BASE PROSPECTUS Finlombarda S.P.A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interest Rate Options

Interest Rate Options Saurav Sen April 2001 Contents 1. Caps and Floors 2 1.1. Defintions . 2 1.2. Plain Vanilla Caps . 2 1.2.1. Caplets . 3 1.2.2. Caps . 4 1.2.3. Bootstrapping the Forward Volatility Curve . 4 1.2.4. Caplet as a Put Option on a Zero-Coupon Bond . 5 1.2.5. Hedging Caps . 6 1.3. Floors . 7 1.3.1. Pricing and Hedging . 7 1.3.2. Put-Call Parity . 7 1.3.3. At-the-money (ATM) Caps and Floors . 7 1.4. Digital Caps . 8 1.4.1. Pricing . 8 1.4.2. Hedging . 8 1.5. Other Exotic Caps and Floors . 9 1.5.1. Knock-In Caps . 9 1.5.2. LIBOR Reset Caps . 9 1.5.3. Auto Caps . 9 1.5.4. Chooser Caps . 9 1.5.5. CMS Caps and Floors . 9 2. Swap Options 10 2.1. Swaps: A Brief Review of Essentials . 10 2.2. Swaptions . 11 2.2.1. Definitions . 11 2.2.2. Payoff Structure . 11 2.2.3. Pricing . 12 2.2.4. Put-Call Parity and Moneyness for Swaptions . 13 2.2.5. Hedging . 13 2.3. Constant Maturity Swaps . 13 2.3.1. Definition . 13 2.3.2. Pricing . 14 1 2.3.3. Approximate CMS Convexity Correction . 14 2.3.4. Pricing (continued) . 15 2.3.5. CMS Summary . 15 2.4. Other Swap Options . 16 2.4.1. LIBOR in Arrears Swaps . 16 2.4.2. Bermudan Swaptions . 16 2.4.3. Hybrid Structures . 17 Appendix: The Black Model 17 A.1. -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

An Analysis of OTC Interest Rate Derivatives Transactions: Implications for Public Reporting

Federal Reserve Bank of New York Staff Reports An Analysis of OTC Interest Rate Derivatives Transactions: Implications for Public Reporting Michael Fleming John Jackson Ada Li Asani Sarkar Patricia Zobel Staff Report No. 557 March 2012 Revised October 2012 FRBNY Staff REPORTS This paper presents preliminary fi ndings and is being distributed to economists and other interested readers solely to stimulate discussion and elicit comments. The views expressed in this paper are those of the authors and are not necessarily refl ective of views at the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors. An Analysis of OTC Interest Rate Derivatives Transactions: Implications for Public Reporting Michael Fleming, John Jackson, Ada Li, Asani Sarkar, and Patricia Zobel Federal Reserve Bank of New York Staff Reports, no. 557 March 2012; revised October 2012 JEL classifi cation: G12, G13, G18 Abstract This paper examines the over-the-counter (OTC) interest rate derivatives (IRD) market in order to inform the design of post-trade price reporting. Our analysis uses a novel transaction-level data set to examine trading activity, the composition of market participants, levels of product standardization, and market-making behavior. We fi nd that trading activity in the IRD market is dispersed across a broad array of product types, currency denominations, and maturities, leading to more than 10,500 observed unique product combinations. While a select group of standard instruments trade with relative frequency and may provide timely and pertinent price information for market partici- pants, many other IRD instruments trade infrequently and with diverse contract terms, limiting the impact on price formation from the reporting of those transactions. -

Panagora Global Diversified Risk Portfolio General Information Portfolio Allocation

March 31, 2021 PanAgora Global Diversified Risk Portfolio General Information Portfolio Allocation Inception Date April 15, 2014 Total Assets $254 Million (as of 3/31/2021) Adviser Brighthouse Investment Advisers, LLC SubAdviser PanAgora Asset Management, Inc. Portfolio Managers Bryan Belton, CFA, Director, Multi Asset Edward Qian, Ph.D., CFA, Chief Investment Officer and Head of Multi Asset Research Jonathon Beaulieu, CFA Investment Strategy The PanAgora Global Diversified Risk Portfolio investment philosophy is centered on the belief that risk diversification is the key to generating better risk-adjusted returns and avoiding risk concentration within a portfolio is the best way to achieve true diversification. They look to accomplish this by evaluating risk across and within asset classes using proprietary risk assessment and management techniques, including an approach to active risk management called Dynamic Risk Allocation. The portfolio targets a risk allocation of 40% equities, 40% fixed income and 20% inflation protection. Portfolio Statistics Portfolio Composition 1 Yr 3 Yr Inception 1.88 0.62 Sharpe Ratio 0.6 Positioning as of Positioning as of 0.83 0.75 Beta* 0.78 December 31, 2020 March 31, 2021 Correlation* 0.87 0.86 0.79 42.4% 10.04 10.6 Global Equity 43.4% Std. Deviation 9.15 24.9% U.S. Stocks 23.6% Weighted Portfolio Duration (Month End) 9.0% 8.03 Developed non-U.S. Stocks 9.8% 8.5% *Statistic is measured against the Dow Jones Moderate Index Emerging Markets Equity 10.0% 106.8% Portfolio Benchmark: Nominal Fixed Income 142.6% 42.0% The Dow Jones Moderate Index is a composite index with U.S. -

Interest Rate Swap Contracts the Company Has Two Interest Rate Swap Contracts That Hedge the Base Interest Rate Risk on Its Two Term Loans

$400.0 million. However, the $100.0 million expansion feature may or may not be available to the Company depending upon prevailing credit market conditions. To date the Company has not sought to borrow under the expansion feature. Borrowings under the Credit Agreement carry interest rates that are either prime-based or Libor-based. Interest rates under these borrowings include a base rate plus a margin between 0.00% and 0.75% on Prime-based borrowings and between 0.625% and 1.75% on Libor-based borrowings. Generally, the Company’s borrowings are Libor-based. The revolving loans may be borrowed, repaid and reborrowed until January 31, 2012, at which time all amounts borrowed must be repaid. The revolver borrowing capacity is reduced for both amounts outstanding under the revolver and for letters of credit. The original term loan will be repaid in 18 consecutive quarterly installments which commenced on September 30, 2007, with the final payment due on January 31, 2012, and may be prepaid at any time without penalty or premium at the option of the Company. The 2008 term loan is co-terminus with the original 2007 term loan under the Credit Agreement and will be repaid in 16 consecutive quarterly installments which commenced June 30, 2008, plus a final payment due on January 31, 2012, and may be prepaid at any time without penalty or premium at the option of Gartner. The Credit Agreement contains certain customary restrictive loan covenants, including, among others, financial covenants requiring a maximum leverage ratio, a minimum fixed charge coverage ratio, and a minimum annualized contract value ratio and covenants limiting Gartner’s ability to incur indebtedness, grant liens, make acquisitions, be acquired, dispose of assets, pay dividends, repurchase stock, make capital expenditures, and make investments. -

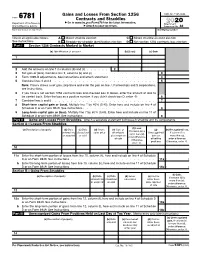

Form 6781 Contracts and Straddles ▶ Go to for the Latest Information

Gains and Losses From Section 1256 OMB No. 1545-0644 Form 6781 Contracts and Straddles ▶ Go to www.irs.gov/Form6781 for the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service ▶ Attach to your tax return. Sequence No. 82 Name(s) shown on tax return Identifying number Check all applicable boxes. A Mixed straddle election C Mixed straddle account election See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election Part I Section 1256 Contracts Marked to Market (a) Identification of account (b) (Loss) (c) Gain 1 2 Add the amounts on line 1 in columns (b) and (c) . 2 ( ) 3 Net gain or (loss). Combine line 2, columns (b) and (c) . 3 4 Form 1099-B adjustments. See instructions and attach statement . 4 5 Combine lines 3 and 4 . 5 Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions. 6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . 6 7 Combine lines 5 and 6 . 7 8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of Schedule D or on Form 8949. See instructions . 8 9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of Schedule D or on Form 8949. -

