State of the Market / Updated June 24, 2020 to Our Downtown Stakeholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

World Class Capital Group & Colliers International 717Harwood.Com

717 Harwood is both Energy Star and LEED Gold certified REPRESENTED BY Colliers International +1 214 692 1100 David N. Quisenberry +1 214 217 1226 [email protected] John Conger +1 972 759 7850 [email protected] Lindsay Wolcott +1 214 217 1243 [email protected] PRESENTED BY World Class Capital Group 401 Congress Avenue & Colliers International 33rd Floor Austin, TX 78701 512.327.3300 colliers.com/texas wccapitalgroup.com 717harwood.com THE ART OF BUSINESS THE HEART OF DALLAS THE ART OF BUSINESS THE HEART OF DALLAS WI-FI POWERED COMMUNITY WORKSPACE REDESIGNED LOBBY a renovation that sparks innovation AND STREETSCAPE 717 Harwood features streamlined, tech-savvy, tenant focused services, in order to meet the needs of a 21st century tenant. WI-FI POWERED modern COMMUNITY WORKSPACE ACCESS TO MULTIPLE FIBER PROVIDERS CONTEMPORARY FURNITURE AND CURATED ARTWORK ON DISPLAY DUAL BACK-UP POWER FROM SEPARATE SUBSTITUTIONS RENOVATED LOBBY MODERN WORKING SPACE PRIVATE MEETING ROOMS WI-FI POWERED COMMUNITY WORKSPACE REDESIGNED LOBBY a renovation that sparks innovation AND STREETSCAPE 717 Harwood features streamlined, tech-savvy, tenant focused services, in order to meet the needs of a 21st century tenant. WI-FI POWERED modern COMMUNITY WORKSPACE ACCESS TO MULTIPLE FIBER PROVIDERS CONTEMPORARY FURNITURE AND CURATED ARTWORK ON DISPLAY DUAL BACK-UP POWER FROM SEPARATE SUBSTITUTIONS RENOVATED LOBBY MODERN WORKING SPACE PRIVATE MEETING ROOMS ONE BLOCK FROM DART AND LIGHT RAIL STATION (SERVICE TO ALL LINES) 24/7 MANNED AND MONITORED -

View Parking

DINING P Parking Church 1 DMA Café 9 Nusr-Et 1617167 Royal Blue Grocery 2 Socca 1909 Playwright Irish Pub 17178 Sloane’s Corner 3 Nasher Café 1101 Tei-An 17198 400 Gradi Trolly Public Art 4 Musume 121 Yolk 2109 Mendocino Farms 5 Akai 123 Perot Museum Café 2 1201 Southpaw’s Grill Bike Rack Shopping 6 The Artisan 1414 Miriam’s Cocina Latina 2 023 Roti 7 Ellie’s 1415145 Fountain Place Café 2 03 Mi Cocina (Coming Soon) 8 Center Café 1615165 Liberty Deli MAPLE - ROUTH CONNECTION E T D O H M Y UN A O L ROLIN WOO Perot Museum Of A M A E OUT R V BOLL ST ALLEN ST R C Nature and Science A R A COLB EY L N H D IN FAI CK M EAR HARTMAN P FIEL . 123 N GUILLOT 14 WOODALL RODGERS ACCESS WOODALL RODGERS ACCESS WOODALL RODGERS ACCESS 23 WOODALL RODGERS FREEWAY Klyde WOODALL RODGERS FREEWAY Warren Park WOODALL RODGERS ACCESS WOODALL RODGERS ACCESS P 9 AT&T Performing Museum Arts Center | Nasher Tower Annette Strauss Y Garden Square 2 1900 Pearl P Future Site of AT&T Performing Arts Center Two Arts Plaza D | Margot and Bill Winspear 1 Opera House OO 3 P W R P A H Booker T. Washington L St. Paul United R High School for P Methodist Church Fast the Performing Park WADE E OLIV Morton H. Meyerson MUNGER Nasher and Visual Arts PEA L Sculpture Symphony Center Future Site of S U P Center 8 Three Arts Plaza A Atelier AN P P Flora Lofts V AMLI AT&T Performing Arts Center 1101 TACA Fountain Place ST. -

