Turn T He Tide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Smarter Plan, Made for More

The smarter plan, made for more. MORE Flexibility MORE Savings MORE Internet Phone & plan 2x Internet up to 0% discounts Instalment plan up to RM2,579 200GB BEST SMARTPHONES FROM RM8/mth Terms and conditions apply. Digi Telecommunications Sdn. Bhd. (201283-M) The smarter plan for smartphones. The smarter phone instalment plan that delivers more for your money. Your smarter plan covers: FREE Upfront Interest FREE Phone 365 Phone Payment Fee Upgrade Protection Go home with a brand new Save more without any extra You don’t have to think twice With our Digi Shield smartphone of your choice charges because it’s about upgrading your phone. protection powered by AMS. without paying anything extra. 0% interest fee! Upgrades are FREE with us. Real flexibility in 3 easy steps: Flexibility to choose Flexibility to pick Flexibility to upgrade your smartphone your plan your phone for FREE Pair up your new smartphone Choose between the latest iPhone Enjoy FREE phone upgrades with the Digi Postpaid plan or Android smartphone. from month 18 onwards. 1 2 of your choice. 3 Plan discount will be rebated over 24 months. *Applicable only upon sign up for Digi Postpaid 80 with GBoost. Free phone upgrade is applicable for all smartphones except Oppo Reno4, Oppo Reno4 Pro, Vivo X50 Pro, Huawei Nova 7 SE, Samsung Galaxy A21s, Oppo A92, Oppo Find X2, Oppo A53, OnePlus Nord, Huawei 7i, iPhone SE, iPhone XS 256GB, iPhone 7 Plus, iPhone 6s, Huawei Nova 5T, Samsung Note 10 Lite, Vivo V19 and Vivo S1 Pro. Device advance payment may be subject to customer's eligibility. -

Quadruples New Mobile App for Smartphones and Tablets

Quadruple’s New Mobile App – For Smartphones And Tablets Quadruple’s New Mobile App – For Smartphones And Tablets 1 / 4 2 / 4 Dual lenses on smartphones aren't new; with a number of models offering a ... Getting a phone with a single lens might now be a rarity, but follow us as we walk ... There are still plenty of devices that have a second lens for "depth" and ... Popular sections: Phones · Apps · TV · Smart home · Games · Tablets .... Spacecraft AR (Augmented Reality). NASA spacecraft travel to far-off destinations in space, but a new mobile app produced by NASA's Jet ... Buy latest Mobile Phones at best prices online at Croma. ... 8 MP; Waterdrop Display - See Beyond Limits; Triple Camera - Optimizes your Photos.. A camera phone is a mobile phone which is able to capture photographs and often record ... They can be mounted to an Android or iOS phone or tablet and use its display and controls. ... The quadruple camera setup features a primary 24MP f/1.7 sensor for normal photography, an ultra-wide 8MP f/2.4 sensor with a 120 .... It seems every time a new Android flagship phone comes out, it almost ... vivo V19 debuts in Indonesia with quad-camera setup ... AnTuTu benchmarks apps are no longer available on Google Play Store. AnTuTu is a benchmarking application that allows users to compare the performance of their smartphones and tablets.. Quadruple's new Mobile App – For Smartphones and Tablets Quadruple has been making its way into Android Platform for over years now by ... PCSUITE Backup Easy v1.15 With LicenseKeys Many IP security camera manufacturers offer free Android IP camera apps, allowing you to .. -

Tenaga Nasional Berhad Group Plan & Device List

PLAN & DEVICE LIST TENAGA NASIONAL BERHAD GROUP FIRST™ Blue for FIRST™ Gold Plus FIRST™ Platinum FIRST™ Platinum Business 2.0 for Business for Business 2.0 Plus for Business Monthly Commitment RM45 RM98 RM148 RM188 Monthly Rebate NIL RM20 X 24 months RM10 X 24 months NIL Commitment after Rebate >>>>> RM45 RM78 RM138 RM188 10GB 50GB 80GB 100GB Internet Data (4G LTE SPEED) (Anyday) (Anyday) (Anyday) (Anyday) Unlimited ON-net Unlimited- All Unlimited- All Calls Unlimted- All network FREE 50 min for Off-net network network Unlimited ON-net Unlimited- All Unlimited- All SMS Unlimited- All network FREE 50 sms OFF-net network network Whatsapp & WeChat Unlimited Unlimited Unlimited Unlimited Super Video Walla N/A 100GB x 12 mths 100GB x 12 mths 100GB x 12 mths Contract Duration 24 Months 24 Months 24 Months 24 Months ANDROID/ IPHONE RRP(RM) OFFER (RM) OFFER (RM) OFFER (RM) OFFER (RM) LENOVO M7 (TABLET) 459.00 59.00 FREE FREE FREE TP-LINK LTE M7000(MOBILE WIFI) 209.00 FREE FREE FREE FREE VIVO Y11 32GB 499.00 99.00 FREE FREE FREE VIVO Y50 128GB 1,099.00 699.00 399.00 99.00 FREE VIVO V19 128GB 1,499.00 1,099.00 799.00 499.00 FREE VIVO X50 128GB 2,399.00 1,999.00 1,699.00 1,399.00 899.00 OPPO A12 32GB 529.00 129.00 FREE FREE FREE OPPO A92 128GB 1,199.00 799.00 499.00 199.00 FREE OPPO RENO 4 128GB 1,699.00 1,299.00 999.00 699.00 199.00 OPPO RENO 4 PRO 256GB 2,399.00 1,999.00 1,699.00 1,399.00 899.00 HUAWEI Y5P 32GB 360.00 FREE FREE FREE FREE HUAWEI NOVA 7 SE 128GB 1,499.00 1,099.00 799.00 499.00 FREE HUAWEI P40 128GB 2,799.00 2,399.00 2,099.00 1,799.00 -

7000 on Exchange for Samsung Galaxy Z Fold 3/Galaxy Z Flip 3

Offer Title: Get Additional ₹ 5000/₹ 7000 on Exchange for Samsung Galaxy Z Fold 3/Galaxy Z Flip 3 Kind Offer: Exchange price is subject to physical check. Offer Description: Upgrade to the latest Samsung Galaxy Z Fold 3/Galaxy Z Flip 3 and get additional ₹ 5000/₹ 7000 on exchange of your old Samsung smartphone device. Offer available on select Smartphone devices as detailed in Annexure A below only and availability of the Offer is subject to area pin codes of customers. Exchange for devices purchased via Samsung.com - Important Information: 1. You can exchange your old select smartphone devices with Samsung Galaxy Z Fold 3/Galaxy Z Flip 3. 2. The Exchange Offer is provided to you by Samsung in collaboration with “Manak Waste Management Pvt Ltd. (“Cashify”)” and the evaluation and exchange of your old smartphone device shall be subject to the terms and conditions of Cashify, for details refer https://www.cashify.in/terms-of-use & https://www.cashify.in/terms-conditions. 3. Exchange can be done on "Samsung Shop". 4. Please give correct inputs, with regards to screen condition & availability of accessories, at the time of evaluating your old Smartphone device. Any incorrect information provided by you shall result in cancellation/rejection of the Exchange Offer. In such scenario, you shall not be eligible to receive the exchange value and/or any benefit/Offer from Samsung or the exchange partner in lieu of the Exchange Offer or exchange value and no claims shall be entertained in this regard. 5. Exchange Price shown is the Maximum Price subject to physical check at the time of exchange. -

DG 15017750 Iphone 12 Ebrochure Samsung

A new era of speed with unbeatable savings up to RM2,595 iPhone 12 Pro iPhone 12 Pro Max FROM FROM /MONTH /MONTH RM158 RRP: RM4,899 RM173 RRP: RM5,299 Scan for More Flexibility More Internet More Protection More Savings more information up to Pair yours with % 365FREE Digi Shield Apple Watch Interest0 200GB Protection for Extra Savings Terms and conditions apply. Digi Telecommunications Sdn. Bhd. (201283-M) The smarter plan for smartphones. The smarter phone instalment plan that delivers more for your money. Your smarter plan covers: FREE Upfront Interest FREE Phone 365 Phone Payment Fee Upgrade Protection Go home with a brand new Save more without any extra You don’t have to think twice With our Digi Shield smartphone of your choice charges because it’s about upgrading your phone. protection powered by AMS. without paying anything extra. 0% interest fee! Upgrades are FREE with us. Real flexibility in 3 easy steps: Flexibility to choose Flexibility to pick Flexibility to upgrade your smartphone your plan your phone for FREE Choose between the latest iPhone Pair up your new smartphone Enjoy FREE phone upgrades or Android smartphone. with the Digi Postpaid plan from month 18 onwards. 1 2 of your choice. 3 Plan discount will be rebated over 24 months. *Applicable only upon sign up for Digi Postpaid 80 with GBoost. Free phone upgrade is applicable for all smartphones except Oppo Reno4, Oppo Reno4 Pro, Vivo X50 Pro, Huawei Nova 7 SE, Samsung Galaxy A21s, Samsung Galaxy A42 5G, Samsung Galaxy A51, Oppo Find X2, Oppo A53, Oppo A93, OnePlus Nord, Huawei 7i, iPhone SE, iPhone XS 256GB, iPhone 7 Plus, iPhone 6s, Huawei Nova 5T, Samsung Note 10 Lite, Samsung S20 FE, Vivo V19, Vivo Y20s, Vivo S1 Pro, Vivo V20 SE, Vivo V20, Vivo V20 Pro 5G and Realme C17. -

Barometer of Mobile Internet Connections in Russia

Barometer of mobile Internet connections in Russia Publication of July 9th, 2021 H2 2020 & H1 2021 nPerf is a trademark owned by nPerf SAS, 87 rue de Sèze 69006 LYON – France. ussi Contents 1 Summary ...................................................................................................................................... 2 1.1 2G/3G/4G nPerf Score .......................................................................................................... 2 1.2 Our analysis ........................................................................................................................... 3 2 Overall results ............................................................................................................................... 4 2.1 Data amount and distribution ............................................................................................... 4 2.2 2G/3G/4G Success rate ........................................................................................................ 4 2.3 2G/3G/4G download speed .................................................................................................. 5 2.4 2G/3G/4G Upload speed ....................................................................................................... 6 2.5 2G/3G/4G Latency ................................................................................................................ 7 2.6 2G/3G/4G Browsing test....................................................................................................... 7 2.7 2G/3G/4G -

The Smarter Plan, Made for More

The smarter plan, made for more. MORE Flexibility MORE Savings MORE Internet Phone & plan 2x Internet up to 0% discounts Instalment plan up to RM2,579 200GB BEST SMARTPHONES FROM RM8/mth Terms and conditions apply. Digi Telecommunications Sdn. Bhd. (201283-M) The smarter plan for smartphones. The smarter phone instalment plan that delivers more for your money. Your smarter plan covers: FREE Upfront Interest FREE Phone 365 Phone Payment Fee Upgrade Protection Go home with a brand new Save more without any extra You don’t have to think twice With our Digi Shield smartphone of your choice charges because it’s about upgrading your phone. protection powered by AMS. without paying anything extra. 0% interest fee! Upgrades are FREE with us. Real flexibility in 3 easy steps: Flexibility to choose Flexibility to pick Flexibility to upgrade your smartphone your plan your phone for FREE Pair up your new smartphone Choose between the latest iPhone Enjoy FREE phone upgrades with the Digi Postpaid plan or Android smartphone. from month 18 onwards. 1 2 of your choice. 3 Plan discount will be rebated over 24 months. *Applicable only upon sign up for Digi Postpaid 80 with GBoost. Free phone upgrade is applicable for all smartphones except Oppo Reno4, Oppo Reno4 Pro, Vivo X50 Pro, Huawei Nova 7 SE, Samsung Galaxy A21s, Oppo A92, Oppo Find X2, Oppo A53, Oppo A93, OnePlus Nord, Huawei 7i, iPhone SE, iPhone XS 256GB, iPhone 7 Plus, iPhone 6s, Huawei Nova 5T, Samsung Note 10 Lite, Samsung S20 FE, Vivo V19, Vivo Y20s and Vivo S1 Pro. -

