Essar Oil Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nayara Energy Limited Annual Report 2015-16

Excellence Breeds Success 2015-16 Annual Report Essar Oil limited Contents 01-13 COMPANY OVERVIEW Excellence Breeds Success 01 Key Performance Indicators 02 Chairman’s Message 04 MD & CEO’s Message 06 Night view of Vadinar Refinery Board of Directors 10 Senior Management 12 14-49 STATUTORY REPORT Directors' Report 14 Indradhanush – Shiksha ke Saat Rang. Committed to 50-168 FINANCIAL STATEMENTS Nation Building Cover Images Standalone Independent Auditors’ Report 50 02 Balance Sheet 58 Statement of Profit and Loss 59 01 03 Cash Flow Statement 60 04 Notes to Financial Statements 62 Consolidated 01 Vacuum Column in CDU-1 Complex Independent Auditors’ Report 109 Partners in Progress through Consolidated Balance Sheet 114 02 education Statement of Consolidated Profit and Loss 115 Product jetty, pipeline Consolidated Cash Flow Statement 116 03 Notes to Consolidated Financial Statements 118 04 Retail outlet in Bhuj, Gujarat Form AOC - 1 168 NOTICE For more details, Please visit: 169-194 www.essaroil.co.in Excellence breeds success In a period that was marked by global line with the philosophy to incubate, The year volatility and a severe downturn in nurture and scale up ideas into world- 2015-16 has been crude prices, we have reported our class businesses and create value for best-ever results. Our refinery clocked all stakeholders, the promoters have a landmark one for the highest current price Gross decided to sell 98% of Essar oil to the us at Essar Oil. We Refining Margin, leading to the highest world’s leading oil and gas companies. have successfully ever EBIDTA and Profit After Tax in our We are proud to be the source of the history. -

Essar Oil Limited (Registered Office Address: Khambhalia Post, Post Box

ESSAR OIL LIMITED (REGISTERED OFFICE ADDRESS: KHAMBHALIA POST, POST BOX. NO.24, DIST. JAMNAGAR – 361305, GUJARAT) REVISED FINANCIAL STATEMENTS 2009 - 10 AMENDMENT TO THE DIRECTORS’ REPORT FOR THE FINANCIAL YEAR 2009-10 To, The Members of Essar Oil Limited The Board of Directors had adopted its report on the financial statements for the financial year 2009-10 on July 26, 2010. Sales Tax Incentive The Hon’ble Supreme Court of India, on January 17, 2012, allowed an appeal filed by the Gujarat Government and set aside a judgment of the Gujarat High Court dated April 22, 2008, thus denying the Company benefits under a sales tax incentive scheme of the Government of Gujarat. Hence, the sales tax amount collected and retained by the Company from May 1, 2008 to January 17, 2012 became payable and the income arising out of defeasement of sales tax liability need to be reversed. The Company proposes to re-open the books of accounts for three financial years 2008-09, 2009-10 and 2010-11 for the limited purpose of reflecting a true and fair view in the books of account. The Company has received approval from the Ministry of Corporate Affairs for the above purpose. Necessary resolution seeking approval of shareholders for re-opening of the said financial statements has been incorporated in nd the Notice dated November 9, 2012 convening the 22 Annual General Meeting on December 20, 2012. Abridged reopened and revised financial statements for the financial year ended on March 31, 2010 form part of the annual report. Consequent to reopening of books -

Nayara Energy Annual Report 2016-17

Essar Oil Limited Annual Report 2016-17 Essar Oil Limited Contents Corporate Overview Reports Financial Statement Scaling New Heights 01 Directors’ Report 11 Standalone The World of Essar Oil 02 Independent Auditor’s Report 44 Snapshot of FY 2016-17 04 Balance Sheet 50 Message from the Former Chairman 06 Statement of Profit and Loss 51 Message from the Former Managing Cash Flow Statement 52 Director & CEO 08 Notes 55 Corporate Information 10 Consolidated Independent Auditor’s Report 123 Balance Sheet 128 Statement of Profit and Loss 129 Cash Flow Statement 130 Notes 133 Form AOC-1 206 Notice AGM Notice 208 2 Annual Report 2016-17 | Scaling New Heights Corporate Overview Reports Financial Statements Scaling New Heights Crude and product storage facility at the Refinery Keeping up with its tradition of setting new records, Essar Oil Given the Company’s commitment to superior performance, continued its streak of stellar performance for yet another year we have been regularly investing in the process and technology in FY 2016-17. The Company clocked its highest-ever crude improvement. Through a slew of proactive strategies, we have throughput of 20.94 MMT in FY 2016-17, while production of been able to achieve three-fold increase in sales of petcoke to HSD and MS also stood at its best 10,053 kT and 3,498 kT, small-scale customers. As a result of these efforts, our petcoke respectively. Essar Oil’s crude receipt through SPM also hit its sales grew by 11% in FY 2016-17 while sulphur sales grew by peak at 18.8 MMT for the first time in the Company’s history. -

