No Point Griping About CEO

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

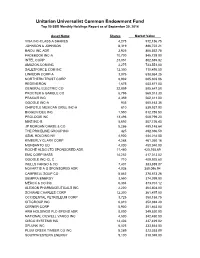

Unitarian Universalist Common Endowment Fund Top 50 SSB Monthly Holdings Report As of September 30, 2014

Unitarian Universalist Common Endowment Fund Top 50 SSB Monthly Holdings Report as of September 30, 2014 Asset Name Shares Market Value VISA INC-CLASS A SHARES 4,275 912,156.75 JOHNSON & JOHNSON 8,319 886,722.21 BAIDU INC ADR 3,925 856,552.75 FACEBOOK INC-A 10,700 845,728.00 INTEL CORP 23,051 802,635.82 AMAZON.COM INC 2,275 733,551.00 SALESFORCE COM INC 12,350 710,495.50 LINKEDIN CORP-A 3,075 638,954.25 NORTHERN TRUST CORP 8,902 605,603.06 REGENERON 1,675 603,871.00 GENERAL ELECTRIC CO 22,859 585,647.58 PROCTER & GAMBLE CO 6,795 569,013.30 PRAXAIR INC 4,359 562,311.00 GOOGLE INC-A 935 550,163.35 CHIPOTLE MEXICAN GRILL INC-A 810 539,937.90 BIOGEN IDEC INC 1,550 512,755.50 PROLOGIS INC 13,496 508,799.20 NIKE INC-B 5,692 507,726.40 JP MORGAN CHASE & CO 8,286 499,148.64 THE PRICELINE GROUP INC 425 492,396.50 ASML HOLDING NV 4,900 484,218.00 KIMBERLY CLARK CORP 4,288 461,260.16 MONSANTO CO 4,000 450,040.00 ROCHE HLDG LTD SPONSORED ADR 11,480 425,168.69 EMC CORP MASS 14,252 417,013.52 GOOGLE INC-CL C 710 409,925.60 WELLS FARGO & CO 7,401 383,889.87 NOVARTIS A G SPONSORED ADR 4,038 380,096.94 CAMPBELL SOUP CO 8,862 378,673.26 SEMPRA ENERGY 3,550 374,099.00 MERCK & CO INC 6,304 373,701.12 ALEXION PHARMACEUTICALS INC 2,200 364,804.00 SCHWAB CHARLES CORP 12,300 361,497.00 OCCIDENTAL PETROLEUM CORP 3,725 358,158.75 CITIGROUP INC 6,810 352,894.20 CERNER CORP 5,900 351,463.00 ARM HOLDINGS PLC-SPONS ADR 8,000 349,520.00 NATIONAL OILWELL VARCO INC 4,500 342,450.00 CISCO SYSTEMS INC 13,406 337,429.02 SPLUNK INC 6,025 333,544.00 PLUM CREEK TIMBER CO INC -

Weyerhaeuser Company 2016 Annual Report

WEYERHAEUSER 2016 ANNUAL REPORT AND FORM 10K Working together to be the world’s premier timber, land, and forest products company DEAR SHAREHOLDER: This past year was transformative for our company. This work continues. We now expect to exceed our Over the past three years, we have been relentlessly focused $100 million cost synergy on making Weyerhaeuser a truly great company by driving value target by 25 percent, realize for our shareholders through a focused portfolio, industry-leading a total of $130–$140 million performance, and disciplined capital allocation. In 2016, we in operational synergies, FRPSOHWHGWZRVLJQLÀFDQWPRYHVWKDWUHSUHVHQWWKHFDSVWRQH and continue delivering on on our portfolio journey: our merger with Plum Creek Timber our operational excellence and the divestiture of our Cellulose Fibers business. targets. Capitalizing on these PORTFOLIO opportunities will enable us Following these transactions, we have emerged as a focused to further improve our relative forest products company with 13 million acres of world-class performance. timberlands and an industry-leading, low-cost wood products CAPITAL ALLOCATION manufacturing business. 2XUÀUVWSULRULW\IRUFDSLWDO 2XUWLPEHUKROGLQJVDUHQHDUO\ÀYHWLPHVWKHVFDOHRIRXU allocation is returning cash largest competitor, and we are one of the largest REITs in the to shareholders, and we continued to deliver on that commitment United States. Through the Plum Creek merger, we also gained in 2016 by repurchasing $2 billion of common shares. We remain unparalleled expertise in Real Estate, Energy and Natural strongly committed to disciplined capital allocation, including a Resources. This new business segment will further maximize sustainable and growing dividend. the value of our acres by identifying tracts with a premium POSITIONED FOR THE FUTURE value over timberland and fully capturing the value of surface In September, we moved our corporate headquarters from and subsurface assets. -

