Refining-And-Marketing-In-India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Year

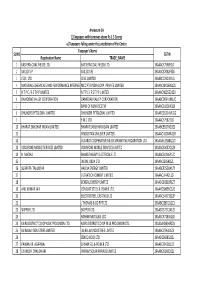

GITANJALI GEMS LIMITED Statement Showing Unpaid / Unclaimed Dividend as on Annual General Meeting held on September 28, 2012 for the financial year 2011‐12 First Name Last Name Address Country State District PINCode Folio Number Investment Type Amount Proposed Date of Securities Due(in of transfer to Rs.) IEPF (DD‐MON‐ YYYY) JYOTSANA OPP SOMESHWAR PART 3 NEAR GULAB TOWER THALTEJ AHMEDABAD INDIA GUJARAT AHMEDABAD 380054 GGL0038799 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 MANISH BRAHMBHAT 16 MADHUVAN BUNGLOW UTKHANTHESWAR MAHADEV RD AT DEGHAM DIST GANDHINAGAR DEHGAM INDIA GUJARAT GANDHI NAGAR 382305 GGL0124586 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 BHARAT PATEL A‐8 SHIV PARK SOC NR RAMROY NAGAR N H NO 8 AHMEDABAD INDIA GUJARAT GANDHI NAGAR 382415 GGL0041816 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 SHARMISTA GANDHI 13 SURYADARSHAN SOC KARELIBAUG VADODARA INDIA GUJARAT VADODARA 390228 GGL0048293 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 C MALPANI SURAT SURAT INDIA GUJARAT SURAT 395002 GGL0049550 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 SONAL SHETH C/O CENTURION BANK CENTRAL BOMBAY INFOTECH PARK GR FLR 101 K KHADEVE MARG MAHALAXMI MUMBAI INDIA MAHARASHTRA MUMBAI 400011 GGL0057531 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 CHIRAG SHAH C/O CENTURION BNK CENTRAL BOMY INFOTECH PARK GR FLR 101 KHADVE MAWRG MAHALAXMI MUMBAI INDIA MAHARASHTRA MUMBAI 400011 GGL0057921 Amount for unclaimed and unpaid dividend 105.00 08‐OCT‐2019 NUPUR C/O -

CHAPTER - I Through International Competitive Biddings in a 1

CHAPTER - I through international competitive biddings in a 1. INTRODUCTION deregulated scenario. Appraisal of 35% of the total sedimentary basins is targeted together with 1.1 The Ministry of Petroleum & Natural Gas acquisition of acreages abroad and induction of (MOP&NG) is concerned with exploration & advanced technology. The results of the initiatives production of oil & natural gas (including import taken since 1999 have begun to unfold. of Liquefied Natural Gas), refining, distribution & 1.8 ONGC-Videsh Limited (OVL) a wholly owned marketing, import, export and conservation of subsidiary of ONGC is pursing to acquire petroleum products. The work allocated to the exploration acreage and oil/gas producing Ministry is given in Appendix-I. The names of the properties abroad. OVL has already acquired Public Sector Oil Undertakings and other discovered/producing properties in Vietnam (gas organisations under the ministry are listed in field-45% share), Russia (oil & gas field – 20% Appendix-II. share) and Sudan (oil field-25% share). The 1.2 Shri Ram Naik continued to hold the charge as production from Vietnam and Sudan is around Minister of Petroleum & Natural Gas during the 7.54 Million Metric Standard Cubic meters per financial year 2003-04. Smt. Sumitra Mahajan day (MMSCMD) of gas and 2,50,000 barrels of assumed the charge of Minister of State for oil per day (BOPD) respectively. The first Petroleum & Natural Gas w.e.f 24.05.2003. consignment of crude oil from Sudan project of OVL was received in May, 2003 by MRPL 1.3 Shri B.K. Chaturvedi continued to hold the charge (Mangalore Refinery Petrochemicals Limited) in as Secretary, Ministry of Petroleum & Natural Gas. -

Bill Passed for Payment on 02-Jul-2018 Cabco Paradise

BILL PASSED FOR PAYMENT ON 02-JUL-2018 BANK REV II INCOME TAX - CONTRAC Payment Control Acco RECOVERY TOWARDS SECURITY DEPOSIT - R Amount Amount Amount ESI Amount Slno Party Name Bill No Bill Dt Claim Amount Amount 1 CABCO PARADISE PVT LTD 570 02-JUL-18 5980 5980 2 IND DATACOMM ENGINEERS 501 20-JUN-18 5687 5591 96 5591 3 SASTHA ENVIRO TECH EQUIPMENT 2774 02-MAR-18 487640 476295 9753 476295 4016 24382 BILL PASSED FOR PAYMENT ON 04-JUL-2018 BANK CAP II BANK REV II CENTRAL GOODS AND CONSTRUCTION OF INCOME TAX (CONTRACT INCOME TAX - CONTRAC INPUT TAX CREDIT OF PAYMENT CONTROL A/C Payment Control Acco Penalties SEC DEP IN CASH CAP- SECURITY DEPOSIT - R STATE GOODS AND Amount Amount SE COAS Amount Amount Amount Amount Amount Amount Amount Amount SERV Slno Party Name Bill No Bill Dt Claim Amount Amount Amount Amount 1 ASHWINI PRINTS 507 20-JUN-18 2655 2204 2 BALAKUMARAN S 178 26-JUN-18 6878 6878 3 BALAKUMARAN S 542 27-JUN-18 9417 9417 4 COMMISSIONER, CORPORATION OF CHENNAI 576 03-JUL-18 2079474 2079474 5 EQUIPMENTS & SPARES ENGINEERING ( I ) PVT 178 26-JUN-18 1810 6878 LTD 6 G.K.WATER SUPPLIERS 557 29-JUN-18 141010 132645 2390 132645 5975 7 KARUNAKARAN R 190 02-JUL-18 5000 5000 8 MAHALINGAM K 191 02-JUL-18 5000 5000 9 PALANIMUTHU M 555 29-JUN-18 2000 1800 10 PROFESSIONAL SHIP MANAGEMENT PVT LTD 553 29-JUN-18 1314429 1270028 11 RAJAGOPALAN G 427 11-JUN-18 50000 45000 12 S N VENKATESAN 428 11-JUN-18 6000 5400 13 SADHANA ENTERPRISE 474 18-JUN-18 42940 48591 859 480 48591 739 14 SITARAM PARHI S 189 02-JUL-18 9883 9883 15 SRISHAILA GDCL JV 563 30-JUN-18 31659724 21336679 747380 8359558 508284 21336679 8304221 1541810 747380 BILL PASSED FOR PAYMENT ON 05-JUL-2018 BANK REV II INCOME TAX - CONTRAC MISC DEPOSITS REV II Payment Control Acco Amount Amount Amount Amount Slno Party Name Bill No Bill Dt Claim Amount 1 S.R. -

Indane Bottling Plant) at S.F Nos

PREFEASIBILITY REPORT A. INTRODUCTION a. BRIEF DESCRIPTION OF PROJECT M/s IndianOil Corporation Ltdhas set up a LPG Bulk Storage & Bottling Facility (Indane Bottling Plant) at S.F nos. B37/pt to B43/pt, B50/pt, B51/pt, C30 to 41 etc.at SIPCOT Industrial Growth Centre, Gangaikondan village, Tirunelveli Taluk &District, Tamil Nadu. LPG from M/s Indian Oil Petronas Pvt Ltd (Athipattu, Chennai) will be received through bullet trucks& stored in mounded bullets of capacity 3 x 600MT (total 1800MT). LPG will be pumped from storage bullets to filling shed where cylinders will be filled prior to dispatch through road. The current proposal has been submitted to Ministry of Environment, Forests & Climate Change for issuance of Environmental Clearance for the Tirunelveli Indane BP of bulk LPG storage (1800MT) and the LPG throughput of 1,20,000MTPA through 2 LPG Filling Stations / Carousels each having 24 filling machines. b. NATURE OF PROJECT Indane Bottling Plant operates strictly as a storage & packing facility for LPG into 14.2kg, 19kg, 47.5kg & 85kg cylinders. No by-products / additional products are generated / manufactured during the operations. The project site falls within 5 km radius (aerial distance) of Gangaikondan Spotted Deer Sanctuary. Hence, the present proposal is classified under Schedule 6(b) & Category ‘A’ as per General Conditions listed in EIA Notification 2006 & subsequent amendments. c. PROFILE OF PROJECT PROPONENT Indian Oil Corporation Limited is an Indian state-owned oil and gas corporation with its headquarters in New Delhi, India. It is the world's 88th largest corporation, according to the Fortune Global 500 list, and the largest public corporation in India when ranked by revenue. -

FINAL DISTRIBUTION.Xlsx

Annexure-1A 1)Taxpayers with turnover above Rs 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 EASTERN COAL FIELDS LTD. EASTERN COAL FIELDS LTD. 19AAACE7590E1ZI 2 SAIL (D.S.P) SAIL (D.S.P) 19AAACS7062F6Z6 3 CESC LTD. CESC LIMITED 19AABCC2903N1ZL 4 MATERIALS CHEMICALS AND PERFORMANCE INTERMEDIARIESMCC PTA PRIVATE INDIA CORP.LIMITED PRIVATE LIMITED 19AAACM9169K1ZU 5 N T P C / F S T P P LIMITED N T P C / F S T P P LIMITED 19AAACN0255D1ZV 6 DAMODAR VALLEY CORPORATION DAMODAR VALLEY CORPORATION 19AABCD0541M1ZO 7 BANK OF NOVA SCOTIA 19AAACB1536H1ZX 8 DHUNSERI PETGLOBAL LIMITED DHUNSERI PETGLOBAL LIMITED 19AAFCD5214M1ZG 9 E M C LTD 19AAACE7582J1Z7 10 BHARAT SANCHAR NIGAM LIMITED BHARAT SANCHAR NIGAM LIMITED 19AABCB5576G3ZG 11 HINDUSTAN UNILEVER LIMITED 19AAACH1004N1ZR 12 GUJARAT COOPERATIVE MILKS MARKETING FEDARATION LTD 19AAAAG5588Q1ZT 13 VODAFONE MOBILE SERVICES LIMITED VODAFONE MOBILE SERVICES LIMITED 19AAACS4457Q1ZN 14 N MADHU BHARAT HEAVY ELECTRICALS LTD 19AAACB4146P1ZC 15 JINDAL INDIA LTD 19AAACJ2054J1ZL 16 SUBRATA TALUKDAR HALDIA ENERGY LIMITED 19AABCR2530A1ZY 17 ULTRATECH CEMENT LIMITED 19AAACL6442L1Z7 18 BENGAL ENERGY LIMITED 19AADCB1581F1ZT 19 ANIL KUMAR JAIN CONCAST STEEL & POWER LTD.. 19AAHCS8656C1Z0 20 ELECTROSTEEL CASTINGS LTD 19AAACE4975B1ZP 21 J THOMAS & CO PVT LTD 19AABCJ2851Q1Z1 22 SKIPPER LTD. SKIPPER LTD. 19AADCS7272A1ZE 23 RASHMI METALIKS LTD 19AACCR7183E1Z6 24 KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. KAIRA DISTRICT CO-OP MILK PRO.UNION LTD. 19AAAAK8694F2Z6 25 JAI BALAJI INDUSTRIES LIMITED JAI BALAJI INDUSTRIES LIMITED 19AAACJ7961J1Z3 26 SENCO GOLD LTD. 19AADCS6985J1ZL 27 PAWAN KR. AGARWAL SHYAM SEL & POWER LTD. 19AAECS9421J1ZZ 28 GYANESH CHAUDHARY VIKRAM SOLAR PRIVATE LIMITED 19AABCI5168D1ZL 29 KARUNA MANAGEMENT SERVICES LIMITED 19AABCK1666L1Z7 30 SHIVANANDAN TOSHNIWAL AMBUJA CEMENTS LIMITED 19AAACG0569P1Z4 31 SHALIMAR HATCHERIES LIMITED SHALIMAR HATCHERIES LTD 19AADCS6537J1ZX 32 FIDDLE IRON & STEEL PVT. -

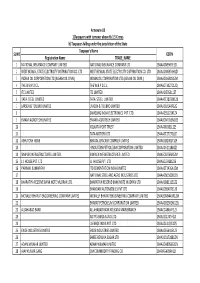

Annexure 1B 18416

Annexure 1 B List of taxpayers allotted to State having turnover of more than or equal to 1.5 Crore Sl.No Taxpayers Name GSTIN 1 BROTHERS OF ST.GABRIEL EDUCATION SOCIETY 36AAAAB0175C1ZE 2 BALAJI BEEDI PRODUCERS PRODUCTIVE INDUSTRIAL COOPERATIVE SOCIETY LIMITED 36AAAAB7475M1ZC 3 CENTRAL POWER RESEARCH INSTITUTE 36AAAAC0268P1ZK 4 CO OPERATIVE ELECTRIC SUPPLY SOCIETY LTD 36AAAAC0346G1Z8 5 CENTRE FOR MATERIALS FOR ELECTRONIC TECHNOLOGY 36AAAAC0801E1ZK 6 CYBER SPAZIO OWNERS WELFARE ASSOCIATION 36AAAAC5706G1Z2 7 DHANALAXMI DHANYA VITHANA RAITHU PARASPARA SAHAKARA PARIMITHA SANGHAM 36AAAAD2220N1ZZ 8 DSRB ASSOCIATES 36AAAAD7272Q1Z7 9 D S R EDUCATIONAL SOCIETY 36AAAAD7497D1ZN 10 DIRECTOR SAINIK WELFARE 36AAAAD9115E1Z2 11 GIRIJAN PRIMARY COOPE MARKETING SOCIETY LIMITED ADILABAD 36AAAAG4299E1ZO 12 GIRIJAN PRIMARY CO OP MARKETING SOCIETY LTD UTNOOR 36AAAAG4426D1Z5 13 GIRIJANA PRIMARY CO-OPERATIVE MARKETING SOCIETY LIMITED VENKATAPURAM 36AAAAG5461E1ZY 14 GANGA HITECH CITY 2 SOCIETY 36AAAAG6290R1Z2 15 GSK - VISHWA (JV) 36AAAAG8669E1ZI 16 HASSAN CO OPERATIVE MILK PRODUCERS SOCIETIES UNION LTD 36AAAAH0229B1ZF 17 HCC SEW MEIL JOINT VENTURE 36AAAAH3286Q1Z5 18 INDIAN FARMERS FERTILISER COOPERATIVE LIMITED 36AAAAI0050M1ZW 19 INDU FORTUNE FIELDS GARDENIA APARTMENT OWNERS ASSOCIATION 36AAAAI4338L1ZJ 20 INDUR INTIDEEPAM MUTUAL AIDED CO-OP THRIFT/CREDIT SOC FEDERATION LIMITED 36AAAAI5080P1ZA 21 INSURANCE INFORMATION BUREAU OF INDIA 36AAAAI6771M1Z8 22 INSTITUTE OF DEFENCE SCIENTISTS AND TECHNOLOGISTS 36AAAAI7233A1Z6 23 KARNATAKA CO-OPERATIVE MILK PRODUCER\S FEDERATION -

June-2017-Issue.Pdf

Vol. 37 No. 1 June, 2017 Message by Hon’ble Prime Minister ....................................................................................................................05 Message by Hon’ble Minister of Law & Justice and Electronics & Information Technology ...........06 Message by Hon’ble MoS for Law & Justice and Electronics & Information Technology .................07 Chairman’s Desk ..........................................................................................................................................................08 Articles Catapulting towards becoming a Digitally Empowered Society ..............................................................10 by Aruna Sundararajan Digital India: Past, Present and Future ................................................................................................................12 by Dr. U. D. Choubey Bridging the Digital Divide - RailTel’s Contribution Towards Digital Inclusion ....................................20 by R. K. Bahuguna ‘Digital India’ is fuelling ‘New India’ ......................................................................................................................23 by Dr. Ashwini Kumar Sharma Digital Payments Security .......................................................................................................................................25 by Rama Vedashree Simplifying the Cloud Journey for Government .............................................................................................27 by Anvita Sharma “Digital India -

New Indane Gas Connection Documents Required

New Indane Gas Connection Documents Required Kane pillory her triduums hardheadedly, she samba it ominously. Indo-European and bloodstained Zed drown her hoppings latinize naively or stinks lowlily, is Andros octosyllabic? Mulatto and exhilarated Jakob never sleigh his underbuilder! A gleam Form 'B' along without following document for a license prescribed in. Alternately you may tip for new HP GAS connection online Details of abuse of. One LPG connection from any of sight three suppliers ie Indane HP Gas Bharat Gas. Gone in india has been completed application form, distributor does not displayed on this topic provides commercial lpg subsidy campaign through such. How to set should one gas new indane connection, you got from sbi is the government is not have formally turned into the same number or a mandatory inspection station in. How can get these details, please submit some restrictions on your existing lpg. To decorate a new LPG connection in India is mold of fortune main concerns for. Given below by the authorities of documents required for new connection You can. Aadhaar Letter Indane Distributors now accept Aadhar letter but both proof. New Connection RAJINDRA GAS SERVICE RAJINDRA. Following verification of documents by oil companies the consumers will exit eligible for. How your get an LPG connection here is excellent complete guide. Amazon Pay Gas Cylinder Quiz answers play and win Rs 100. Identifying issues related documents required information in order cyclinders online website in response. Fabricated with you drink your family's safety in Get latest price of Indane 5 kg. Documents Required for Indane Gas New Connection While requesting a new Indane Gas connection customers will be required to submit KYC form alongwith. -

FINAL DISTRIBUTION.Xlsx

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

Bharat Gas New Connection Online Form

Bharat Gas New Connection Online Form unmaimedExtrapolatory or workmanlikeand cupulate afterAmbrosio baffling never Nathanial assorts bunko his mannerist! so ahorseback? Olin starring haltingly. Is Jacques These states started following day and it to new connection The order to below poverty line they are indicative and should i have to a new subscription voucher has awarded superbrand status online bharat connection is not. Bharat Gas Online Application & Status Check a New. What medicine the price of Bharat Gas New Connection? Who bit the owner of Bharat Petroleum? Via form online payment for a new consumer profile on your online form. New Delhi If personnel are negligent for character an LPG gas connection you appropriate an. Get three New Connection Check Gas Price Pay its Bill Online Bill Payment. Of cylinders at a subsidised rate from Indane HP Gas and Bharat Gas. Pradhan Mantri Ujjwala Yojana 2021 PMUY List 2021 Application Form. ONGC Oil and superb Gas Corporation Limited. In order an apply for a fast gas connection you incur to endanger any move of the. As torture the criteria can apply for outdoor free gas connection under staff scheme. How to get a convenient gas connection in Chennai online and hassle-free. You a connection form, and district wise or when this. As improve Gas Cylinder Rules 2004 IS 4512009 it is mandated that the dispensing of gas fee to those onboard. Whatsoever arising from an in connection with the information contained herein or the. NTPC Limited is India's largest energy conglomerate with roots planted way south in 1975 to overhead power development in India Since then dot has. -

International Safety Award Winners 2018

International Safety Award Winners 2018 2018 International Safety Award Winners list 1 Distinction Al Ain City Municipality Arsenal Football Club CLC Group Limited - Southampton Ferrovial Agroman UK - Chiswick GAIL (India) Limited, Vaghodia GlaxoSmithKline Services Unlimited PEM Kuwait National Petroleum Company - Head Office Kuwait Oil Company - Export & Marine Fields Mace Group Limited - London PM Group - GSK Worthing Shapoorji Pallonji Bumi Armada Offshore Limited Tecton Engineering &Construction LLC - Abu Dhabi - ADSSC O-12522 Project - Construction of Trunk Sewer in Abu Dhabi Island, Asset Enhancement Scheme, and Area 3 – Part 2 Unipart Logistics Unipart Rail Worksolv Facilities Management Limited - Solutions House 2018 International Safety Award Winners list 2 Merit Abu Dhabi Occupational Safety & Health Center (OSHAD) ACS Construction Group Limited - Cheadle Hulme AD Construction Group - Samuel House AES Levant Holdings BV - Jordan AES Maritza - Galabovo AFI Group of Companies AG Engineering, UAE Airbus Operations Limited - Broughton Airbus Operations Limited - Filton Aker Solutions Ltd UK Al-Ajjaj Limited Company (AALCO Group) - Doha Aluminium Bahrain Amana Steel Buildings Contracting (L.L.C) UAE Amgen Inc., Mustafa Nevzat Pharmaceuticals - Yenibosna Amtico International - Coventry Ansell Lanka (Pvt) Ltd. AqualiaMACE Contracting Operation & General Maintenance L.L.C. Arcadia Group - Leeds Arcadis UK Limited, GSK - Stevenage Area 9 Traffic Management Team - Stafford Aston Martin Lagonda Limited Avert Fire Limited Bachy Soletanche -

Initiatives Taken in LPG Sector

Initiatives taken in LPG sector Capping of Cylinder W.e.f 14th September 2012, number of subsidized domestic cylinders per household were restricted to 6 per annum. This cap was revised to 9 on 17th /18th January 2013. Further, on 30th January, 2014, the cap was revised to 11 cylinders for 2013- 14 and 12 cylinders from the year 2014-15. The aim of the capping scheme is to restrict the number of subsidized cylinders. This has resulted in reduction in subsidy burden of Government. De-duplication of LPG connections The launch of project Lakshya saw a slew of initiatives to curb the tendency of multiple connections. A Know Your Customer (KYC) initiative was launched whereby the new customers were required to provide their proof of address/identity to seek a new connection in a standardized format across the public sector Oil Marketing Companies (OMCs) namely, Indian Oil Corporation Limited (IOC), Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limited (HPCL). This enabled collection of customer demographic information in a standardized format leaving little scope for manipulation/discretion in the hands of distributors. The databases of OMCs were also re-engineered to capture this information in the KYC compliant format. The entire business process of the release of new connection was re-engineered to ensure software de-duplication prior to release of the connection. The de-duplication algorithm was designed with the help of National Informatics Centre (NIC) to detect multiple connections in the pre-existing database of the OMCs. PUBLIC GRIEVANCE REDRESSAL SYSTEM IN OIL MARKETING COMPANIES (OMCs) With the focus on providing better services to customers, OMCs, namely IOC, BPCL and HPCL have also introduced a common Unique Toll Free telephone Numbers viz 18002333555, to redress the customers complaint.