Business Divisional Strategies and Projections in FY2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The World in an Amusement Arcade!

contents Founded in 2005 4th year Issue 28 March 2008 Editing AMUSEMENT TIME VIA A.CRISTIANO 4 80028 GRUMO NEVANO (NA) ITALY Editor in chief Dott.ENRICO D’ANIELLO Publisher PHANTASMATA GROUP Advertising, Marketing & Communication [email protected] Contact & News [email protected] Pag.4 Subscripton Sending a free request to [email protected] Amusement NEWS Subscribed Readers : 29.651 Supplement to registration N°59 del 30 Settembre 2005 del Tribunale di Napoli. From world All rights reserved. Reproduction in whole or in part without permission of the publisher is prohibited. Amusement Time © 2008 Pag.29 amusement events Amusement news from world Soundnet - Formerly Known As DT Productions DT Productions will from now on be known exclusively as Soundnet. Soundnet was previously the name used solely for the division of DT Productions that dealt with the digital jukebox industry. However, the name will now cover all the company's business supplying audio and audio/visual content to pubs, bars, shops and clubs. Soundnet sums up the business activity of the company and with a number of new audio, video and karaoke products set for release in 2008 it makes sense to standardise the business into only one brand for recognition purposes. Soundnet specialises in bespoke music and video compilations that capture a brand's unique personality. From mainstream pop to hardcore rock, every programme is carefully compiled from the exclusive library of 50,000 audio titles, 30,000 video titles and 5,000 karaoke tracks. The programming department sources all the content directly from the record labels at the same time as it is dispatched to radio and TV. -

Du Mutisme Au Dialogue

École Nationale Supérieure Louis Lumière Promotion Son 2015 Du mutisme au dialogue Les interactions vocales dans le jeu vidéo Partie pratique : v0x Mémoire de fin d'étude Rédacteur : Charles MEYER Directeur interne: Thierry CODUYS Directrice externe : Isabelle BALLET Rapporteur : Claude GAZEAU Année universitaire 2014-2015 Mémoire soutenu le 15 juin 2015 Remerciements : Je tiens à remercier chaleureusement mes deux directeurs de mémoire pour leur implication, leur confiance et leur exigence. Je remercie tout particulièrement Nicolas GIDON, sans qui la réalisation de la partie pratique de ce mémoire aurait été plus chronophage et complexe.. Je remercie et salue Nicolas FOURNIER et Baptiste PALACIN, dont les travaux et la gentillesse ont été une source d'inspiration et de détermination. Je remercie également ma mère, ma tante, Jordy, Julien et Julien (n'en déplaise à Julien), Timothée et mes amis pour leur soutien indéfectible. Merci à madame VALOUR, monsieur COLLET, monsieur FARBRÈGES ainsi qu'à leurs élèves. Enfin, merci à From Software et à NetherRealm Studios pour leur jeux, qui auront été un défouloir bienvenu. Page 2 Résumé Ce mémoire de master a pour objet d'étude les interactions vocales dans le jeu vidéo. Cependant, il ne se limite pas à une étude historique de l'évolution de la vocalité au sein des jeux vidéo mais en propose une formalisation théorique autour de trois concepts essentiels : Mécanique, Narration et Immersion. De ces trois concepts découlent trois types de voix : les voix système, les voix narratives (linéaires et non- linéaires) et les voix d'ambiance. Dans le prolongement de cette étude et en s'appuyant sur les travaux menés dans le cadre des parties expérimentale et pratique de ce mémoire, ayant abouti à la réalisation d'un jeu vidéo basé sur l'analyse spectrale de la voix du joueur, v0x, nous proposons une extension de cette théorie de la vocalité vidéo-ludique afin d'intégrer l'inclusion de la voix du joueur au sein de ce cadre d'étude. -

