PORTFOLIO NYSE—JPM Performance Record Directors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2007 Proxy Voting Report 3M Company Ticker Security ID: MMM

2007 Proxy Voting Report 3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/08/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Rozanne Ridgway Mgmt For For For 2 Ratification of Auditor Mgmt For For For Amendment to Eliminate Supermajority 3 Voting Requirements Mgmt For For For Amendment to Eliminate Fair-Price 4 Provision Mgmt For For For 5 Executive Annual Incentive Plan Mgmt For For For Approve Material Terms of 6 Performance Unit Plan Mgmt For For For Shareholder Proposal Regarding Pay- 7 for-Superior-Performance ShrHoldr Against Against For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/27/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect Richard Gonzalez Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. -

Jpmorgan Chase London Whale D: Risk-Management Practices

The Journal of Financial Crises Volume 1 Issue 2 2019 JPMorgan Chase London Whale D: Risk-Management Practices Arwin G. Zeissler Yale University Andrew Metrick Yale University Follow this and additional works at: https://elischolar.library.yale.edu/journal-of-financial-crises Part of the Accounting Commons, Business Administration, Management, and Operations Commons, Business Law, Public Responsibility, and Ethics Commons, Business Organizations Law Commons, Corporate Finance Commons, Finance Commons, Organizational Behavior and Theory Commons, Policy History, Theory, and Methods Commons, and the Work, Economy and Organizations Commons Recommended Citation Zeissler, Arwin G. and Metrick, Andrew (2019) "JPMorgan Chase London Whale D: Risk-Management Practices," The Journal of Financial Crises: Vol. 1 : Iss. 2, 92-102. Available at: https://elischolar.library.yale.edu/journal-of-financial-crises/vol1/iss2/5 This Case Study is brought to you for free and open access by the Journal of Financial Crises and EliScholar – A Digital Platform for Scholarly Publishing at Yale. For more information, please contact [email protected]. JPMorgan Chase London Whale D: Risk-Management Practices1 Arwin G. Zeissler2 Andrew Metrick3 Yale Program on Financial Stability Case Study 2014-2d-V1 December 1, 2014, Revised: July 20, 2015 Abstract JPMorgan Chase (JPM) prided itself on having the best risk-management practices in the financial industry, having survived the 2007-09 financial crisis in better shape than many competitors. Chief Executive Officer Jamie Dimon often spoke of the bank’s “fortress balance sheet.” A keen focus on risk management is vital to JPM’s longevity, as is the case with all highly leveraged financial institutions. -

Donors 2016–17

Donors 2016–17 1 Trustees of The Museum of Modern Art In Memorium Glenn Dubin Honorary Trustees David Rockefeller (1915–2017) John Elkann Lin Arison Laurence Fink Mrs. Jan Cowles Jerry I. Speyer Glenn Fuhrman Lewis B. Cullman Chairman Kathleen Fuld H.R.H. Duke Franz of Bavaria Howard Gardner Maurice R. Greenberg Leon D. Black Mimi Haas Wynton Marsalis Co-Chairman Marlene Hess Richard E. Oldenburg‡ Ronnie Heyman Lord Rogers of Riverside Marie-Josée Kravis AC Hudgins Ted Sann President Jill Kraus Yoshio Taniguchi Marie-Josée Kravis Eugene V. Thaw Sid R. Bass Ronald S. Lauder Mimi Haas Michael Lynne Marlene Hess Khalil Gibran Muhammad Ex-Officio Maja Oeri Philip S. Niarchos Glenn D. Lowry Richard E. Salomon James G. Niven Director Vice Chairmen Peter Norton Daniel S. Och Agnes Gund Glenn D. Lowry Maja Oeri Chairman of the Board of Director Michael S. Ovitz MoMA PS1 Ronald O. Perelman Richard E. Salomon David Rockefeller, Jr. Sharon Percy Rockefeller Treasurer Sharon Percy Rockefeller President of the International Richard E. Salomon Council James Gara Marcus Samuelsson Assistant Treasurer Anna Deavere Smith Thomas R. Osborne and Ann Schaffer Jerry I. Speyer Co-Chairmen of Patty Lipshutz Ricardo Steinbruch The Contemporary Arts Council Secretary Jon Stryker Daniel Sundheim Bill de Blasio Ronald S. Lauder Tony Tamer Mayor of the City of New York Honorary Chairman Alice M. Tisch Gary Winnick Gabrielle Fialkoff Robert B. Menschel Mayor’s Designee Chairman Emeritus Life Trustees Wallis Annenberg Melissa Mark-Viverito Agnes Gund Sid R. Bass Speaker of the Council of President Emerita Eli Broad the City of New York Douglas S. -