Managing Interest Rate Risk by Managing Duration

VANDERBILT AVENUE ASSET MANAGEMENT Managing Interest Rate Risk by Managing Duration In a perfect world, interest rates would not fluctuate and the value of the bonds in your portfolio would not change over time. Unfortunately, we live in a world where interest rates move up and down…sometimes dramatically…over the course of a bond’s term. This movement can have a meaningful impact on your portfolio, if not taken into account in the day-to-day management of your fixed income assets. One of the ways we help to insulate your portfolio from negative interest rate moves and to take advantage of those that are positive, is to carefully monitor its duration. In what follows, we will examine the concept of duration and its applicability as an interest rate risk management tool. Duration as a risk measure: There is an inverse relationship between the price of a bond and its yield. The yield on a bond is the discount rate that makes the present value of the bond’s cash flows equal to its price. Thus, as the bond’s price declines, its yield increases, a direct reflection of the discount between the bond’s par value and the price investors are willing to pay for it. In a rising interest rate environment investors demand greater yields, which can only be provided by lowering the asking price for the bond. Conversely, in a decreasing interest rate environment, the bond’s fixed rate of return may make it very attractive to investors, causing its price to rise (a reflection of increased demand) and its yield to decline. -

Fedwire Securities Service

Federal Reserve Banks Fedwire Securities Service Issuer Guide V1.1 Last Updated - August 2021 Fedwire is a registered service mark of the Federal Reserve Banks 1 African Development Bank 6 Avenue Joseph Anoma, Plateau http://www.afdb.org/ 01 BP 1387 [email protected] Abidjan 01 (225) 20.20.44.44 Côte d‘Ivoire The African Development Bank (AFDB) is a multilateral development bank established in 1963 to encourage sustainable economic growth and reduce poverty in Africa. Regional members include any African country that has the status of an independent state. Non- regional countries that are participants in, or contributing to, the African Development Fund, a separate legal entity administered by the African Development Bank to provide loan financing to regional member countries, may be admitted as non-regional member countries. The United States became a non-regional member of the African Development Bank in 1983 pursuant to the African Development Bank Act. Class Product Interest Minimum Multiple Record Date Payment Date Corresponding Code Description Payment Clearing Memo AFDB Bond Semi-annually $1,000 $1,000 Varies Varies 250 AFNT Note Semi-annually $100,000 $1,000 TBD TBD 250 2 Asian Development Bank 815 Connecticut Street, NW http://www.adb.org/ Washington, DC 20006 (202) 728-1500 The Asian Development Bank (ADB) is a multilateral development bank established in 1966 to promote economic growth, environmentally sustainable growth, and regional integration to reduce poverty in Asia and the Pacific region. The Asian Development Bank is owned by its 67 members, including regional and non-regional members. The United States became a member in 1966. -

Chapter 10 Bond Prices and Yields Questions and Problems

CHAPTER 10 Bond Prices and Yields Interest rates go up and bond prices go down. But which bonds go up the most and which go up the least? Interest rates go down and bond prices go up. But which bonds go down the most and which go down the least? For bond portfolio managers, these are very important questions about interest rate risk. An understanding of interest rate risk rests on an understanding of the relationship between bond prices and yields In the preceding chapter on interest rates, we introduced the subject of bond yields. As we promised there, we now return to this subject and discuss bond prices and yields in some detail. We first describe how bond yields are determined and how they are interpreted. We then go on to examine what happens to bond prices as yields change. Finally, once we have a good understanding of the relation between bond prices and yields, we examine some of the fundamental tools of bond risk analysis used by fixed-income portfolio managers. 10.1 Bond Basics A bond essentially is a security that offers the investor a series of fixed interest payments during its life, along with a fixed payment of principal when it matures. So long as the bond issuer does not default, the schedule of payments does not change. When originally issued, bonds normally have maturities ranging from 2 years to 30 years, but bonds with maturities of 50 or 100 years also exist. Bonds issued with maturities of less than 10 years are usually called notes. -