AARON DODD Vancouver B.C

AARON DODD Vancouver B.C. [email protected] 778.908.6870 SENIOR ENVIRONMENT ARTIST www.artstation.com/aarondodd Highlights___________________________________________________________________________ • 11+ years of experience in AAA development • Proactive in learning new skills, software and workflows • Versatile skill set including the execution and integration of art outsourcing • Background in lighting with experience in lighting for cinematics • Active in interviewing, training and mentoring team members • Strong cross-discipline collaborator Professional Experience______________________________________________________________ Senior Environment Artist Feb 2012-Sept 2018 Capcom Vancouver • Dead Rising 4 o Created material sets and texture standards for PBR workflow o Worked with Tech Art to optimize and create best practices o Layout and art production for multiple areas • Dead Rising 3 o World building, set dressing and prop creation o Performance optimizations with Tech Art • Unannounced Project o Responsible for look development, texturing and modelling of key gameplay feature Mentor Apr 2011- Feb 2012 Think Tank Training Center • Coached and trained multiple artists working on their demo reels in their final semester at the Think Tank Training Center Environment Artist Apr 2011- Feb 2012 EA Black Box • Need for Speed: The Run o Responsible for level construction and balancing performance for multiple tracks o Road textures for numerous levels based on specific art direction and style guides Environment Artist/Lighting Artist Apr -

ABSTRACT This Paper Offers a Social History of Funfairs and Arcades In

ABSTRACT This paper offers a social history of funfairs and arcades in mid-20th century urban England. Critiquing existing histories of games for often neglecting players and the specific locales in which games are played, it draws on both new cinema history and cultural studies’ conception of ‘radical contextualism’ to outline what the paper describes as a game’s ludosity. Ludosity, the paper proposes, condition or quality of game experience as shaped by a range of agents, institutions and contexts. Utilising mass observation records, it offers a detailed analysis of the ways in which social interactions influenced ludic experiences of pinball tables and crane machines and posits that games history needs to centre players in order to fully conceptualize games in history. KEYWORDS Games history; social history; arcades; pinball; cultural studies. INTRODUCTION Fun fairs and amusement arcades mushroomed in England’s cities during the 1930s and 40s, to the extent that The Guardian described a ‘fun fair craze’ (‘The Fun Fair Craze’, 1938, p.8). The Daily Mail, the mouthpiece of middle-England, breathlessly portrayed the sights and sounds of these new spaces: Click, click, click! The ball runs down the table, bounces against springs, falls into a slot, is shot back again. Bells ring. Lights appears. On a picturesque background figures dance to the evolutions of a rising score . A crowd gathers round, for the games as fascinating to watch as to play. (Crofton, 1939, p.10) In blending the mechanical and electrical systems with the social experiences specific to the English urban milieus, this description hints at the overarching and interconnected arguments 1 presented in this paper. -

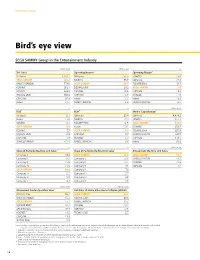

Bird's Eye View

DETERMINATION Bird’s eye view SEGA SAMMY Group in the Entertainment Industry Billions of yen Billions of yen % Net Sales 1 Operating Income 1 Operating Margin 1 Nintendo 1,434.3 Nintendo 356.5 SANKYO 25.0 SEGA SAMMY 384.6 SANKYO 55.7 Nintendo 24.9 NAMCO BANDAI 378.5 SEGA SAMMY 36.7 SQUARE ENIX 14.7 KONAMI 262.1 SQUARE ENIX 28.2 SEGA SAMMY 9.5 SANKYO 222.6 KONAMI 18.6 CAPCOM 8.4 SQUARE ENIX 192.2 CAPCOM 5.5 KONAMI 7.1 CAPCOM 66.8 Heiwa 3.7 Heiwa 5.9 Heiwa 63.3 NAMCO BANDAI 1.8 NAMCO BANDAI 0.5 % % Billions of yen ROE 1 ROA 1, 2 Market Capitalization 4 Nintendo 17.7 Nintendo 20.4 Nintendo 4,434.2 Heiwa 13.0 SANKYO 12.4 SANKYO 451.3 SANKYO 9.1 SQUARE ENIX 11.5 SEGA SAMMY 320.6 SEGA SAMMY 8.8 Heiwa 9.1 KONAMI 258.7 KONAMI 7.3 SEGA SAMMY 8.5 SQUARE ENIX 235.8 SQUARE ENIX 6.3 CAPCOM 5.7 NAMCO BANDAI 227.7 CAPCOM 3.8 KONAMI 3 5.7 CAPCOM 119.5 NAMCO BANDAI –12.4 NAMCO BANDAI 0.6 Heiwa 95.9 % % Billions of yen Share of Pachinko Machine Unit Sales 5 Share of Pachislot Machine Unit Sales 5 Amusement Machine Unit Sales 1 Company S 18.0 SEGA SAMMY 21.3 SEGA SAMMY 45.1 Company S 17.2 Company S 13.6 NAMCO BANDAI 44.0 Company K 12.8 Company U 13.1 KONAMI 32.8 Company N 11.9 Company Y 9.5 CAPCOM 2.2 SEGA SAMMY 10.8 Company K 7.8 Company H 5.1 Company H 5.7 Company D 5.0 Company D 4.6 Company F 4.7 Company A 3.9 Billions of yen Millions of units Amusement Center Operation Sales 1 Unit Sales of Home Video Game Software (Global) ROUND ONE 82.1 SEGA SAMMY 26.7 NAMCO BANDAI 65.3 SQUARE ENIX 26.6 SEGA SAMMY 54.7 NAMCO BANDAI 22.7 SQUARE ENIX 6 52.2 KONAMI 20.2 AEON Fantasy 43.7 CAPCOM 12.5 ADORES 7 19.5 TECMO KOEI 5.7 CAPCOM 11.9 TECMO KOEI 3.3 Note: The above is intended to give an idea of the Group’s position in the industry and only covers companies for which information can be obtained from published documents, such as listed companies or over-the-counter (OTC) companies. -

