Regional Impact Models

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agricultural Structure in a Service Economy

LUTHER TWEETEN Agricultural Structure in a Service Economy INTRODUCTION Highly developed market economies have been described variously as affluent, technocratic, and urban-industrial (see Ruttan 1969; Tweeten 1979, cbs. 1, 2). Such economies may also be characterised by service economies because a large portion of jobs are in service industries, such as, trade, finance, insurance, and government (see Table 1). Approxi mately three out of five jobs in the United States were in service industries in 1982. If service jobs in transportation, communications and public utilities are included, then nearly two out of three jobs were in service industries. Perhaps more important, as many as nine out of ten new jobs were in service industries. Non-metropolitan counties (essen tially those not having a city of 50,000 or more) did not differ sharply in structure from metropolitan communities; the major difference was relatively lower employment in service industries and higher employment in extractive (agriculture and mining) industries in non-metropolitan counties (Table 1). As buying power expands, consumers seek self-fulfilment and self-realisation as opposed to simply meeting basic needs for food, shelter and clothing. Income elasticities tend to be high for entertainment, health care, education, eating out, finance and insurance. Thus, normal workings of the price system cause advanced market economies to become service economies. The thesis of this paper is that transformation of nations into post-industrial service economies has pervasive implica tions for agriculture and rural communities. A number of such implications are explored herein. SERVICE INDUSTRIES Service industries and servcie employment are too diverse to be easily classified. -

Regional Economics: Understanding the Third Great Transition

REGIONAL ECONOMICS: UNDERSTANDING THE THIRD GREAT TRANSITION Paul Krugman September 2019 Memo to young economists: the transition from fiery upstart to old fuddy-duddy elder statesman sneaks up on you. One day, it seems, you’re trying to turn everything upside down; the next thing you know you’ve turned into one of those old guys whose response to any new idea is “It’s trivial, it’s wrong, and I said it in 1962.” Sure enough, in a couple of weeks I’m giving the luncheon keynote speech at a Boston Fed conference on America’s growing regional disparities, basically providing a break and maybe some inspiration in between presentations by real researchers. The brief talk doesn’t require a paper, and I am not someone who reads prepared speeches. But I thought I might take the occasion to write down a few thoughts on the subject. Basically, I want to make three points: 1. The regional divergence we’ve seen since around 1980 probably isn’t trivial or transient. Instead, it reflects a shift in the underlying logic of regional growth — the kind of shift that theories of economic geography predict will happen now and then, when the balance between forces of agglomeration and those of dispersion crosses a tipping point. 2. This isn’t the first time this kind of transition has happened. In fact, it’s the third such shift in the history of the U.S. economy, which went through earlier eras of both regional divergence and regional convergence. 3. There are pretty good although not ironclad arguments for “place-based” policies to limit regional divergence. -

Doctor of Philosophy in Economics

ECO 6525 PUBLIC SECTOR ECONOMICS (3) Course Information Introduction to the public sector and the allocation of resources, emphasis on market failure and the economic role of government. ECO 6115 MICROECONOMICS I (3) (PR: ECO 6115) Microeconomic behavior of consumers, producers, and resource suppliers, price determination in output and factor markets, general ECO 6936 FORECASTING AND ECONOMIC TIME market equilibrium. (PR: ECO 3101, ECO 6405 or CI) SERIES (3) Study of time series econometrics estimation with applications to ECO 7116 MICROECONOMICS II (3) economic forecasting. (PR: ECO 6424) Topics in advanced microeconomic theory, including general equilibrium, welfare economics, intertemporal choice, uncertainty, ECO 6936 BEHAVIORAL ECONOMICS (3) University of South Florida information, and game theory. (PR: ECO 6115) Survey of evidence on departures of economic agents from rationality. Topics include present-based preferences, reference College of Arts and Sciences ECO 6120 ECONOMIC POLICY ANALYSIS (3) dependence, and non-standard beliefs. (PR: ECO 6424) 4202 E. Fowler Avenue The application of economic theory to matters of public policy. (PR: ECO 3101) ECP 6205 LABOR ECONOMICS I (3) Tampa, FL 33620 Labor demand and supply, unemployment, discrimination in labor ECO 6206 MACROECONOMICS I (3) markets, labor force statistics. (PR: ECO 3101 or ECO 6115) Dynamic analysis of the determination of income, employment, prices, and interest rates. (PR: ECO 6405) ECP 7207 LABOR ECONOMICS II (3) Advanced study of labor economics including analysis of the wage Doctor of Philosophy ECO 7207 MACROECONOMICS II (3) structure, labor unions, labor mobility, and unemployment. (PR: Topics in advanced macroeconomic theory with a particular emphasis ECP 6205) on quantitative and empirical applications. -