Information Memorandum

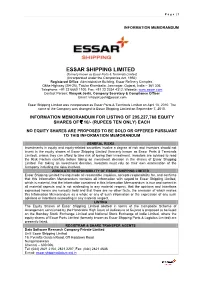

Page | 1 INFORMATION MEMORANDUM ESSAR SHIPPING LIMITED (formerly known as Essar Ports & Terminals Limited) (Incorporated under the Companies Act, 1956) Registered Office: Administrative Building, Essar Refinery Complex, Okha Highway (SH-25), Taluka Khambalia, Jamnagar, Gujarat, India – 361 305. Telephone: +91 22 6660 1100; Fax: +91 22 2354 4312; Website: www.essar.com Contact Person: Vinayak Joshi, Company Secretary & Compliance Officer Email: [email protected] Essar Shipping Limited was incorporated as Essar Ports & Terminals Limited on April 16, 2010. The name of the Company was changed to Essar Shipping Limited on September 7, 2010. INFORMATION MEMORANDUM FOR LISTING OF 205,227,768 EQUITY SHARES OF ` 10/- (RUPEES TEN ONLY) EACH NO EQUITY SHARES ARE PROPOSED TO BE SOLD OR OFFERED PURSUANT TO THIS INFORMATION MEMORANDUM GENERAL RISKS Investments in equity and equity-related securities involve a degree of risk and investors should not invest in the equity shares of Essar Shipping Limited (formerly known as Essar Ports & Terminals Limited), unless they can afford to take risk of losing their investment. Investors are advised to read the Risk Factors carefully before taking an investment decision in the shares of Essar Shipping Limited. For taking an investment decision, investors must rely on their own examination of the Company including the risks involved. ABSOLUTE RESPONSIBILITY OF ESSAR SHIPPING LIMITED Essar Shipping Limited having made all reasonable inquiries, accepts responsibility for, and confirms that this Information Memorandum contains all information with regard to Essar Shipping Limited, which is material, that the information contained in this Information Memorandum is true and correct in all material aspects and is not misleading in any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other facts, the omission of which makes this Information Memorandum as a whole or any of such information or the expression of any such opinions or intentions misleading in any material respect. -

VADINAR OIL TERMINAL LIMITED Corporate Identity No

VADINAR OIL TERMINAL LIMITED Corporate Identity No. (CIN): U35111GJ1993PLC053434 Registered Office: Nayara Energy Refinery Site, 39 KM Stone, Okha Highway (SH-25), Khambhalia, District Devbhumi Dwarka, Gujarat 361305 Tel. No.: +91 2833 661444; Fax No.: +91 2833 662929 Email: [email protected] MEETING OF THE SECURED CREDITORS OF VADINAR OIL TERMINAL LIMITED CONVENED ON THE DIRECTIONS OF THE NATIONAL COMPANY LAW TRIBUNAL, AHMEDABAD BENCH NOTICE TO SECURED CREDITORS Day Wednesday Date March 18, 2020 Time 3:30 p.m. (IST) Venue Nayara Energy Refinery Complex, Khambhalia Post (39th KM stone on Jamnagar – Okha Highway), District Devbhumi Dwarka, Gujarat – 361305 INDEX Sr. No. Content Page No. 1. Notice of meeting of the secured creditors sof Vadinar Oil Terminal Limited convened 2-4 as per the directions of the Hon’ble National Company Law Tribunal, Ahmedabad 2. RBenchoute map to the venue of the Meeting along with landmark 5 3. Explanatory Statement under Sections 230(3) and 102 of the Companies Act, 2013 read with Rule 6 of the Companies (Compromises, Arrangements and Amalgamations) 6-20 Rules, 2016 and other applicable provisions of the Companies Act, 2013 4. Scheme of Amalgamation of Vadinar Oil Terminal Limited with Nayara Energy Limited 21-39 - Annexure A 5. Valuation report dated March 15, 2019 prepared by M/s. BSR & Associates LLP, Independent Chartered Accountants, on the valuation of shares and the consideration 40-66 payable to the resident and non-resident public shareholders - Annexure B 6. Fairness opinion dated March 25, 2019, issued by SBI Capital Markets Limited, an Independent category I Merchant Banker on the Valuation Report submitted by M/s. -