The 1995 Plum Creek Lectures Nick Baker, Editor

Maluolm Hunter .' , Hamish Kimmins Nick Baker, lditor ' . Biodiversity: Toward Operational Definitions Hal Salwasser .._ Jack Ward Thomas .._ Alan Randall ~ F. Henry Lickers Malcolm Hunter .._ Hamish Kimmins The 1995 Plum Creek Lectures Nick Baker, Editor School of Forestry The University of Montana-Missoula Au.gust 1997 School of Forestry The University of Montana-Missoula The School of Forestry at The University of Montana-Missoula is a comprehensive natural resource education and research in stitution offering Bachelor's, Master's and Doctoral programs in forest and range re source management, wildlife biology, natu ral resource recreation, and natural resource conservation. The School's Montana Forest and Conservation Experiment Station, insti tutes, and centers administer its research and outreach programs. Comprehensive information about the School and its programs is available at our WEBsite: http://www.forestry.umt.edu © 1997 School of Forestry The University of Montana-Missoula 1/ Partnerships in Forestry Research and Education The University of Montana School of Forestry has developed productive partnerships in research and education with the forestry industry, conservation organizations, and public agencies. This lecture series and the associated Plum Creek Fellowship are the product of such a partnership. The Plum Creek Fellowship The Plum Creek Fellowship provides a 12-month stipend and tuition for a doctoral candidate in the School of Forestry atThe University of Mont.ana -Missoula. A gift from the Plum Creek Timber Company established the UM Foundation endowment which supports the Fellowship. The Fellow assists the Plum Creek Lecture Committee in developing and hosting the Plum Creek Lectures. Plum Creek Timber Company Plum Creek Timber Company, the largest private forest landowner in Montana (1.5 mill ion acres), strives to manage its lands according to environmental principles based on sound sc ience, and to balance economic returns with protection for the environment. -

Fish Creek State Park Draft Management Plan

FISH CREEK STATE PARK Draft Management Plan DECEMBER 2013 Explore More. Montana State Parks Our Mission is... To preserve and protect our state’s heritage and the natural beauty of our public lands for the benefit of our families, communities, local economies and out-of-state visitors. Our Objectives are... To provide excellent land stewardship, public safety and service through recreation, innovation and education. Our Goals are... To provide an extraordinary experience for our visitors and to keep our state park system strong now and for generations to come. Prepared by Montana State Parks A Division of Montana Fish, Wildlife & Parks 1420 6th East Avenue P.O. Box 200701 Helena, MT 59620-0701 (406) 444-3750 www.stateparks.mt.gov FISH CREEK STATE PARK DRAFT MANAGEMENT PLAN Fish Creek State Park Management Plan Approved Signatures Recommended by: ________________________________ ____________ Chas Van Genderen Date Administrator, Montana State Parks Approved by: ________________________________ ____________ Tom Towe Date Chairman, Montana State Parks & Recreation Board ________________________________ ____________ Jeff Hagener Date Director, Montana Fish, Wildlife & Parks i FISH CREEK STATE PARK DRAFT MANAGEMENT PLAN Acknowledgements Montana State Parks would like to thank the following people for their thoughtful insight and contributions to the Fish Creek State Park Management Plan: Members of the public, neighboring landowners and interested organizations who took time to attend scoping meetings, review the plan and provide constructive -