Devil May Cry 5 Days Gone

MAY 2019 ISSUE 17 TITI MAGAZINE Rage 2 Devil May Cry 5 Tom Clancy's The Division 2 Days Gone Titimag.com EDITOR Dickson Max Prince MAY 2019 ISSUE 17 CONTRIBUTORS Anita .t. Dickson Efenudu Ejiro Michael Bekesu Anthony Rage 2 Dickson Max Prince Ernest .O. Devil May Cry 5 Tom Clancy's The Division 2 PUBLISHERS Days Gone Pucutiti.Inc MECEDES GLE 2019 ACURA MDX titimag.com For more info [email protected] 12 HEALTH BENEFITS OF AVOCADOS +2348134428331 +2348089216836 Titimag.com Titi Magazine and all Titi related Sub sections are trademark of Pucutiti.inc The Pucutiti logo, Titi Magazine logo, Titi Store logo , Titi Games logo, Titi Animation logo, Titi Web Developers logo,, Titi Studios logo, Titi Messenger logo are all trade mark of Pucutiti.inc. Only Pucutiti.Inc reserve the rights to all Titi Magazine and all Titi related Subsections. Copyright © titimag May 2019 Rage 2 (stylized as RAGE 2) is an upcoming first-person shooter video game developed by Avalanche Studios in conjunction with id Soft- ware and published by Bethesda Softworks. The game is the sequel to the 2011 game Rage. The game is set to be released for Microsoft Windows, PlayStation 4and Xbox One on May 14, 2019. Gameplay The game is a first-person shooter. Players assume control of ranger Walker, who is free to explore the game's post-apocalyptic open world. Players are given control over some of Walker's attributes, such as their gender, skills, or attire. Walker is able to wield various firearms and tools to fight against enemies, including returning weapons such as the wingstick. -

Sfrasfrareview.Org

REVIEWS sfrareview.org ARTICLES SFRA UPDATES REVIEW SINCE 1971 VOLUME 50 : ISSUE 1 : WINTER 2020 50/1 THE OPEN ACCESS JOURNAL OF THE WINTER 2020 SFRA MASTHEAD ReSCIENCE FICTIONview RESEARCH ASSOCIATION ISSN 2641-2837 SENIOR EDITORS SFRA Review is an open access journal published four times a year by EDITOR the Science Fiction Research Association (SFRA) since 1971. SFRA Sean Guynes Review publishes scholarly articles and reviews. As the flagship journal [email protected] of SFRA, the Review is devoted to surveying the contemporary field of SF scholarship, fiction, and media as it develops. MANAGING EDITOR Ian Campbell Submissions [email protected] SFRA Review accepts original scholarly articles, interviews, review ASSOCIATE EDITORS Virginia Conn essays, and individual reviews of recent scholarship, fiction, and [email protected] media germane to SF studies. Amandine Faucheux SFRA Review does not accept unsolicited reviews. If you would [email protected] like to write a review essay or review, please contact the relevant review editor. For all other publication types—including special issues and symposia—contact the editor, managing, and/or REVIEWS EDITORS associate editors. NONFICTION EDITOR All submissions should be prepared in MLA 8th ed. style. Accepted Dominick Grace pieces are published at the discretion of the editors under the [email protected] author's copyright and made available open access via a CC-BY- ASSISTANT NONFICTION EDITOR NC-ND 4.0 license. Kevin Pinkham [email protected] SFRA Review History FICTION EDITOR SFRA Review was initially titled SFRA Newsletter and has been Jeremy M. Carnes published since 1971, just after the founding of SFRA in 1970. -

