Annual Report2012 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction

INTRODUCTION Bank Alfalah Limited was incorporated in June 21st, 1997 as a public limited company under the Companies Ordinance 1984. Its banking operations commenced from November 1st, 1997. The bank is engaged in commercial banking and related services as defined in the Banking companies ordinance 1962. The Bank is listed on all the three stock exchanges of Pakistan. The Bank is engaged in banking services as described in the Banking Companies Ordinance, 1962 and is operating through 191 conventional banking branches, 32 Islamic banking branches and 7 overseas branches and 1 Offshore Banking Unit, with the registered office at B.A. Building, I.I. Chandigarh, Karachi. Since, its inception as the new identity of H.C.E.B after the privatization in 1997, the management of the bank has implemented strategies and policies to carve a distinct position for the bank in the market place. Strengthened with the banking of the Abu Dhabi Group and driven by the strategic goals set out by its board of management, the Bank has invested in revolutionary technology to have an extensive range of products and services. This facilitates their commitment to a culture of innovation and seeks out synergies with clients and service providers to ensure uninterrupted services to its customers. The bank perceived the requirements of customers and matches them with quality products and service solutions. During the past five years, bank has emerged as one of the foremost financial institution in the region endeavoring to meet the needs of tomorrow as well as today. To continually upgrade the quality of service to the customers, training of team members in all the integral aspects of banking, customer service and IT was specially focused. -

Annual Report 2011

SoneriBank Soneri B8nk Limited Regla11ered ortlce: Rupall House 241-242, - Upper Mall Scheme, Anand Road, Lahore - 54000, Pakistan Tel: (042) 35713101-04 Head Otnc:e: 90·8-C/11, Uberty Market, Gulberg Ill, LahcnJ • 54000, Pakistan Tal: (042) 35772362-65 Central Office: 51h FlOOr, AJ.Rahim Tower, 1.1. Chundrigar Road, Karachi ·74000, Pakistan J Tal: (021) 32439562-67 Webde: www.aonertbank.com 2417 Call C.ntre: 0800-00500 UAN: 111-80NERI Soneri Bank Limited nnnUHL REPORT 2U II An experience Beyond Banking Soneri Bank Limited R~~URl ~frO~T 2011 OUR MISSION To develop Soneri Bank into an aggressive and dynamic financial institution having the capabilities to provide personalized service to customers with cutting edge technology and a wide range of products, and during the process ensure maximum return on assets with the ultimate goal of serving the economy and the society. Soneri Bank Limited R~~URl ~frO~T 2011 Products and Services 07 Corporate Information 13 Board Committees 14 Management Committees 15 Key Performance Indicators 17 Six Years' Financial Summary 18 Six Years' Growth Summary 20 Six Years' Vertical Analysis 22 Six Years' Horizontal Analysis 24 Directors' Report to Shareholders 27 Statement of Value Addition 33 Statement of Internal Controls- by President 34 Statement of Internal Controls- by Chairman 35 Statement of Compliance with Best Practices of Code of Corporate Governance 36 Auditors' Review Report to The Members on Statement of Compliance with Best Practices of Code of Corporate Governance 38 Auditors' Report to The Members 39 Statement of Financial Position 40 Profit and Loss Account 41 Statement of Comprehensive Income 42 Cash Flow Statement 43 Statement of Changes in Equity 44 Notes to the Financial Statements 45 Shariah Advisor's Report 99 Notice of Annual General Meeting 101 Pattern of Shareholding 103 List of Branches 106 List of Foreign Correspondents 110 Soneri Bank Limited nnn ~Al ~Ero~r 2011 nnn~nl ~Ero~r 2011 As of 31 December 2011 Soneri Bank Limited was incorporated on September 28, 1991. -

