Investing in Iskandar Malaysia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

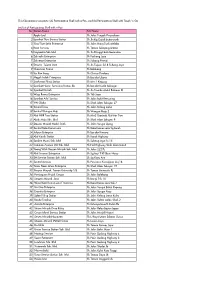

MELAKA Business Name Outlet Address State NASI ARAB 115 NO 76 JALAN LINGKARAN MITC, KOMPLEKS PERNIAGAAN MITC PERDANA, 75450 AYER KEROH, MELAKA

MELAKA Business Name Outlet Address State NASI ARAB 115 NO 76 JALAN LINGKARAN MITC, KOMPLEKS PERNIAGAAN MITC PERDANA, 75450 AYER KEROH, MELAKA. MELAKA MERLIMAU BURGER STATION NO JA 1471 , JLN JASIN, TMN MUHIBBAH , MER 77300 MELAKA BUSUINA ENTERPRISE GERAI NO 10,TMN MERLIMAU BARU,MER77300 MELAKA INSPIRASI JUTA JA 8008,KG SERKAM PANTAI, MER 77300 MELAKA CUTE GF HAIR SALOON JC118 , JLN BMU 2, BDR BARU MERLIMAU, MER 77300 MELAKA RESTORAN KARI KAMBING 41 HARI BT 20, JLN TAMBAK MERAH , SG RAMBAI 77400 MELAKA PERNIAGAAN MUSLIM SU 931 & 932, RUMAH KEDAI SETINGKAT, BANDAR BARU MASJID TANAH 78300 MELAKA RIZ JAYA BATU 33 3/4, KG SG JERNEH , LUBOK CHINA 78100 MELAKA KAFE SERI BALKIS PT 925 PT 2704, JLN BANDAR BARU 6, TAMAN BANDAR BARU, 78300 MASJID TANAH, MELAKA MELAKA PERUSAHAAN MAKANAN & PENGAWETAN ISTIMEWA KG AIR HITAM PANTAI, 78300 MASJID TANAH, MELAKA MELAKA CIK CHINTA SU877, PUSAT PERNIAGAAN BANDAR BARU MASJID TANAH, 78300 MASJID TANAH, MELAKA MELAKA BERKAT SHAYZ ENT NO 6972 BT 20 1/4, KG AIR LIMAU, 78300 MASJID TANAH, MELAKA MELAKA MHA STAR RESOURCES SU 506 JLN MAWAR 3, TMN SG BARU, 78300 MASJID TANAH, MELAKA MELAKA RESTOREN MADINA 254, JALAN MELAKA RAYA 3, TMN MELAKA RAYA, 75000 MELAKA ALONG FIRDAUS CAFÉ ALONG FIRDAUS CAFÉ, GERAI NO 8, DEWAN BENTARA, UITM CAMPUS, MELAKA 78000 MELAKA BOLLYWOOD MAJU ENTERPRISE NO 1, JLN KRISTAL MERAH 2, TAMAN LIMBONGAN JAYA 75200 MELAKA RICHIAMO COFFEE STUDENT BUSINESS CENTRE, UITM ALOR GAJAH 78000 MELAKA EV OPTICAL AG3743, JLN BESAR, ALOR GAJAH 78000 MELAKA AIDAMANSHAFIS CATERING NO 8236, JLN BUNGA RAYA 2, -

I-Park@Indahpura Brochure

Malaysia’s Premium Industrial Park This is Where The Most Sustainable & Your Success is Shaped by Design, Well-managed Industrial Park not Chance ... WORLD CLASS INFRASTRUCTURE & AMENITIES Upgrading and expanding your business operations is now a breeze at i-Park@Indahpura. A fully Overall Development Land Area integrated industrial park catering to the ever-growing demand for quality industrial developments built to international standards. This state-of-the-art park is the ultimate location for industries that wish to expand and upgrade their operations. Fully Gated & Perimeter Fencing Natural High Speed Ample of Electric Guarded with 24-Hour with CCTV Gas Broadband & Water Supply acres Security Control Surveillance (Unifi) 230 Besides being the first holistically managed industrial park in Iskandar Malaysia, i-Park@Indahpura offers its tenants 24-hour security within a fenced compound, world-class infrastructures and industry-leading lush landscaping surrounding the compound. FREEHOLD The i-Park premier fully integrated industrial park development addresses all the sustainability and adaptability issues in such developments. The holistic park management includes strict security Worker’s Green Ready Built / Build with Option to Rent / Platinum Winner of procedures to ensure the safety of each and every tenant, employee and goods within the Dormitory Building Design & Built Fast Speed Outright development each day. Scheduled daily maintenance of the park’s landscape and cleanliness Delivery Purchase helps keep the vicinity pristine. Recognising -

PORT of TANJUNG PELEPAS SETS WORLD RECORD to DEPART OVER 19,000 Teus VESSEL

FOR IMMEDIATE RELEASE PORT OF TANJUNG PELEPAS SETS WORLD RECORD TO DEPART OVER 19,000 TEUs VESSEL 19 August 2018 –– Pelabuhan Tanjung Pelepas Sdn Bhd (PTP), a member of MMC Group became the first port in the world to depart a vessel with a final load over 19,000 TEUs. The milestone was accomplished on 18 August 2018 when Mumbai Maersk, one of Maersk’s 2nd Generation Triple-E vessels left the port with the record load of 19,038 TEUs. The vessel, deployed on the Asia-to-Europe Service (AE5) arrived from Shanghai, China to PTP and is now en route to Port of Rotterdam, Netherlands. Efficient planning and execution of container operations and good optimization of resources were identified as the reasons behind the feat. PTP Chairman and MMC Group Managing Director, Dato’ Sri Che Khalib Mohamad Noh in his statement remarked that the latest achievement is testament to PTP’s commitment in providing best in class service for our customers. “As Malaysia’s leading ports & logistics operators, we take pride in our ability to anticipate and understand the needs of our customers as well as our agility to adapt to the changes of the industries that we operate in, in order for us to stay ahead.” “As such, we are very proud of this significant milestone as it is only made possible by the passion and commitment of our employees and all parties involved. PTP will build on our performance and deliver the service levels and productivity required to meet the demand of our customers and stakeholders.” Che Khalib added. -

Land Use Change Research Projects in Malaysia

Land Use Change Research Projects in Malaysia Mastura Mahmud Earth Observation Centre Universiti Kebangsaan Malaysia NASA-LCLUC Science Team Joint Meeting with MAIRS, GOFC-GOLD and SEA START Programs on Land-Cover/Land-Use Change Processes in Monsoon Asia Region, January 12-17, 2009 in Khon Kaen, Thailand Outline of presentation • Large Development Regions • Landslide Issues • Biomass Burning and Impacts South Johor Development Area • Iskandar Malaysia covers 221,634.1 hectares (2,216.3 km²) of land area within the southern most part of Johor. • The development region encompasses an area about 3 times the size of Singapore. • Iskandar Malaysia covers the entire district of Johor Bahru (including the island within the district), Mukim Jeram Batu, Mukim Sungai Karang, Mukim Serkat, and Kukup Island in Mukim Ayer Masin, all within the district of Pontian. • Five Flagship Zones are proposed as key focal points for developments in the Iskandar Malaysia. Four of the focal points will be located in the Nusajaya-Johor Bahru-Pasir Gudang corridor (Special Economic Corridor -(SEC)). The flagship zones would strengthen further existing economic clusters as well as to diversify and develop targeted growth factors. • Flagship Zone A – Johor Bahru City Centre(New financial district , Central business district , Danga Bay integrated waterfront city , Tebrau Plentong mixed development , Causeway (Malaysia/Singapore) • Flagship Zone B - Nusajaya (Johor state administrative centre , Medical hub , Educity , International destination resort , Southern Industrial logistic cluster ) • Flagship Zone C - Western Gate Development (Port of Tanjung Pelepas , 2nd Link (Malaysia/Singapore) , Free Trade Zone , RAMSAR World Heritage Park , Tanjung Piai ) • Flagship Zone D - Eastern Gate Development ( Pasir Gudang Port and industrial zone , Tanjung Langsat Port , Tanjung Langsat Technology Park, Kim-Kim regional distribution centre ). -

Our New Dna Brings Even More to Life

“OUR NEW DNA BRINGS EVEN MORE TO LIFE” How better to symbolise the coming together of two reputable companies than by making their bond permanent through the fusion of their DNA. Carrying the genetic instructions used in the development and functioning of all known living organisms, DNA is essential for all known forms of life. In this instance, the joining of the DNA of UEM Land Holdings Berhad and Sunrise Berhad signals the culmination of our respective assets, success, expertise, resources, knowledge and culture to create something even better - UEM Sunrise. Our 2013 Annual Report cover, which portrays how thriving communities are residing within the helix of our DNA, seeks to convey the idea that the inherent ability to build communities is imprinted within the DNA of UEM Sunrise. As we leverage on the synergistic strengths of our respective DNA, now made one, we are truly bringing even more to life. UEM Sunrise Berhad Annual Report 2013 1 ovErviEw CorporatE rESponSiBility ContEntS 03 Vision & Mission 74 Our Commitment to Good 03 Living Our Values Workplace Practices 04 Notice of Annual General Meeting 77 Our Commitment to Effective 09 Financial Calendar Marketplace Practices 12 Chairman’s Statement 78 Our Commitment to Enriching 17 In Memory of Dato’ Wan Abdullah Communities Wan Ibrahim 80 Our Commitment to Safeguard 18 Executive Director’s Operations Review the Environment CorporatE FraMEwork aCCoUntaBility 26 2014 Outlook 82 Corporate Governance Statement 27 Corporate Profile 102 Additional Compliance 28 Corporate Information Information -

For Sale - EAST LEDANG, Iskandar Puteri (Nusajaya), Johor Bahru, Johor

iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - EAST LEDANG, Iskandar Puteri (Nusajaya), Johor Bahru, Johor Reference No: 101031708 Tenure: Freehold Address: EAST LEDANG MELODY Occupancy: Vacant PARK, EAST LEDANG, Furnishing: Fully furnished Iskandar Puteri (Nusajaya), 79350, Johor Unit Type: Corner lot State: Johor Land Title: Residential Property Type: Bungalow Property Title Type: Individual Asking Price: RM 3,200,000 Posted Date: 18/05/2021 Built-up Size: 6,000 Square Feet Facilities: Swimming pool Property Features: Kitchen cabinet,Air Built-up Price: RM 533.33 per Square Feet conditioner,Garden,Bath tub Name: Qiqi Chong Land Area Size: 12,763 Square Feet Company: Ceiloz Realty Sdn Bhd Land Area Price: RM 250.72 per Square Feet Email: [email protected] No. of Bedrooms: 7 No. of Bathrooms: 5 FOR SALE Bungalow east ledang Built up 6000 Land Area 12763sqft 5+2 bedroom + 5 bathroom Separate club house wif swimming pool Including Furniture Selling RM3.2 mil NICE LOCATION - East Ledang Melody park is 1-3 minutes to EduCity, Newcastle, Legoland, Kota Iskandar, Puteri Habour, OneMedini etc... \ - East Ledang Melody park is 10 minutes from Tuas Checkpoint from East Ledang Melody Park - East Ledang Melody park is 10 minutes to Bukit Indah (Hypermaket), Horizon Hills, Nusa Idaman etc... from East Ledang Melody Park - East Ledang Melody park is 18 minutes to JB town area via C.... [More] View More Details On iProperty.com iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - EAST LEDANG, Iskandar Puteri (Nusajaya), Johor Bahru, Johor. -

Instructions for Camera-Ready Copies (A4)

American International Journal of Contemporary Research Vol. 3 No. 3; March 2013 The Need for Changes in Travel Behaviour towards a Low Carbon Society Gobi Krishna Sinniah PhD Candidate Department of Urban and Regional Planning Faculty of Built Environment Universiti Teknologi Malaysia 81310 UTM Skudai, Johor, Malaysia Muhammad Zaly Shah Senior Lecturer Department of Urban and Regional Planning Faculty of Built Environment Universiti Teknologi Malaysia 81310 UTM Skudai, Johor, Malaysia Ho Chin Siong Professor Department of Urban and Regional Planning Faculty of Built Environment Universiti Teknologi Malaysia 81310 UTM Skudai, Johor, Malaysia Abstract Travel behaviour studies were the key issues of analysis in transportation sector in the 1950s and 1960s, especially regarding on travel behaviour and spatial interaction. Travel behaviour trend has increased drastically all over the world. With the present reality of climate change, the transportation studies are becoming increasingly important, in regards of travel behaviour changes. It is important to understand the need to change travel behaviour as one of the initiative to achieve sustainable transportation. In achieving transportation sustainability, understanding on travel behaviour and need can be more functional and useful for transportation planners to encourage people to use public transportations. In recent years, Low Carbon Society (LCS) concept has taken place to change the people’s lifestyles, especially to increase the use of public transportations. Undeniably, the only solution to a more sustainable transportation leading to a low carbon society is through a higher adoption rate of public transportation. However, it is still far to achieve as far as transportation planners are concerned because of the lack of understanding of the social needs to complement with public transportations. -

