Platforms Within the UK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL REPORT 2019 Revellers at New Year’S Eve 2018 – the Night Is Yours

AUSTRALIAN BROADCASTING CORPORATION ANNUAL REPORT 2019 Revellers at New Year’s Eve 2018 – The Night is Yours. Image: Jared Leibowtiz Cover: Dianne Appleby, Yawuru Cultural Leader, and her grandson Zeke 11 September 2019 The Hon Paul Fletcher MP Minister for Communications, Cyber Safety and the Arts Parliament House Canberra ACT 2600 Dear Minister The Board of the Australian Broadcasting Corporation is pleased to present its Annual Report for the year ended 30 June 2019. The report was prepared for section 46 of the Public Governance, Performance and Accountability Act 2013, in accordance with the requirements of that Act and the Australian Broadcasting Corporation Act 1983. It was approved by the Board on 11 September 2019 and provides a comprehensive review of the ABC’s performance and delivery in line with its Charter remit. The ABC continues to be the home and source of Australian stories, told across the nation and to the world. The Corporation’s commitment to innovation in both storytelling and broadcast delivery is stronger than ever, as the needs of its audiences rapidly evolve in line with technological change. Australians expect an independent, accessible public broadcasting service which produces quality drama, comedy and specialist content, entertaining and educational children’s programming, stories of local lives and issues, and news and current affairs coverage that holds power to account and contributes to a healthy democratic process. The ABC is proud to provide such a service. The ABC is truly Yours. Sincerely, Ita Buttrose AC OBE Chair Letter to the Minister iii ABC Radio Melbourne Drive presenter Raf Epstein. -

Aberdeen Standard Select Portfolio

Aberdeen Standard Select Portfolio This Fund Summary is for the following ILP sub-fund and should be read in conjunction with the Product Summary Aberdeen Standard India Opportunities Fund Aberdeen Standard Pacific Equity Fund Aberdeen Standard Singapore Equity Fund Aberdeen Standard Thailand Equity Fund Structure of ILP Sub-Fund The ILP Sub-Fund is an open-ended feeder fund and invests all or substantially all of its assets into the underlying Aberdeen Standard Select Portfolio which offers a group of separate and distinct portfolios of securities or obligations, each of which being a sub-fund investing in different securities or portfolios of securities. The units in the ILP Sub-Fund are not classified as Excluded Investment Products. Information on the Manager (the “Underlying Manager”) The Underlying Manager of Aberdeen Standard Select Portfolio (the “Underlying Fund”) Aberdeen Standard Investments (Asia) Limited, a wholly-owned subsidiary of the Aberdeen Asset Management PLC (the “Aberdeen Group”), was established in Singapore in May 1992, as the regional headquarters of the Aberdeen Group to oversee all of its Asia-Pacific assets, including collective investment schemes. In August 2017, Aberdeen Asset Management PLC merged with Standard Life plc to form Standard Life Aberdeen plc and Aberdeen Asset Management PLC became a wholly owned subsidiary of Standard Life Aberdeen plc (collectively the “Group”). Aberdeen Standard Investments is the asset management division of the Group. As at end December 2020, Aberdeen Standard Investments had over US$635.2 billion worth of assets under its management. The Aberdeen Group Standard Life Aberdeen plc was created in August 2017 from the merger of Aberdeen Asset Management plc and Standard Life plc. -

M&G (Lux) Investment Funds 1 M&G (Lux) Global Dividend Fund EUR A

31 May, 2021 M&G (Lux) Investment Funds 1 M&G (Lux) Global Dividend Fund EUR A This fund is managed by M&G Luxembourg S.A. EFC Classification Equity Global Price +/- Date 52wk range 12.65 EUR 0.10 28/05/2021 9.19 12.71 Issuer Profile Administrator M&G Luxembourg S.A. The fund has two aims: • To provide a combination of capital growth and income to deliver Address 16, boulevard Royal 2449 a return that is higher than that of the global stockmarket over any five-year period; • To increase the income stream every year in US dollar terms. Core investment: At least 80% City Luxemburg of the fund is invested in the shares of companies across any sector and of any size that Tel/Fax +33 (0)1 71 70 30 20 are domiciled in any country, including emerging markets*. The fund usually holds shares Website www.mandg.com in fewer than 50 companies. Other investment: The fund also holds cash or assets that can be turned quickly into cash. * Emerging market countries are defined as those included within the MSCI Emerging Markets Index and/or those included in the World General Information Bank’s definition of developing economies, as updated from time to time. Strategy in brief: ISIN LU1670710075 The investment manager focuses on companies with the potential to grow their dividends Fund Type Capitalization over the long term. The investment manager selects stocks with different sources of Quote Frequency daily dividend growth to build a... Quote Currency EUR Currency USD Chart 5 year Foundation Date 18/07/2008 Fund Manager Stuart Rhodes Legal Type Investment -

Standard Life Aberdeen (SLA); FTSE 100; Financial Services

Selling: Standard Life Aberdeen (SLA); FTSE 100; Financial Services Managing a portfolio is a lot like managing a garden. In gardening there are regular recurring tasks such as trimming back fast-growing plants and replacing unattractive plants with more attractive alternatives. In a portfolio this means regularly trimming back oversized positions and replacing unattractive holdings with more attractive alternatives. Average purchase price Current price Holding period (including investment in Aberdeen AM) £3.76 £2.90 Feb 2016 to Apr 2021 (5yrs 2mo) Capital gain Dividend income Annualised return (including return of capital from de-mergers) -13.4% 31.2% 4.0% “Standard Life Aberdeen is one of the world’s largest investment companies, the largest active manager in the UK and one of the largest in Europe. It has a significant global presence and the scale and expertise to help clients meet their investment goals.” Overview Standard Life Aberdeen (SLA) originally joined the model portfolio in 2016 as Aberdeen Asset Management, which was then the second largest active fund manager in the UK (second only to Schroders). This investment worked out well, with the 2017 merger of Aberdeen and Standard Life leading to annualised return of 17% at the merger date. I decided to hold on to the SLA shares post merger because Standard Life was a leading asset manager and the combined group promised additional economies of scale and a more diverse and robust business. Four years later and as a more experienced investor, I now think both companies lacked durable competitive advantages and I think that’s true of the combined business too. -

Active Approach to Passive Investing

SRPInsight Issue 4 | April/May 2021 @SRP_Insider ACTIVE APPROACH TO PASSIVE INVESTING AMERICAS // CUSTOM INDICES PROFILE // FNZ-HUB SRP AWARDS // SOCGEN p10 p24 p28 SRPInsight CONTENTS Editorial: Amelie Labbé, Pablo Conde, Lavanya Nair, Summer Wang, Marc Wolterink Contents Production: Paul Pancham Marketing: News Europe 4 Monique Kimona Bonnick The Application Programming Interface (API), is a web-based software Sales: News Americas 10 application which allows clients to access our data in a controlled Reihaneh Fakhari manner & integrate it using their own software packages & systems. News Apac 16 If you are interested in having a similar bespoke report produced for your organisation, please Expert View: Industry has shown resilience, now it is contact: at an inflection point 21 Retrieve. Reihaneh Fakhari T: +44 (0)20 7779 8220 Profile:FNZ Q-Hub - servicing QIS and AMCs • Download real time SRP data directly to excel M: +44 (0)79 8075 6761 with a customised touch 24 E: Reihaneh@structuredretail • Receive market share on each asset class/payoff for products.com each company of interest Feature: BBVA shifts gear as equities chief plan gains momentum 26 REPRINT POLICY: SRP’s Reprint Policy: Articles published by Feature: SRP 2021 Awards - SG racks up €15bn on SRP can be sent to sources for reference and for internal use only (including decrement, and counting 28 Interrogate. intranet posting and internal distribution). If an article is to be shared with a third party or re-published on a public website Q&A: Barclays: commodities are an interesting • Monitor & increase your market share (i.e. a location on the World Wide Web space to watch 30 that is accessible by anyone with a web • Carry out accurate trend analysis with comprenhensive browser and access to the internet), product data spanning over 15 years in seconds SRP offers reprints, PDFs of articles or Q&A: View from the top: investors want a more advertisements, and the licensing to active approach to saving, investing 32 republish any content published on the SRP website. -

WHAT ARE INVESTMENT ASSETS? • Assets Are What Your Fund Invests In

PORTFOLIO BOND (IPS) – FUNDS KEY FEATURES 5 WHAT ARE INVESTMENT ASSETS? • Assets are what your fund invests in. • The assets that a fund invests in will have a significant impact on the performance of your investment. It’s important that you understand the differences between the main types of assets. • There are four main types of asset and each has its own characteristics: − Equities − Fixed interest securities − Commercial property − Cash. • It’s generally a good idea to invest in a number of different assets so you don’t rely on the performance of one individual asset. This strategy, called ‘diversification’, is basically what funds offer as they spread your investment across lots of assets. • Many funds also invest in more than one type of asset to create even more diversification. • Investing in a mix of funds is another good way to spread your investment. WHAT ARE EQUITIES? NOTES • Equities (also known as 'shares') are a share in a company that allows the owner of those shares to participate in any financial success achieved by • Over the short term, the that company. value of funds investing in equities can go up and • Equities can achieve growth in two ways: down a lot. − Through increases in share prices. The share price reflects the • Company share prices can underlying value of the company. also change dramatically in − Through dividends, which are regular payments made to shareholders response to the activities generally based on the company’s annual profits. and financial performance of individual companies, • Investing in equities is considered by many investment experts to be one as well as being influenced of the best ways to achieve long-term growth. -

27322-ASI Investment Flyer BRO 0817.Indd

An asset manager for today’s global opportunities The coming together of Standard Life Investments and Aberdeen Asset Management under the Aberdeen Standard Investments brand will create the largest active investment manager in the UK* and one of the largest investment houses globally. Assets Investment managed Clients in More than managers in Client support in $718bn** 80 1,000 24 50 countries*** investment offices*** locations*** staff*** ** as of December 31, 2016, £/US$ rate: 1.2356 *** as of May 31, 2017 Source: Standard Life plc, Aberdeen Asset Management PLC “ The industry is changing; we have ensured we are well placed to meet our clients’ evolving needs and remain their trusted partner.” Martin Gilbert, Chief Executive, Standard Life Aberdeen plc * As of May 31, 2017, Source: Standard Life plc, Aberdeen Asset Management PLC An asset manager for today’s global opportunities Standard Life Investments was the investment On-the-ground expertise arm of Standard Life plc, a major UK listed Employing over 1,000 investment professionals, we can draw fi nancial services company which started life upon a breadth of investment talent. Our portfolio managers in 1825. Aberdeen Asset Management plc was are located across 24 offi ces, allowing us to be deeply rooted formed in 1983 via a management buyout and in every market in which we invest. Our uncompromising emphasis on conducting our own fi rst-hand research into has grown from a pioneer investor in Asian and companies and markets helps us fi nd opportunities at an emerging markets into a full-service, UK-listed early stage and screen out market noise. -

FTSE Factsheet

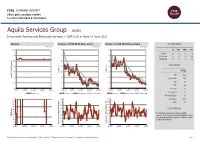

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Aquila Services Group AQSG Investment Banking and Brokerage Services — GBP 0.26 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 0.35 115 115 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 0.3 110 110 Rel.Sector 1.9 2.8 1.0 -2.0 Rel.Market 1.7 1.7 0.4 -8.2 0.25 105 105 VALUATION 0.2 100 100 Trailing 0.15 95 95 Relative Price Relative Price Relative PE 82.2 Absolute Price (local (local currency) AbsolutePrice 0.1 90 90 EV/EBITDA 38.4 0.05 85 85 PB 2.0 PCF +ve 0 80 80 Div Yield 1.1 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 1.3 Absolute Price Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 90 90 Div Payout 90.5 90 80 80 ROE 2.6 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The Company operates as a venture capital 40 40 RSI RSI (Absolute) 30 company. The Company provides financing for one or 30 30 more growing unquoted companies looking for capital 20 20 to expand the business. -

Austar Lifesciences Limited 奧星生命科技有限

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Austar Lifesciences Limited (“Company”), you should at once hand this circular and the accompanying form of proxy to the purchaser, the transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. Austar Lifesciences Limited 奧 星 生 命 科 技 有 限 公 司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 6118) PROPOSED GRANT OF GENERAL MANDATES TO ISSUE AND REPURCHASE SHARES; RE-ELECTION OF RETIRING DIRECTORS AND NOTICE OF ANNUAL GENERAL MEETING A notice convening the annual general meeting of the Company to be held at 10:00 a.m. on Friday, 29 May 2020 at Conference Room, Rooms 2010-2013, 20th Floor, No. 1018, Changning Road, Changning District, Shanghai, the People’s Republic of China (“Annual General Meeting”) (or any adjournment thereof), is set out on pages AGM-1 to AGM-5 of this circular. -

Monthly Fact Sheet

August 2021 Lowes UK Defined Strategy Fund Investment Objective Investment manager: Lowes Investment Management The Fund aims to provide capital growth over the medium to Fund type: Irish Domiciled UCITS long term in rising, directionless or modestly falling UK equities Fund Size: £19,450,340.16 markets. The Fund will aim to achieve this, while being less Unit NAV at 31/08/2021: Class C: £1.0917 volatile than a corresponding investment into UK equity markets. Launch date: 11 December 2018 It will invest in a core portfolio comprised of defined return equity Base currency: GBP strategies that aim to provide capital growth in all but extreme Liquidity: Daily negative market scenarios. Dealing deadline: 10:30am Irish time Pricing: Daily COB Share type: Accumulation Monthly Update Minimum subscription Class B: £1,000,000 amount: Class C: £100 The Fund rose by 1.55% in August, ahead of its performance Annual management Class B: 0.4% comparator of cash (as measured by the Bank of England’s Sterling charge: Class C: 0.5% Overnight Index Average (“SONIA”)) + 5%, which rose by 0.43%. OCF: Maximum of 1% August was a good month for the Fund, rising by just over 2% in Reporting status Registered with HMRC the first fortnight before pulling back slightly to leave the Fund ISIN Class B: IE00BG0NV307 Class C: IE00BG0NV414 up 1.55% over the period. This was ahead of the UK market, as Dealing line +353 (0) 1434 5124 measured by the FTSE 100 index, which was up 1.24% on a price only basis. The pull back in the second half of the month followed the US Federal Reserve signalling it was set to start reducing its quantitative easing program by tapering its asset purchases within months. -

Herbert Geer Letter

20 March 2012 PUBLIC VERSION Mr Bruce Mikkelsen Australian Competition and Consumer Commission GPO Box 3131 Canberra ACT 2601 By email: [email protected] Dear Mr Mikkelsen Proposed acquisition of Austar by Foxtel – response to proposed undertakings This submission is provided by iiNet Limited and its wholly owned subsidiary TransACT Communications Pty Ltd (referred to collectively in this letter as iiNet) in response to the Commission‟s letter of 7 March 2012 inviting comments about the effectiveness of the section 87B undertaking offered by Foxtel in relation to its proposed acquisition of Austar. 1. INTRODUCTION The proposed undertaking will have little (if any) meaningful effect on the market for the acquisition of compelling content in the event that the merger is allowed to go ahead. The undertaking also does nothing to address the market dominance issue in the Australian subscription TV market, or related telecommunications markets, and actually exacerbates the issue which will result in a substantial lessening of competition. It is apparent from the preamble to the proposed undertaking that the main source of competition that is being relied on to provide competitive restraint is IPTV. The only way that this can realistically be achieved is if the undertaking improves the access to compelling content for new and emerging IPTV providers to a level where those IPTV providers will actually be in a position to compete with the merged entity for the acquisition of content. It is impossible for this objective to be achieved unless IPTV providers have access to premium content that is capable of attracting large numbers of subscribers. -

Digital TV Antenna Systems

Digital TV Antenna Systems 2 0 0 8 Handbook Non-Mandatory Document Digital TV Antenna Systems Free-to-Air digital TV in buildings with shared antenna systems 2008 2nd Edition Digital TV Antenna Systems Disclaimer The Australian Building Codes Board (ABCB) and the participating Governments are committed to enhancing the availability and dissemination of information relating to the built environment. Where appropriate, the ABCB seeks to develop non-regulatory solutions to building related issues. This Handbook on Digital TV Antenna Systems (the Handbook) is non-mandatory and is designed to assist in making such information on this topic readily available. However, neither the ABCB, the participating Governments, nor the groups which have endorsed or been involved in the development of the Handbook, accept any responsibility for the use of the information contained in the Handbook and make no guarantee or representation whatsoever that the information is an exhaustive treatment of the subject matters contained therein or is complete, accurate, up-to-date or relevant as a guide to action for any particular purpose. All liability for any loss, damage, injury or other consequence, howsoever caused (including without limitation by way of negligence) which may arise directly or indirectly from use of, or reliance on, this Handbook, is hereby expressly disclaimed. Users should exercise their own skill and care with respect to their use of this Handbook. In any important matter, users should carefully evaluate the scope of the treatment of the particular subject matter, its completeness, accuracy, currency, and relevance for their purposes, and should obtain appropriate professional advice relevant to their particular circumstances.