Dispatch of Bidder's Statement to Mrn Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Your Prime Time Tv Guide ABC (Ch2) SEVEN (Ch6) NINE (Ch5) WIN (Ch8) SBS (Ch3) 6Pm the Drum

tv guide PAGE 2 FOR DIGITAL CHOICE> your prime time tv guide ABC (CH2) SEVEN (CH6) NINE (CH5) WIN (CH8) SBS (CH3) 6pm The Drum. 6pm Seven Local News. 6pm Nine News. 6pm News. 6pm Mastermind Australia. 7.00 ABC News. 6.30 Seven News. 7.00 A Current Affair. 6.30 The Project. 6.30 SBS World News. Y 7.30 Inside Dame 7.00 Better Homes And Gardens. 7.30 Rugby League. NRL. Round 13. 7.30 The Living Room. (PG) 7.30 Belsen: The Untold Story. A Elisabeth’s Garden. 8.30 MOVIE Raising Helen. South Sydney Rabbitohs v 8.30 Have You Been Paying (M) The story of Bergen-Belsen D I 8.30 MotherFatherSon. (MA15+) (2004) (PG) Kate Hudson, Abigail Brisbane Broncos. Attention? (M) concentration camp. Kathryn dedicates herself to her Breslin. A woman cares for her late 9.45 Friday Night Knock Off. 9.30 To Be Advised. 8.30 Walt Disney. (PG) Part 2 of 2. FR son’s recovery. sister’s children. 10.35 MOVIE Homefront. (2013) 10.00 Celebrity Continues to explore the life and 9.30 Marcella. (M) 10.50 To Be Advised. (MA15+) Jason Statham. A former Gogglebox USA. (M) legacy of Walt Disney. 10.20 ABC Late News. DEA agent battles a drug lord. 11.00 WIN News. 10.35 SBS World News Late. 7pm ABC News. 6pm Seven News. 6pm Nine News Saturday. 6pm Bondi Rescue. (PG) 6.30pm SBS World News. Y 7.30 Father Brown. (PG) A choir 7.00 AFL Pre-Game Show. Pre-game 7.00 A Current Affair. -

MEDIA RELEASE 8 May 2019 PERTH NINJA WARRIOR PREPARING TO

MEDIA RELEASE 8 May 2019 PERTH NINJA WARRIOR PREPARING TO STEP UP FOR MSWA Ninja Warrior and local firefighter Alex Matthews is preparing to put his special skills to the test when he takes part in the Shadforth Financial Group Step Up for MSWA, racing to the top of Central Park in the Perth CBD on Sunday, 30 June. 2019 marks the 12th annual Step Up for MSWA. The event sees a broad range of participants – from professional athletes and protective services personnel, to office workers and families – who make the climb up Central Park’s 1,103 stairs (53 flights) to raise funds for people living with MS and all neurological conditions in WA. In preparation for Step Up for MSWA, Alex and other registered participants will take part in an exciting training session at Perth’s own Ninja Academy, in Osborne Park – home to Australia’s most extensive Ninja Warrior-style obstacle course. Alex, a qualified aviation firefighter based at Perth Airport, is competing in the Extreme Firefighter Challenge category of the event and said he would be taking full advantage of the Ninja Academy training session. In the first series of Channel Nine’s Australian Ninja Warrior Alex smashed the gruelling course in six minutes and six seconds. He said that in 2019, he planned to work just as hard when tackling Step Up for MSWA in aid of a very worthy cause. “The reward and exhilaration of climbing 1,103 steps to the top of Central Park, whilst knowing you have helped make a difference to thousands of Western Australians living with MS and all neurological conditions, is incredible,” Alex said. -

Surging Secondary Market Spurs on Organics Maaking Farms Smaarter

Australian Fruitgrower Summer 2019 • Vol 13 • Issue 4 BMSB: Global spread calls for extra vigilance this season Water budgeting and scheduling Variety performance is key to profitability Surging secondary market spurs on organics Maaking farms smaarter. Tie Up Farming is an end-to-end software solution designed for the horticultural industry. UsingUi a full fll suite i of f modules, dl ourr--cloudldbdf based farm management softwaref can he help with planning, management, forecasting and budgeting of harvests, from planting to packing. > Horticulture focused > Costing + ROI > Chemical fertiliser management > Packing shed managemennt (Spray Diaryy)) > Smart dashboard - 360 ananalytics > Labour management (including harvestt)) Call us on 1300 944 318 or email us at [email protected] www.tieupfarming.com CONTENTS A P A L NEWS BIOSECURITY CEO Report ...............................................04 News – $18.6m for Vic/SA netting funding . .05 FEA TURE 12 06 BMSB: Global spread of exotic stink bug calls for extra vigilance Surging secondary this season market spurs on organics Learning from the US BMSB experience . .16 S T A T E R O UNDUP RAISING T H E BAR : R&D - LED INSIGH T S I N T O S M A R TER GROW T H State roundups . .19 FUTURE BUSINE S S Minimising the cost of doing business . .24 33 EXPORT Codling moth biocontrol with Mastrus ridens 26 Integrated pest management – steps forward . 37 Sentinel a step towards national pest surveillance . .38 Agtech drives pesticide use efficiencies . .40 Australian pears Water budget the basis for irrigation scheduling plan . .41 show promise in Finding the triggers of biennial bearing in apple . -

Nine Wins All Key Demos for 2019

NINE WINS ALL KEY DEMOS FOR 2019 • No. 1 Network All Key Demographics • No. 1 Network Total People • No. 1 Primary Channel All Key Demographics and Total People • No. 1 Commercial Free-to-air BVOD: 9Now • No. 1 Overall Program: State of Origin Game 1 • No. 1 Overall Regular Program: Married at First Sight • No. 1 New Program: LEGO Masters • No. 1 & No. 2 Reality Series: Married at First Sight & The Block • No. 1 & No. 2 & No. 3 Light Entertainment Series: Lego Masters, Australian Ninja Warrior & The Voice • No. 1 Comedy Program: Hamish & Andy’s “Perfect” Holiday • No. 1 Sports Program: State of Origin • No. 1 Weekly Public Affairs Program: 60 Minutes • No. 1 Daily Public Affairs Program: A Current Affair • No. 1 Multichannel Program: The Ashes (4th Test, Day 5, Session 1) With the official ratings survey period wrapping up overnight, Nine is celebrating its best ratings share performance of all time. Key to the network’s success is a year-round schedule of premium Australian content that has once again delivered proven consistency of audience across all advertiser-preferred demographics. It is this reliable slate of family-friendly programming that sees Nine crowned Australia’s No. 1 network for 2019 with the demographics most highly sought after – People 25-54, People 16-39 and Grocery Shoppers with Children. Nine’s primary channel also ranks as Australia’s most watched channel in 2019 with all key demographics. Furthermore, Nine also secured the greatest number of viewers (Total People) for both its primary channel and network share. Nine can also lay claim to the highest rating program of the year, with the first State of Origin game between NSW and Queensland securing a national linear broadcast average audience of 3.230 million viewers (Metro: 2.192 million/Regional: 1.038 million). -

Sydney Program Guide

Page 1 of 42 Sydney Program Guide Sun Jul 26, 2020 06:00 ANIMAL TALES Captioned HD WS PG A healing massage makes a police horse happy; we meet a wild cat that lives up to his name and a cheeky ferret who has forgotten his manners; and a man opens his doors to a home-made snake haven in his backyard. 07:00 WEEKEND TODAY Captioned Live HD WS NA Join the Weekend Today team as they bring you the latest in news, current affairs, sports, politics, entertainment, fashion, health and lifestyle. 10:00 SPORTS SUNDAY Captioned Live HD WS PG Featuring Australia's leading sports personalities, Sports Sunday presents a frank and open debate about all the issues in the week of sport, with the promise of heated opinion and a few laughs along the way. 11:00 SUNDAY FOOTY SHOW Captioned Live HD WS PG Join hosts Peter Sterling, Erin Molan and Brad Fittler, with regular special guests to discuss all things NRL. WORLD'S GREATEST ANIMAL 13:00 Captioned Repeat HD WS G ENCOUNTERS Marine Animals The world's oceans, coral reefs and shorelines cover more than 70% of our planet and form the richest ecosystem on earth. This is where life on earth began. And where it continues to surprise those looking for animal encounters with bite. These watery wonderlands are home to the largest ±and indeed many of the smallest ±creatures on Earth. 14:00 GETAWAY Captioned Repeat HD WS PG This week on Getaway, going on Safari in Africa, cruising the Great Barrier Reef plus discovering Sydney's best themed bars 14:30 DRIVING TEST Captioned Repeat HD WS PG Atia With 6-inch heels and heavy makeup, 38-year-old Rose navigates the streets of Darwin; Accountant, Atia is focused on one thing - getting her Australian licence; Driving examiner, Melissa tries to keep speedy teenager, Dylan under control. -

Message Sent on Behalf of Garry Linnell, Editorial Director, Metro Media

Message sent on behalf of Garry Linnell, Editorial Director, Metro Media I'm delighted to announce the following appointments: Glenn Burge has been appointed Executive Editor, Metro, effective immediately. This new role has been formed out of the findings of the staff-led editorial review. Reporting to me, Glenn will be responsible for overall Metro editorial budgets, editorial strategy projects and the ongoing content management system project. As project director of the Editorial Review, he will also steer the implementation of our new newsroom operating model over the coming months. As we bring our print and digital teams together to work as one, there is no-one better qualified in Metro to assist me in this new role than Glenn. Until last year Glenn was Editorial Director of Fairfax Business Media and had been Editor of The Australian Financial Review for nine years, where he guided that masthead’s print and digital integration and the adoption of the Methode content system. He was also responsible for FRG’s magazine division, including BRW. He joined the AFR in 1998 from a deputy editor role at The Sydney Morning Herald where he was responsible for the Business section. Prior to management roles he was a senior reporter and columnist for the SMH. Glenn began his career in journalism as a casual copy person at the Sunday Telegraph in 1978 while completing a Bachelor of Arts and Law degree. He is also co-author of the highly-acclaimed 1992 book Corporate Cannibals: The Taking of Fairfax. Darren Burden has been appointed National Editor. -

Social Media Thought Leaders Updated for the 45Th Parliament 31 August 2016 This Barton Deakin Brief Lists

Barton Deakin Brief: Social Media Thought Leaders Updated for the 45th Parliament 31 August 2016 This Barton Deakin Brief lists individuals and institutions on Twitter relevant to policy and political developments in the federal government domain. These institutions and individuals either break policy-political news or contribute in some form to “the conversation” at national level. Being on this list does not, of course, imply endorsement from Barton Deakin. This Brief is organised by categories that correspond generally to portfolio areas, followed by categories such as media, industry groups and political/policy commentators. This is a “living” document, and will be amended online to ensure ongoing relevance. We recognise that we will have missed relevant entities, so suggestions for inclusions are welcome, and will be assessed for suitability. How to use: If you are a Twitter user, you can either click on the link to take you to the author’s Twitter page (where you can choose to Follow), or if you would like to follow multiple people in a category you can click on the category “List”, and then click “Subscribe” to import that list as a whole. If you are not a Twitter user, you can still observe an author’s Tweets by simply clicking the link on this page. To jump a particular List, click the link in the Table of Contents. Barton Deakin Pty. Ltd. Suite 17, Level 2, 16 National Cct, Barton, ACT, 2600. T: +61 2 6108 4535 www.bartondeakin.com ACN 140 067 287. An STW Group Company. SYDNEY/MELBOURNE/CANBERRA/BRISBANE/PERTH/WELLINGTON/HOBART/DARWIN -

September 11 P&C Newsletter

Friday 14th Sept Final Day to bring in sponsorship money and forms. Wed 19th Sept McGrath Ninja Warrior Athon Saturday 27th Oct Movies Under the Stars at Lugarno Public School. Save the date. P & C Meeting Date: Wednesday 19th September 2018 Time and Location: 7.00pm in the staffroom, all welcome If you are unable to attend but would like something discussed please email your discussion item to the secretary Glenn Dogao [email protected] and we will add it to the agenda. Ideas on Improving Lugarno Rita from The Georges River Council has contacted the P&C to ask for some ideas on how the council can improve Lugarno. Phillip Walker, the P & C Assistant Secretary, will be putting together a letter of reply to the council on the schools behalf but would love to give everyone the opportunity to have their say in what you think Lugarno as a suburb needs or needs to improve. This can be anything in the suburb and can include the school. Some ideas that have already been given include: a skate bowl and bike track at Evatt Park, fixing the cricket nets and half tennis court at Evatt and building a new natural playground in our school grounds - this is just one person’s thoughts. You do not need to repeat these ones they are already included but if you have anything more please email Phill Walker with your suggestion [email protected] or email the P & C and we will pass on your ideas to Phill to include in the letter, email [email protected] Ninja Warrior Athon Proudly sponsored by Hayden and Olivia Duncan from McGrath Real Estate Only 9 days to go until The Ninja Warrior Athon takes place at our school. -

Chapter 1: Radio in Australia the Radio Services That We Have in Australia Are Very Much a Product of Their Early- Twentieth-Century Origins

To access the videos in the exercises, please enter the password abj2013 Chapter 1: Radio in Australia The radio services that we have in Australia are very much a product of their early- twentieth-century origins. As you will have read in Chapter 1 of Australian Broadcast Journalism, the three sectors we have today—commercial, community and public broadcasting—each have a distinct style and brief in relation to how they try to appeal to their audiences. You can hear this just by tuning into different stations and listening for yourself. Exercise 1: Listening to a range of programs The best way to learn about radio is to be a listener! Record a commercial program, a community program and an ABC program. 1 Compare their content and presentation styles. 2 What do the programs tell you about their respective audiences? 3 How do they reflect their respective briefs as commercial, community and public broadcasting services? Exercise 2: Podcasting Far from being dead, radio offers a wealth of creative opportunities in the digital age. In September 2013, Radio National’s Common Knowledge program aired a conversation with two innovators in the area of podcasting as part of a ‘radio beyond radio’ conference. Presenters Cassie McCullagh and Jason Di Rosso talked with Silvain Gire, Director and co-founder of Arte Radio, and Francesca Panetta, Special Projects Editor at The Guardian and creator of The Hackney Podcast. You can access the program at the following link: www.abc.net.au/radionational/programs/commonknowledge/cke-sept-16/4407260. 1 What -

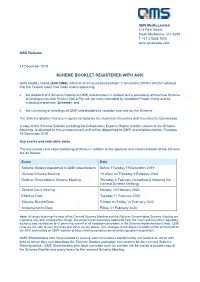

Scheme Booklet Registered with Asic

QMS Media Limited 214 Park Street South Melbourne, VIC 3205 T +61 3 9268 7000 www.qmsmedia.com ASX Release 13 December 2019 SCHEME BOOKLET REGISTERED WITH ASIC QMS Media Limited (ASX:QMS) refers to its announcement dated 12 December 2019 in which it advised that the Federal Court had made orders approving: • the dispatch of a Scheme Booklet to QMS shareholders in relation to the previously announced Scheme of Arrangement with Shelley BidCo Pty Ltd, an entity controlled by Quadrant Private Entity and its institutional partners (Scheme); and • the convening of meetings of QMS shareholders to consider and vote on the Scheme. The Scheme Booklet has been registered today by the Australian Securities and Investments Commission. A copy of the Scheme Booklet, including the Independent Expert's Report and the notices of the Scheme Meetings, is attached to this announcement and will be dispatched to QMS' shareholders before Thursday 19 December 2019. Key events and indicative dates The key events (and expected timing of these) in relation to the approval and implementation of the Scheme are as follows: Event Date Scheme Booklet dispatched to QMS shareholders Before Thursday 19 December 2019 General Scheme Meeting 10.00am on Thursday 6 February 2020 Rollover Shareholders Scheme Meeting Thursday 6 February (immediately following the General Scheme Meeting) Second Court Hearing Monday 10 February 2020 Effective Date Tuesday 11 February 2020 Scheme Record Date 5.00pm on Friday 14 February 2020 Implementation Date Friday 21 February 2020 Note: All dates following the date of the General Scheme Meeting and the Rollover Shareholders Scheme Meeting are indicative only and, among other things, are subject to all necessary approvals from the Court and any other regulatory authority and satisfaction or (if permitted) waiver of all conditions precedent in the Scheme Implementation Deed. -

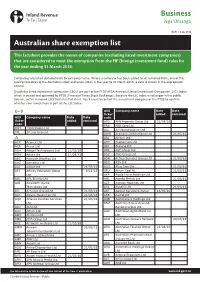

Australian Share Exemption List

Business Ngā Ūmanga IR871 | June 2016 Australian share exemption list This factsheet provides the names of companies (excluding listed investment companies) that are considered to meet the exemption from the FIF (foreign investment fund) rules for the year ending 31 March 2016. Companies are listed alphabetically by company name. Where a company has been added to, or removed from, one of the qualifying indices of the Australian stock exchange (ASX) in the year to 31 March 2016, a date is shown in the appropriate column. Qualifying listed investment companies (LICs) are part of the FTSE AFSA Australia Listed Investment Companies (LIC) Index which is owned and operated by FTSE (Financial Times Stock Exchange). Because the LIC index is no longer in the public domain, we’ve removed LICs from this factsheet. You’ll need to contact the investment company or the FTSE to confirm whether your investment is part of the LIC Index. 0–9 ASX Company name Date Date ticker added removed ASX Company name Date Date code ticker added removed APD APN Property Group Ltd 21/03/16 code ARB ARB Corp Ltd ONT 1300 Smiles Ltd ALL Aristocrat Leisure Ltd 3PL 3P Learning Ltd AWN Arowana International Ltd 21/03/16 A ARI Arrium Ltd ACX Aconex Ltd AHY Asaleo Care Ltd ACR Acrux Ltd AIO Asciano Ltd ADA Adacel Technologies Ltd 21/03/16 AFA ASF Group Ltd ADH Adairs Ltd 21/09/15 ASZ ASG Group Ltd ABC Adelaide Brighton Ltd ASH Ashley Services Group Ltd 21/03/16 AHZ Admedus Ltd ASX ASX Ltd ADJ Adslot Ltd 21/03/16 AGO Atlas Iron Ltd 21/03/16 AFJ Affinity Education Group 2/12/15 -

Federal Court of Australia

FEDERAL COURT OF AUSTRALIA Fairfax Media PublicatÍons Pty Ltd v Reed International Books Australia Pty Lrd [2010] FCA 984 Citation: Fairfax Media Publications Pty Ltd v Reed International Books Australia Pty Ltd [2010] FCA 984 Parties: FAIRF'AX MEDIA PUBLICATIONS PTY LTD (ACN 003 357 720) v REED INTERNATIONAL BOOKS AUSTRALIA pTy LTD (ACN 001 002 357) T/A LEXIS.NEXIS File number: NSD 1306 of 2007 Judge: BENNETT J Date ofjudgment: 7 September 2010 Catchwords: COPYRIGHT - respondent reproduces headlines and creates abstracts of arlicles in the applicant's newspaper - whether reproduction of headlines constitutes copyright infringernent - whether copyright subsists in individual newspaper headlines, in an article with its headline, in the compilation of all the articles and headlines in a newspaper edition and in the compilation of the edition as a whole - literary work - copyright protection for titles - use of headline as citation to article - policy considerations - originality - authorship - whether presumption of originality for anonymous works available - whether work ofjoint authorship - whether the headlines constitute a substantial part of each compilation - whether the work of writing headlines is part of the work of compilation - whether fair dealing for the pu{pose of or associated with reporting news ESTOPPEL - whether applicant estopped from asserting copyright infringement by respondent - applicant has known for many years that heacllines of the applicant,s newspaper are reproduced in the abstracting service - applicant had