800 (206) 622-3150 Washington, DC 20006 (202) 973-4200 Thomas R. Burke DAVIS WRIGHT TREMAINE LLP Counsel for Amici Curiae 505 Montgomery Street, Suite 800 San Francisco, CA 94111 (*Of counsel listed on inside cover) (415) 276-6500 Case: 13-3148 Document: 20-2 Filed: 01/10/2014 Pages: 43 OF COUNSEL Richard A. -

I I I Case 13-13086-KG Doc 1 Filed 11/22/13 Page 1 of 4

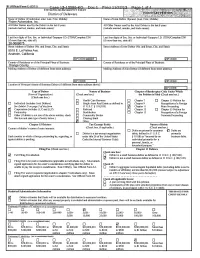

B! (Official Form 11 (12/11) Case 13-13086-KG Doc 1 Filed 11/22/13 Page 1 of 4 UNITED STATES BANKRUPTCY COURT District of Delaware YOLIJ1"4T4RYPET1TION - Name of Debtor (if individual, enter Last, First, Middle): Name of Joint Debtor (Spouse) (Last, First, Middle): Fisker_ Automotive, _Inc. All Other Names used by the Debtor in the last 8 years All Other Names used by the Joint Debtor in the last 8 years (include married, maiden, and trade names): (include married, maiden, and trade names): Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN)/Complete Eli') Last four digits of Soc. Sec. or individual-Taxpayer I.D. (ITIN)/Complete EIN (if more than one, state all): (if more than one, state all): 26-0689075 Street Address of Debtor (No. and Street, City, and State): Street Address of Joint Debtor (No. and Street, City, and State): 5515 E. La Palma Ave. Anaheim, California IZIP CODE 92807 I VIP CODE I County of Residence or of the Principal Place of Business: County of Residence or of the Principal Place of Business: Orange County Mailing Address of Debtor (if different from street address): Mailing Address of Joint Debtor (if different from street address): IZIP CODE I IZIP CODE I Location of Principal Assets of Business Debtor (if different from street address above): IZIP CODE I Type of Debtor Nature of Business Chapter of Bankruptcy Code Under Which (Form of Organization) (Check one box.) the Petition is Filed (Check one box.) (Check one box.) El Health Care Business D Chapter 7 0 Chapter 15 Petition for 0 Individual (includes Joint Debtors) 0 Single Asset Real Estate as defined in 0 Chapter 9 Recognition of a Foreign See Exhibit Don page 2 of thisform. -

Emergency Response Incidents

Emergency Response Incidents Incident Type Location Borough Utility-Water Main 136-17 72 Avenue Queens Structural-Sidewalk Collapse 927 Broadway Manhattan Utility-Other Manhattan Administration-Other Seagirt Blvd & Beach 9 Street Queens Law Enforcement-Other Brooklyn Utility-Water Main 2-17 54 Avenue Queens Fire-2nd Alarm 238 East 24 Street Manhattan Utility-Water Main 7th Avenue & West 27 Street Manhattan Fire-10-76 (Commercial High Rise Fire) 130 East 57 Street Manhattan Structural-Crane Brooklyn Fire-2nd Alarm 24 Charles Street Manhattan Fire-3rd Alarm 581 3 ave new york Structural-Collapse 55 Thompson St Manhattan Utility-Other Hylan Blvd & Arbutus Avenue Staten Island Fire-2nd Alarm 53-09 Beach Channel Drive Far Rockaway Fire-1st Alarm 151 West 100 Street Manhattan Fire-2nd Alarm 1747 West 6 Street Brooklyn Structural-Crane Brooklyn Structural-Crane 225 Park Avenue South Manhattan Utility-Gas Low Pressure Noble Avenue & Watson Avenue Bronx Page 1 of 478 09/30/2021 Emergency Response Incidents Creation Date Closed Date Latitude Longitude 01/16/2017 01:13:38 PM 40.71400364095638 -73.82998933154158 10/29/2016 12:13:31 PM 40.71442154062271 -74.00607638041981 11/22/2016 08:53:17 AM 11/14/2016 03:53:54 PM 40.71400364095638 -73.82998933154158 10/29/2016 05:35:28 PM 12/02/2016 04:40:13 PM 40.71400364095638 -73.82998933154158 11/25/2016 04:06:09 AM 40.71442154062271 -74.00607638041981 12/03/2016 04:17:30 AM 40.71442154062271 -74.00607638041981 11/26/2016 05:45:43 AM 11/18/2016 01:12:51 PM 12/14/2016 10:26:17 PM 40.71442154062271 -74.00607638041981 -

Tenant Diversification 37 Leasing Activity Summary 38-41 Lease Expiration Schedule 42-43

