TCL MULTIMEDIA TECHNOLOGY HOLDINGS LIMITED TCL 多媒體科技控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 01070)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

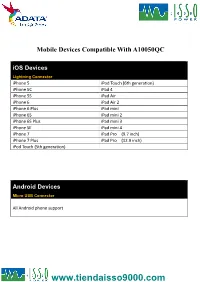

Android Devices

Mobile Devices Compatible With A10050QC iOS Devices Lightning Connector iPhone 5 iPod Touch (6th generation) iPhone 5C iPad 4 iPhone 5S iPad Air iPhone 6 iPad Air 2 iPhone 6 Plus iPad mini iPhone 6S iPad mini 2 iPhone 6S Plus iPad mini 3 iPhone SE iPad mini 4 iPhone 7 iPad Pro (9.7 inch) iPhone 7 Plus iPad Pro (12.9 inch) iPod Touch (5th generation) Android Devices Micro USB Connector All Android phone support Smartphone With Quick Charge 3.0 Technology Type-C Connector Asus ZenFone 3 LG V20 TCL Idol 4S Asus ZenFone 3 Deluxe NuAns NEO VIVO Xplay6 Asus ZenFone 3 Ultra Nubia Z11 Max Wiley Fox Swift 2 Alcatel Idol 4 Nubia Z11miniS Xiaomi Mi 5 Alcatel Idol 4S Nubia Z11 Xiaomi Mi 5s General Mobile GM5+ Qiku Q5 Xiaomi Mi 5s Plus HP Elite x3 Qiku Q5 Plus Xiaomi Mi Note 2 LeEco Le MAX 2 Smartisan M1 Xiaomi MIX LeEco (LeTV) Le MAX Pro Smartisan M1L ZTE Axon 7 Max LeEco Le Pro 3 Sony Xperia XZ ZTE Axon 7 Lenovo ZUK Z2 Pro TCL Idol 4-Pro Smartphone With Quick Charge 3.0 Technology Micro USB Connector HTC One A9 Vodafone Smart platinum 7 Qiku N45 Wiley Fox Swift Sugar F7 Xiaomi Mi Max Compatible With Quick Charge 3.0 Technology Micro USB Connector Asus Zenfone 2 New Moto X by Motorola Sony Xperia Z4 BlackBerry Priv Nextbit Robin Sony Xperia Z4 Tablet Disney Mobile on docomo Panasonic CM-1 Sony Xperia Z5 Droid Turbo by Motorola Ramos Mos1 Sony Xperia Z5 Compact Eben 8848 Samsung Galaxy A8 Sony Xperia Z5 Premium (KDDI Japan) EE 4GEE WiFi (MiFi) Samsung Galaxy Note 4 Vertu Signature Touch Fujitsu Arrows Samsung Galaxy Note 5 Vestel Venus V3 5070 Fujitsu -

Home Appliance Cautious Buy

Sector Research | China Home Appliance THIS IS THE TRANSLATION OF A REPORT ORIGINALLY PUBLISHED IN CHINESE BY GUOSEN SECURITIES CO., LTD ON SEPTEMBER 24, 2012 October 16, 2012 Home Appliance Cautious Buy Cherry pick home-appliance names amid the price corrections Investment highlights Analyst Wang Nianchun We expect home-appliance y-o-y sales volume growth to rebound moderately +755-82130407 in 4Q 2012. Based on our channel checks and data already released for Jul-Aug [email protected] S0980510120027 2012, 3Q sales volume of various sub-sectors was in line with expectations, and the profitability of the TV sub-sector slightly beat expectations. The subsidies for energy efficient home-appliance products introduced in June are unlikely to materially boost sales until three to six months after their launch. We expect the 4Q y-o-y sales Sales Contact volume growth of air conditioners, refrigerators, washing machines and LCD TVs will be 7.5%, 5.8%, 5.0% and 0.8% respectively, representing a modest rebound from the Roger Chiman Managing Director first three quarters. +852 2248 3598 [email protected] Divergence within the sector intensifies, and we suggest waiting for buying Chris Berney opportunities amid price pullbacks. The overall industry sentiment has been tepid Managing Director +852 2248 3568 since the beginning of 2012, but product-mix upgrade and lower material costs could lead [email protected] to an improvement in profitability this year. Based on our estimates, subsidy policies for Andrew Collier energy efficient home-appliance products will have more significant effects in 2013 than Director +852 2248 3528 this year. -