View the Table of Contents for This Issue: Https

http://englishkyoto-seas.org/ View the table of contents for this issue: https://englishkyoto-seas.org/2018/12/vol-7-no-3-of-southeast-asian-studies/ Subscriptions: http://englishkyoto-seas.org/mailing-list/ For permissions, please send an e-mail to: [email protected] SOUTHEAST ASIAN STUDIES Vol. 7, No. 3 December 2018 CONTENTS Divides and Dissent: Malaysian Politics 60 Years after Merdeka Guest Editor: KHOO Boo Teik KHOO Boo Teik Preface ....................................................................................................(269) KHOO Boo Teik Introduction: A Moment to Mull, a Call to Critique ............................(271) ABDUL RAHMAN Ethnicity and Class: Divides and Dissent Embong in Malaysian Studies .........................................................................(281) Jeff TAN Rents, Accumulation, and Conflict in Malaysia ...................................(309) FAISAL S. Hazis Domination, Contestation, and Accommodation: 54 Years of Sabah and Sarawak in Malaysia ....................................(341) AHMAD FAUZI Shifting Trends of Islamism and Islamist Practices Abdul Hamid in Malaysia, 1957–2017 .....................................................................(363) Azmi SHAROM Law and the Judiciary: Divides and Dissent in Malaysia ....................(391) MAZNAH Mohamad Getting More Women into Politics under One-Party Dominance: Collaboration, Clientelism, and Coalition Building in the Determination of Women’s Representation in Malaysia .........................................................................................(415) -

INTERNATIONAL CONFERENCE in ORGANIC SYNTHESIS 2016 ,"Frm

PROGRAMME& ABSTRACTBOOK INTERNATIONAL CONFERENCE IN ORGANIC SYNTHESIS 2016 ,"Frm. ý Fw.. dameoNal RueNrcH, to IwduslrwA, Appti, cMwý, ' ý =Wlz= 201" c=mzz: . 21-24 ,August 2016. Hotel, ý 1 ý'. 'g ý.... f,., dl iý'". ý, i,., iný,. ,: n Im.! ý!,. 4ý f`' , n;. ý. .ý,. ,. L', 1ýn r., c,.. i.., ýgq ,!., d ýS. n. rv; l. .,. ý,. ý.. ICOS2oi6 I International Conference in Organic Synthesis CONTENTS 1 FOREWORD 4 ORGANIZING COMMITTEE 5 PLENARY SPEAKERS 6 INVITED SPEAKERS 7 PROGRAMME SCHEDULE 9 ORAL PRESENTATION SCHEDULE 15 POSTER BOARD CODING 16 LIST OF All PARTICIPANTS ABSTRACT OF PLENARY SPEAKERS 21 t. ['r, f iii oru 1sobc: _, Fortynine Years on Natural Product Chemistry 22 F, It I- FimE.-Jftlrl U(11)2: Enantioselective Synthesis of Natural Products from a-Heteroacetic Acids ABSTRACT OF INVITED SPEAKERS 23 F'rot. Pr !-it 1I I'hir. Some Examples of Design and Synthesis of New Solid Catalysts 24 ['r. iii?. f?Cih UTIlloil: Synthesis And In Silico Studies of Chalcone Derivatives and Its Potential as Dengue Virus Inhibitor 25 itic+i? Illilli: Synthesis of Bioactive Flavonoid and Chalcones Derivatives 26Li?. n Chýý Functionali2ation of Rna by Synthetic Small Molecules (SSMs) 27 Therapeutic In Vivo Synthetic Chemistry: Synthesis of Bloactive Molecules in Live Animal i( From Fundamental Research to Industrial Applications 21.24 August 2016 Riverside Majestic Hotel, Kuching, SARAWAK ICOS2016I International Conference in Organic Synthesis CONTENTS 28 " Prof. XuefengJiang: Sulfur Atom Transfer (SAT) Reaction 29 " Prof. Guo-Qiang Lin: The Advances on Diene- -

UEM SUNRISE AR2015 Front Cover to Page 059.Pdf

COVER RATIONALE COLOURING YOUR LIFE UEM Sunrise is more than a master planner or property developer. In each of our project, we seek to add value to the communities that will eventually populate our buildings, our residential precincts, commercial centres, industrial zones and townships. This we do by respecting the natural environment and ensuring our developments are sustainable. We add colour to the lives of our communities through product designs that promote greater social interaction, physical recreation and spiritual well-being. Our aim is to build wholesome communities supported by smart infrastructure and strengthened by a network of vibrant activity in a conducive setting. One such community is Estuari Gardens, as portrayed on the cover of our Annual Report 2015. The 47.62 acres Estuari Gardens is the first parcel of the overall landed Estuari development located on the north side of Puteri Harbour in Iskandar Puteri (formerly known as Nusajaya). It comprises double storey super-link houses designed to provide a resort living experience within nature’s embrace and is inspired by the scenic mangrove belt of Sungai Perapat nearby that meanders along the Straits of Tebrau, Johor, emanating the joys of living within a larger-than-life ecosystem. UEM Sunrise is the flagship company for township and property development businesses of UEM Group Berhad (“UEM Group”) which is celebrating its 50th anniversary in 2016. UEM Group is an engineering-based infrastructure and services group with an established track record and global operations. It has the ability, expertise and resources to deliver key infrastructure development projects for the public and private sectors spanning expressways, bridges, buildings, urban transits, water infrastructure, airports, hospitals, township & property development and asset & facility management services. -

