Anglo American Meeting the World's Needs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategy Issue 5 V2.Qxd

LOPSG Strategy London Older People’s Strategies Group Issue 5 May 2004 Welcome to Strategy New resource for London Pensioners elcome to Strategy, which we hope will Wappear on a regular basis. It continues and replaces The Link. The editor is David Jones and the editorial committee is Joe Harris, Graeme Matthews and Les Evans. David is an experienced editor, who did a first rate job on the Greater London Pensioner. The articles must come from you, and should be readable and to the point. We hope to include photos, and would like to include cartoons. We are sure that among the many thousands of older Londoners represented on LOPSG there are those who are handy with the pen. Project officers Charlotte and Anna The Link was put together by the representative of Age Concern London, who The Mayor has provided a valuable new kindly offered their facilities. But when she resource for London’s older people. left to work at another charity we were Charlotte Smith opens the door on page 2 unable to find a replacement. For more information on the facility contact Now with a new editor and the new Resource Facility we are starting again. We Anna Roberts or Charlotte Smith expect to distribute 2000 copies of each edition, and would hope that our London Older People's Resource Facility participants will photocopy any additional c/o London Pension Fund Authority copies that may be needed. We also Dexter House decided to give the newsletter a more 2 Royal Mint Court snappy title, which we hope will meet with London EC3N 4LP your approval. -

The Political Thought of Harry Oppenheimer, Under the Editorship of Kalim Rajab

THE JOURNAL OF THE HELEN SUZMAN FOUNDATION | ISSUE 81 | DECEMBER 2017 BOOK REVIEW Gary Ralfe retired from active business life in 2006 after forty A Man Of Africa : The Political years of service firstly with Anglo American Corporation, and then Thought of Harry Oppenheimer with De Beers where he was Managing Director for eight Edited by Kalim Rajab years. In addition to My forty-year career with Anglo American and De Beers developed the HSF he chairs the Board of Governors under the benign shadow of Harry Oppenheimer (HFO). To generations of Michaelhouse, the of managers and staff in what used to be called the greater group HFO fund-raising arm of the Alexandra Education was more than a chairman and leader. He was a living icon. I was Committee, the fund- not the first or the last young man or woman to join Anglo American raising arm of Business Against Crime and the because it was a force for good in Southern Africa, the most important Beyond Foundation engine of economic growth, industrialisation, urbanization and a which does community work in rural areas. better life for all. I associated with the credo attributed to HFO’s father Sir Ernest Oppenheimer that “the purpose of large corporations such as Anglo American is to make profits for its shareholders, but to do so in such a way as to make a real and lasting contribution to the welfare of the communities where it operates”. It is surprising that seventeen years after HFO’s death there is still no biography. I know that the family wisely wanted time to elapse before commissioning one. -

The Diamond Cartel

THE DIAMOND CARTEL Although the United States is the principal consumer of the world's dia- mond supply,' the diamond industry is so cartelized as to be virtually imper- vious to pressure by American users of diamonds. Within the past ten years industrial diamonds have become indispensable to various high-speed, pre- cision manufacturing operations.2 Since distribution of ninety-five percent of the world's diamond production is channelized through a single marketing combine, competitive forces within the industry have been short circuited.a Therefore consumer resistance has been impracticable and American efforts to obtain a better bargaining position have so far been ineffective. The cartel is completely foreign-controlled and operates entirely outside the United States,4 thus obviating effective action under the antitrust laws and making 1. Leslie, Diamonds as Tools Speed up Victory, DoMEsTIc CoxriRcE, Aug. 1945, p, 28. Today, the United States uses approximately 90% of the world's production of Indus- trial diamonds. § 29 Complaint, DeBeers Consolidated Mines Ltd. v. United States, 325 U.S. 212 (1945) [hereinafter referred to as Complaint]. This figure includes all cate- gories of industrial diamonds--ballas, boart and carbonado. For a description of the types of industrial diamonds, see Diamonds for Victory, FOREIGN COMMERCE, Jan. 17, 1942, p. 4; Industrial Diamonds,.FORTUNE, June 1935, p. 22. Carbonado is rare and almost entirely confined to Brazil and will not enter into the discussion hereafter. Post-war production should produce the following ratios of diamond types: out of every 10,000 carats 250 will be carbonado, 1,900 ballas, 1,975 gemstones, and 5,875 boart. -

