Challenging Road Ahead but Outlook Stable on Asset Manager Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aberdeen Standard Select Portfolio

Aberdeen Standard Select Portfolio This Fund Summary is for the following ILP sub-fund and should be read in conjunction with the Product Summary Aberdeen Standard India Opportunities Fund Aberdeen Standard Pacific Equity Fund Aberdeen Standard Singapore Equity Fund Aberdeen Standard Thailand Equity Fund Structure of ILP Sub-Fund The ILP Sub-Fund is an open-ended feeder fund and invests all or substantially all of its assets into the underlying Aberdeen Standard Select Portfolio which offers a group of separate and distinct portfolios of securities or obligations, each of which being a sub-fund investing in different securities or portfolios of securities. The units in the ILP Sub-Fund are not classified as Excluded Investment Products. Information on the Manager (the “Underlying Manager”) The Underlying Manager of Aberdeen Standard Select Portfolio (the “Underlying Fund”) Aberdeen Standard Investments (Asia) Limited, a wholly-owned subsidiary of the Aberdeen Asset Management PLC (the “Aberdeen Group”), was established in Singapore in May 1992, as the regional headquarters of the Aberdeen Group to oversee all of its Asia-Pacific assets, including collective investment schemes. In August 2017, Aberdeen Asset Management PLC merged with Standard Life plc to form Standard Life Aberdeen plc and Aberdeen Asset Management PLC became a wholly owned subsidiary of Standard Life Aberdeen plc (collectively the “Group”). Aberdeen Standard Investments is the asset management division of the Group. As at end December 2020, Aberdeen Standard Investments had over US$635.2 billion worth of assets under its management. The Aberdeen Group Standard Life Aberdeen plc was created in August 2017 from the merger of Aberdeen Asset Management plc and Standard Life plc. -

M&G (Lux) Investment Funds 1 M&G (Lux) Global Dividend Fund EUR A

31 May, 2021 M&G (Lux) Investment Funds 1 M&G (Lux) Global Dividend Fund EUR A This fund is managed by M&G Luxembourg S.A. EFC Classification Equity Global Price +/- Date 52wk range 12.65 EUR 0.10 28/05/2021 9.19 12.71 Issuer Profile Administrator M&G Luxembourg S.A. The fund has two aims: • To provide a combination of capital growth and income to deliver Address 16, boulevard Royal 2449 a return that is higher than that of the global stockmarket over any five-year period; • To increase the income stream every year in US dollar terms. Core investment: At least 80% City Luxemburg of the fund is invested in the shares of companies across any sector and of any size that Tel/Fax +33 (0)1 71 70 30 20 are domiciled in any country, including emerging markets*. The fund usually holds shares Website www.mandg.com in fewer than 50 companies. Other investment: The fund also holds cash or assets that can be turned quickly into cash. * Emerging market countries are defined as those included within the MSCI Emerging Markets Index and/or those included in the World General Information Bank’s definition of developing economies, as updated from time to time. Strategy in brief: ISIN LU1670710075 The investment manager focuses on companies with the potential to grow their dividends Fund Type Capitalization over the long term. The investment manager selects stocks with different sources of Quote Frequency daily dividend growth to build a... Quote Currency EUR Currency USD Chart 5 year Foundation Date 18/07/2008 Fund Manager Stuart Rhodes Legal Type Investment -

Standard Life Aberdeen (SLA); FTSE 100; Financial Services

Selling: Standard Life Aberdeen (SLA); FTSE 100; Financial Services Managing a portfolio is a lot like managing a garden. In gardening there are regular recurring tasks such as trimming back fast-growing plants and replacing unattractive plants with more attractive alternatives. In a portfolio this means regularly trimming back oversized positions and replacing unattractive holdings with more attractive alternatives. Average purchase price Current price Holding period (including investment in Aberdeen AM) £3.76 £2.90 Feb 2016 to Apr 2021 (5yrs 2mo) Capital gain Dividend income Annualised return (including return of capital from de-mergers) -13.4% 31.2% 4.0% “Standard Life Aberdeen is one of the world’s largest investment companies, the largest active manager in the UK and one of the largest in Europe. It has a significant global presence and the scale and expertise to help clients meet their investment goals.” Overview Standard Life Aberdeen (SLA) originally joined the model portfolio in 2016 as Aberdeen Asset Management, which was then the second largest active fund manager in the UK (second only to Schroders). This investment worked out well, with the 2017 merger of Aberdeen and Standard Life leading to annualised return of 17% at the merger date. I decided to hold on to the SLA shares post merger because Standard Life was a leading asset manager and the combined group promised additional economies of scale and a more diverse and robust business. Four years later and as a more experienced investor, I now think both companies lacked durable competitive advantages and I think that’s true of the combined business too. -