Pre Feasibility Report – Proposed LPG Storage Facilities of PTIL, Bharana Page 2 EXECUTIVE SUMMARY

PETRO TANKAGES INDIA Limited Pre-Feasibility Report Proposed LPG Storage of Petro Tankages India Ltd. (PTIL) at Bharana (Gujarat) AUGUST 2014 Contents 1. EXECUTIVE SUMMARY ....................................................................................... 3 1.1 Background ........................................................................................................... 3 1.2 Proposed LPG Storage.......................................................................................... 4 1.3 Site Description ..................................................................................................... 4 1.4 Site Condition ....................................................................................................... 5 1.5 Rehabilitation and Resettlement issues................................................................. 5 1.6 Pollution Control Mesaures.................................................................................... 5 1.7 Project Schedule and Cost Estimates.................................................................... 5 2. INTRODUCTION OF THE PROJECT................................................................... 6 3. SITE INFORMATION............................................................................................. 8 3.1 Site Location.......................................................................................................... 8 3.2 Site Condition ........................................................................................................ 9 3.2.1 -

Energy Resources of India: Petroleum, Fibers, Natural Gas Petroleum Refineries

Energy Resources of India: Petroleum, Fibers, Natural Gas Petroleum Refineries . There are two stages → Production (drilling) + Refining . For Petroleum refineries, the raw material sources were less decisive factors for industrial location . Because industries were already setup in coalfields and did not move away due to industrial inertia. Petroleum refining does not lead significant weight loss, unlike aluminium/copper/sugarcane/ timber processing. Virtually all the by-products can be used. Therefore, refineries can be set up . Near the raw material or . Near the market or . at an intermediate break of the bulk location (Ports/Coastal locations) At raw material site: Disadvantages . Refinery will become useless after oil is exhausted from oil well . So whatever millions of dollars you had invested in setting up that refinery will be wasted . Oil refining close to production site represents a weight loss of 10-11 % only . Hence not much cost saving in transport even if located near raw material site . Refined products have higher rate of evaporation, therefore it is better to set up the refinery near the market . After 1970s, many of the Middle East and African countries started nationalizing their oil operations . The ownership of refineries/oil wells were transferred from MNCs to government owned PSUs . Hence nowadays, MNCs are reluctant to setup refineries in this region for the fear of nationalization Unrest / Instability as a location factor . Multinational companies do not feel confident to setup refineries inside the middle-east or South America . During Arab-Israeli war, OPEC members stopped supplying oil to countries that had supported Israel . There have been war/war-like situations due to Israel-Palestine conflicts, Iran-Iraq, Iraq-Kuwait . -

Annual Report (2013-14)

4 th ANNUAL REPORT 2013-2014 BOARD OF DIRECTORS COMMITTEES OF THE BOARD Mr. P. K. Srivastava AUDIT COMMITTEE Chairman Mr. Michael P. Pinto (Chairman) Mr. A. R. Ramakrishnan Mr. N. Srinivasan Managing Director Captain Bhupinder Singh Kumar Mr. Michael P. Pinto^ Independent Non-Executive Director SHAREHOLDERS’/INVESTORS’ GRIEVANCE Mr. N. Srinivasan COMMITTEE Independent Non-Executive Director Captain Bhupinder Singh Kumar (Chairman) Mr. N. C. Singhal^ Mr. A. R. Ramakrishnan Independent Non-Executive Director Captain Anoop Kumar Sharma Captain Bhupinder Singh Kumar^ Independent Non-Executive Director NOMINATION & REMUNERATION COMMITTEE Captain Anoop Kumar Sharma Mr. N. Srinivasan (Chairman) Chief Executive Offi cer Captain Bhupinder Singh Kumar Mr. Ankur Gupta Mr. Michael P. Pinto Director Mr. P. K. Srivastava ^ Appointed as Additional Director with effect from August 7, 2013 CORPORATE SOCIAL RESPONSIBILITY COMPANY SECRETARY COMMITTEE Mr. Hitesh Kumar Jain (From August 12, 2014) Captain Bhupinder Singh Kumar (Chairman) Mr. Vinayak Joshi (Till May 31, 2014) Mr. A. R. Ramakrishnan AUDITORS Captain Anoop Kumar Sharma Deloitte Haskins & Sells, Ahmedabad Mr. Ankur Gupta (Firm Registration No. 117365W) REGISTERED OFFICE CORPORATE OFFICE REGISTRAR & SHARE TRANSFER AGENT Administrative Building Essar House Data Software Research Company Private Limited Essar Refi nery Complex 11, K. K. Marg 19, Pycrofts Garden Road, Off Haddows Road Okha Highway (SH-25) Mahalaxmi Nungambakkam, Chennai - 600 006 Taluka Khambalia Mumbai - 400 034 Ph.No. 044-28213738 -

Let's Energise: Meeting India's Growing Fuel Demand the Promise

Content India’s energy scenario p6/Equity oil p11/Role of refining sector in India’s energy security p17 Let’s energise Meeting India’s growing fuel demand www.pwc.in Foreword Preface The 4th National Oil & Gas Convention organised by India-Tech Foundation Promoting energy security is a platform for all stakeholders to assemble and brainstorm on issues related to energy security while planning a roadmap for the future. PwC is The promise of energy security is compelling for a developing privileged to be associated as the knowledge partner for this event. country like India. For a nation of over 1.2 billion people, riding on The National Steering Committee of this convention has invited leaders in the hopes and aspirations of a thriving economy, satiating energy the spheres of policy making. This will give them access to the stakeholders’ needs forms the nucleus of inclusive growth. With India importing viewpoint while also making them available for consultation. 80% of its oil and gas requirements, the country has always been infinitely conscious that diversification remains the cornerstone To achieve this objective of the convention, PwC has put together this background paper for achieving energy security. Any effort at enhancing domestic titled ‘Let’s energise: Meeting India’s growing fuel demand.’ The paper sets out the current discoveries has to be matched with the acquisition of international energy scenario in the country, which is characterised by rising demand and high import acreages in parallel, to complement domestic production. As a frontrunner in this dependency, and its impact. It also sets out the challenges faced by India in the quest for field, ONGC Videsh is focussed on expanding horizons by entering newer geographies energy independence. -

Geography of India – Part 3

A M K RESOURCE WORLD GENERAL KNOWLEDGE www.amkresourceinfo.com Geography of India – Part 3 INDIAN MINERAL RESOURCES Coal Resources in India West Bengal ( Raniganj, Burdwan, Bankura, Purulio, Birbhum, Jalpaigudi, Darjeeling ), Jharkhand ( Jharia, Giridih, Kharhawadi, Bokaro, Hazaribagh, Kamapura, Rampur, Palamau ), Orissa ( Rampur, Hindgir, Talcher, Sambal ), Madbyo Pradesh and Chhatisgarh ( Rewa, Pench valley, Umaria, Korba, Sohagpur, Mand river area, Kanha valley, Betul ), etc. Power sector is the largest consumer of coal in India followed by steel industry, cement industry, etc. Manganese Orissa, Maharashtra ( Nagpur, Bhandara, Ratnagiri ), Madhya Pradesh ( Balaghat, Chhindawara ), Karnataka ( Keonjhar, Bonai, Kalahandi ), Andhra Pradesh ( Kadur, Garibadi ). Copper Minerals Madhya Pradesh ( Balaghat ), Rajasthan ( Khetri ), Jharkhand ( Singhbhum, Masobani, Surda ), Karnataka ( Chitradurg, Hassan ). Mica Minerals Jharkhand ( Hazaribagh, Giridih, Kodarma ), Bihar ( Goya, Bhagalpur ), Andhra Pradesh ( Guntur, Vizag, Kurnool ), Rajasthan ( Bhilwara, Udaipur, Jaipur ). 1 www.amkresourceinfo.com A M K RESOURCE WORLD GENERAL KNOWLEDGE Petroleum Resources in India Assam ( Digboi, Naharkatiya, Badarpur, Masinpur and Pallharia ), Gujarat, ( Ankleshwar, Khambat, Kalol ), Mumbai High, Bassein ( south of Mumbai High ), etc. Recently oil has been discovered in Cauvery basin, Krishna and Godavary basin, Khambat basin, etc. Iron Resources India possesses Haematite, a very high – grade iron ore. In Madhya Pradesh ( Bailadila, Jabalpur ), Goa ( North -

ESSAR Shipping AR 15-16 Cover.Cdr

Essar Shipping Limited Annual Report - 2015-16 6th ANNUAL REPORT 2015-16 BOARD OF DIRECTORS COMMITTEES OF THE BOARD Mr. P. K. Srivastava AUDIT COMMITTEE Chairman Captain Bhupinder Singh Kumar (Chairman) Mr. N. Srinivasan Captain Anoop Kumar Sharma* Ms. S. Gayathri Managing Director Mr. N. Srinivasan STAKEHOLDERS RELATIONSHIP COMMITTEE Captain Bhupinder Singh Kumar (Chairman) Independent Non-Executive Director Captain Anoop Kumar Sharma Captain Bhupinder Singh Kumar Independent Non-Executive Director NOMINATION & REMUNERATION COMMITTEE Ms. S. Gayathri Mr. N. Srinivasan (Chairman) Non-Executive Director Captain Bhupinder Singh Kumar Mr. P. K. Srivastava * Appointed as Managing Director with effect from November 01, 2015 Whole-time Director and CEO up to October 31, 2015. CORPORATE SOCIAL RESPONSIBILITY COMMITTEE Captain Bhupinder Singh Kumar (Chairman) Captain Anoop Kumar Sharma COMPANY SECRETARY Ms. S. Gayathri Mr. Awaneesh Srivastava AUDITORS RISK MANAGEMENT COMMITTEE CNK & Associates LLP, Chartered Accountants Captain Bhupinder Singh Kumar (Chairman) (Firm Registration No. 101961W) Captain Anoop Kumar Sharma Add.: Mistry Bhavan, 3rd Floor, Dinshaw Bachha Road, Mr. Vikram Gupta Churchgate, Mumbai - 400 020. REGISTERED OFFICE CORPORATE OFFICE REGISTRAR & TRANSFER AGENT Administrative Building Essar House Data Software Research Company Pvt. Limited Essar Refinery Complex 11, K. K. Marg 19, Pycroft Garden Road, Off Haddows Road, Okha Highway (SH-25) Mahalaxmi Nungambakkam, Chennai - 600 006 Taluka Khambalia Mumbai 400 034 Ph.No.044-28213738 -

43N9q7o5dbl46rfdabru.Pdf

Corporate Information BOARD OF DIRECTORS BANKERS (As on August 24, 2015) State Bank of India Prashant Ruia, Chairman ICICI Bank Ltd. Naresh K. Nayyar, Deputy Chairman IDBI Bank Ltd. Lalit Kumar Gupta, Managing Director & CEO Punjab National Bank Chakrapany Manoharan, Director (Refinery) Axis Bank Ltd. Dilip J. Thakkar, Independent Director Indian Overseas Bank K. N. Venkatasubramanian, Independent Director HDFC Bank Ltd. Virendra Singh Jain, Independent Director Bank of India Deepak Kumar Varma, Independent Director Central Bank of India Dr. Sabyasachi Sen, Independent Director State Bank of Patiala Rugmani Shankar, Independent Director Oriental Bank of Commerce R. Sudarsan, Nominee of LIC of India Allahabad Bank Sudhir Garg, Nominee of IFCI Ltd. State Bank of Mysore Yes Bank Ltd. Indian Bank CHIEF FINANCIAL OFFICER Suresh Jain REGISTERED OFFICE Khambhalia Post, Post Box No. 24 Dist. Devbhumi Dwarka – 361305 Gujarat. COMPANY SECRETARY Tel: +91-2833-661444 Fax: +91-2833-662929 Sheikh S. Shaffi Email: [email protected] CORPORATE OFFICE TRANSFER AGENTS Equinox Business Park, 4th Floor, Tower-2, Off Bandra Kurla Complex M/s.Datamatics Financial Services Ltd. L.B.S. Marg, Kurla (W) Unit: Essar Oil Limited Mumbai – 400070. Plot No. B-5, Part B Cross Lane, Tel: +91-22-67335000 MIDC, Andheri (East), Mumbai – 400 093 Fax: +91-22-67082183 Tel: +91-22-66712151 to 66712156 Website: www.essaroil.co.in Fax: +91-22-66712209 Email: [email protected] Website: www.dfssl.com AUDITORS M/s Deloitte Haskins & Sells, Ahmedabad Contents 02 Company Overview Key Performance Indicators .......................... 3 Chairman’s Message .................................... 4 MD & CEO’s Message .................................. 6 Board of Directors ........................................ 10 Senior Management ....................................