Gender and Gaming: Postmodern Narratives of Liminal Spaces and Selves

Georgia State University ScholarWorks @ Georgia State University Learning Sciences Dissertations Department of Learning Sciences 1-8-2016 Gender and Gaming: Postmodern Narratives of Liminal Spaces and Selves Amana Marie Le Blanc Follow this and additional works at: https://scholarworks.gsu.edu/ltd_diss Recommended Citation Le Blanc, Amana Marie, "Gender and Gaming: Postmodern Narratives of Liminal Spaces and Selves." Dissertation, Georgia State University, 2016. https://scholarworks.gsu.edu/ltd_diss/1 This Dissertation is brought to you for free and open access by the Department of Learning Sciences at ScholarWorks @ Georgia State University. It has been accepted for inclusion in Learning Sciences Dissertations by an authorized administrator of ScholarWorks @ Georgia State University. For more information, please contact [email protected]. ACCEPTANCE This dissertation, GENDER AND GAMING: POSTMODERN NARRATIVES OF LIMINAL SPACES AND SELVES, by AMANA MARIE LE BLANC, was prepared under the direction of the candidate‘s Dissertation Advisory Committee. It is accepted by the committee members in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the College of Education and Human Development, Georgia State University. The Dissertation Advisory Committee and the student‘s Department Chairperson, as representatives of the faculty, certify that this dissertation has met all standards of excellence and scholarship as determined by the faculty. _________________________________ _________________________________ Jodi Kaufmann, Ph.D. Brendan Calandra, Ph.D. Committee Co-Chair Committee Co-Chair _________________________________ _________________________________ Teri J. Peitso-Holbrook, Ph.D. Jen Jenson, Ph.D. Committee Member Committee Member ________________________________ Date _________________________________ Stephen Harmon, Ph.D. Chairperson, Learning Technologies Division _________________________________ Paul A. Alberto, Ph.D. -

ANNUAL REPORT 2012 Editorial Policy Strength Capcom’S

Year Ended March 31, 2012 22012ANNUAL0 1REPORT 2 Border-less. Interract more. Code Number: 9697 Corporate Philosophy “Capcom: Creator of Entertainment Culture that Stimulates Your Senses” Our principle is to be a creator of entertainment culture. Through development of highly creative software contents that excite people and stimulate their senses, we have been aiming to offer an entirely new level of game entertainment. By taking advantage of our optimal use of our world-class development capabilities to create original content, which is our forte, we have been actively releasing a number of products around the world. Today, young and old, men and women enjoy a gaming experience all over the world. It is now common to see people easily enjoying mobile content (games for cell phones) on streets or enjoying an exchange through an online game with someone far away. Moreover, game content is an artistic media product that fascinates people, consisting of highly creative, multi-faceted elements such as characters, storyline, a worldview and music. It has also evolved to be used in a wide range of areas of media such as Hollywood movies, TV animation programs and books. As the ever-expanding entertainment industry becomes pervasive in our everyday lives, Capcom will continue to strive to be a unique company recognized for its world-class development capabilities by continuously creating content brimming with creativity. 1 CAPCOM ANNUAL REPORT 2012 Editorial Policy Strength Capcom’s This report was prepared for a wide range of readers, from individual shareholders to institutional investors, 3 Capcom’s Strength and is intended as a tool to aid in the understanding of Capcom management policies and business strategies. -

