Building Strength Shaping Growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 International Student Handbook.Pdf

2018 LCC International Students Guidebook 1. OVERVIEW OF LINGANG ....................................... 2 2. APPLICATION SYSTEM LOG-IN ................................. 3 3. REGISTRATION ................................................ 4 4. TUITION PAYMENT ............................................. 6 5. ACCOMMODATION ............................................. 7 6. FOOD ......................................................... 10 7. SHOPPING ..................................................... 13 8. TRANSPORT ................................................... 14 9. HEALTH INSURANCE .......................................... 20 10. VISA AFFAIRS ................................................. 25 11. SCHOLARSHIP STUDENT ISSUES ............................... 28 12. BANKING ..................................................... 32 13. SIM Card Purchase in Mainland China ............................. 33 14. ABOUT SJTU .................................................. 34 15. TOP ATTRACTIONS IN SHANGHAI ............................. 34 16. CITIES NEARBY ............................................... 37 17. USEFUL APPS ................................................. 39 18. USEFUL WEBSITES ............................................ 40 19. CONTACT US ................................................. 41 China-UK Low Carbon College No3, Yinlian Road, Pudong New District, Shanghai 1 1. OVERVIEW OF LINGANG Lingang is located at the southeast tip of continental Shanghai. It is 75 km away from the City Centre of Shanghai. Standing at the -

Study Away Student Handbook

NYU Shanghai STUDY AWAY STUDENT HANDBOOK Summer 2017 Shanghai Global Affairs [email protected] https://shanghai.nyu.edu/summer-admitted Table of Contents Welcome 1.Important Dates 2. Contacts 2.1 NYU Shanghai Staff and Offices Academics Global Affairs Chinese Language Clinic Student Life Ner Student Programs Student Mobility Residential Life Health and Wellness IT Services 2.2 Emergency Contacts 3. Academic Policies & Resources Academic Requirements & Registration Guidelines Courses Learning Chinese Language Academic Support Academic Advising Textbook Policy at NYU Shanghai Attendance Policy Religious Holidays and Attendance Academic Integrity Examination and Grades Policies on Examinations Makeup Examinations Grades Policies on Assigned Grades Grade of P 1 Grade of W Grade of I Incompletes Pass/Fail Option Withdrawing from a Course Program Withdrawal Tuition Refund Schedule 4. Student Life Policies & Resources Student Conduct Policies and Process Residential Life Residence Hall Policies Resource Center How to Submit a Facilities Work Order Fitness Center Health and Wellness Health Insurance 5. Arriving in Shanghai Arrival Information Transportation to NYU Shanghai Shanghai Airports and Railway Stations Traveling from the Airport Move-In Day Arrangement Move-In Day 6. Life in Shanghai Arranging Your Finance Living Cost in Shanghai Banking and ATMs Exchanging Money Getting Around Dining Shopping Language Tips Religious Services Shanghai Attractions 2 Travel 7. Information Technology (IT) Printing IT FAQ – Setup VPN 8. Be Safe Public Safety Crime Prevention Safety in Shanghai Emergency Medical Transport NYU Shanghai Card Services Lost and Found Services Shuttle bus Safety Tips Safety on Campus Regulations Tips for Pickpocket Prevention If You Already Have Been Pickpocketed Information alert 3 Welcome On behalf of the entire NYU Shanghai team, congratulations on your acceptance to NYU Shanghai’s Summer Program. -

Study of the Leftover Space in the City Based on Reutilization: Take the Space Under Elevated Road in Shanghai As an Example

POLYTECHNIC UNIVERSITY OF CATALONIA Master in Urban Management and Valuation Study of the leftover space in the city based on reutilization: Take the space under elevated road in Shanghai as an example STUDENT: Jie Shi TUTOR: Carlos Marmolejo Duarte Date: 20/05/2016 MASTER IN URBAN MANAGEMENT AND VALUATION Study of the leftover space in the city based on reutilization: Take the space under elevated road in Shanghai as an example STUDENT: Jie Shi TUTOR: Carlos Marmolejo Duarte Date: 05/2016 CONTENTS Contenido abstract ......................................................................................................................... 5 1 introduction................................................................................................................. 6 1.1 reason.................................................................................................................. 6 1.1.1 background ................................................................................................... 6 1.1.2 problems ....................................................................................................... 6 1.2 Definition of the research .................................................................................... 7 1.2.1 Definition of elevated road or overpass (flyover) ......................................... 7 1.2.2 Definition of leftover space ........................................................................... 8 1.2.3 Definition of urban areas of Shanghai ........................................................ -

