The Occurrence of Gold at the Getchell Mine, Nevada

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stibnite Gold Project

STIBNITE GOLD PROJECT PAYETTE & BOISE NATIONAL FORESTS INTERMOUNTAIN REGION August 22, 2018 STIBNITE MINING DISTRICT, PAYETTE NATIONAL FOREST, KRASSEL RANGER DISTRICT Regarding Locatable Minerals , 36 CFR 228, Subpart A: requires the Forest Service to: "Where conflicting interests Respond to a mining plan, evaluate that plan must be reconciled, the Consider requirements to minimize adverse effects to the extent feasible question shall always be Comply with applicable laws, regulations and answered from the stand- standards for environmental protection point of the greatest good of Assure appropriate reclamation Further respond by following National Environmental the greatest number in the Policy Act (NEPA) processes. long run." - James Wilson, Secretary Per 36 CFR 228.4, the Forest Service is required to take of Agriculture, 1905 in a letter to Gifford action to ensure that “operations are conducted so as, Pinchot, 1st Chief of the Forest Service. where feasible, to minimize adverse environmental impacts on National Forest surface resources. 1 Table of Contents Project Context STIBNITE GOLD Project Location 4 Mining History at Stibnite 5 PROJECT Who is Midas Gold 6 Stibnite Plan of Operations PAYETTE & BOISE NATIONAL Proposed Mining Plan of FOREST - INTERMOUNTAIN REGION Operations 7 Open Pit Mining 8 Anadromous Fish - Tunnel 9 Inventoried Roadless Areas - Why is this project of interest to many Access and Powerline 10 people and organizations? Facilities During Mining Operations 10 5 million recoverable ounces of gold x -

The Economics of Mining Evolved More Favorably in Mexico Than Peru

Created by Richard L. Garner 3/9/2007 1 MINING TRENDS IN THE NEW WORLD 1500-1810 "God or Gold?" That was the discussion question on an examination that I took many years ago when I started my studies in Latin American history. I do not recall how I answered the question. But the phrase has stuck in my mind ever since. And it has worked its way into much of the history written about the conquest and post-conquest periods, especially the Spanish conquests. From the initial conquests in the Caribbean and certainly after the conquests of Mexico and Peru the search for minerals became more intensive even as the Spanish Crown and its critics argued over religious goals. In the middle of the sixteenth century after major silver discoveries in Mexico and Peru the value of the output of the colonial mines jumped significantly from a few million pesos annually (mainly from gold) to several tens of millions. Perhaps “Gold” (mineral output) had not yet trumped “God” (religious conversion) on every level and in every region, but these discoveries altered the economic and financial equation: mining while not the largest sector in terms of value or labor would become the vehicle for acquiring and consolidating wealth. Until the late seventeenth century Spanish America was the New World’s principal miner; but then the discovery of gold in Brazil accorded it the ranking gold producer in the New World while Spanish American remained the ranking silver producer. The rise of mining altered fundamentally the course of history in the New World for the natives, the settlers, and the rulers and had no less of an effect on the rest of the world. -

