Australian Agrifood Hubs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MINUTES AAA VIC Division Meeting

MINUTES AAA VIC Division Meeting Wednesday 7 August 2019 08:30 – 15:30 Holiday Inn Melbourne Airport Grand Centre Room, 10-14 Centre Road, Melbourne Airport Chair: Katie Cooper Attendees & Apologies: Please see attached 1. Introduction from Victorian Chair, Apologies, Minutes and Chair’s Report (Katie Cooper) • Introduced Daniel Gall, Deputy Chair for Vic Division • Provided overview of speakers for the day. • Dinner held previous evening which was a great way to meet and network – feedback welcome on if it is something you would like to see as an ongoing event Chairman’s Report Overview – • Board and Stakeholder dinner in Canberra with various industry and political leader and influences in attendance • AAA represented at the ACI Asia Pacific Conference and World AGM in Hong Kong • AAA Pavement & Lighting Forum held in Melbourne CBD with excellent attendance and positive feedback on its value to the industry • June Board Meeting in Brisbane coinciding with Qld Div meeting and dinner • Announcement of Federal Government $100M for regional airports • For International Airports, the current revisions of the Port Operators Guide for new and redeveloping ports which puts a lot of their costs onto industry is gaining focus from those affected industry members • MOS 139 changes update • Airport Safety Week in October • National Conference in November on the Gold Coast incl Women in Airports Forum • Launch of the new Corporate Member Advisory Panel (CMAP) which will bring together a panel of corporate members to gain feedback on issues impacting the AAA and wider airport sector and chaired by the AAA Chairman Thanks to Smiths Detection as the Premium Division Meetings Partner 2. -

ADF Serials Telegraph Newsletter

John Bennett ADF Serials Telegraph Newsletter Volume 10 Issue 3: Winter 2020 Welcome to the ADF-Serials Telegraph. Articles for those interested in Australian Military Aircraft History and Serials Our Editorial and contributing Members in this issue are: John ”JB” Bennett, Garry “Shep” Shepherdson, Gordon “Gordy” Birkett and Patience “FIK” Justification As stated on our Web Page; http://www.adf-serials.com.au/newsletter.htm “First published in November 2002, then regularly until July 2008, the ADF-Serials Newsletter provided subscribers various news and articles that would be of interest to those in Australian Military Heritage. Darren Crick was the first Editor and Site Host; the later role he maintains. The Newsletter from December 2002 was compiled by Jan Herivel who tirelessly composed each issue for nearly six years. She was supported by contributors from a variety of backgrounds on subjects ranging from 1914 to the current period. It wasn’t easy due to the ebb and flow of contributions, but regular columns were kept by those who always made Jan’s deadlines. Jan has since left this site to further her professional ambitions. As stated “The Current ADF-Serials Telegraph is a more modest version than its predecessor, but maintains the direction of being an outlet and circulating Email Newsletter for this site”. Words from me I would argue that it is not a modest version anymore as recent years issues are breaking both page records populated with top quality articles! John and I say that comment is now truly being too modest! As stated, the original Newsletter that started from December 2002 and ended in 2008, and was circulated for 38 Editions, where by now...excluding this edition, the Telegraph has been posted 44 editions since 2011 to the beginning of this year, 2020. -

SLR Consulting Australia Comments and Feedback on The: Noise Limit

SLR-0282 31 October 2019 SLR Feedback on Noise Protocol 20191031.docx EPA Victoria GPO Box 4395 Melbourne Victoria 3001 Attention: Director of Policy and Regulation Dear Sir / Madam SLR Consulting Australia comments and feedback on the: Noise limit and assessment protocol for the control of noise from commercial, industrial and trade premises and entertainment venues GENERAL COMMENTS The following comments apply to the Protocol generally. 1. The scope of the document is not defined within the document. For this document to be stand alone, the definition of ‘noise sensitive area’ should be provided within the Protocol, and not just in the Environment Protection Regulations Exposure Draft and the Summary of proposed noise framework. If it is determined that the definitions should not be provided within the Protocol itself, the Protocol should, as a minimum, direct the reader to these documents for the definition. 2. The Protocol appears to have dropped the use of italics, inverted comments and / or capitalisation when using terms that have a specific technical meaning in the context of the document. This can lead to confusion as the terms typically also have common usage interpretations. Instances include: • Noise sensitive area. See (1). • Receiver distance. See (20)a and (20)c. • Background relevant area. See (21). We recommend that all terms with a specific technical meaning in the Protocol, and particularly those that use common English, be italicised or marked in some other way so that the reader knows to refer to the glossary for their meaning. 3. There is no ‘Agent of Change’ option for the assessment of commercial noise. -