Matching Gift Programs

Plexus Technology Group,$50 SPX Corp,d,$100 TPG Capital,$100 U.S. Venture,$25 Maximize the Impact of Your Gift Plum Creek Timber Co Inc.,$25 SPX FLOW,d,$100 TSI Solutions,$25 U.S.A. Motor Lines,$1 Pohlad Family Fdn,$25 SSL Space Systems/Loral,$100 Tableau Software,$25 UBM Point72 Asset Mgt, L.P. STARR Companies,$100 Taconic Fdn, Inc.,$25 UBS Investment Bank/Global Asset Mgt,$50 Polk Brothers Fdn Sabre Holdings Campaign (October 2017),$1 Taft Communications,$1 Umpqua Bank,$1 Polycom Inc.,$20 Safety INS Group, Inc.,$250 Takeda Pharma NA,$25 Unilever North America (HQ),s,d Portfolio Recovery Associates,$25 Sage Publications, Inc.,$25 Talent Music,$5 Union Pacific Corp MoneyPLUS,d Match Your Gift PotashCorp,d,$25 Salesforce.com,$50 Tallan Union Pacific Corp TimePLUS,$25 Potenza,$50 Sallie Mae Dollars for Doers,d Talyst,$25 United States Cellular Corp,$25 when you donate to Power Integrations,$25 Saltchuk,$25 Tampa Bay Times Fund,r,$25 United Technologies Corp - UTC,d,$25 Praxair,d,$25 Samaxx,$5 TargetCW,$1 UnitedHealth Group Precor,$25 Samuel Roberts Noble Fdn Inc.,d,$100 Teagle Fdn, Inc.,d UnitedHealth Group (Volunteer) Preferred Personnel Solutions SanMar Technology Sciences Group,$10 Universal Leaf Tobacco Corp,$25 Preformed Line Products Co,r,d,$25 Sandmeyer Steel Co,r,$50 Teichert, Inc. Unum Corp,2:1,d,$50 Premier, Inc.,$50 Sanofi,$50 Teknicks,$1 Premier, Inc. Volunteer,$25 Schneider Electric Co (Cash & Volunteer),d,$25 Tektronix, Inc.,d,$20 Principal Financial Group,r,$50 Scripps Networks Interactive,r,$25 Teleflex,r,d,$50 V/W/X/Y/Z VISA Intl ProLogis,d,$50 Scripps Networks Volunteer,d,$250 Teradata Campaign (October),$25 VMware Inc.,$31 ProQuest LLC,$25 Securian Financial Group,r,d,$35 Terex Corp,$50 Vanderbilt Ventures, Inc. -

WEYERHAEUSER 2018 Annual Report and Form 10-K

WEYERHAEUSER 2018 Annual Report and Form 10-K Working together to be the world’s premier timber, land, and forest products company DEAR SHAREHOLDER This is an exciting time to be assuming leadership for Weyerhaeuser. :HDOVRFRQWLQXHGRXUGLVFLSOLQHGXVHRIFDSLWDOWRLQYHVWEDFN I’m thrilled and honored to be part of the journey that lies ahead for LQRXUEXVLQHVVWKURXJKORZULVNKLJKUHWXUQSURMHFWVWKDW this great company. UHGXFHRXUFRVWVWUXFWXUHLPSURYHSURGXFWLYLW\DQGLQFUHDVH reliability across our operations. )RUWKHODVWÀYH\HDUVZH·YHEHHQLQWHQVHO\IRFXVHGRQJHQHUDWLQJ VKDUHKROGHUYDOXHE\VWUHDPOLQLQJRXUSRUWIROLRLPSURYLQJSHUIRUPDQFH A LEADER IN CORPORATE RESPONSIBILITY DFURVVDOOEXVLQHVVOLQHVDOORFDWLQJFDSLWDOLQDGLVFLSOLQHGPDQQHU (DFK\HDUZHUHFHLYHQXPHURXVWKLUGSDUW\UHFRJQLWLRQVIRURXU GHYHORSLQJRXUSHRSOHDQGGULYLQJPHDQLQJIXOFXOWXUHFKDQJH sustainability and corporate citizenship performance. I encourage ,·PSURXGRIWKHZRUNZH·YHGRQH2XUEXVLQHVVVWUDWHJ\LVVLPSOH \RXWRUHYLHZDQHZVHFWLRQLQRXU3UR[\6WDWHPHQWWKDWIRFXVHV IRFXVHGDQGHIIHFWLYHDQGZHZLOOFRQWLQXHWRH[HFXWHDJDLQVWWKHVH RQRXUHQYLURQPHQWDOVWHZDUGVKLSVRFLDOUHVSRQVLELOLW\HWKLFV priorities in the years ahead. DQGWUDQVSDUHQF\7KHVHKDYHORQJEHHQFRUHYDOXHVIRURXU STRONG FINANCIAL PERFORMANCE IN 2018 FRPSDQ\7KH\DWWUDFWJUHDWSHRSOHWRFRPHZRUNIRUXVDQGKHOS XVPDLQWDLQVWURQJUHODWLRQVKLSVZLWKFXVWRPHUVDQGWKHFRPPXQLWLHV ,QZHGHOLYHUHGVWURQJSHUIRUPDQFHWKURXJKDEURDGUDQJHRI ZKHUHZHRSHUDWH,·PSURXGWREHSDUWRIDFRPSDQ\WKDWPDNHV PDUNHWFRQGLWLRQV2XUUHYHQXHZDVQHDUO\ELOOLRQIURPZKLFKZH FRUSRUDWHUHVSRQVLELOLW\DSULRULW\DQG,NQRZWKLVLVFULWLFDOO\ JHQHUDWHGQHWHDUQLQJVRIPLOOLRQXSIURPPLOOLRQLQ -