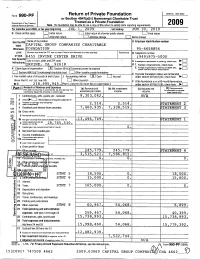

Form 990-PF Return of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust

OMB No 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private. Foundation Internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirements 2 00 9 For calendar year 2009 , or tax year beginning JUL 1, 2009 , and ending JUN 30 , 2010 G Check all that apply 0 Initial return initial return of a former public charity Final return 0 Amended return 0 Address change LI Name change Use the IRS Name of foundation A Employer identification number label. CAPITAL GROUP COMPANIES CHARITABLE Otherwise , F OUNDATION 95-4658856 print Number and street (or P O box number if mail is not delivered to street address) Room/suite B Telephone number ortype . 6455-IRVINE CENTER DRIVE ( 949 ) 975-5000 See Specific ^ City or town, state, and ZIP code C exemption ► Instructions . If application is pending, check here IRVINE , CA 92618 0 1. Foreign organizations, check here 2. Foreign organizations meeting the 85% test, ► H Check typea of organization Section 501(c)(3) exempt private foundation check here and attach computation Section 4947 (a )( 1 ) nonexem pt charitable trust 0 Other taxable p rivate foundation E If private foun dation status was terminated I Fair market value of all assets at end of year J Accounting method OX Cash LI Accrual under section 507(b)(1)(A), check here ► ll, (c), (from Part co! line 16) 0 Other (specify) F If the foundation is in a 60-month termination ► $ 218 , 995 , 94 5 . -

Fountain Place

FOUNTAIN PLACE WORK IN ART 1445 ROSS AVENUE | DALLAS, TEXAS Amongst a skyline filled with icons, it takes a truly unique vision to stand out. “Fountain Place…is quite simply the most beautiful building in the Dallas skyline.” – D Magazine, May, 2019 FOUNTAIN PLACE “A Work of Art” WORK IN ART. – David Dillon, Architecture Critic, Dallas Morning News 1981-2006 “If glass skyscraper design has further leaps to make, it is hard to imagine what they could be.” – David Dillon “My favorite building in Dallas” – Everyone 2 3 EVOLUTION OF AN ICON 1 Ascension Annex + 10,000 sf of additional dining options 5 2 A transformed lobby - new, modern finishes with 30’ vaulted ceilings surrounded by glass on both sides. 3 A new 10-story 1,500-space parking garage, 3/1000 parking ratio 4 • New tenant lounge and conference facility • On-site hospitality concierge • State-of-the-art, full-service fitness center 5 COMING SOON High-rise luxury AMLI apartments 6 COMING SOON • 20-story, 220 room boutique hotel • Additional food & beverage experiences 6 3 4 1 2 4 5 ARRIVE IN STYLE The redevelopment of the lobby was designed with an uncompromising level of detail including a 30’ vaulted ceiling and stunning glass wall feature designed by Architect James Carpenter. The new Fountain Place lobby embraces a bold future while never losing touch with its timeless design. 6 7 ROOM TO BREATHE The tree-lined courtyard and iconic water gardens at Fountain Place is an oasis within the city. The perfect venue to reset and re-energize as you take on the day. -