WHAT ARE INVESTMENT ASSETS? • Assets Are What Your Fund Invests In

PORTFOLIO BOND (IPS) – FUNDS KEY FEATURES 5 WHAT ARE INVESTMENT ASSETS? • Assets are what your fund invests in. • The assets that a fund invests in will have a significant impact on the performance of your investment. It’s important that you understand the differences between the main types of assets. • There are four main types of asset and each has its own characteristics: − Equities − Fixed interest securities − Commercial property − Cash. • It’s generally a good idea to invest in a number of different assets so you don’t rely on the performance of one individual asset. This strategy, called ‘diversification’, is basically what funds offer as they spread your investment across lots of assets. • Many funds also invest in more than one type of asset to create even more diversification. • Investing in a mix of funds is another good way to spread your investment. WHAT ARE EQUITIES? NOTES • Equities (also known as 'shares') are a share in a company that allows the owner of those shares to participate in any financial success achieved by • Over the short term, the that company. value of funds investing in equities can go up and • Equities can achieve growth in two ways: down a lot. − Through increases in share prices. The share price reflects the • Company share prices can underlying value of the company. also change dramatically in − Through dividends, which are regular payments made to shareholders response to the activities generally based on the company’s annual profits. and financial performance of individual companies, • Investing in equities is considered by many investment experts to be one as well as being influenced of the best ways to achieve long-term growth. -

27322-ASI Investment Flyer BRO 0817.Indd

An asset manager for today’s global opportunities The coming together of Standard Life Investments and Aberdeen Asset Management under the Aberdeen Standard Investments brand will create the largest active investment manager in the UK* and one of the largest investment houses globally. Assets Investment managed Clients in More than managers in Client support in $718bn** 80 1,000 24 50 countries*** investment offices*** locations*** staff*** ** as of December 31, 2016, £/US$ rate: 1.2356 *** as of May 31, 2017 Source: Standard Life plc, Aberdeen Asset Management PLC “ The industry is changing; we have ensured we are well placed to meet our clients’ evolving needs and remain their trusted partner.” Martin Gilbert, Chief Executive, Standard Life Aberdeen plc * As of May 31, 2017, Source: Standard Life plc, Aberdeen Asset Management PLC An asset manager for today’s global opportunities Standard Life Investments was the investment On-the-ground expertise arm of Standard Life plc, a major UK listed Employing over 1,000 investment professionals, we can draw fi nancial services company which started life upon a breadth of investment talent. Our portfolio managers in 1825. Aberdeen Asset Management plc was are located across 24 offi ces, allowing us to be deeply rooted formed in 1983 via a management buyout and in every market in which we invest. Our uncompromising emphasis on conducting our own fi rst-hand research into has grown from a pioneer investor in Asian and companies and markets helps us fi nd opportunities at an emerging markets into a full-service, UK-listed early stage and screen out market noise. -

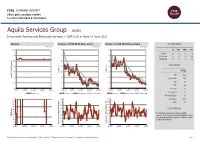

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Aquila Services Group AQSG Investment Banking and Brokerage Services — GBP 0.26 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 0.35 115 115 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 0.3 110 110 Rel.Sector 1.9 2.8 1.0 -2.0 Rel.Market 1.7 1.7 0.4 -8.2 0.25 105 105 VALUATION 0.2 100 100 Trailing 0.15 95 95 Relative Price Relative Price Relative PE 82.2 Absolute Price (local (local currency) AbsolutePrice 0.1 90 90 EV/EBITDA 38.4 0.05 85 85 PB 2.0 PCF +ve 0 80 80 Div Yield 1.1 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 1.3 Absolute Price Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 90 90 Div Payout 90.5 90 80 80 ROE 2.6 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The Company operates as a venture capital 40 40 RSI RSI (Absolute) 30 company. The Company provides financing for one or 30 30 more growing unquoted companies looking for capital 20 20 to expand the business. -