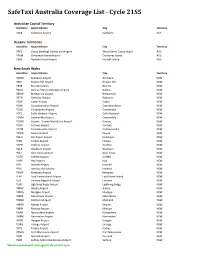

Safetaxi Australia Coverage List - Cycle 21S5

SafeTaxi Australia Coverage List - Cycle 21S5 Australian Capital Territory Identifier Airport Name City Territory YSCB Canberra Airport Canberra ACT Oceanic Territories Identifier Airport Name City Territory YPCC Cocos (Keeling) Islands Intl Airport West Island, Cocos Island AUS YPXM Christmas Island Airport Christmas Island AUS YSNF Norfolk Island Airport Norfolk Island AUS New South Wales Identifier Airport Name City Territory YARM Armidale Airport Armidale NSW YBHI Broken Hill Airport Broken Hill NSW YBKE Bourke Airport Bourke NSW YBNA Ballina / Byron Gateway Airport Ballina NSW YBRW Brewarrina Airport Brewarrina NSW YBTH Bathurst Airport Bathurst NSW YCBA Cobar Airport Cobar NSW YCBB Coonabarabran Airport Coonabarabran NSW YCDO Condobolin Airport Condobolin NSW YCFS Coffs Harbour Airport Coffs Harbour NSW YCNM Coonamble Airport Coonamble NSW YCOM Cooma - Snowy Mountains Airport Cooma NSW YCOR Corowa Airport Corowa NSW YCTM Cootamundra Airport Cootamundra NSW YCWR Cowra Airport Cowra NSW YDLQ Deniliquin Airport Deniliquin NSW YFBS Forbes Airport Forbes NSW YGFN Grafton Airport Grafton NSW YGLB Goulburn Airport Goulburn NSW YGLI Glen Innes Airport Glen Innes NSW YGTH Griffith Airport Griffith NSW YHAY Hay Airport Hay NSW YIVL Inverell Airport Inverell NSW YIVO Ivanhoe Aerodrome Ivanhoe NSW YKMP Kempsey Airport Kempsey NSW YLHI Lord Howe Island Airport Lord Howe Island NSW YLIS Lismore Regional Airport Lismore NSW YLRD Lightning Ridge Airport Lightning Ridge NSW YMAY Albury Airport Albury NSW YMDG Mudgee Airport Mudgee NSW YMER Merimbula -

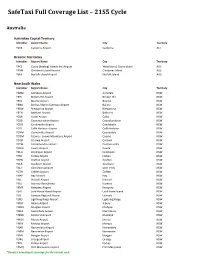

Safetaxi Full Coverage List – 21S5 Cycle

SafeTaxi Full Coverage List – 21S5 Cycle Australia Australian Capital Territory Identifier Airport Name City Territory YSCB Canberra Airport Canberra ACT Oceanic Territories Identifier Airport Name City Territory YPCC Cocos (Keeling) Islands Intl Airport West Island, Cocos Island AUS YPXM Christmas Island Airport Christmas Island AUS YSNF Norfolk Island Airport Norfolk Island AUS New South Wales Identifier Airport Name City Territory YARM Armidale Airport Armidale NSW YBHI Broken Hill Airport Broken Hill NSW YBKE Bourke Airport Bourke NSW YBNA Ballina / Byron Gateway Airport Ballina NSW YBRW Brewarrina Airport Brewarrina NSW YBTH Bathurst Airport Bathurst NSW YCBA Cobar Airport Cobar NSW YCBB Coonabarabran Airport Coonabarabran NSW YCDO Condobolin Airport Condobolin NSW YCFS Coffs Harbour Airport Coffs Harbour NSW YCNM Coonamble Airport Coonamble NSW YCOM Cooma - Snowy Mountains Airport Cooma NSW YCOR Corowa Airport Corowa NSW YCTM Cootamundra Airport Cootamundra NSW YCWR Cowra Airport Cowra NSW YDLQ Deniliquin Airport Deniliquin NSW YFBS Forbes Airport Forbes NSW YGFN Grafton Airport Grafton NSW YGLB Goulburn Airport Goulburn NSW YGLI Glen Innes Airport Glen Innes NSW YGTH Griffith Airport Griffith NSW YHAY Hay Airport Hay NSW YIVL Inverell Airport Inverell NSW YIVO Ivanhoe Aerodrome Ivanhoe NSW YKMP Kempsey Airport Kempsey NSW YLHI Lord Howe Island Airport Lord Howe Island NSW YLIS Lismore Regional Airport Lismore NSW YLRD Lightning Ridge Airport Lightning Ridge NSW YMAY Albury Airport Albury NSW YMDG Mudgee Airport Mudgee NSW YMER -

21 November 2019 Innovation And

21 November 2019 Innovation and excellence on show at AAA National Airport Industry Awards A development project that changes how we respond to emergencies, a community engagement program reaching tens of thousands of people and a technical solution that allowed a taxiway replacement to be completed in just five weeks were among the winning projects at the Australian Airports Association (AAA) 2019 National Airport Industry Awards last night. AAA Chief Executive Officer Caroline Wilkie said this year once again showcased the industry’s commitment to delighting passengers, inspiring technical excellence and innovation, and supporting the growth of our cities and communities. “Every year the standard rises even higher as airports find new ways to work smarter, faster and always with the passenger in focus,” Ms Wilkie said. “We have seen airports once again improve how passengers access the airport, enjoy their time before their flight and move quickly through airport processes as a result of some innovative projects this year. “There are also some fantastic examples of airports forging ever-stronger links with their local area as an important part of the fabric of their communities. “it is great to see so many airports investing in a truly passenger-centric and sustainable future for our industry.” Brisbane Airport took out the capital city airport of the year after ramping up its community engagement program ahead of the opening of its new runway next year. Avalon Airport won the major airport category after welcoming its first international services, while Dubbo City Regional Airport took out the large regional airport category. Bendigo Airport was named small regional airport of the year after its first commercial flights in more than 30 years commenced in 2019, while West Sale Airport’s upgrade earned it the title of small regional aerodrome of the year. -

July 2017 West Sale Airport Master Plan Update 2017 West Sale Airport

July 2017 West Sale Airport Master Plan Update 2017 West Sale Airport (WSA) July 2017 West Sale Airport Master Plan Update 2017 Page 1 West Sale Airport Master Plan Update 2017 Wellington Shire Council Prepared for Wellington Shire Council 18 Desailly St, PO Box 506Sale VIC 3850 Prepared by To70 Aviation (Australia) Pty Ltd Suite 14, 204-218 Dryburgh Street North Melbourne, VIC 3051 Australia E-mail: [email protected] In association with: Kneebush Planning Pty Ltd PO Box 2326, Moorabbin VIC 3189 North Melbourne, July 2017 July 2017 West Sale Airport Master Plan Update 2017 Page 1 Table of Contents 1 Introduction 4 1.1 Overview of the Airport 4 1.2 Purpose and Objectives of the Master Plan 5 1.3 Methodology and Consultation 6 1.4 Report Structure 7 2 Background Information 9 2.1 Master Plan Context 9 2.1.1 Historical Background 12 2.1.2 Regional Context 12 2.1.3 Socio-Economic Context 13 2.1.4 Regulatory Context 14 2.1.5 Policy Context 16 2.1.6 Planning Controls 24 2.1.7 Key Stakeholders 25 2.2 Current Situation 26 2.2.1 Ownership and Management 26 2.2.2 Site Description 26 2.2.3 Surrounding Land 28 2.2.4 Existing Activities 29 2.2.5 Existing Facilities 29 2.2.6 Ground Transport Access 31 2.2.7 Utility Services 31 2.2.8 Environmental Values 32 2.2.9 Heritage Values 33 2.3 SWOT Analysis 33 2.3.1 Strengths and Advantages 33 2.3.2 Weaknesses and Constraints 34 2.3.3 Opportunities and Prospects 34 2.3.4 Threats and Risks 34 2.3.5 Summary of SWOT Analysis 34 2.4 Strategic Vision and Objectives 35 2.4.1 Strategic Vision 35 2.4.2 Objectives 35 -