Eu Morro, Tu Morres, Eles Morrem

UNIVERSIDADE DE LISBOA FACULDADE DE MOTRICIDADE HUMANA Eu morro, tu morres, eles morrem Heurísticas para uma boa experiência de fracasso nos videojogos Dissertação elaborada com vista à obtenção do grau de Mestre em Ergonomia Orientador: Professor Doutor Paulo Ignacio Noriega Pinto Machado Coorientador: Professor Doutor Francisco dos Santos Rebelo Júri: Presidente: Doutor José Domigos de Jesus Carvalhais Professor Auxiliar da Faculdade de Motricidade Humana, Universidade de Lisboa Vogais: Doutor Francisco dos Santos Rebelo Professor com agregação da Faculdade de Motricidade Humana, Universidade de Lisboa Doutor Ernesto Vilar Filgueiras Professor Auxiliar da Universidade da Beira Interior Inês Alexandrino Borges Pereira 2016 (Página intencionalmente deixada em branco) Agradecimentos Em primeiro lugar gostaria de agradecer ao Doutor Paulo Noriega, pela sua disponibilidade e apoio contínuo, e pela sua abertura mental que nunca deixa de ser munida por uma precisão científica. Ao professor Doutor Francisco Rebelo desejo agradecer pelos contributos práticos e metodológicos, e também pela abertura de espírito a novas abordagens. Aos dois agradeço a liberdade que me deram para explorar, poucos professores têm a autoconfiança necessária para o fazer. Muito obrigado. Gostaria ainda de agradecer ao Nuno Nóbrega da Miniclip, ao Paulo Duarte da Marmalade, ao Nuno Folhadela da Bica Studios, ao Ivan Barroso e ao Doutor Ricardo Flores, pela preciosa partilha de informação sobre a indústria dos jogos portuguesa, pela disponibilidade contínua e pelos exemplos de jogos cruciais para a construção desta dissertação. Ainda, o meu obrigado ao Diogo Vasconcelos, Nélio Codices, David Amador, Bernardo Porto, Fernando D’Andrea, Eduardo Pereira, Marcella Andrade, Carina Missae, Alexandre Kikuchi e Vicente Vieira. Agradeço profundamente ao meu pai por me ter ensinado a importância de ter um pensamento organizado e racional, e pelo apoio incondicional durante todo o decorrer do mestrado em Ergonomia na FMH – Ulisboa. -

History of Video Games-Wikipedia

History of video games From Wikipedia, the free encyclopedia The Atari VCS was a popular home video game console in the late 1970s and early 1980s. Pictured is the four-switch model from 1980–1982. An Atari CX40 joystick controller, with a single button The history of video games goes as far back as the early 1950s, when academic computer scientists began designing simple games and simulations as part of their research or just for fun. At M.I.T. in the 1960s, professors and students played games such as 3D tic-tac-toe and Moon Landing. These games were played on computer such as the IBM 1560, and moves were made by means of punch cards. Video gaming did not reach mainstream popularity until the 1970s and 1980s, when video arcade games and gaming consoles using joysticks, buttons, and other controllers, along with graphics on computer screens and home computer games were introduced to the general public. Since the 1980s, video gaming has become a popular form of entertainment and a part of modern popular culture in most parts of the world. One of the early games was Spacewar!, which was developed by computer scientists. Early arcade video games developed from 1972 to 1978. During the 1970s, the first generation of home consoles emerged, including the popular game Pong and various "clones". The 1970s was also the era of mainframe computer games. The golden age of arcade video games was from 1978 to 1982. Video arcades with large, graphics- decorated coin-operated machines were common at malls and popular, affordable home consoles such as the Atari 2600 and Intellivision enabled people to play games on their home TVs. -

Designing Facility Layout Using Business Intelligence Approach: a Case Study in an Amusement Arcade

Proceedings of the International Conference on Industrial Engineering and Operations Management Sao Paulo, Brazil, April 5 - 8, 2021 Designing Facility Layout Using Business Intelligence Approach: A Case Study in an Amusement Arcade Tanti Octavia, Siana Halim and Christian Alianto Industrial Engineering Department Petra Christian University Surabaya, Indonesia [email protected], [email protected], [email protected] Abstract This paper discus a facility layout design in an amusement arcade in Surabaya. In this arcade, there are many idle game machines, since the customers only play in certain games. This problem is difficult to resolve since playing patterns and game categories have not been acknowledged. Business intelligence are used to analyze play patterns so that the game machines layout could be proposed. The proposed layout of game machines also applies the concept of store’s layout. The purpose of this study is to propose game machine layout considering the playing patterns and categories. The results of this study are to develop a new layout design with considering age. The new layout design is to juxtapose the game machine which has the biggest revenue in a category with game machine which has the smallest revenue from other categories. These juxtapositions do not cost any money because they are done during working hours and using manpower. The proposed layout attracts customers spend their money to play. Keywords Business Intelligence, Data Mining, Facility Layout, Power BI 1. Introduction Traditionally, the main objective of facility layout problem is to minimize the total material flow cost. Facilities layout design refers to the arrangement of all equipment, machinery and furnishings within a building envelope after considering various objectives of the facility (Riedel 2011).