Digging Deep

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Fall of Warisan in Sabah's Election

ISSUE: 2021 No. 8 ISSN 2335-6677 RESEARCHERS AT ISEAS – YUSOF ISHAK INSTITUTE ANALYSE CURRENT EVENTS Singapore | 29 January 2021 The Fall of Warisan in Sabah’s Election: Telltale Signs, Causes and Salient Issues Arnold Puyok* President of the Sabah Heritage Party (Warisan) Shafie Apdal (centre), shows his inked finger after casting his vote at a polling station during state elections in Semporna, a town in Malaysia's Sabah state on Borneo island, on September 26, 2020. Photo: AFP * Arnold Puyok is Senior Lecturer in Politics and Government Studies at the Faculty of Social Sciences and Humanities, Universiti Malaysia Sarawak (UNIMAS). 1 ISSUE: 2021 No. 8 ISSN 2335-6677 EXECUTIVE SUMMARY • Public opinion polls conducted prior to the 16th Sabah state election provided telltale signs of Warisan’s loss of support and impending electoral defeat. • Warisan’s fall from power was mostly due to the party’s inability to address the priority needs of the largely rural Muslim Bumiputera and Kadazandusun voters. • Research fieldwork during the election campaign and post-election analysis reveal that rural Sabah voters are more concerned with bread-and-butter issues, while their partisan loyalties are not steadfast. They are willing to trade their political support for programmes and policies that yield tangible benefits. • The new state government led by Gabungan Rakyat Sabah (GRS) will face the twin challenges of appeasing increasingly demanding voters and delivering public goods effectively. • As GRS navigates these politically uncertain times, its future in Sabah looks unpromising. 2 ISSUE: 2021 No. 8 ISSN 2335-6677 INTRODUCTION In the recent Sabah state election, GRS (Gabungan Rakyat Sabah), comprising BN (Barisan Nasional), PN (Perikatan Nasional) and PBS (Parti Bersatu Sabah), won 38 seats in the state legislative assembly, prevailing over a Warisan-led coalition by a six-seat margin. -

RIGHTS in REVERSE: One Year Under the Perikatan Nasional Government in Malaysia MARCH 2021 RIGHTS in REVERSE

RIGHTS IN REVERSE: One year under the Perikatan Nasional government in Malaysia MARCH 2021 RIGHTS IN REVERSE: EXECUTIVE SUMMARY Malaysian people have experienced seismic upheavals in the past year. In late February 2020, the ruling Pakatan Harapan government collapsed amid surreptitious political manoeuvring. On 1 March 2020, Malaysia’s King appointed Tan Sri Muhyiddin Yassin as Prime Minister after determining that he commanded the support of a majority of elected MPs under the umbrella of the Perikatan Nasional coalition. The turnover in government marked a political sea change and the abrupt end to the reform agenda of the Pakatan Harapan government. The ascendence of the Perikatan Nasional government coincided with the onset of the COVID-19 pandemic in Malaysia. The government implemented a strict Movement Control Order (MCO) that severely curtailed travel and social interactions. While the government’s efforts to stymie the spread of the virus have been successful in many respects, authorities have at times applied measures in a discriminatory manner and used the pandemic as an excuse to restrict human rights. This report examines the Perikatan Nasional government’s record on fundamental freedoms during its first year in power. Specifically, the report considers the government’s actions against its obligations to respect, protect, and fulfil the rights to freedom of expression, peaceful assembly, and association. These rights are the focus of ARTICLE 19 and CIVICUS’s work in Malaysia. Last year’s change of government has proven to be a major setback for fundamental freedoms in Malaysia. While the Pakatan Harapan government’s track record on human rights was disappointing in many ways,1 it took some steps to roll back repressive laws and policies and was much more open to engaging with civil society and the human rights community than its predecessor. -

Penyata Rasmi Parlimen Dewan Rakyat Parlimen Keempat Belas Penggal Ketiga Mesyuarat Ketiga

Naskhah belum disemak PENYATA RASMI PARLIMEN DEWAN RAKYAT PARLIMEN KEEMPAT BELAS PENGGAL KETIGA MESYUARAT KETIGA Bil. 35 Khamis 12 November 2020 K A N D U N G A N JAWAPAN-JAWAPAN MENTERI BAGI PERTANYAAN-PERTANYAAN (Halaman 1) JAWAPAN-JAWAPAN LISAN BAGI PERTANYAAN-PERTANYAAN (Halaman 3) RANG UNDANG-UNDANG: Rang Undang-undang Perbekalan 2021 (Halaman 22) USUL: Usul Anggaran Pembangunan 2021 (Halaman 22) DR. 12.11.2020 1 MALAYSIA DEWAN RAKYAT PARLIMEN KEEMPAT BELAS PENGGAL KETIGA MESYUARAT KETIGA Khamis, 12 November 2020 Mesyuarat dimulakan pada pukul 10.00 pagi DOA [Tuan Yang di-Pertua mempengerusikan Mesyuarat] Tuan Yang di-Pertua: Assalamualaikum semua, selamat sejahtera dan selamat pagi. Sebelum kita mula pada hari ini, saya ada sedikit makluman mengenai ujian COVID-19. Ahli-ahli Yang Berhormat, saya telah mendapat permohonan daripada ramai juga di kalangan Ahli-ahli Yang Berhormat agar pegawai-pegawai pengiring Ahli-ahli Yang Berhormat turut membuat ujian COVID-19 menggunakan kaedah RT-PCR di Parlimen Malaysia. Sehubungan itu, sukacita dimaklumkan bahawa pihak Pentadbiran Parlimen Malaysia dan Kementerian Kesihatan Malaysia (KKM) telah bersetuju menyediakan kemudahan saringan ujian COVID-19 kepada pegawai-pegawai pengiring Ahli-ahli Yang Berhormat di Dewan Serbaguna Parlimen Malaysia pada hari ini, jam 9.00 pagi hingga 2.00 petang. Untuk tujuan ini, hanya seramai tiga orang pegawai pengiring setiap Ahli-ahli Yang Berhormat dibenarkan membuat ujian COVID-19 tersebut. Sekian, terima kasih. Tuan Karupaiya a/l Mutusami [Padang Serai]: Tuan Yang di-Pertua, pertanyaan. Tuan Yang di-Pertua: Saya. Tuan Karupaiya a/l Mutusami [Padang Serai]: Terima kasih Tuan Yang di- Pertua. Saya ingin mencadangkan pada masa-masa akan datang, panjangkan cuti sedikit untuk Deepavali. -

1996Vol16no.9

COVER STORY t Aliran's 1996 An- l nual General Meet ing, members unani mously agreed that this issue 1 of A/iran Monthly should fo cus on the recently aborted Second Asia Pacific Confer ence on East Timor (APCET II) in Kuala Lumpur. As one of the sponsors of this conference, Aliran was shocked that a legally-consti tuted conference could be so violently disrupted. Four of our members were among those arrested and detained. In this issue, we carry a first person account of the melee aL the meeting and of the de plorable conditions at the po lice lock-ups. Also included are articles on the fiasco, which attracted international media attenLion. Many reactions were received The conference disrupted ... from around the world, which publish in our next issue ~orne of the reactions from indh du were totally ignored by the lo a1s and groups within Asia reflecting the concern o~- ordinary cal media. Of these, we will Asians for a peaceful resolution of the East Timor :ssue. :J Aliran Monthly 1996: /6(9) Page 2 UI•SF:TTING COVERAGE 7 CONFERF.:'o~CE L"i CH .\OS 10 EAST TIMOR : The hidden ~ tory 16 HU~lASITY BE\0.._0 BORDERS WINOS OF CHANGE 40 19 LETTERS 27 62. lsi t·loor. Wlsma Saw Khaw Uan. Pnlp... a "tid. I 031MI CURRE!IOT COSCER'IS 30 l'nDied b} RP Prlnun SDCI.IIIMI. SLBS<:RIPTION 18 66. 611 &. 70 Jalan .\lr I tam APPEAL 28 I 0460 Pulau l'lnan~, Malloy• Ia. 1fl : fiO.I- 2.!6$~ t'ar. -

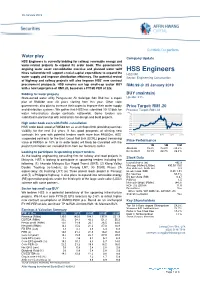

HSS Engineers Is Currently Bidding for Railway, Renewable Energy and Water-Related Projects to Expand Its Order Book

28 January 2019 Water play Company Update HSS Engineers is currently bidding for railway, renewable energy and water-related projects to expand its order book. The government’s ongoing water asset consolidation exercise and planned water tariff HSS Engineers hikes nationwide will support crucial capital expenditure to expand the HSS MK water supply and improve distribution efficiency. The potential revival Sector: Engineering Construction of highway and railway projects will also improve HSS’ new contract procurement prospects. HSS remains our top small-cap sector BUY RM0.99 @ 25 January 2019 with a new target price of RM1.20, based on a FY19E PER of 22x. Bidding for water projects BUY (maintain) State-owned water utility Pengurusan Air Selangor Sdn Bhd has a capex Upside: 21% plan of RM30bn over 30 years starting from this year. Other state governments also plan to increase their capex to improve their water supply Price Target: RM1.20 and distribution systems. We gather that HSS has submitted 10-12 bids for Previous Target: RM1.18 (RM) water infrastructure design contracts nationwide. Some tenders are 2.00 1.80 submitted in partnership with contractors for design and build projects. 1.60 1.40 1.20 High order book even with ECRL cancellation 1.00 0.80 HSS’ order book stood at RM588.6m as at 30 Sept 2018, providing earnings 0.60 0.40 visibility for the next 2-3 years. It has good prospects of winning new 0.20 0.00 contracts this year with potential tenders worth more than RM300m. HSS’ Dec-16 May-17 Oct-17 Mar-18 Aug-18 Jan-19 suspended contracts for the East Coast Rail Link (ECRL) project (remaining Price Performance value of RM95m or 16% of its order book) will likely be cancelled with the project termination; we excluded them from our forecasts earlier. -

DAFTAR-PPS-PUSAT-INTERNET.Pdf

SURUHANJAYA KOMUNIKASI DAN MULTIMEDIA MALAYSIA (MALAYSIAN COMMUNICATIONS AND MULTIMEDIA COMMISSION) DAFTAR PPS 31 DISEMBER 2018 CAPAIAN KOMUNITI DAN PROGRAM SOKONGAN – PUSAT INTERNET No. Negeri Parlimen UST Nama Tapak Lokasi Kompleks Penghulu Mukim 7, Kg. Parit Hj 1 Johor Ayer Hitam Yong Peng Batu 6 Jalan Besar, Kg. Hj Ghaffar Ghaffar, 86400 Yong Peng Kompleks Kompleks Penghulu, Mukim 2 Johor Bakri Ayer Hitam Penghulu Ayer Batu 18 Setengah, 84600 Ayer Hitam Hitam Taman Rengit 9, Jalan Rengit Indah, Taman 3 Johor Batu Pahat Rengit Indah Rengit Indah, 83100 Rengit Pusat Aktiviti Kawasan Rukun 4 Johor Batu Pahat Batu Pahat Taman Nira Tetangga, Taman Nira, 83000 Batu Pahat Kompleks Penghulu, Jalan 5 Johor Gelang Patah Gelang Patah Gelang Patah Meranti, 83700 Gelang Patah Jalan Jurumudi 1, Taman Desa Desa Paya 6 Johor Gelang Patah Gelang Patah Paya Mengkuang, Mengkuang 81550 Gelang Patah Balairaya, Jalan Ilham 25, 7 Johor Kluang Taman Ilham Taman Ilham Taman Ilham, 86000 Kluang Dewan Jengking Kem Mahkota, 8 Johor Kluang Kluang Kem Mahkota 86000 Kluang Felda Bukit Pejabat JKKR Felda Bukit Aping 9 Johor Kota Tinggi Kota Tinggi Aping Barat Barat, 81900 Kota Tinggi Bilik Gerakan Persatuan Belia Felcra Sungai Felcra Sg Ara, Kawasan Sungai 10 Johor Kota Tinggi Kota Tinggi Ara Ara, KM 40 Jalan Mersing, 81900 Kota Tinggi Mini Sedili Pejabat JKKK Sedili Besar, Sedili 11 Johor Kota Tinggi Kota Tinggi Besar Besar, 81910 Kota Tinggi Felda Bukit Bekas Kilang Rossel, Felda Bukit 12 Johor Kota Tinggi Kota Tinggi Easter Easter, 81900 Kota Tinggi No. 8, Gerai Felda Pasak, 13 Johor Kota Tinggi Kota Tinggi Felda Pasak 81900 Kota Tinggi Bangunan GPW Felda Lok Heng Felda Lok 14 Johor Kota Tinggi Kota Tinggi Selatan, Sedili Kechil, Heng Selatan 81900 Kota Tinggi Bangunan Belia, Felda Bukit Felda Bukit 15 Johor Kulai Johor Bahru Permai, 81850 Layang-Layang, Permai Kulai Felda Inas Bangunan GPW, Felda Inas 16 Johor Kulai Johor Bahru Utara Utara, 81000 Kulai No. -

Malaysia: the 2020 Putsch for Malay Islam Supremacy James Chin School of Social Sciences, University of Tasmania

Malaysia: the 2020 putsch for Malay Islam supremacy James Chin School of Social Sciences, University of Tasmania ABSTRACT Many people were surprised by the sudden fall of Mahathir Mohamad and the Pakatan Harapan (PH) government on 21 February 2020, barely two years after winning the historic May 2018 general elections. This article argues that the fall was largely due to the following factors: the ideology of Ketuanan Melayu Islam (Malay Islam Supremacy); the Mahathir-Anwar dispute; Mahathir’s own role in trying to reduce the role of the non-Malays in the government; and the manufactured fear among the Malay polity that the Malays and Islam were under threat. It concludes that the majority of the Malay population, and the Malay establishment, are not ready to share political power with the non- Malays. Introduction Many people were shocked when the Barisan National (BN or National Front) govern- ment lost its majority in the May 2018 general elections. After all, BN had been in power since independence in 1957 and the Federation of Malaysia was generally regarded as a stable, one-party regime. What was even more remarkable was that the person responsible for Malaysia’s first regime change, Mahathir Mohammad, was also Malaysia’s erstwhile longest serving prime minister. He had headed the BN from 1981 to 2003 and was widely regarded as Malaysia’s strongman. In 2017, he assumed leader- ship of the then-opposition Pakatan Harapan (PH or Alliance of Hope) coalition and led the coalition to victory on 9 May 2018. He is remarkable as well for the fact that he became, at the age of 93, the world’s oldest elected leader.1 The was great hope that Malaysia would join the global club of democracy but less than two years on, the PH government fell apart on 21 February 2020. -

Economic Performance and Prospects

(FRQRPLF 3HUIRUPDQFHDQG 3URVSHFWV Chapter 3.indd 47 9/30/11 4:42:27 AM 48 Chapter 3.indd 48 9/30/11 4:42:27 AM Economic Performance and Prospects Overview by the Government such as tax incentives and liberalisation measures to attract investment, Economy continues to expand particularly in the oil and gas as well as services sectors. Public expenditure is envisaged to remain he Malaysian economy continued to expand supportive of economic activities with expansion Tdespite the more challenging external in capital spending by the Non-Financial Public environment. Real Gross Domestic Product Enterprises (NFPEs). (GDP) registered a growth of 4.4% during the first half of 2011. The moderation was On the supply side, all sectors are expected due to slowing exports following the weaker- to post positive growth, except mining due than-expected United States (US) economic to lower production of crude oil. In tandem performance, deepening euro sovereign debt with robust private consumption, the services crisis, global supply chain disruptions resulting sector is envisaged to grow strongly led by from earthquake and tsunami in Japan as well the wholesale and retail trade, finance and as rising global inflation. The moderation was insurance, real estate and business services as also partly attributed to the high-base effect well as communication sub-sectors. Despite the as GDP grew at a strong pace of 9.5% during contraction in output of electrical and electronics Economic Performance and the same period in 2010. However, the growth (E&E) and transport equipment in the first half momentum is expected to pick up in the second of 2011, the manufacturing sector is expected to half of the year on the back of resilient private record positive growth supported by strong output Prospects consumption and strong private investment. -

Penyata Rasmi Parlimen Dewan Rakyat Parlimen Keempat Belas Penggal Ketiga Mesyuarat Kedua

Naskhah belum disemak PENYATA RASMI PARLIMEN DEWAN RAKYAT PARLIMEN KEEMPAT BELAS PENGGAL KETIGA MESYUARAT KEDUA Bil. 10 Isnin 27 Julai 2020 K A N D U N G A N PEMASYHURAN DARIPADA TUAN YANG DI-PERTUA: - Perubahan Tempat Duduk Ahli-ahli (Halaman 1) JAWAPAN-JAWAPAN LISAN BAGI PERTANYAAN-PERTANYAAN (Halaman 2) RANG UNDANG-UNDANG DIBAWA KE DALAM MESYUARAT (Halaman 29) USUL-USUL: Waktu Mesyuarat dan Urusan Dibebaskan Daripada Peraturan Mesyuarat (Halaman 30) Usul Menjunjung Kasih Titah Seri Paduka Baginda Yang di-Pertuan Agong (Halaman 30) DR. 27.7.2020 1 MALAYSIA DEWAN RAKYAT PARLIMEN KEEMPAT BELAS PENGGAL KETIGA MESYUARAT KEDUA Isnin, 27 Julai 2020 Mesyuarat dimulakan pada pukul 10.00 pagi DOA [Timbalan Yang di-Pertua (Dato' Mohd Rashid Hasnon) mempengerusikan Mesyuarat] ____________________________________________________________________ PEMASYHURAN DARIPADA TUAN YANG DI-PERTUA PERUBAHAN TEMPAT DUDUK AHLI Timbalan Yang di-Pertua [Dato' Mohd Rashid Hasnon]: Ahli-ahli Yang Berhormat, untuk makluman, terdapat perubahan tempat duduk di mana Ahli-ahli Yang Berhormat daripada Galeri Awam telah dipindahkan semula ke tempat duduk pegawai di sebelah kiri saya. [Tepuk] Ini permintaan daripada Ahli Yang Berhormat juga. Beberapa mikrofon dipasang di tempat duduk pegawai di sebelah kiri dan dua rostrum diletakkan di sebelah blok E Dewan, bagi memberi kemudahan kepada Ahli-ahli Yang Berhormat mengajukan pertanyaan atau terlibat dengan perbahasan. Bagi melancarkan lagi urusan persidangan, mohon kerjasama Ahli-ahli Yang Berhormat yang berada di tempat duduk pegawai di sebelah kiri untuk menyebut nama kawasan masing- masing sebelum memulakan sesuatu pertanyaan ataupun perbahasan. Ini untuk memudahkan urusan merekodkan untuk penyediaan Penyata Rasmi. Terdapat beberapa blind spot yang terlindung daripada pandangan Pengerusi, dipohon Ahli-ahli Yang Berhormat berdiri memandang ke arah Pengerusi agar Pengerusi dapat melihat kedudukan Ahli-ahli Yang Berhormat. -

Construction Sector Remains Challenging As the Federal Government Is Reviewing Ongoing Infrastructure Projects to Reduce Costs by 20-33%

4 October 2018 Waiting for the other shoe to drop Sector Update The outlook for the Construction sector remains challenging as the federal government is reviewing ongoing infrastructure projects to reduce costs by 20-33%. Projects that could be affected include the Construction Klang Valley MRT Line 2 (MRT2) and LRT Line 3 (LRT3), Pan Borneo Highway (PBH) and Gemas-Johor Bahru Electrified Double Tracking (EDT). There are opportunities in state government projects in Penang and Sarawak. Maintain our NEUTRAL call. Top BUYs are IJM, Suncon Neutral (maintain) and HSS. Potential MRT2 cost cuts We gather that the MRT2 project could see a 25% reduction in cost to RM24bn from an initial estimate of RM32bn. The MMC Gamuda Joint Absolute Performance (%) Venture (JV) will be the most affected as it is the main contractor for the underground section and the Project Delivery Partner (PDP) for the above- 1M 3M 12M ground section of the MRT2. Other listed contractors that could be affected AQRS (6.4) (14.9) (37.9) due to ongoing work on above-ground packages secured include Ahmad Gamuda (10.0) 2.8 (37.1) HSS Eng 2.2 33.3 (9.5) Zaki, Gadang, George Kent, IJM Corp, MRCB, MTD ACPI, Mudajaya, IJM Corp (6.3) 1.7 (45.9) SunCon, TRC, TSR and WCT. Since the cost reductions will come from MRCB 0.7 15.8 (23.2) the reduction in the scope of works, we believe only the contract values will Suncon (0.4) (6.5) (37.4) be reduced while profit margins should be preserved. -

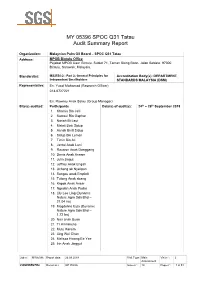

MY 05396 SPOC Q31 Tatau Audit Summary Report

MY 05396 SPOC Q31 Tatau Audit Summary Report Organization: Malaysian Palm Oil Board – SPOC Q31 Tatau Address: MPOB Bintulu Office Pejabat MPOB Caw. Bintulu, Sublot 71, Taman Siong Boon, Jalan Sebiew, 97000 Bintulu, Sarawak, Malaysia. Standard(s): MS2530-2 : Part 2: General Principles for Accreditation Body(s): DEPARTMENT Independent Smallholders STANDARDS MALAYSIA (DSM) Representative: En. Yusof Mohamad (Research Officer) 013-6727221 En. Rowney Anak Salau (Group Manager) Site(s) audited: Participants Date(s) of audit(s): 24th – 26th September 2019 1. Khamis Bin Jalil 2. Samsul Bin Gaphar 3. Noriah Bt Laut 4. Malati Binti Sidup 5. Asnah Binti Sidup 6. Sidup Bin Leman 7. Timin Bin Ali 8. Jantai Anak Lani 9. Rauwon Anak Danggang 10. Denis Anak Ansam 11. Julin Jingut 12. Jeffrey Anak Engah 13. Uchong ak Nyelipan 14. Sangau anak Empinit 15. Tutong Anak abang 16. Kapok Anak Ansar 17. Ngedan Anak Pudai 18. Lily Lee Ling (Dynamic Nature Agro Sdn Bhd – 21.04 ha) 19. Magdeline Eyta (Dynamic Nature Agro Sdn Bhd – 1.72 ha) 20. Nair anak Buan 21. Tr Kinminsna 22. Mutu Karsim 23. Ling Wei Chan 24. Melissa Hwang Ee Yee 25. Irin Anak Jinggut Job n°: MY05396 Report date: 26.09.2019 Visit Type: Main Visit n°: 2 Assessment CONFIDENTIAL Document: GP 7003A Issue n°: 10 Page n°: 1 of 51 Visit Type: MSPO Audit Stage 2 Type of Certification Main Audit Assessment Lead auditor: Dickens Mambu (LA) Additional team Abdul Khalik Bin Arbi (AM) member(s): Jeffrey Denis Ridu (AM) Audit Member (AM) This report is confidential and distribution is limited to the audit team, audit attendees, client representative, the SGS office and may be subject to Accreditation Body, Certification Scheme owners or any other Regulatory Body sampling in line with our online Privacy Statement which can be accessed. -

Teks Ucapan Yab Perdana Menteri Bersama

TEKS UCAPAN YAB PERDANA MENTERI BERSAMA MEMULIHKAN NEGARA Bismillahirrahmanirrahim Assalamualaikum warahmatullahi wa barakatuh dan salam sejahtera Apa khabar semua? Saya doakan saudara dan saudari sihat walafiat. 1. Negara kita masih berhadapan dengan cabaran getir pandemik Covid-19. Saya dengan perasaan hiba ingin mengucapkan takziah kepada ahli keluarga mangsa Covid-19 yang telah pergi meninggalkan kita buat selama-lamanya dan mendoakan semoga semua pesakit Covid-19 diberikan kesembuhan segera. 2. Saya berharap program vaksinasi yang sedang giat dijalankan pada masa ini bakal memulihkan negara kita dalam tempoh tidak berapa lama lagi, insyaAllah. 3. Malaysia dijangka mencapai kadar vaksinasi 100 peratus populasi dewasa dan 80 peratus populasi keseluruhan pada bulan Oktober tahun ini, iaitu dalam jangkamasa dua bulan akan datang. Pada masa itu, insyaAllah, kes- kes Covid-19 akan mencatatkan penurunan yang ketara dan menjadi lebih terkawal. 1 4. Kita terus berdoa kepada Allah s.w.t. dan berikhtiar dengan sepenuh jiwa dan raga agar kita semua terhindar dari wabak ini. Saya amat menghargai pengorbanan para frontliners kita yang terus cekal bertugas saban hari tanpa mengenal penat dan lelah, serta kesabaran saudara dan saudari semua dalam menghadapi ujian getir ini. InsyaAllah, negara kita akan pulih. 5. Apabila negara kita telah pulih daripada wabak ini, saya percaya bukan sahaja kita semua dapat kembali kepada kehidupan biasa, tetapi dapat bersama-sama membawa semula negara kita ke mercu kejayaan dan kegemilangan. 6. Hari ini, kita telah mengumumkan bahawa ekonomi Malaysia berkembang sebanyak 16.1% pada suku kedua 2021. Berbanding dengan suku-suku sebelumnya, tren pemulihan yang berterusan ini adalah bukti jelas bahawa dasar-dasar kerajaan telah membuahkan hasil, walaupun dalam keadaan yang amat mencabar.