Gippsland Tertiary Education Plan Is Pleased to Furnish This Report

educationaccesstrainingpathwaysequityqualitypartnershipslifelonglearningpreparationconnectedness aspirationaleducationaccesstrainingpathwaysequityqualitypartnershipslifelonglearningpreparation connectednessaspirational educationaccesstrainingpathwaysequityqualitypartnershipslifelonglearning preparationconnectednessaspirationaleducationaccesstrainingpathwaysequityqualitypartnerships lifelonglearningpreparationconnectednessaspirationaleducationaccesstrainingpathwaysequityquality partnershipslifelonglearningpreparationconnectednessaspirationaleducationaccesstrainingpathways equityqualitypartnershipslifelonglearningpreparationconnectednessaspirationaleducationaccesstraining pathwaysequityqualitypartnershipslifelonglearningpreparationconnectednessaspirationaleducationaccessGippsland Tertiary trainingpathwaysequityqualitypartnershipslifelonglearningpreparationconnectednessaspirationaleducationEducation Plan accesstrainingpathwaysequityqualitypartnershipslifelonglearningpreparationconnectednessaspirational educationaccesstrainingpathwaysequityqualitypartnershipslifelonglearningpreparationconnectedness aspirationaleducationaccessequitytrainingpathwaysequityqualitypartnershipslifelonglearningpreparationconnected- nessaspirationaleducationaccesstrainingpathwaysequityqualitypartnershipslifelonglearningpreparationDecember 2011 connectednessaspirationaleducationaccesstrainingpathwaysequityqualitypartnershipslifelonglearning preparationconnectednessaspirational educationaccesstrainingpathwaysequityqualitypartnershipsReport of the Expert Panel lifelonglearningpreparationconnectednessaspirationaleducationaccesstrainingpathwaysequityqualityProfessor -

KODY LOTNISK ICAO Niniejsze Zestawienie Zawiera 8372 Kody Lotnisk

KODY LOTNISK ICAO Niniejsze zestawienie zawiera 8372 kody lotnisk. Zestawienie uszeregowano: Kod ICAO = Nazwa portu lotniczego = Lokalizacja portu lotniczego AGAF=Afutara Airport=Afutara AGAR=Ulawa Airport=Arona, Ulawa Island AGAT=Uru Harbour=Atoifi, Malaita AGBA=Barakoma Airport=Barakoma AGBT=Batuna Airport=Batuna AGEV=Geva Airport=Geva AGGA=Auki Airport=Auki AGGB=Bellona/Anua Airport=Bellona/Anua AGGC=Choiseul Bay Airport=Choiseul Bay, Taro Island AGGD=Mbambanakira Airport=Mbambanakira AGGE=Balalae Airport=Shortland Island AGGF=Fera/Maringe Airport=Fera Island, Santa Isabel Island AGGG=Honiara FIR=Honiara, Guadalcanal AGGH=Honiara International Airport=Honiara, Guadalcanal AGGI=Babanakira Airport=Babanakira AGGJ=Avu Avu Airport=Avu Avu AGGK=Kirakira Airport=Kirakira AGGL=Santa Cruz/Graciosa Bay/Luova Airport=Santa Cruz/Graciosa Bay/Luova, Santa Cruz Island AGGM=Munda Airport=Munda, New Georgia Island AGGN=Nusatupe Airport=Gizo Island AGGO=Mono Airport=Mono Island AGGP=Marau Sound Airport=Marau Sound AGGQ=Ontong Java Airport=Ontong Java AGGR=Rennell/Tingoa Airport=Rennell/Tingoa, Rennell Island AGGS=Seghe Airport=Seghe AGGT=Santa Anna Airport=Santa Anna AGGU=Marau Airport=Marau AGGV=Suavanao Airport=Suavanao AGGY=Yandina Airport=Yandina AGIN=Isuna Heliport=Isuna AGKG=Kaghau Airport=Kaghau AGKU=Kukudu Airport=Kukudu AGOK=Gatokae Aerodrome=Gatokae AGRC=Ringi Cove Airport=Ringi Cove AGRM=Ramata Airport=Ramata ANYN=Nauru International Airport=Yaren (ICAO code formerly ANAU) AYBK=Buka Airport=Buka AYCH=Chimbu Airport=Kundiawa AYDU=Daru Airport=Daru -

