Floating Rate Note Examplary Underlying: Underlying Rate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fedwire Securities Service

Federal Reserve Banks Fedwire Securities Service Issuer Guide V1.1 Last Updated - August 2021 Fedwire is a registered service mark of the Federal Reserve Banks 1 African Development Bank 6 Avenue Joseph Anoma, Plateau http://www.afdb.org/ 01 BP 1387 [email protected] Abidjan 01 (225) 20.20.44.44 Côte d‘Ivoire The African Development Bank (AFDB) is a multilateral development bank established in 1963 to encourage sustainable economic growth and reduce poverty in Africa. Regional members include any African country that has the status of an independent state. Non- regional countries that are participants in, or contributing to, the African Development Fund, a separate legal entity administered by the African Development Bank to provide loan financing to regional member countries, may be admitted as non-regional member countries. The United States became a non-regional member of the African Development Bank in 1983 pursuant to the African Development Bank Act. Class Product Interest Minimum Multiple Record Date Payment Date Corresponding Code Description Payment Clearing Memo AFDB Bond Semi-annually $1,000 $1,000 Varies Varies 250 AFNT Note Semi-annually $100,000 $1,000 TBD TBD 250 2 Asian Development Bank 815 Connecticut Street, NW http://www.adb.org/ Washington, DC 20006 (202) 728-1500 The Asian Development Bank (ADB) is a multilateral development bank established in 1966 to promote economic growth, environmentally sustainable growth, and regional integration to reduce poverty in Asia and the Pacific region. The Asian Development Bank is owned by its 67 members, including regional and non-regional members. The United States became a member in 1966. -

Glossary of Bond Terms

Glossary of Bond Terms Accreted value- The current value of your zero-coupon municipal bond, taking into account interest that has been accumulating and automatically reinvested in the bond. Accrual bond- Often the last tranche in a CMO, the accrual bond or Z-tranche receives no cash payments for an extended period of time until the previous tranches are retired. While the other tranches are outstanding, the Z-tranche receives credit for periodic interest payments that increase its face value but are not paid out. When the other tranches are retired, the Z-tranche begins to receive cash payments that include both principal and continuing interest. Accrued interest- (1) The dollar amount of interest accrued on an issue, based on the stated interest rate on that issue, from its date to the date of delivery to the original purchaser. This is usually paid by the original purchaser to the issuer as part of the purchase price of the issue; (2) Interest deemed to be earned on a security but not yet paid to the investor. Active tranche- A CMO tranche that is currently paying principal payments to investors. Adjustable-rate mortgage (ARM)- A mortgage loan on which interest rates are adjusted at regular intervals according to predetermined criteria. An ARM's interest rate is tied to an objective, published interest rate index. Amortization- Liquidation of a debt through installment payments. Arbitrage- In the municipal market, the difference in interest earned on funds borrowed at a lower tax-exempt rate and interest on funds that are invested at a higher-yielding taxable rate. -

TREASURY FLOATING RATE NOTE TERM SHEET I. ISSUER United States Treasury II. DATED DATE Last Calendar Day of a Month. III. ISSUE

TREASURY FLOATING RATE NOTE TERM SHEET I. ISSUER United States Treasury II. DATED DATE Last calendar day of a month. III. ISSUE DATE Original issue offerings will be issued on the last calendar day of a month, or the first business day thereafter. Reopening offerings will be issued on the last Friday of a month, or the first business day thereafter. IV. MATURITY DATE Last calendar day of the month two years after the Dated Date. V. MATURITY PAYMENT Principal will be paid on the Maturity Date, or the first business day thereafter. VI. INTEREST DATES Quarterly from the Dated Date, to and including the Maturity Date, on the last calendar day of a month. VII. INTEREST PAYMENTS Interest will be paid on each Interest Date, or the first business day thereafter. VIII. INTEREST: A. ACCRUAL PERIOD From and including, the Dated Date or last Interest Payment date to, but excluding the next Interest Payment date or Maturity Date. B. INTEREST ACCRUAL In general, the interest accrual for a particular calendar day in an Accrual Period shall be the Index Rate computed from the most recent auction of 13-week Treasury bills that took place on a day before the accrual day, plus the Spread, divided by 360, subject to a minimum of zero. However, a 13-week Treasury bill auction whose rate becomes effective in the two business day Lock-Out Period prior to an FRN Issue Date or FRN Interest Date shall be ignored for purposes of calculating the interest accrual on that FRN for that day. Instead, the rate in effect for the Lock-Out Period will be from the most recent 13-week Treasury bill auction result that occurred prior to the start of the Lock-Out Period. -