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks

12. BANKING 12.1 Scheduled Banks Operating in Pakistan Pakistani Banks Public Sector Banks Nationalized Banks 1. First Women Bank Limited 2. National Bank of Pakistan Specialized Banks 1. Industrial Development Bank of Pakistan (IDBP) 2. Punjab Provincial Co-operative Bank Limited (PPCB) 3. Zarai Traqiati Bank Limited 4. SME Bank Ltd. Provincial Banks 1. The Bank of Khyber 2. The Bank of Punjab Private Domestic Banks Privatized Bank 1. Allied Bank of Pakistan Limited 2. Muslim Commercial Bank Limited 3. United Bank Limited 4. Habib Bank Ltd. Private Banks 1. Askari Commercial Bank Limited 2. Bank Al-Falah Ltd. 3. Bank Al-Habib Ltd. 4. Bolan Bank Ltd. 5. Faysal Bank Ltd. 6. KASB Bank Limited 7. Meezan Bank Ltd. 8. Metropolitan Bank Ltd 9. Prime Commercial Bank Ltd. 10. PICIC Commercial Bank Ltd. 11. Saudi-Pak Commercial Bank Limited 12. Soneri Bank Ltd. 13. Union Bank Ltd. Contd. 139 12.1 Scheduled Banks Operating in Pakistan Private Banks 14. Crescent Commercial Bank Ltd. 15. Dawood bank Ltd. 16. NDLC - IFIC Bank Ltd. Foreign Banks 1. ABN AMRO Bank NV 2. Al-Baraka Islamic Bank BSC 3. American Express Bank Ltd. 4. Citi Bank NA 5. Deutsche Bank AE 6. Habib Bank AG Zurich 7. Oman International Bank SAOG 8. Rupali Bank Ltd 9. Standard Chartered Bank Ltd. 10. The Bank of Tokyo-Mitsubishi Ltd. 11. The Hong Kong & Shanghai Banking Corporation Ltd. Source: SBP Note: Banks operating as on 30th June, 2004 140 12.2 State Bank of Pakistan - Assets of the Issue Department (Million Rupees) Last Day of June Particulars 2003 2004 2005 Total Assets 522,891.0 611,903.7 705,865.7 1. -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

ANNUAL REPORT 2008 the Management Team Is Also Being Trained on Various Basel II Requirements

Contents Corporate Information......................................................................01 Director’s Report to the Shareholders........................................02 Statement of Compliance with the Code of Corporate Governance.......................................................07 Statement of Internal Control........................................................09 Notice of Annual General Meeting...........................................10 Review Report to the Members on Statement of the Compliance with Best Practices of Code of Corporate Governance...................................................................12 Auditor’s Report to Members.......................................................13 Balance Sheet......................................................................................15 Profit and Loss Account..................................................................16 Cash Flow Statement.......................................................................17 Statement Of Changes In Equity................................................18 Notes to Financial Statements.....................................................19 Six Years Key financial Data...........................................................62 Annexure - 1.........................................................................................63 Combined Pattern of CDC and Physical Share Holdings...................................................................64 Combined Pattern of CDC and Physical Share Holdings ..................................................................65 -

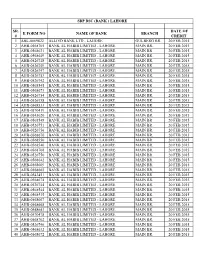

Sr. # E Form No Name of Bank Branch Date of Credit 1 Abl-0069822 Allied Bank

SBP BSC (BANK ) LAHORE SR. DATE OF E FORM NO NAME OF BANK BRANCH # CREDIT 1 ABL-0069822 ALLIED BANK LTD - LAHORE GULBERG BR. 20 FEB 2015 2 AHB-0568705 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 3 AHB-0568631 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 4 AHB-0568649 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 5 AHB-0526748 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 6 AHB-0526749 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 7 AHB-0526747 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 8 AHB-0526753 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 9 AHB-0526742 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 10 AHB-0568545 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 11 AHB-0568673 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 12 AHB-0526754 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 13 AHB-0526758 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 14 AHB-0568533 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 15 AHB-0570419 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 16 AHB-0543020 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 17 AHB-0568548 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 18 AHB-0526751 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 19 AHB-0526756 BANK AL HABIB LIMITED - LAHORE MAIN BR. 20 FEB 2015 20 AHB-0568670 BANK AL HABIB LIMITED - LAHORE MAIN BR. -

