A Public BBC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Newspaper Licensing Agency - NLA

Newspaper Licensing Agency - NLA Publisher/RRO Title Title code Ad Sales Newquay Voice NV Ad Sales St Austell Voice SAV Ad Sales www.newquayvoice.co.uk WEBNV Ad Sales www.staustellvoice.co.uk WEBSAV Advanced Media Solutions WWW.OILPRICE.COM WEBADMSOILP AJ Bell Media Limited www.sharesmagazine.co.uk WEBAJBSHAR Alliance News Alliance News Corporate ALLNANC Alpha Newspapers Antrim Guardian AG Alpha Newspapers Ballycastle Chronicle BCH Alpha Newspapers Ballymoney Chronicle BLCH Alpha Newspapers Ballymena Guardian BLGU Alpha Newspapers Coleraine Chronicle CCH Alpha Newspapers Coleraine Northern Constitution CNC Alpha Newspapers Countydown Outlook CO Alpha Newspapers Limavady Chronicle LIC Alpha Newspapers Limavady Northern Constitution LNC Alpha Newspapers Magherafelt Northern Constitution MNC Alpha Newspapers Newry Democrat ND Alpha Newspapers Strabane Weekly News SWN Alpha Newspapers Tyrone Constitution TYC Alpha Newspapers Tyrone Courier TYCO Alpha Newspapers Ulster Gazette ULG Alpha Newspapers www.antrimguardian.co.uk WEBAG Alpha Newspapers ballycastle.thechronicle.uk.com WEBBCH Alpha Newspapers ballymoney.thechronicle.uk.com WEBBLCH Alpha Newspapers www.ballymenaguardian.co.uk WEBBLGU Alpha Newspapers coleraine.thechronicle.uk.com WEBCCHR Alpha Newspapers coleraine.northernconstitution.co.uk WEBCNC Alpha Newspapers limavady.thechronicle.uk.com WEBLIC Alpha Newspapers limavady.northernconstitution.co.uk WEBLNC Alpha Newspapers www.newrydemocrat.com WEBND Alpha Newspapers www.outlooknews.co.uk WEBON Alpha Newspapers www.strabaneweekly.co.uk -

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

NOISE and MILITARY SERVICE Implications for Hearing Loss and Tinnitus

NOISE AND MILITARY SERVICE Implications for Hearing Loss and Tinnitus Committee on Noise-Induced Hearing Loss and Tinnitus Associated with Military Service from World War II to the Present Medical Follow-up Agency Larry E. Humes, Lois M. Joellenbeck, and Jane S. Durch, Editors THE NATIONAL ACADEMIES PRESS Washington, DC www.nap.edu THE NATIONAL ACADEMIES PRESS • 500 Fifth Street, N.W. • Washington, DC 20001 NOTICE: The project that is the subject of this report was approved by the Governing Board of the National Research Council, whose members are drawn from the councils of the National Academy of Sciences, the National Academy of Engineering, and the Insti- tute of Medicine. The members of the committee responsible for the report were chosen for their special competences and with regard for appropriate balance. This study was supported by Contract No. V101(93)P-1637 #29 between the Na- tional Academy of Sciences and the Department of Veterans Affairs. Any opinions, find- ings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the organizations or agencies that provided support for this project. Library of Congress Cataloging-in-Publication Data Noise and military service : implications for hearing loss and tinnitus / Committee on Noise-Induced Hearing Loss and Tinnitus Associated with Military Service from World War II to the Present, Medical Follow- up Agency ; Larry E. Humes, Lois M. Joellenbeck, and Jane S. Durch, editors. p. ; cm. Includes bibliographical references. ISBN 0-309-09949-8 — ISBN 0-309-65307-X 1. Deafness—Etiology. -