Employer Matching Funds Companies

Current Organizations already Associated Chemists, Inc. Cooper Industries participating: AT & T Corning, Inc. IBM Autodesk, Inc. Countrywide Microsoft Automatic Data Processing, Inc. Crown Pacific Inland Sales Morgan Stanley Wealth Management Avon Products Davidson Companies Time Warner AXA Financial Deluxe Corporation Bank of America Deutsche Bank Americas Find your organization here! Bank of Clark County Dow AgroSciences, LLC 3Com Corporation Barclays Global Investors Dow Corning Corp. 3M Baxter International, Inc. Duke Energy Abbott Laboratories Becker Capital Management, Inc. Ease Software, Inc. ACE INA Bemis Co., Inc. Eaton Corporation Adobe Systems Benjamin Moore & Co. Ecolab, Inc. The AES Corporation Black & Decker Corp. Eli Lilly and Company Aetna BNSF Railway Equifax, Inc. AgriSense Boeing Company ExxonMobil Akzo Nobel BP Federated Department Stores, Inc. Alaska Tanker Company Brooks Resources Corp. FIJI Water Aldrich Kilbride & Tatone LLP Butler Manufacturing Co. First Data Corporation Allstate Insurance Company Cadence Design Systems, Inc. First Independent Bank Altria Group, Inc. Calpine FM Global American Express Co. Capital Group Companies FMC Technologies, Inc. American Honda Motor Co., Inc. Cardinal Health Freddie Mac Ameriprise Financial Carnegie Foundation Gannett Company, Inc. AMSTED Industries Caterpillar, Inc. Gap, Inc Analog Devices, Inc. ChevronTexaco Corporation Gartner Group Anthro Corporation Chubb and Sons, Inc. GATX Corporation Aon Corporation CIGNA Corporation GE Applied Materials Circuit City Stores, Inc. General Mills, Inc. Archer-Daniels-Midland Climax Portable Machine Tools, Inc. The Gillette Company Argonaut Group, Inc. CNA Insurance GlaxoSmithKline Arkema, Inc. Coca-Cola Company Goodrich Corporation W.W. Grainger, Inc. Lubrizol National Computer Systems Gramco Construction Mallinckrodt, Inc. National Instruments Hallock Modey, Inc. Management Compensation NCR Corporation Hanna Andersson Group/Dulworth, Inc. -

