Fedwire Securities Service

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Online Trust Audit & Honor Roll Report

Internet Society’s Online Trust Alliance (OTA) 2 TABLE OF CONTENTS Overview & Background .......................................................................................................................... 3 Executive Summary & Highlights ............................................................................................................. 4 Best Practices Highlights ......................................................................................................................... 9 Consumer Protection .......................................................................................................................... 9 Site Security ........................................................................................................................................ 9 Privacy Trends ................................................................................................................................... 10 Domain, Brand & Consumer Protection ................................................................................................. 12 Email Authentication ......................................................................................................................... 12 Domain-based Message Authentication, Reporting & Conformance (DMARC) ................................... 14 Opportunistic Transport Layer Security (TLS) for Email ...................................................................... 15 Domain Locking ................................................................................................................................ -

The Sallie Mae Saga: a Government-Created, Student Debt Fueled Profit Machine

_Why The Sallie Mae Saga: A Government-Created, Student Debt Fueled Profit Machine January 2014 Deanne Loonin National Consumer Law Center® © Copyright 2014, National Consumer Law Center, Inc. All rights reserved. ABOUT THE AUTHOR Deanne Loonin is an attorney with the National Consumer Law Center (NCLC) and the Director of NCLC’s Student Loan Borrower Assistance Project. Deanne assists attorneys representing low-income consumers, and teaches consumer law to legal services, private consumer attorneys, and other advocates. Deanne is the co-author of NCLC’s publications Student Loan Law and Guide to Surviving Debt as well as numerous reports on the student loan industry and borrower issues. Prior to joining NCLC in 1997, Deanne worked as a legal aid attorney in Los Angeles. She is a member of the California and Massachusetts bars. ACKNOWLEDGEMENTS This report is a release of the National Consumer Law Center’s Student Loan Borrower Assistance Project. NCLC research assistant Marina Levy provided extensive research and editorial content. The author thanks NCLC colleagues Carolyn Carter, Jan Kruse, Robyn Smith and Persis Yu for valuable comments and assistance. We also thank NCLC colleague Beverlie Sopiep for layout assistance. The findings and conclusions presented in this report are those of the authors alone. NCLC’s Student Loan Borrower Assistance Project provides information about student loan rights and responsibilities for borrowers and advocates. We also seek to increase public understanding of student lending issues and to identify policy solutions to promote access to education, lessen student debt burdens, and make loan repayment more manageable. www.studentloanborrowerassistance.org ABOUT THE NATIONAL CONSUMER LAW CENTER Since 1969, the nonprofit National Consumer Law Center® (NCLC®) has used its expertise in consumer law and energy policy to work for consumer justice and economic security for low- income and other disadvantaged people, including older adults, in the United States. -

Government-Sponsored Enterprises and Their Implicit Federal Subsidy

GovernmentSponsored Enterpriks and Their Implicit Federal Subsi*: The Case of Sallie Mae GOVERNMENT-SPONSORED ENTERPRISES AND THEIR IMPLICIT FEDERAL SUBSIDY: THE CASE OF SALLIE MAE The Congress of the United States Congressional Budget Office PREFACE This report on the Student Loan Marketing Association (Sallie Mae) is part of an ongoing study of government-sponsored enterprises (GSEs). The Con- gressional Budget Office undertook the study at the request of the Senate Budget Committee and the Subcommittee on Federal Credit Programs of the Senate Banking Committee. Government-sponsored enterprises include, in addition to the Student Loan Marketing Association, the Federal National Mortgage Association, the Farm Credit Banks, the Federal Home Loan Mortgage Corporation, and the Federal Home Loan Banks. Although the emphasis in this report is on Sallie Mae, the analysis is applicable to the other sponsored enterprises. In keeping with CBO's mandate to provide ob- jective analysis, the paper offers no recommendations. This paper was prepared by Marvin Phaup of.the Budget Process Unit under the supervision of Richard P. Emery, Jr. A significant contribution to the study was made by Robert W. Hartman, Senior Analyst for Budget Pro- cess. Useful comments and suggestions were also made by Ron Boster, Jim Carr, Samuel Chase, Barry L. Cooper, Alfred B. Fitt, Ray Garea, Janet Hansen, Carol Hartwell, Timothy Howard, Ronald F. Hunt, Jan Lilja, Fred- erick C. Meltzer, Carl Mintz, William Schmidt, Robin Seiler, Kevin E. Villani, and Dan A. Woods. CBO analysts Deborah Kalcevic, Maureen McLaughlin, Roy Meyers, Mitchell Mutnick, Pearl Richardson, and Mark Weatherly also contributed to the paper. -

PORTFOLIO of INVESTMENTS – As of September 30, 2020 (Unaudited)

PORTFOLIO OF INVESTMENTS – as of September 30, 2020 (Unaudited) Loomis Sayles Investment Grade Bond Fund Principal ________________________________Amount Description ____________________________________________________________ Value (†) Bonds and Notes – 94.5% of Net Assets Non-Convertible Bonds – 93.6% ABS Car Loan – 6.4% $ 16,590,000 Ally Auto Receivables Trust, Series 2019-1, Class A3, 2.910%, 9/15/2023 $ 16,913,658 7,865,000 American Credit Acceptance Receivables Trust, Series 2019-3, Class D, 2.890%, 9/12/2025, 144A 8,047,444 1,965,000 AmeriCredit Automobile Receivables Trust, Series 2018-2, Class D, 4.010%, 7/18/2024 2,087,775 10,515,000 AmeriCredit Automobile Receivables Trust, Series 2018-3, Class D, 4.040%, 11/18/2024 11,116,717 25,880,000 AmeriCredit Automobile Receivables Trust, Series 2019-1, Class D, 3.620%, 3/18/2025 26,998,148 12,340,000 AmeriCredit Automobile Receivables Trust, Series 2019-2, Class D, 2.990%, 6/18/2025 12,984,709 1,395,000 AmeriCredit Automobile Receivables Trust, Series 2020-2, Class D, 2.130%, 3/18/2026 1,413,280 4,800,000 Avis Budget Rental Car Funding AESOP LLC, Series 2020-2A, Class A, 2.020%, 2/20/2027, 144A 4,841,880 3,650,000 CarMax Auto Owner Trust, Series 2018-3, Class D, 3.910%, 1/15/2025 3,759,026 13,585,000 CarMax Auto Owner Trust, Series 2019-1, Class D, 4.040%, 8/15/2025(a)(b) 13,970,250 5,811,000 CarMax Auto Owner Trust, Series 2019-2, Class D, 3.410%, 10/15/2025 5,945,447 2,315,000 CarMax Auto Owner Trust, Series 2019-3, Class D, 2.850%, 1/15/2026 2,393,670 4,625,000 CarMax Auto Owner -

Private Equity in the 2000S 1 Private Equity in the 2000S

Private equity in the 2000s 1 Private equity in the 2000s Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks. The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new "Golden Age" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007. Bursting the Internet Bubble and the private equity crash (2000–2003) The Nasdaq crash and technology slump that started in March 2000 shook virtually the entire venture capital industry as valuations for startup technology companies collapsed. Over the next two years, many venture firms had been forced to write-off large proportions of their investments and many funds were significantly "under water" (the values of the fund's investments were below the amount of capital invested). Venture capital investors sought to reduce size of commitments they had made to venture capital funds and in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market. -

Glossary of Bond Terms

Glossary of Bond Terms Accreted value- The current value of your zero-coupon municipal bond, taking into account interest that has been accumulating and automatically reinvested in the bond. Accrual bond- Often the last tranche in a CMO, the accrual bond or Z-tranche receives no cash payments for an extended period of time until the previous tranches are retired. While the other tranches are outstanding, the Z-tranche receives credit for periodic interest payments that increase its face value but are not paid out. When the other tranches are retired, the Z-tranche begins to receive cash payments that include both principal and continuing interest. Accrued interest- (1) The dollar amount of interest accrued on an issue, based on the stated interest rate on that issue, from its date to the date of delivery to the original purchaser. This is usually paid by the original purchaser to the issuer as part of the purchase price of the issue; (2) Interest deemed to be earned on a security but not yet paid to the investor. Active tranche- A CMO tranche that is currently paying principal payments to investors. Adjustable-rate mortgage (ARM)- A mortgage loan on which interest rates are adjusted at regular intervals according to predetermined criteria. An ARM's interest rate is tied to an objective, published interest rate index. Amortization- Liquidation of a debt through installment payments. Arbitrage- In the municipal market, the difference in interest earned on funds borrowed at a lower tax-exempt rate and interest on funds that are invested at a higher-yielding taxable rate. -

