Google-Doubleclick Case

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Intro to Google for the Hill

Introduction to A company built on search Our mission Google’s mission is to organize the world’s information and make it universally accessible and useful. As a first step to fulfilling this mission, Google’s founders Larry Page and Sergey Brin developed a new approach to online search that took root in a Stanford University dorm room and quickly spread to information seekers around the globe. The Google search engine is an easy-to-use, free service that consistently returns relevant results in a fraction of a second. What we do Google is more than a search engine. We also offer Gmail, maps, personal blogging, and web-based word processing products to name just a few. YouTube, the popular online video service, is part of Google as well. Most of Google’s services are free, so how do we make money? Much of Google’s revenue comes through our AdWords advertising program, which allows businesses to place small “sponsored links” alongside our search results. Prices for these ads are set by competitive auctions for every search term where advertisers want their ads to appear. We don’t sell placement in the search results themselves, or allow people to pay for a higher ranking there. In addition, website managers and publishers take advantage of our AdSense advertising program to deliver ads on their sites. This program generates billions of dollars in revenue each year for hundreds of thousands of websites, and is a major source of funding for the free content available across the web. Google also offers enterprise versions of our consumer products for businesses, organizations, and government entities. -

Google Apps Premier Edition: Easy, Collaborative Workgroup Communication with Gmail and Google Calendar

Google Apps Premier Edition: easy, collaborative workgroup communication with Gmail and Google Calendar Messaging overview Google Apps Premier Edition messaging tools include email, calendar and instant messaging solutions that help employees communicate and stay connected, wherever and whenever they work. These web-based services can be securely accessed from any browser, work on mobile devices like BlackBerry and iPhone, and integrate with other popular email systems like Microsoft Outlook, Apple Mail, and more. What’s more, Google Apps’ SAML-based Single Sign-On (SSO) capability integrates seamlessly with existing enterprise security and authentication services. Google Apps deliver productivity and reduce IT workload with a hosted, 99.9% uptime solution that gets teams working together fast. Gmail Get control of spam Advanced filters keep spam from employees’ inboxes so they can focus on messages that matter, and IT admins can focus on other initiatives. Keep all your email 25 GB of storage per user means that inbox quotas and deletion schedules are a thing of the past. Integrated instant messaging Connect with contacts instantly without launching a separate application or leaving your inbox. No software required. Built-in voice and video chat Voice and video conversations, integrated into Gmail, make it easy to connect face-to-face with co-workers around the world. Find messages instantly Powerful Google search technology is built into Gmail, turning your inbox into your own private and secure Google search engine for email. Protect and secure sensitive information Additional spam filtering from Postini provides employees with an additional layer of protection and policy-enforced encryption between domains using standard TLS protocols. -

Chromebooks for Education

Chromebooks for Education Chromebooks for Education include • Chromebook computers • Cloud-based management console • Ongoing support from Google • 3 year hardware warranty Pricing Chromebooks for Education start at $20/Chromebook per month For more information, visit: google.com/chromebook/education Chromebooks for Education give students, teachers, and administrators a simple solution for fast, intuitive, and easy-to-manage computing. Chromebooks provide access to the web’s education and collaboration resources, as well as off er centralized management and low total cost of ownership. Using Chromebooks, teachers spend more time teaching and less time managing classroom technology, and schools can deploy more computers into the hands of their students and teachers. “ From the day the students got the Chromebooks, they could maneuver around. It’s pretty simple. Individual learning at their own pace.” —Zach Fleming, Teacher, Crook County Middle School At home in the classroom (and beyond) Chromebooks provide the teaching and learning benefi ts of computers without the typical distractions that come with technology in the classroom. They “ We don’t have to worry about installing boot in 8 seconds and resume instantly – eliminating the time wasted while software or doing updates and imaging. traditional computers start up and connect to a network. Long battery life It’s just plug and play, it’s amazing!” —Bruce Hahn, Technology Coordinator, means Chromebooks last an entire school day. And since it’s easy to connect Crook County School District, Prineville OR a Chromebook anytime and anywhere with built-in Wi-Fi and optional 3G, students can continue learning after school and at home. -

1592213370-Monetize.Pdf

Table of Contents 1. Online Monetization: How to Turn Your Following into Cash 1.1 What is monetization? 1.2 How to monetize your website, blog, or social media channel 1.3 Does a monetization formula exist? Chapter 1 Takeaways 2. How to Monetize Your Blog The Right Way 2.1 Why should you start monetizing with your blog? 2.2 How to earn money from blogging 2.3 How to transform your blog visitors into loyal fans 2.4 Blog monetization tools you should know about Chapter 2 Takeaways 3. Facebook Monetization: The What, Why, Where, and How 3.1 How Facebook monetization works 3.2 Facebook monetization strategies Chapter 3 Takeaways 4. How to monetize your Instagram following 4.1 Before you go chasing that Instagram money... 4.2 The four main ways you can earn money on Instagram 4.3 Instagram monetization tools 4.4 Ideas to make money on Instagram Chapter 4 Takeaways 5. Monetizing a YouTube Brand Without Ads 5.1 How to monetize Youtube videos without Adsense 5.2 Essential Youtube monetization tools 5.3 Factors that determine your channel’s long-term success Chapter 5 Takeaways 1. Online Monetization: How to Turn Your Following into Cash 5 Stop me if you’ve heard this one before. Jenn, a customer service agent at a car leasing company, is fed up with her job. Her pay’s lousy, she’s on edge with customers yelling at her over the phone all day (they actually treat her worse in person), and her boss ignores all her suggestions, even though she knows he could make her job a lot less stressful. -

Google Ad Tech

Yaletap University Thurman Arnold Project Digital Platform Theories of Harm Paper Series: 4 Report on Google’s Conduct in Advertising Technology May 2020 Lissa Kryska Patrick Monaghan I. Introduction Traditional advertisements appear in newspapers and magazines, on television and the radio, and on daily commutes through highway billboards and public transportation signage. Digital ads, while similar, are powerful because they are tailored to suit individual interests and go with us everywhere: the bookshelf you thought about buying two days ago can follow you through your favorite newspaper, social media feed, and your cousin’s recipe blog. Digital ads also display in internet search results, email inboxes, and video content, making them truly ubiquitous. Just as with a full-page magazine ad, publishers rely on the revenues generated by selling this ad space, and the advertiser relies on a portion of prospective customers clicking through to finally buy that bookshelf. Like any market, digital advertising requires the matching of buyers (advertisers) and sellers (publishers), and the intermediaries facilitating such matches have more to gain every year: A PwC report estimated that revenues for internet advertising totaled $57.9 billion for 2019 Q1 and Q2, up 17% over the same half-year period in 2018.1 Google is the dominant player among these intermediaries, estimated to have netted 73% of US search ad spending2 and 37% of total US digital ad spending3 in 2019. Such market concentration prompts reasonable questions about whether customers are losing out on some combination of price, quality, and innovation. This report will review the significant 1 PricewaterhouseCoopers for IAB (October 2019), Internet Advertising Revenue Report: 2019 First Six Months Results, p.2. -

Google Adsense Fuels Growth for Android- Focused Site

Google AdSense Case Study Google AdSense fuels growth for Android- focused site About elandroidelibre • elandoidelibre.com • Based in Madrid • Blog about the Android operating system “We regard AdSense as an essential tool that’s helping us to set up more blogs, take on more staff, and earn more revenue.” — Paolo Álvarez, administrator and editor. elandroidelibre.com (“the free Android”) is a leading Spanish-language blog about the Android operating system, featuring news, reviews, games and other apps for Android smartphone users. Launched in 2009, it now employs six people and attracts 6.5 million visits each month. Since the outset, Google AdSense has accounted for around 40 per cent of its income. Administrator and editor Paolo Álvarez says: “I was attracted to AdSense because it was simple and effective. I began using it right from the start, and even though I wasn’t an expert, I could see that it worked.” He’s highly satisfied with the quality and relevance of the ads appearing on his site, and says the 300 x 250 Medium Rectangle and the 728 x 90 Leaderboard formats work particularly well. Álvarez uses Google AdSense reports and Google Analytics to analyse the return on the site and gain a better understanding of the kind of visitors it attracts: for example 30 per cent of traffic and income comes from mobile devices. He has also begun using Google’s free ad serving solution, DoubleClick for Publishers, allowing him to manage his online advertising more effectively and segment traffic from different countries. He plans to continue improving the quality and quantity of content in the future. -

Google-Doubleclick Acquisition Background Information September 2007

Google-DoubleClick Acquisition Background Information September 2007 On April 13, 2007, Google announced an agreement to acquire DoubleClick, a digital marketing technology and services company. DoubleClick offers online ad serving and management technology to advertisers, web publishers, and ad agencies. It helps companies place their graphical and video ads on Web sites in a highly efficient manner, allowing advertisers to target ads and improve the productivity and results of their online advertising campaigns. • Competition: Google and DoubleClick are not competitors. Google generates most of its revenue from selling space to place text ads on its own website and on small portions of partners' websites. DoubleClick does not sell ad space. Its core products offer support technology for storing, serving, and tracking display ads. In addition, the broader advertising market is highly competitive and dynamic, and thousands of companies compete in selling ad space online. • Privacy: Google has a history of being an advocate for user privacy. Our goal is to improve privacy protection and data security for all Internet users. Users will continue to benefit from our commitment to protecting user privacy following this acquisition. • What People Are Saying: Academics, analysts, legal experts, competitors, advertisers, and newspapers are saying that the acquisition should be approved, noting that Google and DoubleClick are in complementary but not identical markets; Google has a strong track record on privacy; government should allow the free market to work; and that there is minimal legal precedent for rejecting an acquisition of this kind. Benefits of Acquisition Google's goal is to make advertising on the Internet work better: better for users with less intrusive ads, better for advertisers with greater accountability and effectiveness, and better for online publishers with improved monetization and cleaner site integration. -

Broadband Video Advertising 101

BROADBAND VIDEO ADVERTISING 101 The web audience’s eyes are already on broadband THE ADVERTISING CHALLENGES OF video, making the player and the surrounding areas the ONLINE PUBLISHERS perfect real estate for advertising. This paper focuses on what publishers need to know about online advertising in Why put advertising on your broadband video? When order to meet their business goals and adapt as the online video plays on a site, the user’s attention is largely drawn advertising environment shifts. away from other content areas on the page and is focused on the video. The player, therefore, is a premium spot for advertising, and this inventory space commands a premium price. But adding advertising to your online video involves a lot of moving parts and many decisions. You need to consider the following: • What types and placements of ads do you want? • How do you count the ads that are viewed? • How do you ensure that the right ad gets shown to the right viewer? Luckily, there are many vendors that can help publishers fill up inventory, manage their campaigns, and get as much revenue from their real estate as possible. This paper focuses on the online advertising needs of the publisher and the services that can help them meet their advertising goals. THE VIDEO PLATFORM COMCASTTECHNOLOGYSOLUTIONS.COM | 800.844.1776 | © 2017 COMCAST TECHNOLOGY SOLUTIONS ONLINE VIDEO ADS: THE BASICS AD TYPES You have many choices in how you combine ads with your content. The best ads are whatever engages your consumers, keeps them on your site, and makes them click. -

13 Cool Things You Can Do with Google Chromecast Chromecast

13 Cool Things You Can Do With Google Chromecast We bet you don't even know half of these Google Chromecast is a popular streaming dongle that makes for an easy and affordable way of throwing content from your smartphone, tablet, or computer to your television wirelessly. There’s so much you can do with it than just streaming Netflix, Hulu, Spotify, HBO and more from your mobile device and computer, to your TV. Our guide on How Does Google Chromecast Work explains more about what the device can do. The seemingly simple, ultraportable plug and play device has a few tricks up its sleeve that aren’t immediately apparent. Here’s a roundup of some of the hidden Chromecast tips and tricks you may not know that can make casting more magical. Chromecast Tips and Tricks You Didn’t Know 1. Enable Guest Mode 2. Make presentations 3. Play plenty of games 4. Cast videos using your voice 5. Stream live feeds from security cameras on your TV 6. Watch Amazon Prime Video on your TV 7. Create a casting queue 8. Cast Plex 9. Plug in your headphones 10. Share VR headset view with others 11. Cast on the go 12. Power on your TV 13. Get free movies and other perks Enable Guest Mode If you have guests over at your home, whether you’re hosting a family reunion, or have a party, you can let them cast their favorite music or TV shows onto your TV, without giving out your WiFi password. To do this, go to the Chromecast settings and enable Guest Mode. -

Digital Advertising Standards and Creative Specifications Last Revised: May 26, 2021

