Global ESG Investment Q3 ESG Report 2020 02 Global ESG Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements 2016 Introduction

ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 INTRODUCTION Antofagasta is a Chilean copper mining group with signifi cant by-product production and interests in transport. The Group creates value for its stakeholders through the discovery, development and operation of copper mining assets. The Group is committed to generating value in a safe and sustainable way throughout the commodity cycle. See page 2 for more information CONTENTS STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS 01-05 66-119 120-187 OVERVIEW 2016 highlights 1 Leadership Independent auditors’ report 122 At a glance 2 Chairman’s Governance Q&A 68 Consolidated income statement 127 Letter from the Chairman 4 Senior Independent Director’s Q&A 70 Consolidated statement Governance overview 71 of comprehensive income 128 Board of Directors 72 Consolidated statement of Executive Committee 76 changes in equity 128 06-27 Effectiveness Consolidated balance sheet 129 STRATEGY Board activities 78 Consolidated cash flow statement 130 Professional development 80 Notes to the financial statements 131 Effectiveness reviews 82 Parent company financial statements 181 Statement from the CEO 8 Accountability Question and answer 9 Nomination and Governance Committee 85 Investment case 10 Audit and Risk Committee 88 Our new operating model 11 Sustainability and Stakeholder Our position in the market 14 188-204 Management Committee 92 Our strategy 16 OTHER INFORMATION Projects Committee 94 Key performance indicators 18 Remuneration Risk management 20 Five year summary 188 Committee Chairman’s Principal -

Sellafield What to Do in a Radiation Emergency Booklet

WHAT TO DO IN AN Emergency At Sellafield This information is prepared for everyone within the Detailed Emergency Planning Zone and the Inner Emergency Planning Zone for the Sellafield Site. EMERGENCY INFORMATION Listen to local radio. Monitor social media platforms. Dial the Sellafield Emergency Information Line on 29th September 2021 It is important that you study this booklet carefully and keep it in a safe and prominent place. WHAT TO DO IN AN EMERGENCY Introduction • This booklet gives advice on what to do in the event of an emergency at the Sellafield Site. • Sellafield is Europe’s largest single nuclear site and stores and handles industrial size quantities of radioactive material. Although unlikely, an emergency could occur involving material being stored and processed on the Site. In addition, Sellafield also holds a large inventory of other hazardous substances and again although unlikely an emergency could occur involving the chemicals being utilised on the Site. • It must be stressed that the possibility of such emergencies occurring is remote and that the design and operation of all plants on the site are independently monitored by the Office for Nuclear Regulation (ONR), Health and Safety Executive (HSE) and Environment Agency (EA). • Current assessments of the radiological hazards indicate that areas between 6.1km & 8km from the centre of the Sellafield Site could be the most likely areas to be directly affected during and following a radiation emergency, this area is referred to as the Detailed Emergency Planning Zone (DEPZ). To see its geographical extent please see map A (pg13) & C (pg20). • In addition, other assessments of the chemical hazards indicate that an area up to 2km from the centre of the Sellafield Site could be the most likely area to be directly affected during and following a chemical emergency, this area is referred to as the Inner Emergency Planning Zone (IEPZ). -

Compliance Updater

COMPLIANCE UPDATER Regulatory andUP complianceUPDATERUPUPDATFina news in brief Issue: July 2019 Swiss v EU spat – is this a signal for the post-Brexit world? Swiss regulators have placed a ban on the trading of Swissnce equities Updater on EU exchanges after the European Commission allowed discussions on reaching an ‘equivalence’ decision to expire. From 1 July Swiss shares can only be traded on the Zurich exchange through a recognised broker. The impasse also means that Swiss traders lost their access to EU-based stock exchanges from the same date. It is thought the EU’s line hardened in the light of negotiations with the UK, where there is the possibility of an equivalence status for financial services post-Brexit. Orcel set to sue Santander for €100m. Andrea Orcel is set to sue Spanish bank Santander €100m after the bank withdrew its offer to make him Chief Executive. Santander offered to hire Mr Orcel as Chief Executive earlier in 2019 and he quit his job at UBS, but Santander withdrew the offer whilst he was on gardening leave. The public reason for the withdrawn offer was that Santander could not justify paying Mr Orcel a signing on package worth €50m. The €100m claim represents potential earnings Mr Orcel missed out on, plus legal fees and other costs. UK’s FCA plans ban on bitcoin derivatives for retail investors. A paper from the UK’s Financial Conduct Authority (FCA) plans to ban the sale or marketing of derivatives linked to crypto assets such as bitcoin and ethereum in early 2020. The decision follows a study that concluded cryptocurrencies could not be valued easily – one example found two analysts using the same pricing model arriving at bitcoin values of $20 and $8,000. -