Transportation the Conference Will Be Held in North Zhongshan Road

Transportation The conference will be held in North Zhongshan Road campus of East China Normal University (ECNU). The address is: No. 3663, North Zhongshan Road, Putuo, Shanghai. The hotel where all participants will stay is Yifu Building (逸夫楼) located on the campus. Arrival by flights: There are two airports in Shanghai: the Pudong Airport in east Shanghai and the Hongqiao Airport in west Shanghai. Both are convenient to get to the North Zhongshan Road campus of ECNU. At the airport, you can take taxi or metro to North Zhongshan Road Campus of ECNU. Taxi is recommended in terms of its convenience and time saving. Our students will be there for helping you to find the taxi. By taxi From Pudong Airport: about one hour and 200 CNY when traffic is not busy. From Hongqiao Airport: about 30 minutes and 60 CNY when traffic is not busy. Please print the following tips if you like “请带我去华东师范大学中山北路校区正门” in advance and show it to the taxi driver. The Chinese words in tips mean "Please take me to the main gate of North Zhongshan Road Campus of ECNU". By metro From Pudong Airport: 1. Metro Line 2 (6:00 - 22:00)->Zhongshan Park (中山公园) station (Note: exchange at Guanglan Road station(广兰路)), then take taxi for about 10 minutes and 14 CNY cost to North Zhongshan Road Campus of ECNU, or take the bus 67 for 2 stops and get off at ECNU station(华东师大站)instead. 2. Metro Line 2->Jiangsu Road (江苏路) station-> Metro Line 11->Longde Road (隆德路) station->Metro Line 13-> Jinshajiang Road (金沙江路) Station->10 minutes walk. -

GP Shanghai 2015 Travel Guide

GP Shanghai Travel Guide Welcome to Shanghai! 上海欢迎您! Quick facts about China Electricity: AC 220 V, 50 Hz Plug Type: Event Fact Sheet: Timezone: GMT +8 http://magic.wizards.com/en/content/fact-sheet-grand-prix-shanghai-2015 Calling code: +86 Emergency Calls: 110 (Police), In order to facilitate planning your visit to Shanghai, as well as make your 119 (Fire), 120 (Ambulance) stay in Shanghai more enjoyable, we local judges at Shanghai prepared this Local Guide. We hope it proves useful and informative. This edition of Shanghai Travel Guide is broken down into the following sections each served a different purposes: Language and Traveling Information, Transportation Guides, Scenic Spots, and finally, Magic Stores. Climate Information Month Jan Feb Mar Apr May Jun 22.1 27 29.6 34.3 35.5 37.5 Record high °C (°F) -71.8 -80.6 -85.3 -93.7 -95.9 -99.5 8.1 10.1 13.8 19.5 24.8 27.8 Average high °C (°F) -46.6 -50.2 -56.8 -67.1 -76.6 -82 4.8 6.6 10 15.3 20.7 24.4 Daily mean °C (°F) -40.6 -43.9 -50 -59.5 -69.3 -75.9 2.1 3.7 6.9 11.9 17.3 21.7 Average low °C (°F) -35.8 -38.7 -44.4 -53.4 -63.1 -71.1 −10.1 −7.9 −5.4 −0.5 6.9 12.3 Record low °C (°F) -13.8 -17.8 -22.3 -31.1 -44.4 -54.1 Contents GP Shanghai Travel Guide ......................................................................................................................................................... -

MGCCT's Maiden Acquisition of Sandhill Plaza in Shanghai For

For Immediate Release MGCCT’s Maiden Acquisition of Sandhill Plaza in Shanghai for Approximately S$402 million Expands MGCCT’s footprint to Shanghai, the first-tier commercial hub in China Captures growing demand for business park due to decentralisation trend in Shanghai 15 June 2015 – Mapletree Greater China Commercial Trust Management Ltd., as manager (the “Manager”) of Mapletree Greater China Commercial Trust (“MGCCT”), is pleased to announce the acquisition of a property located at 2290 Zuchongzhi Road, Zhangjiang Hi-tech Park, Pudong New Area, Shanghai, People’s Republic of China (“Sandhill Plaza”) by MGCCT. A conditional sale and purchase agreement (the “SPA”) has today been entered into with MSREF VII LEAPHART BV, being an unrelated third party vendor. Pursuant to the SPA, MGCCT will acquire 100.0% interest in Glamour II Limited (an entity incorporated in the Cayman Islands), which holds 100.0% interest in China Orient Limited (an entity incorporated in Hong Kong), which in turns holds 100.0% interest in Shanghai Zhan Xiang Real Estate Company Limited (an entity incorporated in the People’s Republic of China), the registered owner of Sandhill Plaza. The purchase consideration for the acquisition is RMB1,888.1 million (or approximately S$412.2 million1) ("Purchase Consideration") which comprises the property purchase price of RMB1,840.3 million (or approximately S$401.8 million) for Sandhill Plaza and the estimated working capital adjustments 2 attributable to the entities being acquired in connection with the acquisition (the “Acquisition”). Ms Cindy Chow, Chief Executive Officer of the Manager, said, “We are pleased to announce our first acquisition since listing, with the purchase of Sandhill Plaza – a premium quality business park located in Zhangjiang Hi-tech Park in Shanghai. -

{PDF} Shanghai Architecture Ebook, Epub

SHANGHAI ARCHITECTURE PDF, EPUB, EBOOK Anne Warr | 340 pages | 01 Feb 2008 | Watermark Press | 9780949284761 | English | Balmain, NSW, Australia Shanghai architecture: the old and the new | Insight Guides Blog Retrieved 16 July Government of Shanghai. Archived from the original on 5 March Retrieved 10 November Archived from the original on 27 January Archived from the original on 26 May Retrieved 5 August Basic Facts. Shanghai Municipal People's Government. Archived from the original on 3 October Retrieved 19 July Demographia World Urban Areas. Louis: Demographia. Archived PDF from the original on 3 May Retrieved 15 June Shanghai Municipal Statistics Bureau. Archived from the original on 24 March Retrieved 24 March Archived from the original on 9 December Retrieved 8 December Global Data Lab China. Retrieved 9 April Retrieved 27 September Long Finance. Retrieved 8 October Top Universities. Retrieved 29 September Archived from the original on 29 September Archived from the original on 16 April Retrieved 11 January Xinmin Evening News in Chinese. Archived from the original on 5 September Retrieved 12 January Archived from the original on 2 October Retrieved 2 October Topographies of Japanese Modernism. Columbia University Press. Daily Press. Archived from the original on 28 September Retrieved 29 July Archived from the original on 30 August Retrieved 4 July Retrieved 24 November Archived from the original on 16 June Retrieved 26 April Archived from the original on 1 October Retrieved 1 October Archived from the original on 11 September Volume 1. South China Morning Post. Archived from the original on 6 May Retrieved 2 May Office of Shanghai Chronicles. -

Precast Concrete Segmental Liners for Large Diameter Road Tunnels

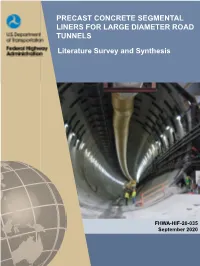

PRECAST CONCRETE SEGMENTAL LINERS FOR LARGE DIAMETER ROAD TUNNELS Literature Survey and Synthesis FHWA-HIF-20-035 September 2020 Precast Concrete Segmental Liners Large Diameter Road Tunnels – Literature Survey and Synthesis Technical Report Documentation Page 1. Report No. 2. Government Accession No. 3. Recipient’s Catalog No. FHWA-HIF-20-035 4. Title and Subtitle 5. Report Date September, 2020 Precast Concrete Segmental Liners for Large Diameter 6. Performing Organization Code Road Tunnels – Literature Survey and Synthesis 7. Principal Investigator(s): 8. Performing Organization Report William Bergeson, PE (FHWA), John Wisniewski, PE (WSP), Sotirios Vardakos, PhD, (WSP), Michael Mooney, PhD, PE (Colorado School of Mines), Axel Nitschke, PhD, PE (WSP) 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) WSP USA, Inc. One East Pratt Street 11. Contract or Grant No. Suite 300 DTFH6114D00048 Baltimore, MD 21202 12. Sponsoring Agency Name and Address 13. Type of Report and Period Covered Final Report Federal Highway Administration 09, 2018 – 09, 2020 U.S. Department of Transportation 14. Sponsoring Agency Code 1200 New Jersey Avenue, SE DOT/FHWA/HIF Washington, DC 20590 15. Supplementary Notes Cover photo: SR 99 Tunnel, Seattle, Washington. Photo: John Wisniewski. 16. Abstract Increased roadway traffic demands have led to a notable increase of large diameter tunnel boring machine-driven tunnels across the world. The technological advancements of tunnel boring machines have made them a viable technical option for tunneling in difficult conditions in urban environments at ever increasing diameters. Such tunnels utilize precast concrete segmental linings. Although precast concrete segments have been widely used and designed in the US since the mid-1970s, the significant increase in diameter demands brings about new challenges in design and construction. -

Spatiotemporal Dynamics of Urban Green Space Influenced by Rapid

Article Spatiotemporal Dynamics of Urban Green Space Influenced by Rapid Urbanization and Land Use Policies in Shanghai Song Liu 1, Xinsu Zhang 1, Yongjiu Feng 2,*, Huan Xie 2, Li Jiang 1 and Zhenkun Lei 2 1 College of Architecture and Urban Planning, Tongji University, Shanghai 200082, China; [email protected] (S.L.); [email protected] (X.Z.); [email protected] (L.J.) 2 College of Surveying and Geo-Informatics, Tongji University, Shanghai 200082, China; [email protected] (H.X.); [email protected] (Z.L.) * Correspondence: [email protected] Abstract: Urbanization has led to the continuous expansion of built-up areas and the ever-growing urban population, threatening the quantity and quality of urban green space (UGS). Exploring the spatiotemporal variations of UGS is substantially conducive to the formulation of land-use policies to protect the ecosystems. As one of the largest megacities all around the world, Shanghai has experienced rapid urbanization in the past three decades. Insights into how UGS changes in response to urbanization and greening policies are essential for guiding sustainable urban development. This paper employed integrated approaches to characterize the changing patterns and intensities of green space in Shanghai, China from 1990 to 2015. The spatiotemporal dynamics of the UGS pattern were derived through four main methods: green space ratio, dynamic change degree (DCD), transition matrix and landscape metrics. The results showed that Shanghai’s green space decreased from 84.8% in 1990 to 61.9% in 2015 while the built-up areas increased from 15.0% to 36.5%. -

Report on the Investment Environment of Changning District, Shanghai

Report on the Investment Environment of Changning District, Shanghai 上海长宁_en.indd 1 2015/11/16 9:41:31 Map of China Geographical Location of Shanghai Changning District Shanghai Yangzhou Zhenjiang Nantong Map of the Yangtze River Delta region Nanjing Chongming Island Changzhou Yangzhou Zhenjiang Nantong Nanjing Changzhou Wuxi Shanghai Yangtze River Bridge Wuxi Suzhou Shanghai Shanghai Changning Waigaoqiao Pot Huzhou District Jiaxing Suzhou Shanghai Hangzhou Zhoushan Shanghai Pudong International Airport Shaoxing Ningbo Hongqiao Airport Tai Lake Hongqiao Transport Hub Donghai Bridge Huzhou Jiaxing Yangshan Port Legend Provincial Capital Major Cities Hangzhou Bay Sea-Crossing Bridge Railway Station Airport 銭塘江 Port Wharf Boundaries of Province, Hangzhou autonomous region and municipalities Hangzhou Xiaoshan Zhoushan Expressway International Airport Railway Fresh water lake, salt water lake Shaoxing Ningbo 上海长宁_en.indd 2 2015/11/16 9:41:32 Map of China Geographical Location of Shanghai Changning District Shanghai Yangzhou Zhenjiang Nantong Map of the Yangtze River Delta region Nanjing Chongming Island Changzhou Yangzhou Zhenjiang Nantong Nanjing Changzhou Wuxi Shanghai Yangtze River Bridge Wuxi Suzhou Shanghai Shanghai Changning Waigaoqiao Pot Huzhou District Jiaxing Suzhou Shanghai Hangzhou Zhoushan Shanghai Pudong International Airport Shaoxing Ningbo Hongqiao Airport Tai Lake Hongqiao Transport Hub Donghai Bridge Huzhou Jiaxing Yangshan Port Legend Provincial Capital Major Cities Hangzhou Bay Sea-Crossing Bridge Railway Station Airport -