Glossary of Bond Terms

Glossary of Bond Terms Accreted value- The current value of your zero-coupon municipal bond, taking into account interest that has been accumulating and automatically reinvested in the bond. Accrual bond- Often the last tranche in a CMO, the accrual bond or Z-tranche receives no cash payments for an extended period of time until the previous tranches are retired. While the other tranches are outstanding, the Z-tranche receives credit for periodic interest payments that increase its face value but are not paid out. When the other tranches are retired, the Z-tranche begins to receive cash payments that include both principal and continuing interest. Accrued interest- (1) The dollar amount of interest accrued on an issue, based on the stated interest rate on that issue, from its date to the date of delivery to the original purchaser. This is usually paid by the original purchaser to the issuer as part of the purchase price of the issue; (2) Interest deemed to be earned on a security but not yet paid to the investor. Active tranche- A CMO tranche that is currently paying principal payments to investors. Adjustable-rate mortgage (ARM)- A mortgage loan on which interest rates are adjusted at regular intervals according to predetermined criteria. An ARM's interest rate is tied to an objective, published interest rate index. Amortization- Liquidation of a debt through installment payments. Arbitrage- In the municipal market, the difference in interest earned on funds borrowed at a lower tax-exempt rate and interest on funds that are invested at a higher-yielding taxable rate. -

Floating Rate Note Examplary Underlying: Underlying Rate

Floating Rate Note Examplary Underlying: Underlying rate In general, Floating Rate Notes (FRN) offer you floating coupon payments based on an underlying interest rate and a redemption at 100% of the nominal value on the redemption date (subject to the credit risk of the issuer). The floating coupon is subject to a minimum coupon (floor). The payout profile is for illustrative purposes only and is based on the assumption that no exceptional cancellation will occur, in accordance with the issuer’s product documentation. Main features of a sample product Currency Term Return USD 3 years Underlying rate, minimum 2.90% p.a. Participation Capital no additional participation Floor at 100% (subject to issuer risk) You may consider an investment in this product, if You look for a way to enhance yield on your cash positions You are familiar with both structured products and fixed income markets You are comfortable being exposed to floating coupon payments based on an underlying interest rate You intend to be invested in this product until its redemption date You wish to be invested in the investment currency of the product. If your reference currency is not equal to the investment currency of the product, the return may increase or decrease in reference currency terms as a result of exchange rate fluctuations Summary of main product- Summary of main product- specific benefits specific risks Quarterly adjustment of the coupon Decreasing underlying rate resulting in lower Floor offering a minimum coupon payment coupon payments (but not below the floor) Full capital protection on the redemption date If the currency of the product is different from your reference currency, the return may increase or decrease as a result of currency fluctuations You are fully exposed to the default risk of the issuer. -

Recent Interest Rate Changes, Effective Duration and Effect on Your Portfolio

CMTA Conference Track 2 April 15th, 2015 Recent Interest Rate Changes, Effective Duration and Effect on Your Portfolio Presented by: Jessica Burruss, Director, BondEdge Sales BondEdge is a leading provider of fixed income portfolio analytics to institutional investors with over 30 years expertise working with a client base that includes more than 400 investment managers, banks, insurance companies, state and local government agencies, brokerage firms, depository institutions, and pension funds 1 Agenda Review of recent interest rate movements Specific examples of analytic measures that matter Forward looking simulations -BondEdge best practices 2 6/16/2015 3 6/16/2015 Are shifts parallel ….? Recent Shifts in the US Yield Curve Page 4 CONFIDENTIAL Dynamic Risk Measures - Dynamic risk measures were developed to overcome the limitations inherent in static risk measures - Dynamic risk measures include, but are not limited to: ‣ Option-adjusted spread (OAS) ‣ Option-adjusted duration (OAD) ‣ Option-adjusted convexity (OAC) ‣ Key rate durations (KRD) ‣ Spread Duration - Dynamic risk measures are a “probabilistic” combination of static outcomes March 7-9, 2012 5 Dynamic Risk Measures – Price Sensitivity Effective Duration ‣ Option-adjusted measure of a bond‘s sensitivity to changes in interest rates. Calculated as the average percentage change in a bond's value (price plus accrued interest) under parallel shifts of the Treasury curve. ‣ Incorporates the effect of embedded options for corporate bonds and changes in prepayments for mortgage-backed securities (including pass-throughs, CMOs and ARMs) . For Municipal Variable Rate Demand Notes (VRDNs), Effective Duration is calculated based on cash flows to the next reset date. ‣ BondEdge uses +/- 100 bps, then derives two new spot curves from the shifted par curves.