Major Candlestick Signals If You Want To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stochastic Oscillator

www.ScientificForex.com Presents... The Truth Behind Commonly Used Indicators www.ScientificForex.com ABOUT THE AUTHOR Cristina Ciurea is a Mathematician and Accountant by profession. She completed her degree in Mathematics at the University “Alexandru Ioan Cuza” in 1990 in Iasi, Romania, and her degree in Accounting at the Chamber of Commerce in 1994. She also earned a Masters degree in Audit of Banking and Financial Institutions in the Academy of Economic Studies-Bucharest in 2006. As soon as she received her license in Mathematics, Cristina worked as a Math teacher from 1990 to 1994. She then founded her first company in 1994. Since then, she has 14 years of managerial experience and has also served as a consultant for companies regarding fiscal and financial issues. Cristina has been a Forex trader for several years. One of her greatest achievements in the field of Forex trading is winning the prestigious Surefire Trading Challenge, the largest independent Forex trading competition in the world, in 2011. Cristina now spends most of her day watching the charts, monitoring economic news, trading, sharing her knowledge of the Forex market on the web, and providing private trading lessons to a select few. On March 9th, Cristina plans to unveil something that she says will help more people to understand how to use her scientific approach to trading and which will do more to improve the odds of success to their favour, than anything she has ever shared. www.ScientificForex.com Table Of Contents ABOUT THE AUTHOR ................................................................................. 2 INTRODUCTION .......................................................................................... 5 METHODOLOGY ......................................................................................... 7 MOVING AVERAGES .................................................................................. 8 I. -

Bullish Pattern Created by Connecting Two Or More Lows, with Each Successive Low Higher Than the Previous Low

1 Account Value: The account value is how much one’s account is worth. ADP Non Farm Employment Change: This U.S. report is a measure of non-farm private employment. It was developed in order to help meet the need for timely and accurate estimates of short-term movements in the labor market. Analyst: When analyzing the market, analysts can generally be divided into two camps – fundamentals and technicals. Fundamental analysts are those who mainly look at the fundamental aspects of an economy in forming their opinions. They stay on top of the markets by reading and analyzing what the current economic data say about current market conditions, what is fundamentally driving the market, and where it’s headed. Technical analysts are those who primarily rely on chart indicators and patterns to help predict where price will move next. Some tools that technical analysts use are Fibonacci retracement, candlesticks and momentum indicators. Ascending Trend Channel: An ascending trend channel is a basic chart pattern used in technical analysis. Ascending trend channels are a useful tool due to their ability to predict overall changes in trend. As long as prices remain within the ascending trend channel, the upward trend in price can be expected to continue. As soon as prices exceed either trendline forming the channel, however, a strong signal either to buy or to sell is generated. A break through the upper trendline generates a strong buy signal, while a break through the lower trendline generates a strong sell signal. Ascending Trend Line: A bullish pattern created by connecting two or more lows, with each successive low higher than the previous low. -

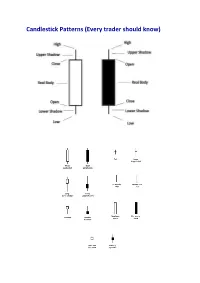

Candlestick Patterns (Every Trader Should Know)

Candlestick Patterns (Every trader should know) A doji represents an equilibrium between supply and demand, a tug of war that neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have moved higher. Now, the outcome of the latest skirmish is in doubt. After a long downtrend, the opposite is true. The bears have been victorious in previous battles, forcing prices down. Now the bulls have found courage to buy, and the tide may be ready to turn. For example = INET Doji Star A “long-legged” doji is a far more dramatic candle. It says that prices moved far higher on the day, but then profit taking kicked in. Typically, a very large upper shadow is left. A close below the midpoint of the candle shows a lot of weakness. Here’s an example of a long-legged doji. For example = K Long-legged Doji A “gravestone doji” as the name implies, is probably the most ominous candle of all, on that day, price rallied, but could not stand the altitude they achieved. By the end of the day. They came back and closed at the same level. Here ’s an example of a gravestone doji: A “Dragonfly” doji depicts a day on which prices opened high, sold off, and then returned to the opening price. Dragonflies are fairly infrequent. When they do occur, however, they often resolve bullishly (provided the stock is not already overbought as show by Bollinger bands and indicators such as stochastic). For example = DSGT The hangman candle , so named because it looks like a person who has been executed with legs swinging beneath, always occurs after an extended uptrend The hangman occurs because traders, seeing a sell-off in the shares, rush in to grab the stock a bargain price. -

Developing a Forex Expert Advisor Based on Japanese Candlestick Patterns and Technical Trading Strategies

International Journal of Trade, Economics and Finance, Vol. 9, No. 6, December 2018 Developing a Forex Expert Advisor Based on Japanese Candlestick Patterns and Technical Trading Strategies Watthana Pongsena, Prakaidoy Ditsayabut, Panida Panichkul, Nittaya Kerdprasop, and Kittisak Kerdprasop for similar patterns that have been formed in the past and Abstract—Foreign Exchange or Forex market is considered expects that movement of the price may act in the same way the largest trading market in the world. Trading in the Forex as it did previously [6]. In technical analysis, technical market, traders need to have a good trading strategy in order to indicators are mathematical calculations based on historical make profits and be a successful trader. However, there are data that are generally plotted as a chart pattern. There are some factors that create limitations for many traders, such as, trading behaviors, emotions, and time. The development of several technical indicators, which often used, such as, Expert Advisor or EA allows automation of the analytical and Moving Average Convergence Divergence (MACD) [7], trading processes under the MT4 platform. An EA with a good Relative Strength Index (RSI) [8], and Stochastic oscillator trading instruction can provide the ability to make profits and [9]. Many traders include these technical indicators to make it fulfill the limitations of human trades. In this research, we easier for them to forecast the market direction. propose a novel EA that performs an automatically trade In order to make a profit and be a successful trader in the following the trading strategy. Our trading strategy is the combination between technical analysis including the ancient Forex market, a trader requires a powerful trading strategy but powerful Japanese candlestick patterns and the modern and trades following the strategy. -

The Shooting Star Candlestick Pattern: Raining Profits from the Heavens

The Shooting Star Candlestick Pattern: Raining Profits From The Heavens The shooting star is a single bearish candlestick pattern that is common in technical analysis. The candle falls into the “hammer” group and is a first cousin of the – hanging man, hammer, and inverted hammer. If you’re unfamiliar with any of these patterns, check out our Quick Reference Guide. Our trading expert, Aiman Almansoori describes these patterns and how to trade them in a fantastic webinar. Be sure to follow our YouTube channel to watch more educational content like this. What is the Shooting Star Candle? The shooting star has a small body and a very long upper candle wick. As you see, the candle has a small body located in the lower part of the pattern. However, this also looks like an inverted hammer candle pattern. So, how can we distinguish the two? The answer to this question is hidden in the price direction before the creation of the candle. The shooting star candle is a reversal pattern of an upwards price move. The inverted hammer occurs at the end of a down trend. Shooting Star Confirmation If a stock is in a bullish uptrend and you identify a shooting star candle, then there is a solid chance that the trend will reverse. For this reason, traders use this candle to enter short trades on the assumption that the bullish move is running out of steam. shooting star candlestick potential Once you are able to identify the shooting star, you should look to open a short position on a break of the low of the candle. -

Index.Pdf (69.91KB)

26_178089 bindex.qxp 2/27/08 9:38 PM Page 329 Index • Symbols & • B • Numerics • bar charts candlestick chart, compared to, 19, 20, %K (fast) stochastic oscillators, 263 317–319 %D (slow) stochastic oscillators, 263 defined, 10, 27–28 5-day moving average, 253–254, 256, 257, single line, 28 258–260 on Web sites, 53 10-day moving average, 259–260 BEA Systems, 220 20-day moving average, 255, 256, 258–260 bear market, defined, 22 24-hour electronic trading Bear Stearns Companies, Inc., 147 high and low prices, futures, 36–37 bearish state volume, relationship to, 25 candlestick charting and patterns, 20–22, 30-minute chart, 74–75 279–290 200-day moving average, 253 closing price as body of candlestick, 38 defined, 96 double-stick patterns • A • dark cloud cover, 172–174 abandoned baby doji star, 167–168 bearish, 229–231 engulfing pattern, 156–158 bullish, 199–201 harami, 159–161 affordability and trading choices, 15 harami cross, 161–164 after-hours trading inverted hammer, 164–167 high and low prices, futures, 36–37 meeting line, 168–172 volume, relationship to, 25 neck lines, 180–183 Alcoa, 170, 171 piercing line, 172–174 Altera Corp., 304 separating lines, 178–180 Amazon.com, 269 thrusting lines, 175–177 American Express, 310–311 sell indicators, 279–290 American Stock Exchange (AMEX), 33, 68 single-stick pattern Amgen, Inc., 151–152 belt hold, 113 Analog Devices Inc., 206–207 doji, 90–94 Apple Computer, 93–94, 168, 169, 276, gravestone doji, 90–94 292–293 long black candle, 84–90 Applebee’s International, 221–222 long marubozus, 86–88 -

Does a Candlestick Strategy Have Its Value in the VIX Future Market?

國立中山大學 金融創新產業碩士專班 碩士論文 Industrial Technology Graduate Program in Financial Innovation National Sun Yat-sen University Master Thesis K 棒策略在 VIX 期貨市場中的價值 Does a candlestick strategy have its value in the VIX future market? 研究生:洪志穎 Chin-Ying Hung 指導教授:蔡維哲 博士 Dr. Wei-Che Tsai 中華民國 108 年 7 月 July 2019 論文審定書 i 摘要 本研究探討 K 棒策略在 VIX 期貨上是否能找尋到一些價值。本文蒐集了芝加哥 交易所(CBOE)VIX 期貨,並使用 9 種單根及 7 種雙根,總計 16 種的燭台策 略做為 VIX 期貨市場的交易策略。我們嘗試利用 6、8、10 個 K 棒持有區間推斷 有效預測週期。此外我們將 VIX 用到期日及指數分群,最後我們所得,到期日 30 天、31 至 60 天、61 至 90 天、VIX 指數 15.00 以下、VIX 指數 15.00 至 25.00 和 VIX 指數 25.00 以上的六種類別。實證結果發現,在日內 VIX 期貨市場中預 測區間建議 50 至 90 分鐘為主。在分群方面的結果發現,距離到期日 30 天內的 期貨相較於其他到期日區間較有顯著的獲利;VIX 指數低於 15.00 的情況相較於 其他分群,較有顯著的獲利。結果讓我們發現在 VIX 期貨市場中,K 棒策略在 近到期日及低 VIX 時較能反映期價值。 關鍵字: K 棒、燭台分析、技術分析、VIX 期貨 ii Abstract This study explores the potential value for a K-bar strategy in VIX futures trading. We collect the VIX futures historical transaction data from the Chicago Board Options Exchange (CBOE) with 9 kinds of single candlestick strategies and 7 kinds of double candlestick strategies, for a total of 16 candlestick strategies. During the back-testing phase, we utilize 6, 8, and 10 K-bar holding intervals to infer an effective prediction period and choose expiration day and index level in order to classify the VIX. Ultimately, we got six categories with above factor. The empirical results clearly recommend that the prediction interval in the VIX futures intraday market be 50 to 90 minutes. -

SHORT TERM PATTERNS Tradesmart Education Center

SHORT TERM PATTERNS TradeSmart Education Center TABLE OF CONTENTS Short Term Patterns . Bullish Patterns: …………………………………………………………………………………………………………… 2 Engulfing Line (Bullish)……………………………………………………………………………………….. 3 Exhaustion Bar (Bullish)……………………………………………………………………………………… 4 Gravestone (Bullish) ………………………………………………………………………………………….. 6 Hammer (Bullish) ………………………………………………………………………………………………. 7 . Inside Bar (Bullish)……………………………………………………………………………………………… 9 Inverted Hammer………………………………………………………………………………………………. 11 Island Bottom ……………………………………………………………………………………………………. 12 . Key Reversal Bar (Bullish)…………………………………………………………………………………… 13 Outside Bar (Bullish)…………………………………………………………………………………………… 15 Two Bar Reversal (Bullish)………………………………………………………………………………… 17 . Bearish Patterns……………………………………………………………………………………………………………. 19 Engulfing Line (Bearish) ……………………………………………………………………………………… 20 Exhaustion Bar (Bearish) ……………………………………………………………………………………. 21 Gravestone (Bearish)………………………………………………………………………………………….. 23 Hanging Man……………………………………………………………………………………………………… 24 Inside Bar (Bearish) ……………………………………………………………………………………………. 26 Island Top…………………………………………………………………………………………………………… 28 Key Reversal Bar (Bearish) …………………………………………………………………………………. 29 . Outside Bar (Bearish) ………………………………………………………………………………………… 31 Shooting Star……………………………………………………………………………………………………… 33 Two Bar Reversal (Bearish)…………………………………………………………………………………. 34 Other Patterns………………………………………………………………………………………………………………. 36 Gap Down………………………………………………………………………………………………………….. 37 Gap up………………………………………………………………………………………………………………. -

Candlestick Trading for Maximum Profits Netpicks.Com

Candlestick Trading For Maximum Profits NetPicks.com Copyright © 2017 All Rights Reserved CONTENTS Earnings Disclaimer ......................................................................................................................... 4 Introduction .................................................................................................................................... 5 The Candlestick Purist ................................................................................................................. 6 The Email ..................................................................................................................................... 6 Let’s Get Started! ........................................................................................................................ 8 The Basic Candle ............................................................................................................................. 8 Parts of a Candle ......................................................................................................................... 9 The Story A Candle Tells ................................................................................................................ 11 The First Tick ............................................................................................................................. 12 Important Candles ........................................................................................................................ 13 Long and Short Days ................................................................................................................ -

Doji and Pin Bars

Doji and Pin Bars The lesson on the Doji and Pin Bars is combined because they basically represent the same thing and it is the most important concept in the Delta 1-2-3 trade. The Doji and the Pin Bar represent indecision in the marketplace. In other words, the market doesn't know if it wants to go up or down so it ends up at the same price (Doji), or nearly the same price (Pin Bar). A Doji is a candlestick that has no real body color. It looks like a cross and is formed when the opening price and the closing price are the same price. A Pin Bar look like a Doji but there is a little bit of a price difference. What is important is the length of the wick (also called the leg or shadow) The longer the wick of the Doji in one direction the more significant of a price rejection just took place and the more significant the indecision is in the marketplace. Doji Candlestick Patterns: Pin Bar Candlestick Patterns Common Star Long Wicked Dragonfly Gravestone Hammer/ Inverted Hammer Shooting Star Hanging Man Indecision represents the end of a short-term trend The stronger the price rejection the more likely that there will be a price movement in the opposite direc- tion. However, just because you have a Doji or Pin Bar, doesn’t necessary mean that the price will change. On the chart there will be a colored line beneath the Doji or Pin Bar indicating the direction of the price rejection, if the price is rejected in an upward movement the line beneath the candlestick will be green. -

Candlestick Ebook Join Free Telegram Today!

STOCK SNIPER TRADING FREE CANDLESTICK EBOOK JOIN FREE TELEGRAM TODAY! FREE CONTENT DAILY W E H A V E B E E N T R A D I N G T H E F O R E X A N D S T O C K M A R K E T S F O R 2 5 + Y E A R S . O U R S P E C I A L T Y I S F O R E X T R A D I N G A S W E L I K E T H E L U X U R Y I T G I V E S Y O U B Y B E I N G A B L E T O T R A D E 2 4 H O U R S . W H Y W E S T A R T E D T H I S C O M P A N Y W A S T O S H O W T H E P E O P L E T H A T L E A R N I N G T H E F O R E X M A R K E T I S V E R Y P O S S I B L E , A N D H O W P O W E R F U L I T C A N B E O N C E Y O U L E A R N T H E C O R E C O N C E P T S . -

Ifmc Institute

IFMC INSTITUTE COURSE BROCHURE IFMC BRANCHES LAJPAT NAGAR VAISHALI NORTH CAMPUS GHAZIABAD NOIDA (DELHI) (DELHI) ND E-90, PLOT No. 3, 2 FLOOR, SHOP No. 3, VIJAY BASEMENT, FIRST FLOOR, RELIANCE PLAZA 2 NAGAR, HUDSON MAAN SINGH COMPLEX, LAJPAT NAGAR 1, MAIN MARKET LANE, KINGSWAY SECTOR 15 MAIN ROAD, NEW DELHI - 110024 SECTOR 4, VAISHALI, CAMP, OPPOSITE NEXT TO BHAGMAL GHAZIABAD - 201012 NDPL OFFICE, COMPLEX, NEAR Mc NEAR SHIV MANDIR, DONALD SECTOR 16, NEW DELHI - 110009 NOIDA – 201301 PH: +91-981-021-6889 PH: +91-120-437-7006 +91-981-026-0089 PH: +91-981-026-0089 PH: +91-981-021-6889 CONTENTS Stock Market Course for Traders ............................................................................................................ 3 Unique Feature of Stock Market Course for Traders .......................................................................... 3 What You Will Get ............................................................................................................................... 4 Fees and Duration ............................................................................................................................... 4 Detail Curriculum ................................................................................................................................ 4 Module 1: capital market & its operation ....................................................................................... 4 Module 2: Derivatives Market & its Operations ............................................................................