1 Overview of Derivatives

1 Overview of Derivatives A financial derivative is usually defined as an instrument whose value is derived from some underlying cash market instrument. Familiar examples include • options to { buy (\call options") or { sell (\put options") a specified security or commodity at a specified price on a specified date, and • contracts such as { futures or { options on equity indices such Standard & Poor's 500. Newer examples include structured notes, which are securities whose interest or principal payments depend on market conditions, such as floating rate notes and inverse floaters. Swaps of various kinds are also derivatives. Various kinds of derivative are described by Hull, with both details of how their markets operate and the theory of pricing. 1.1 Exchange-Traded versus Over-the-Counter A significant distinction is that between exchange-traded and over-the-counter (\OTC") derivatives. Derivatives that are traded on an exchange are stan- dardized to promote liquidity. They are \marked to market" as of the close of business every day, and the holder's brokerage account is credited or deb- ited with the day's change in value. The holder is required to keep cash or securities in the account sufficient to cover the next day's possible losses with a very high level of probability; this margin protects the other partici- pants against default by the holder of an \out of the money" position. Each instrument is a contract between the holder and the exchange. The OTC market consists of an informal system of dealers linked by telephone, and allows transactions to be customized to meet the precise needs 1 of the dealers' clients. -

A Guide to Investing in Floating-Rate Securities What You Should Know Before You Buy

A guide to investing in floating-rate securities What you should know before you buy What are floating-rate securities? Are floating rate bonds appropriate for you? Also known as “floaters,” these fixed income investments provide interest The features, risks, and income based on widely used interest rate benchmarks. The interest rate on characteristics of floating floaters will adjust periodically (float) depending on movement in the benchmark rate bonds are different from rates to which they are tied. Floaters can be linked to almost any benchmark and traditional fixed income pay interest based on a variety of formulas, some very complex. Basic floaters, products and should be though, pay a coupon equal to the benchmark plus a spread that does not change. evaluated by you and your This type of floater, along with others, will be discussed later in this guide. financial advisor before We have a responsibility to consider reasonably available alternatives in making making an investment a recommendation. We do not need to evaluate every possible alternative either decision. Investors should within our products or outside the firm in making a recommendation. We are not note that changes in interest required to offer the “best” or lowest cost product. While cost is a factor that we payments can significantly take into consideration in making a recommendation, it is not the only factor. affect an investor’s yield and, You should consider factors such as those below prior to accepting consequently, the price of the a recommendation: security may vary. • The potential risks, rewards, and costs in purchasing and in the future selling of a security. -

Report Title Here

Executive Summary SIFMA Research Quarterly – 3Q19 US Fixed Income Markets December 2019 US Fixed Income Page | 1 Executive Summary Contents Executive Summary ................................................................................................................................................................................... 4 Quarterly Performance ............................................................................................................................................................................... 5 Chart Book: Total Fixed Income ................................................................................................................................................................. 6 Chart Book: US Treasuires (UST) .............................................................................................................................................................. 7 Chart Book: Mortgage-Backed Securities (MBS) ....................................................................................................................................... 9 Chart Book: Corporate Bonds (Corporates) ............................................................................................................................................. 10 Chart Book: Municipal Securities (Munis) ................................................................................................................................................. 12 Chart Book: Federal Agency Securities (Agency) ................................................................................................................................... -

Progress in Transitioning to Risk-Free Rates Opportunities for Deepening Capital Markets Union Initiatives on Sustainable Finance