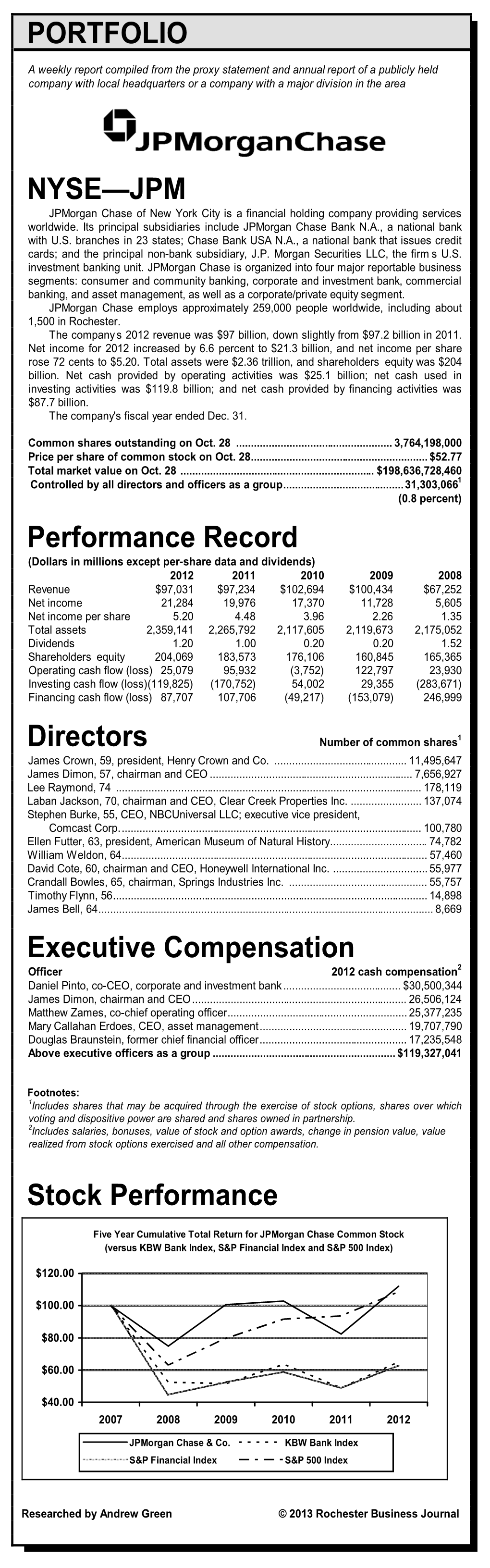

PORTFOLIO NYSE—JPM Performance Record Directors Executive Compensation Stock Performance

PAGE 31 OCTOBER 24, 2014 MARKETWATCH ROCHESTER BUSINESS JOURNAL PORTFOLIO LOCAL STOCK PERFORMANCE A weekly report compiled from the proxy statement and annual report of a publicly held company with local headquarters or a company with a major division in the area CLOSING CLOSING PERCENT ANNUAL PRICE PRICE NET CHANGE CHANGE IN P/E EARNINGS PER DIVIDEND 52 - WEEK 10.20.14 10.13.14 IN PERIOD PERIOD RATIO SHARE1 RATE2 HIGH LOW ADT Corp. (NY-ADT) 32.93 31.88 1.05 3.29 19.86 1.66 0.80 46.05 27.93 AT&T Inc. (NY-T) 34.28 33.82 0.46 1.36 10.11 3.40 1.84 37.48 31.74 Arista Power Inc. (OTC-ASPW) 0.08 0.06 0.02 33.33 0.00 -0.01 NONE 0.00 0.00 Bank of America Corp. (NY-BAC) 16.26 16.40 -0.14 -0.85 25.91 0.63 0.04 18.03 13.80 NYSE—JPM Bon-Ton Stores Inc. (NAS-BONT) 9.41 8.25 1.16 14.06 LOSS -0.38 0.20 19.13 8.00 JPMorgan Chase of New York City is a financial holding company providing services worldwide. Its principal subsidiaries include JPMorgan Chase Bank N.A., a national bank CVS Caremark Corp. (NY-CVS) 81.76 80.12 1.64 2.05 20.01 4.09 1.10 83.45 60.21 with U.S. branches in 23 states; Chase Bank USA N.A., a national bank that issues credit Ciber Inc. (NY-CBR) 3.23 3.26 -0.03 -0.92 LOSS -0.17 NONE 5.09 3.05 cards; and the principal non-bank subsidiary, J.P. -

Executive Summary

Federal Reserve Consent Order – JPMorgan Chase Response Executive Summary The Board of Directors of JPMorgan Chase & Co. (JPMC Board) recognizes its obligation to ensure that JPMorgan Chase Bank, National Association (Bank) has the appropriate financial and managerial resources to meet the requirements of the Federal Reserve Board of Governors and the Office of the Comptroller of the Currency (OCC) Consent Orders issued April 13, 2011. The Orders require significant actions to enhance the Bank’s Compliance, Audit, and Risk programs and to aggressively improve the state of controls for residential mortgage loan servicing, loss mitigation, and foreclosure activities. The Bank is taking those actions, which are provided as “FRB Consent Order Action Plan Milestones” in this submission. Source of Strength The Bank has developed an Action Plan to address OCC Articles IV through XII, which relate to redefining core business controls including policies and procedures, data integrity, staffing, training, fee management, third-party oversight, and management reporting. Deloitte & Touche LLP has been engaged as the independent consultant to conduct independent Foreclosure Reviews required under both Orders. A Consent Order Steering Committee has been created and is responsible for setting overall program direction, monitoring progress and results, ensuring compliance with the Order, and serving as a point of escalation to resolve issues. The Consent Order Steering Committee meets on a weekly basis to review the status of the progress with respect to the Consent Order Action plans. During this meeting, progress against key milestones, interdependencies and issue identification and remediation are discussed. In February 2011, of JPMC and Head of Home Lending, established a weekly Home Lending Metrics Meeting representing a focused approach to managing and governing the business. -

Annual Report 2005 J P M O R G a N C H a S E

JPMORGAN CHASE & CO. Annual Report 2005 JPMorgan Chase & Co. 2005 Annual Report JPMorgan Chase & Co. www.jpmorganchase.com JPMorgan Chase & Co. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $1.2 trillion and operations in more than 50 countries. The firm is a leader in investment banking, financial services Corporate headquarters Directors Direct deposit of dividends for consumers, small business and commercial banking, financial transaction processing, asset and wealth 270 Park Avenue To contact any of the Board members please For information about direct deposit of management, and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase New York, New York 10017-2070 mail correspondence to: dividends, please contact Mellon Investor serves millions of consumers in the United States and many of the world’s most prominent corporate, Telephone: 212-270-6000 JPMorgan Chase & Co. Services LLC. http://www.jpmorganchase.com Attention (Board member) institutional and government clients under its JPMorgan and Chase brands. Stockholder inquiries Office of the Secretary Principal subsidiaries 270 Park Avenue Contact Mellon Investor Services LLC: JPMorgan Chase Bank, New York, New York 10017-2070 National Association By telephone: Chase Bank USA, The corporate governance principles of Within the United States, Canada and National Association the board, the charters of the principal Puerto Rico: 1-800-758-4651 J.P. Morgan Securities Inc. board committees and other governance (toll free) information can be accessed by visiting From all other locations: JPMorgan has one of the largest client franchises in the world. Our clients include corporations, Annual report on Form 10-K www.jpmorganchase.com and clicking on 1-201-680-6578 (collect) institutional investors, hedge funds, governments and affluent individuals in more than 100 countries. -

Download JPM Deferred Prosecution Agreement

UNITED STATES DISTRICT COURT DISTRICT OF CONNECTICUT UNITED STATES OF AMERICA v. CRIMINAL NO. JPMORGAN CHASE & CO. DEFERRED PROSECUTION AGREEMENT Defendant JPMorgan Chase & Co. (the “Company”), pursuant to authority granted by the Company’s Board of Directors reflected in Attachment B, and the United States Department of Justice, Criminal Division, Fraud Section, and the United States Attorney’s Office for the District of Connecticut (collectively, the “Fraud Section and the Office”), enter into this deferred prosecution agreement (the “Agreement”). The Company’s subsidiaries, JPMorgan Chase Bank, N.A. (“JPMC”), and J.P. Morgan Securities LLC (“JPMS”) (together, the “Related Entities”), also agree, pursuant to the authority granted by their respective Boards of Directors, also reflected in Attachment B, to certain terms and obligations of the Agreement as described below. The terms and conditions of this Agreement are as follows: Criminal Information and Acceptance of Responsibility 1. The Company acknowledges and agrees that the Fraud Section and the Office will file the attached two-count criminal Information in the United States District Court for the District of Connecticut charging the Company with two counts of wire fraud, in violation of Title 18, United States Code, Section 1343. In so doing, the Company: (a) knowingly waives any right it may have to indictment on these charges, as well as all rights to a speedy trial pursuant to the Sixth Amendment to the United States Constitution, Title 18, United States Code, Section 3161, and Federal Rule of Criminal Procedure 48(b); and (b) knowingly waives any objection with respect -1- to venue to any charges by the United States arising out of the conduct described in the Statement of Facts attached hereto as Attachment A (the “Statement of Facts”) and consents to the filing of the Information, as provided under the terms of this Agreement, in the United States District Court for the District of Connecticut. -

($25K and Over) 1

8.25.18 ASPEN INSTITUTE 2017 TRANSPARENCY REPORT Gifts,Grants and Program Support ($25K and over) CONSTITUENT NAME PROGRAM GIFT/GRANT AMOUNT ANONYMOUS GIFTS* NON-CHARITABLE SUPPORT The Angelo Family Charitable Foundation Arts Program $25,000.00 Arnhold Foundation Arts Program $25,000.00 The Eisner Foundation Arts Program $375,000.00 Ford Foundation Arts Program $100,000.00 Jane & Marc Nathanson Family Foundation Arts Program $25,000.00 Leonard Lauder Arts Program $25,000.00 The Laurie M. Tisch Foundation Inc. Arts Program $25,000.00 Millstone Family Charitable Trust Arts Program $25,000.00 Robert H. Smith Family Foundation Arts Program $50,000.00 Roger Sant Arts Program $50,000.00 Arts Program Total $725,000.00 Ann B. and Thomas L. Friedman Family Foundation Ascend $50,000.00 Annie E. Casey Foundation Ascend $200,000.00 Charlotte Perret Family Trust Ascend $300,000.00 David and Lucile Packard Foundation Ascend $350,000.00 Ford Foundation Ascend $100,000.00 JB and MK Pritzker Family Foundation Ascend $50,000.00 The Kresge Foundation Ascend $500,000.00 The Morgridge Family Foundation Ascend $264,910.00 The Richard W. Goldman Family Foundation Ascend $350,000.00 Robert Wood Johnson Foundation Ascend $990,327.00 Two-Generation Approach Fund of the Community Foundation Ascend $50,000.00 of Sarasota County Walton Family Foundation Ascend $215,605.00 W.K. Kellogg Foundation Ascend $661,177.00 Ascend Total $4,082,019.00 Fullerton Family Charitable Trust Aspen Community Programs $55,000.00 Jerry Murdock Aspen Community Programs $75,000.00 Aspen Community Programs Total $130,000.00 Barr Foundation Aspen Forum for Community Solutions $75,000.00 Best Buy Aspen Forum for Community Solutions $100,000.00 Bank of America Corporation Aspen Forum for Community Solutions $50,000.00 California Endowment Aspen Forum for Community Solutions $250,000.00 Casey Family Programs Aspen Forum for Community Solutions $100,000.00 Charles Stewart Mott Foundation Aspen Forum for Community Solutions $400,000.00 Citi Foundation Aspen Forum for Community Solutions $250,000.00 The Conrad N. -

Jpmorgan Chase & Co

JPMORGAN CHASE & CO FORM DEF 14A (Proxy Statement (definitive)) Filed 04/10/13 for the Period Ending 12/31/12 Address 270 PARK AVE 38TH FL NEW YORK, NY 10017 Telephone 2122706000 CIK 0000019617 Symbol JPM Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2013, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material Pursuant to §240.14a-12 JPMorgan Chase & Co. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which the transaction applies: (2) Aggregate number of securities to which the transaction applies: (3) Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of the transaction: (5) Total fee paid: Fee paid previously with preliminary materials. -

ANNUAL REPORT 2004 Financial Highlights

ANNUAL REPORT 2004 Financial highlights As of or for the year ended December 31, (in millions, except per share, ratio and headcount data) 2004 2003 Reported basis(a) Total net revenue $ 43,097 $ 33,384 Net income 4,466 6,719 Net income per share: Basic 1.59 3.32 Diluted 1.55 3.24 Return on common equity 6% 16% Headcount 160,968 96,367 Pro forma combined-operating basis Total net revenue $ 57,280 $ 55,697 Earnings 10,289 9,330 Diluted earnings per share 2.85 2.61 Return on common equity 10% 9% (a) Results are presented in accordance with accounting principles generally accepted in the United States of America. 2004 results include six months of the combined Firm’s results and six months of heritage JPMorgan Chase results. 2003 reflects the results of heritage JPMorgan Chase only. The financial information provided on pages 1-15 is presented on a pro forma combined- operating basis. The unaudited pro forma combined historical results represent how the financial information of JPMorgan Chase & Co. and Bank One Corporation may have appeared on a combined basis had the two companies been merged as of the earliest date indicated. Additional information, including reconciliation of the pro forma numbers to GAAP, can be found on Form 8-K/A furnished to the Securities and Exchange Commission on January 19, 2005. For a description of operating basis, including management's reasons for its use of such measures, see page 25 of this Annual Report. Right: Bill Harrison Chairman and Chief Executive Officer Left: Jamie Dimon President and Chief Operating Officer Dear fellow shareholder, On January , , we shared with you our plan to unite Bank One and JPMorgan Chase with the goal of creating the best financial services company in the world. -

J.P. Morgan Structured Products B.V. J.P. Morgan Securities

SUPPLEMENT NO. 3 DATED 10 MAY 2019 TO THE REGISTRATION DOCUMENT DATED 29 JUNE 2018 J.P. Morgan Structured Products B.V. (incorporated with limited liability in The Netherlands) and J.P. Morgan Securities plc (incorporated with limited liability in the United Kingdom) This supplement pursuant to section 16 of the German Securities Prospectus Act (Wertpapier- prospektgesetz) (the "Supplement") constitutes a supplement to the registration document dated 29 June 2018 (the "Original Registration Document") as supplemented by Supplement No. 1 dated 9 October 2018 and Supplement No. 2 dated 26 April 2019 (the Original Registration Document as so supplemented, the "Registration Document") constituting two registration documents: (i) the registration document in relation to J.P. Morgan Structured Products B.V., Amsterdam, The Netherlands (the "Issuer" or "JPMSP") and (ii) the registration document in relation to J.P. Morgan Securities plc, London, United Kingdom as guarantor for certain securities issued by JPMSP ("JPMS plc" or, the "Guarantor"). Subject of this Supplement is the inclusion of new factors into the Registration Document following the publication of the audited JPMS plc Annual Report for the financial year ended 31 December 2018 (the "JPMS plc 2018 Annual Report"). The JPMS plc 2018 Annual Report has been published on 8 May 2019. Amendments and supplemental information to Registration Document I. Amendments in relation to the Table of Contents In the Table of Contents on page 2 of the Registration Document the following item shall be inserted prior to the item "SIGNATURE PAGE": "APPENDIX III……………………………………………………………………………….………H-1" II. Amendments to the section "I. RISK FACTORS" The information contained in the subsection "15.1. -

Formal Agreement and Restitution 2011-108

#2011-108 AGREEMENT BY AND BETWEEN JPMorgan Chase Bank, N.A. Columbus, Ohio And The Office of the Comptroller of the Currency Whereas, JPMorgan Chase Bank, N.A., Columbus, Ohio (“Bank”) and the Comptroller of the Currency of the United States of America (“Comptroller” or “OCC”) wish to protect the interests of the depositors, customers, and shareholders of the Bank, and toward that end, wish the Bank to operate safely and soundly and in accordance with all applicable laws, rules, and regulations; and Whereas, the Comptroller, through his National Bank Examiners, has conducted ongoing examinations of the Bank and reviewed available information indicating that certain employees and agents of the Bank and its predecessors in interest engaged in illegal conduct and/or unsafe or unsound practices in connection with the marketing and sale of certain derivative financial products to certain municipalities and other non-profit organizations (“counterparties”) in certain competitively bid and negotiated transactions, prior to 2006; and Whereas, the Bank terminated its participation in the marketing and sale of derivative financial products, other than commodities derivatives, to municipalities in August 2008, but continues to provide such products to certain non-profit organizations known as “Section 501(c)(3) organizations” (e.g., major universities and large non-profit hospitals) and public pension funds; and Whereas, those business units within the Bank, where the illegal conduct and/or unsafe or unsound practices related to the marketing and