Bell Media - Digital Advertising Standards and Creative Specifications Last revised: May 26, 2021 Digital Advertising Standards and Creative Specifications (Last revised: May 26, 2021) To learn more about Bell Media Digital visit: http://www.bellmedia.ca/digital/ Contact [email protected] for any questions Bell Media sites are IAB Canada compliant. All Bell Media ads are served through Google’s DoubleClick for Publishers Premium ad server. Bell Media reserves the right to refuse any advertising/advertisers, make exceptions to this policy on a case-by-case basis, as well as, to make changes and add to this policy at any time. If you have any questions regarding creative submissions, please contact your Bell Media Account Representative. PLEASE NOTE: ANY ELEMENT NOT MEETING SPEC WILL BE RETURNED FOR REVISION, WHICH MAY DELAY THE EXPECTED LAUNCH DATE AND RESULT IN LOST IMPRESSIONS Page 1 of 27 Bell Media - Digital Advertising Standards and Creative Specifications Last revised: May 26, 2021 Contents Available Web Ad Placements ......................................................................................................................... 4 . ESPN Ad Sizes ................................................................................................................................................. 5 Apple News .............................................................................................................................................................. 5 SLA Creative Deadlines ..................................................................................................................................... -

GOOGLE LLC V. ORACLE AMERICA, INC

(Slip Opinion) OCTOBER TERM, 2020 1 Syllabus NOTE: Where it is feasible, a syllabus (headnote) will be released, as is being done in connection with this case, at the time the opinion is issued. The syllabus constitutes no part of the opinion of the Court but has been prepared by the Reporter of Decisions for the convenience of the reader. See United States v. Detroit Timber & Lumber Co., 200 U. S. 321, 337. SUPREME COURT OF THE UNITED STATES Syllabus GOOGLE LLC v. ORACLE AMERICA, INC. CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE FEDERAL CIRCUIT No. 18–956. Argued October 7, 2020—Decided April 5, 2021 Oracle America, Inc., owns a copyright in Java SE, a computer platform that uses the popular Java computer programming language. In 2005, Google acquired Android and sought to build a new software platform for mobile devices. To allow the millions of programmers familiar with the Java programming language to work with its new Android plat- form, Google copied roughly 11,500 lines of code from the Java SE pro- gram. The copied lines are part of a tool called an Application Pro- gramming Interface (API). An API allows programmers to call upon prewritten computing tasks for use in their own programs. Over the course of protracted litigation, the lower courts have considered (1) whether Java SE’s owner could copyright the copied lines from the API, and (2) if so, whether Google’s copying constituted a permissible “fair use” of that material freeing Google from copyright liability. In the proceedings below, the Federal Circuit held that the copied lines are copyrightable. -

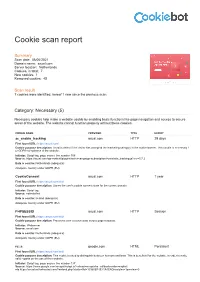

Cookie Scan Report

Cookie scan report Summary Scan date: 08/06/2021 Domain name: axual.com Server location: Netherlands Cookies, in total: 7 New cookies: 1 Removed cookies: 45 Scan result 7 cookies were identified, hereof 1 new since the previous scan. Category: Necessary (5) Necessary cookies help make a website usable by enabling basic functions like page navigation and access to secure areas of the website. The website cannot function properly without these cookies. COOKIE NAME PROVIDER TYPE EXPIRY ac_enable_tracking axual.com HTTP 29 days First found URL: https://axual.com/ Cookie purpose description: Used to detect if the visitor has accepted the marketing category in the cookie banner. This cookie is necessary f or GDPR-compliance of the website. Initiator: Script tag, page source line number 508 Source: https://axual.com/wp-content/plugins/activecampaign-subscription-forms/site_tracking.js?ver=5.7.2 Data is sent to: Netherlands (adequate) Adequate country under GDPR (EU) CookieConsent axual.com HTTP 1 year First found URL: https://axual.com/trial/ Cookie purpose description: Stores the user's cookie consent state for the current domain Initiator: Script tag Source: notinstalled Data is sent to: Ireland (adequate) Adequate country under GDPR (EU) PHPSESSID axual.com HTTP Session First found URL: https://axual.com/trial/ Cookie purpose description: Preserves user session state across page requests. Initiator: Webserver Source: axual.com Data is sent to: Netherlands (adequate) Adequate country under GDPR (EU) rc::a google.com HTML Persistent First found URL: https://axual.com/trial/ Cookie purpose description: This cookie is used to distinguish between humans and bots.