House of Representatives

COMMONWEALTH OF AUSTRALIA Official Committee Hansard HOUSE OF REPRESENTATIVES STANDING COMMITTEE ON TRANSPORT AND REGIONAL SERVICES Reference: Commercial regional aviation services in Australia and alternative transport links to major populated islands WEDNESDAY, 26 FEBRUARY 2003 TULLAMARINE BY AUTHORITY OF THE HOUSE OF REPRESENTATIVES INTERNET The Proof and Official Hansard transcripts of Senate committee hearings, some House of Representatives committee hearings and some joint com- mittee hearings are available on the Internet. Some House of Representa- tives committees and some joint committees make available only Official Hansard transcripts. The Internet address is: http://www.aph.gov.au/hansard To search the parliamentary database, go to: http://search.aph.gov.au HOUSE OF REPRESENTATIVES STANDING COMMITTEE ON TRANSPORT AND REGIONAL SERVICES Wednesday, 26 February 2003 Members: Mr Neville (Chair), Mr Andren, Mr Gibbons, Mr Haase, Mrs Ley, Mr McArthur, Mr Mossfield, Ms O’Byrne, Mr Schultz and Mr Secker Members in attendance: Mr Gibbons, Mr McArthur, Mr Neville, Ms O’Byrne and Mr Secker Terms of reference for the inquiry: To inquire into and report on: Commercial regional aviation services in Australia and alternative transport links to major populated islands. WITNESSES BARBER, Mr William Garfield Thomas, Investment Manager, Latrobe City...................................... 175 BREWSTER, Councillor Geoffrey David, Mayor, King Island Council................................................. 260 DUBOIS, Mr Michael, Chairman, New South Wales Division, Australian Airports Association ........ 224 FORTE, Mr Andrew, Chairman, Western Australian Division, Australian Airports Association ...... 224 GRAHAM, Councillor Neil Raymond, Councillor, King Island Council................................................ 260 KEARNS, Mr Nicholas Peter, Strategic Planner, East Gippsland Shire Council .................................. 249 KEECH, Mr Ken, Chief Executive Officer, Australian Airports Association....................................... -

Accelerating Growth for the Gippsland Food and Fibre Industry

Accelerating growth for the Gippsland food and fibre industry Supported by March 2019 KPMG.com.au 2 Accelerating growth for the Gippsland food and fibre industry Supporting Food & Fibre Gippsland Newly formed entity Food & Fibre This paper proposes six capability The keys to growth of the region’s Gippsland has engaged with platforms to accelerate growth, and food and fibre sector is dependent KPMG to assist in developing will inform an industry alignment upon attracting and developing this discussion paper to set an workshop with key stakeholders in capability of the current and future aspirational growth target for the the first half of 2019. work force and equipping them with regional food and fibre industry the skills, connectivity and enabling that will contribute to the economic • Positioning food and fibre as the infrastructure needed to produce prosperity of the Gippsland region. backbone of Gippsland’s economy higher value added products and services. Without an aspiration for • Transforming food and fibre’s Roughly the same size as the world’s growth Gippsland’s Food and Fibre innovation ecosystems second largest food exporter, the industry will struggle to compete for Netherlands, Gippsland covers over and retain the necessary capital and 1 • Developing future industries 41,500 square kilometres, with 28 talent from competing industries percent of the land being used for • Connecting Gippsland and regions. A growth target agricultural purposes. The region had backed with a growth mindset and a population of approximately 274,600 • Sustainable energy, land use innovation framework is fundamental in 2017 and some 15,400 people and water to aligning interests of stakeholders are directly employed in agriculture, across Gippsland’s Food and Fibre forestry and fisheries activities. -

NEWSLETTER of the Australasian Society for Historical Archaeology Inc

NEWSLETTER of the Australasian Society for Historical Archaeology Inc. Volume 37 No. 2 June 2007 Box 220, Holme Building Print Post Regulations No: PP24359/00114 University of Sydney NSW 2006 ISSN 0156-9295 Secretary: [email protected] ABN: 41 196 332 496 Website: www.asha.org.au Contents STATE OF THE ART .......................................................................................................... 2 ACT News............................................................................................................................ 2 Heritage Division, Department Of The Environment And Water Resources (DEW) ......... 2 New South Wales News ...................................................................................................... 3 ACHM ............................................................................................................................... 3 Department of Environment and Climate Change ............................................................ 4 AMBS ............................................................................................................................... 4 Ainsworth Heritage ........................................................................................................... 4 South Australia News ........................................................................................................ 12 Queensland News ............................................................................................................. 13 National Archaeology Week