FY15 Annual Report

JULY 1, 2014 - JUNE 30, 2015 Mountains to Sound Greenway Trust ANNUAL REPORT 2014-15 Mountains to 40,362 4,739 HOURS spent by volunteers Sound Greenway Trust PEOPLE building trails, planting trees, volunteered 50% maintaining native plant nursery, with us YOUTH and removing invasive weeds mission The Mountains to Sound Greenway Trust 75MILES 15,520 leads and inspires action to conserve TRAIL work NATIVE TREES AND and enhance the landscape from Seattle completed SHRUBS planted across the Cascade Mountains to Central Washington, ensuring a long-term volunteers balance between people and nature. education 5,114 +52% INCREASE STUDENTS participated student involvement in in the education program land stewardship activities 3,789 National Heritage Area vision new ENDORSEMENTS An iconic 1.5 million-acre landscape secured that conserves a healthy and sustainable relationship between land and people by national balancing built and natural environments. A landscape providing places for nature and wildlife, for outdoor recreation and heritage area education, for working forests and local ACRES of new lands agricultural production, while embracing conserved in the Greenway media vibrant urban areas with strong economies. 43,770 A landscape supported by a broad cross- section of society, working together as an effective coalition to preserve this heritage for future generations. 53,681 3,819 VISITORS to our website FOLLOWERS on www.mtsgreenway.org Facebook/Twitter recreation national heritage area Community asks Congress to designate the TESTIMONY Crafting a vision for the Middle Fork Snoqualmie. Once a haven Greenway as a National Heritage Area. for illegal activities, the Middle Fork Snoqualmie River Valley has been “By recognizing the reclaimed as a recreation destination after 20 years of land conservation • Legislation gained great momentum in the value of this landscape and cleanup by many individuals and organizations. -

Giving Foster Kids a Childhood and a Future

Treehouse gratefully acknowledges the generosity of all our Platt LeRoss Family Foundation • Jill Marsden and Ros Bond • Susan and Matt Maury • Glen Milliman and Alison Wyckoff-Milliman • Netmotion Wireless Marvin Scott • Seattle Rotary Service Foundation • Cynthia Simchuk • Michael Slade • Jerry and Laura Slater • Robert H. Smith • James and Burnley Snyder donors – individuals, foundations and corporations – Jeannie and Bruce Nordstrom • Northern Trust • NW Washington Association Of Health Underwriters • Thomas and Kristin Ogren • Janice and Brian Tad and Jeanne Sommerville • Mark Spain • Sprague Israel Giles, Inc. • Stanton & Everybody, Inc. • Tamara and Gregg Steeb • Sheri Stewart • Leigh Orrico • Pharmaceutical Research and Manufacturers of America • Jeanne Quinton • Ragen MacKenzie, Seattle • Shelly Brown Reiss and Michael Stokes • Kara and Don Stout • Elizabeth Strathy and Nick Merrill • Mark and Patti Streissguth • Fayette Stross • Sophie Sussman • Franciene Sznewajs for their gifts in fiscal year 2008. Reiss • Jack and Janice Sabin • Safeco Insurance - Employee Giving Programs • Sealy, Inc. • Seattle Mariners • Ann Simons • Greg and Mimi The Capital Group Companies Charitable Foundation • The Melody S. Robidoux Foundation • The Oki Foundation • Mikal and Lynn Thomsen • Mark Blake and Slyngstad • Starbucks Matching Gifts Program • State Farm Mutual Automobile Insurance Company • Sterling Realty Organization • The Auld Foundation Katherine Tilley • Todd Meyers Communication • Tommy Bahama • Ed Torkelson • Ann Trapp • TuTu Time • -

Appoint Members of Advisory Boards and Committees

G–2 STANDING COMMITTEES Governance Committee Appoint Members of Advisory Boards and Committees RECOMMENDED ACTION It is the recommendation of the Governance Committee that the Board of Regents make or confirm the following appointments and reappointments to its advisory committees and boards for the terms hereafter provided: Audit Advisory Committee Joel Benoliel Regent 9/1/2017 8/31/2020 David Zeeck Regent 9/1/2018 8/31/2021 new appt. Robert L. Gerth 9/1/2017 8/31/2020 (Bob) Richard D. Greaves 9/1/2017 8/31/2020 Brandon S. Pedersen 9/1/2017 8/31/2020 Daniel C. Smith 9/1/2018 8/31/2021 new appt. The University of Washington Audit Advisory Committee (AAC) was established in January 2014 as an advisory committee to the Board of Regents, its appropriate standing committees, and the University President, or his or her designee, on matters relating to the University’s financial practices and standards of conduct. The committee is responsible for reviewing and advising on any external and internal financial audits and internal controls. The committee may, through its Chair or a majority vote of its members, ask management to address specific issues within the responsibilities of the committee. As noted in the Board of Regents Governance, Standing Orders, Chapter 4, Section 3, the Audit Advisory Committee will consist of no more than eight members to be appointed by the Board on the recommendation of the Governance Committee. The Audit Advisory Committee is comprised of both Regent and non- Regent members. Members will be asked to make a minimum commitment of three consecutive years, and will serve at the pleasure of the Board. -