CLITHEROE ROAD, WHALLEY Utilities Study Commercial Estates Group 31/01/2013 Revised: 08/02/2013

CLITHEROE ROAD, WHALLEY Utilities Study Commercial Estates Group 31/01/2013 Revised: 08/02/2013 Quality Management Issue/revision Issue 1 Revision 1 Revision 2 Revision 3 Remarks DRAFT DRAFT Date 31/01/2013 08/02/2013 Prepared by C Scott C Scott Signature Checked by C Cozens C Cozens Signature Authorised by C Cozens C Cozens Signature Project number 50600485 50600485 File reference S:\50600485 - Clitheroe Road, S:\50600485 - Clitheroe Whalley\C Road, Whalley\C Documents\Reports\Working\ Documents\Reports\Working 2013 Utilities Study \2013 Utilities Study S:\50600485 - Clitheroe Road, Whalley\C Documents\Reports\Working\2013 Utilities Study Project number: 50600485 Dated: 31/01/2013 2 Revised: 08/02/2013 CLITHEROE ROAD, WHALLEY Utilities Study 31/01/2013 Client Commercial Estates Group Consultant WSP UK Limited Three White Rose Office Park Leeds LS11 0DL UK Tel: +44 (0)11 3395 6200 Fax: +44 (0)11 3395 6201 www.wspgroup.co.uk Registered Address WSP UK Limited 01383511 WSP House, 70 Chancery Lane, London, WC2A 1AF 3 Table of Contents Executive Summary........................................................................... 5 1 Introduction ............................................................................... 6 2 Existing Site .............................................................................. 7 3 Water Supply ............................................................................ 8 4 Gas Supply ............................................................................. 13 5 Electricity Supply .................................................................... -

Credit Suisse Fires 2 Employees After Sexual Assault Investigation

7/23/2020 Credit Suisse fires 2 employees after sexual assault investigation | Financial Times Credit Suisse Group AG Credit Suisse fires 2 employees after sexual assault investigation Senior banker and manager based in London have had their contracts terminated Stephen Morris in London AUGUST 23 2018 Credit Suisse has fired two male employees in London after uncovering new evidence during an investigation into a sexual assault from eight years ago. The bank has terminated the contract of the senior banker at the centre of the 2010 incident, as well as a second manager who was found to have hampered the original probe, according to a person familiar with the internal review, which was completed last week. The assault took place eight years ago when a group of staff went to a bar near Credit Suisse’s London office, where the female banker was kissed and inappropriately touched by her senior colleague. She reported the assault to the police at the time but no action was taken on the grounds of insufficient evidence. The victim subsequently left the company, but in January this year was inspired by the #MeToo movement to send two letters to current chief executive Tidjane Thiam, urging him to look again at the case. While the letters initially slipped through the cracks, Mr Thiam apologised to the woman and ordered a new investigation into the assault after the Financial Times alerted him to their existence in March. Lara Warner, the bank’s chief compliance and regulatory officer, and her chief of staff reviewed the evidence and interviewed those involved again and determined the two men had misled investigations and withheld vital information. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Annual Report and Accounts