Ivision and the BBC: Building Public Value

Observatorio (OBS*) Journal, 5 (2008), 041-055 1646-5954/ERC123483/2008 041 iVision and the BBC: Building Public Value Michael Klontzas, City University, London, UK Abstract Breaking with conventional wisdom that sees public service broadcasters as conveyors of content in line with historically shaped socio-political ideals, centred on quality, access, diversity and independence, evidence suggests that PSB is often the driving force behind key technological innovations serving public policy aims. In the drive towards wholesale digitalisation and the accelerated introduction of an information society, this hitherto understated function is now deemed critical and comes to the fore. More specifically, recent public policy initiatives in the UK, culminating to the 2006 White Paper, openly assign the mission of contributing to the process of ‘building digital Britain’ to the BBC, the flagship public service broadcaster. This vision of digitalisation is defined in broad terms in the policy discourse, as involving all platforms indiscriminately. The BBC’s contribution, designed to entice users to a digital future and simultaneously cement the continued relevancy of the institution in the 21st century, finds expression in a variety of implemented and proposed digital services deliverable over a range of digital platforms, including television and radio, the internet and mobile networks. This paper seeks to interrogate the host of controversial and closely scrutinised internet services offered by the BBC in the light of the digital vision articulated in the public policy discourse. These services shift the emphasis away from the time-honoured broadcasting paradigm to a more interactive approach. Through widespread application of emerging Web 2.0 practices, the users are now invited to participate, and generate and share their own content. -

Scotland's Home of News and Entertainment

Scotland’s home of news and entertainment Strategy Update May 2018 STV in 2020 • A truly multi-platform media company with a balanced profit base across broadcast, production and digital o Expect around 1/3rd of profit from sources other than linear spot advertising (vs 17% today) • A magnet for the best creative talent from Scotland and beyond • A brand famous for a range of high quality programming and accessible by all Scots wherever they are in the world via the STV app • One of the UK’s leading producers, making world class returning series for a range of domestic and international players • Working in partnership with creative talent, advertisers, businesses and Government to drive the Scottish economy and showcase Scotland to the world Scotland’s home of news and entertainment 2 We have a number of strengths and areas of competitive advantage Strong, trusted brand Unrivalled Talented, connection with committed people Scottish viewers and advertisers Robust balance sheet and growing Scotland’s most returns to powerful marketing shareholders platform Settled A production relationship with business well ITV which placed for incentivises STV Profitable, growing “nations and to go digital digital business regions” growth holding valuable data 3 However, there is also significant potential for improvement •STV not famous for enough new programming beyond news •STV brand perceived as ageing and safe BROADCAST •STV2 not cutting through •News very broadcast-centric and does not embrace digital •STV Player user experience lags competition -

DATABANK INSIDE the CITY SABAH MEDDINGS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

10 The Sunday Times November 11, 2018 BUSINESS Andrew Lynch LETTERS “The fee reflects the cleaning out the Royal Mail Send your letters, including food sales at M&S and the big concessions will be made for Delia’s fingers burnt by online ads outplacement amount boardroom. Don’t count on it SIGNALS full name and address, supermarkets — self-service small businesses operating charged by a major company happening soon. AND NOISE . to: The Sunday Times, tills. These are hated by most retail-type operations, but no Delia Smith’s website has administration last month for executives at this level,” 1 London Bridge Street, shoppers. Prices are lower at such concessions would been left with a sour taste owing hundreds of says Royal Mail, defending London SE1 9GF. Or email Lidl and other discounters, appear to be available for after the collapse of Switch thousands of pounds to its the Spanish practice. BBC friends [email protected] but also you can be served at businesses occupying small Concepts, a digital ad agency clients. Delia, 77 — no You can find such advice Letters may be edited a checkout quickly and with a industrial workshop or that styled itself as a tiny stranger to a competitive for senior directors on offer reunited smile. The big supermarkets warehouse units. challenger to Google. game thanks to her joint for just £10,000 if you try. Eyebrows were raised Labour didn’t work in the have forgotten they need Trevalyn Estates owns, Delia Online, a hub for ownership of Norwich FC — Quite why the former recently when it emerged 1970s, and it won’t again customers. -

And Public Health

Medicine, the Market and the Mass Media It is sixty years since the end of the Second World War, but historians have only just begun to explore thoroughly the postwar history of health and its interwar antecedents. Most research and literature has focused on health services and the arrival of the NHS; where public health is concerned many historical surveys ignore the recent past and base their investigations on the nineteenth-century public health legacy. This collection opens up the postwar history of public health to sustained research- based, historical scrutiny. Medicine, the Market and the Mass Media examines the development of a new view of ‘the health of the public’ and the influences that shaped it in the postwar years. The book looks at the dual legacy of social medicine through health services and health promotion, and analyses the role of the mass media along with the connections between public health and industry. These essays take a broad perspective examining developments in Western Europe, and the relationships between Europe and the USA. Virginia Berridge is Professor of History and head of the Centre for History in Public Health at the London School of Hygiene and Tropical Medicine, University of London. She has published books and articles on health and society in the twentieth century. Kelly Loughlin is a lecturer in History at the London School of Hygiene and Tropical Medicine and the main focus of her research is the history of health and medical communications in the UK. Routledge Studies in the Social History of Medicine Edited by Joseph Melling, University of Exeter, and Anne Borsay, University of Wales at Swansea. -

Transnational Television in Sub-Saharan Africa

Transnational Television in Sub-Saharan Africa By GRAHAM MYTTON, RUTH TEER-TOMASELLI & ANDRE-JEAN TUDESQ Introduction that will begin to shape much of the Television is less developed in Africa future of African TV in a different wav than in any other ~tmtinent. Fewer European influence continues' to people have a television set at home and guide the development of African TV, there are fewer TV stations transmitting This is not necessarily always something per head of population than on any that comes direct from Europe; it other continenti Television 111 sub- happens because of the linguistic legacy Saharan coun tries is characterised bv that the colonial powers bequeathed the the following features: . continent for good or ill. As noted • The dominance of state-owned and earlier, European languages dominate -controlled broadcasting. African television, and chieflv this • Broadcasting that is for the most means English and French, with the less part national, rather than local or widespread addition of Portuguese It regional. means that these three languages define three broadly different television • Dominance of imported content, landscapes, certainlv so far as ma in lv from Europe and the United transnational television activitx 15 States. concerned." US influence and input IS • Dominance of three European now also of growing importance. mainlx languages: French, English and III anglophone countries. Sim ilarlv. Portuguese. Brazilian involvement and influence 'is • Under-investment and poverty of beginning to be seen !!1 Iusophone facilities leading to low levels of local countries. production. • Lox levels of inter-African co- operation in television production, Transnational Television in exchange and marketing. -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

Resolution No. 118 Authorizing an Agreement with Insite Wireless Group for Distributed Antenna System for the Times Union Center

RESOLUTION NO. 118 AUTHORIZING AN AGREEMENT WITH INSITE WIRELESS GROUP FOR DISTRIBUTED ANTENNA SYSTEM FOR THE TIMES UNION CENTER Introduced: 4/12/17 By Civic Center Committee: WHEREAS, The Department of General Services through the Purchasing Agent issued a Request for Proposals regarding a Distributed Antenna System (DAS) for the Times Union Center, and WHEREAS, Four Proposals were received and representatives of the Department of General Services reviewed said Proposals and recommended awarding the contract to InSite Wireless Group as the lowest responsible bidder, and WHEREAS, The Commissioner of the Department of General Services indicated that the Times Union Center and Albany Capital Center will split the projected revenues of $500,000 over a ten year period, guaranteed by InSite Wireless Group with the Times Union Center will retain seventy-five percent of revenues and the Albany Capital Center will retain twenty-five percent of revenues collected and paid by InSite Wireless Group, and WHEREAS, The Commissioner of the Department of General Services has proposed to enter into an agreement with InSite Wireless Group for the DAS project to combine services at the Times Union Center and the Albany Capital Center with InSite Wireless Group is responsible for funding of the project, now, therefore be it RESOLVED, By the Albany County Legislature that the County Executive is authorized to enter into an agreement with InSite Wireless Group regarding a Distributed Antenna System, in collaboration with the Times Union Center and Albany Capital Center for a term commencing May 1, 2017 and ending April 30, 2027, and, be it further RESOLVED, That the County Attorney is authorized to approve said agreement as to form and content, and, be it further RESOLVED, That the Clerk of the County Legislature is directed to forward certified copies of this resolution to the appropriate County Officials. -

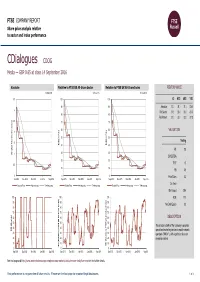

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets.