Nifty Outlook & Learn How to Improve Short Term Accuracy in Nifty Trades by Correlating Volatility Index (VIX) and Put Call Ratio (PCR)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Estimating 90-Day Market Volatility with VIX and VXV

Estimating 90-Day Market Volatility with VIX and VXV Larissa J. Adamiec, Corresponding Author, Benedictine University, USA Russell Rhoads, Tabb Group, USA ABSTRACT The CBOE Volatility Index (VIX) has historically been a consistent indicator of 30-day or 1-month (21-day actual) realized market volatility. In addition, the Chicago Board Options Exchange also quotes the CBOE 3-Month Volatility Index (VXV) which indicates the 3-month realized market volatility. This study demonstrates both VIX and VXV are still reliable indicators of their respective realized market volatility periods. Both of the indexes consistently overstate realized volatility, indicating market participants often perceive volatility to be much higher than volatility actually is. The overstatement of expected volatility leads to an indicator which is consistently higher. Perceived volatility in the long-run is often lower than volatility in the short-run which is why VXV is often lower than VIX (VIX is usually lower than VXV). However, the accuracy of the VXV is roughly 35% as compared with the accuracy of the VIX at 60.1%. By combining the two indicators to create a third indicator we were able to provide a much better estimate of 64-Day Realized volatility, with an accuracy rate 41%. Due to options often being over-priced, historical volatility is often higher than both realized volatility or the volatility index, either the VIX or the VXV. Even though the historical volatility is higher we find the estimated historical volatility to be more easily estimated than realized volatility. Using the same time period from January 2, 2008 through December 31, 2016 we find the VIX estimates the 21-Day Historical Volatility with 83.70% accuracy. -

Copyrighted Material

Index 12b-1 fee, 68–69 combining with Western analysis, 3M, 157 122–123 continuation day, 116 ABC of Stock Speculation, 157 doji, 115 accrual accounting, 18 dragonfl y doji, 116–117 accumulated depreciation, 46–47 engulfi ng pattern, 120, 121 accumulation phase, 158 gravestone doji, 116, 117, 118 accumulation/distribution line, hammer, 119 146–147 hanging man, 119 Adaptive Market Hypothesis, 155 harami, 119, 120 Altria, 29, 127, 185–186 indicators 120 Amazon.com, 151 long, 116, 117, 118 amortization, 47, 49 long-legged doji, 118 annual report, 44–46 lower shadow, 115 ascending triangle, 137–138, 140 marubozu, 116 at the money, 192 real body, 114–115 AT&T, 185–186 segments illustrated, 114 shadows, 114 back-end sales load, 67–68 short,116, 117 balance sheet, 46–50 spinning top, 118–119 balanced mutual funds, 70–71 squeeze alert, 121, 122, 123 basket of stocks, 63 tails, 114 blue chip companies, 34 three black crows, 122, 123 Boeing, 134–135 three white soldiers, 122, 123 book value, 169 trend-based, 117–118 breadth, 82–83, 97 upper shadow, 115 breakaway gap, 144 wicks, 114 break-even rate, 16–17 capital assets, 48, 49 breakout, 83–84, 105–106 capitalization-based funds, 71 Buffett, Warren, 152 capitalization-weighted average, 157 bull and bear markets,COPYRIGHTED 81, 174–175 Caterpillar, MATERIAL 52–54, 55, 57, 58, 59, 131 Bureau of Labor Statistics (BLS), 15 CBOE Volatility Index (VIX), 170, 171 Buy-and-hold strategy, 32, 204–205 Chaikin Money Flow (CMF), 146 buy to open/sell to open, 96 channel, 131–132 charting calendar spreads, 200–201 -

Asset Allocation POINT WHAT DOES a LOW VIX TELL US June 2017 ABOUT the MARKET? Timely Intelligence and Analysis for Our Clients

PRICE Asset Allocation POINT WHAT DOES A LOW VIX TELL US June 2017 ABOUT THE MARKET? Timely intelligence and analysis for our clients. KEY POINTS . The financial press has been paying considerable attention lately to the Chicago Board Options Exchange Volatility Index (VIX), with many financial pundits citing recent low readings on the VIX as evidence of investor complacency and rising equity risk. Robert Harlow, CFA, CAIA . Quantitative Analyst Media coverage often implies that a low current VIX is a strong signal of expected Asset Allocation future volatility and will be followed by a sell-off in U.S. equities and other risk-seeking assets. Historical evidence shows that, over the near term, investors typically overestimate the next 30-day volatility of the S&P 500 Index. Further, when the VIX has been low, U.S. equities have outperformed U.S. bonds on average over the next 12 months, regardless of the change in the VIX over that horizon. Without a meaningful and prolonged catalyst, we do not believe a low level of the VIX David Clewell, CFA alone implies investor complacency or an immediate danger of a risk-off event. Research Analyst Asset Allocation BACKGROUND There has been much discussion in the financial press recently about the danger of investor complacency—with a low VIX frequently cited as compelling evidence that equity investors have grown too relaxed about potential risks. The problem is that it is difficult to determine whether markets are truly complacent or not; we can’t survey all investors and, even if we could, how many investors would admit that they were complacent? Instead, we take a mental shortcut and presume that something we can measure is a good proxy for the thing we actually care about. -

Stock Market Explained

Stock Market Explained A Beginner's Guide to Investing and Trading in the Modern Stock Market © Ardi Aaziznia www.PeakCapitalTrading.com Copyrighted Material © Peak Capital Trading CHAPTER 1 Copyrighted Material © Peak Capital Trading Figure 1.1: “covid-19” and “stock market” keyword Google search trends between April 2019 and April 2020. As you can see, there is a clear correlation. As the stock market drop hit the news cycles, people started searching more and more about the stock market in Google! Copyrighted Material © Peak Capital Trading COVID-19 Bear Market 2019 Bull Market 2020 recession due to pandemic v Figure 1.2: Comparison between the bull market of 2019 and the bear market of 2020, as shown by the change in share value of 500 of the largest American companies. These companies are tracked by the S&P 500 and are traded in an exchange-traded fund known as the SPDR S&P 500 ETF Trust (ticker: SPY). For your information, S&P refers to Standard & Poor’s, one of the indices which used to track this information. Copyrighted Material © Peak Capital Trading Figure 1.3: How this book is organized. Chapters 1-4 and 7-11 are written by me. Chapters 5 and 6 on day trading are written by Andrew Aziz. Copyrighted Material © Peak Capital Trading CHAPTER 2 Copyrighted Material © Peak Capital Trading Figure 2.1: The return on investing $100 in an exchange-traded fund known as the SPDR S&P 500 ETF Trust (ticker: SPY) (which tracks the share value of 500 of the largest American companies (as rated by the S&P 500)) vs. -

Futures & Options on the VIX® Index

Futures & Options on the VIX® Index Turn Volatility to Your Advantage U.S. Futures and Options The Cboe Volatility Index® (VIX® Index) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index® (SPX) option prices. Since its introduction in 1993, the VIX® Index has been considered by many to be the world’s premier barometer of investor sentiment and market volatility. To learn more, visit cboe.com/VIX. VIX Futures and Options Strategies VIX futures and options have unique characteristics and behave differently than other financial-based commodity or equity products. Understanding these traits and their implications is important. VIX options and futures enable investors to trade volatility independent of the direction or the level of stock prices. Whether an investor’s outlook on the market is bullish, bearish or somewhere in-between, VIX futures and options can provide the ability to diversify a portfolio as well as hedge, mitigate or capitalize on broad market volatility. Portfolio Hedging One of the biggest risks to an equity portfolio is a broad market decline. The VIX Index has had a historically strong inverse relationship with the S&P 500® Index. Consequently, a long exposure to volatility may offset an adverse impact of falling stock prices. Market participants should consider the time frame and characteristics associated with VIX futures and options to determine the utility of such a hedge. Risk Premium Yield Over long periods, index options have tended to price in slightly more uncertainty than the market ultimately realizes. Specifically, the expected volatility implied by SPX option prices tends to trade at a premium relative to subsequent realized volatility in the S&P 500 Index. -

The Best Candlestick Patterns

Candlestick Patterns to Profit in FX-Markets Seite 1 RISK DISCLAIMER This document has been prepared by Bernstein Bank GmbH, exclusively for the purposes of an informational presentation by Bernstein Bank GmbH. The presentation must not be modified or disclosed to third parties without the explicit permission of Bernstein Bank GmbH. Any persons who may come into possession of this information and these documents must inform themselves of the relevant legal provisions applicable to the receipt and disclosure of such information, and must comply with such provisions. This presentation may not be distributed in or into any jurisdiction where such distribution would be restricted by law. This presentation is provided for general information purposes only. It does not constitute an offer to enter into a contract on the provision of advisory services or an offer to buy or sell financial instruments. As far as this presentation contains information not provided by Bernstein Bank GmbH nor established on its behalf, this information has merely been compiled from reliable sources without specific verification. Therefore, Bernstein Bank GmbH does not give any warranty, and makes no representation as to the completeness or correctness of any information or opinion contained herein. Bernstein Bank GmbH accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this presentation. This presentation may contain forward- looking statements of future expectations and other forward-looking statements or trend information that are based on current plans, views and/or assumptions and subject to known and unknown risks and uncertainties, most of them being difficult to predict and generally beyond Bernstein Bank GmbH´s control. -

COVID-19 Update Overview

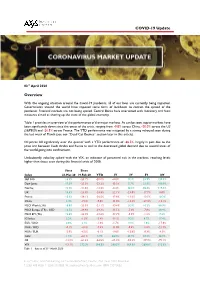

COVID-19 Update 03rd April 2020 Overview With the ongoing situation around the Covid-19 pandemic, all of our lives are currently being impacted. Governments around the world have imposed some form of lockdown to contain the spread of the pandemic. Financial markets are not being spared. Central Banks have intervened with monetary and fiscal measures aimed at shoring up the state of the global economy. Table 1 provides an overview of the performance of the major markets. As can be seen, equity markets have been significantly down since the onset of the crisis, ranging from -9.8% across China, -20.0% across the US (S&P500) and -26.5% across France. The YTD performance was mitigated by a strong rebound seen during the last week of March (see our “Dead Cat Bounce” section later in this article). Oil prices fell significantly over the quarter with a YTD performance of -66.5%, largely in part due to the price war between Saudi Arabia and Russia as well as the decreased global demand due to several areas of the world going into confinement. Undoubtedly volatility spiked with the VIX, an indicator of perceived risk in the markets, reaching levels higher than those seen during the financial crisis of 2008. Since Since Index 23-Mar-20 19-Feb-20 YTD 1Y 3Y 5Y 10Y S&P 500 15.5% -23.7% -20.0% -8.8% 9.1% 23.9% 120.3% Dow Jones 17.9% -25.3% -23.2% -15.5% 5.7% 21.9% 100.9% Nasdaq 12.2% -21.6% -14.2% -0.4% 30.2% 55.6% 219.4% UK 13.6% -23.9% -24.8% -22.1% -23.0% -17.7% 0.0% France 12.3% -28.1% -26.5% -17.8% -13.6% -13.5% 10.3% China 3.4% -7.6% -9.8% -11.0% -

Trading System Development

Trading System Development An Interactive Qualifying Project Submitted to the Faculty of WORCESTER POLYTECHNIC INSTITUTE In partial fulfillment of the requirements for the Degree of Bachelor of Science By Brian O’Day Dylan Stimson Branden Diniz Submitted to: Prof. Michael Radzicki (advisor) Prof. Hossein Hakim (co-advisor) May 9, 2015 Abstract The purpose of this project was to construct a system of trading systems that would demonstrate a successful long term return on investment across different market conditions. The team was given $300,000 to distribute amongst three scientifically developed systems on the TradeStation platform provided by our advisors. The strategies were designed to incorporate both technical and fundamental data as well as trade diverse markets. The resulting cultivation of systems involved the use of two automated trading strategies and one manual trading strategy that showed substantial profits in the long term. 1 Acknowledgments We would like to thank Professor Radzicki and Professor Hakim for their guidance and support throughout the course of the project. We would also like to thank TradeStation for providing us with a platform for trading that made this project possible. 2 Authorship Page Introduction - Brian Problem Statement - Brian Overview of Systems - All Foundations of Trading and Investing Trading vs Investing - Branden Types of Exchanges - Branden, Dylan Investment Funds - Dylan Types of Orders - Dylan Market Conditions - Dylan Trading different Time Frames - Brian, Branden Costs of Trading/Investing -

Candlestick Patterns

INTRODUCTION TO CANDLESTICK PATTERNS Learning to Read Basic Candlestick Patterns www.thinkmarkets.com CANDLESTICKS TECHNICAL ANALYSIS Contents Risk Warning ..................................................................................................................................... 2 What are Candlesticks? ...................................................................................................................... 3 Why do Candlesticks Work? ............................................................................................................. 5 What are Candlesticks? ...................................................................................................................... 6 Doji .................................................................................................................................................... 6 Hammer.............................................................................................................................................. 7 Hanging Man ..................................................................................................................................... 8 Shooting Star ...................................................................................................................................... 8 Checkmate.......................................................................................................................................... 9 Evening Star .................................................................................................................................... -

© 2012, Bigtrends

1 © 2012, BigTrends Congratulations! You are now enhancing your quest to become a successful trader. The tools and tips you will find in this technical analysis primer will be useful to the novice and the pro alike. While there is a wealth of information about trading available, BigTrends.com has put together this concise, yet powerful, compilation of the most meaningful analytical tools. You’ll learn to create and interpret the same data that we use every day to make trading recommendations! This course is designed to be read in sequence, as each section builds upon knowledge you gained in the previous section. It’s also compact, with plenty of real life examples rather than a lot of theory. While some of these tools will be more useful than others, your goal is to find the ones that work best for you. Foreword Technical analysis. Those words have come to have much more meaning during the bear market of the early 2000’s. As investors have come to realize that strong fundamental data does not always equate to a strong stock performance, the role of alternative methods of investment selection has grown. Technical analysis is one of those methods. Once only a curiosity to most, technical analysis is now becoming the preferred method for many. But technical analysis tools are like fireworks – dangerous if used improperly. That’s why this book is such a valuable tool to those who read it and properly grasp the concepts. The following pages are an introduction to many of our favorite analytical tools, and we hope that you will learn the ‘why’ as well as the ‘what’ behind each of the indicators. -

Identifying Chart Patterns with Technical Analysis

746652745 A Fidelity Investments Webinar Series Identifying chart patterns with technical analysis BROKERAGE: TECHNICAL ANALYSIS BROKERAGE: TECHNICAL ANALYSIS Important Information Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Investing involves risk, including risk of loss. Past performance is no guarantee of future results Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in pe riods of market volatility. Stop loss orders could be triggered by price swings and could result in an execution well below your trigg er price. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Trailing stop orders are held on a separat e, internal order file, place on a "not held" basis and only monitored between 9:30 AM and 4:00 PM Eastern. Technical analysis focuses on market action – specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Past performance is no guarantee of future results. -

Trade Clustering and Power Laws in Financial Markets

Theoretical Economics 15 (2020), 1365–1398 1555-7561/20201365 Trade clustering and power laws in financial markets Makoto Nirei Graduate School of Economics, University of Tokyo John Stachurski Research School of Economics, Australian National University Tsutomu Watanabe Graduate School of Economics, University of Tokyo This study provides an explanation for the emergence of power laws in asset trad- ing volume and returns. We consider a two-state model with binary actions, where traders infer other traders’ private signals regarding the value of an asset from their actions and adjust their own behavior accordingly. We prove that this leads to power laws for equilibrium volume and returns whenever the number of traders is large and the signals for asset value are sufficiently noisy. We also provide nu- merical results showing that the model reproduces observed distributions of daily stock volume and returns. Keywords. Herd behavior, trading volume, stock returns, fat tail, power law. JEL classification. G14. 1. Introduction Recently, the literature on empirical finance has converged on a broad consensus: Daily returns on equities, foreign exchange, and commodities obey a power law. This striking property of high-frequency returns has been found across both space and time through a variety of statistical procedures, from conditional likelihood methods and nonpara- metric tail decay estimation to straightforward log-log regression.1 A power law has also been found for trading volume by Gopikrishnan et al. (2000)andPlerou et al. (2001). Makoto Nirei: [email protected] John Stachurski: [email protected] Tsutomu Watanabe: [email protected] We have benefited from comments by the anonymous referees, Daisuke Oyama, and especially Koichiro Takaoka.