Eleventh Malaysia Plan 2016-2020 Anchoring GRowth on People

ELEVENTH MALAYSIA PLAN 2016-2020 ANCHORING G ROWTH ON PEOPLE ISBN 978-9675842085 For further information refer to: Director General, Economic Planning Unit, Prime Minister’s Department, Block B5 & B6, Federal Government Administrative Centre, 62502 Putrajaya. MALAYSIA. http://www.epu.gov.my email: [email protected] Tel.: 603-8000 8000 Fax: 603-8888 3755 Released on 21st May 2015 Reprinted on 29th May 2015 Publisher’s Copyright© All rights reserved. No part of this publication may be reproduced, copied, stored in any retrieval system or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise; without prior permission of Economic Planning Unit, Prime Minister’s Department, Malaysia. Printed by Percetakan Nasional Malaysia Berhad, Kuala Lumpur, 2015 www.printnasional.com.my Email: [email protected] Tel: 03-92366895 Fax: 03-92224773 ELEVENTH MALAYSIA PLAN 2016-2020 ANCHORING G ROWTH ON PEOPLE Foreword Dato’ Sri Mohd Najib bin Tun Haji Abdul Razak Prime Minister of Malaysia i The Eleventh Malaysia Plan, 2016-2020, marks a momentous milestone in our nation’s history. With 2020 now just five years away, the Eleventh Plan is the next critical step in our journey to become an advanced nation that is inclusive and sustainable. In the last five years, although Malaysia encountered headwinds from a global economic slowdown, our economy has done extremely well with GDP growth among the fastest in the region. The quality of life of the rakyat has also improved as reflected by the increase in both per capita income and the average household income. This was made possible by the numerous reforms that were put in place by the Government to improve the quality of life of the people. -

This File Contains Two Parts: (A) Participating Shell with E-Pay, and (B) Participating Shell with Touch 'N Go

This file contains two parts: (A) Participating Shell with e-Pay, and (B) Participating Shell with Touch 'n Go (A) List of Participating Shell with e-Pay No Station Name Site Name 1 Apple Leaf Sh Jalan Tengah Perusahaan 2 Syarikat Thye Service Station Sh Jln Kg Gajah Butterworth 3 Eng Thye Setia Enterprise Sh Jalan Hang Tuah Melaka 4 Reza Services Sh Taman Selayang Utama 5 Dayapetro Sdn Bhd Sh Jln Pringgit Batu Berendam 6 Zahiedin Enterprise Sh Puchong Jaya 7 Zahienor Enterprise Sh Subang Permai 8 Stesyen Tujuan Jaya Sh Jln Tujuan Ss18 Subang Jaya 9 Chop Lian Seong Sh Balakong 10 Sin Kee Sang Sh Cheras Perdana 11 Megah Indah Enterprise Sh Bandar Utama 12 Saaharaa Filing Station Sh Mrr 2 Kepong 13 Syarikat Henry Servicing Station SB Sh Bandar Kuala Selangor 14 Syarikat Durrah Sh Jln Tuanku Abdul Rahman Kl 15 Waja Reena Enterprise Sh Ttdi Jaya 16 Syarikat Arbi Service Sh Jalan Bukit Kemuning 17 YW Global Sh Shah Alam Seksyen 27 18 Sentral Tiraz Sh Jalan Kelang Lama 19 Sentral Wangsa Maju Sh Wangsa Maju 2 20 Alaf MRR Two Station Sh Mrr2 Gombak Alaf Mrr Two 21 Abah Maju Sdn. Bhd. Sh Shah Alam Seksyen 9 22 Stesyen Minyak Mohd. Diah Sh Jalan Sungai Ujong 23 Sentral Kota Damansara Sh Kota Damansara Sg Buloh 24 Jufiyun Enterprise Sh Bandar Kinrara 25 Alaf Karak Station Sh Karak Highway 26 Spektra Murni Sdn. Bhd. Sh Subang Jaya Ss 15 27 Common Avenue (M) Sdn. Bhd. Sh Fed Highway Shah Alam Batu3 28 Yeong Wah Stesyen Minyak Sdn.