Senior Managing Director Mr

PROFESSIONAL PROFILE John S. Brownlee Career Summary Senior Managing Director Mr. Brownlee is a Senior Managing Director in HFF’s Dallas office with more than 24 years of experience in commercial real estate finance. He is primarily responsible for originating debt and equity placement transactions throughout the southern United States. Mr. Brownlee’s focus is on multi-housing, office, retail and industrial properties, with a specialization in multi-housing and office. During the course of his career with HFF, he has completed more than $7 billion in commercial real estate transactions. Mr. Brownlee joined the firm in August 1994. Representative Assignments PROPERTY LOCATION TYPE VALUE 700 Louisiana Houston, TX Floating-rate $252,000,000 Bank of America Center Houston, TX Fixed-rate $232,000,000 Highland Park Village (17) Dallas, TX Fixed-rate $225,000,000 Fountain Place Dallas, TX Fixed-rate $190,000,000 Comerica Bank Tower Dallas, TX Floating-rate $185,000,000 One Victory Park City Center Towers I&II Fort Worth, TX Fixed-rate $170,000,000 2323 Victory Avenue Highland Park Village (11) Dallas, TX Fixed-rate $125,000,000 Suite 1200 Tower at Cityplace Dallas, TX Floating-rate $100,000,000 Dallas, TX 75219 Tonti Multifamily Portfolio Various (AZ,TX, LA) Fixed-rate $85,000,000 Gardner Tanenbaum Industrial Portfolio I & II Various, OK Fixed-rate $81,200,000 T (469) 232-1935 Post Addison Circle I & II Dallas, TX Fixed-rate $80,000,000 F (214) 265-1686 The Carnegie & Sanguinet Ft. Worth, TX Adjustable-rate $72,500,000 [email protected] Riverwood -

Dallas-Fort Worth Guide

FACULTY: SEDEF DOGANER, PhD STUDENTS: MICHAEL BRADEN MICHAEL LOCKWOOD LEVI SANCIUC hE/sZ^/dzK&dy^^EEdKE/K COLLEGE OF ARCHITECTURE ARCHITOURISM CONTENTS CHAPTER 1 p. 04 /ŶƚƌŽĚƵĐƟŽŶ CHAPTER 2 p. 11 The Architourist City: Dallas / Ft. Worth History 2.1.1 Importance 2.1.2 DFW Economy Related to Tourism 2.1.3 &t^ƚĂƟƐƟĐƐZĞůĂƚĞĚƚŽdŽƵƌŝƐŵϮ͘ϭ͘ϰ dƌĂŶƐĨŽƌŵĂƟŽŶŽĨ^ŝƚĞƐZĞůĂƚĞĚƚŽdŽƵƌŝƐŵϮ͘ϭ͘ϱ DFW Current Problems 2.1.6 The Architourist 2.2.1 Importance of Architourism 2.2.2 DFW Economy 2.2.3 &t^ƚĂƟƐƟĐƐZĞůĂƚĞĚƚŽdŽƵƌŝƐŵϮ͘Ϯ͘ϰ &tdŽƵƌŝƐƚWƌŽĮůĞƐϮ͘Ϯ͘ϱ &tƌĐŚŝƚŽƵƌŝƐƚ^ŝƚĞϮ͘Ϯ͘ϲ CHAPTER 3 p. 27 Analysis of Tourism in DFW CHAPTER 4 p. 87 Architourist Guide to DFW ARCHITOURISM CHAPTER 1 IntroducƟ on Introduc on: The focus of this analysis is to look at the eff ects of Architourism in the Dallas/Ft Worth area. What kind of culture if any has been created by Architourism and is it authen c or inauthen c. What kinds of developments have occurred there recently and what has this done to boost or change the local community. In the 2010 census the city of Dallas saw less than a one percent increase in its total popula on while Ft Worth increased by more than 38%. Did Architourism play a role in this? If so, what? Our analysis will begin with researching the demographics of the local users and types of tourists, their income level, race, educa on and loca on of residency. We will also include looking into the histories of selected sites with respect to their economies, culture, tourist ac vi es, and rela onship to the built environment. -

Q4 2017 Office Brief.Indd

The Lee Offi ce Brief 1 LEE OVERVIEW 2 NATIONAL OVERVIEW 2017 3 KEY MARKET SNAPSHOTS 4 SIGNIFICANT TRANSACTIONS Q4 5 NATIONWIDE LEE OFFICES 1 CANADA THE POWER OF THE LEE NETWORK THE LEE ADVANTAGE LEE & ASSOCIATES IS A COMMERCIAL REAL EAST WEST MIDWEST ESTATE BROKERAGE, MANAGEMENT AND APPRAISAL SERVICES FIRM. ESTABLISHED IN 1979, LEE & ASSOCIATES HAS GROWN ITS SOUTH SERVICE PLATFORM TO INCLUDE OFFICES IN THE UNITED STATES AND CANADA. Every Lee SOUTH & Associates offi ce delivers world class service to WEST an array of regional, national and international clients--from small businesses and local investors SERVING OUR CLIENTS to major corporate users and institutional THROUGHOUT THE U.S. AND investors. Our professionals combine the latest CANADA technology, resources and market intelligence ARIZONA with their experience, expertise and commitment BRITISH COLUMBIA to superior service to optimize your results. CALIFORNIA COLORADO INDUSTRY 1 FLORIDA SPONSORSHIPS & MARKET LEADER GEORGIA ORGANIZATIONS SPECIALIZING IN MARKET INTELLIGENCE IDAHO 2 ILLINOIS RELEVANT WORK INDIANA SEASONED PROFESSIONALS WITH RELEVANT MARYLAND TRANSACTION EXPERIENCE MICHIGAN 3 MINNESOTA WE SAVE YOU TIME MISSOURI CREATIVE PROBLEM SOLVING SKILL SETS NEVADA NEW JERSEY 4 ABILITY TO UNDERSTAND NEW YORK EFFECTIVE CLIENT COMMUNICATION OHIO PENNSYLVANIA 5 INTEGRITY SOUTH CAROLINA SHAPES OUR CULTURE & TEXAS DEFINES THE CHARACTER WASHINGTON WISCONSIN AFFILIATE INTERNATIONAL RELATIONSHIP 62% $11.6 billion 900 ▶ AUSTRIA ▶ NETHERLANDS ▶ BELGIUM ▶ POLAND ▶ FRANCE ▶ POLAND increase -

WELLS FARGO – 2601 Lakeview Pkwy ROWLETT, TEXAS 75088

v FOR SALE WELLS FARGO – 2601 Lakeview Pkwy ROWLETT, TEXAS 75088 Property Information • 5% CAP RATE • $2,900,000 • Ground Lease (Fee Interest) • NEC Lakeview Parkway & Kenwood Drive Rudy Blankenship Senior Director Lic. #00515550 +1 559 433 3525 [email protected] 9 River Park Place E Suite 101 Fresno, CA 93720 phone: +1 559 433 3500 paccra.com Real Property Photo Listed in association with Cushman & Wakefield, Dallas Texas Independently Owned and Operated / A Member of the Cushman & Wakefield Alliance PACCOM Realty Advisors, Inc., Copyright 2016. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by the property owner(s). As applicable, we make no representation as to the condition of the property (or properties) in question. v FOR SALE WELLS FARGO – 2601 Lakeview Pkwy ROWLETT, TEXAS 75088 AGENDA CONFIDENTIALITY AGREEMENT Pg. 2 DEMOGRAPHICS Pg. 8 BROKERAGE SERVICES Pg. 3 PHOTOS • Texas Law Requirements • Wells Fargo (Real property photos) Pg. 9 EXECUTIVE SUMMARY Pg. 4 • Surrounding Retailers Pg. 10 - 12 • Offering Summary • Wells Fargo Bank Lease Abstract DALLAS • Site Description • Overview & History Pg. 13 • Geography, Central & East Dallas Pg. 14 WELLS FARGO TENANT OVERVIEW Pg. 5 AERIALS • South Dallas, Architecture, Economy Pg. 15 - 16 • Map of Dallas & Site Location Pg. 6 BROKER BIOGRAPHY Pg. 17 • Birds Eye Site Location & Immediate Area Amenities Pg. 7 Independently Owned and Operated / A Member of the Cushman & Wakefield Alliance PACCOM Realty Advisors, Inc., Copyright 2016. -