QUARTERLY ASSESSMENT OF MARKET PRACTICE AND REPORT REGULATORY POLICY INSIDE: PROGRESS IN TRANSITIONING TO RISK-FREE RATES OPPORTUNITIES FOR DEEPENING CAPITAL MARKETS UNION INITIATIVES ON SUSTAINABLE FINANCE 10 January 2020 First Quarter. Issue 56. Editor: Paul Richards SECTION TITLE The mission of ICMA is to promote resilient and well-functioning international and globally integrated cross-border debt securities markets, which are essential to fund sustainable economic growth and development. ICMA is a membership association, headquartered in Switzerland, committed to serving the needs of its wide range of members. These include public and private sector issuers, financial intermediaries, asset managers and other investors, capital market infrastructure providers, central banks, law firms and others worldwide. ICMA currently has over 580 members located in 62 countries. ICMA brings together members from all segments of the wholesale and retail debt securities markets, through regional and sectoral member committees, and focuses on a comprehensive range of market practice and regulatory issues which impact all aspects of international market functioning. ICMA prioritises four core areas – primary markets, secondary markets, repo and collateral markets, and the green and social bond markets. 2 | ISSUE 56 | | icmagroup.org First Quarter 2020 SECTION TITLE FEATURES: Progress01: in Opportunities02: for Initiatives03: on transitioning to deepening Capital sustainable risk-free rates Markets Union finance CONTENTS 4 MESSAGE FROM THE CHIEF 37 -

Credit Product Conventions Contents

July 2020 Credit Product Conventions Contents Preface: AFMA Code of Conduct ................................................................................................................ 2 1. Description ............................................................................................................................................ 2 2. Products ................................................................................................................................................. 3 2.1. Fixed Rate Bonds .................................................................................................................... 3 2.2. Floating Rate Notes ................................................................................................................ 3 2.3. Credit Default Swaps .............................................................................................................. 3 2.4. Credit Linked Notes ................................................................................................................ 4 2.5. Total Rate of Return Swap ...................................................................................................... 4 2.6. Credit Spread Options ............................................................................................................ 4 3. Dealing ................................................................................................................................................... 4 3.1. Methods of Dealing ............................................................................................................... -

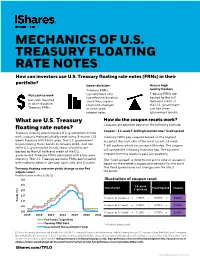

MECHANICS of U.S. TREASURY FLOATING RATE NOTES How Can Investors Use U.S

MECHANICS OF U.S. TREASURY FLOATING RATE NOTES How can investors use U.S. Treasury floating rate notes (FRNs) in their portfolio? Lower duration Access high Treasury FRNs quality floaters Treasury FRNs are Put cash to work typically have very low effective duration, backed by the full Get cash invested since the coupons faith and credit of in short duration reset with changes the U.S. government, Treasury FRNs in short-term just like other interest rates government bonds What are U.S. Treasury How do the coupon resets work? floating rate notes? Coupons are adjusted based on the following formula: Coupon = 13-week T-bill high auction rate + fixed spread Treasury floating rate notes are U.S. government bonds with coupons that periodically reset using 3-month (13 Treasury FRNs pay coupons based on the highest week) Treasury bill (T-bill) rates. The U.S. government accepted discount rate of the most recent 13-week began issuing these bonds in January 2014. Just like T-bill auction, which occurs each Monday. The coupon other U.S. government bonds, these securities are will update the following business day. The accrued backed by the full faith and credit of the U.S. government. Treasury FRNs are issued with a two-year interest from the resets is paid out quarterly. maturity. The U.S. Treasury auctions FRNs each quarter The “fixed spread” is determined at the time of issuance with maturity dates in January, April, July, and October. based on the market’s supply and demand for the bond. Treasury floating rate note yields change as the Fed The fixed spread does not change over the life of adjusts rates1 the bond. -