Standard Settlement Instructions

Treasury & Financial Institutions Group STANDARD SETTLEMENT INSTRUCTIONS BANK ALFALAH LTD. - PAKISTAN CONVENTIONAL BANKING S. No. CURRENCY BANK / COUNTRY ACCOUNT NO. SWIFT CODE 1. ACU Dollar Bank Alfalah Limited 0701-32029040 ALFHBDDH 2. ACU Dollar Habib Bank Limited 2624032800618 HABBBDDH 3. ACU Dollar Union Bank of India 01003 UBININBB 4. ACU Dollar ICICI Bank Ltd. 000408000491 ICICINBB 5. ACU Dollar Hatton National Bank Ltd., 054010065847 HBLILKLX Mashreqbank PSC, 6. ACU Dollar Mumbai, India 61050949 MSHQINBB 7. ACU Euro Hatton National Bank Ltd 54010066822 HBLILKLX 8. ACU Euro MashreqBank PSC, Mumbai 61049703 MSHQINBB Bank Alfalah Limited 9. ACU Euro Bangladesh, Dhaka 0701-01660001 ALFHBDDH 10. AUD Westpac Banking Corporation ALF0001976 WPACAU2S 11. Canadian Dollar Bank of Montreal Account Number: 31691056928 BOFMCAM2 CNY (Chinese Yuan) Standard Chartered Bank 12. RMB (Renminbi) (China) Limited, Account Number:501510476874 SCBLCNSXSHA 3996019616 13. Danish Krone Danske Bank DK7230003996019616 DABADKKK IBAN: DE24 5004 0000 0880 7182 01; 14. Euro Commerzbank, A.G. Account Number: 400880718201 COBADEFF IBAN: AT79 1100 0010 1161 8400; 15. Euro Unicredit Bank Austria AG Account Number: 01011618400 BKAUATWW Account Number: 1149245009; IBAN: 16. Euro National Bank of Pakistan DE27 501 30000 1149245001 NBPADEFF Account Number: 100100004291; IBAN: 17. Euro Intesa Sanpaolo SpA IT05Z0306940101100100004291 BCITITMM 18. Euro SCB, Frankfurt 018080105 SCBLDEFX 19. Japanese Yen National Bank of Pakistan 21063 NBPAJPJT 20. Pound National Westminster Bank IBAN: GB84NWBK60000404625528; Sort Sterling plc Code: 60-00-04 NWBKGB2L Pound 01707999001 21. Sterling Standard Chartered Bank IBAN: GB87 SCBL 6091 0417 0799 90 SCBLGB2L Alawwal Bank ( Formerly 31002231021 22. Saudi Riyal Saudi Hollandi Bank) IBAN # SA2150000000031002231021 AAALSARI 23. Saudi Riyal Banque Saudi Fransi IBAN # SA5655000000000705900137 BFSRSARI Singapore 24. -

The Hub Power Company Limited

growth through energy THE HUB POWER COMPANY LIMITED UNAUDITED QUARTERLY FINANCIAL STATEMENTS FOR THE THIRD QUARTER ENDED MARCH 31, 2013 C O N T E N T S THE HUB POWER COMPANY LIMITED PAGE Company Information 1 Report of the Directors 3 Condensed Interim Unconsolidated Profit & Loss Account 5 Condensed Interim Unconsolidated Statement of 6 Comprehensive Income Condensed Interim Unconsolidated Balance Sheet 7 Condensed Interim Unconsolidated Cash Flow Statement 8 Condensed Interim Unconsolidated Statement of Changes in Equity 9 Notes to the Condensed Interim Unconsolidated Financial Statements 10 THE HUB POWER COMPANY LIMITED and its Subsidiary Company Report of the Directors on the Consolidated Financial Statements 14 Condensed Interim Consolidated Profit & Loss Account 15 Condensed Interim Consolidated Statement of Comprehensive Income 16 Condensed Interim Consolidated Balance Sheet 17 Condensed Interim Consolidated Cash Flow Statement 18 Condensed Interim Consolidated Statement of Changes in Equity 19 Notes to the Condensed Interim Consolidated Financial Statements 20 COMPANY INFORMATION BOARD OF DIRECTORS Hussain Dawood (Chairman) Zafar Iqbal Sobani (Chief Executive) Syed Muhammad Ali Iqbal Alimohamed Muhammad Aliuddin Ansari Dr. Asif A. Brohi NBP Nominee Abdul Samad Dawood Qaiser Javed Khaleeq Nazar Kiani GOB Nominee Ruhail Muhammed Ali Munir Shahid Hamid Pracha Inam ur Rehman Shahid Aziz Siddiqi Syed Khalid Siraj Subhani Audit Committee Iqbal Alimohamed Chairman Qaiser Javed Ruhail Mohammad Ali Munir Shahid Aziz Siddiqi COMPANY SECRETARY Shamsul Islam MANAGEMENT Zafar Iqbal Sobani Chief Executive Officer Abdul Nasir Chief Financial Officer Abdul Vakil Chief Technical Officer Shamsul Islam Company Secretary Mustafa Giani Sr. Manager Commercial & Contracts REGISTERED & 3rd Floor, Islamic Chamber of Commerce Bldg; HEAD OFFICE ST-2/A, Block 9, Clifton, P. -

Government of Pakistan, Commercial Bank, Development Finance Institutions

Budget Special 2014-15 1. Budget Speech 2014-15 2. Finance Bill 2014-15 3. Notes on Clauses 4. Salient Features 5. Budget at a glance 2014-15 6. Budget Brief 2014-15 7. www.imranghazi.com/mtbaTax Expenditure 8. Fiscal Development 9. Highlights of Economic Survey 2013-14 10. Comments on Budget 2014-15 For more material, visit "www.imranghazi.com/mtba" Budget Special 2014-15 Speech BUDGET SPEECH 2014-15 Bismillahir-Rehmanir-Rahim PART-I Mr. Speaker, 1. As I rise to present the second budget of the democratic government, I want to thank Allah (SWT) for remarkable mercies He has bestowed on us by giving enormous success to the policies and initiatives we announced in our first budget. This success is the outcome of a democratic process that has allowed people to choose their representatives and they, in turn, are working to achieve their aspirations. 2. When we started our journey, we were facing the most daunting task of repairing a broken economy. We embarked on a very comprehensive agenda of economic reforms aimed to reinvigorate the economy, spur growth, maintain price stability, provide jobs to the youth and rebuild the key infrastructure of the country. Prime Minister Mohammed Nawaz Sharif set a rare example of foresight, courage and political sagacity when he did not shy away from taking painful decisions; decisions that were surely unpopular but imperative for restoringwww.imranghazi.com/mtba economic health of the country. Today, with the blessings of Allah, I say in all humility that we have not only restored the health of the economy but have put it firmly on the path of stability and growth. -

Annual REPORT 2011 SILKBANKT

ANNUAl REPORT 2011 SILKBANKT Notice of AGM & Auditors' Review 35 Auditors' Report 39 Financial Statements 43 Six Years' Rnancial Highlights 44 Statement of Financial Position 50 Profit & Loss Account 51 Statement of Comprehensive Income 52 Vision & Mission 02 Cash Row Statement 53 Message from Chairman 04 Statement of Changes in Equity 54 President & CEO's Review 06 Notes to the Financial Statements 55 Senior Management Committee 09 Statement of Written-off Loans 100 Profiles of Board of Directors 13 Achievements & CSR 103 Corporate Information 17 Additional Shareholders' Information 110 Directors' Report 21 Pattern of Share Holdings CDC & Physical 111 Statement of Compliance with 29 Branch Network 114 the Code of Corporate Governance Foreign Correspondents 116 & Statement of Internal Control Proxy Form 119 To be the leader in premier banking, trusted by customers for accessibility, service and innovation; be an employer of choice creating value for all stakeholders In the aftermath of the economic slowdown since 2008, Non-Performing Loans (NPLs) have dampened the profitability dynamics of commercial banks. I am pleased to advise you that contrary to the banking industry trend, your Bank managed to register a significant reduction in NPLs, in each consecutive year since the takeover by the new management. An NPL reduction by the Special Assets Management team of Rs. 3.398 billion and a Provision Reversal of Rs. 1.829 billion was recorded for the year 2011. The Real Estate Asset Management team (REAM) also supported the Special Assets Management team by successfully selling off various properties held as OREO (Other Real Estate Owned), during the year. -