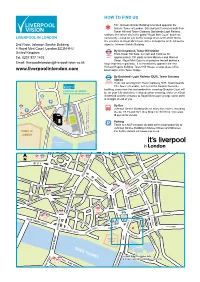

Block Adjacent to Tower Bridge

HOW TO FIND US The Johnson Smirke Building is located opposite the historic Tower of London. Situated just 5 minutes walk from Tower Hill and Tower Gateway Docklands Light Railway stations, the venue sits in the gated “Royal Mint Court” business LIVERPOOL IN LONDON community – keep an eye out for a large stone arch which forms the entrance to Royal Mint Court. Once through the arch, follow the 2nd Floor, Johnson Smirke Building signs to Johnson Smirke Building. 4 Royal Mint Court, London EC3N 4HJ By Underground, Tower Hill Station United Kingdom From Tower Hill Tube, turn left and continue for Tel: 0207 977 1433 approximately 100 yards across Minories and Mansell Street. Royal Mint Court is situated on the left behind a Email: [email protected] large impressive gateway. It is immediately opposite the new Richard Rogers building, Tower Hill House, a large glass office www.liverpoolinlondon.com block adjacent to Tower Bridge. By Docklands Light Railway (DLR), Tower Gateway Station If you are arriving from Tower Gateway DLR, head towards The Tower of London, turn left at the Societe Generale building, cross over the next pedestrian crossing (Sceptre Court will LIVERPOOL IN LONDON www.liverpoolinlondon.com be on your left) and at the next pedestrian crossing, cross over East Smithfield and the entrance to Royal Mint Court (a large stone arch) is straight ahead of you. MI N O R I E S By Bus Johnson Smirke Building sits on many bus routes, including C A R the 42, 78,15 and RV1. Bus Stop TE/TN/TH/TA. -

(By Email) Our Ref: MGLA120221-5818 24 March 2021

(By email) Our Ref: MGLA120221-5818 24 March 2021 Dear Thank you for your request for information which the GLA received on 11 February 2021. Your request has been dealt with under the Environmental Information Regulations (EIR) 2004. You asked for; 1. a copy of all correspondence in relation to the relocation of the new Chinese Embassy at Royal Mint Court from 1st January 2018 to date, between: • Edward Lister • CBRE • The Chinese Embassy • The FCO • Delancey • And the GLA planning department. 2. Please provide any documents retained from the Deputy Mayoralty of Edward Lister related to the relocation of the new Chinese Embassy, which may include meeting minutes, official correspondence, or reports into adequate sites. Our response to your request is as follows: Please find attached the information that the GLA holds within scope of your request. Please note that some names of non-senior members of staff are exempt from disclosure under Regulation 13 (Personal information) of the EIR. Information that identifies specific employees constitutes as personal data which is defined by Article 4(1) of the General Data Protection Regulation (GDPR) to mean any information relating to an identified or identifiable living individual. It is considered that disclosure of this information would contravene the first data protection principle under Article 5(1) of GDPR which states that Personal data must be processed lawfully, fairly and in a transparent manner in relation to the data subject. Please note that all accounts belonging to the former Mayoral team have now been deleted. If you have any further questions relating to this matter, please contact me, quoting the reference at the top of this letter. -

Preferred Office Location Boundary Review (2017)

London Borough of Tower Hamlets Preferred Office Locations Boundary review Peter Brett Associates Final July 2017 Office Address: 16 Brewhouse Yard, Clerkenwell, London EC1V 4LJ T: +44 (0)207 566 8600 E: [email protected] Project Ref 40408 Name Position Signature Date Prepared by Andrew Lynch Associate AL 19th May ‘17 Reviewed by Richard Pestell Director RP 23rd May ‘17 Approved by Richard Pestell Director RP 24th July ‘17 For and on behalf of Peter Brett Associates LLP Revision Date Description Prepared Reviewed Approved 23rd May 1 draft AL RP RP ‘17 24th July 2 Final AL RP RP ‘17 Peter Brett Associates LLP disclaims any responsibility to the client and others in respect of any matters outside the scope of this report. This report has been prepared with reasonable skill, care and diligence within the terms of the contract with the client and taking account of the manpower, resources, investigations and testing devoted to it by agreement with the client. This report has been prepared for the client and Peter Brett Associates LLP accepts no responsibility of whatsoever nature to third parties to whom this report or any part thereof is made known. Any such party relies upon the report at their own risk. © Peter Brett Associates LLP 2017 THIS REPORT IS FORMATTED FOR DOUBLE-SIDED PRINTING. ii London Borough of Tower Hamlets - Preferred Office Locations Boundary review CONTENTS 1 INTRODUCTION .......................................................................................................... 1 2 OVERVIEW OF THE BOROUGH-WIDE OFFICE FLOORSPACE DEMAND SUPPLY BALANCE ............................................................................................................................. 4 3 METHOD FOR BOUNDARY ASSESSMENTS ............................................................ 6 4 NORTH OF THE ISLE OF DOGS (CANARY WHARF) - BOUNDARY ASSESSMENT 7 The potential for intensification .................................................................................... -

Directory of Organisations and Resources for People with Disabilities in South Africa

DISABILITY ALL SORTS A DIRECTORY OF ORGANISATIONS AND RESOURCES FOR PEOPLE WITH DISABILITIES IN SOUTH AFRICA University of South Africa CONTENTS FOREWORD ADVOCACY — ALL DISABILITIES ADVOCACY — DISABILITY-SPECIFIC ACCOMMODATION (SUGGESTIONS FOR WORK AND EDUCATION) AIRLINES THAT ACCOMMODATE WHEELCHAIRS ARTS ASSISTANCE AND THERAPY DOGS ASSISTIVE DEVICES FOR HIRE ASSISTIVE DEVICES FOR PURCHASE ASSISTIVE DEVICES — MAIL ORDER ASSISTIVE DEVICES — REPAIRS ASSISTIVE DEVICES — RESOURCE AND INFORMATION CENTRE BACK SUPPORT BOOKS, DISABILITY GUIDES AND INFORMATION RESOURCES BRAILLE AND AUDIO PRODUCTION BREATHING SUPPORT BUILDING OF RAMPS BURSARIES CAREGIVERS AND NURSES CAREGIVERS AND NURSES — EASTERN CAPE CAREGIVERS AND NURSES — FREE STATE CAREGIVERS AND NURSES — GAUTENG CAREGIVERS AND NURSES — KWAZULU-NATAL CAREGIVERS AND NURSES — LIMPOPO CAREGIVERS AND NURSES — MPUMALANGA CAREGIVERS AND NURSES — NORTHERN CAPE CAREGIVERS AND NURSES — NORTH WEST CAREGIVERS AND NURSES — WESTERN CAPE CHARITY/GIFT SHOPS COMMUNITY SERVICE ORGANISATIONS COMPENSATION FOR WORKPLACE INJURIES COMPLEMENTARY THERAPIES CONVERSION OF VEHICLES COUNSELLING CRÈCHES DAY CARE CENTRES — EASTERN CAPE DAY CARE CENTRES — FREE STATE 1 DAY CARE CENTRES — GAUTENG DAY CARE CENTRES — KWAZULU-NATAL DAY CARE CENTRES — LIMPOPO DAY CARE CENTRES — MPUMALANGA DAY CARE CENTRES — WESTERN CAPE DISABILITY EQUITY CONSULTANTS DISABILITY MAGAZINES AND NEWSLETTERS DISABILITY MANAGEMENT DISABILITY SENSITISATION PROJECTS DISABILITY STUDIES DRIVING SCHOOLS E-LEARNING END-OF-LIFE DETERMINATION ENTREPRENEURIAL -