THE ROAD STILL BECKONS Mountains to Sound Greenway by James R

A Glance at History in the THE ROAD STILL BECKONS Mountains to Sound Greenway by James R. Ellis In 1911 travelers faced a rocky path (left) past the site of present-day Interstate 90 at Lake Keechelus, just east of Snoqualmie Pass. Travel over Snoqualmie Pass used to be an arduous In the nineteenth century, coal miners immigrated to Photographer Clark Kinsey labeled this Western Redcedar journey, with trees, rocks and mud on the road. Sometimes Roslyn from all over Europe and Asia. Roslyn miners with a 100-foot circumference in the Snoqualmie Valley horses worked better than cars. The Sunset Highway was worked together but each ethnic group had its own the “largest tree in Washington” in 1900. constructed in 1914 and 1915, and until 1931 the road was neighborhood and its own cemetary. The last coal mines in Photos courtesy of the Museum of History and Industry. closed during the winter and had to be cleared each spring. Roslyn closed in 1963. MOUNTAINS TO SOUND GREENWAY TRUST 911 WESTERN AVENUE, SUITE 523 SEATTLE, WA 98104 PHONE: 206.382.5565 VOLUNTEER LINE: 206.812.0122 email: [email protected] Web: Www.mtsgreenway.org Today, the Mountains to Sound Greenway along Interstate 90 remains a scenic route through forests and mountains. Remarks delivered to Downtown Rotary Club of Seattle August 30, 2006 MOUNTAINS TO SOUND GREENWAY TRUST OFFICERS, BOARD OF DIRECTORS AND STAFF 2006 President Maryanne Tagney Jones, Chair, Cascade Land Conservancy Bill Chapman (*), Attorney Ken Konigsmark, The Boeing Company Preston Gates & Ellis LLP Washington Wildlife and Recreation Coalition Leon Kos (*), City Administrator, City of Issaquah Immediate Past President Gary Kurtz, Park & Recreation District Commissioner Sally Jewell (*), President and CEO Kittitas County Recreational Equipment, Inc. -

News Release

NEWS RELEASE For more information contact: Analysts - Beth Baum, 206-539-3907 Media - Nancy Thompson, 919-861-0342 Weyerhaeuser reports second quarter results • Net earnings increased 18% compared with first quarter • Earnings before special items increased 21% compared with first quarter and 57% compared with one year ago • Highest Wood Products EBITDA on record SEATTLE (July 27, 2018) — Weyerhaeuser Company (NYSE: WY) today reported second quarter net earnings of $317 million, or 42 cents per diluted share, on net sales of $2.1 billion. This compares with earnings of $24 million, or 3 cents per diluted share, on net sales of $1.8 billion for the same period last year. Excluding net after-tax special charges of $15 million, the company reported net earnings of $332 million, or 44 cents per diluted share for the second quarter. This compares with net earnings before special items of $212 million for the same period last year and $275 million for the first quarter of 2018. Adjusted EBITDA for the second quarter was $637 million compared with $506 million for the second quarter of last year and $544 million for the first quarter of 2018. “I am very pleased with our second quarter financial results, as each of our businesses delivered solid operational performance and capitalized on market conditions to drive strong year-over-year improvement, including the highest Wood Products EBITDA on record,” said Doyle R. Simons, president and chief executive officer. “In addition, we delivered Weyerhaeuser’s highest EBITDA since 2006, when the company’s operations were nearly three times larger than they are today.