China Equity Strategy

June 5, 2019 09:40 AM GMT MORGAN STANLEY ASIA LIMITED+ China Equity Strategy | Asia Pacific Jonathan F Garner EQUITY STRATEGIST [email protected] +852 2848-7288 The Rubio "Equitable Act" - Our Laura Wang EQUITY STRATEGIST [email protected] +852 2848-6853 First Thoughts Corey Ng, CFA EQUITY STRATEGIST [email protected] +852 2848-5523 Fran Chen, CFA A new bill sponsored by US Senator Marco Rubio has the EQUITY STRATEGIST potential to cause significant change in the listing domains of [email protected] +852 2848-7135 Chinese firms. After the market close in the US yesterday 4th June the Wall Street Journal published an Op-Ed by US Senator Marco Rubio in which he announced that he intends to sponsor the “Equitable Act” – an acronym for Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges. At this time the text of the bill has not been published and we are seeking additional information about its contents and likelihood of passing. However, our early reaction is that this has the potential to cause significant changes in the domain for listings of Chinese firms going forward with the potential for de- listing of Chinese firms on US exchanges and re-listing elsewhere (most likely Hong Kong). More generally we see this development as part of an increased escalation of tensions between China and the US on multiple fronts which should cap the valuation multiple for China equities, in particular in the offshore index constituents and US-listed parts of the universe. We provide a list of the potentially impacted China / HK names with either primary or secondary listings on Amex, NYSE or Nasdaq. -

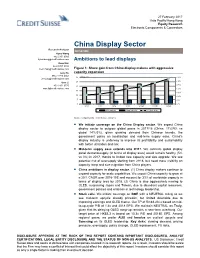

China Display Sector

27 February 2017 Asia Pacific/Hong Kong Equity Research Electronic Components & Connectors China Display Sector Research Analysts INITIATION Kyna Wong 852 2101 6950 [email protected] Ambitions to lead displays Keon Han 82 2 3707 3740 [email protected] Figure 1: Share gain from China display makers with aggressive Jerry Su capacity expansion 886 2 2715 6361 30 (M sq. m) 35% [email protected] 30% Sam Li 25 25% 852 2101 6775 20 [email protected] 20% 15 15% 10 10% 5 5% 0 0% 2012 2013 2014 2015 2016E 2017E 2018E WW capacity China capacity % China share Source: Company data, Credit Suisse estimates ■ We initiate coverage on the China Display sector. We expect China display sector to outgrow global peers in 2017/18 (China: 17%/9% vs global 14%/3%), given growing demand from Chinese brands, the government policy on localisation and mid-term supply ease. China's display industry is underway to improve its profitability and sustainability with better utilisation and mix. ■ Mid-term supply ease extends into 2H17. We estimate global display panel demand-supply (in terms of display area) would remain healthy (5% vs 3%) in 2017, thanks to limited new capacity and size upgrade. We see potential risk of oversupply starting from 2H18, but need more visibility on capacity ramp and size migration from China players. ■ China ambitions in display sector. (1) China display makers continue to expand capacity for scale capabilities. We expect China capacity to grow at a 25% CAGR over 2016-18E and account for 33% of worldwide capacity in terms of display area by 2018. -

Haier Electronics

The role of the Belt and Road Initiative on Chinese multinational enterprise strategy: a multiple case study A Master Thesis Presented to the Faculty of Economics and Business by Justin Brandsma S2734818 Supervisor: H.U. Haq Co-assessor: J.R. de Wit WC: 16484 June 2020 Groningen, The Netherlands The role of the BRI on Chinese MNE strategy 2 The role of the BRI on Chinese MNE strategy Foreword In front of you lies my master thesis on: “the Role of the Belt and Road Initiative on Chinese multinational strategy: a multiple case study“, written as part of the master’s degree in International Business and Management at the University of Groningen. I consider this thesis to be the culmination of 6 beautiful student years in the even more beautiful city of Groningen, a wonderful period of my life! My choice for this thesis topic dates back to my late middle-school and early high-school years where I developed a big interest in the ancient Greek history and mythology. Especially the tales of Alexander the Great who managed to expand the Macedonian empire all the way to northeast India were intriguing to me. This Greek venture East in 334BC led to the establishment of the earliest version of a trade route between Constantinople (Turkey) and Xi’an (China), known as the Silkroad. 1600 years later Marco Polo would travel this route from Venice to China and work as the personal advisor of the Mongolian ruler: Kublai Khan. The accumulation of his experiences and adventures in the East came together in the brilliant travel memoire written by Rusticello da Pisa named ‘il Milione’ or commonly known as the ‘the travels of Marco Polo’. -

1 the Last Four Digits of the Debtor's Federal Tax Identification Number Are 8972. the Debtor's Mailing Address Is 91 Margue

1 Richard M. Pachulski (CA Bar No. 90073) Jeffrey W. Dulberg (CA Bar No. 181200) 2 Mahar S. Pagay (CA Bar No. 189289) PACHULSKI STANG ZIEHL & JONES LLP 3 10100 Santa Monica Blvd., 13th Floor Los Angeles, California 90067 4 Telephone: 310-277-6910 Facsimile: 310-201-0760 5 Email: [email protected] [email protected] 6 [email protected] 7 Counsel for Debtor and Debtor in Possession 8 Suzzanne Uhland (CA Bar No. 136852) Diana M. Perez (NY Bar No. 4636403) 9 O’MELVENY & MYERS LLP Times Square Tower 10 7 Times Square New York, New York 10036 11 Telephone: 212-326-2000 Facsimile: 212-326-2061 12 Email: [email protected] [email protected] 13 Special Corporate, Litigation, and International 14 Counsel for Debtor and Debtor in Possession 15 UNITED STATES BANKRUPTCY COURT CENTRAL DISTRICT OF CALIFORNIA 16 LOS ANGELES DIVISION 17 In re: 18 Case No. 2:19-bk-24804-VZ YUETING JIA,1 19 Chapter 11 Debtor. 20 FOURTH AMENDED DISCLOSURE STATEMENT WITH RESPECT TO 21 DEBTOR’S THIRD AMENDED PLAN OF REORGANIZATION UNDER CHAPTER 22 11 OF THE BANKRUPTCY CODE 23 Confirmation Hearing Date: May 21, 2020 24 Time: 9:30 a.m. (Pacific Time) Place: Courtroom 1368 25 Roybal Federal Building 255 E. Temple Street 26 Los Angeles, California 90012 Judge: Hon. Vincent P. Zurzolo 27 1 The last four digits of the Debtor’s federal tax identification number are 8972. The Debtor’s mailing address is 91 28 Marguerite Drive, Rancho Palos Verdes, CA 90275. 1 IMPORTANT INFORMATION FOR YOU TO READ 2 THE DEADLINE TO VOTE ON THE DEBTOR’S THIRD AMENDED PLAN OF 3 REORGANIZATION UNDER CHAPTER 11 OF THE BANKRUPTCY CODE (AS MAY 4 BE AMENDED OR MODIFIED, THE “PLAN”) IS APRIL 30, 2020 AT 4:00 P.M. -

Phase Exhibitior Section Stand Number 1 SASSIN INTERNATIONAL ELECTRIC SHANGHAI CO.,LTD

VIP Exhibitors of the 114th Session of Canton Fair Phase Exhibitior Section Stand Number 1 SASSIN INTERNATIONAL ELECTRIC SHANGHAI CO.,LTD. Electronic and Electrical Products 5.1A09-22 1 SICHUAN JIUZHOU ELECTRIC GROUP CO., LTD. Consumer Electronics 11.3C35-46 1 Guangzhou Midea Hualing Refrigerator Co., Ltd. Household Electrical Appliances 3.2A77-92 1 GREE ELECTRIC APPLIANCES,INC.OF ZHUHAI Household Electrical Appliances 4.2A51-78 1 MIDEA GROUP CO.,LTD. Household Electrical Appliances 3.2A09-60 1 HAIER GROUP Household Electrical Appliances 3.2B01-54 1 GUANGDONG XINBAO APPLIANCES HOLDINGS CO.,LTD. Household Electrical Appliances 4.2F31-47 1 NO.168 HUANCHENG EAST RD.ZHOUXIANG CIXI,NINGBO P.R.C. Household Electrical Appliances 4.2F19-30 1 NINGBO AUX IMP.& EXP CO.,LTD. Household Electrical Appliances 4.2D13-46 1 XINGXING GROUP CO.,LTD Household Electrical Appliances 4.2I07-21 1 TCL CORPORATION Household Electrical Appliances 3.2G41-60 1 GUANGDONG GALANZ ENTERPRISE CO., LTD. Household Electrical Appliances 4.2A06-45 1 Guangzhou Wanbao Group Co.,Ltd. Household Electrical Appliances 3.2E50-67 1 GUANGDONG CHIGO AIR CONDITIONING CO.LTD Household Electrical Appliances 4.2D51-71 1 Homa Appliances Co., Ltd Household Electrical Appliances 3.2C01-12 1 NINGBO KAIBO GROUP CO.,LTD. Household Electrical Appliances 2.2D37-42,2.2E07-12 1 NINGBO XINLE HOUSEHOLD APPLIANCES CO., LTD. Household Electrical Appliances 3.2C85-96 1 SICHUAN CHANGHONG ELECTRIC CO.,LTD. Household Electrical Appliances 3.2E20-35 1 NINGBO LAMO ELECTRIC APPLIANCE CO.,LTD. Household Electrical Appliances 3.2G29-40 1 HEFEI MEILING COMPANY LIMITED Household Electrical Appliances 3.2E36-49 1 CUORI ELECTRICAL APPLICANAES GROUP CO.,LTD. -

Hisense Kelon Electrical Holdings Company Limited 海信科龍電器股份有限公司

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. HISENSE KELON ELECTRICAL HOLDINGS COMPANY LIMITED 海信科龍電器股份有限公司 (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 00921) DISCLOSEABLE TRANSACTIONS SUBSCRIPTION OF WEALTH MANAGEMENT PRODUCTS Reference is made to the announcements of the Company dated 1 September 2016 and 7 September 2016 in respect of the August Wealth Management Agreement, the First September Wealth Management Agreement and the Second September Wealth Management Agreement, pursuant to which Hisense Refrigerator (as subscriber) subscribed for the wealth management products in the aggregate subscription amount of RMB900,000,000 (equivalent to approximately HK$1,045,504,145Note 1) from the Agricultural Bank of China (as issuer). The Board is pleased to announce that apart from the August Wealth Management Agreement, the First September Wealth Management Agreement and the Second September Wealth Management Agreement, on 26 September 2016, Hisense Refrigerator entered into the Third September Wealth Management Agreement with the Agricultural Bank of China to subscribe for the 75-day Wealth Management Product in the subscription amount of RMB200,000,000 (equivalent to approximately HK$232,660,943Note 2). The Third September Wealth Management Agreement by itself does not constitute discloseable transaction of the Company under Rule 14.06 of the Listing Rules. -

Charles Zhang

In a little over 35 years China’s economy has been transformed Week in China from an inefficient backwater to the second largest in the world. If you want to understand how that happened, you need to understand the people who helped reshape the Chinese business landscape. china’s tycoons China’s Tycoons is a book about highly successful Chinese profiles of entrepreneurs. In 150 easy-to- digest profiles, we tell their stories: where they came from, how they started, the big break that earned them their first millions, and why they came to dominate their industries and make billions. These are tales of entrepreneurship, risk-taking and hard work that differ greatly from anything you’ll top business have read before. 150 leaders fourth Edition Week in China “THIS IS STILL THE ASIAN CENTURY AND CHINA IS STILL THE KEY PLAYER.” Peter Wong – Deputy Chairman and Chief Executive, Asia-Pacific, HSBC Does your bank really understand China Growth? With over 150 years of on-the-ground experience, HSBC has the depth of knowledge and expertise to help your business realise the opportunity. Tap into China’s potential at www.hsbc.com/rmb Issued by HSBC Holdings plc. Cyan 611469_6006571 HSBC 280.00 x 170.00 mm Magenta Yellow HSBC RMB Press Ads 280.00 x 170.00 mm Black xpath_unresolved Tom Fryer 16/06/2016 18:41 [email protected] ${Market} ${Revision Number} 0 Title Page.qxp_Layout 1 13/9/16 6:36 pm Page 1 china’s tycoons profiles of 150top business leaders fourth Edition Week in China 0 Welcome Note.FIN.qxp_Layout 1 13/9/16 3:10 pm Page 2 Week in China China’s Tycoons Foreword By Stuart Gulliver, Group Chief Executive, HSBC Holdings alking around the streets of Chengdu on a balmy evening in the mid-1980s, it quickly became apparent that the people of this city had an energy and drive Wthat jarred with the West’s perception of work and life in China. -

HR Kompatibilitätsübersicht

Kompatibilitätsübersicht HR-imotion HR-imotion Kompatibilität/Compatibility 2017 / 03 Gerätetyp Telefon 22410001 23010201 22110001 23010001 23010101 22010401 22010501 22010301 22010201 22110101 22010701 22011101 22010101 22210101 22210001 23510101 23010501 23010601 23010701 23510320 22610001 23510420 Smartphone Acer Liquid Zest Plus Smartphone AEG Voxtel M250 Smartphone Alcatel A3 Smartphone Alcatel A3 XL Smartphone Alcatel A5 LED Smartphone Alcatel Idol 4S Smartphone Alcatel U5 Smartphone Allview X3 Soul Smartphone Apple iPhone Smartphone Apple iPhone 3G / 3GS Smartphone Apple iPhone 4 / 4S Smartphone Apple iPhone 5 / 5S Smartphone Apple iPhone 5C Smartphone Apple iPhone 6 / 6S Smartphone Apple iPhone 6 Plus / 6S Plus Smartphone Apple iPhone 7 Smartphone Apple iPhone 7 Plus Smartphone Apple iPhone SE Smartphone Archos 50 Saphir Smartphone Archos Diamond 2 Plus Smartphone Asus ZenFone 3 Smartphone Asus ZenFone 3 Deluxe Smartphone Asus ZenFone 3 Zoom Smartphone Asus ZenFone AR Smartphone BlackBerry Classic Smartphone Blackberry DTEK 50 Smartphone Blackberry KEYOne Smartphone BlackBerry Passport Smartphone BlackBerry Priv Smartphone BlackBerry Z30 Smartphone BQ Aquaris X5 Smartphone BQ Aquaris X5 Plus Smartphone CAT B15 Smartphone Cubot P11 Smartphone Cubot S500 Smartphone Elephone P8000 Smartphone Emporia Pure Smartphone Gigaset GS160 Smartphone Gigaset ME Smartphone Gigaset ME Pro Smartphone Gigaset ME Pure Smartphone Google Nexus 5 Smartphone Google Nexus 5X Smartphone Google Nexus 6 Smartphone Google Nexus 6P Smartphone Google Pixel -

Brand Old Device

# New Device Old Device - Brand Old Device - Model Name 1 Galaxy A6+ Asus Asus Zenfone 2 Laser ZE500KL 2 Galaxy A6+ Asus Asus Zenfone 2 Laser ZE601KL 3 Galaxy A6+ Asus Asus ZenFone 2 ZE550ML 4 Galaxy A6+ Asus Asus Zenfone 2 ZE551ML 5 Galaxy A6+ Asus Asus Zenfone 3 Laser 6 Galaxy A6+ Asus Asus Zenfone 3 Max ZC520TL 7 Galaxy A6+ Asus Asus Zenfone 3 Max ZC553KL 8 Galaxy A6+ Asus Asus Zenfone 3 ZE520KL 9 Galaxy A6+ Asus Asus Zenfone 3 ZE552KL 10 Galaxy A6+ Asus Asus Zenfone 3s Max 11 Galaxy A6+ Asus Asus Zenfone Max 12 Galaxy A6+ Asus Asus Zenfone Selfie 13 Galaxy A6+ Asus Asus ZenFone Zoom ZX550 14 Galaxy A6+ Gionee Gionee A1 15 Galaxy A6+ Gionee Gionee A1 Lite 16 Galaxy A6+ Gionee Gionee A1 Plus 17 Galaxy A6+ Gionee Gionee Elife E8 18 Galaxy A6+ Gionee Gionee Elife S Plus 19 Galaxy A6+ Gionee Gionee Elife S7 20 Galaxy A6+ Gionee Gionee F103 21 Galaxy A6+ Gionee Gionee F103 Pro 22 Galaxy A6+ Gionee Gionee Marathon M4 23 Galaxy A6+ Gionee Gionee Marathon M5 24 Galaxy A6+ Gionee Gionee marathon M5 Lite 25 Galaxy A6+ Gionee Gionee Marathon M5 Plus 26 Galaxy A6+ Gionee Gionee P5L 27 Galaxy A6+ Gionee Gionee P7 Max 28 Galaxy A6+ Gionee Gionee S6 29 Galaxy A6+ Gionee Gionee S6 Pro 30 Galaxy A6+ Gionee Gionee S6s 31 Galaxy A6+ Gionee Gionee X1s 32 Galaxy A6+ Google Google Pixel 33 Galaxy A6+ Google Google Pixel XL LTE 34 Galaxy A6+ Google Nexus 5X 35 Galaxy A6+ Google Nexus 6 36 Galaxy A6+ Google Nexus 6P 37 Galaxy A6+ HTC Htc 10 38 Galaxy A6+ HTC Htc Desire 10 Pro 39 Galaxy A6+ HTC Htc Desire 628 40 Galaxy A6+ HTC HTC Desire 630 41 Galaxy A6+ -

Coolpad's Half-Year Revenue Reaches Around HK$5.28 Billion

[Press Release] Coolpad’s Half-year Revenue Reaches around HK$5.28 Billion * * * Enriches Mobile Content and Internet Experience through Business Integration with LeEco Aims to Become an Internet+Hardware Ecosystem Enterprise (Hong Kong, 30 August 2016) – Coolpad Group Limited (“Coolpad” or the “Group”) (stock code: 2369.HK), China’s leading provider of smartphones and integrated wireless data solutions, announced today its unaudited interim results for the six months ended 30 June 2016. During the period, the Group recorded revenue of approximately HK$5.28 billion, gross profit of approximately HK$705 million and overall gross profit margin at 13.5%, up 0.8 percentage point against the same period last year. The growth was attributable to the lower costs and higher selling prices of 4G smartphones. Net loss attributable to owners of the Company was approximately HK$2.05 billion. It was mainly due the Group making a HK$2.66 billion gain in the first half of 2015 from disposal of part of its equity interest in a subsidiary of the Group, Coolpad E-commerce, while in the period under review a loss of HK$1.89 billion was incurred by the Group from the disposal of certain equity interest in Coolpad E-commerce. Basic and diluted loss per share were HK40.90 cents and HK40.90 cents respectively. Mr. Jia Yueting, Chairman of Coolpad, said, “I am honored to be a member of the Coolpad management team. As an outstanding smartphone supplier, Coolpad boasts strong capabilities in research and development and supply chain management and a prominent brand reputation.