KPMG FIPS Survey 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021Febmarrs

NEW ZEALAND: USPP: LONG-TERM VIEW DEBT STRATEGISTS: RBA MARKET COMES BACK AND SUSTAINABILITY ON GRAVITATIONAL PULL TOGETHER IN PERSON MARKET AGENDA DEFINES MARKET ORBIT VOLUME 16 ISSUE 123 _ FEB/MAR 2021 www.kanganews.com AUSTRALIAN CREDIT CHANGES SHAPE A RAFT OF FACTORS HAVE ALTERED THE AUSTRALIAN CREDIT-ISSUANCE LANDSCAPE FOR THE MEDIUM TERM AT LEAST. LOCAL ASSET MANAGERS SAY THEIR MARKET REMAINS FUNCTIONAL AND INVESTABLE, THOUGH. Australian Securitisation Deal of the Year The $12bn AUM La Trobe Financial group is honoured to be recognised by peers and the Australia debt capital markets community for our $1.25 billion RMBS transaction in May 2020. Widely hailed as effectively re-opening Australian securitisation markets, the transaction saw support from global investment houses in Asia, the US and Europe and from Australian institutional investors. We thank KangaNews for this award, as well as our local and global investment partners and clients for their continued trust and support over the past seven decades. We also thank the team at the Australian Office of Financial Management for their invaluable support for the industry as a whole at a time of unprecedented market volatility. Australian Securitisation Deal of the Year 13 80 10 | latrobefinancial.com La Trobe Financial Custody & Securitisation Services Pty Limited ACN 141 583 191 Australian Financial Services License 379454 La Trobe Financial Services Pty Ltd ACN 006 479 527 Australian Credit Licence 392385 KangaNews FEB/MAR 2021 EDITION VOLUME 16 ISSUE 123 www.kanganews.com Contents COVER STORY Head of content and editor Australian credit LAURENCE DAVISON [email protected] changes shape Deputy editor 29 MATT ZAUNMAYR The Australian dollar credit market has been reshaped in the [email protected] wake of COVID-19, largely as a consequence of RBA market Staff writer CHRIS RICH intervention. -

Connections & Collaboration

APCA Annual Review 2016 The Australia Payments Environment Connections & Collaboration APCA Annual Review 2016 Australian Payments Clearing Association 1 APCA Annual Review 2016 Connections & Collaboration Click here to return to Contents Contents Chair and CEO Message 3 The Australian Payments Clearing Snapshot 4 Association has Highlights 6 been at the heart of the Australian The Australia Payments Environment 7 payments system for Driving Payments 10 close to 25 years. Evolution As a member organisation and industry association, we have grown to represent the needs of a diverse set of stakeholders, as the payments system itself has evolved. With a clear understanding of the requirements Positioned for 14 of a digital economy, we are the home for the Future collaboration and cross industry innovation. In our role as self-regulatory body for payments, we bring rigour to the application of existing regulation and an inquisitive, front-footed Engaging with approach to supporting the requirements the Community 18 of the emerging payments landscape. Decision Making 22 Glossary & Contact 29 APCA has 103 members including Australia’s leading financial institutions major retailers, payments system This Annual Review is designed to provide our members and stakeholders with a summary of what was achieved operators and other in financial year 2015-2016. References in this report to payments service providers. a year are to financial year ended 30 June 2016 unless otherwise stated. A full list of our members is available on page 28. Australian Payments Clearing Association 2 APCA Annual Review 2016 Connections & Collaboration Chair and CEO message The Australian payments landscape has never been more vibrant and it’s for this reason that we have chosen the theme of ‘connections and collaboration’ for our annual report this year. -