SEDIMENT-HOSTED AU DEPOSITS (MODEL 26A; Berger, 1986) By

SEDIMENT-HOSTED AU DEPOSITS (MODEL 26a; Berger, 1986) by Albert H. Hofstra, Joel S. Leventhal, David J. Grimes, and William D. Heran SUMMARY OF RELEVANT GEOLOGIC, GEOENVIRONMENTAL, AND GEOPHYSICAL INFORMATION Carlin-type deposits are epigenetic, large-tonnage, low-grade, sediment-hosted disseminated gold deposits. The deposits are known mainly in northern Nevada and northwestern Utah where they are arranged in clusters and belts. The deposits in this region are estimated to contain about 5,000 tonnes of gold, more than half of which (~3100 tonnes) is in the Carlin Trend. Approximately 1,000 tonnes of gold have been produced. Carlin-type gold deposits are one of the most important types currently being mined in the western United States. Many aspects of this geoenvironmental model also apply to distal disseminated deposits as defined by Cox and Singer (1990), Doebrich and Theodore (in press), and Howe and others (1995). Deposit geology Unoxidized refractory ore: Refractory ore consists of variably decalcified, dedolomitized, argillized, silicified, sulfidized, carbonaceous sedimentary rocks that contain disseminated iron, arsenic, antimony, mercury, and thallium sulfide minerals. Base-metal sulfide minerals are rare or absent in most deposits. Although pyrite, marcasite, orpiment, and realgar have high acid-generating capacity, they generally are present in small amounts (much less than 5 volume percent) and are usually disseminated in, or surrounded by, carbonate rocks with high acid-consuming capacity. Zones with 5-50 volume percent pyrite, marcasite, orpiment, or realgar are present in some deposits. Ore is refractory because much of the gold forms sub-micron grains in pyrite and marcasite and because carbon in the rock can extract gold from cyanide solutions. -

Technical Report Getchell Project NI 43-101 Technical Report Premier Gold Mines Limited and I-80 Gold Corp

AMC Mining Consultants (Canada) Ltd. BC0767129 200 Granville Street, Suite 202 Vancouver BC V6C 1S4 Canada T +1 604 669 0044 E [email protected] W amcconsultants.com Technical Report Getchell Project NI 43-101 Technical Report Premier Gold Mines Limited and i-80 Gold Corp Humboldt County, Nevada, USA In accordance with the requirements of National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators Qualified Persons: D Nussipakynova, P.Geo. P Greenhill, FAusIMM (CP) AMC Project 720031 Effective date 23 July 2020 Report date 22 January 2021 Unearth a smarter way Getchell Project NI 43-101 Technical Report Premier Gold Mines Limited and i-80 Gold Corp 720031 1 Summary 1.1 Introduction This Technical Report (the Report) provides an update of the Mineral Resource estimates and metallurgy of the Mineral Resources identified within the Getchell Project (Property) located in Humboldt County, Nevada, USA. The Report has been prepared by AMC Mining Consultants (Canada) Ltd. (AMC) of Vancouver, Canada on behalf of Premier Gold Mines Limited / i-80 Gold Corp (i-80 or the Companies). On 10 August 2020, Premier entered into a definitive purchase agreement with affiliates of Waterton Global Resource Management, Inc. to acquire from Waterton all of the outstanding membership interests of Osgood Mining Company LLC (OMC). The Property comprises a number of property parcels which collectively encompass 2,545 acres in the Potosi mining district. The four-square miles of land contain all areas of past gold production and the area of the currently estimated Mineral Resource. This area includes the historical Pinson Mine. -

40 Common Minerals and Their Uses

40 Common Minerals and Their Uses Aluminum Beryllium The most abundant metal element in Earth’s Used in the nuclear industry and to crust. Aluminum originates as an oxide called make light, very strong alloys used in the alumina. Bauxite ore is the main source aircraft industry. Beryllium salts are used of aluminum and must be imported from in fluorescent lamps, in X-ray tubes and as Jamaica, Guinea, Brazil, Guyana, etc. Used a deoxidizer in bronze metallurgy. Beryl is in transportation (automobiles), packaging, the gem stones emerald and aquamarine. It building/construction, electrical, machinery is used in computers, telecommunication and other uses. The U.S. was 100 percent products, aerospace and defense import reliant for its aluminum in 2012. applications, appliances and automotive and consumer electronics. Also used in medical Antimony equipment. The U.S. was 10 percent import A native element; antimony metal is reliant in 2012. extracted from stibnite ore and other minerals. Used as a hardening alloy for Chromite lead, especially storage batteries and cable The U.S. consumes about 6 percent of world sheaths; also used in bearing metal, type chromite ore production in various forms metal, solder, collapsible tubes and foil, sheet of imported materials, such as chromite ore, and pipes and semiconductor technology. chromite chemicals, chromium ferroalloys, Antimony is used as a flame retardant, in chromium metal and stainless steel. Used fireworks, and in antimony salts are used in as an alloy and in stainless and heat resisting the rubber, chemical and textile industries, steel products. Used in chemical and as well as medicine and glassmaking. -

Net Income Rises 29% to $514 Million ($0.59 Per Share) Expanded Margins Increase Profitability in Q1

FIRST QUARTER REPORT - MAY 6, 2008 For a full explanation of results, the Financial Statements and Management Discussion & Analysis, Based on US GAAP and expressed in US dollars full-year guidance at significant mines, and mine statistics, please see the Company’s website, www.barrick.com. Net Income Rises 29% to $514 Million ($0.59 per share) Expanded Margins Increase Profitability in Q1 Highlights • The Company reported first quarter net income of $514 million ($0.59 per share) and operating cash flow of $728 million ($0.83 per share) compared to a net loss of $159 million ($0.18 per share) and operating cash flow of $163 million ($0.19 per share) in the prior year period. Reported net income rose 29% compared to prior year adjusted net income of $398 million ($0.46 per share)1 and included $29 million of post-tax special items that reduced income by $0.03 per share. Adjusting for these special items, earnings of $0.62 per share are a Company record. The realized gold price of $925 per ounce matched the average spot price for the quarter. • First quarter gold production was 1.74 million ounces at total cash costs of $393 per ounce2, and copper production was 87 million pounds at total cash costs of $0.94 per pound2. The Company maintains full year production guidance of 7.6 - 8.1 million ounces of gold at total cash costs of $390 - $415 per ounce and 380 - 400 million pounds of copper at total cash costs of $1.15 - $1.25 per pound. -

Annual Information Form for the Year Ended December 31, 2018 Dated As of March 22, 2019 BARRICK GOLD CORPORATION

Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, ON M5J 2S1 Annual Information Form For the year ended December 31, 2018 Dated as of March 22, 2019 BARRICK GOLD CORPORATION ANNUAL INFORMATION FORM TABLE OF CONTENTS GLOSSARY OF TECHNICAL AND BUSINESS TERMS 4 REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION 10 FORWARD-LOOKING INFORMATION 11 SCIENTIFIC AND TECHNICAL INFORMATION 14 THIRD PARTY DATA 15 GENERAL INFORMATION 15 Organizational Structure 15 Subsidiaries 16 Areas of Interest 18 General Development of the Business 18 History 18 Significant Acquisitions 18 Strategy 19 Recent Developments 21 Results of Operations in 2018 22 NARRATIVE DESCRIPTION OF THE BUSINESS 26 Production and Guidance 26 Reportable Operating Segments 26 Barrick Nevada 27 Pueblo Viejo (60% basis) 28 Lagunas Norte 29 Veladero (50% basis) 29 Turquoise Ridge (75% basis) 30 Acacia Mining plc (63.9% basis) 31 Pascua-Lama Project 32 Mineral Reserves and Mineral Resources 33 Marketing and Distribution 46 Employees and Labor Relations 47 Competition 48 Sustainability 48 Operations in Emerging Markets: Corporate Governance and Internal Controls 49 Board and Management Experience and Oversight 50 Communications 51 - i - Internal Controls and Cash Management Practices 51 Managing Cultural Differences 52 Books and Records 52 MATERIAL PROPERTIES 52 Cortez Property 52 Goldstrike Property 58 Turquoise Ridge Mine 63 Pueblo Viejo Mine 69 Veladero Mine 76 Kibali Mine 86 Loulo-Gounkoto Mine Complex 93 EXPLORATION -

Carlin-Type Gold Deposits in Nevada: Critical Geologic Characteristics and Viable Models