Notes on Structural Change and Economic Development Vivianne

ISSN 2222-4815 A service-based economy: where do we stand? Notes on structural change and economic development Vivianne Ventura-Dias WorkingPaper # 139 | Septiembre 2011 A service-based economy: where do we stand? Notes on structural change and economic development Vivianne Ventura-Dias LATN – Latin American Trade Network ([email protected]) Abstract The purpose of this paper is to provide a comprehensive view of the state of the art of economic research on services and the service economy and thereby contribute to the discussion of a model of inclusive and sustainable development in Latin America. The economic literature on services is widely dispersed in different academic fields that study services, namely economics, marketing, urban and regional studies, geography, human resources and operations research, with very little exchange between these disciplines than it is desired. Although the literature covered much of the empirical ground, it still proposes more questions than answers on macro and micro issues related to growth, employment and productivity in service-based economies. The paper is divided into five sections, including this introduction. Next section is focused on two aspects of the services debate: (i) the definition and measurement of services; and (ii) the determinants of growth of services. Section 3 discusses new trends in international trade that gave prominence to the formation of international supply chains through widespread outsourcing. Section 4 proposes a discussion on the role of services in Latin American -

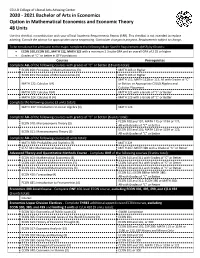

2020-2021 Bachelor of Arts in Economics Option in Mathematical

CSULB College of Liberal Arts Advising Center 2020 - 2021 Bachelor of Arts in Economics Option in Mathematical Economics and Economic Theory 48 Units Use this checklist in combination with your official Academic Requirements Report (ARR). This checklist is not intended to replace advising. Consult the advisor for appropriate course sequencing. Curriculum changes in progress. Requirements subject to change. To be considered for admission to the major, complete the following Major Specific Requirements (MSR) by 60 units: • ECON 100, ECON 101, MATH 122, MATH 123 with a minimum 2.3 suite GPA and an overall GPA of 2.25 or higher • Grades of “C” or better in GE Foundations Courses Prerequisites Complete ALL of the following courses with grades of “C” or better (18 units total): ECON 100: Principles of Macroeconomics (3) MATH 103 or Higher ECON 101: Principles of Microeconomics (3) MATH 103 or Higher MATH 111; MATH 112B or 113; All with Grades of “C” MATH 122: Calculus I (4) or Better; or Appropriate CSULB Algebra and Calculus Placement MATH 123: Calculus II (4) MATH 122 with a Grade of “C” or Better MATH 224: Calculus III (4) MATH 123 with a Grade of “C” or Better Complete the following course (3 units total): MATH 247: Introduction to Linear Algebra (3) MATH 123 Complete ALL of the following courses with grades of “C” or better (6 units total): ECON 100 and 101; MATH 115 or 119A or 122; ECON 310: Microeconomic Theory (3) All with Grades of “C” or Better ECON 100 and 101; MATH 115 or 119A or 122; ECON 311: Macroeconomic Theory (3) All with -

The Neoliberal Rhetoric of Workforce Readiness

The Neoliberal Rhetoric of Workforce Readiness Richard D. Lakes Georgia State University, Atlanta, USA Abstract In this essay I review an important report on school reform, published in 2007 by the National Center on Education and the Economy, and written by a group of twenty-five panelists in the USA from industry, government, academia, education, and non-profit organizations, led by specialists in labor market economics, named the New Commission on the Skills of the American Workforce. These neoliberal commissioners desire a broad overhaul of public schooling, ending what is now a twelve-year high school curriculum after the tenth-grade with a series of state board qualifying exit examinations. In this plan vocational education (also known as career and technical education) has been eliminated altogether in the secondary-level schools as curricular tracks are consolidated into one, signifying a national trend of ratcheting-up prescribed academic competencies for students. I argue that college-for-all neoliberals valorize the middle-class values of individualism and self-reliance, entrepreneurship, and employment in the professions. Working-class students are expected to reinvent themselves in order to succeed in the new capitalist order. Imperatives in workforce readiness Elected officials in state and national legislatures and executive offices share a neoliberal perspective that public school students are academically deficient and under-prepared as future global workers. Their rhetoric has been used to re-establish the role of evidence-based measurement notably through report cards of student's grade-point-averages and test-taking results. Thus, states are tightening their diploma offerings and consolidating curricular track assignments. -

International Undergraduate Prospectus 2011 E at Du a R UNDERG Contents

International Undergraduate Prospectus 2011 Prospectus Undergraduate International UNDERGRAduATE Contents UWS AND YOU ..................... 1 Why choose UWS? . 2 Student Services and Facilities . 4 Teaching and Learning – a different style . 6 UWS Life – Where will you study? UWS campuses . 7 Bankstown campus . 8 Campbelltown campus . 10 Hawkesbury campus . 12 Nirimba (Blacktown) campus . 14 Parramatta campus . 16 Penrith campus . 18 Westmead precinct . 20 UWS Life Accommodation . 22 Preparing for life at UWS . 24 Your study destination . 26 Cost of living . 28 Working in Australia . 30 COURSE GUIDE .................... 31 Course and Career Index . 32 Agriculture, Horticulture, Food and Natural Sciences and Animal Science . 34 Arts, International Studies, Languages, Interpreting and Translation . 38 Business . 41 Communication, Design and Media . 49 Computing and Information Technology . 51 Engineering, Construction and Industrial Design . 54 Forensics, Policing and Criminology . 60 Health and Sport Sciences . 62 Law . 68 Medicine . 71 Natural Environment and Tourism . 72 Nursing . 76 Psychology . 78 Sciences . 80 Social Sciences . 85 Teaching and Education . 87 ADMISSION ....................... 91 Academic entry requirements . 92 Undergraduate coursework entry requirements and 2011 fees . 94 English language entry requirements . 100 UWSCollege – your pathway to UWS . 101 How to apply . 106 Important information . 108 International student undergraduate application form . 109 UWS and You U UWS AND YO Jasper Duineveld, Netherlands » Bachelor of Arts (Psychology) ‘My experience at UWS has taught me that there are so many possibilities in life and every part has a positive outlook. The people and especially the lecturers at UWS are great, they are always willing to help you out.’ UWS has been recognised for outstanding contributions to student learning at the 2010 national Australian Learning and Teaching Council (ALTC) Awards. -

OECD Comparable and Other Selected Small Area Indicators

PROJECT FACT SHEET OECD comparable and other selected small area indicators Vision statement This project will develop a suite of indicators across a number of domains which can Project deliverables be used to assess and measure local community (SLA) socio-economic performance. * Review of the literature on social indicators These indicators will be accessible to urban researchers via the AURIN portal. * Benchmarked indicators comparable with OECD indicators for wellbeing at national level and the appropriate benchmarks to derive small Project overview area estimates Measures and benchmarks of local socio-economic performance are important * A final report containing a technical description of the modelling, a technical description of the tools for research and policy surrounding sustainable and effective communities. database including metadata and instructions The final set of indicators will be informed by the OECD Indicators project (Society on the service, user manual on how to use. at a Glance). The set of indicators will cover the same domains as Society at a Glance * Suite of social indicators available through the (general context; self sufficiency; equity; health; and social cohesion), and where AURIN portal possible will use similar indicators (see Figure 1). These indicators will be Fig.1 Conceptual model of OECD Comparable and Other Small Area Social Indicators for Australia project The AURIN Project is an initiative of the Australian Government being conducted as part of the Super Science Initiative and financed from the Education Investment Fund. The University of Melbourne is the Commonwealth-appointed Lead Agent of the AURIN Project PROJECT FACT SHEET OECD comparable and other selected small area indicators Project overview cont’d Team provided for Statistical Local Areas in Australia using the latest available data. -

The Growing Importance of Service Employment

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Service Economy Volume Author/Editor: Victor R. Fuchs, assisted by Irving F. Leveson Volume Publisher: NBER Volume ISBN: 0-87014-475-8 Volume URL: http://www.nber.org/books/fuch68-1 Publication Date: 1968 Chapter Title: The Growing Importance of Service Employment Chapter Author: Victor R. Fuchs Chapter URL: http://www.nber.org/chapters/c1156 Chapter pages in book: (p. 14 - 45) 2 THEGROWING IMPORTANCE OF SERVICE EMPLOYMENT In 1947 U.S. employment stood at 58million.The comparable figure for 1965 was 71 million, an increase of 13 million over eighteen years. Nearly all of this net growth occurred in the Service sector; modest in- creases in manufacturing and construction have been almost completely offset by declines in agriculture and mining. Between 1929 and 1965 Service sector employment grew by 20 million. The Industry sector in- creased by only 10 million and Agricultural employment declined by 5million.This chapter is primarily concerned with delineating the growth of service employment from several different points of view. Trends in recent decades are examined in detail, but longer-term trends are also considered. The growth of the Service sector's share of employ- ment in individual states and in foreign countries is discussed. Greatest attention is given to the distribution of employment by industry and sector, but some occupational data are presented as well. The chapter begins with a discussion of the sector definitions. It concludes by examin- ing some of the reasons for the shift to service employment. -