List of Correspondent Banks Asia & Oceania

LIST OF CORRESPONDENT BANKS ASIA & OCEANIA ASIA SINGAPORE 1 ABN Amro Bank N.V. ABNA SG 2A 2 Arab Bank PLC ARAB SG SG 3 Australia & New Zealand Banking Group Ltd. ANZB SG SX 4 Bangkok Bank, Singapore BKKB SG SG 5 Bank of America NA BOFA SG 2X 6 Bank of China Ltd. BKCH SG SG 7 Bank of New York Mellon, THE IRVT SG SX 8 Bank of Nova Scotia, Singapore NOSC SG SG 9 Bank of Tokyo Mitsubishi UFJ, Ltd., THE BOTK SG SX 10 BNP Paribas BNPA SG SG / GEBA SG SG 11 BNP Paribas Wealth Management BPPB SG SG 12 Canadian Imperial Bank of Commerce CIBC SG SG 13 Chinatrust Commercial Bank, Singapore Branch CTCB SG SG 14 CIMB Bank Berhad CIBB SG SG 15 Citibank NA CITI SG SG 16 Commerzbank AG COBA SG SX 17 Credit Agricole Corporate and Investment Bank CRLY SG SG 18 Credit Suisse CRES SG SG 19 Credit Suisse AG, SINGAPORE PRIVATE BANKING CSPB SG SG 20 DBS Bank DBSS SG SG 21 Deutsche Bank AG DEUT SG SG 22 DNB Nor Bank ASA DNBA SG SG 23 Hongkong & Shanghai Banking Corporation Ltd., THE HSBC SG SG 24 HSBC Private Bank BLIC SG SX 25 HSH Nordbank HSHN SG SG 26 Hua Nan Commercial Bank HNBK SG SG 27 ING Bank N.V. INGB SG SG 28 Intesa SanPaolo S.P.A. BCIT SG SG 29 JP Morgan Chase Bank NA CHAS SG SG 30 KBC Bank, Singapore KRED SG SX 31 Landesbank Baden Wurttemberg SOLA SG SG 32 Malayan Banking Berhad MBBE SG SG 33 Mizuho Corporate Bank Ltd. -

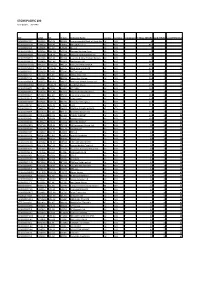

I-Select Superannuation Scheme | 30 September 2020 IOS I-Select Superannuation Scheme

i-Select Superannuation Scheme | 30 September 2020 IOS i-Select Superannuation Scheme Investment Options Supplement 30 September 2020 IOS Issued by i-Select Limited This Investment Options Supplement is provided under the terms of an exemption that the i-Select Superannuation Scheme has from some of the provisions of the Financial Markets Conduct Act 2013 and Financial Markets Conduct Regulations 2014. You can find a copy of the exemption notice on FMA’s website at www.fma.govt.nz/compliance/exemptions. 1 i-select.co.nz i-Select Superannuation Scheme | 30 September 2020 IOS Description of your Please note that: investment options • any changes to the investment options will only be updated quarterly; and A description of the investment options that • any changes to the estimated total annual fund charges, other charges are currently available to Members, and the and any individual action fees in estimated annual fund charges for those respect of each investment option investment options, is set out in the table below. will only be updated annually. • further possible investment options are available for Annual Scheme Charges selection by a Member after consultation with their Manager’s fee 0.4% Authorised Financial Adviser. Scheme expenses (from 01/12/20)* 0.06% Total 0.46% * Scheme expenses include estimates of the Scheme’s accountancy, audit and Supervisor’s fees. These are re-estimated each year for the following year and may, therefore, change without notice. Custodian Brokerage Fees Aegis/ICSL FNZ Investment type Other charges NZX Shares 0.35% min $24.95 NZD 0.30% min $30 NZD Bank fees may apply where the plus Trade Fee $4.50 plus Trade Fee $10 Manager has to move member funds between accounts, such NZX Fixed Interest 0.25% min $25 NZD 0.25% min $30 NZD as from the Scheme’s trust plus Trade Fee $10 account to the Custodian. -

STOXX PACIFIC 100 Selection List

STOXX PACIFIC 100 Last Updated: 20210401 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 99 1 2 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 86.5 2 1 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 78 3 3 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 58 4 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 55.6 5 5 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 52 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 38.7 7 7 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 33.5 8 8 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 32.5 9 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 26.6 10 9 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 26.2 11 12 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 23.6 12 13 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 22.5 13 11 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 19.7 14 15 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD Y 16.1 15 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 15 16 16 AU000000ALL7 6253983 ALL.AX 605156 Aristocrat Leisure Ltd. -

Fixed Interest Daily Rate Sheet

Thursday 30 September 2021 Fixed Interest Daily Rate Sheet Government Bonds Rating Issuer Code Maturity Coupon Int Yield Price Min %pa Freq %pa ($) ($) AAA GB0423 15/04/2023 5.500% 2 0.99% 1.0941 10000 0800 272Sovereign 442 Debt / craigsip.com Securities AAA GB0524 15/05/2024 0.500% 2 1.23% 0.9832 10000 Sovereign Debt Securities AAA GB0425 15/04/2025 2.750% 2 1.37% 1.0603 10000 A disclosureSovereign statement Debt Securities is available on AAA GB0526 15/05/2026 0.500% 2 1.53% 0.9562 10000 request and free ofSovereign charge. Debt Please Securities AAA GB0427 15/04/2027 4.500% 2 1.61% 1.1734 10000 contactSovereign your Adviser.Debt Securities AAA GB0528 15/05/2028 0.250% 2 1.74% 0.9082 10000 Sovereign Debt Securities AAA GB0429 20/04/2029 3.000% 2 1.82% 1.0965 10000 Sovereign Debt Securities AAA GB0531 15/05/2031 1.500% 2 1.95% 0.9665 10000 Sovereign Debt Securities 1 yr swap 1.09% 5 yr swap 1.86% 7 yr swap 2.06% Local Authority Bonds Rating Issuer Code Maturity Coupon Int Yield Price Min Security Type %pa Freq %pa ($) ($) AAA NZ Local Govt Funding Agency LGF090 14/04/2022 2.750% 2 0.79% 1.0233 10000 Unsecured Unsubordinated Debt Securities AA- Christchurch City Holdings CCH010 6/12/2022 3.400% 2 1.30% 1.0354 5000 Unsecured Unsubordinated Debt Securities AAA NZ Local Govt Funding Agency LGF050 15/04/2023 5.500% 2 1.28% 1.0895 10000 Unsecured Unsubordinated Debt Securities AA Auckland Council AKC070 25/03/2024 5.806% 2 1.65% 1.1018 5000 Secured Unsubordinated Debt Securities AAA NZ Local Govt Funding Agency LGF100 15/04/2024 2.250% 2 1.57% -

KPMG FIPS Survey 2016

FIPS Financial Institutions Performance Survey Review of 2016 February 2017 kpmg.com/nz Contents 2 The Survey 88 Non-banks industry overview 4 A KPMG view from the editor 90 Non-banks – Industry overview 8 Banking industry overview 98 Looking back at the non-bank sector 10 Registered banks – Industry overview 100 Non-banks – Timeline of events 22 Registered banks – Timeline of events 102 Financial Services Federation 26 Registered banks – Sector performance 104 Non-banks – Sector performance 38 Registered banks – Analysis of annual results 112 Where is P2P lending at today? 46 Major banks – Quarterly analysis 114 Non-banks – Analysis of annual results 50 Review of bank directors’ attestation regime 118 Cyber security: It’s not just about technology 52 Sustainable performance requires good conduct 124 Registered banks – ownership and credit ratings 54 More legislation? Success is all about 125 Non-banks – Credit ratings customer-centricity 126 Non-banks – Ownership 58 Transforming the agri-food industry 127 Descriptions of the credit rating grades 62 Customers drive banking innovation 128 Definitions 64 Get ready to embrace digital disruption 129 Endnotes 66 Blockchain – time to understand the value 132 KPMG’s Financial Services Team 70 IFRS 9 – Rising to the challenge 134 Contact us 74 Generating a leading house price index 78 Productivity is a strategic imperative for New Zealand banks 80 What FATCA, GATCA and other tax changes will mean 82 Banking industry forecasts KPMG’s Financial Services team provides focused and practical audit, tax and advisory services to the insurance, retail banking, corporate and investment banking, and investment management sectors. -

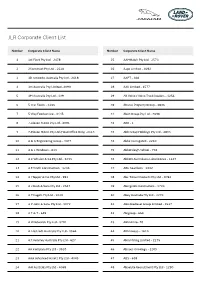

JLR Corporate Client List

JLR Corporate Client List Number Corporate Client Name Number Corporate Client Name 1 1st Fleet Pty Ltd - 2478 25 AAMHatch Pty Ltd - 2573 2 2Construct Pty Ltd - 2620 26 Aapc Limited - 4092 3 3D networks Australia Pty Ltd - 2618 27 AAPT - 468 4 3m Australia Pty Limited -4090 28 AAV Limited - 1577 5 3M Australia Pty Ltd - 139 29 AB Volvo / Volvo Truck Dealers - 1256 6 5 Star Foods - 3166 30 Abacus Property Group - 3036 7 5 Way Foodservice - 3145 31 Abah Group Pty Ltd - 2698 8 7-eleven Stores Pty Ltd - 4091 32 ABB - 1 9 7-Eleven Stores Pty Ltd (Head Office Only) -2113 33 Abb Group Holdings Pty Ltd - 4093 10 A & G Engineering Group - 3473 34 Abbe Corrugated - 2210 11 A & L Windows - 613 35 Abbotsleigh School - 702 12 A C Whalan & Co Pty Ltd - 3233 36 Abbott Australasia Laboratories - 1247 13 A E Smith Construction - 1236 37 ABC Seamless - 1002 14 A I Topper & Co. Pty Ltd - 991 38 Abc Tissue Products Pty Ltd - 4094 15 A J Bush & Sons Pty Ltd - 2647 39 Abergeldie Contractors - 1724 16 A P Eagers Pty Ltd - 3020 40 Abey Australia Pty Ltd - 3270 17 A P John & Sons Pty Ltd - 1072 41 ABG Biodiesel Group Limited - 1537 18 A T & T - 649 42 Abigroup - 650 19 A W Edwards Pty Ltd - 3701 43 ABN Amro -70 20 A. Hartrodt Australia Pty Ltd - 3564 44 ABN Group - 1610 21 A.T. Kearney Australia Pty Ltd - 627 45 Abra Mining Limited - 2275 22 AA Company Pty Ltd - 3510 46 Abraxis Oncology - 2209 23 AAA Advanced Assets Pty Ltd - 4045 47 ABS - 638 24 AAI Australia Pty Ltd - 4068 48 Absolute Recruitment Pty Ltd - 1290 JLR Corporate Client List Number Corporate Client -

Macquarie Group Annual Report 2020

MACQUARIE GROUP ANNUAL REPORT Year ended 31 March 2020 For personal use only MACQUARIE GROUP LIMITED ACN 122 169 279 Macquarie is a global financial services group operating in 31 markets in asset management, retail and business banking, wealth management, leasing and asset financing, market access, commodity trading, renewables development, investment banking and principal investment. 2020 Annual General Meeting Macquarie Group Limited’s 2020 AGM will be held at 10:30 am on Thursday, 30 July 2020 at the Sofitel Sydney Wentworth, Wentworth Ballroom, 61–101 Phillip St, Sydney NSW 2000 and may be held as a hybrid or virtual meeting with online facilities to comply with any COVID‑19 restrictions. Details of the business of the meeting will be forwarded to shareholders separately. We are closely monitoring the COVID‑19 pandemic and, depending on government restrictions in place at the time the meeting is held, the meeting venue may be changed. For personal use only Shareholders should refer to the Macquarie website and any ASX announcement concerning the venue of the meeting. Cover image Macquarie is one of the largest agricultural investment managers in the world. Located in Western Australia, the Tantanoola property – operated by Macquarie‑managed Viridis Ag – grows grains such as wheat, barley, lupins and canola. For personal use only 0102 About Governance Contents About Macquarie 7 Corporate Governance 30 Letter from the Chairman 8 Diversity & Inclusion 38 Letter from the Managing Director Environmental, Social and Governance 42 and CEO -

Australia Trade & Supply Chain Finance Conference

2nd Annual Australia Trade & Supply Chain Finance Conference Sydney, Australia | Sheraton on the Park March 2-3, 2015 Delegate pack #GTRAU Name: Company: Arthur J. Gallagher, a market leader in the provision of Trade Credit, Surety & Political Risk solutions. Experienced, dedicated insurance professionals with offices in Sydney, Melbourne, London, New York and Singapore: To find out more contact: Michael Woodward Ewan Berkemeier Frank Barbuto National Practice Leader Client Manager - Practice Leader Trade Credit and Political Risk Surety and Financial Products Trade Credit D: +61 2 9242 2003 D: +61 2 9242 2045 D: +61 3 9412 1251 M: +61 417 231 115 M: +61 409 806 928 M: +61 417 769 827 E: [email protected] E: [email protected] E: [email protected] Level 12, 201 Miller St Level 12, 201 Miller St 289 Wellington Pde South North Sydney NSW 2060 North Sydney NSW 2060 East Melbourne VIC 3002 430198_ANZ GLOBAL TRADE REVIEW MAGAZINE PRESS AD_91386.indd 1 16/02/2015 3:40 pm INTELLIGENT PROTECTION AGAINST FINANCIAL CRIME. THE NETREVEAL® TRADE FINANCE SOLUTION PROVIDES PROVEN CAPABILITIES IN AML AND FRAUD PREVENTION. · Expose collusion between buyers and suppliers using sophisticated social network analytics · Empower business with horizontal view of trade activity between a client and their counterparties · Holistic profile of customers and counterparties (KYC/KYCC) · Drastically reduce alert volumes and false positives for significant risk reduction and cost savings www.baesystems.com/tradefinance Trade Finance Magazine Advert.indd 1 20/08/2014 12:59 SPONSORS PLATINUM & EVENING RECEPTION SPONSOR LUNCH SPONSOR GOLD & DELEGATE BAG SPONSOR SILVER SPONSORS NETWORKING SPONSOR LANYARD SPONSOR HOST PARTNER CO-SPONSORS INSTITUTIONAL PARTNERS MEDIA PARTNER WELCOME LETTER 2nd Annual Australia Trade & Supply Chain Finance Conference Sydney, Australia | Sheraton on the Park March 2-3, 2015 Dear delegate, Welcome to GTR’s 2nd Annual Australia Trade & Supply Chain Finance Conference. -

E-Commerce Assessment December 2020

E-commerce Assessment December 2020 Pacific Region © Copyright Pacific Islands Forum Secretariat, 2020 ISBN 978-982-202-071-7 Supported by Disclaimer This publication was commissioned as an independent consultancy report at the initiative of the Pacific Islands Forum Secretariat (PIFS). The publication is supported by the TradeCom II Programme Management Unit (TCII PMU) an OACPS managed and European Union (EU) funded Programme. While this assessment draws on the United Nations Conference on Trade and Development (UNCTAD) eTrade Readiness Assessment methodology, UNCTAD has not been involved in conducting this report. The views and opinions presented in this report are those of the author(s) and should not be attributed to the institutions supporting the study. The institutions bear no responsibility for the accuracy of the facts represented in this report. ii Preface by Zarak Khan, Director Programs and Initiatives, Pacific Islands Forum Secretariat This regional report represents an important milestone of Secretariat’s work on E-commerce, also known as Pacific E-commerce Initiative. In line with 2018 determinations by Forum Trade Officials, the Secretariat has worked relentlessly to support analytical and policy work aimed at improving E-commerce readiness in the Pacific region. It has done so by facilitating approval of Enhanced Integrated Framework (EIF) funding for E-Trade Readiness Assessments undertaken by the United Nation Conference for Trade and Development (UNCTAD) in our Least Developed Country Members, and by securing additional funds and overseeing the development of E-commerce Assessments in additional five Members. As of November 2020, ten Forum Island Countries (FIC) have finalised reports assessing challenges and proposing solutions to promote digital trade in their respective territories. -

Snapshots Fastest Growing Industries N0.: 24650

Up to date business Industry intelligence reports covering developments in the world’s SnapShots fastest growing industries N0.: 24650 Follow us on : AUSTRALIA BANKING 20 January 2021 This Week’s News • The Sydney Morning Herald - Major banks to stop accepting COVID-19 mortgage holiday applications - 20/1/2021 Australia’s biggest banks will stop giving automatic mortgage holidays to home owners struggling due to the coronavirus pandemic, as major lenders contact tens of thousands of Contents customers who are yet to start repaying their loans. For the complete story, see: https://www.smh.com.au/politics/federal/major-banks-to-stop-accepting-covid-19- • News and Commentary mortgage-holiday-applications-20210119-p56v5m.html • Media Releases • The Canberra Times - National Australia Bank moves to rid internet funds transfers of ‘abusive’ terms - 20/1/2021 • Latest Research One of Australia’s big four banks has confirmed it’s moved to stop internet banking transfers from • The Industry going ahead if a word or phrase from a list of terms “that may be considered abusive” is used. For the complete story, see: https://www.canberratimes.com.au/story/7091770/bank-moves-to-rid-internet-funds- • Leading Companies in the Industry transfers-of-abusive-terms/?cs=14231 • The Australian Financial Review - Westpac tips 15pc rise in property prices - 20/1/2021 Expectations on house prices have risen again despite a stumble in consumer sentiment caused by a spike in coronavirus cases in December. For the complete story, see: https://www.afr.com/policy/economy/westpac-tips-15pc-rise-in-property-prices-20210120-