The-Diamond-Empire-Transcript.Pdf

1 MEDIA EDUCATION F O U N D A T I O N 60 Masonic St. Northampton, MA 01060 | TEL 800.897.0089 | [email protected] | www.mediaed.org The Diamond Empire Transcript Part 1 begins on pg. 1 Part 2 begins on pg. 15 PART 1: INTRODUCTION NARRATOR: On a hill above Johannesburg is the private estate of one of the wealthiest families on earth. They’ve made their fortune by manipulating markets and fixing prices. Their money has come from ordinary people all over the world who imagine they’re investing in something rare and valuable. But this is a family which deals in illusion. It presides over one of the last great cartels, an extraordinarily successful business empire worth $60 billion. This is the Oppenheimer family and their trade is diamonds. NARRATOR: The richest diamond jewelry market in the world is in New York. It’s a $10.8 billion business. Around 47th Street, there are twenty-five thousand people who buy, cut, polish and sell diamonds, from the most glamorous jewelry to the cheapest mail-order. It’s a highly secretive and risky business. The Oppenheimers themselves declined to help in any way in the making of this film. Bill Goldberg is one of the few top dealers who will talk openly about what he does. BILL GOLDBERG: It’s fascinating, it’s amazing that a lot of men that are ten years younger than I am can’t wait to retire and I can’t wait to get here in the morning at eight o’clock, to produce these beautiful works, these beautiful pieces of art from what looks like a pebble on the beach. -

Measuring the Strategic Value of Ir

IR SOCIETY NEWS AND EVENTS | CHAIRMAN’S LETTER | PERSONAL VIEW | NEW MEMBERS INFORMED THE VOICE OF INVESTOR RELATIONS IN THE UK ISSUE 80 AUTUMN 2013 MEASURING THE STRATEGIC VALUE OF IR A special feature which looks at the growing contribution of IR to corporate success THE IR BEST PRACTICE AWARDS AND ANNUAL DINNER 2013 See the shortlist of potential winners and further information on the 19 November event. Book your places now! PLUS Letter from Asia IR in Middle East markets Service providers directory The IR Society Best Practice Awards 2013 19 November 2013 The IR Society Best Practice Awards recognise and reward excellence in investor relations. Join us for the premier event in the IR calendar – book your table now! www.irs.org.uk The Pavilion, at the Tower of London, EC3N 4AB 6.30pm For more information please contact: Dipty Patel on [email protected] or call +44 (0)20 7379 1763 Promoting excellence in investor relations PLATINUM SPONSOR GOLD SPONSOR SILVER SPONSOR MEDIA PARTNER SUPPORTER INFORMED AUTUMN 2013 CONTENTS 4 CHAIRMAN’S LETTER Surprising on the upside 12 IR: THE STRATEGIC VALUE John Dawson, IR Society chairman 13 TAKE IT FROM THE TOP... THE 5 NEWS FROM THE SOCIETY CHAIRMAN AND THE IRO Krishnan Guru-Murthy to host IR awards dinner Gillian Karran-Cumberlege, Fidelio Partners Best practice awards – shortlist announced for self-entry and voted categories (page 6) 16 PUTTING IR INTO PERSPECTIVE How to contribute to our ‘white paper’ emails (page 9) Craig Marks, Halfords New IR Society members (page 9) 18 FOLLOWING A SOCIAL MEDIA ROADMAP FOR IROs 8 A PERSONAL VIEW Jim Delaney, Marketwired After the long, hot summer.. -

The Heart of the Matter

THE HEART OF THE MATTER SIERRA LEONE, DIAMONDS & HUMAN SECURITY (COMPLETE REPORT) Ian Smillie Lansana Gberie Ralph Hazleton Partnership Africa Canada (PAC) is a coalition of Canadian and African organizations that work in partnership to promote sustainable human development policies that benefit African and Canadian societies. The Insights series seeks to deepen understanding of current issues affecting African development. The series is edited by Bernard Taylor. The Heart of the Matter: Sierra Leone, Diamonds and Human Security (Complete Report) Ian Smillie, Lansana Gberie, Ralph Hazleton ISBN 0-9686270-4-8 © Partnership Africa Canada, January 2000 Partnership Africa Canada 323 Chapel St., Ottawa, Ontario, Canada K1N 7Z2 [email protected] P.O. Box 60233, Addis Ababa, Ethiopia pac@ telecom.net.et ________________ The Authors Ian Smillie, an Ottawa-based consultant, has 30 years of international development experience, as manager, programmer, evaluator and writer. He was a founder of the Canadian NGO Inter Pares, and was Executive Director of CUSO from 1979 to 1983. His most recent publications include The Alms Bazaar: Altruism Under Fire; Non Profit Organizations and International Development (IT Publications, London, 1995) and Stakeholders: Government-NGO Partnerships for International Development (ed. With Henny Helmich, Earthscan, London, 1999). Since 1997 he has worked as an associate with the Thomas J. Watson Jr. Institute at Brown University on issues relating to humanitarianism and war. Ian Smillie started his international work in 1967 as a teacher in Koidu, the centre of Sierra Leone’s diamond mining area. Lansana Gberie is a doctoral student at the University of Toronto and research associate at the Laurier Centre for Military, Strategic and Disarmament Studies, Waterloo, Ontario. -

A Review of Debswana‟S Performance Pre and Post the Acquisition of De Beers Shares by Anglo American Plc

A review of Debswana‟s performance pre and post the acquisition of De Beers shares by Anglo American plc. Khumo Mothulatshipi A research report submitted to the Faculty of Engineering and the Built Environment, University of the Witwatersrand, in partial fulfillment of the requirements for the degree of Master of Science in Engineering. Johannesburg, 2015 Declaration I declare that this research report is my own unaided work. Where work of other authors has been used, it has been duly acknowledged. It is being submitted for the Master of Science in Mining Engineering to the University of the Witwatersrand, Johannesburg. It has not been submitted before for any degree or examination to any other university. ………………………………………………………………. Signature …………… day of ……………………year ………………………………….. i Abstract The minerals industry has in the last decade witnessed volatility, uncertainty, complexity and ambiguity (VUCA). The diamond industry has not been immune to these challenges. These challenges coincided with the decision of the diamond mining family in 2011 to opt out of De Beers after approximately a century of being in control by selling their 40 % stake to Anglo American plc (AA) which already had 45 % stake in De Beers. This transaction increased Anglo American plc‟s stake in De Beers to 85% thus joining venture with the Government of the Republic of Botswana (GRB) under an already existing entity called Debswana. Botswana has been hailed as a beacon of success and a model African state both politically and economically mainly due to its effective management of economic proceeds generated mainly through Debswana diamonds. Something that might be seen as a possible threat to this economic stability is the merger and acquisition (M&A) between the GRB and AA. -

Another Giant Mining Fortune Represented in the Pilgrims Society (History’S Biggest Pandora’S Box!)

ANOTHER GIANT MINING FORTUNE REPRESENTED IN THE PILGRIMS SOCIETY (HISTORY’S BIGGEST PANDORA’S BOX!) Presented October 2017 by Charles Savoie Refused coverage by Dave Janda, Greg Hunter, And dozens of “alt media” You Tube channels! Refused coverage by 24 Hour Gold, Silver Seek, And the rest of the “Ha-Ha” Parade! (Save this in your Downloads File; read in several sessions.) In April we reviewed details on James Ben Ali Haggin (1827- 1914, Episcopalian; Pilgrims Society member known as “the greatest mine owner on earth”) in “Silver Mining Kingpin Opposed Silver Money.” In August we reviewed the Guggenheim mining dynasty in “Vast Mining Fortune Represented in Pilgrims Society World Money Trust.” This item will be about the South Africa Oppenheimer mining fortune (diamonds, gold, platinum, uranium, titanium, zinc, copper, cobalt, coal, chemicals, manganese, rhodium, nickel, iron etc.) and there was a marriage in 1660 between the Guggenheims and Oppenheimers, back in the Old World. Not only that, but Jakob Oppenheimer ran a bank at Hanover, Germany, where the first Rothschild was an apprentice during 1757-1763! Samuel Oppenheimer (1630-1703) was military supplier to King Leopold I of Hungary, Croatia and Bohemia. The Guggenheims appear to have mostly died out and those still bearing that name being of lesser influence, the fortune shifting into Episcopalian hands (The Lawson-Johnstons, Episcopalians and Pilgrims Society members). I realize those releases were way longer than most metals investors are used to reading (539 pages together) but the background on Haggin, the Guggenheims and the Lawson-Johnstons is extensive, and in fact, I only provided a basic outline on both.