©2005 Society of Economic Geologists, Inc. Economic Geology 100th Anniversary Volume pp. 451–484 Carlin-Type Gold Deposits in Nevada: Critical Geologic Characteristics and Viable Models JEAN S. CLINE,† University of Nevada, Las Vegas, 4505 Maryland Parkway, Box 454010, Las Vegas, Nevada 89154-4010 ALBERT H. HOFSTRA, Mineral Resources Program, U.S. Geological Survey, Mail Stop 973, Box 25046, Denver, Colorado 80225 JOHN L. MUNTEAN, Nevada Bureau of Mines and Geology, Mail Stop 178, University of Nevada, Reno, Nevada 89557-0088 RICHARD M. TOSDAL, AND KENNETH A. HICKEY Mineral Deposit Research Unit, University of British Columbia, 6339 Stores Road, Vancouver, British Columbia, Canada V6T 1Z4 Abstract Carlin-type Au deposits in Nevada have huge Au endowments that have made the state, and the United States, one of the leading Au producers in the world. Forty years of mining and numerous studies have pro- vided a detailed geologic picture of the deposits, yet a comprehensive and widely accepted genetic model re- mains elusive. The genesis of the deposits has been difficult to determine owing to difficulties in identifying and analyzing the fine-grained, volumetrically minor, and common ore and gangue minerals, and because of postore weathering and oxidation. In addition, other approximately contemporaneous precious metal deposits have overprinted, or are overprinted by, Carlin-type mineralization. Recent geochronological studies have led to a consensus that the Nevada deposits formed ~42 to 36 m.y. ago, and the deposits can now be evaluated in the context of their tectonic setting. Continental rifting and deposi- tion of a passive margin sequence followed by compressional orogenies established a premineral architecture of steeply dipping fluid conduits, shallow, low dipping “traps” and reactive calcareous host rocks. -

4.5 Cultural Resources

4.5 – Cultural Resources 4.5 Cultural Resources This section identifies cultural and paleontological resources along the IC Project Alignment, identifies applicable significance thresholds, assesses the IC Project’s impacts to these resources and their significance, and recommends measures to avoid or substantially reduce any effects found to be potentially significant. Cultural resources are defined as any object or specific location of past human activity, occupation, or use that is identifiable through historical documentation, inventory, or oral evidence. Cultural resources can be separated into three categories: archaeological, building/structural, and traditional resources. Archaeological resources include prehistoric and historic remains of human activity. Prehistoric resources can be composed of lithic scatters, ceramic scatters, quarries, habitation sites, temporary camps/rock rings, ceremonial sites, and trails. Historic-era resources are typically those that are 50 years or older. Historic archaeological resources can consist of structural remains (e.g., concrete foundations), historic objects (e.g., bottles and cans), features (e.g., refuse deposits or scatters), and sites (e.g., resources that contain one or more of the aforementioned categories). Built environment resources range from historic buildings to canals, historic roads and trails, bridges, ditches, cemeteries, and electrical infrastructure, such as transmission lines, substations, and generating facilities. A traditional cultural resource is a resource associated with the cultural practices, traditions, beliefs, lifeways, arts, crafts, or social institutions of a living community. They are rooted in a traditional community’s history and are important in maintaining the continuing cultural identity of the community. See Section 4.18, Tribal Cultural Resources, for a discussion on cultural resources of potential importance to California Native American tribes. -

2019 Asset Handbook 2019 Asset Handbook

2019 Asset Handbook 2019 Asset Handbook Franco-Nevada Corporation’s 2019 Asset Handbook is intended to assist investors and analysts in their understanding of our business and portfolio of assets. Franco-Nevada Corporation is the leading gold royalty and streaming company with the largest and most diversified portfolio of assets. The Company’s business model provides investors with gold price and exploration optionality with less exposure to operating risks. Franco-Nevada has a strong balance sheet and uses its free cash flow to expand its portfolio and pay dividends. It trades under the symbol FNV on both the Toronto and New York stock exchanges. Since its IPO, Franco-Nevada’s share price has outperformed the gold price and all relevant gold equity benchmarks. Franco-Nevada is the gold investment that works. Information relating to projects, properties and their owners and operators presented in this Asset Handbook has been sourced from the public disclosure of the owners and operators of our assets available as of March 15, 2019. More current information may be available in our subsequent disclosure and our website. This Asset Handbook contains information about many of our assets, including those that may not currently be material to us. Also, the description and depiction of our business and assets have been simplified for presentation purposes. Dollar references are in U.S. dollars unless otherwise noted. This Asset Handbook should be read with reference to the explanatory notes and cautionary statements contained in the Additional Information section found at the end of this Asset Handbook. Please also refer to the additional supporting information and explanatory notes found in our Annual Information Form (“AIF”), our annual Management’s Discussion & Analysis (“MD&A“), and our Annual Report on Form 40-F available at www.sedar.com and www.sec.gov, respectively, and on our website at www.franco-nevada.com. -

