ASIFMA Tech & Ops Week 2021 Final Attendee List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Symphony Innovate 2019

Symphony Innovate 2019 Workflows and Use Cases © Copyright 2019 Symphony Communication Services, LLC — Private and Confidential – Proprietary Information Symphony – SPARC | Front Office Workflow Simplify and automate OTC negotiation Challenge: • Trading OTC derivatives is slow, disjointed, and often relies on disconnected platforms. • Constant window switching, manual entry, human error, and forgotten RFQ information are all too commonplace and can result in frustrated clients. Solution: • With SPARC, traders can create and send RFQs in seconds within a Symphony chat room, and even interact with dealers. • Buy side traders can take action faster leveraging use pre-set commands, while all RFQ details are stored in an easily accessible audit log. “SPARC is a blueprint for future collaboration in the industry; it’s been a unique journey of collaboration between the buy side and sell side, built for and by market participants.” Andrew Mosson, Executive Director, CIB Digital Strategy, J.P. Morgan “© Copyright 2019 Symphony Communication Services, LLC — Private and Confidential – Proprietary Information FlexTrade – SPARC & FlexTrade Integration | Front Office Workflow Automate the EMS to RFQ process Challenge: • Switching between execution management systems (EMS) and communication tools is tedious and can result in time lags and loss of relevant information. Solution: • Traders can seamlessly create RFQs and choose dealers using the FlexTrade & SPARC integration on Symphony. • Trade details are automatically integrated into SPARC via through -

2021Febmarrs

NEW ZEALAND: USPP: LONG-TERM VIEW DEBT STRATEGISTS: RBA MARKET COMES BACK AND SUSTAINABILITY ON GRAVITATIONAL PULL TOGETHER IN PERSON MARKET AGENDA DEFINES MARKET ORBIT VOLUME 16 ISSUE 123 _ FEB/MAR 2021 www.kanganews.com AUSTRALIAN CREDIT CHANGES SHAPE A RAFT OF FACTORS HAVE ALTERED THE AUSTRALIAN CREDIT-ISSUANCE LANDSCAPE FOR THE MEDIUM TERM AT LEAST. LOCAL ASSET MANAGERS SAY THEIR MARKET REMAINS FUNCTIONAL AND INVESTABLE, THOUGH. Australian Securitisation Deal of the Year The $12bn AUM La Trobe Financial group is honoured to be recognised by peers and the Australia debt capital markets community for our $1.25 billion RMBS transaction in May 2020. Widely hailed as effectively re-opening Australian securitisation markets, the transaction saw support from global investment houses in Asia, the US and Europe and from Australian institutional investors. We thank KangaNews for this award, as well as our local and global investment partners and clients for their continued trust and support over the past seven decades. We also thank the team at the Australian Office of Financial Management for their invaluable support for the industry as a whole at a time of unprecedented market volatility. Australian Securitisation Deal of the Year 13 80 10 | latrobefinancial.com La Trobe Financial Custody & Securitisation Services Pty Limited ACN 141 583 191 Australian Financial Services License 379454 La Trobe Financial Services Pty Ltd ACN 006 479 527 Australian Credit Licence 392385 KangaNews FEB/MAR 2021 EDITION VOLUME 16 ISSUE 123 www.kanganews.com Contents COVER STORY Head of content and editor Australian credit LAURENCE DAVISON [email protected] changes shape Deputy editor 29 MATT ZAUNMAYR The Australian dollar credit market has been reshaped in the [email protected] wake of COVID-19, largely as a consequence of RBA market Staff writer CHRIS RICH intervention. -

Connections & Collaboration

APCA Annual Review 2016 The Australia Payments Environment Connections & Collaboration APCA Annual Review 2016 Australian Payments Clearing Association 1 APCA Annual Review 2016 Connections & Collaboration Click here to return to Contents Contents Chair and CEO Message 3 The Australian Payments Clearing Snapshot 4 Association has Highlights 6 been at the heart of the Australian The Australia Payments Environment 7 payments system for Driving Payments 10 close to 25 years. Evolution As a member organisation and industry association, we have grown to represent the needs of a diverse set of stakeholders, as the payments system itself has evolved. With a clear understanding of the requirements Positioned for 14 of a digital economy, we are the home for the Future collaboration and cross industry innovation. In our role as self-regulatory body for payments, we bring rigour to the application of existing regulation and an inquisitive, front-footed Engaging with approach to supporting the requirements the Community 18 of the emerging payments landscape. Decision Making 22 Glossary & Contact 29 APCA has 103 members including Australia’s leading financial institutions major retailers, payments system This Annual Review is designed to provide our members and stakeholders with a summary of what was achieved operators and other in financial year 2015-2016. References in this report to payments service providers. a year are to financial year ended 30 June 2016 unless otherwise stated. A full list of our members is available on page 28. Australian Payments Clearing Association 2 APCA Annual Review 2016 Connections & Collaboration Chair and CEO message The Australian payments landscape has never been more vibrant and it’s for this reason that we have chosen the theme of ‘connections and collaboration’ for our annual report this year. -

List of Correspondent Banks Asia & Oceania

LIST OF CORRESPONDENT BANKS ASIA & OCEANIA ASIA SINGAPORE 1 ABN Amro Bank N.V. ABNA SG 2A 2 Arab Bank PLC ARAB SG SG 3 Australia & New Zealand Banking Group Ltd. ANZB SG SX 4 Bangkok Bank, Singapore BKKB SG SG 5 Bank of America NA BOFA SG 2X 6 Bank of China Ltd. BKCH SG SG 7 Bank of New York Mellon, THE IRVT SG SX 8 Bank of Nova Scotia, Singapore NOSC SG SG 9 Bank of Tokyo Mitsubishi UFJ, Ltd., THE BOTK SG SX 10 BNP Paribas BNPA SG SG / GEBA SG SG 11 BNP Paribas Wealth Management BPPB SG SG 12 Canadian Imperial Bank of Commerce CIBC SG SG 13 Chinatrust Commercial Bank, Singapore Branch CTCB SG SG 14 CIMB Bank Berhad CIBB SG SG 15 Citibank NA CITI SG SG 16 Commerzbank AG COBA SG SX 17 Credit Agricole Corporate and Investment Bank CRLY SG SG 18 Credit Suisse CRES SG SG 19 Credit Suisse AG, SINGAPORE PRIVATE BANKING CSPB SG SG 20 DBS Bank DBSS SG SG 21 Deutsche Bank AG DEUT SG SG 22 DNB Nor Bank ASA DNBA SG SG 23 Hongkong & Shanghai Banking Corporation Ltd., THE HSBC SG SG 24 HSBC Private Bank BLIC SG SX 25 HSH Nordbank HSHN SG SG 26 Hua Nan Commercial Bank HNBK SG SG 27 ING Bank N.V. INGB SG SG 28 Intesa SanPaolo S.P.A. BCIT SG SG 29 JP Morgan Chase Bank NA CHAS SG SG 30 KBC Bank, Singapore KRED SG SX 31 Landesbank Baden Wurttemberg SOLA SG SG 32 Malayan Banking Berhad MBBE SG SG 33 Mizuho Corporate Bank Ltd. -

2018 Annual Report

ASEAN ANNUAL REPORT 2018 CATALYST RECORD PROFITS FIRMER FOOTING DIGITAL TRANSFORMATION Grew stronger in terms of performance, Well-positioned to embark on our next Wider spectrum of solutions to improve value propositions and competitiveness. mid-term growth strategy plan. employee and customer experience. PG 29 PG 11 PG 45 VIETNAM LAOS MYANMAR PHILIPPINES THAILAND CAMBODIA MALAYSIA BRUNEI SINGAPORE INDONESIA The cover depicts our operating footprint across ASEAN and reinforces our commitment to connect our customers, our people and partners to seamless financial solutions, new markets, and opportunities for growth. View our Annual Report, Accounts and other information about CIMB Group Holdings Berhad at www.cimb.com b 1 ABOUT OUR REPORT OUR REPORTS At CIMB Group Holdings Berhad, we produce a range of corporate reports for the benefit of our multiple stakeholders, mainly to equip them with critical information on the many areas of our business operations and performance. ANNUAL REPORT This is the primary source of information about our Group and gives a simple and comprehensive overview of our financial and non-financial milestones and achievements for each year. By studying the report, our stakeholders can learn about our strategy; businesses and performance; approach to governance and risk as well as our future goals. The report demonstrates our accountability and strengthens the trust AR/15 AR/16 AR/17 of our stakeholders. AR/18 ANNUAL FINANCIAL STATEMENTS During the year, we publish a range of financial statements, including quarterly financial statements and the audited annual financial results. These statements present to our stakeholders a clear and full analysis of our financial affairs at the end of each financial year. -

I-Select Superannuation Scheme | 30 September 2020 IOS I-Select Superannuation Scheme

i-Select Superannuation Scheme | 30 September 2020 IOS i-Select Superannuation Scheme Investment Options Supplement 30 September 2020 IOS Issued by i-Select Limited This Investment Options Supplement is provided under the terms of an exemption that the i-Select Superannuation Scheme has from some of the provisions of the Financial Markets Conduct Act 2013 and Financial Markets Conduct Regulations 2014. You can find a copy of the exemption notice on FMA’s website at www.fma.govt.nz/compliance/exemptions. 1 i-select.co.nz i-Select Superannuation Scheme | 30 September 2020 IOS Description of your Please note that: investment options • any changes to the investment options will only be updated quarterly; and A description of the investment options that • any changes to the estimated total annual fund charges, other charges are currently available to Members, and the and any individual action fees in estimated annual fund charges for those respect of each investment option investment options, is set out in the table below. will only be updated annually. • further possible investment options are available for Annual Scheme Charges selection by a Member after consultation with their Manager’s fee 0.4% Authorised Financial Adviser. Scheme expenses (from 01/12/20)* 0.06% Total 0.46% * Scheme expenses include estimates of the Scheme’s accountancy, audit and Supervisor’s fees. These are re-estimated each year for the following year and may, therefore, change without notice. Custodian Brokerage Fees Aegis/ICSL FNZ Investment type Other charges NZX Shares 0.35% min $24.95 NZD 0.30% min $30 NZD Bank fees may apply where the plus Trade Fee $4.50 plus Trade Fee $10 Manager has to move member funds between accounts, such NZX Fixed Interest 0.25% min $25 NZD 0.25% min $30 NZD as from the Scheme’s trust plus Trade Fee $10 account to the Custodian. -

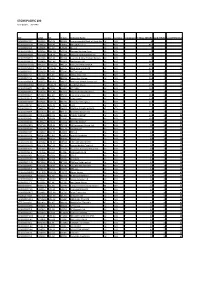

STOXX PACIFIC 100 Selection List

STOXX PACIFIC 100 Last Updated: 20210401 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 99 1 2 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 86.5 2 1 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 78 3 3 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 58 4 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 55.6 5 5 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 52 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 38.7 7 7 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 33.5 8 8 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 32.5 9 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 26.6 10 9 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 26.2 11 12 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 23.6 12 13 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 22.5 13 11 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 19.7 14 15 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD Y 16.1 15 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 15 16 16 AU000000ALL7 6253983 ALL.AX 605156 Aristocrat Leisure Ltd. -

Bloomberg Blames Router Hardware for Asia Terminal Interruption

INFORMATIONASIA-PACIFICSPECIAL CONFERENCE FINANCIAL REPORT Inside Market Data November 16, 2015 waterstechnology.com/imd Volume 31, Number 3 Users Seek Justification for LSE Fee Hikes NEWSWIRES 5 Finwire Unveils Swedish The London Stock Exchange Group (LSEG) is share of trading in FTSE 100 stocks currently Mutual Funds News Service introducing an average 4.8 percent fee increase below 60 percent, data subscribers say the price for its UK and International Level 1 and Level of the data no longer reflects its value. DELIVERY TECHNOLOGIES 2 market data products, which officials say In a notification sent to end users on Sept. 6 Lucera, Perseus Launch reflects continued enhancement of its “content 29, Caroline O’Shaughnessy, global head of Global On-Demand SDN delivery and scope,” but data consumers say the sales and marketing for LSEG’s Information Financial Network exchange is simply raising fees to combat falling Services division, informed customers of the data revenues. new pricing model, which will take effect on SPECIAL REPORT Combined with two earlier fee hikes for the Jan. 1, 2016. 7 Asia-Pacific Financial same products in July 2013 and January 2014, Monthly non-member fees for UK Level Information Conference the new fees represent a cumulative increase 1 data will rise by 4.75 percent from £40 to of between five and 15 percent over two-and- £41.90 per device for professional users, while SPECIAL REPORT a-half years. However, with the LSE’s market UK Level 2 data will rise by 4.9 per- >3 10 Buy Side Still Taking Wait-and-See Approach to Symphony Markit Unveils Total Return Swap Data Service ORGANIZATION & STRATEGY Information and services provider Markit is In 2012, Markit launched a set of standard- 11 RSRCHX Preps for Hiring rolling out a new total return swap (TRS) data ized TRSs based on a series of its iBoxx bond Spree, Content Push service to provide quote data and daily trading market indices. -

Businesses'and'startups'in'2015' By:$UTBA$ the Past Two Months Have Been Very Eventful for the Business World

Businesses'and'Startups'in'2015' By:$UTBA$ The past two months have been very eventful for the business world. Markets worldwide were rattled on the 24th of August by the collapse in the Chinese stock markets, with the S&P 500 closing 3.9% down at the end of the day’s trading.1 Subsequently, the Fed delayed raising interest rates last month and doubt exists, as to whether it will do so this month. In other news, the world’s largest carmaker, Volkswagen has taken a serious beating both in terms of its reputation and market capitalization after the EPA announced that it had installed software in nearly 11 million “clean diesel” automobiles that masked the emission of hazardous compounds.2 Subsequent legal issues could prove to be very damaging for VW. As you would be knowing, speakers from over 12 startups in different industries will be part of the UTBA’s first speaker series on entrepreneurship. As a follow-up to the event, and to keep up your interest in the challenging start-up environment, here are three that could bring radical changes to their industries. 1)! Symphony Symphony Communication Services LLC, is a communications platform in the financial services industry that allows “financial firms and their customers to put all digital communications on a single platform”.3 For a business with more than 50 users, the platform costs just $15 (American) per user for a month and is free for smaller businesses and individuals.4 Bloomberg LP and Thomas Reuters Corp. provide similar services that can cost “tens of thousands of dollars per year for each customer”.5 Symphony is being backed by a total of 14 banks and money managers which include Goldman Sachs Group Inc., Deutsche Bank AG, Credit Suisse Group AG, Bank of New York Mellon Corp. -

Symphony Foundation Formed to Enable Community-Built Advancements of Communication Platform

Symphony Foundation Formed to Enable Community-Built Advancements of Communication Platform May 26, 2015 New Foundation Promotes Innovation Through Open-Source Access to the Symphony Source Code PALO ALTO, Calif.--(BUSINESS WIRE)--Symphony Communication Services LLC, a secure communication and workflow technology company, announced today the formation of the Symphony Foundation, the nonprofit counterpart of the company focused on open, collaborative community development of the platform's source code to further communication innovation. The Symphony Foundation was established based on the belief that open-source development will empower community members to customize the platform and allow for choice amongst platform users. Through an open-source license, the Foundation will enable community members to make and share modifications that both serve the common interests of and will be used for the mutual benefit of the community. Additionally, the Foundation will influence the direction of the platform by incorporating elements such as enhanced security and increased functionality. "Providing open-source access to the Symphony platform has been our goal since inception to further innovation," says David Gurle, chief executive officer at Symphony. "The operating source code offers full transparency and flexibility, while building trust within our community. Furthermore, we have the opportunity to hear from our users and community regarding how we can make the platform better and more efficient for them. The Symphony Foundation allows us to become better partners in building the communication ecosystem that best meets our customers' needs." The Symphony Foundation joins the growing number of technology companies that are embracing open-source licensing for better industry collaboration. -

Fixed Interest Daily Rate Sheet

Thursday 30 September 2021 Fixed Interest Daily Rate Sheet Government Bonds Rating Issuer Code Maturity Coupon Int Yield Price Min %pa Freq %pa ($) ($) AAA GB0423 15/04/2023 5.500% 2 0.99% 1.0941 10000 0800 272Sovereign 442 Debt / craigsip.com Securities AAA GB0524 15/05/2024 0.500% 2 1.23% 0.9832 10000 Sovereign Debt Securities AAA GB0425 15/04/2025 2.750% 2 1.37% 1.0603 10000 A disclosureSovereign statement Debt Securities is available on AAA GB0526 15/05/2026 0.500% 2 1.53% 0.9562 10000 request and free ofSovereign charge. Debt Please Securities AAA GB0427 15/04/2027 4.500% 2 1.61% 1.1734 10000 contactSovereign your Adviser.Debt Securities AAA GB0528 15/05/2028 0.250% 2 1.74% 0.9082 10000 Sovereign Debt Securities AAA GB0429 20/04/2029 3.000% 2 1.82% 1.0965 10000 Sovereign Debt Securities AAA GB0531 15/05/2031 1.500% 2 1.95% 0.9665 10000 Sovereign Debt Securities 1 yr swap 1.09% 5 yr swap 1.86% 7 yr swap 2.06% Local Authority Bonds Rating Issuer Code Maturity Coupon Int Yield Price Min Security Type %pa Freq %pa ($) ($) AAA NZ Local Govt Funding Agency LGF090 14/04/2022 2.750% 2 0.79% 1.0233 10000 Unsecured Unsubordinated Debt Securities AA- Christchurch City Holdings CCH010 6/12/2022 3.400% 2 1.30% 1.0354 5000 Unsecured Unsubordinated Debt Securities AAA NZ Local Govt Funding Agency LGF050 15/04/2023 5.500% 2 1.28% 1.0895 10000 Unsecured Unsubordinated Debt Securities AA Auckland Council AKC070 25/03/2024 5.806% 2 1.65% 1.1018 5000 Secured Unsubordinated Debt Securities AAA NZ Local Govt Funding Agency LGF100 15/04/2024 2.250% 2 1.57% -

External Community Over 500 Companies Are Part of the Symphony Community

July 2021 THE INFORMATION IN THIS DOCUMENT IS CONFIDENTIAL AND SHOULD NOT BE SHARED OUTSIDE OF YOUR FIRM. External Community Over 500 companies are part of the Symphony community Not all firms on Symphony are represented in the Symphony Community grid. Please reach out to your Account Manager if you wish to check if a firm is on Symphony that is not represented in this list. This month 11 firms joined the Symphony Community, including: Creighton Capital IG Markets Ltd K5 Global Capital Meraki Global Mine Digital Ltd Sona Asset Management Advisors Management BUY SIDE | SELL SIDE | ASSET SERVICING | IDBs & EXCHANGES | TECH & PARTNERS | CORPORATES Buy Side (Asset Owners & Managers, Alternative Fund Managers, Central Banks & Official Institutions) COMPANY EQUITIES FICC OPS AMER EMEA APAC AMER EMEA APAC AMER EMEA APAC ABC Arbitrage AM • • • Alger • Alliance Bernstein • • • • • • • • • Amundi • • • • • AQR • • Ardea IM • • Artisan Partners • • BlackRock • • • BNP Paribas AM • • • • • BTG Pactual AM • • CedarKnight • • • Challenger • Citadel • • • • • • Comgest • • New joiners are indicated in blue SECURE TEAM COLLABORATION SYMPHONY.COM © 2021 Symphony Communication Services, LLC - Proprietary and Confidential. All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. BUY SIDE | SELL SIDE | ASSET SERVICING | IDBs & EXCHANGES | TECH & PARTNERS | CORPORATES COMPANY EQUITIES FICC OPS AMER EMEA APAC AMER EMEA APAC AMER EMEA APAC Dimensional Fund Advisors • • • • DWS • • • • • Empirical Capital • Exane AM • Fulcrum AM • • • Global Macro Cycle Partners • • Graticule AM • • • • • • • • • Insight Investment • • • • • • • • • Jane Street • • • • • • • • • J.P. Morgan AM • • • • • • • • • Key Capital Partners • • Kingdon Capital • • Lighthouse Canton • • • Luminus Management • Maverick • Mendon Capital • Monarch Partners • Nine Masts Capital • • • Ohman J:or Fonder • • Perpetual • Puma Capital • • Schroders • • • SPX Intl.