Akira Kumaki

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Imperial Pools Commissions, Trailing Commissions, Management Fees, and Expenses All May Be Associated with an Investment in the Imperial Pools

Imperial Pools Commissions, trailing commissions, management fees, and expenses all may be associated with an investment in the Imperial Pools. Please read the Imperial Pools simplified prospectus CIBC before investing. The Imperial Pools are not guaranteed, their values change frequently, 5650 Yonge Street, 19th Floor and past performance may not be repeated. Toronto, Ontario M2M 4G3 CIBC Asset Management is the asset management arm of CIBC. CIBC Asset Management is a trademark of CIBC. The CIBC logo and “For what matters.” are trademarks of CIBC. CIBC Securities Inc. 1-888-357-8777 Website www.cibc.com/mutualfunds Imperial Pools Interim Financial Statements June 30, 2006 514A231E 08/06 For what matters. Inside This Report FINANCIAL STATEMENTS IMPERIAL POOLS Imperial Money Market Pool 2 Imperial Short-Term Bond Pool 4 Imperial Canadian Bond Pool 7 Imperial Canadian Dividend Pool 13 Imperial International Bond Pool 16 Imperial Canadian Income Trust Pool 20 Imperial Canadian Dividend Income Pool 22 Imperial Canadian Equity Pool 25 Imperial Registered U.S. Equity Index Pool 29 Imperial U.S. Equity Pool 31 Imperial Registered International Equity Index Pool 40 Imperial International Equity Pool 43 Imperial Overseas Equity Pool 51 Imperial Emerging Economies Pool 55 NOTES TO FINANCIAL STATEMENTS 58 1 Imperial Money Market Pool Statement of Investment Portfolio As at June 30, 2006 (unaudited) Average Cost Current Value Par Value ($) ($) Canadian Bonds 13,400,000 407 International Inc., Variable Rate, 4.379%, 2006/11/22 13,400,000 13,403,484 -

Retirement Funds June 30, 2011 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK TEMPCASH-FUND(21

Retirement Funds June 30, 2011 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000640% BLACKROCK TEMPCASH-FUND(21) 0.000800% BLACKROCK TEMPCASH-FUND(21) 0.002411% BLACKROCK TEMPCASH-FUND(21) 0.006249% BLACKROCK TEMPCASH-FUND(21) 0.004483% BLACKROCK TEMPCASH-FUND(21) 0.006950% BLACKROCK TEMPCASH-FUND(21) 0.004160% BLACKROCK TEMPCASH-FUND(21) 0.037118% BLACKROCK TEMPCASH-FUND(21) 0.016490% BLACKROCK TEMPCASH-FUND(21) 0.024515% BLACKROCK TEMPCASH-FUND(21) 0.009724% BLACKROCK TEMPCASH-FUND(21) 0.003364% BLACKROCK TEMPCASH-FUND(21) 0.025435% BLACKROCK TEMPCASH-FUND(21) 0.000800% BLACKROCK TEMPCASH-FUND(21) 1.283244% BLACKROCK TEMPCASH-FUND(21) 0.007796% BLACKROCK TEMPCASH-FUND(21) 0.985249% BLACKROCK TEMPCASH-FUND(21) 0.265337% BLACKROCK TEMPCASH-FUND(21) 0.002817% BLACKROCK TEMPCASH-FUND(21) 0.000005% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.007022% BLACKROCK TEMPCASH-FUND(21) 0.062065% BLACKROCK TEMPCASH-FUND(21) 0.017717% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.016891% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.060016% BLACKROCK TEMPCASH-FUND(21) 0.007350% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000003% BLACKROCK TEMPCASH-FUND(21) 0.007313% BLACKROCK TEMPCASH-FUND(21) 0.001022% BLACKROCK TEMPCASH-FUND(21) 0.001257% BLACKROCK TEMPCASH-FUND(21) 0.138078% BLACKROCK TEMPCASH-FUND(21) 0.011193% BLACKROCK TEMPCASH-FUND(21) -

Protecting Pennsylvania's Investments

Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2013 September 30, 2013 The Commonwealth of Pennsylvania has enacted legislation (Act 44 of 2010) requiring public funds to divest from companies doing business in Iran and/or Sudan that meet certain thresholds of activity. Additionally, Act 44 prohibits Pennsylvania’s public funds from purchasing securities of a company once it appears on scrutinized business activities lists, regardless of whether the funds already have direct holdings in such company. Act 44 requires that the public funds each year assemble and provide a report to the Governor, the President Pro Tempore of the Senate, the Speaker of the House of Representatives, and each member of the boards of the Pennsylvania Municipal Retirement System, the State Employees’ Retirement System, and the Public School Employees’ Retirement System. Accordingly, we have prepared this report on the activities our funds have undertaken to comply with the requirements of Act 44 during the period July 1, 2012 to June 30, 2013. This report includes: The most recent scrutinized companies lists (Sudan and Iran). A summary of correspondence with scrutinized companies. All investments sold, redeemed, divested or withdrawn in compliance with Act 44, the costs and expenses of such transfers, and a determination of net gain or loss on account of such transactions incurred in compliance with the Act. A list of publicly traded securities held by the public funds. Page 1 of 119 Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2013 A copy of Act 44 of 2010 can be downloaded from the Pennsylvania Treasury website at www.patreasury.gov. -

Managing for the Future

Managing for the future Annual Report 2005 Additional Information Annual Report 2005 – Additional Information I. Tables of returns 1. Auditors’ Report ................................................................................................. 1 2. General Notes .................................................................................................... 2 3. Short Term Investments ....................................................................................... 4 4. Real Return Bonds............................................................................................... 6 5. Long Term Bonds................................................................................................. 8 6. Bonds ..............................................................................................................10 7. Fixed Income - Bonds .........................................................................................12 8. Canadian Equity ................................................................................................14 9. Canadian Equity Quoted Markets .........................................................................16 10. U.S. Equity (Hedged) .........................................................................................18 11. U.S. Equity (Unhedged) .......................................................................................20 12. U.S. Equity Quoted Markets ................................................................................22 13. EAFE Foreign Equity -

Protecting Pennsylvania's Investments

刀 攀瀀 漀 爀琀 漀 昀 䄀 挀琀椀瘀椀琀椀攀猀 倀甀 爀猀甀 愀渀 琀 䄀 挀琀 㐀㐀 漀 昀 ㈀ 䄀 渀 渀 甀 愀氀 刀 攀瀀 漀 爀琀 匀攀瀀琀攀洀 戀攀爀 ㌀ Ⰰ ㈀ 㔀 倀甀 爀 倀甀 爀 Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2015 September 30, 2015 The Commonwealth of Pennsylvania has enacted legislation (Act 44 of 2010) requiring public funds to divest from companies doing business in Iran and/or Sudan that meet certain thresholds of activity. Additionally, Act 44 prohibits Pennsylvania’s public funds from purchasing securities of a company once it appears on scrutinized business activities lists, regardless of whether the funds already have direct holdings in such company. Act 44 requires that the public funds each year assemble and provide a report to the Governor, the President Pro Tempore of the Senate, the Speaker of the House of Representatives, and each member of the boards of the Pennsylvania Municipal Retirement System, the State Employees’ Retirement System, and the Public School Employees’ Retirement System. Accordingly, we have prepared this report on the activities our funds have undertaken to comply with the requirements of Act 44 during the period July 1, 2014 to June 30, 2015. This report includes: • The most recent scrutinized companies lists (Sudan and Iran). • A summary of correspondence with scrutinized companies. • All investments sold, redeemed, divested or withdrawn in compliance with Act 44, the costs and expenses of such transfers, and a determination of net gain or loss associated with such transactions executed in compliance with the Act. • A list of publicly traded securities held by the public funds. -

Semi-Annual Report 2006 the Pinnacle Program Funds the Pinnacle Portfolios

Professional Investment Advice Semi-Annual Report 2006 The Pinnacle Program Funds The Pinnacle Portfolios Money Market Fund Pinnacle Short Term Income Fund Bond Funds Pinnacle Income Fund Pinnacle High Yield Income Fund Pinnacle American Core-Plus Bond Fund Real Estate Fund Pinnacle Global Real Estate Securities Fund Balanced Funds Pinnacle Strategic Balanced Fund Pinnacle Global Tactical Asset Allocation Fund Canadian Equity Funds Pinnacle Canadian Value Equity Fund Pinnacle Canadian Mid Cap Value Equity Fund Pinnacle Canadian Growth Equity Fund Pinnacle Canadian Small Cap Equity Fund Foreign Equity Funds Pinnacle American Value Equity Fund Pinnacle American Mid Cap Value Equity Fund Pinnacle American Large Cap Growth Equity Fund Pinnacle American Mid Cap Growth Equity Fund Pinnacle International Equity Fund Pinnacle International Small to Mid Cap Value Equity Fund Pinnacle Global Equity Fund The Pinnacle Portfolios Pinnacle Balanced Income Portfolio Pinnacle Conservative Balanced Growth Portfolio Pinnacle Balanced Growth Portfolio Pinnacle Conservative Growth Portfolio Pinnacle Growth Portfolio ScotiaMcLeod: A Tradition of Trust The Pinnacle Program Funds and 1 and Performance The Pinnacle Portfolios For more than 75 years, ScotiaMcLeod has been 2006 Semi-Annual Report providing professional service and expert 2 Message to Clients investment advice to Canadians. In today’s Money Market Fund complex financial markets, 3 ) Pinnacle Short Term Income Fund that service and advice is more important than ever. Bond Funds At ScotiaMcLeod, we offer 5 ) Pinnacle Income Fund our clients the best of both 7 ) Pinnacle High Yield Income Fund worlds – the strength and 10 ) Pinnacle American Core-Plus Bond Fund security of one of Canada’s largest financial Real Estate Funds institutions; and the insight 17 ) Pinnacle Global Real Estate Securities Fund and personal attention of our well-respected advisors. -

Stoxx® Developed and Emerging Markets Total Market Index

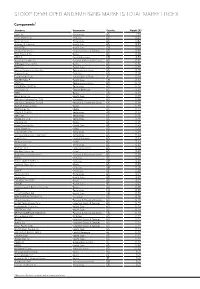

STOXX® DEVELOPED AND EMERGING MARKETS TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology US 1.70 Exxon Mobil Corp. Oil & Gas US 0.85 Microsoft Corp. Technology US 0.82 Johnson & Johnson Health Care US 0.65 NOVARTIS Health Care CH 0.60 General Electric Co. Industrial Goods & Services US 0.59 Wells Fargo & Co. Banks US 0.58 NESTLE Food & Beverage CH 0.57 Procter & Gamble Co. Personal & Household Goods US 0.52 JPMorgan Chase & Co. Banks US 0.52 Pfizer Inc. Health Care US 0.49 Verizon Communications Inc. Telecommunications US 0.46 Chevron Corp. Oil & Gas US 0.46 Toyota Motor Corp. Automobiles & Parts JP 0.45 ROCHE HLDG P Health Care CH 0.43 AT&T Inc. Telecommunications US 0.40 FACEBOOK CLASS A Technology US 0.40 Coca-Cola Co. Food & Beverage US 0.39 HSBC Banks GB 0.39 Merck & Co. Inc. Health Care US 0.38 Berkshire Hathaway Inc. Cl B Insurance US 0.38 Samsung Electronics Co Ltd Personal & Household Goods KR 0.38 Bank of America Corp. Banks US 0.38 Walt Disney Co. Media US 0.37 GOOGLE CLASS C Technology US 0.37 Intel Corp. Technology US 0.36 Google Inc. Cl A Technology US 0.36 Citigroup Inc. Banks US 0.36 Gilead Sciences Inc. Health Care US 0.35 Home Depot Inc. Retail US 0.35 Cisco Systems Inc. Technology US 0.34 International Business Machine Technology US 0.34 PepsiCo Inc. Food & Beverage US 0.33 Amazon.com Inc. Retail US 0.33 Oracle Corp. -

Stoxx® Developed and Emerging Markets Total Market Index

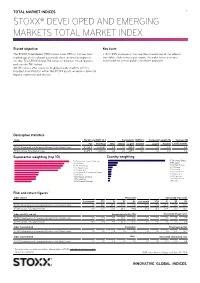

TOTAL MARKET INDICES 1 STOXX® DEVELOPED AND EMERGING MARKETS TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Developed and Emerging Markets Total Market Index 41,234.4 33,535.7 4.8 1.0 469.2 0.0 1.4 0.0 3.4 STOXX Global Total Market Index 41,428.5 33,610.4 4.6 1.0 469.2 0.0 1.4 0.0 3.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Developed and Emerging Markets Total Market Index 3.9 12.7 21.9 64.1 0.0 57.5 19.2 21.4 17.5 0.0 STOXX Global Total Market Index 3.9 12.7 21.8 63.3 94.6 57.6 19.2 21.4 17.3 13.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Developed and Emerging Markets Total Market Index 9.0 8.9 8.4 10.5 0.0 3.0 2.0 2.3 1.6 0.9 STOXX Global Total Market Index 9.0 8.9 8.4 10.4 15.6 3.0 2.0 2.3 1.5 0.8 Index to benchmark Correlation Tracking error (%) STOXX Developed and Emerging Markets Total Market Index 1.0 1.0 1.0 1.0 1.0 0.1 0.1 0.1 0.4 0.4 Index to benchmark Beta Annualized information ratio STOXX Developed and Emerging Markets Total Market Index 1.0 1.0 1.0 1.0 1.0 -0.2 -0.1 0.1 0.5 0.6 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Alberta Heritage Savings Trust Fund

Alberta Heritage Savings Trust Fund Detailed List of Investments March 31, 2006 Alberta Finance Page 1 ALBERTA HERITAGE SAVINGS TRUST FUND DETAILED LIST OF INVESTMENTS AS AT MARCH 31, 2006 (unaudited) The Alberta Heritage Savings Trust Fund (AHSTF) is a portfolio of investments comprised of bonds, mortgages, public equities, real estate, absolute return strategies, private equities, private income and timberland investments. At March 31, 2006, the value of the Fund's investments was $13,681,632,285 on a cost basis and $15,007,467,853 on a fair value basis. The majority of the Fund's investments are held in pooled investment funds esblished and administered by Alberta Finance. Pooled investment funds have a market based unit value that is used to allocate income to participants and to value purchases and sales of pooled units. Table 1 provides the Heritage Fund's investments in units of pooled investment funds and directly held securities. Schedules A to DD provide the Heritage Fund's share of each investment held in the following pooled investment funds. Schedule A: Consolidated Cash Investment Trust Fund Schedule B: Canadian Dollar Public Bond Pool Schedule C: Private Mortgage Pool Schedule D: Currency Alpha Pool Schedule E: Domestic Passive Equity Pooled Fund Schedule F: Canadian Pooled Equity Fund Schedule G: External Managers Canadian Large Cap Equity Pool Schedule H: Growing Equity Income Pool Schedule I: Canadian Equity Enhanced Index Pool Schedule J: Canadian Multi Cap Pool Schedule K: S&P's 500 Pooled Index Schedule L: External -

AAAAAAA* a * AAAAAAAAA * a * * a * 5 a Gross Rents AAAAAAAAAAAAAAAAA

!"#$ #$ %Uursqhvhirhiyrrhpsuv r hvshr r vt rv rr ")'& )!( ( &'& ( * + ," ) ! -$ . "!"/ 0 1 $& 2 )/ .$ $/ 3 / "$ ! '/ 4 , . 5 s Qh DDpypyvr % 6 !""!"# Qh Dpyqirphuihv . +")$ $ ,$$Uur hyshvpyiphqq ! hrprh vyrhyurhv pyhrrhtr surv pv ""!"# ' 7 %"!"!# "!"%# ""# %""!!# 8 ! 9 "!"!"#*** ! 69,820!!!#,872,680. """%# : ! STMT 1 "%"%%# "!"!# ' # "/ ""%"!%# "!!""# SEE ATTACHMENT A 7 FOR DETAIL 8 9 "!!!# "!!!# ! %"# %"# % ""# ""# : && ""# "%"!# ' ' '' # # '7 ""!# ""# # ' # " ( $ $$/ %"%"%# "!"# %# 0 (+ $ ,$$ '8 """# "!!""# '9 # "$$ $!$$/ "%"%%"%# "!"# "!!!""# ' ,$$ $$ $!$$ "%%"%"# ! $ "!"!"# +;$ NONE )+ 1 < + &$(7 $ $/ && ***SEE ATTACHMENT F FOR PUBLIC DISCLOSURE ' .. 2" $ ! %"# ' """# "%"%# "%"%# 7 "%"# ""!# "%"# "%"# 8 9 : "%"# H&& ""%# %"%"!"!# %"%"!"!# +$$$ ! ! "!"!"# !""!"# !""!"# """# "!!""# "!!""# ' 7 """# ""%"# ""%"# ""# 8 !""# 9 # "$$$ """%%# !""!"# !""!"# ""%# !""%# : ""%!"%# ' ' = ! " $ '' %"%"!# %"%%"# ' 7 # "" ! " $ "%"!"!# !""# $ "" 1+& < "" $' ( '9" $77/ ' H "%""!%# !"""# '8 '9 $ "" 1+& < "" $' ( 7/ ' ': ' 7 # "$$$ !"$ "%""!%# !"""# +$$$ 2"$ 7 # "" ! " $$$$> !"$ """%%# !""!"# ... +")$ $ ($ +$$$ 2"$ J "%""!%# ' ' "%%"%"# 7 7 """!%%#