2020 Annual Report and Accounts Do the right thing! For the Real Economy We quickly took decisive actions to support the backbone of the real economy in Europe: small and medium sized enterprises. AWARDED ‘WORLD'S BEST BANK FOR SMES’ In October, UniCredit was awarded ‘Best Bank for SMEs’ by Global Finance magazine in its World’s Best Global Banks Awards. This was based on our performance over the past year, based on criteria including reputation and management excellence. Contents Board of Directors, Board of Statutory Auditors and External Auditors as at 31 December 2020 5 Chairman’s message 10 Chief Executive Officer’s message 14 Preliminary notes 33 CONSOLIDATED REPORT AND ACCOUNTS 2020 OF UNICREDIT GROUP 37 COMPANY REPORT AND ACCOUNTS 2020 OF UNICREDIT S.P.A. 503 Incorporations of qualitative information by reference 755 Glossary 761 Contacts 775 Notes The following conventional symbols have been used in the tables: • a dash (-) indicates that the item/figure is non-existent; • two stops (..) or “n.m.” when the figures do not reach the minimum considered significant or are not meaningful; • “n.a.” indicates that the figure is not available. Any discrepancies between data are solely due to the effect of rounding. UniCredit · 2020 Annual Report and Accounts 3 I UniCredit S.p.A. A joint stock company Registered Office and Head Office: Piazza Gae Aulenti, 3 - Tower A - 20154 Milano Share capital €21,059,536,950.48 fully paid in Registered in the Register of Banking Groups and Parent Company of the UniCredit Banking Group, with cod. 02008.1 Cod. -

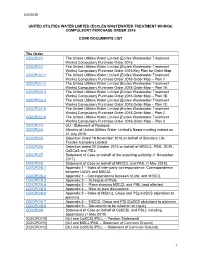

Compulsory Purchase Order 2016 Core Documents List

6/6/2018 UNITED UTILITIES WATER LIMITED (ECCLES WASTEWATER TREATMENT WORKS) COMPULSORY PURCHASE ORDER 2016 CORE DOCUMENTS LIST The Order CD/CPO/1 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 CD/CPO/2 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Key Plan for Order Map CD/CPO/2.1 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1 CD/CPO/2.2 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1A CD/CPO/2.3 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1B CD/CPO/2.4 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1C CD/CPO/2.5 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 2 CD/CPO/2.6 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 3 CD/CPO/3 UU - Statement of Reasons CD/CPO/4 Minutes of United Utilities Water Limited's Board meeting extract on 21 July 2016 CD/CPO/5 Objection dated 18 November 2016 on behalf of Standard Life Trustee Company Limited CD/CPO/6 Objection dated 20 October 2016 on behalf of MSCCL, PINL, SCPL, CoSCoS and PSLL CD/CPO/7 Statement of Case on behalf of the acquiring authority (1 November -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

Unicredit Italy

UniCredit Italy Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Apr 16 2021 About UniCredit The UniCredit Group, founded in 1998, is the result of the merger of nine of Italy's largest banks and the subsequent combination with the German HVB Group and the Italian Capitalia Group. It is now a banking group based in Milan that also includes (amongst others) Bank Austria and Hypovereinsbank. UniCredit is a major international financial institution. The group operates in 14 European countries: Austria, Germany, Russia, Bosnia and Herzegovina, Hungary, Serbia, Bulgaria, Italy, Slovakia, Croatia, Romania, Slovenia, Czech Republic and Turkey. Website http://www.unicreditgroup.eu Headquarters Plazza Gae Aulenti 3 - Tower A 20154 Milan Italy CEO/chair Andrea Orcel CEO Supervisors Banca d'Italia & Bundesbank Annual report Annual report 2020 Ownership listed on Borsa Italia, Frankfurt Stock Exchange & Warsaw Stock Exchange Unicredit's shareholder structure can be accessed here. Complaints UniCredit does not operate a complaints channel for individuals and communities that may be adversely affected by its and finance. The bank can be contacted via its online contact form. grievances Stakeholders may also raise complaints via the OECD National Contact Points (see OECD Watch guidance). Sustainability Voluntary standards UniCredit has committed itself to the following voluntary standards: Klimaschutz-Selbstverpflichtung des Finanzsektors Carbon Disclosure Project Equator Principles Global Reporting Initiative Natural Capital Declaration Paris Agreement Capital Transition Assessment (PACTA) Principles for Responsible Banking (PRB) Principles for Responsible Investment (PRI) Thun Group on Human Rights UN Guiding Principles on Business and Human Rights UNEP Finance Initiative United Nations Global Compact Universal Declaration of Human Rights Investment policies UniCredit's web page on corporate social responsibility can be accessed here. -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek