2018 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interim Report

MANULIFE INVESTMENT -CM FLEXI FUND CONTENTS PAGE 1 General Information 1 2 Manager’s Report 3 3 Policy On Stockbroking Rebates And So Commissions 9 4 Statement By The Manager 10 5 Trustee’s Report 11 6 Statement Of Comprehensive Income 12 7 Statement Of Financial Position 13 8 Statement Of Changes In Equity 14 9 Statement Of Cash Flows 15 10 Summary Of Signicant Accounting Policies 16 11 Notes To The Financial Statements 21 12 Corporate Information 36 MANULIFE INVESTMENT -CM FLEXI FUND 1 GENERAL INFORMATION 1.1 THE TRUST The Fund commenced operations on 23 January 2007 and will continue its operations until terminated as provided under Clause 48.2 of the Deed. 1.2 FUND TYPE / CATEGORY Growth / Mixed Assets 1.3 BASE CURRENCY Ringgit Malaysia (RM) 1.4 OBJECTIVE OF THE FUND The Fund seeks to provide Unit Holders with long-term capital appreciation. Note: Any material change to the Fund’s investment objective would require Unit Holders’ approval. 1.5 DISTRIBUTION POLICY Income distribution (if any) is incidental. 1.6 PERFORMANCE BENCHMARK 50% FTSE Bursa Malaysia Top 100 Index (FBM100) + 50% CIMB 12-month xed deposit (FD) rate. Note: The composite benchmark provides a balanced gauge on the asset allocation of the Fund which can invest up to 98% of its net asset value (NAV) in equities and/or equity-related instruments or xed income instruments. The composite benchmark is only used as a reference for performance gauge purpose. The risk prole of the Fund is not the same as the risk prole of this benchmark. -

Malaysian Invited Companies Company Name Country Robecosam Industry AMMB Holdings Bhd Malaysia BNK Banks Astro Malaysia Holdings

Malaysian invited companies Company_Name Country RobecoSAM_Industry AMMB Holdings Bhd Malaysia BNK Banks Astro Malaysia Holdings Bhd Malaysia PUB Media Axiata Group Bhd Malaysia TLS Telecommunication Services Batu Kawan Bhd Malaysia CHM Chemicals British American Tobacco Malaysia Bhd Malaysia TOB Tobacco Bumi Armada Bhd Malaysia OIE Energy Equipment & Services CIMB Group Holdings Bhd Malaysia BNK Banks Dialog Group Bhd Malaysia CON Construction & Engineering Digi.com Bhd Malaysia TLS Telecommunication Services Felda Global Ventures Holdings Bhd Malaysia FOA Food Products Gamuda Bhd Malaysia CON Construction & Engineering Genting Bhd Malaysia CNO Casinos & Gaming Genting Malaysia Bhd Malaysia CNO Casinos & Gaming Hong Leong Bank Bhd Malaysia BNK Banks Hong Leong Financial Group Bhd Malaysia BNK Banks IHH Healthcare Bhd Malaysia HEA Health Care Providers & Services IJM Corp Bhd Malaysia CON Construction & Engineering IOI Corp Bhd Malaysia FOA Food Products IOI Properties Group Bhd Malaysia REA Real Estate Kuala Lumpur Kepong Bhd Malaysia FOA Food Products Lafarge Malaysia Bhd Malaysia COM Construction Materials Malayan Banking Bhd Malaysia BNK Banks Malaysia Airports Holdings Bhd Malaysia TRA Transportation and Transportation Infrastructure Maxis Bhd Malaysia TLS Telecommunication Services MISC Bhd Malaysia TRA Transportation and Transportation Infrastructure Nestle Malaysia Bhd Malaysia FOA Food Products Petronas Chemicals Group Bhd Malaysia CHM Chemicals Petronas Dagangan BHD Malaysia OIX Oil & Gas Petronas Gas BHD Malaysia GAS Gas Utilities -

The 4Th World Islamic Economic Forum Conference Report State Of

The 4th World Islamic Economic Forum Conference Report State of Kuwait I 28 April – 1 May 2008 5 Special Message by Tun Musa Hitam Chairman, WIEF Foundation 6 Special Message by Tan Sri Ahmad Fuzi Abdul Razak Secretary-General, WIEF Foundation 7 Special Message by Syed Abu Bakar Almohdzar Managing Director, WIEF Foundation 9 Introduction by Fazil Irwan Som Director, Editorial and Business Development, WIEF Foundation 12 WIEF Businesswomen Forum: “Capacity Building & Synergistic Linkages – The Way to Success” 22 2nd WIEF Young Leaders Forum 30 Development & Finance in the Islamic World: Between Islamic Development Agencies, Kuwait & International Financial Institutions 32 Meeting Programme of the Commercial & Islamic Chambers Chairmen & Businessmen with Members of the Kuwait Chamber of Commerce & Industry 2I¿FLDO2SHQLQJ&HUHPRQ\ 42 Leadership Panel: Islamic Countries in a Competitive World 46 Parallel Session: Small and Medium Enterprises 49 Parallel Session: Telecommunications, Transport & Logistics 52 Parallel Session: Infrastructure & Real Estate 54 Parallel Session: Tourism & Travel 58 Plenary Session: The Muslim World as a Burgeoning Market 64 Plenary Session: The Future of Energy in a Changing World 67 Plenary Session: Economic Partnership between the Gulf Cooperation Council Countries (GCC) & the Muslim World 71 Plenary Session: The Role of Investment in Poverty Reduction 76 Parallel Session: Education and Development in the Islamic World 79 Parallel Session: Private Sector Role in Development 84 Concluding Session 87 Concluding Speech by the Patron of WIEF Foundation: The Hon. Dato’ Seri Abdullah bin Haji Ahmad Badawi, Prime Minister of Malaysia 91 About The Organiser and Supporting Organisations 96 Programme of the 4th WIEF 116 Photo Gallery 112 Declaration of the 4th WIEF 114 Acknowledgement 4 I THE 4TH WORLD ISLAMIC ECONOMIC FORUM t gives me great pleasure to present to you the Report of the 4th World Islamic Economic Forum that was held on 28th April – 1st May 2008 in Kuwait. -

Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia

Asian Social Science; Vol. 12, No. 3; 2016 ISSN 1911-2017 E-ISSN 1911-2025 Published by Canadian Center of Science and Education Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia Wan Sallha Yusoff1, Mohd Fairuz Md. Salleh2, Azlina Ahmad2 & Norida Basnan2 1 School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia 2 School of Accounting, Faculty of Economics and Management, Universiti Kebangsaan Malaysia, Malaysia Correspondence: Wan Sallha Yusoff, School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia. E-mail: [email protected] Received: August 8, 2015 Accepted: January 18, 2016 Online Published: February 23, 2016 doi:10.5539/ass.v12n3p14 URL: http://dx.doi.org/10.5539/ass.v12n3p14 Abstract This study investigates the relationships between financial hegemony groups, global diversification strategies and firm value of the Malaysia’s 30 largest companies listed in FTSE Bursa Malaysia Index Series during 2009 to 2012 period. We chose Malaysia as an ideal setting because the findings contribute to the phenomenon of the diversification–performance relationship in the Southeast Asian countries. We apply hegemony stability theory to explain the importance of financial hegemony groups in deciding international locations for operations. By using panel data analysis, we find that financial hegemony groups are significantly important in international location decisions. Results reveal that the stability of financial hegemony in BRICS and G7 groups enhances the financial value of the Malaysia’s 30 largest companies, whereas the stability of financial hegemony in ASEAN groups is able to enhance the non-financial value of the firms. -

ASEAN Asset Class Publicly Listed Companies 2019 (Score 97.50 Points and Above - by Alphabetical Order)

ASEAN Asset Class Publicly Listed Companies 2019 (score 97.50 points and above - by alphabetical order) NAME OF PUBLICLY LISTED COMPANY COUNTRY 1 2GO GROUP, INC. Philippines 2 ADVANCE INFO SERVICE PUBLIC COMPANY LIMITED Thailand 3 AIRPORTS OF THAILAND PUBLIC COMPANY LIMITED Thailand 4 ALLIANCE BANK MALAYSIA BHD Malaysia 5 ALLIANZ MALAYSIA BHD Malaysia 6 AMATA CORPORATION PUBLIC COMPANY LIMITED Thailand 7 AMMB HOLDINGS BHD Malaysia 8 ASTRO MALAYSIA HOLDINGS BERHAD Malaysia 9 AXIATA GROUP BERHAD Malaysia 10 AYALA CORPORATION Philippines 11 AYALA LAND, INC. Philippines 12 BANGCHAK CORPORATION PUBLIC COMPANY LIMITED Thailand 13 BANGKOK AVIATION FUEL SERVICES PUBLIC COMPANY LIMITED Thailand 14 BANK OF AYUDHYA PUBLIC COMPANY LIMITED Thailand 15 BANK OF THE PHILIPPINE ISLANDS Philippines 16 BDO UNIBANK, INC. Philippines 17 BELLE CORPORATION Philippines 18 BIMB HOLDINGS BHD Malaysia 19 BRITISH AMERICAN TOBACCO (MALAYSIA) BHD Malaysia 20 BURSA MALAYSIA BHD Malaysia 21 CAHYA MATA SARAWAK BHD Malaysia 22 CAPITALAND LIMITED Singapore 23 CENTRAL PATTANA PUBLIC COMPANY LIMITED Thailand 24 CHAROEN POKPHAND FOODS PUBLIC COMPANY LIMITED Thailand 25 CHINA BANKING CORPORATION Philippines 26 CIMB GROUP HOLDINGS BHD Malaysia 27 CITY DEVELOPMENTS LIMITED Singapore 28 COL PUBLIC COMPANY LIMITED Thailand 29 COMFORTDELGRO CORP LIMITED Singapore 30 DBS GROUP HOLDINGS LTD Singapore NAME OF PUBLICLY LISTED COMPANY COUNTRY 31 DIGI.COM BHD Malaysia 32 DMCI HOLDINGS, INC. Philippines 33 EASTERN WATER RESOURCES DEVELOPMENT AND MANAGEMENT PCL. Thailand 34 ELECTRICITY GENERATING PUBLIC COMPANY LIMITED Thailand 35 FAR EAST ORCHARD LIMITED Singapore 36 FRASER AND NEAVE LIMITED Singapore 37 FRASERS PROPERTY LIMITED Singapore 38 GLOBAL POWER SYNERGY PUBLIC COMPANY LIMITED Thailand 39 GLOBE TELECOM, INC. -

Lesser Government in Business: an Unfulfilled Promise? by Wan Saiful Wan Jan Policy Brief NO

Brief IDEAS No.2 April 2016 Lesser Government in Business: An Unfulfilled Promise? By Wan Saiful Wan Jan Policy Brief NO. 2 Executive Summary Introduction This paper briefly outlines the promise made by Reducing the Government’s role in business has the Malaysian Government to reduce its role in been on Prime Minister Dato’ Sri Najib Tun business as stated in the Economic Transformation Razak’s agenda since March 2010, when he Programme (ETP). It presents a general argument launched the New Economic Model (NEM). The of why the Government should not be involved NEM called for a reduction in Government in business. It then examines the progress intervention in the economy and an increase made by the Government to reduce its role in economic liberalisation efforts. The NEM in business through data showing Government furthermore, acknowledged that private sector divestments in several listed companies. growth in Malaysia has been hampered by “heavy Government and GLC presence” and This paper then demonstrates how this progress is offset by two factors – (i) the increased shares of Government-Linked Companies that there is a serious need to “reduce direct (GLCs) in the Kuala Lumpur Composite Index (KLCI) and (ii) the state participation in the economy” (National higher amount of combined GLC and GLIC asset acquisitions as opposed to asset disposals. This paper concludes with the argument Economic Advisory Council (NEAC), 2009). that the Government has not fulfilled its promise but in fact, has done the exact opposite. The increased shares of Government- 01 Linked Companies (GLCs) in the Kuala Author Two Factors Lumpur Composite Index (KLCI). -

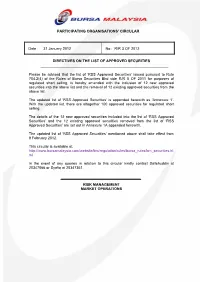

Directives on the List of Approved Securities

PARTICIPATING ORGANISATIONS’ CIRCULAR Date : 31 January 2012 No : R/R 3 OF 2012 DIRECTIVES ON THE LIST OF APPROVED SECURITIES Please be advised that the list of ‘RSS Approved Securities’ issued pursuant to Rule 704.2(4) of the Rules of Bursa Securities Bhd vide R/R 5 OF 2011 for purposes of regulated short selling, is hereby amended with the inclusion of 12 new approved securities into the above list and the removal of 12 existing approved securities from the above list. The updated list of ‘RSS Approved Securities’ is appended herewith as ‘Annexure 1’. With the updated list, there are altogether 100 approved securities for regulated short selling. The details of the 12 new approved securities included into the list of ‘RSS Approved Securities’ and the 12 existing approved securities removed from the list of ‘RSS Approved Securities’ are set out in Annexure 1A appended herewith. The updated list of ‘RSS Approved Securities’ mentioned above shall take effect from 9 February 2012. This circular is available at: http://www.bursamalaysia.com/website/bm/regulation/rules/bursa_rules/bm_securities.ht ml In the event of any queries in relation to this circular kindly contact Sallehuddin at 20347066 or Syafiq at 20347361. RISK MANAGEMENT MARKET OPERATIONS Annexure 1 RSS APPROVED SECURITIES No STOCK CODE STOCK LONG NAME 1 5185 AFFIN HOLDINGS BERHAD 2 5099 AIRASIA BERHAD 3 5115 ALAM MARITIM RESOURCES BERHAD 4 2488 ALLIANCE FINANCIAL GROUP BERHAD 5 1015 AMMB HOLDINGS BERHAD 6 6888 AXIATA GROUP BERHAD 7 3395 BERJAYA CORPORATION BERHAD 8 1562 BERJAYA -

Ac 2021 61.Pdf

Accounting 7 (2021) 1033–1048 Contents lists available at GrowingScience Accounting homepage: www.GrowingScience.com/ac/ac.html Can investors benefit from corporate social responsibility and portfolio model during the Covid19 pandemic? Ternence T. J. Tana* and Baliira Kalyebarab aFaculty of Business, Economics and Social Development, University of Malaysia Terengganu, Kuala Nerus, Terengganu, Malaysia bDepartment of Accounting and Finance, School of Business, American University of Ras Al Khaimah, United Arab Emirates C H R O N I C L E A B S T R A C T Article history: Since late 2019 and throughout 2020, the global economy has been experiencing difficult times due Received: November 15, 2020 to the outbreak of the lethal Coronavirus (COVID-19). This study looks at the financial impact of Received in revised format: this epidemic on the global economy using Malaysian market index i.e., FTSE Bursa Malaysia KLCI January 28 2021 before and during COVID-19. Measuring the financial impact of this epidemic on the Malaysia Accepted: March 2, 2021 Available online: economy may help policy makers to develop measures to avert similar financial catastrophic impacts March 2, 2021 on the global economy. The study uses Sharpe optimal and naïve diversification model to solve a scenario that factors in the level of corporate social responsibility (CSR) exhibited before and during Keywords: Corporate Social Responsibility the epidemic to measure the financial impact on the stock portfolio. The results show that the Naïve Diversification emergence of COVID-19exacerbated the already weak Malaysian economy. Our findings may help Optimal Portfolio the policy makers in Malaysia to develop and maintain techniques and policies that may mitigate the Sharpe Ratio negative financial impact and handle similar epidemics in the future. -

Symphony Innovate 2019

Symphony Innovate 2019 Workflows and Use Cases © Copyright 2019 Symphony Communication Services, LLC — Private and Confidential – Proprietary Information Symphony – SPARC | Front Office Workflow Simplify and automate OTC negotiation Challenge: • Trading OTC derivatives is slow, disjointed, and often relies on disconnected platforms. • Constant window switching, manual entry, human error, and forgotten RFQ information are all too commonplace and can result in frustrated clients. Solution: • With SPARC, traders can create and send RFQs in seconds within a Symphony chat room, and even interact with dealers. • Buy side traders can take action faster leveraging use pre-set commands, while all RFQ details are stored in an easily accessible audit log. “SPARC is a blueprint for future collaboration in the industry; it’s been a unique journey of collaboration between the buy side and sell side, built for and by market participants.” Andrew Mosson, Executive Director, CIB Digital Strategy, J.P. Morgan “© Copyright 2019 Symphony Communication Services, LLC — Private and Confidential – Proprietary Information FlexTrade – SPARC & FlexTrade Integration | Front Office Workflow Automate the EMS to RFQ process Challenge: • Switching between execution management systems (EMS) and communication tools is tedious and can result in time lags and loss of relevant information. Solution: • Traders can seamlessly create RFQs and choose dealers using the FlexTrade & SPARC integration on Symphony. • Trade details are automatically integrated into SPARC via through -

ESG Ratings of Plcs Assessed by FTSE Russell# in Accordance with FTSE Russell ESG Ratings Methodology

ESG Ratings of PLCs assessed by FTSE Russell# in accordance with FTSE Russell ESG Ratings Methodology Definition Top 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 26-50% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 51%- 75% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Bottom 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Stock Company Name Sector F4GBM ESG Grading Code (sorted By Alphabetical) Index Band 6599 AEON CO. (M) BHD CONSUMER PRODUCTS & SERVICES ** 5139 AEON CREDIT SERVICE (M) BHD FINANCIAL SERVICES Yes *** 7078 AHMAD ZAKI RESOURCES BHD CONSTRUCTION *** 5099 AIRASIA GROUP BERHAD CONSUMER PRODUCTS & SERVICES *** 5238 AIRASIA X BERHAD CONSUMER PRODUCTS & SERVICES ** 2658 AJINOMOTO (M) BHD CONSUMER PRODUCTS & SERVICES Yes *** 2488 ALLIANCE BANK MALAYSIA BERHAD FINANCIAL SERVICES Yes *** 5293 AME ELITE CONSORTIUM BERHAD CONSTRUCTION * 1015 AMMB HOLDINGS BHD FINANCIAL SERVICES Yes **** 6556 ANN JOO RESOURCES BHD INDUSTRIAL PRODUCTS & SERVICES * 6399 ASTRO MALAYSIA HOLDINGS BERHAD TELECOMMUNICATIONS & MEDIA Yes **** 6888 AXIATA GROUP BERHAD TELECOMMUNICATIONS & MEDIA Yes *** 5106 AXIS REITS REAL ESTATE INVESTMENT TRUSTS ** 3395 BERJAYA CORPORATION BHD INDUSTRIAL PRODUCTS & SERVICES ** 1562 BERJAYA SPORTS TOTO BHD CONSUMER PRODUCTS & SERVICES ** 5248 BERMAZ AUTO BERHAD CONSUMER PRODUCTS & SERVICES Yes **** 2771 BOUSTEAD HOLDINGS BHD INDUSTRIAL PRODUCTS & SERVICES ** 4162 BRITISH AMERICAN -

Stay Defensive on Expectation of More Pressure on Stocks

Headline Stay defensive on expectation of more pressure on stocks MediaTitle The Edge Date 04 May 2020 Language English Circulation 25,910 Readership 77,730 Section Corporate Page No 22,23 ArticleSize 1300 cm² Journalist N/A PR Value RM 67,149 Stay defensive on expectation of more pressure on stocks T*P hpnrhmark index FTSE Bursa Malaysia KLCI has rebounded since March 19, but analysts say there could ^sSnoS^Shrust. With the uncertainty over Covid-19 and how the worlds economy, respond post- pandemic, what should investors do when it comes to investing in the local stock market. BY KAMARUL AZHAR t has been a tumultuous four months for Malaysian equities, and analysts warn of further volatility ahead as a possible recession looms, caused by the Move- ment Control Order (MCO) and cautious consumer sentiment. Investors are ad- vised to stay defensive and invest in stocks that have defensive earnings qualities and strong fundamentals. Imran Yusof, senior analyst at MIDF Research,believes the FBM KLCI will face some downward pressure, given that sen- timent is likely to be hit by weak econom- ic data and corporate earnings, which are scheduled for release in the next couple of months following nearly two months of economic stagnation. "Therefore, there might be another downward thrust in the direction of the FBM KLCI. In addition, a bear market gen- erally follows a three-wave pattern, where- by the downward thrust (which we saw in March) would normally be interrupted by -19) at a department store in Seoul, South Korea April 30, 2020. an intermittent rebound and subsequent- People wear masks to avoid the spread of the coronavirus disease (COVID ly followed by another downward thrust," Imran tells The Edge via email. -

IFN Non-Banking Financial Institutions Poll 2020: Winners Revealed!

The World’s Leading Islamic Finance News Provider (All Cap) Uzbekistan Turkey aims for Egypt one step UK fintech 1400 1,370.68 finalizes draft Islamic banking closer to issuing eyes Q1 2021 1350 3.79% regulations efficiency with debut sovereign launch date 1300 1,319.94 on Sukuk in new banking Sukuk with for Islamic 1250 preparation for infrastructure ... 5 approval of platform ...13 1200 W T F S S M T first issuance in draft law ...6 Powered by: IdealRatings® 2021..5 COVER STORY 11th November 2020 (Volume 17 Issue 45) IFN Non-Banking Financial Institutions Poll 2020: Winners revealed! Non-banking financial institutions Al Barakah Multi-Purpose Co-operative (NBFIs) play a crucial role in fulfilling Society in ensuring Muslims in Mauritius the financing demand that cannot be are still able to access Riba-free financial met by banking institutions. For their products in line with their faith. With indispensable contribution to the global small humble beginnings in 1998 when Islamic finance industry, IFN is honored several Mauritian Muslims pooled to be recognizing the top Islamic together their resources to form the NBFIs through the inaugural IFN Non- country’s first Islamic credit cooperative, Banking Financial Institutions Poll 2020 Al Barakah Multi-Purpose Co-operative as voted by the readers of IFN. Society has grown over the last two decades expanding its operations to 22% of the votes, Al Barakah Multi- Purpose Cooperative Society took Best Islamic Financial nine branches throughout the island and serving over 2,000 members, about 10% home the title of Best Islamic Financial Cooperative of the local Muslim population.