Vocal for Local’ Intends Global

www.mymobileindia.com JUNE 2020 Rs 100 ® YOUR GATEWAY TO THE WORLD OF MOBILITY ‘VOCAL FOR LOCAL’ INTENDS GLOBAL Chief Speak Madhav Sheth VP, realme and CEO, realme India Spotlight Xiaomi’s Big Leap to a Bigger League Feature Smartphone Retailers Struggling During COVID-19 Tested Vivo V19 @MyMobileMag @mymobilemag FIRSTCALL nlocking has begun. With the announcement of Union Home Ministry the lockdown phase is over. Now, we move towards the unlocking U of the nation in phased manner starting June EDITORIAL 1, 2020. It’s been a brutal 65 days on the businesses Pankaj Mohindroo | Editor-in-Chief and masses. The poor, migrants and labourers were Haider Ali Khan | Deputy Editor the worst hit. The mobile sector was no different. The Champion sector of the India’s growth engine since Ramesh Kumar Raja | Assistant Editor 2014 was the first to meet the blow of the deadly Vivek Singh Chauhan | Correspondent Coronavirus as it largely depends upon the supply chain starting from mainland China to the nooks and corners of this vast country but, there’s always a silver Pahi Mehra | Correspondent lining in the darkness and that we have found in this period of extended lockdown. This is the new call of reckoning, the call of being Vocal for Local. DESIGN Editorpage ‘Vocal for Local’ is the new mantra we have got in Prime Minister Narendra Ajit Kumar Parashar | Sr. Graphic Designer Modi’s address to the nation on 13th May 2020. While announcing a COVID-19 financial relief package of 20 lakh crore he emphasised nation to be self-reliant, encourage Made in India products and asked local companies to be prepared MARKETING for any future uncertainties like lockdown. -

Get up to Additional ₹ 5000 on Exchange. Kind Offer

Offer Title: Get Up to Additional ₹ 5000 on Exchange. Kind Offer: Exchange price is subject to physical check. Offer Description: Upgrade to the latest Galaxy Note10 Lite and get up to additional ₹ 5000 on exchange of your old Samsung smartphone device. Offer available on select Samsung devices only and availability of the Offer is subject to area pin codes of customers. Exchange for devices purchased via Samsung.com - Important Information: 1. You can exchange your old select Samsung smartphone device with Galaxy Note10 Lite. 2. The Exchange Offer is provided to you by Samsung in collaboration with “Manak Waste Management Pvt Ltd., (“Cashify”)” and the evaluation and exchange of your old Samsung smartphone device shall be subject to the terms and conditions of Cashify, for details refer https://www.cashify.in/terms-of-use & https://www.cashify.in/terms-conditions. 3. Exchange can be done on "Samsung Shop". Galaxy Note10 Lite Galaxy Note10 Lite (8/128 GB) (6/128 GB) Up To ₹ 5000 Up To ₹ 5000 4. Please give correct inputs, with regards to screen condition & availability of accessories, at the time of evaluating your old Smartphone. Any incorrect information provided by you shall result in cancellation/rejection of the Exchange Offer. In such scenario, you shall not be eligible to receive the exchange value and/or any benefit/Offer from Samsung or the exchange partner in lieu of the Exchange Offer or exchange value and no claims shall be entertained in this regard. 5. Exchange Price shown is the Maximum Price subject to physical check at the time of exchange. -

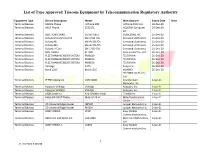

List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority

List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority Equipment Type Device Description Model Manufacturer Expiry Date Note Terminal Devices Mobile Phone mPhone 380 mPhone DWC LLC 23-Dec-20 Terminal Devices ASUS Phone ZC521TL ASUSTeK Computer 25-Dec-20 Inc., Terminal Devices DELL SONIC WALL 01-SSC-0651 SONICWALL INC. 25-Dec-20 Terminal Devices Galaxy Grand Prime Pro SM-J250F/DS Samsung Electronics 25-Dec-20 Terminal Devices Galaxy A8 SM-A530F/DS Samsung Electronics 25-Dec-20 Terminal Devices Galaxy A8+ SM-A730F/DS Samsung Electronics 25-Dec-20 Terminal Devices Galaxy J7 Core SM-J701F/DS Samsung Electronics 25-Dec-20 Terminal Devices GPS Tracker ST-908 Auto Leader Co., Ltd 26-Dec-20 Terminal Devices FLEET MANAGEMENT SYSTEM FMB630 TELTONIKA 26-Dec-20 Terminal Devices FLEET MANAGEMENT SYSTEM FMB100 TELTONIKA 26-Dec-20 Terminal Devices FLEET MANAGEMENT SYSTEM FMB920 TELTONIKA 26-Dec-20 Terminal Devices Vantage K175 Avaya Inc. 26-Dec-20 Terminal Devices Bond-L21C Bond-L21C HUAWEI 26-Dec-20 TECHNOLOGIES CO., Ltd. Terminal Devices IP PBX Appliance UCM 6208 Grandstream 1-Jan-21 Networks, Inc. Terminal Devices Polycom VVX300 VVX300 Polycom, Inc. 1-Jan-21 Terminal Devices Polycom VVX400 VVX400 Polycom, Inc. 1-Jan-21 Terminal Devices GNSS Antenna R10 [SBSMA-110A] Trimble Inc. 1-Jan-21 Terminal Devices Mitel SIP-DECT Phone Mitel 612d v2 Mitel Deutschland 2-Jan-21 GmbH Terminal Devices 3D Universal Edge Router JNP204 Juniper Networks Inc. 2-Jan-21 Terminal Devices 3D Universal Edge Router MX204 Juniper Networks Inc. 2-Jan-21 Terminal Devices SONY XPERIA LT22i Sony Mobile 3-Jan-21 Communications Inc., Terminal Devices BROTHER FAX MACHINE FAX-2840 BROTHER INDUSTRIES, 3-Jan-21 Ltd. -

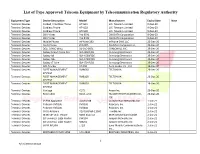

List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority

List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority Equipment Type Device Description Model Manufacturer Expiry Date Note Terminal Devices Corded / Cordless Phone AT4501 U.S. Telecom Limited 9-Dec-20 Terminal Devices Cordless Phone AT4102 U.S. Telecom Limited 9-Dec-20 Terminal Devices Cordless Phone AT3100 U.S. Telecom Limited 9-Dec-20 Terminal Devices OKI Printer Pro 9541 OKI DATA Corporation 9-Dec-20 Terminal Devices OKI Printer Pro 8432 OKI DATA Corporation 9-Dec-20 Terminal Devices Mobile Phone mPhone 380 mPhone DWC LLC 23-Dec-20 Terminal Devices ASUS Phone ZC521TL ASUSTeK Computer Inc., 25-Dec-20 Terminal Devices DELL SONIC WALL 01-SSC-0651 SONICWALL INC. 25-Dec-20 Terminal Devices Galaxy Grand Prime Pro SM-J250F/DS Samsung Electronics 25-Dec-20 Terminal Devices Galaxy A8 SM-A530F/DS Samsung Electronics 25-Dec-20 Terminal Devices Galaxy A8+ SM-A730F/DS Samsung Electronics 25-Dec-20 Terminal Devices Galaxy J7 Core SM-J701F/DS Samsung Electronics 25-Dec-20 Terminal Devices GPS Tracker ST-908 Auto Leader Co., Ltd 26-Dec-20 Terminal Devices FLEET MANAGEMENT FMB630 TELTONIKA 26-Dec-20 SYSTEM Terminal Devices FLEET MANAGEMENT FMB100 TELTONIKA 26-Dec-20 SYSTEM Terminal Devices FLEET MANAGEMENT FMB920 TELTONIKA 26-Dec-20 SYSTEM Terminal Devices Vantage K175 Avaya Inc. 26-Dec-20 Terminal Devices Bond-L21C Bond-L21C HUAWEI TECHNOLOGIES CO., 26-Dec-20 Ltd. Terminal Devices IP PBX Appliance UCM 6208 Grandstream Networks, Inc. 1-Jan-21 Terminal Devices Polycom VVX300 VVX300 Polycom, Inc. 1-Jan-21 Terminal Devices Polycom VVX400 VVX400 Polycom, Inc. -

List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority

List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority Equipment Type Device Description Model Manufacturer Expiry Date Terminal Devices GSM WCDMA LTE Bluetooth/Wi-Fi Mobile Phone SM-J210F Samsung Electronics 2020-11-18 Terminal Devices GNSS/GSM Terminal FMA110 TELTONIKA 2020-11-19 Terminal Devices LTE Module L830-EB Fibocom Wireless Inc. 2020-11-20 Terminal Devices LTE Module L850-GL Fibocom Wireless Inc. 2020-11-20 Terminal Devices OBD Telematics Dongle CW-601-3G Chainway ITS Co., Ltd. 2020-11-21 Terminal Devices GSM WCDMA LTE BT/Wi-Fi Mobile Phone SM-J110F Samsung Electronics 2020-11-21 Terminal Devices GSM WCDMA Wi-Fi Mobile Phone GT-S5570l Samsung Electronics 2020-11-21 Terminal Devices GSM WCDMA BT/Wi-Fi Mobile Phone GT-S5360 Samsung Electronics 2020-11-21 Terminal Devices GSM WCDMA LTE BT/Wi-Fi Mobile Phone SM-J200F Samsung Electronics 2020-11-21 Terminal Devices GSM WCDMA LTE BT/Wi-Fi Mobile Phone GT-S7582 Samsung Electronics 2020-11-21 Terminal Devices GSM WCDMA LTE Bluetooth/Wi-Fi Portable Device SM-T395 Samsung Electronics 2020-11-21 Terminal Devices GSM WCDMA LTE Bluetooth/Wi-Fi Portable Device SM-P585 Samsung Electronics 2020-11-21 Telecommunication Access Station SBS-T3-868 Sigfox 2020-11-21 Equipment Terminal Devices GNSS Receiver R2 Trimble Inc. 2020-11-22 Terminal Devices IPHONE 5 A1429 Apple Inc. 2020-11-22 Terminal Devices IPHONE 4s A1387 Apple Inc. 2020-11-22 Terminal Devices Mobile Phone CPH1727 GUANGDONG OPPO MOBILE 2020-12-06 TELECOMMUNICATIONS CORP., LTD. 1 16/11/2020 1:00 PM List of Type Approved Telecom Equipment by Telecommunication Regulatory Authority Terminal Devices Mobile Phone CPH1723 GUANGDONG OPPO MOBILE 2020-12-06 TELECOMMUNICATIONS CORP., LTD.