WHY SILK? 111-007-455 2009 Inspiration for the Name Silkbank Comes from the Silk Route - a Trade Corridor Connecting Asia to Europe and the Rest of the World

Silkbank Building ANNUAL I.I. Chundrigar Road, Karachi REPORT www.silkbank.com.pk WHY SILK? 111-007-455 2009 Inspiration for the name Silkbank comes from the Silk Route - a trade corridor connecting Asia to Europe and the rest of the world. Silk, known for its distinctive properties and characteristics, symbolizes Silkbank’s brand beliefs. Premium & Upscale Silk is known for class and premium quality. Silkbank is positioned as an upscale bank providing its customers with premium banking experience. Talent & Innovation Silk embodies talent and timeless innovation. Silkbank promises its customers innovative products delivered through talented staff. Strong & Reliable Silk is amongst the strongest fibres known to mankind. Silkbank derives its strength from its strong international institutional sponsors giving it credibility and reliability. Dependable Silk through the times has held its value. Silkbank driven by a team of professionals provides an optimal experience that you can depend on. Contents Vision & Mission 02 Chairman's Message 03 Silkbank Products President & CEO's Message 05 Senior Management Committee 07 Assets Corporate Information 11 Directors’ Report 15 Statement of Compliance with the Code of Liabilities Corporate Governance 23 Statement of Internal Control 25 Notice of AGM 29 Review Report to the Members on Statement of Compliance with the Best Practices of Code of Corporate Governance 30 Independent Auditors’ Report 33 Balance Sheet 37 Profit and Loss Account 38 Statement of Comprehensive Income 39 Cash Flow Statement -

Annual Report 2017 01 02 Annual Report 2017 Annual Report 2017 03 C�AIRMAN’S MESSAGE

CONTENTS Introduction 02 Other Information Chairman’s Message 04 Corporate DNA 06 Consumer Grievances Handling Mechanism 193 Board of Directors – Profiles 10 Pattern of Shareholding 195 Company Information 14 Branch Network – Conventional 202 Board Meeting Attendance 16 Branch Network – Islamic 217 Senior Management – Profiles 24 Code of Conduct 234 Shariah Board – Profiles 27 Glossary of Terms 245 Senior Management and Internal Committees 29 Form of Proxy 251 Corporate Social Responsibility 32 Organisational Structure 34 Six Year Financial Summary 36 Statement of Value Added 46 Notice of the 23rd Annual General Meeting 48 Report of the Board Audit and Corporate Governance Committee 54 Auditors’ Review Report on Compliance with Code of Corporate Governance 56 Statement of Compliance with Code of Corporate Governance 57 Shariah Board’s Report 60 Faysal Bank Financials Directors’ Report 64 Statement of Internal Control 74 Auditors’ Report to the Members 75 Statement of Financial Position 76 Profit and Loss Account 77 Statement of Comprehensive Income 78 Statement of Changes in Equity 79 Cash Flow Statement 80 Notes to the Financial Statements 81 Annexures 173 Annual Report 2017 01 02 Annual Report 2017 Annual Report 2017 03 CAIRMAN’S MESSAGE ssalam o laikm During 20 asa an ceerated seera signiicant miestones incuding the successu competion o 0 ears o presence in aistan his ourney hich started in ith one ranch as mared ith numerous chaenges hoeer the strong consistent support o our aued customers and staehoders aoed the an to grow. Now ater thirt ears asa an has a countride presence o 40 conentiona and Isamic ranches spread across 24 cities urthermore the addition o 0 Isamic aning ranches during 20 has increased the Isamic ranch netor to ranches maing it the argest netor o dedicated Isamic ranches amongst a conentiona ans in the country.