2019-Shanghai Basic Facts

SHANGHAI BASIC FACTS 2019 Editorial Board Adviser: Zhou Huilin, Zhu Yonglei Editors-in-Chief: Xu Wei, Zhou Ya, Tang Huihao Deputy Editors-in-Chief: Yin Xin, Chen Yongqi, Qian Fei Editor: Cao Meifang SHANGHAI BASIC FACTS 2019 Compiled by: Information Office of Shanghai Municipality Shanghai Municipal Statistics Bureau ZHONGXI BOOK COMPANY SHANGHAI Located at the estuary of the Yangtze River in eastern China and facing the Pacific Ocean, Shanghai sprawls across an area of over 6,340.5 square kilometers with a population of 24.2378 million in 2018. Shanghai is China’s most thriving economic center, with GDP per capita climbing to US$20,398 by the end of 2018. Shanghai is a pioneer in China’s reform and opening- up, as well as innovation. A total of 670 multinational enterprises have set up regional headquarters in the city, and 441 foreign- invested R&D centers have also been established here. Shanghai is one of the world’s financial centers with its financial markets generating a total transaction volume of 1,645.78 trillion yuan and trading volumes of several products ranked top among global markets. An RMB products center, which matches the currency’s international status, has taken form in the city. Shanghai is an important shipping center, handling 730.4794 million tons of goods in 2018. On top of that, its international container volume reached 42.0102 million TEUs, the highest in the world for nine straight years. When it comes to the number of cruise ship passengers, the city ranked fourth in the world. Some 771,600 flights were processed at Shanghai Pudong and Hongqiao international airports, reaching 117.6343 million inbound and outbound trips. -

Mobility for Development

Mobility for development Shanghai I China Disclaimer The Case study is prepared for the background information for a Stakeholder Dialogue, on behalf of the Mobility for Development (M4D) Project at the World Business Council for Sustainable Development (WBCSD). The objectives of this study are to assess the mobility challenges, opportunities and experience in Shanghai with reference to Yangtze Delta Region. We hope this report can make some contribution on knowledge exchange in the development of sustainable mobility for the whole society in the world. Mobility for development Shanghai I China Professor Pan Haixiao, Dr. Zhuo Jian and Dr. Liu Bing Department of Urban Planning, Tongji University Mobility for Development -Shanghai Case Study This case study has been prepared for the World Business Council for Sustainable Development (WBCSD) by the Department of Urban Planning, Tongji University. Project team Professor Pan Haixiao, Project Leader, [email protected] Dr. Zhuo Jian, Associate Professor, Project Researcher Dr. Liu Bing, Associate Professor, Project Researcher Ms. Xu Xiaomin, Project Assistant Mr. Liu Weiwei, Project Assistant Mr. Xue Song, Project Assistant Mr. Wang Xiaobo, Project Assistant Mr. Chen Ye, Project Assistant Acknowledgements The authors are indebted to and acknowledge Shona Grant and Dr. George Eads and are grateful for their thoughtful and patient advice during formulation of this case study. 2 Mobility for Development -Shanghai Case Study CONTENTS Executive summary ________________________________________________________