Floating Rate Note Examplary Underlying: Underlying Rate

Floating Rate Note Examplary Underlying: Underlying rate In general, Floating Rate Notes (FRN) offer you floating coupon payments based on an underlying interest rate and a redemption at 100% of the nominal value on the redemption date (subject to the credit risk of the issuer). The floating coupon is subject to a minimum coupon (floor). The payout profile is for illustrative purposes only and is based on the assumption that no exceptional cancellation will occur, in accordance with the issuer’s product documentation. Main features of a sample product Currency Term Return USD 3 years Underlying rate, minimum 2.90% p.a. Participation Capital no additional participation Floor at 100% (subject to issuer risk) You may consider an investment in this product, if You look for a way to enhance yield on your cash positions You are familiar with both structured products and fixed income markets You are comfortable being exposed to floating coupon payments based on an underlying interest rate You intend to be invested in this product until its redemption date You wish to be invested in the investment currency of the product. If your reference currency is not equal to the investment currency of the product, the return may increase or decrease in reference currency terms as a result of exchange rate fluctuations Summary of main product- Summary of main product- specific benefits specific risks Quarterly adjustment of the coupon Decreasing underlying rate resulting in lower Floor offering a minimum coupon payment coupon payments (but not below the floor) Full capital protection on the redemption date If the currency of the product is different from your reference currency, the return may increase or decrease as a result of currency fluctuations You are fully exposed to the default risk of the issuer. -

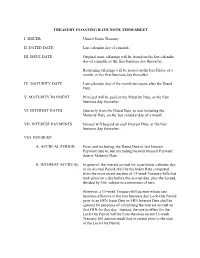

TREASURY FLOATING RATE NOTE TERM SHEET I. ISSUER United States Treasury II. DATED DATE Last Calendar Day of a Month. III. ISSUE

TREASURY FLOATING RATE NOTE TERM SHEET I. ISSUER United States Treasury II. DATED DATE Last calendar day of a month. III. ISSUE DATE Original issue offerings will be issued on the last calendar day of a month, or the first business day thereafter. Reopening offerings will be issued on the last Friday of a month, or the first business day thereafter. IV. MATURITY DATE Last calendar day of the month two years after the Dated Date. V. MATURITY PAYMENT Principal will be paid on the Maturity Date, or the first business day thereafter. VI. INTEREST DATES Quarterly from the Dated Date, to and including the Maturity Date, on the last calendar day of a month. VII. INTEREST PAYMENTS Interest will be paid on each Interest Date, or the first business day thereafter. VIII. INTEREST: A. ACCRUAL PERIOD From and including, the Dated Date or last Interest Payment date to, but excluding the next Interest Payment date or Maturity Date. B. INTEREST ACCRUAL In general, the interest accrual for a particular calendar day in an Accrual Period shall be the Index Rate computed from the most recent auction of 13-week Treasury bills that took place on a day before the accrual day, plus the Spread, divided by 360, subject to a minimum of zero. However, a 13-week Treasury bill auction whose rate becomes effective in the two business day Lock-Out Period prior to an FRN Issue Date or FRN Interest Date shall be ignored for purposes of calculating the interest accrual on that FRN for that day. Instead, the rate in effect for the Lock-Out Period will be from the most recent 13-week Treasury bill auction result that occurred prior to the start of the Lock-Out Period. -

1 Overview of Derivatives

1 Overview of Derivatives A financial derivative is usually defined as an instrument whose value is derived from some underlying cash market instrument. Familiar examples include • options to { buy (\call options") or { sell (\put options") a specified security or commodity at a specified price on a specified date, and • contracts such as { futures or { options on equity indices such Standard & Poor's 500. Newer examples include structured notes, which are securities whose interest or principal payments depend on market conditions, such as floating rate notes and inverse floaters. Swaps of various kinds are also derivatives. Various kinds of derivative are described by Hull, with both details of how their markets operate and the theory of pricing. 1.1 Exchange-Traded versus Over-the-Counter A significant distinction is that between exchange-traded and over-the-counter (\OTC") derivatives. Derivatives that are traded on an exchange are stan- dardized to promote liquidity. They are \marked to market" as of the close of business every day, and the holder's brokerage account is credited or deb- ited with the day's change in value. The holder is required to keep cash or securities in the account sufficient to cover the next day's possible losses with a very high level of probability; this margin protects the other partici- pants against default by the holder of an \out of the money" position. Each instrument is a contract between the holder and the exchange. The OTC market consists of an informal system of dealers linked by telephone, and allows transactions to be customized to meet the precise needs 1 of the dealers' clients. -