A COMPLETE and CONNECTED CITY CENTER City of Dallas Mayor and City Council the 360 Plan Team Katy Murray, A.H

DRAFT A COMPLETE AND CONNECTED CITY CENTER City of Dallas Mayor and City Council The 360 Plan Team Katy Murray, A.H. Belo Noah Nelson, Texas A&M Commerce Mayor Mike Rawlings The 360 Plan Chairs District 1 – Scott Griggs Theresa O’Donnell, COD Resilience Office District 2 – Adam Medrano T.C. Broadnax, City Manager, City of Dallas Mike Peterson, AT&T District 3 – Casey Thomas, II Kourtny Garrett, President/ CEO, Downtown Dallas Inc. Joseph Pitchford, Crescent Real Estate District 4 – Dwaine R. Caraway Melissa Prycer, Cedars Neighborhood Association District 5 – Rickey D. Callahan Steering Committee Ben Reavis, Downtown Residents Council District 6 – Omar Narvaez Holly Reed, Texas Central Dr. Jose Adames, El Centro College District 7 – Kevin Felder Cheryl Richards, Dallas Convention & Visitors Bureau Majed Al-Ghafry, COD Assistant City Manager District 8 – Tennell Atkins Scott Rohrman, 42 Real Estate Dr. Lew Blackburn, DISD District 9 – Mark Clayton Jon Ruff, Spire Realty Paula Blackmon, DISD District 10 – B. Adam McGough Jennifer Sanders, Dallas Innovation Alliance District 11 – Lee M. Kleinman Charles Brideau, COD Housing James Schmeltekopf, Wells Fargo District 12 – Sandy Greyson Tanya Brooks, COD Mobility Planning Katherine Seale, Landmark Commission District 13 – Jennifer Staubach Gates Brent Brown, Building Community Workshop Katy Slade, Gables Residential/ Uptown Dallas Inc. District 14 – Philip T. Kingston Dustin Bullard, Downtown Dallas Inc. Neal Sleeper, Cityplace Kryslyn Burks, Communications & Branding, Tracylocke Billy Snow, DISD Partner Organizations Jessica Burnham, Deep Ellum Foundation Kevin Spath, COD Economic Development AIA Dallas Peer Chacko, COD Planning & Urban Design Acknowledgments Sarah Standifer, COD Trinity Watershed Management bcWorkshop John Crawford, Downtown Dallas Inc. -

Dallas Business Journal

UP AND RUNNING, How Downtown Dallas is continuing to accelerate growth, promote diversity, READY and encourage community. TOGETHER ADVERTISING SUPPLEMENT | NOVEMBER 6, 2020 2 ADVERTISING SUPPLEMENT DOWNTOWN DALLAS LETTER FROM KOURTNY GARRETT employers in the region. Our residential surrounding neighborhoods, guiding interests are at the forefront of those, population growth has outpaced any the City Center to continued, long-term and many other, critical agendas. other locality over the last decade. We success. Further, as the organization charged are the hub of regional transportation, with the everyday experience today and Downtown’s livability has elevated Today, we find ourselves in uncharted our programs, communications, and with the evolution of our arts, parks, waters. As we continue implementing focus on quality of life will return our schools, and services. Downtown is an The 360 Plan, we must be flexible in neighborhoods to the vibrancy we have economic engine and a neighborhood ensuring Downtown does not lose come to know in Downtown. – it is where Dallas comes together as the momentum built over the last a place for all, built by all. two decades. With this in mind, we’re In this year’s Dallas Business Journal leveraging the principles and priorities focus on Downtown, you will discover Recently, we have all experienced set forth in The 360 Plan to develop key points we believe are critical in challenges that no one could have a comprehensive path forward, our moving forward with market optimism, imagined, much less predicted. These Momentum Strategy. This plan is plus a call to action for unity and impacts have been felt all over the laser-focused on five priority areas: inspiration as we look forward to what’s world. -

Cibodivino Restaurant

BUILDING FEATURES A Dallas Landmark Bryan Tower is an all glass, gold skyscraper, designed by acclaimed Texas architects Neuhaus & Taylor. An icon of Downtown Dallas, Bryan Tower is a class A office building that features 40 stories and 1.1 million square feet of space. • Floor-to-ceiling glass curtain walls • 27,000 square foot floors • Striking lobby of granite and glass • CiboDivino Marketplace and patio • State-of-the-art conference centers • New outdoor plaza • 40,000 square foot health club • 2.5/1,000 future parking • Unparalleled views of the Dallas skyline • Connected by climate-controlled sky bridge systems to Dallas’ restaurants, shops and hotels Easy Walk Score Transit Score ACCESS 94 90 Over 100 amenities Dart Light Rail station within one mile within one block CONVENIENT CBD LOCATION High Walk Score • DART Light Rail M-Line Trolley • Close to Major Highways BRYAN TOWER Area Highlights • Three blocks from the Dallas Arts District: - Dallas Museum of Art - Morton H. Meyerson Symphony Center - Crow Collection of Asian Art - Winspear Opera House - Nasher Sculpture Garden - Wyly Theatre • Four blocks from Klyde Warren Park • A few feet from the DART station THE BUILDING Conference Rooms • Full Glass Curtain Walls Incredible Views of Downtown • 40,000 SF Fitness Center CIBODIVINO RESTAURANT CHEE-boh Dee-VEE-no Means Divine Food in Italian NOW OPEN AT BRYAN TOWER CiboDivino Marketplace is an Italian market and restaurant that offers house-made bread, Italian food, gourmet groceries, and wine. Bryan Tower tenants can stop in for a coffee, a quick lunch, or to grab prepared food for dinner. -

Market Insights Dallas/Fort Worth 4Q 2020 - OFFICE

Market Insights Dallas/Fort Worth 4Q 2020 - OFFICE Bradford Commercial Real Estate Services 3100 McKinnon Street, Suite 400 Dallas, Texas 75201 DALLAS-FORT WORTH OFFICE MARKET INSIGHTS 4Q2019 Table of Contents BRADFORD DALLAS-FORT WORTH OFFICE TEAM 1 DALLAS - FORT WORTH OVERALL MARKET INSIGHT 2 SUBMARKET EXPERTISE • Central Expressway • Dallas CBD • Fort Worth CBD 3 • Far North Dallas • White Rock/East Dallas • Las Colinas • LBJ Freeway • Mid Cities • Preston Center • Stemmons • Richardson/Plano • Uptown-Turtle Creek The information contained herein was obtained from CoStar; however, Bradford Companies makes no guarantees, warranties, or representation as to the completeness or accuracy thereof. The presentation of this property is submitted subject to errors, omissions, change of price or conditions prior to sale or lease or withdrawal without notice. 1 DFW OFFICE COVERAGE BinformedOFFICE MARKET EXPERTS Melanie Hughes Richmond Collinsworth Erik Blais Jared Laake Senior Vice President First Vice President Vice President Vice President 972.776.7046 972.776.7041 817.921.8179 972.776.7045 Dallas Dallas Fort Worth Dallas Susan Singer, CCIM Paul Richter Shane Benner Executive Vice President Vice President Vice President Brokerage Services 972.776.7036 817.921.8174 972.776.7043 Dallas Fort Worth Dallas • Bradford Corporate Office • Bradford Field Offices Bret Cooper Elizabeth Robertson Kyle Espie Market Director Market Director Senior Associate 972.776.7035 972.776.7199 972.776.7070 Dallas Dallas Dallas 2 3 Existing Inventory Vacancy Delivered