Floating Rate Bonds.Indd

MAY 2014 Floating-Rate Bonds: Switching One Risk for Others Floating-rate bonds (FRB) and FRB funds are attracting investors searching for more income and capital protection. Strong performance has compounded the attraction. Th e primary benefi ts of FRBs seem compelling, but there are risks: credit risk, liquidity risk, concentration risk and valuation risk. In this piece, Floating Rate we address each. Bond Risks: Credit Risk: Issuers tend What is a Floating Rate Bond? to be non-investment grade, increasing the Unlike traditional bonds, FRBs do not have a fi xed rate coupon. Instead, their rate fl uctuates or fl oats potential for default. based on the market (oft en the quarterly London Interbank Off ered Rate or LIBOR) plus a spread. As a result, FRBs tend to be less vulnerable to interest-rate fl uctuations. Many believe FRBs can help preserve Liquidity Risk: The market for FRBs has grown principal, while off ering above-average yields—especially if rates rise. signifi cantly, but remains vulnerable to “shocks.” Typically, FRBs are issued by banks or other fi nancial fi rms to companies. Th ese loans are oft en pooled and sold to investors. FRBs are fairly senior in terms of a company’s capital structure. Th at means FRB holders Valuation Risk: Recent have a high priority claim on company assets in the event of bankruptcy. However, it does not protect demand has pushed prices for FRBs up, leaving less against the potential for default. of a margin of safety for long-term investors. Swapping Interest-Rate Risk for Credit Risk Little Diversifi cation In essence, FRB investors are exchanging one risk for another; they are minimizing interest-rate risk, but Benefi t: Returns for exposing themselves to greater credit risk. -

A Primer on Credit Default Swaps (Cds)

A PRIMER ON CREDIT DEFAULT SWAPS (CDS) Thomas S. Coleman, PhD Close Mountain Advisors LLC [email protected] 21 October 2008, updated 23 March 2009, 29 December 2009 (to include pricing) INTRODUCTION The market for Credit Default Swaps (CDS) has grown from nothing just over ten years ago to a huge market today. But what is a CDS? How does a CDS behave in response to changes in the markets? How does one value a CDS? What is the risk? This primer aims to answer these questions for plain- vanilla single-name CDS. Although CDS are often portrayed as complex, mysterious, even malevolent, they are really no more complex or mysterious than a corporate bond. I show how and why a CDS behaves, in almost all respects, as a leveraged or financed floating-rate corporate bond. The equivalence between a CDS and a floating-rate bond is very useful because it means that anyone acquainted with corporate bonds, anyone who understands how and why they behave in the market as they do, how they are valued, and what their risks are, understands the most important aspects of a CDS. In essence, a CDS is no harder (and no easier) to value or understand than the underlying corporate bond. I also point out the particular ways in which a CDS differs from a corporate bond. To preview the main points: • Selling protection through a CDS is equivalent to buying a floating-rate corporate bond (a floating rate note or FRN) using leverage. − Selling protection for x years is in most respects the same as being long a corporate bond with x years to maturity. -

The U.S. Treasury Floating Rate Note Puzzle: Is There A

THE U.S. TREASURY FLOATING RATE NOTE PUZZLE: IS THERE A PREMIUM FOR MARK-TO-MARKET STABILITY? Matthias Fleckenstein Francis A. Longstaff Abstract. We find that Treasury floating rate notes (FRNs) trade at a signif- icant premium relative to the prices of Treasury bills and notes. This premium differs from previously-documented liquidity premia in Treasury security prices, is directly related to the near-constant nature of FRN prices, and is correlated with measures reflecting investor demand for safe assets. Motivated by evidence that money market funds are often the primary investors in FRNs, we use an important discontinuity in the recent regulatory reform of money market funds to identify exogenous shocks in the demand for investments with stable net asset values (NAVs). The FRN premium is related to flows into money market funds with fixed NAVs, but not to flows into similar funds with variable NAVs. These results provide strong evidence that the FRN premium represents a convenience yield for the mark-to-market stability feature of FRNs. Current draft: June 2019. Matthias Fleckenstein is with the University of Delaware. Francis A. Longstaff is with the UCLA Anderson School and the NBER. This paper was previously titled: “Floating Rate Money? The Stability Premium in Treasury Floating Rate Notes.” We are grateful for the comments and insights of Gurdip Bakshi, Xiao- hui Gao Bakshi, Geert Bekaert, David Brown, Hui Chen, John Cochrane, Dou- glas Diamond, Christian Dreyer (discussant), Andrey Ermolov, Mark Grinblatt, Jean Helwege, Burton Hollifield