Foi-19-01414

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEMPLATE Media Release Corporate

Media release Rio Tinto agrees sale of its Lochaber assets for $410 million 23 November 2016 Rio Tinto has reached an agreement to sell its assets at Lochaber, Scotland to SIMEC for consideration totalling $410 million (£330 million). The sale purchase agreement comprises the sale of Rio Tinto’s 100 per cent shareholding in Alcan Aluminium UK Limited which includes the operating smelter, the hydroelectric facilities at Kinlochleven and Lochaber as well as all associated land. Rio Tinto Aluminium chief executive Alf Barrios said “This is a value-creating sale for Rio Tinto and represents another example of refining our portfolio to focus on our suite of tier one assets. “At the same time, our priority has been to ensure a long-term sustainable future for Lochaber and economic benefit for the wider Fort William community. There was significant interest in the assets, but SIMEC is committed to continuing operations at the smelter and working with the community on further economic development.” SIMEC’s intention is that the smelter will be operated by the Liberty House Group, its sister company within the international GFG Alliance. GFG Alliance strategic board executive chairman Sanjeev Gupta said “This is a significant boost to our renewables portfolio and will be another major step towards reducing our carbon footprint in metals production. “This is a natural next step for us in our Scottish investment programme and is a springboard for wider manufacturing growth, creating many more jobs in Scotland. We are grateful for the continuing support of the Scottish Government and for their far-sighted approach to industry." The Scottish Government’s Cabinet Secretary for Rural Economy and Connectivity Fergus Ewing said “I am delighted at this news from Rio Tinto today. -

The Role of Industry 4.0 in Liberty House Group's Strategic Green Steel

The role of Industry 4.0 in Liberty House Group’s strategic green steel vision Wednesday, 6 June 2018 Eric Vitse Chief Technology officer GFG Alliance/Liberty House Group Shane Murphy- Simon Pike- Andrea Fontana: Liberty steel 4.0 incubators 1 www.gfgalliance.comwww.gfgalliance.com June 2018 1 Agenda • GFG Alliance • 4.0 fits with our strategic green steel vision • Areas of opportunity for applying cyber physical systems in our existing plants • 4.0 requirements • Example of 4.0 development programs • Already a wide set of practical examples 2 www.gfgalliance.com 2 3 www.gfgalliance.com 3 GFG Alliance GFG Alliance Ownership PKG SKG SKG PKG/SKG PKG/SKG Liberty House SIMEC Group Wyelands JAHAMA GFG Foundation Group Liberty Commodities Liberty Industries Liberty Engineering Liberty Aluminium Liberty Steel 4 www.gfgalliance.com 4 GFG Alliance Global Footprint • The GFG Alliance has a presence across 30 countries. • Global turnover of c.US$13bn • Net assets of c.US$2.3bn • Global head offices located in: • London • Dubai • Singapore • Hong Kong • Sydney 5 www.gfgalliance.com 5 GFG Alliance GFG Alliance in Numbers 6 www.gfgalliance.com 6 4.0 FITS WITH OUR STRATEGIC GREENSTEEL VISION ▸ Our business is experiencing the early stages of an economy wide disruptive change to the 4th generation of industrialisation - cyber-physical systems for business ▸ Liberty house group GREENSTEEL : • A high efficient production process aiming at first time first choice • A green process using as much as possible renewables raw material as scrap recycling , energy and achieving high steel quality standards • A high level of integration in the complete supply chain and to ensure integrity of final components at customers and optimised lead time. -

Letter to TITRE DE CIVILITE, PRENOM

PRESS RELEASE 1 July 2019 Liberty completes landmark acquisition of European ArcelorMittal steel assets Deal catapults Liberty into top 10 steel producers globally excluding China Liberty Steel, part of Sanjeev Gupta’s global GFG Alliance, today completed the acquisition of seven major steelworks and five service centres across seven European countries from ArcelorMittal. The €740 million deal makes Liberty Steel one of the top ten producers globally, excluding China, with a total rolling capacity in excess of 18 million tonnes covering a wide range of finished products. This is the largest single transaction undertaken by GFG and brings the Alliance’s worldwide workforce to nearly 30,000 across 30 counties. The seven sites, which today became part of Liberty, employ over 14,000 people and include the major integrated steel works at Ostrava in the Czech Republic and Galaţi in Romania as well as rolling mills at Skopje (North Macedonia), Piombino (Italy), Dudelange (Luxembourg) and two plants near Liege in Belgium. The service centres are based in France and Italy. These operations, with a combined rolling capacity of over ten million tonnes pa, supply steel to multiple sectors across Europe’s industrial heartlands, including: construction and infrastructure products, automotive, aerospace, energy, industrial equipment, consumer products and yellow goods. Liberty Steel aims to boost sales from these sites by around 50% over the next three years. Today’s announcement triggers the start of a 100-day review during which Liberty Steel, working with local management, trade unions, customers and suppliers, will complete a comprehensive analysis of the businesses to explore investment opportunities and develop detailed plans to boost competitiveness, extend product range and support sales growth. -

Yorkshire Region Programme of Events 2018/19

Improving the world through engineering YORKSHIRE REGION PROGRAMME OF EVENTS 2018/19 Sponsored by: The largest team dedicated to Engineering & Manufacturing recruitment in the region Permanent | Temporary | Interim South Yorkshire West Yorkshire 01709 723 248 01924 635 007 Our Specialist Disciplines: Leadership & General Management Contact Elevation to discuss how we can use our exceptional sector Manufacturing & Production knowledge and unrivalled candidate networks to attract the best talent for your organisation. Maintenance & Reliability Engineering & Technical Design & Projects Quality, Safety & Environment FMCG Technical Sales Parkinson | Lee - Executive Search part of www.elevationrecruitmentgroup.com CONTENTS Page 2 Elevation Recruitment Group Page 4 Introduction Page 5 Regional Chairman’s Letter Page 6, 7, 8, 9 & 10 2018/19 Event Details Page 11 Support Network Page 12 2018/19 Event Details cont... Page 13 Withers & Rogers LLP Page 13 2018/19 Event Details cont... Page 14 & 15 Speak Out for Engineering Page 16 & 17 2018/19 Event Details cont... Page 18 AESSEAL Page 18, 19, 20, 21, 22, 23 & 24 2018/19 Event Details cont... Page 25 Doncasters Bramah Page 25 & 26 2018/19 Event Details cont... Page 27 Social Media Page 28 Contacts Front cover image courtesy of Steve Medhi The landmark Steel Man sculpture will honour the people and places that forged the region, signposting the emergence of the new technology sector. To support The Steel Man and play your part in building an icon which will be seen by millions every year, creating a lasting economic legacy for the Yorkshire Region, please visit www.thesteelman.co.uk 3 INTRODUCTION The Yorkshire Region would like to thank all the companies and local universities who offer their support in a multitude of ways, including hosting visits and providing facilities for events and committee meetings. -

Fergus Ewing Meeting with Sanjeev Gupta

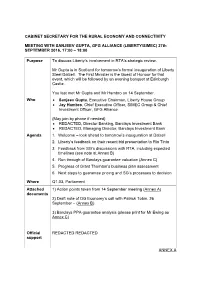

CABINET SECRETARY FOR THE RURAL ECONOMY AND CONNECTIVITY MEETING WITH SANJEEV GUPTA, GFG ALLIANCE (LIBERTY/SIMEC) 27th SEPTEMBER 2016, 17:00 – 18:00 Purpose To discuss Liberty’s involvement in RTA’s strategic review. Mr Gupta is in Scotland for tomorrow’s formal inauguration of Liberty Steel Dalzell. The First Minister is the Guest of Honour for that event, which will be followed by an evening banquet at Edinburgh Castle. You last met Mr Gupta and Mr Hambro on 14 September. Who Sanjeev Gupta, Executive Chairman, Liberty House Group Jay Hambro, Chief Executive Officer, SIMEC Group & Chief Investment Officer, GFG Alliance (May join by phone if needed) REDACTED, Director Banking, Barclays Investment Bank REDACTED, Managing Director, Barclays Investment Bank Agenda 1. Welcome – look ahead to tomorrow’s inauguration at Dalzell 2. Liberty’s feedback on their recent bid presentation to Rio Tinto 3. Feedback from SG’s discussions with RTA, including expected timelines (see note at Annex B) 4. Run through of Barclays guarantee valuation (Annex C) 5. Progress of Grant Thornton’s business plan assessment 6. Next steps to guarantee pricing and SG’s processes to decision Where Q1.03, Parliament Attached 1) Action points taken from 14 September meeting (Annex A) documents 2) Draft note of DG Economy’s call with Patrick Tobin, 26 September – (Annex B) 3) Barclays PPA guarantee analysis (please print for Mr Ewing as Annex C) Official REDACTED REDACTED support ANNEX A MEETING WITH SANJEEV GUPTA, GFG ALLIANCE (LIBERTY/SIMEC) – 14th SEPTEMBER 2016 Attendees: -

Steel Success Strategies 2019 Attendees ABB Inc. HYL

Steel Success Strategies 2019 Attendees ABB Inc. HYL Technologies S.A. de C.V. R L Steels & Energy Ltd Able Industries Co Ltd Hyundai Motor Company Ranger Steel ABN Amro Bank Hyundai Steel Company Raw Materials & Ironmaking Global Consulting Aceromex Hyundai Steel USA, Inc. RCG Consulting Group AG Acescco International ICD Alloys and Metals Rea Jet Aeternus Steel Illinois Tool Works Reis Viking AHMSA International Inc Imperial Manufacturing Group Reliance Steel & Aluminum Co Air Liquide Global Interlake Steamship Company RES (Renewable Energy Management Services GmbH Systems) Air Liquide USA Intersteel Research and Consulting Group AG Air Products & Chemicals Inc intherightvein.com Rheem Manufacturing AK Steel Corporation INTL FCStone Robindale Energy Algoma Ispat Indo Roc Global, LLC Algoma Steel Inc. Jamar Company Rocky Mountain Recycling, Inc Altos Hornos De Mexico Jefferies International RS Metrics Amalgamated Trading Ltd Jefferies LLC Russula American Heavy Plates Jemison Metals S&M Media American Institute of JFE Shoji Trade America Inc Salzgitter Mannesmann International Steel Espana S.A. American Iron and Steel JFE Steel America Inc Salzgitter Mannesmann Institute International AMI GE JFE Steel Corporation Samuel AMI International JSW Group Scrap Metal Services LLC ArcelorMittal JSW Steel USA SeAH Steel America Arcosa Inc Kansas City Southern SeAH Steel Corp Argus Media Inc. Kentron Sector3 Appraisals Inc Association for Iron & Steel Kenwal Steel Corp Seneca Food Corp Technology Atkore International KeyBanc Capital Markets Shanghai -

PRESS RELEASE Liberty Seals Committed Financing Agreement to Acquire Europe's Largest Smelter

PRESS RELEASE 9 November 2018 Liberty seals committed financing agreement to acquire Europe’s largest smelter British-owned Liberty, part of Sanjeev Gupta’s global GFG Alliance, has announced today (9 November) that it has entered into a committed financing agreement with a syndicate of major international banks for the purchase of Aluminium Dunkerque, Europe’s largest aluminium smelter from Rio Tinto. The term loan secured on standard financial terms, provides five year committed funds. This now clears the way for the eagerly-anticipated deal on the 560-worker site to be formally completed before the end of November following the completion of closing mechanics. Today’s announcement follows extensive talks over recent months aimed at securing French Government approvals, long-term power price contracts and robust measures to protect the business in the face of aluminium market turbulence arising in part from US sanctions against Rusal and the closure of a major alumina refinery in Brazil. After completion Liberty intends to make substantial investments in the flagship plant, making it the cornerstone of a major integrated manufacturing business, producing metals and components for the automotive and other growing industries in France. As part of this Liberty recently acquired the aluminium wheels factory at Chateauroux in central France. Commenting on today’s sign-off from the banks, Sanjeev Gupta, executive chairman of the GFG Alliance said: “I’m very pleased to have completed this committed facility with a broad range of leading banks allowing Liberty to complete this landmark transaction. It allows us to press ahead with our plans to develop Dunkerque, to expand production and create added-value downstream operations. -

Libe Spe Teels Liberty Speciality Steels

STEEL STEEL STEEL Liberty Liberty Liberty Speciality Steels Steels Speciality Speciality Steels Supporting our our Supporting Supporting our local communities communities local local communities libertyhousegroup.com libertyhousegroup.com libertyhousegroup.com libertyhousegroup.com libertyhousegroup.com libertyhousegroup.com Binding Edge local communities local local communities local communities our Supporting Supporting our Supporting our Speciality Steels Speciality Speciality Steels Speciality Steels Liberty Liberty Liberty STEEL STEEL STEEL STEEL STEEL STEEL Liberty Liberty Liberty Speciality Steels Steels Speciality Speciality Steels Supporting our our Supporting Supporting our local communities communities local local communities libertyhousegroup.com libertyhousegroup.com libertyhousegroup.com 0 LIBERTY SPECIALITY STEELS SPECIALITY LIBERTY Community Policy Liberty’s Speciality Steels business is proud to play an active role in the local community and aims to make a positive contribution to the communities in which it operates. The community policy is based around the desire to support the key themes of education, engagement with young people and employee involvement. Community Partners We aim to build a strong partnership with the community groups we choose to work with. We achieve this through seeking out ways in which we can work together and encouraging regular communication. We have developed admirable partnerships with the following community groups: Titans Community Foundation is the community arm of Rotherham Titans Rugby Club. | Supporting our local communities | Supporting our local It is an initiative that was set up to use sport to teach disadvantaged young people about life skills, Binding Edge respect and building self-esteem. The programmes have had proven results in crime reduction. Stocksbridge Park Steels is a community football club with over 350 players aged between five and fifty. -

Letter to TITRE DE CIVILITE, PRENOM

23rd July 2019 Liberty hires Tim Dillon to spearhead U.S sales growth Liberty Steel USA, part of Sanjeev Gupta’s global GFG Alliance, has stepped up its drive to capture a bigger share of the American wire rod market with the appointment of highly-experienced steel executive, Tim Dillon, as a senior vice-president of sales and marketing. The appointment follows a series of acquisitions over the past year which have quickly established Liberty as a leading player in the American wire rod market, with major production capacity in the Mid West and on the East Coast. In a 40-year career, which began with the United States Steel Corporation and encompassed American Steel and Wire/Birmingham Steel, GS Industries, Georgetown Steel/ISG and Baron Drawn Steel, Michigan, where he was president, Tim has consistently distinguished himself by leading strong sales growth in multiple scenarios including start-ups, restarts and major expansions. Specialising in wire, rod and long products, Tim, who is a business graduate from Miami University, Oxford Ohio, has developed unparalleled knowledge of these markets and earned a reputation for building high-performing teams that achieve outstanding results in all market conditions. In his new role he will lead all sales, marketing and customer support activities both in Liberty Steel USA’s current markets and in future target sectors. He will report to company President Vikrant Sharma. Commenting on the appointment Vikrant Sharma said: “Tim has the talent, drive and depth of experience to make a real difference as Liberty grows its position at the forefront of the US wire rod market. -

ALLOY WHEEL FACILITY EIA Report

British Aluminium ALLOY WHEEL FACILITY EIA REPORT Volume 1 of 2 November 2017 ALLOY WHEEL FACILITY EIA Report This document is Volume 1 of the EIA Report for the proposed Alloy Wheel Facility on the site of the Lochaber aluminium smelter, Fort William. This EIA Report has been prepared by Golder Associates in accordance with The Town and Country Planning (Environmental Impact Assessment) (Scotland) Regulations 2017 for Liberty Lochaber Aluminium Ltd to accompany a planning application for the proposed Alloy Wheel Facility.Specialist technical input has been provided as follows: Socio-Economics BiGGAR Economics Geology, Hydrology and Hydrogeology Golder Associates Ground Contamination Golder Associates Access, Traffic and Transport Systra Ltd Air Quality and Noise ITPEnergised Environments Landscape and Visual Amenity LDA Design Ecology & Ornithology Alba Ecology Ltd Forestry Chris Piper Cultural Heritage CFA Archaeology Ltd The EIA Report comprises two volumes: Volume 1 Non-technical Summary Environmental Impact Assessment Appendices Drawings Volume 2 Technical Appendices CD copies of the EIA report are available free on request. Further hard copies of the EIA report are available at a cost of £150.00. The Non-technical Summary is also available free on request as a stand-alone document. For further information, please contact: Golder Associates (UK) Ltd Sirius Building The Clocktower South Gyle Crescent Edinburgh EH12 9LB Tel: 0131 314 5900 ALLOY WHEEL FACILITY LIBERTY LOCHABER ALUMINIUM LTD Table of Contents 5.0 SOCIO-ECONOMICS .......................................................................................................................................... -

Liberty House Group Response to the National Assembly's Economy

Liberty House Group response to the National Assembly’s Economy, Infrastructure and Skills Committee consultation on the future of the steel industry in Wales. About Liberty House Liberty House Group is an international business specialising in metals trading and the manufacture and distribution of steel and advanced engineering products. Operating from four hubs in London, Dubai, Singapore and Hong Kong, the Group has sites in Europe, Africa, the Middle East, the Far East, Australia and North America. With a network of offices spread across 30 countries around the world, its current turnover is about $4.3 billion and it employs around 3,000 people globally – including currently 250 in South Wales. Liberty is focused on promoting GREENSTEEL; a sustainable, balanced international business that is non-cyclical, environmentally conscious and socially responsible, and has an integrated and agile business model. The Group has a strong, established business with a deep knowledge of the global steel sector, developed over the last quarter of a century. Over recent years it has developed a track record of investing in the UK steel and engineering industries and securing jobs in these sectors. Liberty House Group is a member of the GFG Alliance, an association of businesses owned by Parduman K Gupta and Sanjeev K Gupta. The Alliance’s key focus is the creation of a resilient, integrated supply chain – ranging from liquid steel production based on recycled scrap and powered by renewable energy, to steel and highly- engineered products manufactured locally on a global basis, funded through a pioneering financial approach. In 2016 GFG’s combined turnover totalled US $6.7bn with net assets are valued at US $1bn. -

Liberty-Speciality-Steels-Brochure.Pdf

Liberty Speciality Steels Specialists within a global industry 2 LIBERTY SPECIALITY STEELS | INTRO Liberty Speciality Steels Specialists within a global industry Liberty Speciality Steels is experienced in manufacturing highly engineered steels, with capabilities ranging from liquid steel production right through to high-value precision engineered components. We are focused on offering a wide range of product from carbon, free-cutting and stainless steels along with high alloys internationally for demanding sectors such as Aerospace, Oil & Gas, Industrial Engineering, Automotive and Engineering Bar. Our products are available as: ingots, blooms, billets, bars, coils, slabs, narrow strip and complex components. Bars can be supplied in rolled, drawn, peeled or heat-treated condition to service each customers’ specific requirements. This fully integrated production capability includes electric arc steelmaking, vacuum induction melting, ESR/VAR remelting , mill processing capabilities and machining along with dedicated service centres located across the globe. At Liberty Speciality Steels, we see ourselves as steeped “ in steelmaking heritage with our headquarters based in the Sheffield city region and our business dating back to 1849. ” INTRO | LIBERTY SPECIALITY STEELS 3 For maximum market focus, Liberty Speciality Steels is split into four business units: Rotherham Steel and Bar High Value Manufacturing Includes primary and secondary EAF Offering VIM steelmaking, VAR and steelmaking, vacuum degassing, ingot casting, ESR re-melting, primary rolling, finishing, continuous casting, bar and coil rolling, and bar stockholding and machined components. processing & inspection. Engineering Bar Narrow Strip Offering bright drawing, bar turning, cut pieces With capabilities in hot rolling, hire rolling, and heat treatment including stress relieving (or annealing and finishing.