Important Information About Our Services

Important Information about our Services Welcome to Independent Financial Solutions Who are we and what do we do? We are a firm of independent financial advisers established in 1997 and have been helping our clients to meet their financial goals. As members of the Personal Finance Society (PFS), we believe in establishing and maintaining long term relationships, to help clients successfully achieve their financial goals. We are an appointed representative of TenetConnect Services Limited, which is authorised and regulated by the Financial Conduct Authority (FCA). The FCA is the independent regulator of financial services in the United Kingdom. TenetConnect Services Limited is entered on the Financial Services Register (www.fca.org.uk/register) under reference 150643. Who is TenetConnect Services Limited? TenetConnect Services Limited is wholly owned by Tenet Limited, which is a wholly owned subsidiary of Tenet Group Limited (‘TGL’), a leading distributor of financial products and services in the UK. TGL is majority owned by the following corporate shareholders; AEGON UK Distribution Holdings Ltd (22%), Aviva Life & Pensions UK Limited (23%), Aviva Life Holdings UK Ltd (24%) and Standard Life Aberdeen PLC (25%). Aviva Life & Pensions UK Limited and Aviva Life Holdings UK Ltd are both companies within the Aviva plc group. Their address is: TenetConnect Services Limited, 5 Lister Hill, Horsforth, Leeds, LS18 5AZ. Tel: 01132 390011. To find out more about TenetConnect Services Limited and the support and backing they provide us with, please visit their website www.tenetgroup.co.uk/consumer What can we do for you? Our mainstream service is to act on your behalf for the purpose of arranging and advising on the following: Investments & Pensions, for example an ISA or Personal Pension Plan; Personal & Family Protection, for example a Life Assurance or Critical Illness Plan; For all the services described above we will complete a detailed fact find so we can understand your circumstances, specific needs and objectives to determine if these services are suitable for you. -

JOHCM UK Equity Income Fund Monthly Update

Professional Investors Only JOHCM UK Equity Income Fund Monthly Bulletin: June 2020 Active sector bets for the month ending 31 May 2020: Top five Sector % of Portfolio % of FTSE All-Share Active % Life Insurance 9.65 3.08 +6.57 Mining 12.76 6.80 +5.96 Media 8.51 3.81 +4.70 Financial Services 8.25 4.33 +3.92 Food & Drug Retailers 6.03 2.11 +3.92 Bottom five Sector % of Portfolio % of FTSE All-Share Active % Pharmaceuticals & Biotechnology 0.00 10.62 -10.62 Equity Investment Instruments 0.00 6.18 -6.18 Tobacco 0.00 4.56 -4.56 Beverages 0.00 3.88 -3.88 Personal Goods 0.00 2.78 -2.78 Active stock bets for the month ending 31 May 2020: Top ten Stock % of Portfolio % of FTSE All-Share Active % Standard Life Aberdeen 3.52 0.31 +3.21 Phoenix Group 3.33 0.17 +3.16 Legal & General Group 3.77 0.63 +3.14 Barclays 4.20 1.08 +3.12 WPP 3.43 0.39 +3.04 Tesco 4.11 1.16 +2.95 ITV 3.10 0.16 +2.94 Glencore 3.76 0.87 +2.89 BP 6.00 3.20 +2.80 Vistry Group 2.80 0.09 +2.71 Bottom five Stock % of Portfolio % of FTSE All-Share Active % AstraZeneca 0.00 5.85 -5.85 GlaxoSmithKline 0.00 4.23 -4.23 HSBC 0.00 3.99 -3.99 British American Tobacco 0.00 3.83 -3.83 Diageo 0.00 3.49 -3.49 JOHCM UK Equity Income Fund: June 2020 Performance to 31 May 2020 (%): Since Strategy 1 month Year to date Fund size inception size Fund – A Acc GBP 0.11 -30.59 183.40 £1,870mn £2,270mn Lipper UK Equity Income mean* 1.27 -21.10 132.51 FTSE All-Share TR Index 2.17 -17.79 152.26 (12pm adjusted) Discrete 12-month performance (%) to: 31.05.20 31.05.19 31.05.18 31.05.17 31.05.16 JOHCM UK Equity -20.99 -12.21 12.66 27.85 -11.12 Income Fund – A Acc GBP FTSE All-Share TR Index -10.02 -3.52 6.41 24.51 -6.80 (12pm adjusted) Past performance is no guarantee of future returns. -

Schroders Plc 23 October 2018

Schroders plc 23 October 2018 SCHRODERS AND LLOYDS ANNOUNCE WEALTH MANAGEMENT STRATEGIC PARTNERSHIP AND AGREEMENT TO MANAGE £80BN OF SCOTTISH WIDOWS AND LLOYDS ASSETS Schroders plc (‘Schroders’) and Lloyds Banking Group (‘Lloyds’) today announce that they are entering into a strategic partnership to create a market-leading wealth management proposition. This strategic partnership will combine Schroders’ investment and wealth management expertise and technology capabilities with Lloyds’ significant client base, multi-channel distribution and digital capabilities. For Schroders, the partnership will continue its expansion into the strategically important UK wealth management market, building on its core strengths in active investment management. It will also leverage Benchmark Capital’s1 award-winning adviser platform technology. For Lloyds, the partnership is in line with the strategic objectives outlined in its latest strategic review and will accelerate the development of its Financial Planning and Retirement business, and deliver significant additional growth. This strategic partnership includes: Financial Planning Lloyds and Schroders will establish a new financial planning joint venture company (‘JV’) for affluent customers. Lloyds will own 50.1% of the share capital and Schroders the remaining 49.9%. The JV will address the growing gap in the advice market through a personalised, advice-led proposition, backed by world-class investment expertise and best in class technology. Lloyds will transfer approximately £13 billion of assets and associated advisers from its existing Wealth Management business to the JV. There will also be a referral agreement in place to enable Lloyds’ customers to benefit from this enhanced proposition. The JV aims to commence activities by the end of H1 2019 (subject to required regulatory and other approvals) and will be led by a management team comprising representatives from both partners. -

SL M&G Property Portfolio Life Fund

Q2 SL M&G Property Portfolio Life 2021 Fund 30 June 2021 This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. The SL M&G Property Portfolio Life Fund invests primarily in the M&G Feeder of Property Portfolio Fund. The aim Life Investment of the M&G Feeder of Property Portfolio Fund is summarised below. Fund The Trust aims to provide a higher total return (capital growth plus income), net of the Ongoing Charge Figure and Property Expense Ratio, than the average return of the IA UK Direct Property Sector over any five-year period solely through investment in M&G Property Portfolio. Property Fund The value of any investment can fall as well as rise and is not guaranteed – you may get back less than you pay in. For further information on the M&G Feeder of Property Portfolio Fund, please refer to the fund manager fact sheet, link provided below. Standard Life does not control or take any responsibility for the content of this. Quarterly M&G Feeder of Property Portfolio - Fund Factsheet http://webfund6.financialexpress.net/clients/StandardLife/FS.aspx?Code=I10Z&Date=01/06/2021 Underlying Fund Launch Date January 2013 Standard Life Launch Date March 2006 Underlying Fund Size (30/06/2021) £867.5m Standard Life Fund Size (30/06/2021) £7.8m Underlying Fund Manager Justin Upton Standard Life Fund Code 3F Volatility Rating (0-7) 4 The investment performance you will experience from investing in the Standard Life version of the fund will vary from the investment performance you would experience from investing in the underlying fund directly. -

M&G Global Dividend Fund

M&G Global Dividend Fund Annual Long Report and audited Financial Statements for the year ended 31 March 2021 Special version for Switzerland An Open-Ended Investment Company with variable capital authorised in the United Kingdom Contents Authorised Corporate Director’s Report ............ 1 Directors’ statement ........................... 3 Depositary’s Responsibilities and Report ........... 4 Independent Auditor’s Report .................... 5 Authorised Corporate Director’s Report, including the financial highlights and financial statements and notes ......................................... 8 Other regulatory disclosures .....................45 Glossary.......................................46 Annual Long Report and audited Financial Statements • March 2021 Authorised Corporate Director’s Report The Authorised Corporate Director (ACD) of Directors of the ACD M&G Global Dividend Fund presents its Annual Long C Dobson (non executive director), N M Donnelly*, Report and audited Financial Statements for the year S A Fitzgerald, P R Jelfs, ended 31 March 2021. M McGrade (non executive director), Please note that we have included an explanation of key LJMumford investment terminology in the ‘Glossary’ (at the back of * Resigned 30 June 2020. this report). Investment manager M&G Investment Management Limited, Company information 10 Fenchurch Avenue, London EC3M 5AG, UK This Open-Ended Investment Company (OEIC) is an Telephone: +44 (0)20 7626 4588 Investment Company with Variable Capital (ICVC) (Authorised and regulated by the Financial Conduct -

SL M&G Global Select Pension Fund

Q2 SL M&G Global Select Pension 2021 Fund 30 June 2021 This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. The SL M&G Global Select Pension Fund invests primarily in the M&G Global Select Fund. The aim of the M&G Pension Global Select Fund is summarised below. Investment Fund The Fund aims to provide a higher total return (the combination of capital growth and income), net of the Ongoing Charge Figure, than that of the MSCI World Index over any five-year period. The value of any investment can fall as well as rise and is not guaranteed – you may get back less than you pay Equity Fund in. For further information on the M&G Global Select Fund, please refer to the fund manager fact sheet, link provided below. Standard Life does not control or take any responsibility for the content of this. Quarterly M&G Global Select - Fund Factsheet http://webfund6.financialexpress.net/clients/StandardLife/FS.aspx?Code=MG48&Date=01/06/2021 Underlying Fund Launch Date December 1967 Standard Life Launch Date February 2007 Underlying Fund Size (30/06/2021) £604.8m Standard Life Fund Size (30/06/2021) £17.4m Underlying Fund Manager John William Standard Life Fund Code YB Olsen, Michael Oliveros Volatility Rating (0-7) 6 The investment performance you will experience from investing in the Standard Life version of the fund will vary from the investment performance you would experience from investing in the underlying fund directly.