Nevada Excellence in Mine Reclamation Awards 1991-2020

Nevada Excellence in Mine Reclamation Awards 1991-2020 Year Company and Project Description Award Category Pg 1 of 3 2020 KGHM Robinson Mine – Lane City Waste Rock Legacy Waste Rock Reclamation Facility Reclamation Project 2020 Hudbay Minerals/Mason Resources (US) Inc. – Concurrent Exploration Reclamation Mason Exploration Project 2019 B2Gold Corp. – Rockland Exploration Drilling Exploration Project Reclamation Project 2019 Barrick Gold – Bullfrog Mine Partial Pit Backfill Pit Lake Remediation 2019 Nevada Gold Mines – Butte Canyon Historic WRF Legacy WRF Remediation and Closure Reclamation 2019 Newmont USA Limited – Buttes Exploration Project Abandoned Mines Hazard Mitigation Reclamation 2019 Paramount Gold Nevada Corp. – Sleeper Mine Pit Post-Mining Land Use Planning Lake Recreation Site 2019 Western Exploration LLC – Doby George Concurrent Exploration Reclamation Exploration Project 2018 Coeur Rochester, Inc. – Marzen House Museum Cooperative Partnership in Preservation of Exhibit on Rochester Mining District Mining History 2018 KGHM Robinson Mine – Reclamation through Leadership in Reclamation Mining 2018 Kinross Gold U.S.A., Inc. – Nevada Conservation Leadership in Conservation Planning Credit System Credit Transfer at Bald Mtn. Mine 2018 Lithium Nevada Corporation – Upper Basin Exploration Project Reclamation Exploration Project Reclamation 2018 Newmont USA Ltd. – North Area Leach Phase I-II Concurrent Reclamation Closure 2017 Comstock Mining, Inc. – Rebuilding of State Route Abandoned Mine Lands Hazard 342 and Reclamation of Historic -

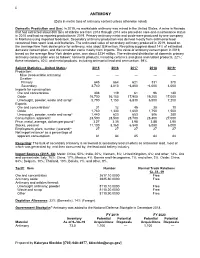

Antimony Data Sheet

22 ANTIMONY (Data in metric tons of antimony content unless otherwise noted) Domestic Production and Use: In 2019, no marketable antimony was mined in the United States. A mine in Nevada that had extracted about 800 tons of stibnite ore from 2013 through 2014 was placed on care-and-maintenance status in 2015 and had no reported production in 2019. Primary antimony metal and oxide were produced by one company in Montana using imported feedstock. Secondary antimony production was derived mostly from antimonial lead recovered from spent lead-acid batteries. The estimated value of secondary antimony produced in 2019, based on the average New York dealer price for antimony, was about $34 million. Recycling supplied about 14% of estimated domestic consumption, and the remainder came mostly from imports. The value of antimony consumption in 2019, based on the average New York dealer price, was about $234 million. The estimated distribution of domestic primary antimony consumption was as follows: nonmetal products, including ceramics and glass and rubber products, 22%; flame retardants, 40%; and metal products, including antimonial lead and ammunition, 39%. Salient Statistics—United States: 2015 2016 2017 2018 2019e Production: Mine (recoverable antimony) — — — — — Smelter: Primary 645 664 621 331 370 Secondary 3,740 3,810 e3,800 e4,000 4,000 Imports for consumption: Ore and concentrates 308 119 61 96 140 Oxide 16,700 16,100 17,900 19,200 17,000 Unwrought, powder, waste and scrap1 5,790 7,150 6,830 6,500 7,200 Exports: Ore and concentrates1 31