The Spectre of Monetarism

The Spectre of Monetarism Speech given by Mark Carney Governor of the Bank of England Roscoe Lecture Liverpool John Moores University 5 December 2016 I am grateful to Ben Nelson and Iain de Weymarn for their assistance in preparing these remarks, and to Phil Bunn, Daniel Durling, Alastair Firrell, Jennifer Nemeth, Alice Owen, James Oxley, Claire Chambers, Alice Pugh, Paul Robinson, Carlos Van Hombeeck, and Chris Yeates for background analysis and research. 1 All speeches are available online at www.bankofengland.co.uk/publications/Pages/speeches/default.aspx Real incomes falling for a decade. The legacy of a searing financial crisis weighing on confidence and growth. The very nature of work disrupted by a technological revolution. This was the middle of the 19th century. Liverpool was in the midst of a golden age; its Custom House was the national Exchequer’s biggest source of revenue. And Karl Marx was scribbling in the British Library, warning of a spectre haunting Europe, the spectre of communism. We meet today during the first lost decade since the 1860s. In the wake of a global financial crisis. And in the midst of a technological revolution that is once again changing the nature of work. Substitute Northern Rock for Overend Gurney; Uber and machine learning for the Spinning Jenny and the steam engine; and Twitter for the telegraph; and you have dynamics that echo those of 150 years ago. Then the villains were the capitalists. Should they today be the central bankers? Are their flights of fancy promoting stagnation and inequality? Does the spectre of monetarism haunt our economies?i These are serious charges, based on real anxieties. -

Syllabus - ECON 137 – Urban & Regional Economics Summer 2006 (Session C)

Syllabus - ECON 137 – Urban & Regional Economics Summer 2006 (session C) Instructor: Guillermo Ordonez ([email protected]) Lecture hours: Monday and Wednesday 1:00 – 3:05pm, Room: Dodd 175 Office hours: Monday and Wednesday 3:30 – 4:30pm, Room: Bunche 2265 Webpage: http://www.sscnet.ucla.edu/061/econ137-1/ UCLA campus “A city within a city” (UCLA undergraduate admission webpage) “A great city is not to be confounded with a populous one” Aristotle (Ancient Greek Philosopher, 384 BC-322 BC) “Los Angeles is 72 suburbs in search of a city” Dorothy Parker (American short- story writer and poet, 1893-1967) “What I like about cities is that everything is king size, the beauty and the ugliness.” Joseph Brodsky (Russian born American Poet and Writer. Nobel Prize for Literature in 1987. 1940- 1996) Course description In this class we will study the economics of cities and urban problems by understanding the effects of geographic location on the decisions of individuals and firms. The importance of location in everyday choices is easily assessed from our day-to- day lives (especially living in LA!), yet traditional microeconomic models are spaceless, (i.e we do not account for geographic factors). First we will try to answer general and interesting questions such as, Why do cities exist? How do firms decide where to locate? Why do people live in cities? What determines the growth and size of a city? Which policies can modify the shape of a city? Having discussed why we live in cities, we will analyze the economic problems that arise because we are living in cities. -

The Employment Shift to Services

The employment shift to services: where did it come from? Services did not gain all of its jobs from those lost in the agriculture and goods-producing sectors; employment growth stemmed largely from expansion of'the labor force, particularly the increased participation of women MICHAEL URQUHART The decline in manufacturing employment associated with ment can be readily explained by the combination of rising the recent recession, coupled with the continued growth of productivity and limited appetites, the cause of the changing services, has renewed interest in the distribution of em- relationship between the goods-producing and service-pro- ployment among the three major sectors-agriculture, goods- ducing sectors remains more complex and problematical . producing, and service-producing industr;-s. While the U .S . Given the interdependence of the goods and services sec- economy has beer a "service economy" for more than 30 tors, the growth of each is somewhat related to growth in years, the increasing shift from goods production to services the other. Thus, greater production and consumption of has raised fears about a possible national "deindustriali- goods require the development of numerous services, from zation ."' These fears have been manifest in speculation on transportation to retail sales outlets, as well as -epair ser- many aspects of employment policy, ranging from the im- vices . Furthermore, many business or producer services pro- pact on earnings and potential economic growth to the future vide inputs which contribute to the production of goods . of work . Indeed, Ronald Shelp has argued that the "development of Much of the current discussion has focused on the po- the service sector can and should encourage the growth in tential negative consequences of the continuing shift of em- manufacturing ."` To a degree, then, the growth of both ployment to services, ignoring the fact that, in the past, sectors is complementary .