A Guide to Investing in Floating-Rate Securities What You Should Know Before You Buy

A guide to investing in floating-rate securities What you should know before you buy What are floating-rate securities? Are floating rate bonds appropriate for you? Also known as “floaters,” these fixed income investments provide interest The features, risks, and income based on widely used interest rate benchmarks. The interest rate on characteristics of floating floaters will adjust periodically (float) depending on movement in the benchmark rate bonds are different from rates to which they are tied. Floaters can be linked to almost any benchmark and traditional fixed income pay interest based on a variety of formulas, some very complex. Basic floaters, products and should be though, pay a coupon equal to the benchmark plus a spread that does not change. evaluated by you and your This type of floater, along with others, will be discussed later in this guide. financial advisor before We have a responsibility to consider reasonably available alternatives in making making an investment a recommendation. We do not need to evaluate every possible alternative either decision. Investors should within our products or outside the firm in making a recommendation. We are not note that changes in interest required to offer the “best” or lowest cost product. While cost is a factor that we payments can significantly take into consideration in making a recommendation, it is not the only factor. affect an investor’s yield and, You should consider factors such as those below prior to accepting consequently, the price of the a recommendation: security may vary. • The potential risks, rewards, and costs in purchasing and in the future selling of a security. -

Report Title Here

Executive Summary SIFMA Research Quarterly – 3Q19 US Fixed Income Markets December 2019 US Fixed Income Page | 1 Executive Summary Contents Executive Summary ................................................................................................................................................................................... 4 Quarterly Performance ............................................................................................................................................................................... 5 Chart Book: Total Fixed Income ................................................................................................................................................................. 6 Chart Book: US Treasuires (UST) .............................................................................................................................................................. 7 Chart Book: Mortgage-Backed Securities (MBS) ....................................................................................................................................... 9 Chart Book: Corporate Bonds (Corporates) ............................................................................................................................................. 10 Chart Book: Municipal Securities (Munis) ................................................................................................................................................. 12 Chart Book: Federal Agency Securities (Agency) ................................................................................................................................... -

Progress in Transitioning to Risk-Free Rates Opportunities for Deepening Capital Markets Union Initiatives on Sustainable Finance

QUARTERLY ASSESSMENT OF MARKET PRACTICE AND REPORT REGULATORY POLICY INSIDE: PROGRESS IN TRANSITIONING TO RISK-FREE RATES OPPORTUNITIES FOR DEEPENING CAPITAL MARKETS UNION INITIATIVES ON SUSTAINABLE FINANCE 10 January 2020 First Quarter. Issue 56. Editor: Paul Richards SECTION TITLE The mission of ICMA is to promote resilient and well-functioning international and globally integrated cross-border debt securities markets, which are essential to fund sustainable economic growth and development. ICMA is a membership association, headquartered in Switzerland, committed to serving the needs of its wide range of members. These include public and private sector issuers, financial intermediaries, asset managers and other investors, capital market infrastructure providers, central banks, law firms and others worldwide. ICMA currently has over 580 members located in 62 countries. ICMA brings together members from all segments of the wholesale and retail debt securities markets, through regional and sectoral member committees, and focuses on a comprehensive range of market practice and regulatory issues which impact all aspects of international market functioning. ICMA prioritises four core areas – primary markets, secondary markets, repo and collateral markets, and the green and social bond markets. 2 | ISSUE 56 | | icmagroup.org First Quarter 2020 SECTION TITLE FEATURES: Progress01: in Opportunities02: for Initiatives03: on transitioning to deepening Capital sustainable risk-free rates Markets Union finance CONTENTS 4 MESSAGE FROM THE CHIEF 37