SLSL Green Green Realty Realty Corp. Corp. SecondThird Quarter Quarter 2007 2005 SupplementalSupplemental Data Data JuneMarch 30, 31 2007, 2005 SL Green Realty Corp. is a fully integrated, self-administered 21E of the Securities Exchange Act of 1934, as amended. All and self-managed Real Estate Investment Trust, or REIT, that statements, other than statements of historical facts, included in primarily acquires, owns, manages, leases and repositions this report that address activities, events or developments that office properties in emerging, high-growth submarkets of the Company expects, believes or anticipates will or may occur Manhattan. in the future, including such matters as future capital expenditures, dividends and acquisitions (including the amount • SL Green’s common stock is listed on the New York Stock and nature thereof), expansion and other development trends of Exchange, and trades under the symbol SLG. the real estate industry, business strategies, expansion and • SL Green maintains an internet site at www.slgreen.com at growth of the Company’s operations and other such matters are which most key investor relations data pertaining to dividend forward-looking statements. These statements are based on declaration, payout, current and historic share price, etc. can certain assumptions and analyses made by the Company in be found. Such information is not reiterated in this light of its experience and its perception of historical trends, supplemental financial package. This supplemental financial current conditions, expected future developments and other package is available through the Company’s internet site. factors it believes are appropriate. Such statements are subject • This data is presented to supplement audited and unaudited to a number of assumptions, risks and uncertainties, general regulatory filings of the Company and should be read in economic and business conditions, the business opportunities conjunction with those filings. -

01/08/2021 Defendant's MOL ISO Motion to Dismiss

FILED: NEW YORK COUNTY CLERK 01/08/2021 06:30 PM INDEX NO. 655632/2020 NYSCEF DOC. NO. 9 RECEIVED NYSCEF: 01/08/2021 SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK SCHULTE ROTH & ZABEL LLP, Mot. Seq. 001 Plaintiff, Index No. 655632/2020 - against - Assigned to METROPOLITAN 919 3rd AVENUE LLC, in its Justice Andrea Masley individual capacity and as successor in interest to 919 Part 48 THIRD AVENUE ASSOCIATES L.P., Oral Argument Requested Defendant. MEMORANDUM OF LAW IN SUPPORT OF DEFENDANT’S MOTION DISMISSING PLAINTIFF’S COMPLAINT 1 of 27 FILED: NEW YORK COUNTY CLERK 01/08/2021 06:30 PM INDEX NO. 655632/2020 NYSCEF DOC. NO. 9 RECEIVED NYSCEF: 01/08/2021 TABLE OF CONTENTS TABLE OF CONTENTS ................................................................................................................. i PRELIMINARY STATEMENT .................................................................................................... 1 STATEMENT OF FACTS ............................................................................................................. 4 I. THE LEASE AND THE PREMISES ..................................................................................... 4 II. SL GREEN AND SCHULTE RESPOND TO THE COVID-19 PANDEMIC ...................... 6 III. NEW YORK COMMENCES ITS PHASED REOPENING .................................................. 8 ARGUMENT .................................................................................................................................. 9 I. SCHULTE’S COMPLAINT SHOULD BE DISMISSED -

2006 Speakers

THIRTY-SECOND ANNUAL SOUTHEASTERN BANKRUPTCY LAW INSTITUTE APRIL 6-8, 2006 SPEAKERS Honorable Keith M. Lundin Frank J. Santoro United States Bankruptcy Court Marcus, Santoro, Kozak & Melvin, P.C. Middle District of Tennessee 355 Crawford Parkway 260 Customs House Suite 700 701 Broadway P.O. Drawer 69 Nashville, Tennessee 37203 Portsmouth, Virginia 23705 Telephone: (615) 736-5586 Telephone: (757) 393-2555 [email protected] Harry E. Hildebrand, III Honorable Thomas F. Waldron Lassiter, Tidwell & Hildebrand PLLC Chief Judge PO Box 190664 United States Bankruptcy Court Nashville, Tennessee 37219 Southern District of Ohio Telephone: (615) 244-1001 120 W. 3rd Street Telecopier: (615) 242-4214 Dayton, Ohio 45402 [email protected] Telephone: 937-225-2863 Telecopier: 937-225-2702 [email protected] Thomas Moers Mayer Michael S. Stamer Kramer Levin Naftalis & Frankel LLP Akin Gump Strauss Hauer & Feld LLP 919 Third Avenue 590 Madison Avenue 39th Floor New York, New York 10022-2524 New York, New York 10022-3902 Telephone: 212.872.1025 Telephone: (212) 715-9169 Telecopier: 212.872.1002 Telecopier: (212) 715-8000 [email protected] [email protected] Honorable Michael G. Williamson Paul S. Singerman United States Bankruptcy Judge Berger Singerman Middle District of Florida 200 S. Biscayne Boulevard Sam M. Gibbons Courthouse Suite 1000 9th Floor, 801 N. Florida Avenue Miami, Florida 33131 Tampa, Florida 33602 Telephone: (305) 714-4343 Telephone: (813) 301-5162 Telecopier: (305) 714-4340 Telecopier: (813) 301-5527 [email protected] [email protected] Mary Jo Wiggins Michael Sabbath University of San Diego School of Law Walter Homer Drake Professor of Law 5998 Alcala Park Mercer University Walter F. -

Board Liaison

BOARD OF DIRECTORS LIAISON ASSIGNMENTS 2021/22 BUSINESS CLUSTER CHILDREN & FAMILY CLUSTER CRIMINAL JUSTICE CLUSTER Antitrust & Trade Regulation Children & the Law Capital Punishment Banking Law Children, Council on Corrections and Community Reentry Bankruptcy & Corporate Reorganization Domestic Violence Criminal Advocacy Commercial Law & Uniform State Laws Education & the Law Criminal Courts Consumer Affairs Family Court & Family Law Criminal Justice Operations Employee Benefits & Executive Juvenile Justice Criminal Law Compensation Matrimonial Law Mass Incarceration Task Force Hospitality Law White Collar Crime Judith Whiting David Levine Community Service Society of NY Sarah J. Berger Bloomberg LP 633 Third Avenue, Fl 10 Phone: (646) 386-3992 731 Lexington Avenue New York, NY 10017 [email protected] Legal Dept. FL 14 Phone: (212)614-5323 New York, NY 10022 [email protected] Phone: (212) 318-2000 [email protected] DIVERSITY CLUSTER GOVERNMENT/ FINANCIAL CLUSTER Diversity, Equity and Inclusion ENVIRONMENT/TRANSPORTATION Compliance Diversity Pipeline Initiatives CLUSTER Corporation Law Lesbian, Gay, Bisexual, Transgender & Administrative Law Emerging Companies and Venture Capital Queer Rights Aeronautics Financial Reporting Minorities in the Profession Election Law Futures & Derivatives Regulation Recruitment & Retention of Lawyers Energy Investment Management Regulation Women in the Legal Profession Environmental Law Mergers Acquisitions & Corporate Control Government Ethics and State Affairs Contests Anna M. Pohl International -

Building Envelope • Sustainability Consulting

BUILDING ENVELOPE • SUSTAINABILITY CONSULTING • MONITORING 40 Bond Street InterActiveCorp (IAC) Headquarters 841 Broadway New York, NY New York, NY New York, NY Hearst Tower World Trade Centers 1-4, 7 Bank of America at New York, NY 9/11 Memorial and Museum One Bryant Park New York, NY New York, NY FIRM INTRODUCTION Vidaris, Inc. is a consulting firm specializing in building envelope, sustainability and energy efficiency. The company was created by combining the legacy firms of Israel Berger and Associates, LLC (IBA) and Viridian Energy & Environmental, LLC. Formed in 1994, IBA established an exterior wall consulting practice providing niche services to real estate owners, owner representatives and architects. Services were provided for new construction as well as investigation, repositioning, repair, and restoration of existing buildings. Later expansion included roofing as well as waterproofing consulting, encompassing the entire building envelope. IBA developed into an industry-leading resource. Viridian Energy & Environmental was established in 2006, providing consulting services to assist building owners and managers in energy efficiency, sustainability and LEED certifications. Energy modeling expertise set Viridian apart from other consultants offering more standardized service and support. In 2011, IBA and Viridian Energy & Environmental merged their specialized service offerings to form Vidaris. As building envelope designs and mechanical systems were becoming more complex, the two companies recognized that it was an opportunity, more so a necessity, for them to be able to provide a holistic approach to these closely related disciplines for their clients. Deep technical knowledge, a long proven track record, reputation, and a sophisticated analytical approach would allow Vidaris to provide a level of service second to none. -

1438-20 IBP-OTC Retail Listing V3 SP FINAL WEB 508

Lista de comercios de artículos sin receta (OTC) de Healthfirst Para la lista actualizada de los comercios participantes, por favor visite otcnetwork.com/member 1-888-260-1010 Plan de Beneficios Adicionales (HMO SNP) de Healthfirst TTY 1-888-867-4132, Healthfirst Increased Benefits Plan (HMO SNP) los 7 días de la semana, de 8:00 a.m. a 8:00 p.m. (de octubre a marzo), y lunes a viernes, de 8:00 a.m. a 8:00 p.m. (de abril a septiembre) Healthfirst.org/medicare H3359_MSD21_38 1438-20_C Your OTC card can be used at any location for the national retailers listed 0123 4567 8901 2345 678 below, as well as the participating IBP retailers listed in this brochure: Su tarjeta de artículos sin receta (OTC) puede usarse en cualquieraBACK de los siguientes establecimientos comerciales a nivel nacional, así como en los comercios participantes que se mencionan dentro del folleto: 您的自選藥物與用品OTC卡可在以下所列的全美零售商家 a tca d a egiste ad a o n t d ng C 0 MDDYY 以及本手冊所列的其他零售商家使用:25 Not : CVSe a d 1/ " Sa Pharmacy y are Dollar General Duane Reade Family Dollar Rite Aid Walgreens Walmart También puede comprar en línea en Nations OTC. Llame al 1-877-236-7027 (TTY 711), de lunes a viernes, de 8:00 a.m. a 8:00 p.m., o visite NationsOTC.com/Healthfirst. Tenga a la mano el número de su tarjeta OTC de 19 dígitos. Lista de comercios de artículos sin receta Para la lista más reciente de comercios participantes, (OTC) de Healthfirst para el 2021 por favor visite otcnetwork.com/member CONDADO DEL BRONX 161st St Pharmacy and Agra Pharmacy Best Aid Pharmacy Surgical Supplies 1575