Tax Seasontoolkit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wildfires from Space

Wildfires from Space More Lessons from the Sky Satellite Educators Association http://SatEd.org This is an adaptation of an original lesson plan developed and published on-line by Natasha Stavros at NASA’s Jet Propulsion Laboratory. The original problem set and all of its related links is available from this address: https://www.jpl.nasa.gov/edu/teach/activity/fired-up-over-math-studying-wildfires-from-space/ Please see the Acknowledgements section for historical contributions to the development of this lesson plan. This spotlight on the “Wildfires from Space” lesson plan was published in November 2016 in More Lessons from the Sky, a regular feature of the SEA Newsletter, and archived in the SEA Lesson Plan Library. Both the Newsletter and the Library are freely available on-line from the Satellite Educators Association (SEA) at this address: http://SatEd.org. Content, Internet links, and materials on the lesson plan's online Resources page revised and updated in October 2019. SEA Lesson Plan Library Improvement Program Did you use this lesson plan with students? If so, please share your experience to help us improve the lesson plan for future use. Just click the Feedback link at http://SatEd.org/library/about.htm and complete the short form on-line. Thank you. Teaching Notes Wildfires from Space Invitation Wildfire is a global reality, and with the onset of climate change, the number of yearly wildfires is increasing. The impacts range from the immediate and tangible to the delayed and less obvious. In this activity, students assess wildfires using remote sensing imagery. -

Department Emergency Operations Plan (DEOP)

San Bernardino County PROBATION DEPARTMENT Department Emergency Operations Plan (DEOP) October 2020 San Bernardino County SAN BERNARDINO COUNTY Probation Department Emergency Operations Plan Department (DEOP) THIS PAGE LEFT BLANK San Bernardino County SAN BERNARDINO COUNTY Probation Department Emergency Operations Plan Department (DEOP) RECORD OF CHANGES On an annual basis, the County Departments/Agencies shall review their respective DEOP and/or update Department/Agency Functional Annexes as appropriate. Document the date of the review and the names of personnel conducting the review. Change Section Change Revised By Description of Change # Date 1 10/3/18 Carrie Cruz ICEMA response Part I - Basic 2 6/26/19 Carrie Cruz Added Sec. 4.2 – DEOP Implementation Language Plan, Sec. 4 Part I - Basic Added Sec. 4.2.1 – Decision Matrix for DEOP 3 6/26/19 Carrie Cruz Plan, Sec. 4 Implementation Part II – 4 6/27/19 Carrie Cruz Revised Sec. Title and Additional Language Annex 2 Part II – Added Sec. 2.1.1 – MEF Initial Screening Aid and 5 6/27/19 Carrie Cruz Annex 2 Language Part II – Added Standardized MEF Chart for all County 6 Annex 2, 6/27/19 Carrie Cruz Department/Agencies and Language Sec. 2.1.1 Table of 7 6/27/19 Carrie Cruz Updated TOC Contents Part II – 8 7/1/19 Carrie Cruz Added Planning Tips – Step 1 Annex 1 Part II – 9 7/1/19 Carrie Cruz Added Planning Tips – Step 2 Annex 2 Part II – 10 7/1/19 Carrie Cruz Added Planning Tips – Step 3 Annex 3 Part II – 11 7/1/19 Carrie Cruz Added Planning Tips – Step 4 Annex 4 Part II – 12 7/1/19 Carrie -

Adapt to More Wildfire in Western North American Forests As Climate

PERSPECTIVE PERSPECTIVE Adapt to more wildfire in western North American forestsasclimatechanges Tania Schoennagela,1, Jennifer K. Balcha,b, Hannah Brenkert-Smithc, Philip E. Dennisond, Brian J. Harveye, Meg A. Krawchukf, Nathan Mietkiewiczb, Penelope Morgang, Max A. Moritzh, Ray Raskeri, Monica G. Turnerj, and Cathy Whitlockk,l Edited by F. Stuart Chapin III, University of Alaska, Fairbanks, AK, and approved February 24, 2017 (received for review October 25, 2016) Wildfires across western North America have increased in number and size over the past three decades, and this trend will continue in response to further warming. As a consequence, the wildland–urban in- terface is projected to experience substantially higher risk of climate-driven fires in the coming decades. Although many plants, animals, and ecosystem services benefit from fire, it is unknown how ecosystems will respond to increased burning and warming. Policy and management have focused primarily on spec- ified resilience approaches aimed at resistance to wildfire and restoration of areas burned by wildfire through fire suppression and fuels management. These strategies are inadequate to address a new era of western wildfires. In contrast, policies that promote adaptive resilience to wildfire, by which people and ecosystems adjust and reorganize in response to changing fire regimes to reduce future vulnerability, are needed. Key aspects of an adaptive resilience approach are (i) recognizing that fuels reduction cannot alter regional wildfire trends; (ii) targeting fuels reduction to increase adaptation by some ecosystems and residential communities to more frequent fire; (iii) actively managing more wild and prescribed fires with a range of severities; and (iv) incentivizing and planning residential development to withstand inevitable wildfire. -

News Headlines 11/9/2016

____________________________________________________________________________________________________________________________________ News Headlines 11/9/2016 Measure A: Town voters say yes to fire tax - overwhelmingly Family of 6 displaced in San Bernardino apartment fire Firefighters Rescue Man Pinned Under SUV These 13 states have the most homes at risk from wildfires 2016 Wildfire Season Not Likely to Top Record-Setting 2015 Season 1 Measure A: Town voters say yes to fire tax - overwhelmingly Matthew Cabe, Daily Press Posted: November 8, 2016, 12:01 AM APPLE VALLEY — Voters are saying yes to the tax measure designed to bolster emergency services in the town, according to unofficial election results posted at 10 p.m. Tuesday. With more than 34 percent of precincts reporting, Measure A has received overwhelming approval, amassing 10,364 votes, which translates to 77 percent of the vote, according to the San Bernardino County Elections Office. Measure A needed a two-thirds majority to pass. Doug Qualls — former Apple Valley Fire Protection District Chief and Measure A’s principal officer — told the Daily Press things are “going well” in the district as a result of the voting. “The threshold of reaching two-thirds of the voters is an extraordinary effort,” Qualls said. “To get two-thirds of the people to agree on something, and we far exceeded that expectation, that’s by commitment to the community.” Qualls called Tuesday’s outcome the result of a reality wherein fire stations need to be reopened; currently just three of the district’s seven fire stations are opened, and emergency-response times are below the national averages. “In 1997,” Qualls said, “the fire district promised the voters that they would deliver the best service they can deliver with the resources provided. -

The Costs and Losses of Wildfires a Literature Review

NIST Special Publication 1215 The Costs and Losses of Wildfires A Literature Review Douglas Thomas David Butry Stanley Gilbert David Webb Juan Fung This publication is available free of charge from: https://doi.org/10.6028/NIST.SP.1215 NIST Special Publication 1215 The Costs and Losses of Wildfires A Literature Survey Douglas Thomas David Butry Stanley Gilbert David Webb Juan Fung Applied Economics Office Engineering Laboratory This publication is available free of charge from: https://doi.org/10.6028/NIST.SP.1215 November 2017 U.S. Department of Commerce Wilbur L. Ross, Jr., Secretary National Institute of Standards and Technology Walter Copan, NIST Director and Under Secretary of Commerce for Standards and Technology Certain commercial entities, equipment, or materials may be identified in this document in order to describe an experimental procedure or concept adequately. Such identification is not intended to imply recommendation or endorsement by the National Institute of Standards and Technology, nor is it intended to imply that the entities, materials, or equipment are necessarily the best available for the purpose. Photo Credit: Lake City, Fla., May 15, 2007 -- The Florida Bugaboo Fire still rages out of control in some locations. FEMA Photo by Mark Wolfe - May 14, 2007 - Location: Lake City, FL: https://www.fema.gov/media-library/assets/images/51316 National Institute of Standards and Technology Special Publication 1215 Natl. Inst. Stand. Technol. Spec. Publ. 1215, 72 pages (October 2017) CODEN: NSPUE2 This publication is available free of charge from: https://doi.org/10.6028/NIST.SP.1215 Abstract This report enumerates all possible costs of wildfire management and wildfire-related losses. -

Fire Departments by County FDID Dept Name Mailing Address City Zip Chief Namereg Year Phone Chief E-Mail

Fire Departments by County FDID Dept Name Mailing Address City Zip Chief NameReg Year Phone Chief E-Mail ADAIR 00105 ADAIR COUNTY RURAL FIRE DIST #1 801 N Davis Greentop 63546 Barry Mitchell2010 (660) 627-5394 [email protected] 00103 EASTERN ADAIR FIRE & RESCUE P. O. BOX 1049 Brashear 63533 JAMES SNYDER2010 (660) 865-9886 [email protected] 00101 KIRKSVILLE FIRE DEPARTMENT 401 N FRANKLIN KIRKSVILLE 63501 RANDY BEHRENS2010 (660) 665-3734 [email protected] 00106 NOVINGER COMMUNITY VOL FIRE ASSOCATION INC P. O. BOX 326 NOVINGER 63559 DAVID KETTLE2010 (660) 488-7615 00104 SOUTHWESTERN ADAIR COUNTY FIRE DEPARTMENT 24013 STATE HIGHWAY 3 KIRKSVILLE 63501 DENNIS VANSICKEL2010 (660) 665-8338 [email protected] ANDREW 00202 BOLCKOW FIRE PROTECTION DISTRICT PO BOX 113 BOLCKOW 64427 JIM SMITH2008 (816) 428-2012 [email protected] 00201 COSBY-HELENA FIRE PROTECTION DISTRICT COSBY 64436 Dennis Ford2010 (816) 662-2106 [email protected] 00203 FILLMORE FIRE PROTECTION DIST P. O. BOX 42 FILLMORE 64449 RON LANCE2008 (816) 487-4048 00207 ROSENDALE FIRE PROTECTION DISTRICT PO BOX 31 ROSENDALE 64483 BRYAN ANDREW 2003 00205 SAVANNAH FIRE DEPARTMENT PO BOX 382 SAVANNAH 64485 Tommy George2010 (816) 324-7533 [email protected] 00206 SAVANNAH RURAL FIRE PROTECTION DISTRICT PO BOX 382 SAVANNAH 64485 Tommy George2010 (816) 324-7533 [email protected] ATCHISON 00301 FAIRFAX VOLUNTEER FIRE DEPT P.O. BOX 513 FAIRFAX 64446 ROBERT ERWIN 2008 00308 ROCK PORT VOLUNTEER FIRE DEPARTMENT PO Box 127 ROCK PORT 64482 STEPHEN SHINEMAN2010 (660) 744-2141 [email protected] 00304 TARKIO FIRE DEPARTMENT 112 WALNUT TARKIO 64491 DUANE UMBAUGE 2006 00306 WATSON VOLUNTEER FIRE DEPARTMENT PO BOX 127 ROCKPORT 64482 TOM GIBSON2008 (660) 744-2141 00305 WEST ATCHISON RURAL FIRE DISTRICT 516 SOUTH MAIN ST ROCKPORT 64482 STEPHEN SHINEMAN2010 (660) 744-2141 [email protected] 00302 WESTBORO VOLUNTEER FIRE DEPT. -

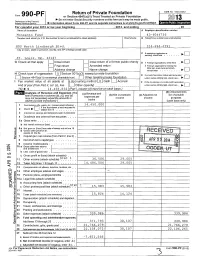

Return of Private Foundation OMB No 1545-0052 Form 990 -PF Or Section 4947 ( A)(1) Trust Treated As Private Foundation This Form Be Made Public

Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947 ( a)(1) Trust Treated as Private Foundation this form be made public. 2013 ► Do not enter Social Security numbers on as it may Revenuethe Treasury InternalInte Revenue Service ► Information about Form 990-PF and its separate instructions is at www. irs. gov/form990(^ f. For calendar y ear 2013 or tax y ear be g innin g , 2013 , and endin g 20 Name of foundation A Employer identification number Mon.Gantn Fund 43-6044736 Number and street (or P 0 box number tf mail is not delivered to street address) Room/suite B Telephone number (see instructions) 800 North Lindber g h Blvd. 314-694-4391 City or town, state or province , country, and ZIP or foreign postal code q C If exemption application is ► pending , check here • • • • • • St. Louis, Mo. 63167 G Check all that apply Initial return Initial return of a former public charity D 1 Foreign organizations , check here . ► Final return Amended return 2 Foreign organizations meeting the 85% test, check here and attach Address chang e Name chang e computation ► H Check type of organization X Section 501(c 3 exempt private foundation E If private foundation status was terminated Section 4947 (a)(1) nonexempt charitable trust Other taxable p rivate foundation under section 507 (b)(1)(A), check here . ► I Fair market value of all assets at J Accountin g method X Cash Accrual F If the foundation is in a 60-month termination under section 507(b )(1)(B), check here end of year (from Part ll, col (c), line Other ( specify) . -

Sonoma County Community Wildfire Protection Plan

Sonoma County Community Wildfire Protection Plan FIRE SAFE SONOMA Disclaimer Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the authors and do not necessarily reflect the view(s) of any governmental agency, organization, corporation or individual with which the authors may be affiliated. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. The Sonoma County Community Wildfire Prevention Plan (the Plan) is a work in progress. Various changes are anticipated throughout the Plan over the next several years. Readers are urged to consult with their own agencies having jurisdiction regarding the use or implementation of this Plan, as well as their own legal counsel on matters of concern. While the publisher and authors have used their best efforts in preparing this Plan, they make no representations or warranties with respect to the accuracy or completeness of the contents and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by receiving this publication. The advice and strategies contained herein may not be suitable for your specific situation. The publisher, sponsors and authors shall not be liable for any loss of profit or any other damages, including but not limited to, special incidental and/or consequential damages. This Plan is not to be construed as indicative of project “activity” as defined under the “Community Guide to the California Environmental Quality Act, Chapter Three; Projects Subject to CEQA.” Because the Sonoma County CWPP does not legally commit any public agency to a specific course of action or conduct and thus, is not a project subject to CEQA or NEPA. -

California Directory of Building, Fire, and Water Agencies

California Directory Of Building, Fire, And Water Agencies American Society of Plumbing Engineers Los Angeles Chapter www.aspela.com Kook Dean [email protected] California Directory Of Building, Fire, And Water Agencies American Society of Plumbing Engineers Los Angeles Chapter www.aspela.com Kook Dean [email protected] 28415 Pinewood Court, Saugus, CA 91390 Published by American Society of Plumbing Engineers, Los Angeles Chapter Internet Address http://www.aspela.com E-mail [email protected] Over Forty years of Dedication to the Health and safety of the Southern California Community A non-profit corporation Local chapters do not speak for the society. Los Angeles Chapter American Society of Plumbing Engineers Officers - Board of Directors Historian President Treasurer RICHARD REGALADO, JR., CPD VIVIAN ENRIQUEZ KOOK DEAN, CPD Richard Regalado, Jr., Mechanical Consultants Arup City of Los Angeles PHONE (626) 964-9306 PHONE (310) 578-4182 PHONE (323) 342-6224 FAX (626) 964-9402 FAX (310) 577-7011 FAX (323) 342-6210 [email protected] [email protected] Administrative Secratary ASPE Research Foundation Vice President - Technical Walter De La Cruz RON ROMO, CPD HAL ALVORD,CPD South Coast Engineering Group PHONE (310) 625-0800 South Coast Engineering Group PHONE (818) 224-2700 [email protected] PHONE (818) 224-2700 FAX (818) 224-2711 FAX (818) 224-2711 [email protected] Chapter Affiliate Liaison: [email protected] RON BRADFORD Signature Sales Newsletter Editor Vice President - Legislative PHONE (951) 549-1000 JEFF ATLAS RICHARD DICKERSON FAX (957) 549-0015 Symmons Industries, Inc. Donald Dickerson Associates [email protected] PHONE (714) 373-5523 PHONE (818) 385-3600 FAX (661) 297-3015 Chairman - Board of Governors FAX (818) 990-1669 [email protected] Cory S. -

Estimating Post-Fire Debris-Flow Hazards Prior to Wildfire Using a Statistical Analysis of Historical Distributions of Fire Severity from Remote Sensing Data

CSIRO PUBLISHING International Journal of Wildland Fire 2018, 27, 595–608 https://doi.org/10.1071/WF17122 Estimating post-fire debris-flow hazards prior to wildfire using a statistical analysis of historical distributions of fire severity from remote sensing data Dennis M. StaleyA,D, Anne C. TilleryB, Jason W. KeanA, Luke A. McGuireC, Hannah E. PaulingA, Francis K. RengersA and Joel B. SmithA AU.S. Geological Survey, Landslide Hazards Program, Golden, CO 80422, USA. BU.S. Geological Survey, New Mexico Water Science Center, Albuquerque, NM 87113, USA. CUniversity of Arizona, Department of Geosciences, Tucson, AZ 85721, USA. DCorresponding author. Email: [email protected] Abstract. Following wildfire, mountainous areas of the western United States are susceptible to debris flow during intense rainfall. Convective storms that can generate debris flows in recently burned areas may occur during or immediately after the wildfire, leaving insufficient time for development and implementation of risk mitigation strategies. We present a method for estimating post-fire debris-flow hazards before wildfire using historical data to define the range of potential fire severities for a given location based on the statistical distribution of severity metrics obtained from remote sensing. Estimates of debris-flow likelihood, magnitude and triggering rainfall threshold based on the statistically simulated fire severity data provide hazard predictions consistent with those calculated from fire severity data collected after wildfire. Simulated fire severity data also produce hazard estimates that replicate observed debris-flow occurrence, rainfall conditions and magnitude at a monitored site in the San Gabriel Mountains of southern California. Future applications of this method should rely on a range of potential fire severity scenarios for improved pre-fire estimates of debris-flow hazard. -

News Headlines 08/20-22/2016

____________________________________________________________________________________________________________________________________ News Headlines 08/20-22/2016 Newest wildfire advances on thousands of California homes Raging Blue Cut fire leaves some homes in smoldering ruins, but scope of loss still a mystery Blue Cut Fire Updates: Moves to Lytle Creek BLUECUT FIRE UPDATE: Crews increase containment to 40 percent; no federal aid for victims Some Blue Cut fire victims ‘just glad’ to be alive as more than 100 homes destroyed Bulldozers serve an integral role in fighting Bluecut Fire Haze coming as SoCal fire rages, health risks low in Havasu Crews turn corner; Wrightwood reopened to residents Blue Cut fire in the Cajon Pass destroys 105 homes and 213 other buildings Blue Cut fire triggers extra caution for busy fire season Residents return to charred homes Southern California Wildfire 73% Contained, Firefighters Transition to 'Mop-Up Phase' As crews tame wildfire, focus turns to what exactly burned Southern California wildfire evacuees allowed to return home Emotional homecoming for evacuees 1 Newest wildfire advances on thousands of California homes Christopher Weber and Christine Armario, The Associated Press Posted: August 17, 2016, 4:37 PM A firefighter prepares to battle a wildfire in the Cajon Pass in San Bernardino county, Calif., on Tuesday, Aug. 16, 2016. The wildfire that began as a small midmorning patch of flame next to Interstate 15 in the Cajon Pass had by Tuesday’s end turned into a 28-square-mile monster that burned an untold number of homes. Stan Lim — The Press-Enterprise via AP SAN BERNARDINO >> California’s newest huge wildfire advanced on thousands of homes Wednesday, feeding on drought-stricken vegetation and destroying an untold number of structures as it expanded to nearly 47 square miles. -

Storm Data and Unusual Weather Phenomena

Storm Data and Unusual Weather Phenomena Time Path Path Number of Estimated June 2002 Local/ Length Width Persons Damage Location Date Standard (Miles) (Yards) Killed Injured Property Crops Character of Storm ALABAMA, North Central ALZ006 Madison 03 1600CST 0 0 0 0 Excessive Heat The afternoon high temperature measured at the Huntsville International Airport was 95 degrees. This reading tied the previous record high temperature last set in 1998. Talladega County 5 S Talladega 04 1219CST 0 0 5K 0 Hail(1.75) Golf ball size hail was reported in the Brecon community, just south of Talladega. St. Clair County Ragland 04 1301CST 0 0 0 0 Hail(1.00) Quarter size hail was observed in and around the city of Ragland. St. Clair County Ragland 04 1301CST 0 0 3K 0 Thunderstorm Wind (G55) Several trees had their tops snapped off along SR 144 south of Ragland. A few of the downed trees snapped power lines. Tallapoosa County Newsite 04 1314CST 0 0 2K 0 Hail(1.75) Tallapoosa County Newsite 04 1314CST 0 0 2K 0 Thunderstorm Wind (G50) Tallapoosa County Alexander City 04 1320CST 0 0 0 0 Hail(1.00) Golf ball size hail was reported and trees were blown down on SR 22 near New Site. Quarter size hail was observed in Alexander City. Cherokee County 4 S Centre 04 1335CST 0 0 0 0 Hail(0.75) Penny size hail was reported at the Tennala community about 4 miles south of Centre. Clay County 13 N Ashland 04 1400CST 0 1 3K 0 Lightning A seven year old girl was struck by lightning inside the Cheaha State Park grounds.